Statistiques de base

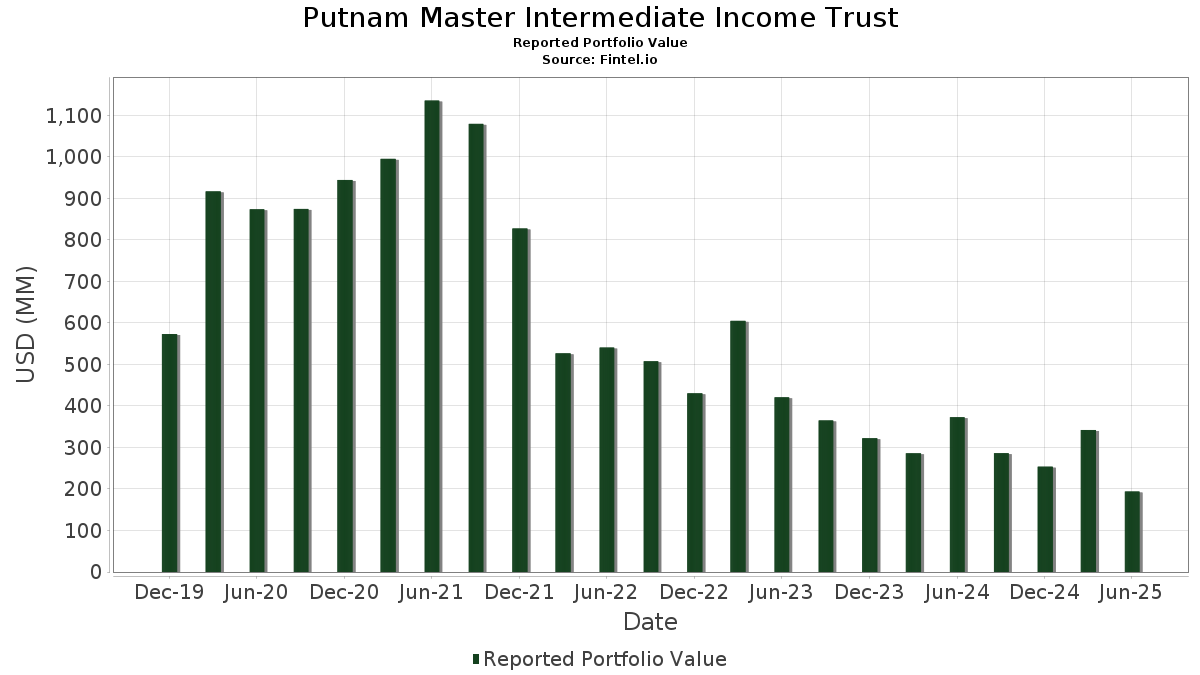

| Valeur du portefeuille | $ 193 935 642 |

| Positions actuelles | 771 |

Dernières positions, performances, ASG (à partir des dépôts 13F, 13D)

Putnam Master Intermediate Income Trust a déclaré un total de 771 positions dans ses derniers dépôts auprès de la SEC. La valeur la plus récente du portefeuille est calculée à 193 935 642 USD. Les actifs sous gestion réels (ASG) sont cette valeur plus les liquidités (qui ne sont pas divulguées). Les principales positions de Putnam Master Intermediate Income Trust sont Uniform Mortgage-Backed Security, TBA (US:US01F0526727) , SHORT TERM INV FUND (US:US74676P6640) , Ginnie Mae (US:US21H0526788) , Franklin Templeton ETF Trust - Franklin Ultra Short Bond ETF (US:FLUD) , and Uniform Mortgage-Backed Security, TBA (US:US01F0606750) . Les nouvelles positions de Putnam Master Intermediate Income Trust incluent Uniform Mortgage-Backed Security, TBA (US:US01F0526727) , Ginnie Mae (US:US21H0526788) , Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , Ginnie Mae (US:US21H0506723) , and Ginnie Mae (US:US21H0426799) .

Meilleures augmentations ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 10,00 | 5,9914 | 5,3923 | ||

| 3,93 | 2,3547 | 2,3547 | ||

| 0,17 | 4,18 | 2,5053 | 0,8906 | |

| 1,29 | 0,7704 | 0,7704 | ||

| 1,07 | 0,6415 | 0,6415 | ||

| 1,00 | 0,5996 | 0,5996 | ||

| 0,85 | 0,5094 | 0,5094 | ||

| 1,66 | 0,9938 | 0,4977 | ||

| 0,82 | 0,4904 | 0,4904 | ||

| 0,80 | 0,4765 | 0,4765 |

Principales baisses ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 4,07 | 2,4357 | -10,9646 | ||

| 1,98 | 1,98 | 1,1886 | -2,3856 | |

| 0,90 | 0,5395 | -1,6832 | ||

| 2,87 | 1,7209 | -1,1660 | ||

| -2,87 | -1,7196 | -1,1624 | ||

| -0,93 | -0,5572 | -1,1445 | ||

| 9,18 | 9,18 | 5,5023 | -0,4774 | |

| -0,63 | -0,3752 | -0,3752 | ||

| -0,55 | -0,3271 | -0,3271 | ||

| 0,56 | 0,3345 | -0,2466 |

Déclarations 13F et dépôts de fonds

Ce formulaire a été déposé le 2025-08-26 pour la période de déclaration 2025-06-30. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau pour débloquer les données premium et exporter vers Excel ![]() .

.

| Titre | Type | Prix moyen de l'action | Actions (en millions) |

ΔActions (%) |

ΔActions (%) |

Valeur ($ en millions) |

Portefeuille (%) |

ΔPortefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 10,00 | 914,10 | 5,9914 | 5,3923 | |||||

| US74676P6640 / SHORT TERM INV FUND | 9,18 | -7,10 | 9,18 | -7,09 | 5,5023 | -0,4774 | |||

| US21H0526788 / Ginnie Mae | 5,01 | 0,97 | 3,0008 | -0,0124 | |||||

| FLUD / Franklin Templeton ETF Trust - Franklin Ultra Short Bond ETF | 0,17 | 56,52 | 4,18 | 56,65 | 2,5053 | 0,8906 | |||

| US01F0606750 / Uniform Mortgage-Backed Security, TBA | 4,07 | -81,57 | 2,4357 | -10,9646 | |||||

| US21H0506723 / Ginnie Mae | 3,93 | 2,3547 | 2,3547 | ||||||

| US21H0426799 / Ginnie Mae | 2,87 | -39,56 | 1,7209 | -1,1660 | |||||

| US74680A8696 / SHORT TERM INV FUND | 1,98 | -66,43 | 1,98 | -66,44 | 1,1886 | -2,3856 | |||

| US01F0226757 / Uniform Mortgage-Backed Security, TBA | 1,66 | 103,19 | 0,9938 | 0,4977 | |||||

| US3137G0HZ50 / CORP CMO | 1,33 | -1,92 | 0,7961 | -0,0230 | |||||

| U.S. Treasury Bills / STIV (US912797MS31) | 1,29 | 0,7704 | 0,7704 | ||||||

| US30711XCH52 / CORP CMO | 1,17 | -3,63 | 0,7010 | -0,0330 | |||||

| US02146QAD51 / CORP CMO | 1,17 | -1,60 | 0,6982 | -0,0181 | |||||

| US52523KBH68 / Lehman XS Trust 2006-17 | 1,09 | 5,32 | 0,6526 | 0,0270 | |||||

| OIS / DIR (N/A) | 1,07 | 0,6415 | 0,6415 | ||||||

| US105756CC23 / Brazilian Government International Bond | 1,00 | 0,5996 | 0,5996 | ||||||

| Mizuho Bank Ltd. / STIV (US60710TA431) | 1,00 | 0,00 | 0,5993 | -0,0058 | |||||

| EW / Edwards Lifesciences Corporation | 0,98 | 8,89 | 0,5873 | 0,0478 | |||||

| US19688JAC18 / CORP CMO | 0,98 | 0,21 | 0,5859 | -0,0041 | |||||

| EW / Edwards Lifesciences Corporation | 0,90 | -75,40 | 0,5395 | -1,6832 | |||||

| US01F0306781 / UMBS TBA | 0,87 | 1,76 | 0,5186 | 0,0017 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0,85 | 0,5094 | 0,5094 | ||||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 0,85 | -0,12 | 0,5092 | -0,0053 | |||||

| US3137FWKE98 / FHLMC CMO IO | 0,84 | -3,33 | 0,5039 | -0,0225 | |||||

| US46647PDW32 / JPMorgan Chase & Co | 0,84 | -0,12 | 0,5021 | -0,0057 | |||||

| US35563GAB59 / Freddie Mac Multifamily Structured Credit Risk | 0,82 | -0,84 | 0,4937 | -0,0088 | |||||

| ABN AMRO Funding USA LLC / STIV (US00084BW345) | 0,82 | 0,4904 | 0,4904 | ||||||

| US35565XBE94 / CORP CMO | 0,81 | -0,74 | 0,4841 | -0,0079 | |||||

| US35563XBE13 / Freddie Mac Stacr Trust 2018-HQA2 | 0,81 | -0,49 | 0,4830 | -0,0072 | |||||

| Canadian Imperial Bank of Commerce / STIV (US13606DEU28) | 0,80 | 0,00 | 0,4796 | -0,0044 | |||||

| AU3FN0029609 / AAI Ltd | 0,80 | 0,4765 | 0,4765 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,80 | -10,07 | 0,4764 | -0,0589 | |||||

| US87264ABV61 / T-Mobile USA Inc | 0,79 | 1,28 | 0,4760 | 0,0015 | |||||

| Panama Government Bond / DBT (US698299BX19) | 0,78 | 2,91 | 0,4665 | 0,0091 | |||||

| CBAPJ / Commonwealth Bank of Australia - Preferred Security | 0,75 | 0,4494 | 0,4494 | ||||||

| DNB Bank ASA / STIV (US23345HPE26) | 0,75 | 0,4494 | 0,4494 | ||||||

| US56168P1049 / Mana Capital Acquisition Corp. | 0,75 | 0,4491 | 0,4491 | ||||||

| 62939LU72 / NRW Bank | 0,75 | 0,4490 | 0,4490 | ||||||

| NRW Bank / STIV (US62939LX201) | 0,74 | 0,4443 | 0,4443 | ||||||

| GNMA, Series 2020-96, Class KS / ABS-MBS (US38382GU912) | 0,73 | 3,38 | 0,4403 | 0,0106 | |||||

| USP5015VAQ97 / REPUBLIC OF GUATEMALA 6.600000% 06/13/2036 | 0,71 | 0,85 | 0,4265 | -0,0004 | |||||

| US38382RPL68 / GNMA CMO IO | 0,71 | -2,34 | 0,4258 | -0,0144 | |||||

| XS2287912450 / Verisure Midholding AB | 0,71 | 9,30 | 0,4226 | 0,0321 | |||||

| CQP Holdco LP, First Lien, Initial CME Term Loan / LON (US12657QAE35) | 0,69 | 0,29 | 0,4148 | -0,0028 | |||||

| US38383AQC17 / GNMA CMO IO | 0,68 | 14,00 | 0,4103 | 0,0474 | |||||

| US38382WBR79 / GNMA CMO IO | 0,68 | 1,50 | 0,4066 | 0,0023 | |||||

| USP75744AL92 / PARAGUAY | 0,67 | 73,45 | 0,4033 | 0,1681 | |||||

| US3136BCLU21 / FNMA CMO IO | 0,66 | -1,64 | 0,3963 | -0,0108 | |||||

| US77586RAK68 / Romanian Government International Bond | 0,66 | 0,3941 | 0,3941 | ||||||

| US62548QAD34 / Multifamily Connecticut Avenue Securities Trust 2020-01 | 0,66 | -1,20 | 0,3936 | -0,0084 | |||||

| USP3699PGK77 / Costa Rica Government International Bond | 0,64 | 96,91 | 0,3828 | 0,1866 | |||||

| US900123DJ66 / Turkey Government International Bond | 0,63 | 93,27 | 0,3792 | 0,1811 | |||||

| US61747YFA82 / Morgan Stanley | 0,62 | 0,32 | 0,3720 | -0,0022 | |||||

| US30711XCR35 / CORP CMO | 0,61 | -2,57 | 0,3633 | -0,0133 | |||||

| US35563PMX41 / Seasoned Credit Risk Transfer Trust Series 2019-4 | 0,61 | 1,51 | 0,3632 | 0,0017 | |||||

| US3137H1X689 / FHLMC CMO IO | 0,60 | -3,06 | 0,3601 | -0,0154 | |||||

| US38382TD275 / GNMA CMO IO | 0,60 | -8,17 | 0,3573 | -0,0356 | |||||

| A&D Mortgage Trust, Series 2024-NQM1, Class A1 / ABS-MBS (US00039GAA76) | 0,59 | -8,10 | 0,3535 | -0,0348 | |||||

| US168863DZ80 / Chile Government International Bond | 0,59 | 1,03 | 0,3532 | 0,0005 | |||||

| US3137G0GZ69 / CORP CMO | 0,57 | -2,88 | 0,3434 | -0,0139 | |||||

| US35565MBE30 / CORP CMO | 0,57 | -0,70 | 0,3408 | -0,0056 | |||||

| US195325EL56 / Colombia Government International Bond | 0,56 | 0,00 | 0,3378 | -0,0033 | |||||

| Saluda Grade Alternative Mortgage Trust, Series 2024-RTL4, Class A1 / ABS-MBS (US79584CAA99) | 0,56 | 0,18 | 0,3348 | -0,0024 | |||||

| XS2064786754 / Ivory Coast Government International Bond | 0,56 | -41,87 | 0,3345 | -0,2466 | |||||

| GNMA, Series 2024-186 / ABS-MBS (US38384XVG59) | 0,54 | -2,86 | 0,3265 | -0,0126 | |||||

| US17312EAE68 / Citigroup Mortgage Loan Trust, Inc. | 0,54 | -0,55 | 0,3247 | -0,0047 | |||||

| XS2010026305 / Hungary Government International Bond | 0,53 | 168,34 | 0,3205 | 0,1999 | |||||

| US38383FDA84 / Government National Mortgage Association, Series 2021-214, Class AI | 0,53 | -1,87 | 0,3153 | -0,0091 | |||||

| US20753VBE74 / Connecticut Avenue Securities Trust 2020-SBT1 | 0,52 | -0,38 | 0,3140 | -0,0048 | |||||

| XS0240295575 / Iraq International Bond | 0,52 | 36,15 | 0,3096 | 0,0801 | |||||

| US62547NAB55 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,51 | -3,58 | 0,3070 | -0,0146 | |||||

| US38383VL975 / GNMA CMO IO | 0,51 | 5,82 | 0,3055 | 0,0141 | |||||

| US88167AAR23 / Teva Pharmaceutical Finance Netherlands III BV | 0,51 | 1,60 | 0,3050 | 0,0019 | |||||

| US63861CAE93 / Nationstar Mortgage Holdings Inc | 0,51 | 1,60 | 0,3045 | 0,0019 | |||||

| US38382RRP54 / GNMA CMO IO | 0,51 | -2,32 | 0,3030 | -0,0101 | |||||

| GNMA, Series 2020-13, Class AI / ABS-MBS (US38382CCP41) | 0,50 | -3,28 | 0,3011 | -0,0134 | |||||

| US61690FAS20 / Morgan Stanley Bank of America Merrill Lynch Trust 2015-C22 | 0,50 | 0,40 | 0,2995 | -0,0016 | |||||

| US501797AL82 / L Brands Inc | 0,50 | 2,47 | 0,2987 | 0,0042 | |||||

| US49272YAB92 / Kevlar SpA | 0,49 | 1,24 | 0,2935 | 0,0007 | |||||

| USP3579ECB13 / Dominican Republic International Bond | 0,49 | 46,99 | 0,2926 | 0,0915 | |||||

| BBD.A / Bombardier Inc. | 0,48 | 4,54 | 0,2905 | 0,0101 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,48 | -3,03 | 0,2881 | -0,0118 | |||||

| US01741RAL69 / Allegheny Technologies, Inc. | 0,48 | 2,78 | 0,2878 | 0,0053 | |||||

| Jefferson Capital Holdings LLC / DBT (US472481AB63) | 0,48 | -0,63 | 0,2854 | -0,0046 | |||||

| US87724RAJ14 / Taylor Morrison Communities Inc | 0,48 | 3,71 | 0,2850 | 0,0074 | |||||

| THC / Tenet Healthcare Corporation | 0,47 | 2,17 | 0,2822 | 0,0028 | |||||

| US92332YAB74 / Venture Global LNG, Inc. | 0,47 | 2,41 | 0,2802 | 0,0040 | |||||

| US00914AAT97 / AIR LEASE CORPORATION | 0,47 | 0,43 | 0,2790 | -0,0014 | |||||

| White Cap Supply Holdings LLC, First Lien, CME Term Loan, C / LON (US96350TAH32) | 0,46 | 0,2784 | 0,2784 | ||||||

| XS2366832496 / Benin Government International Bond | 0,46 | -21,26 | 0,2780 | -0,0781 | |||||

| US71713UAW27 / Pharmacia LLC | 0,46 | 0,00 | 0,2767 | -0,0023 | |||||

| US83283WAE30 / Smyrna Ready Mix Concrete LLC | 0,46 | 1,10 | 0,2766 | 0,0006 | |||||

| US49461MAA80 / Kinetik Holdings LP | 0,46 | 2,00 | 0,2751 | 0,0025 | |||||

| XS1807300105 / KazMunayGas National Co JSC | 0,45 | 2,02 | 0,2721 | 0,0027 | |||||

| US69331CAJ71 / PG&E Corp | 0,45 | -0,88 | 0,2713 | -0,0048 | |||||

| US78419CAD65 / SG Commercial Mortgage Securities Trust 2016-C5 | 0,45 | 0,45 | 0,2684 | -0,0013 | |||||

| US06051GLC14 / BANK OF AMERICA CORP | 0,45 | 0,22 | 0,2682 | -0,0022 | |||||

| Jane Street Group / JSG Finance, Inc. / DBT (US47077WAE84) | 0,45 | 0,2682 | 0,2682 | ||||||

| US1248EPCQ45 / CCO Holdings LLC / CCO Holdings Capital Corp | 0,45 | 76,59 | 0,2667 | 0,1140 | |||||

| XS2580269426 / Serbia International Bond | 0,44 | 0,91 | 0,2666 | 0,0004 | |||||

| US3137FVT288 / FHLMC CMO IO | 0,44 | -10,71 | 0,2654 | -0,0345 | |||||

| US36253GAK85 / GS Mortgage Securities Trust 2014-GC24 | 0,44 | 0,68 | 0,2646 | -0,0008 | |||||

| AES Andes SA / DBT (US00111VAD91) | 0,44 | 90,04 | 0,2631 | 0,1229 | |||||

| XS2571923007 / Romanian Government International Bond | 0,44 | 2,10 | 0,2624 | 0,0026 | |||||

| BBCMS Mortgage Trust, Series 2024-5C29, Class XA / ABS-MBS (US05555PAD42) | 0,44 | -5,42 | 0,2614 | -0,0177 | |||||

| US94989VAD10 / Wells Fargo Commercial Mortgage Trust 2015-NXS3 | 0,44 | 0,46 | 0,2608 | -0,0016 | |||||

| US927804GB45 / Virginia Electric & Power Co | 0,43 | 1,41 | 0,2590 | 0,0009 | |||||

| US366651AG25 / Gartner Inc | 0,43 | 0,94 | 0,2566 | -0,0001 | |||||

| US925650AC72 / VICI Properties LP | 0,43 | 1,43 | 0,2563 | 0,0011 | |||||

| US3137FTQF70 / FHLMC CMO IO | 0,43 | -1,84 | 0,2557 | -0,0071 | |||||

| US12629NAJ46 / COMM 2015-DC1 Mortgage Trust | 0,43 | -1,16 | 0,2554 | -0,0057 | |||||

| XS1953057061 / Egypt Government International Bond | 0,42 | 5,49 | 0,2539 | 0,0112 | |||||

| US95000U3E14 / Wells Fargo & Co. | 0,42 | 0,48 | 0,2537 | -0,0011 | |||||

| US04010LBE20 / Ares Capital Corp. | 0,42 | 0,24 | 0,2536 | -0,0022 | |||||

| US718172DA46 / Philip Morris International Inc | 0,42 | 0,72 | 0,2528 | -0,0001 | |||||

| Hyundai Capital America / DBT (US44891ADG94) | 0,42 | 1,20 | 0,2524 | 0,0008 | |||||

| US91087BAR15 / Mexican Government International Bond | 0,42 | -26,96 | 0,2522 | -0,0960 | |||||

| US29278NAG88 / Energy Transfer Operating LP | 0,42 | 1,45 | 0,2517 | 0,0006 | |||||

| GTLS.PRB / Chart Industries, Inc. - Preferred Stock | 0,42 | 0,2509 | 0,2509 | ||||||

| SOP / DIR (N/A) | 0,42 | 0,2497 | 0,2497 | ||||||

| US12515DAU81 / CD 2017-CD4 Mortgage Trust | 0,42 | 1,46 | 0,2497 | 0,0011 | |||||

| US12591VAK70 / Commercial Mortgage Trust, Series 2014-CR16, Class C | 0,42 | 0,48 | 0,2496 | -0,0014 | |||||

| US455780BX36 / Indonesia Government International Bond | 0,41 | 0,74 | 0,2466 | -0,0008 | |||||

| FCFS / FirstCash Holdings, Inc. | 0,41 | 2,24 | 0,2464 | 0,0030 | |||||

| Waste Pro USA, Inc. / DBT (US94107JAC71) | 0,41 | 722,00 | 0,2463 | 0,2159 | |||||

| US20754BAB71 / Connecticut Avenue Securities Trust 2022-R02 | 0,41 | 0,25 | 0,2453 | -0,0017 | |||||

| DIRECTV Financing LLC, First Lien, 2024 Refinancing CME Term Loan, B / LON (US25460HAD44) | 0,41 | -1,92 | 0,2450 | -0,0070 | |||||

| US00206RGL06 / AT&T Inc | 0,41 | 0,74 | 0,2447 | -0,0007 | |||||

| N1RG34 / NRG Energy, Inc. - Depositary Receipt (Common Stock) | 0,41 | 260,18 | 0,2443 | 0,1758 | |||||

| US983133AC37 / Wynn Resorts Finance LLC / Wynn Resorts Capital Corp | 0,41 | 462,50 | 0,2430 | 0,1991 | |||||

| US03027XAX84 / AMERICAN TOWER CORP SR UNSECURED 01/27 2.75 | 0,40 | 0,76 | 0,2399 | -0,0003 | |||||

| US12532BAD91 / CFCRE Commercial Mortgage Trust 2016-C7 | 0,40 | 0,76 | 0,2393 | -0,0004 | |||||

| US94989WAS61 / Wells Fargo Commercial Mortgage Trust 2015-C31 | 0,40 | 0,25 | 0,2381 | -0,0015 | |||||

| US35640YAL11 / CORP. NOTE | 0,39 | 0,51 | 0,2360 | -0,0008 | |||||

| US3137HANZ52 / FHLMC CMO IO | 0,39 | 3,97 | 0,2358 | 0,0067 | |||||

| LSTAR Commercial Mortgage Trust, Series 2017-5, Class A5 / ABS-MBS (US54910TAJ16) | 0,39 | 0,78 | 0,2338 | -0,0007 | |||||

| XS2580270275 / Serbia International Bond | 0,39 | 2,36 | 0,2337 | 0,0029 | |||||

| Petronas Capital Ltd. / DBT (US716743AV14) | 0,39 | 1,57 | 0,2324 | 0,0016 | |||||

| HRI / Herc Holdings Inc. | 0,39 | 0,2324 | 0,2324 | ||||||

| US38382LDU26 / GNMA CMO IO | 0,39 | -1,53 | 0,2322 | -0,0059 | |||||

| US715638DF60 / Peruvian Government International Bond | 0,39 | 2,12 | 0,2314 | 0,0027 | |||||

| US30711XBQ60 / CORP CMO | 0,38 | -2,29 | 0,2306 | -0,0075 | |||||

| US73928RAB24 / Power Finance Corp Ltd | 0,38 | 0,79 | 0,2299 | -0,0001 | |||||

| BANK, Series 2024-BNK48, Class XA / ABS-MBS (US06541GAN79) | 0,38 | -2,34 | 0,2248 | -0,0076 | |||||

| US060335AB23 / Banijay Entertainment SASU | 0,37 | 0,81 | 0,2240 | -0,0002 | |||||

| XS2010028939 / Republic of Armenia International Bond | 0,37 | 90,77 | 0,2232 | 0,1050 | |||||

| US38382LMH14 / GNMA CMO IO | 0,37 | -7,27 | 0,2219 | -0,0196 | |||||

| US3137FYLH76 / FHLMC CMO IO | 0,37 | 0,83 | 0,2192 | -0,0000 | |||||

| XS1319820897 / Southern Gas Corridor CJSC | 0,37 | 0,55 | 0,2188 | -0,0013 | |||||

| US35563PCF45 / Seasoned Credit Risk Transfer Trust Series 2017-3 | 0,36 | -3,96 | 0,2187 | -0,0112 | |||||

| Philippines Government Bond / DBT (US718286DG92) | 0,36 | 0,83 | 0,2175 | -0,0004 | |||||

| Carnival Corp., First Lien, 2025 Repricing Advance CME Term Loan / LON (XAP2121YAY40) | 0,36 | 0,2165 | 0,2165 | ||||||

| XS1602130947 / LEVI STRAUSS 3.375 3/27 | 0,36 | 9,12 | 0,2156 | 0,0165 | |||||

| US08263DAA46 / Benteler International AG | 0,36 | 0,28 | 0,2146 | -0,0016 | |||||

| US38382QX212 / GNMA CMO IO | 0,36 | -1,10 | 0,2145 | -0,0049 | |||||

| US3137FUAM68 / Freddie Mac REMICS | 0,35 | -1,40 | 0,2103 | -0,0055 | |||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 0,35 | 2,67 | 0,2073 | 0,0033 | |||||

| AAdvantage Loyalty IP Ltd., First Lien, CME Term Loan / LON (US02376CBS35) | 0,35 | 0,2069 | 0,2069 | ||||||

| Bulgaria Government Bond / DBT (XS2890420834) | 0,34 | 11,40 | 0,2051 | 0,0192 | |||||

| Cloud Software Group, Inc., First Lien, Initial Dollar CME Term Loan, B / LON (US88632NBF69) | 0,34 | 0,2049 | 0,2049 | ||||||

| XS2335148024 / Constellium SE | 0,34 | 12,21 | 0,2042 | 0,0204 | |||||

| XS1953916290 / Republic of Uzbekistan Bond | 0,34 | 3,98 | 0,2038 | 0,0058 | |||||

| US576485AF30 / Matador Resources Co | 0,34 | 0,59 | 0,2036 | -0,0005 | |||||

| XAC0787FAB85 / Bausch + Lomb Corp | 0,34 | 0,2014 | 0,2014 | ||||||

| US12592LBP67 / COMM 2014-CCRE20 Mortgage Trust | 0,33 | -0,60 | 0,1982 | -0,0032 | |||||

| XS2706258436 / Energo-Pro A/S | 0,32 | 0,31 | 0,1929 | -0,0010 | |||||

| Raizen Fuels Finance SA / DBT (US75102XAF33) | 0,32 | 0,1905 | 0,1905 | ||||||

| Benchmark Mortgage Trust, Series 2024-V10, Class XA / ABS-MBS (US08163UAD19) | 0,31 | -3,98 | 0,1887 | -0,0093 | |||||

| XS2318315921 / Asian Infrastructure Investment Bank/The | 0,31 | 4,33 | 0,1880 | 0,0063 | |||||

| XS2582981952 / Transnet SOC Ltd | 0,31 | 1,64 | 0,1862 | 0,0012 | |||||

| US3136B66Y43 / FNMA CMO IO | 0,31 | -0,32 | 0,1856 | -0,0022 | |||||

| XS2231188876 / Vmed O2 UK Financing I PLC | 0,31 | 13,19 | 0,1852 | 0,0198 | |||||

| US38382WSM00 / GNMA CMO IO | 0,31 | 1,66 | 0,1843 | 0,0010 | |||||

| BANK5, Series 2024-5YR10, Class XA / ABS-MBS (US06604AAH77) | 0,31 | -4,08 | 0,1837 | -0,0095 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBL81) | 0,31 | 1,33 | 0,1829 | 0,0003 | |||||

| SOP / DIR (N/A) | 0,31 | 0,1828 | 0,1828 | ||||||

| US38382FGP36 / GNMA CMO IO | 0,30 | -4,46 | 0,1798 | -0,0104 | |||||

| US836205AY00 / Republic of South Africa Government International Bond | 0,30 | 2,75 | 0,1792 | 0,0027 | |||||

| ECPG / Encore Capital Group, Inc. | 0,30 | 0,1786 | 0,1786 | ||||||

| XS2360598630 / Republic of Cameroon International Bond | 0,30 | 8,06 | 0,1773 | 0,0121 | |||||

| XS2113615228 / Gabon Government International Bond | 0,30 | 1,72 | 0,1770 | 0,0015 | |||||

| CCO / Clear Channel Outdoor Holdings, Inc. | 0,29 | 50,00 | 0,1764 | 0,0577 | |||||

| US3137FJK993 / FHLMC CMO IO | 0,29 | 3,55 | 0,1754 | 0,0046 | |||||

| US3136AWLE51 / FNMA CMO IO | 0,29 | 0,69 | 0,1744 | -0,0010 | |||||

| US76774LAC19 / Ritchie Bros Holdings Inc | 0,29 | 0,35 | 0,1741 | -0,0009 | |||||

| USP3579EBV85 / Dominican Republic International Bond | 0,29 | 0,70 | 0,1721 | -0,0007 | |||||

| US61762MBC47 / Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C10, Class D | 0,29 | 2,14 | 0,1717 | 0,0024 | |||||

| US257867BA88 / Rr Donnelley & Sons Bond | 0,29 | 43,94 | 0,1709 | 0,0509 | |||||

| US83001AAD46 / Six Flags Entertainment Corp | 0,28 | 2,17 | 0,1694 | 0,0023 | |||||

| US32052MAE12 / FIRST HORIZON ALTERNATIVE MORT FHAMS 2006 AA6 2A1 | 0,28 | -2,45 | 0,1674 | -0,0061 | |||||

| US35564KFH77 / FREDDIE MAC STACR REMIC TRUST 2021-DNA3 SER 2021-DNA3 CL B2 V/R REGD 144A P/P 6.26000000 | 0,28 | 1,09 | 0,1668 | -0,0001 | |||||

| US61767FBF71 / Morgan Stanley Capital I Trust, Series 2016-UB11, Class C | 0,28 | 0,73 | 0,1659 | -0,0001 | |||||

| US12592GAG82 / Commercial Mortgage Trust, Series 2014-CR19, Class D | 0,28 | -30,30 | 0,1658 | -0,0743 | |||||

| US17323CAN74 / Citigroup Commercial Mortgage Trust 2015-GC27 | 0,27 | -4,53 | 0,1644 | -0,0093 | |||||

| Protective Life Global Funding / DBT (US74368CBV54) | 0,27 | 0,74 | 0,1644 | -0,0006 | |||||

| BMO Mortgage Trust, Series 2024-5C6, Class XA / ABS-MBS (US05593QAD60) | 0,27 | -5,52 | 0,1642 | -0,0114 | |||||

| US3137G0HM48 / CORP CMO | 0,27 | -2,50 | 0,1641 | -0,0055 | |||||

| SOP / DIR (N/A) | 0,27 | 0,1640 | 0,1640 | ||||||

| US842587DS35 / Southern Co. (The) | 0,27 | 0,75 | 0,1622 | -0,0000 | |||||

| US857691AH24 / Station Casinos LLC | 0,27 | 4,30 | 0,1601 | 0,0050 | |||||

| IRB Holding Corp., First Lien, 2024 Second Replacement CME Term Loan, B / LON (US44988LAL18) | 0,27 | 0,1591 | 0,1591 | ||||||

| FR001400F2R8 / Air France-KLM | 0,26 | 9,09 | 0,1585 | 0,0121 | |||||

| US94989QBA76 / Wells Fargo Commercial Mortgage Trust 2015-SG1 | 0,26 | 0,38 | 0,1581 | -0,0005 | |||||

| US92840VAH50 / VISTRA OPERATIONS CO LLC 4.375% 05/01/2029 144A | 0,26 | 2,73 | 0,1578 | 0,0025 | |||||

| US227046AB51 / Crocs Inc | 0,26 | 1,95 | 0,1567 | 0,0017 | |||||

| GNMA, Series 2024-4, Class IG / ABS-MBS (US38384HZW14) | 0,26 | -1,14 | 0,1565 | -0,0032 | |||||

| US3136B1S470 / FNMA CMO IO | 0,26 | 1,56 | 0,1561 | 0,0010 | |||||

| US91087BAM28 / Mexico Government International Bond | 0,26 | 0,1559 | 0,1559 | ||||||

| US428102AE79 / Hess Midstream Operations LP | 0,26 | 1,97 | 0,1557 | 0,0019 | |||||

| US36198EAP07 / GS MTG SECS TR 2013-GC13 AS CSTR 07/10/2046 144A | 0,26 | -7,19 | 0,1547 | -0,0140 | |||||

| Montenegro Government Bond / DBT (XS3037625400) | 0,26 | 10,30 | 0,1540 | 0,0129 | |||||

| MPT Operating Partnership LP / MPT Finance Corp. / DBT (US55342UAQ76) | 0,26 | 62,03 | 0,1538 | 0,0582 | |||||

| US50205BAA17 / CORP CMO | 0,25 | -0,78 | 0,1528 | -0,0021 | |||||

| CSTM / Constellium SE | 0,25 | 4,10 | 0,1524 | 0,0046 | |||||

| US577081BF84 / Mattel Inc | 0,25 | 1,20 | 0,1523 | 0,0002 | |||||

| CDI / DCR (N/A) | 0,25 | 0,1522 | 0,1522 | ||||||

| KMIC34 / Kinder Morgan, Inc. - Depositary Receipt (Common Stock) | 0,25 | 0,40 | 0,1522 | -0,0004 | |||||

| US69007TAB08 / Outfront Media Capital LLC / Outfront Media Capital Corp | 0,25 | 1,20 | 0,1521 | 0,0004 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,25 | 32,63 | 0,1516 | 0,0366 | |||||

| Sinclair Television Group, Inc. / DBT (US829259BH26) | 0,25 | 31,25 | 0,1515 | 0,0350 | |||||

| US03674XAS53 / ANTERO RESOURCES CORP 5.375% 03/01/2030 144A | 0,25 | 2,45 | 0,1508 | 0,0023 | |||||

| GNMA, Series 2024-32 / ABS-MBS (US38381J2J58) | 0,25 | -2,34 | 0,1502 | -0,0051 | |||||

| US200474BF05 / COMM Mortgage Trust | 0,25 | 0,40 | 0,1497 | -0,0008 | |||||

| US71654QDB59 / Petroleos Mexicanos | 0,25 | 33,33 | 0,1491 | 0,0365 | |||||

| US073685AD12 / Beacon Roofing Supply Inc 4.875% 11/01/2025 144a Bond | 0,25 | 0,1485 | 0,1485 | ||||||

| US3137FQNN92 / FHLMC CMO IO | 0,25 | 0,82 | 0,1482 | -0,0000 | |||||

| US201723AR41 / Commercial Metals Co | 0,25 | 2,07 | 0,1475 | 0,0012 | |||||

| US35566ABE82 / CORP CMO | 0,25 | 1,24 | 0,1470 | 0,0002 | |||||

| US836205BC70 / Republic of South Africa Government International Bond | 0,25 | 3,38 | 0,1468 | 0,0029 | |||||

| SOP / DIR (N/A) | 0,25 | 0,1468 | 0,1468 | ||||||

| US38380YYA71 / GNMA CMO IO | 0,24 | -2,40 | 0,1467 | -0,0051 | |||||

| US61765TAM53 / Morgan Stanley Bank of America Merrill Lynch Trust 2015-C25 | 0,24 | 1,67 | 0,1457 | 0,0008 | |||||

| US36264FAL58 / GSK Consumer Healthcare Capital US LLC | 0,24 | 1,26 | 0,1449 | 0,0003 | |||||

| US35563FAB76 / FHLMC Multifamily Structured Pass-Through Certificates, Series 2021-MN1, Class M2 | 0,24 | -1,23 | 0,1447 | -0,0034 | |||||

| US12591YBD67 / COMM 2014-UBS3 MORTGAGE TRUST COMM 2014-UBS3 AM | 0,24 | -10,41 | 0,1446 | -0,0182 | |||||

| Phoenix Newco, Inc., First Lien, Sixth Amendment CME Term Loan / LON (US71911KAE47) | 0,24 | 0,00 | 0,1441 | -0,0014 | |||||

| US12769GAB68 / Caesars Entertainment, Inc. | 0,24 | 2,13 | 0,1440 | 0,0017 | |||||

| BANK5, Series 2024-5YR7, Class XA / ABS-MBS (US06211UBR59) | 0,24 | -5,88 | 0,1440 | -0,0105 | |||||

| US279158AS81 / Ecopetrol SA | 0,24 | -56,67 | 0,1423 | -0,1888 | |||||

| Cogent Communications Group LLC / Cogent Finance, Inc. / DBT (US19240WAB54) | 0,24 | 0,1418 | 0,1418 | ||||||

| Nouryon Finance BV, First Lien, Term Loan, B / LON (N/A) | 0,24 | 0,1418 | 0,1418 | ||||||

| US38382RPZ54 / GNMA CMO IO | 0,24 | -1,67 | 0,1418 | -0,0036 | |||||

| 743424AA1 / Proofpoint, Inc. 1.25% Convertible Bond due 2018-12-15 | 0,24 | 0,00 | 0,1412 | -0,0015 | |||||

| US90276GAY89 / UBS Commercial Mortgage Trust 2017-C3 | 0,23 | 1,30 | 0,1402 | 0,0008 | |||||

| US38382GXV93 / GNMA CMO IO | 0,23 | 6,39 | 0,1402 | 0,0076 | |||||

| US12631DAG88 / COMM 2014-CCRE17 Mortgage Trust | 0,23 | -2,11 | 0,1394 | -0,0043 | |||||

| Chobani LLC, First Lien, 2025 New CME Term Loan / LON (US17026YAK55) | 0,23 | 0,1381 | 0,1381 | ||||||

| US389376AZ77 / Gray Television Inc | 0,23 | 5,56 | 0,1371 | 0,0061 | |||||

| US38382FGY43 / GNMA CMO IO | 0,23 | -1,31 | 0,1355 | -0,0035 | |||||

| GA Global Funding Trust / DBT (US36143L2N47) | 0,22 | 0,45 | 0,1346 | -0,0007 | |||||

| Benchmark Mortgage Trust, Series 2024-V11, Class XA / ABS-MBS (US081921BA52) | 0,22 | -5,08 | 0,1346 | -0,0085 | |||||

| US38381W6R40 / GNMA CMO IO | 0,22 | 2,28 | 0,1342 | 0,0011 | |||||

| Wells Fargo Commercial Mortgage Trust, Series 2024-5C1, Class XA / ABS-MBS (US95003VAD01) | 0,22 | -5,91 | 0,1338 | -0,0096 | |||||

| US38382FGR91 / GNMA CMO IO | 0,22 | 0,91 | 0,1329 | -0,0001 | |||||

| US126281BD56 / CSAIL 2015-C1 Commercial Mortgage Trust | 0,22 | -3,95 | 0,1316 | -0,0064 | |||||

| Vistra Operations Co. LLC / DBT (US92840VAR33) | 0,22 | 2,34 | 0,1316 | 0,0020 | |||||

| US12592KBE38 / Commercial Mortgage Trust, Series 2014-UBS5, Class AM | 0,22 | -3,96 | 0,1307 | -0,0069 | |||||

| US87264ACA16 / T-MOBILE USA INC 2.05% 02/15/2028 | 0,22 | 1,40 | 0,1303 | 0,0003 | |||||

| Caesars Entertainment, Inc., First Lien, CME Term Loan, B1 / LON (US12768EAH99) | 0,22 | 0,1303 | 0,1303 | ||||||

| US12668AEV35 / CORP CMO | 0,22 | -2,26 | 0,1300 | -0,0037 | |||||

| Aris Water Holdings LLC / DBT (US04041NAA00) | 0,22 | 0,1299 | 0,1299 | ||||||

| US38381XK399 / GNMA CMO IO | 0,22 | -1,37 | 0,1299 | -0,0029 | |||||

| US045054AJ25 / Ashtead Capital Inc | 0,22 | 1,41 | 0,1299 | 0,0007 | |||||

| US103304BV23 / BOYD GAMING CORP 4.75% 06/15/2031 144A | 0,22 | 3,86 | 0,1293 | 0,0037 | |||||

| TEX / Terex Corporation | 0,22 | 270,69 | 0,1292 | 0,0939 | |||||

| Allied Universal Holdco LLC / DBT (US019576AD90) | 0,21 | 3,38 | 0,1284 | 0,0027 | |||||

| US928668BN15 / VOLKSWAGEN GROUP AMER FIN LLC 1.625% 11/24/2027 144A | 0,21 | 1,42 | 0,1283 | 0,0004 | |||||

| US06051GGC78 / Bank of America Corp | 0,21 | 0,47 | 0,1283 | -0,0006 | |||||

| Aviation Capital Group LLC / DBT (US05369AAQ40) | 0,21 | 0,95 | 0,1282 | 0,0001 | |||||

| US31556PAB31 / Fertitta Entertainment LLC, Term Loan B | 0,21 | 0,1282 | 0,1282 | ||||||

| Zegona Finance plc / DBT (US98927UAA51) | 0,21 | 0,47 | 0,1282 | -0,0002 | |||||

| US88947EAU47 / Toll Brothers Finance Corp | 0,21 | 1,91 | 0,1280 | 0,0011 | |||||

| MSI / Motorola Solutions, Inc. - Depositary Receipt (Common Stock) | 0,21 | 0,47 | 0,1279 | -0,0005 | |||||

| GEHC34 / GE HealthCare Technologies Inc. - Depositary Receipt (Common Stock) | 0,21 | 1,43 | 0,1277 | 0,0002 | |||||

| McAfee Corp., First Lien, CME Term Loan, B1 / LON (US57906HAF47) | 0,21 | 0,1277 | 0,1277 | ||||||

| US401494AX79 / GOVERNMENT BOND | 0,21 | 0,1276 | 0,1276 | ||||||

| US210385AB64 / CONSTELLATION ENERGY GENERATION | 0,21 | 0,95 | 0,1271 | -0,0003 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,21 | 0,48 | 0,1269 | -0,0008 | |||||

| US00135TAD63 / AIB Group PLC | 0,21 | 0,00 | 0,1268 | -0,0009 | |||||

| US29450YAA73 / EquipmentShare.com, Inc. | 0,21 | 1,93 | 0,1267 | 0,0013 | |||||

| US264399DK95 / Duke Energy Corp 6.000% Senior Notes 12/01/28 | 0,21 | 0,48 | 0,1266 | -0,0005 | |||||

| RHP Hotel Properties LP / RHP Finance Corp. / DBT (US749571AK15) | 0,21 | 2,94 | 0,1264 | 0,0025 | |||||

| Athene Global Funding / DBT (US04685A3Q28) | 0,21 | 0,48 | 0,1263 | -0,0004 | |||||

| South Bow USA Infrastructure Holdings LLC / DBT (US83007CAC64) | 0,21 | 0,96 | 0,1263 | 0,0002 | |||||

| US00973RAL78 / Aker BP ASA | 0,21 | 0,48 | 0,1262 | -0,0005 | |||||

| US77289KAA34 / Rockcliff Energy II LLC | 0,21 | 3,45 | 0,1261 | 0,0027 | |||||

| US87612GAE17 / Targa Resources Corp | 0,21 | 0,48 | 0,1261 | -0,0005 | |||||

| Miter Brands Acquisition Holdco, Inc. / MIWD Borrower LLC / DBT (US60672JAA79) | 0,21 | 3,45 | 0,1261 | 0,0031 | |||||

| US30040WAT53 / Eversource Energy | 0,21 | 0,48 | 0,1261 | -0,0007 | |||||

| US92676XAG25 / Viking Cruises Ltd | 0,21 | 5,53 | 0,1259 | 0,0065 | |||||

| Rocket Cos., Inc. / DBT (US77311WAB72) | 0,21 | 0,1258 | 0,1258 | ||||||

| US45827MAA53 / Intelligent Packaging Ltd Finco Inc / Intelligent Packaging Ltd Co-Issuer LLC | 0,21 | 2,94 | 0,1258 | 0,0021 | |||||

| US81180WBM29 / Seagate HDD Cayman | 0,21 | 0,00 | 0,1257 | -0,0010 | |||||

| US30190AAC80 / F&G Annuities & Life Inc | 0,21 | 0,48 | 0,1256 | -0,0007 | |||||

| US09739DAD21 / Boise Cascade Co | 0,21 | 2,96 | 0,1254 | 0,0023 | |||||

| US64952WFD02 / NEW YORK LIFE GLOBAL FUNDING 144A LIFE SR SEC 1ST LIEN 4.9% 06-13-28 | 0,21 | 0,97 | 0,1254 | -0,0004 | |||||

| US12634NAY40 / Csail 2015-C2 Commercial Mortgage Trust | 0,21 | 0,00 | 0,1252 | -0,0016 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 0,21 | 0,00 | 0,1252 | -0,0008 | |||||

| US44701QBE17 / Huntsman International LLC | 0,21 | -1,42 | 0,1251 | -0,0026 | |||||

| OneSky Flight LLC / DBT (US68278CAA36) | 0,21 | 65,08 | 0,1249 | 0,0484 | |||||

| US12803RAA23 / CaixaBank SA | 0,21 | 0,00 | 0,1246 | -0,0009 | |||||

| Beach Acquisition Bidco LLC / DBT (US07337JAC18) | 0,21 | 0,1245 | 0,1245 | ||||||

| US038522AQ17 / Aramark Services Inc | 0,21 | 1,47 | 0,1242 | 0,0006 | |||||

| US694308KL02 / Pacific Gas and Electric Co | 0,21 | 0,49 | 0,1242 | -0,0008 | |||||

| Acrisure LLC / Acrisure Finance, Inc. / DBT (US00489LAL71) | 0,21 | 1,48 | 0,1239 | 0,0007 | |||||

| XS2602742285 / Jordan Government International Bond | 0,21 | 2,50 | 0,1232 | 0,0019 | |||||

| US46641JAE64 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,21 | 0,99 | 0,1232 | 0,0001 | |||||

| US74166MAE66 / PRIME SECSRVC BRW / FINANC | 0,21 | 0,00 | 0,1231 | -0,0011 | |||||

| Filtration Group Corp., First Lien, 2025 Incremental Dollar CME Term Loan / LON (US31732FAV85) | 0,21 | 0,1231 | 0,1231 | ||||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 0,21 | 0,99 | 0,1231 | -0,0001 | |||||

| Clydesdale Acquisition Holdings, Inc. / DBT (US18972EAD76) | 0,21 | 64,00 | 0,1231 | 0,0469 | |||||

| US146869AL63 / Carvana Co. | 0,21 | 0,1230 | 0,1230 | ||||||

| US00928QAT85 / Aircastle Ltd | 0,20 | -0,49 | 0,1228 | -0,0013 | |||||

| Novelis Corp. / DBT (US670001AL04) | 0,20 | 158,23 | 0,1227 | 0,0748 | |||||

| Phoenix Guarantor, Inc., First Lien, CME Term Loan, B5 / LON (US71913BAK89) | 0,20 | 0,50 | 0,1221 | -0,0003 | |||||

| US71568QAE70 / Perusahaan Listrik Negara PT | 0,20 | 0,50 | 0,1221 | -0,0002 | |||||

| US11134LAH24 / Broadcom Corp / Broadcom Cayman Finance Ltd | 0,20 | 0,50 | 0,1220 | -0,0006 | |||||

| Chobani LLC / Chobani Finance Corp., Inc. / DBT (US17027NAC65) | 0,20 | 0,1219 | 0,1219 | ||||||

| US12636LAY65 / CSAIL Commercial Mortgage Trust, Series 2016-C5, Class A5 | 0,20 | -4,69 | 0,1218 | -0,0071 | |||||

| Scientific Games Holdings LP, First Lien, 2024 Refinancing Dollar CME Term Loan / LON (US80875CAE75) | 0,20 | 0,50 | 0,1216 | -0,0009 | |||||

| IHS / IHS Holding Limited | 0,20 | 1,51 | 0,1213 | 0,0008 | |||||

| US64072UAK88 / CSC Holdings, LLC, Term Loan | 0,20 | 3,59 | 0,1212 | 0,0027 | |||||

| Pertamina Hulu Energi PT / DBT (US74448WAA27) | 0,20 | 0,1211 | 0,1211 | ||||||

| Quikrete Holdings, Inc., First Lien, CME Term Loan, B2 / LON (US74839XAK54) | 0,20 | 1,00 | 0,1211 | -0,0004 | |||||

| US48020RAB15 / Jones Deslauriers Insurance Management Inc | 0,20 | 1,01 | 0,1208 | -0,0001 | |||||

| US35563WBE30 / STACR Trust 2018-DNA3 | 0,20 | 0,50 | 0,1206 | -0,0007 | |||||

| US026932AC79 / CORP CMO | 0,20 | -1,97 | 0,1198 | -0,0036 | |||||

| US92676XAG25 / Viking Cruises Ltd | 0,20 | 1,02 | 0,1195 | -0,0002 | |||||

| US105756CF53 / Brazilian Government International Bond | 0,20 | 2,06 | 0,1191 | 0,0011 | |||||

| WEC US Holdings, Inc., First Lien, Initial CME Term Loan / LON (US92943LAC46) | 0,20 | 0,1191 | 0,1191 | ||||||

| US948565AD85 / Weekley Homes LLC / Weekley Finance Corp | 0,20 | 2,06 | 0,1191 | 0,0012 | |||||

| US12635QBL32 / COMM 2015-CCRE27 Mortgage Trust | 0,20 | 0,51 | 0,1189 | -0,0004 | |||||

| Alliant Holdings Intermediate LLC, First Lien, Initial CME Term Loan / LON (US01881UAM71) | 0,20 | 0,51 | 0,1188 | -0,0004 | |||||

| US71677HAL96 / PetSmart, Inc., Term Loan B | 0,20 | 0,00 | 0,1186 | -0,0008 | |||||

| US55759VAB45 / MADISON IAQ LLC | 0,20 | 0,51 | 0,1185 | -0,0000 | |||||

| US23329PAB67 / DNB Bank ASA | 0,20 | 0,1184 | 0,1184 | ||||||

| US893647BS53 / TransDigm Inc | 0,20 | 1,55 | 0,1182 | 0,0006 | |||||

| US89177JAB44 / Towd Point Mortgage Trust 2019-2 | 0,20 | 0,00 | 0,1170 | -0,0010 | |||||

| US71643VAB18 / Petroleos Mexicanos | 0,20 | 5,98 | 0,1170 | 0,0053 | |||||

| Crescent Energy Finance LLC / DBT (US45344LAG86) | 0,20 | 0,1170 | 0,1170 | ||||||

| US95000CBJ18 / Wells Fargo Commercial Mortgage Trust 2016-NXS5 | 0,19 | 4,30 | 0,1168 | 0,0042 | |||||

| US38381YWU45 / GNMA CMO IO | 0,19 | -3,00 | 0,1163 | -0,0047 | |||||

| EMRLD Borrower LP, First Lien, Second Amendment Incremental CME Term Loan / LON (US26872NAD12) | 0,19 | 0,1162 | 0,1162 | ||||||

| BBCMS Mortgage Trust, Series 2024-C26, Class XA / ABS-MBS (US05555AAF21) | 0,19 | -2,03 | 0,1160 | -0,0037 | |||||

| US02146BAA44 / CORP CMO | 0,19 | -3,52 | 0,1154 | -0,0055 | |||||

| C2AC34 / CACI International Inc - Depositary Receipt (Common Stock) | 0,19 | 0,1145 | 0,1145 | ||||||

| US38381XBN57 / GNMA CMO IO | 0,19 | -3,06 | 0,1143 | -0,0043 | |||||

| Ambipar Lux SARL / DBT (US02319WAB72) | 0,19 | -7,80 | 0,1136 | -0,0105 | |||||

| US20754BAF85 / CAS_22-R02 | 0,19 | 0,00 | 0,1126 | -0,0013 | |||||

| CommScope, Inc., First Lien, Initial CME Term Loan / LON (N/A) | 0,19 | 0,1124 | 0,1124 | ||||||

| SUN / Sunoco LP - Limited Partnership | 0,19 | 49,60 | 0,1122 | 0,0364 | |||||

| DVAI34 / DaVita Inc. - Depositary Receipt (Common Stock) | 0,19 | 0,1118 | 0,1118 | ||||||

| US61767YBE95 / Morgan Stanley Capital I Trust, Series 2018-H3, Class C | 0,19 | 0,54 | 0,1116 | -0,0006 | |||||

| US35563PKR90 / CORP CMO | 0,19 | -37,16 | 0,1116 | -0,0675 | |||||

| Flash Charm, Inc., First Lien, CME Term Loan, B2 / LON (US45168RAT05) | 0,19 | 0,1116 | 0,1116 | ||||||

| Fortress Intermediate 3, Inc., First Lien, Initial CME Term Loan / LON (US34966LAB09) | 0,19 | 0,1110 | 0,1110 | ||||||

| US12667GZ303 / CORP CMO | 0,18 | -2,13 | 0,1108 | -0,0034 | |||||

| US46643ABL61 / JPMBB Commercial Mortgage Securities Trust 2014-C23 | 0,18 | -2,13 | 0,1103 | -0,0039 | |||||

| XHR LP / DBT (US98372MAE57) | 0,18 | 438,24 | 0,1100 | 0,0892 | |||||

| BBCMS Mortgage Trust, Series 2025-C32, Class XA / ABS-MBS (US07337AAJ51) | 0,18 | -2,16 | 0,1089 | -0,0032 | |||||

| US513075BW03 / Lamar Media Corp | 0,18 | 0,1089 | 0,1089 | ||||||

| US61762DAG60 / Morgan Stanley Bank of America Merrill Lynch Trust 2013-C9 | 0,18 | 1,12 | 0,1081 | 0,0002 | |||||

| US12527DAG51 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,18 | 0,56 | 0,1078 | -0,0001 | |||||

| Medline Borrower LP, First Lien, Dollar Incremental CME Term Loan / LON (US58503UAF03) | 0,18 | 0,1078 | 0,1078 | ||||||

| US12629NAH89 / COMM 2015-DC1 Mortgage Trust | 0,18 | 25,17 | 0,1075 | 0,0209 | |||||

| Hunter Douglas, Inc., First Lien, CME Term Loan, B1 / LON (XAN8137FAE06) | 0,18 | 0,1073 | 0,1073 | ||||||

| US94989XBC83 / Wells Fargo Commercial Mortgage Trust, Series 2015-NXS4, Class A4 | 0,18 | 0,57 | 0,1062 | -0,0007 | |||||

| US46640LAN29 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,18 | 0,57 | 0,1058 | -0,0006 | |||||

| US61762XAC11 / Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C12, Class D | 0,18 | 2,92 | 0,1056 | 0,0016 | |||||

| Quikrete Holdings, Inc. / DBT (US74843PAB67) | 0,18 | 3,55 | 0,1052 | 0,0027 | |||||

| Endo Finance Holdings, Inc., First Lien, 2024 Refinancing CME Term Loan / LON (US29280UAD54) | 0,17 | 0,1047 | 0,1047 | ||||||

| US35563KBE91 / CORP CMO | 0,17 | -0,57 | 0,1046 | -0,0013 | |||||

| US94989TBB98 / Wells Fargo Commercial Mortgage Trust 2015-LC22 | 0,17 | 0,58 | 0,1044 | -0,0007 | |||||

| US023608AQ57 / Ameren Corp | 0,17 | 1,17 | 0,1037 | -0,0001 | |||||

| US46591ABG94 / JPMDB Commercial Mortgage Securities Trust 2018-C8 | 0,17 | 2,40 | 0,1025 | 0,0014 | |||||

| USP1850NAA92 / Braskem Idesa SAPI | 0,17 | -9,14 | 0,1016 | -0,0114 | |||||

| US75114HAA59 / CORP CMO | 0,17 | 0,60 | 0,1013 | -0,0008 | |||||

| CCO / Clear Channel Outdoor Holdings, Inc. | 0,17 | 0,1013 | 0,1013 | ||||||

| XS2278994418 / BENIN INTL GOV BOND 4.875000% 01/19/2032 | 0,17 | 11,26 | 0,1012 | 0,0097 | |||||

| WestJet Loyalty LP, First Lien, Initial CME Term Loan / LON (XAC9763HAB33) | 0,17 | 3,70 | 0,1010 | 0,0027 | |||||

| US92939FAY51 / WFRBS Commercial Mortgage Trust 2014-C21 | 0,17 | 0,00 | 0,1010 | -0,0010 | |||||

| US38375UG460 / GNMA CMO IO | 0,17 | -9,73 | 0,1006 | -0,0115 | |||||

| SOP / DIR (N/A) | 0,17 | 0,1003 | 0,1003 | ||||||

| US38380CH714 / GNMA CMO IO | 0,17 | -3,47 | 0,1003 | -0,0047 | |||||

| US38379BNA25 / GNMA CMO IO | 0,17 | 0,00 | 0,1003 | -0,0008 | |||||

| US12592XBG07 / COMM 15-CR22 B FRN 03-10-48/03-12-25 | 0,17 | -2,34 | 0,1001 | -0,0035 | |||||

| US38380XSS70 / GNMA CMO IO | 0,17 | -3,49 | 0,0995 | -0,0049 | |||||

| US36257UAN72 / GS Mortgage Securities Trust 2019-GC42 | 0,17 | -5,17 | 0,0991 | -0,0065 | |||||

| US02146QAC78 / CORP CMO | 0,17 | -0,60 | 0,0991 | -0,0019 | |||||

| US07336AAG22 / BBCMS Mortgage Trust 2022-C14 | 0,16 | -3,55 | 0,0981 | -0,0045 | |||||

| US12620BAR15 / CPM Holdings, Inc. 2023 Term Loan | 0,16 | -0,61 | 0,0979 | -0,0016 | |||||

| US46643ABK88 / JPMBB Commercial Mortgage Securities Trust | 0,16 | -2,99 | 0,0975 | -0,0039 | |||||

| US95002MAY57 / Wells Fargo Commercial Mortgage Trust, Series 2019-C52, Class XA | 0,16 | -4,73 | 0,0968 | -0,0058 | |||||

| McGraw-Hill Education, Inc. / DBT (US58064LAA26) | 0,16 | 3,92 | 0,0957 | 0,0025 | |||||

| SOP / DIR (N/A) | 0,16 | 0,0950 | 0,0950 | ||||||

| US46634SAM70 / JP MORGAN CHASE COMMERCIAL MOR JPMCC 2012 C6 E 144A | 0,16 | 0,00 | 0,0941 | -0,0010 | |||||

| US02146BAB27 / CORP CMO | 0,16 | -4,32 | 0,0934 | -0,0048 | |||||

| US06541UCB08 / BANK 2020-BNK30 | 0,15 | -4,35 | 0,0927 | -0,0052 | |||||

| US43730VAE83 / CORP CMO | 0,15 | 0,00 | 0,0917 | -0,0010 | |||||

| Seagate Data Storage Technology Pte. Ltd. / DBT (US81180LAA35) | 0,15 | 0,0914 | 0,0914 | ||||||

| U1AI34 / Under Armour, Inc. - Depositary Receipt (Common Stock) | 0,15 | 0,0912 | 0,0912 | ||||||

| SNOWD / Snowflake Inc. - Depositary Receipt (Common Stock) | 0,15 | 31,03 | 0,0912 | 0,0210 | |||||

| US12591KAG04 / COMM 2013-CCRE12 Mortgage Trust | 0,15 | 0,68 | 0,0895 | -0,0005 | |||||

| US12667GY983 / CORP CMO | 0,15 | -1,99 | 0,0888 | -0,0029 | |||||

| US89115A2V36 / Toronto-Dominion Bank/The | 0,15 | 0,68 | 0,0881 | -0,0008 | |||||

| US61759FAU57 / CORP CMO | 0,15 | -1,35 | 0,0876 | -0,0025 | |||||

| US65249BAA70 / News Corp | 0,14 | -42,80 | 0,0861 | -0,0652 | |||||

| Seagate HDD Cayman / DBT (US81180WBL46) | 0,14 | 16,39 | 0,0852 | 0,0108 | |||||

| US3617LNR973 / GII30 | 0,14 | -1,40 | 0,0850 | -0,0019 | |||||

| US35564LBE65 / CORP CMO | 0,14 | 0,00 | 0,0846 | -0,0007 | |||||

| US36253GAS12 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,14 | 53,85 | 0,0844 | 0,0289 | |||||

| US91282CAY75 / UST NOTES 0.625% 11/30/2027 | 0,14 | 1,45 | 0,0841 | 0,0001 | |||||

| US85205TAR14 / Spirit AeroSystems Inc | 0,14 | 0,0834 | 0,0834 | ||||||

| US90932LAH06 / United Airlines Inc | 0,14 | 246,15 | 0,0815 | 0,0594 | |||||

| US61762MBC47 / Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C10, Class D | 0,14 | 0,75 | 0,0812 | -0,0002 | |||||

| US38379V6K50 / GNMA CMO IO | 0,14 | 0,00 | 0,0809 | -0,0014 | |||||

| US55316HAB15 / GENESEE+WYOMING INC TERM LOAN | 0,13 | 0,0800 | 0,0800 | ||||||

| Standard Building Solutions, Inc. / DBT (US853191AA25) | 0,13 | 2,31 | 0,0799 | 0,0012 | |||||

| US097023CM50 / Boing Company (The) 2.70%, Due 02/01/2027 | 0,13 | 0,76 | 0,0798 | -0,0001 | |||||

| US38379LL461 / GNMA CMO IO | 0,13 | 3,13 | 0,0795 | 0,0018 | |||||

| CDSCMBX / DCR (N/A) | 0,13 | 0,0792 | 0,0792 | ||||||

| TK Elevator Midco GmbH, First Lien, CME Term Loan, B1 / LON (XAD9000BAJ17) | 0,13 | 0,0791 | 0,0791 | ||||||

| US46645LAY39 / JPMBB Commercial Mortgage Securities Trust 2016-C1 | 0,13 | 0,00 | 0,0784 | -0,0004 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,13 | 420,00 | 0,0783 | 0,0630 | |||||

| US30711XDN12 / CORP CMO | 0,13 | -2,29 | 0,0771 | -0,0023 | |||||

| J.P. Morgan Mortgage Trust, Series 2024-9, Class A11 / ABS-MBS (US46593DAX57) | 0,13 | -9,86 | 0,0770 | -0,0090 | |||||

| US38375U6A37 / GNMA CMO IO | 0,13 | -9,22 | 0,0769 | -0,0089 | |||||

| US35564MBE49 / FREDDIE MAC STACR TRUST 2019-HQA2 SER 2019-HQA2 CL B2 V/R REGD 144A P/P 13.07275000 | 0,13 | 0,79 | 0,0769 | -0,0002 | |||||

| US46640LAS16 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,13 | 0,00 | 0,0765 | -0,0004 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 0,13 | 17,59 | 0,0763 | 0,0105 | |||||

| US16678XAB01 / CORP CMO | 0,13 | -1,55 | 0,0763 | -0,0019 | |||||

| US38376RA632 / GNMA CMO IO | 0,13 | -16,11 | 0,0752 | -0,0151 | |||||

| Beach Acquisition Bidco LLC / DBT (XS3109433477) | 0,12 | 0,0747 | 0,0747 | ||||||

| XAC0787FAG72 / BAUSCH + LOMB CORP | 0,12 | 0,00 | 0,0745 | -0,0007 | |||||

| US3136B5A545 / FNMA CMO IO | 0,12 | 1,64 | 0,0744 | -0,0000 | |||||

| MSTRD / Strategy Inc - Depositary Receipt (Common Stock) | 0,12 | 23,00 | 0,0740 | 0,0133 | |||||

| D1LR34 / Digital Realty Trust, Inc. - Depositary Receipt (Common Stock) | 0,12 | 6,03 | 0,0739 | 0,0036 | |||||

| U.S. Treasury 10 Year Ultra Notes / DIR (N/A) | 0,12 | 0,0734 | 0,0734 | ||||||

| US92938CAL19 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,12 | -26,22 | 0,0728 | -0,0264 | |||||

| Stonex Escrow Issuer LLC / DBT (US86189AAA79) | 0,12 | 0,0727 | 0,0727 | ||||||

| US531229AQ58 / CONV. NOTE | 0,12 | 10,00 | 0,0726 | 0,0056 | |||||

| BANK5, Series 2024-5YR12, Class XA / ABS-MBS (US06644XBM74) | 0,12 | -4,72 | 0,0725 | -0,0047 | |||||

| SOP / DIR (N/A) | 0,12 | 0,0717 | 0,0717 | ||||||

| US38382BH894 / GNMA CMO IO | 0,12 | -4,03 | 0,0717 | -0,0037 | |||||

| US377320AA45 / Glatfelter Corp | 0,12 | 0,0716 | 0,0716 | ||||||

| US38378GHA94 / GNMA CMO IO | 0,12 | -3,25 | 0,0716 | -0,0030 | |||||

| US89364MCA09 / TRANSDIGM INC | 0,12 | 0,00 | 0,0712 | -0,0005 | |||||

| US57767XAA81 / Mav Acquisition Corp | 0,12 | 2,63 | 0,0706 | 0,0014 | |||||

| US38378HK703 / GNMA CMO IO | 0,12 | -0,85 | 0,0706 | -0,0011 | |||||

| US94989NAL10 / Wells Fargo Commercial Mortgage Trust 2015-C30 | 0,12 | 0,00 | 0,0705 | -0,0008 | |||||

| US92939HBB06 / WFRBS Commercial Mortgage Trust 2014-C23 | 0,12 | 0,86 | 0,0703 | -0,0004 | |||||

| I1LM34 / Illumina, Inc. - Depositary Receipt (Common Stock) | 0,12 | 0,86 | 0,0702 | -0,0005 | |||||

| US3136B07G54 / FNMA CMO IO | 0,12 | -0,85 | 0,0700 | -0,0008 | |||||

| US55024UAF66 / Lumentum Holdings Inc | 0,12 | 12,62 | 0,0696 | 0,0068 | |||||

| US3136ANRR02 / FNMA CMO IO | 0,11 | -7,38 | 0,0683 | -0,0058 | |||||

| US902252AB17 / Tyler Technologies Inc | 0,11 | 0,91 | 0,0665 | -0,0001 | |||||

| SOP / DIR (N/A) | 0,11 | 0,0661 | 0,0661 | ||||||

| G2WR34 / Guidewire Software, Inc. - Depositary Receipt (Common Stock) | 0,11 | 6,86 | 0,0658 | 0,0039 | |||||

| ITRI / Itron, Inc. | 0,11 | 0,0658 | 0,0658 | ||||||

| US538034BA63 / CONV. NOTE | 0,11 | 11,22 | 0,0655 | 0,0057 | |||||

| D2AS34 / DoorDash, Inc. - Depositary Receipt (Common Stock) | 0,11 | 0,0651 | 0,0651 | ||||||

| Flutter Financing BV, First Lien, 2024 Refinancing CME Term Loan, B / LON (XAN3313EAG51) | 0,11 | 0,0648 | 0,0648 | ||||||

| US89383JAA60 / Transocean Poseidon Ltd | 0,11 | 0,00 | 0,0646 | -0,0001 | |||||

| US12635FAT12 / CSAIL 2015-C3 Commercial Mortgage Trust | 0,11 | 0,0643 | 0,0643 | ||||||

| US12625FBA30 / COMM 2013-CCRE7 Mortgage Trust | 0,11 | -2,75 | 0,0640 | -0,0021 | |||||

| D1EX34 / DexCom, Inc. - Depositary Receipt (Common Stock) | 0,11 | 4,95 | 0,0638 | 0,0026 | |||||

| US86361HAB06 / STRUCTURED ASSET MORTGAGE INVE SAMI 2006 AR7 A1BG | 0,11 | -1,85 | 0,0637 | -0,0022 | |||||

| US94988QAU58 / Wells Fargo Commercial Mortgage Trust 2013-LC12 | 0,11 | 0,00 | 0,0636 | -0,0010 | |||||

| US35563MBE57 / FREDDIE MAC STACR TRUST 2019-HQA1 SER 2019-HQA1 CL B2 V/R REGD 144A P/P 13.95800000 | 0,10 | 0,97 | 0,0628 | -0,0001 | |||||

| US46590XAN66 / CORP. NOTE | 0,10 | 1,96 | 0,0627 | 0,0004 | |||||

| T1SO34 / The Southern Company - Depositary Receipt (Common Stock) | 0,10 | 0,00 | 0,0624 | -0,0010 | |||||

| US3136ARFT00 / FNMA CMO IO | 0,10 | -6,54 | 0,0604 | -0,0047 | |||||

| US362348AS37 / ASSET BACKED SECURITY | 0,10 | -0,99 | 0,0601 | -0,0014 | |||||

| PPL Capital Funding, Inc. / DBT (US69352PAS20) | 0,10 | -3,88 | 0,0597 | -0,0027 | |||||

| U.S. Treasury 5 Year Notes / DIR (N/A) | 0,10 | 0,0596 | 0,0596 | ||||||

| US85205TAN00 / Spirit AeroSystems Inc | 0,10 | -1,01 | 0,0592 | -0,0009 | |||||

| US3622NAAE07 / CORP CMO | 0,10 | -3,00 | 0,0587 | -0,0024 | |||||

| SOP / DIR (N/A) | 0,10 | 0,0586 | 0,0586 | ||||||

| US30711XCY85 / CORP CMO | 0,10 | -3,03 | 0,0579 | -0,0022 | |||||

| US29786AAN63 / CONV. NOTE | 0,10 | 1,06 | 0,0572 | 0,0000 | |||||

| E2XA34 / Exact Sciences Corporation - Depositary Receipt (Common Stock) | 0,09 | 6,82 | 0,0568 | 0,0031 | |||||

| Ahead DB Holdings LLC, First Lien, CME Term Loan, B3 / LON (US00866HAH84) | 0,09 | 0,0563 | 0,0563 | ||||||

| Waystar Technologies, Inc., First Lien, Initial CME Term Loan / LON (US63939WAM55) | 0,09 | 0,0555 | 0,0555 | ||||||

| US143658BV39 / CONV. NOTE | 0,09 | 31,43 | 0,0554 | 0,0130 | |||||

| US89386MAA62 / Transocean Titan Financing Ltd | 0,09 | 0,0551 | 0,0551 | ||||||

| US94419LAP67 / CONV. NOTE | 0,09 | 16,88 | 0,0541 | 0,0072 | |||||

| PG Polaris BidCo SARL, First Lien, Initial CME Term Loan / LON (US91728NAB55) | 0,09 | 0,00 | 0,0537 | -0,0005 | |||||

| Glatfelter Corp., First Lien, CME Term Loan / LON (US89458XAB38) | 0,09 | 0,0528 | 0,0528 | ||||||

| CLF / Cleveland-Cliffs Inc. | 0,09 | -10,42 | 0,0520 | -0,0061 | |||||

| US61762MBG50 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,09 | 14,67 | 0,0519 | 0,0064 | |||||

| US46643AAG85 / JPMBB Commercial Mortgage Securities Trust, Series 2014-C23, Class D | 0,09 | -1,15 | 0,0516 | -0,0014 | |||||

| US94989WBB28 / Wells Fargo Commercial Mortgage Trust | 0,09 | 0,0515 | 0,0515 | ||||||

| SOP / DIR (N/A) | 0,09 | 0,0514 | 0,0514 | ||||||

| US428102AF45 / Hess Midstream Operations LP | 0,09 | 2,41 | 0,0512 | 0,0008 | |||||

| US3434125080 / FLUOR CORP PC 6.5% PERP | 0,08 | 23,53 | 0,0504 | 0,0092 | |||||

| US911365BN33 / United Rentals North America Inc | 0,08 | 3,70 | 0,0504 | 0,0012 | |||||

| US38380LAD55 / GNMA CMO IO | 0,08 | -9,78 | 0,0503 | -0,0059 | |||||

| US95041AAB44 / WELLTOWER OP LLC | 0,08 | 0,00 | 0,0498 | -0,0005 | |||||

| US737446AT14 / CONV. NOTE | 0,08 | 60,78 | 0,0494 | 0,0183 | |||||

| US02043QAB32 / CONV. NOTE | 0,08 | 12,50 | 0,0491 | 0,0051 | |||||

| US00971TAL52 / CONV. NOTE | 0,08 | -1,22 | 0,0489 | -0,0007 | |||||

| O2NS34 / ON Semiconductor Corporation - Depositary Receipt (Common Stock) | 0,08 | 6,58 | 0,0489 | 0,0029 | |||||

| Banijay Entertainment SAS, First Lien, CME Term Loan, B3 / LON (XAF6456UAE38) | 0,08 | 0,0484 | 0,0484 | ||||||

| L1YV34 / Live Nation Entertainment, Inc. - Depositary Receipt (Common Stock) | 0,08 | 5,26 | 0,0483 | 0,0019 | |||||

| US61764PBZ45 / Morgan Stanley Bank of America Merrill Lynch Trust 2014 C19 | 0,08 | -13,04 | 0,0483 | -0,0076 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,08 | 2,56 | 0,0483 | 0,0007 | |||||

| US69007TAG94 / Outfront Media Capital LLC / Outfront Media Capital Corp | 0,08 | 1,27 | 0,0482 | 0,0003 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0,08 | 0,0478 | 0,0478 | ||||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0,08 | 0,0473 | 0,0473 | ||||||

| D1DG34 / Datadog, Inc. - Depositary Receipt (Common Stock) | 0,08 | 9,86 | 0,0472 | 0,0039 | |||||

| US82452JAD19 / SHIFT4 PAYMENTS INC | 0,08 | 5,48 | 0,0464 | 0,0022 | |||||

| RHP Hotel Properties LP / RHP Finance Corp. / DBT (US749571AL97) | 0,08 | 0,0463 | 0,0463 | ||||||

| Quikrete Holdings, Inc. / DBT (US74843PAA84) | 0,08 | 2,67 | 0,0462 | 0,0005 | |||||

| US3137ASB788 / FHLMC CMO IO | 0,08 | -3,75 | 0,0462 | -0,0023 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 0,08 | -22,68 | 0,0453 | -0,0136 | |||||

| N2TN34 / Nutanix, Inc. - Depositary Receipt (Common Stock) | 0,07 | 7,25 | 0,0449 | 0,0026 | |||||

| US38375UF884 / GNMA CMO IO | 0,07 | -8,64 | 0,0446 | -0,0044 | |||||

| US40637HAF64 / CONV. NOTE | 0,07 | -10,84 | 0,0444 | -0,0059 | |||||

| SOP / DIR (N/A) | 0,07 | 0,0444 | 0,0444 | ||||||

| US38378JL673 / GNMA CMO IO | 0,07 | -3,95 | 0,0440 | -0,0022 | |||||

| US38379PE947 / GNMA CMO IO | 0,07 | -5,19 | 0,0440 | -0,0027 | |||||

| G1PI34 / Global Payments Inc. - Depositary Receipt (Common Stock) | 0,07 | -5,26 | 0,0436 | -0,0028 | |||||

| N2ET34 / Cloudflare, Inc. - Depositary Receipt (Common Stock) | 0,07 | 0,0428 | 0,0428 | ||||||

| XS2066744231 / Carnival PLC | 0,07 | 2,90 | 0,0427 | 0,0005 | |||||

| Integer Holdings Corp. / DBT (US45826HAC34) | 0,07 | 3,03 | 0,0413 | 0,0008 | |||||

| US46590XAL01 / JBS USA LUX SA/JBS USA Food Co./JBS USA Finance, Inc. | 0,07 | -68,08 | 0,0411 | -0,0881 | |||||

| US38376R4R42 / GNMA CMO IO | 0,07 | -6,85 | 0,0408 | -0,0037 | |||||

| US08265TAD19 / CONV. NOTE | 0,07 | 4,62 | 0,0408 | 0,0012 | |||||

| TransDigm, Inc. / DBT (US893647BV82) | 0,07 | 3,08 | 0,0404 | 0,0005 | |||||

| HRI / Herc Holdings Inc. | 0,07 | 1,54 | 0,0400 | 0,0005 | |||||

| US41161PLQ45 / CORP CMO | 0,07 | -7,04 | 0,0399 | -0,0034 | |||||

| OSIS / OSI Systems, Inc. | 0,07 | 11,86 | 0,0399 | 0,0037 | |||||

| US819047AB70 / CONVERTIBLE ZERO | 0,07 | 15,79 | 0,0399 | 0,0051 | |||||

| W1EL34 / Welltower Inc. - Depositary Receipt (Common Stock) | 0,07 | 1,54 | 0,0398 | 0,0001 | |||||

| Hess Midstream Operations LP / DBT (US428102AH01) | 0,07 | 1,54 | 0,0396 | 0,0000 | |||||

| US38376RUG90 / GNMA CMO IO | 0,07 | -16,67 | 0,0394 | -0,0081 | |||||

| US92922F4V78 / CORP CMO | 0,07 | -2,99 | 0,0390 | -0,0020 | |||||

| PRGS / Progress Software Corporation | 0,07 | 10,17 | 0,0390 | 0,0032 | |||||

| M2KS34 / MKS Inc. - Depositary Receipt (Common Stock) | 0,06 | 10,34 | 0,0386 | 0,0031 | |||||

| BOX / Box, Inc. | 0,06 | 8,47 | 0,0384 | 0,0021 | |||||

| US665531AJ80 / CONV. NOTE | 0,06 | -1,56 | 0,0382 | -0,0008 | |||||

| US38376MSQ14 / GNMA CMO IO | 0,06 | -7,35 | 0,0381 | -0,0035 | |||||

| MTH / Meritage Homes Corporation | 0,06 | 0,00 | 0,0379 | -0,0006 | |||||

| US46644YAU47 / JPMBB Commercial Mortgage Securities Trust 2015-C31 | 0,06 | -67,71 | 0,0377 | -0,0786 | |||||

| US38375UZV50 / GNMA CMO IO | 0,06 | -15,07 | 0,0375 | -0,0067 | |||||

| CHEF / The Chefs' Warehouse, Inc. | 0,06 | 12,73 | 0,0374 | 0,0037 | |||||

| US38376RFK77 / GNMA CMO IO | 0,06 | -18,42 | 0,0374 | -0,0089 | |||||

| BLDR / Builders FirstSource, Inc. | 0,06 | 0,0371 | 0,0371 | ||||||

| JH North America Holdings, Inc. / DBT (US46593WAB19) | 0,06 | 0,0366 | 0,0366 | ||||||

| US02146QAA13 / CORP CMO | 0,06 | 0,00 | 0,0362 | -0,0005 | |||||

| Clarios Global LP, First Lien, Amendment No. 6 Dollar CME Term Loan / LON (XAC8000CAP86) | 0,06 | 0,0360 | 0,0360 | ||||||

| US38379B6E35 / GNMA CMO IO | 0,06 | -1,64 | 0,0360 | -0,0014 | |||||

| US38376RTH92 / GNMA CMO IO | 0,06 | -17,14 | 0,0353 | -0,0073 | |||||

| US38376R2Q86 / GNMA CMO IO | 0,06 | -20,55 | 0,0351 | -0,0092 | |||||

| US516544AB96 / CONV. NOTE | 0,06 | -10,77 | 0,0351 | -0,0043 | |||||

| US38379EAL65 / GNMA CMO IO | 0,06 | 1,79 | 0,0347 | 0,0003 | |||||

| US703343AG80 / Patrick Industries Inc | 0,06 | 5,66 | 0,0338 | 0,0016 | |||||

| US05493NAA00 / BDS 2021-FL9 Ltd | 0,06 | -48,62 | 0,0338 | -0,0326 | |||||

| Rivian Automotive, Inc. / DBT (US76954AAB98) | 0,06 | 5,66 | 0,0336 | 0,0010 | |||||

| US38380LJK08 / GNMA CMO IO | 0,06 | -11,29 | 0,0334 | -0,0045 | |||||

| CDSCMBX / DCR (N/A) | 0,05 | 0,0327 | 0,0327 | ||||||

| US05464CAB72 / CONV. NOTE | 0,05 | 5,88 | 0,0326 | 0,0014 | |||||

| C1MS34 / CMS Energy Corporation - Depositary Receipt (Common Stock) | 0,05 | -3,57 | 0,0326 | -0,0016 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0,05 | 0,0316 | 0,0316 | ||||||

| COIN / Coinbase Global, Inc. - Depositary Receipt (Common Stock) | 0,05 | 44,44 | 0,0314 | 0,0093 | |||||

| ACA / Arcosa, Inc. | 0,05 | 2,00 | 0,0311 | 0,0004 | |||||

| US38378HVU75 / GNMA CMO IO | 0,05 | -5,56 | 0,0311 | -0,0017 | |||||

| US3136A1D440 / FNMA CMO IO | 0,05 | -1,96 | 0,0302 | -0,0010 | |||||

| US126192AL71 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,05 | 4,17 | 0,0302 | 0,0008 | |||||

| R2GE34 / Repligen Corporation - Depositary Receipt (Common Stock) | 0,05 | 2,08 | 0,0298 | 0,0002 | |||||

| 5290 / Vertex Corporation | 0,05 | -18,33 | 0,0295 | -0,0073 | |||||

| HAE / Haemonetics Corporation | 0,05 | 4,35 | 0,0293 | 0,0010 | |||||

| US92339LAA08 / VERDE PURCHASER LLC 10.5% 11/30/2030 144A | 0,05 | 2,13 | 0,0292 | 0,0004 | |||||

| SOP / DIR (N/A) | 0,05 | 0,0289 | 0,0289 | ||||||

| M1CH34 / Microchip Technology Incorporated - Depositary Receipt (Common Stock) | 0,05 | 0,0284 | 0,0284 | ||||||

| SOP / DIR (N/A) | 0,05 | 0,0280 | 0,0280 | ||||||

| WESCO Distribution, Inc. / DBT (US95081QAS30) | 0,05 | 2,22 | 0,0279 | 0,0005 | |||||

| US589889AA22 / Merit Medical Systems Inc | 0,05 | -8,00 | 0,0278 | -0,0027 | |||||

| US09061GAK76 / CONV. NOTE | 0,05 | 0,00 | 0,0277 | -0,0002 | |||||

| US38376R2S43 / GNMA CMO IO | 0,05 | -9,80 | 0,0277 | -0,0036 | |||||

| SOP / DIR (N/A) | 0,05 | 0,0276 | 0,0276 | ||||||

| AVNT / Avient Corporation | 0,05 | 2,27 | 0,0272 | 0,0002 | |||||

| SOP / DIR (N/A) | 0,05 | 0,0272 | 0,0272 | ||||||

| US38376RC877 / GNMA CMO IO | 0,04 | -16,98 | 0,0270 | -0,0054 | |||||

| SOP / DIR (N/A) | 0,04 | 0,0269 | 0,0269 | ||||||

| B2UR34 / Burlington Stores, Inc. - Depositary Receipt (Common Stock) | 0,04 | 0,00 | 0,0264 | -0,0008 | |||||

| PSN / Parsons Corporation | 0,04 | 4,88 | 0,0262 | 0,0014 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0,04 | 0,00 | 0,0260 | -0,0000 | |||||

| US38376RV786 / GNMA CMO IO | 0,04 | -17,65 | 0,0257 | -0,0057 | |||||

| US46639YAX58 / JP Morgan Chase Commercial Mortgage Securities Trust, Series 2013-LC11, Class D | 0,04 | -10,64 | 0,0256 | -0,0031 | |||||

| US38376RNL68 / GNMA CMO IO | 0,04 | -14,29 | 0,0254 | -0,0044 | |||||

| SOP / DIR (N/A) | 0,04 | 0,0250 | 0,0250 | ||||||

| US852234AK99 / CONV. NOTE | 0,04 | 2,50 | 0,0247 | 0,0001 | |||||

| US38376RYA84 / GNMA CMO IO | 0,04 | -13,04 | 0,0243 | -0,0037 | |||||

| US38378GNB04 / GNMA CMO IO | 0,04 | 0,00 | 0,0236 | -0,0005 | |||||

| SOP / DIR (N/A) | 0,04 | 0,0232 | 0,0232 | ||||||

| US38376RAE62 / GNMA CMO IO | 0,04 | -9,52 | 0,0228 | -0,0030 | |||||

| US38376RSF46 / GNMA CMO IO | 0,04 | -11,63 | 0,0228 | -0,0032 | |||||

| CDSCMBX / DCR (N/A) | 0,04 | 0,0222 | 0,0222 | ||||||

| CDSCMBX / DCR (N/A) | 0,04 | 0,0221 | 0,0221 | ||||||

| HRI / Herc Holdings Inc. | 0,04 | 0,0219 | 0,0219 | ||||||

| WK / Workiva Inc. | 0,04 | 0,00 | 0,0217 | -0,0003 | |||||

| Adient Global Holdings Ltd. / DBT (US00687YAD76) | 0,04 | 9,38 | 0,0215 | 0,0016 | |||||

| US38376RNT94 / GNMA CMO IO | 0,03 | -5,56 | 0,0209 | -0,0012 | |||||

| US38375UPZ74 / GNMA CMO IO | 0,03 | -17,07 | 0,0206 | -0,0046 | |||||

| US07386HYW59 / BEAR STEARNS ALT A TRUST BALTA 2005 10 11A1 | 0,03 | -2,86 | 0,0205 | -0,0012 | |||||

| SOP / DIR (N/A) | 0,03 | 0,0204 | 0,0204 | ||||||

| Verde Purchaser LLC, First Lien, Second Refinancing CME Term Loan / LON (US92338TAB26) | 0,03 | 0,00 | 0,0199 | -0,0001 | |||||

| US3617LELG72 / GII30 | 0,03 | 0,00 | 0,0199 | -0,0004 | |||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AB20) | 0,03 | 0,0195 | 0,0195 | ||||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AA47) | 0,03 | 0,0193 | 0,0193 | ||||||

| US94988XAC02 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,03 | 6,67 | 0,0192 | 0,0006 | |||||

| HCXY / Hercules Capital, Inc. - Corporate Bond/Note | 0,03 | -3,12 | 0,0192 | -0,0005 | |||||

| US38379LX920 / GNMA CMO IO | 0,03 | -8,82 | 0,0188 | -0,0023 | |||||

| US38375UYG92 / GNMA CMO IO | 0,03 | -11,43 | 0,0187 | -0,0029 | |||||

| US38376RFF82 / GNMA CMO IO | 0,03 | -14,71 | 0,0180 | -0,0032 | |||||

| US453204AD18 / CONV. NOTE | 0,03 | 7,41 | 0,0180 | 0,0014 | |||||

| XS1493296500 / Spectrum Brands, Inc. | 0,03 | 0,0175 | 0,0175 | ||||||

| US38375UK256 / GNMA CMO IO | 0,03 | -12,50 | 0,0172 | -0,0025 | |||||

| SOP / DIR (N/A) | 0,03 | 0,0169 | 0,0169 | ||||||

| US46639YAC12 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,03 | 0,00 | 0,0168 | -0,0002 | |||||

| SOP / DIR (N/A) | 0,03 | 0,0167 | 0,0167 | ||||||

| OIS / DIR (N/A) | 0,03 | 0,0161 | 0,0161 | ||||||

| CDSCMBX / DCR (N/A) | 0,03 | 0,0159 | 0,0159 | ||||||

| DVAI34 / DaVita Inc. - Depositary Receipt (Common Stock) | 0,03 | 0,0155 | 0,0155 | ||||||

| US3617K4U964 / GII30 | 0,02 | -4,00 | 0,0150 | -0,0002 | |||||

| US3617K4U881 / GII30 | 0,02 | 0,00 | 0,0145 | -0,0002 | |||||

| US31398PJU49 / FNMA CMO IO | 0,02 | 4,35 | 0,0144 | 0,0001 | |||||

| SOP / DIR (N/A) | 0,02 | 0,0142 | 0,0142 | ||||||

| US38376RHE99 / GNMA CMO IO | 0,02 | -17,86 | 0,0140 | -0,0033 | |||||

| US3136A9C486 / FNMA CMO IO | 0,02 | 0,00 | 0,0135 | -0,0004 | |||||

| US38376RJK32 / GNMA CMO IO | 0,02 | -24,14 | 0,0134 | -0,0043 | |||||

| SOP / DIR (N/A) | 0,02 | 0,0132 | 0,0132 | ||||||

| US30711XDY76 / Fannie Mae Connecticut Avenue Securities | 0,02 | 0,00 | 0,0128 | -0,0003 | |||||

| DTRS / DIR (N/A) | 0,02 | 0,0128 | 0,0128 | ||||||

| US61915RAN61 / CORP CMO | 0,02 | -8,70 | 0,0127 | -0,0014 | |||||

| US977852AD45 / CONV. NOTE | 0,02 | 16,67 | 0,0127 | 0,0015 | |||||

| SOP / DIR (N/A) | 0,02 | 0,0125 | 0,0125 | ||||||

| American Airlines, Inc., First Lien, 2025 Incremental CME Term Loan / LON (US02376CBT18) | 0,02 | 0,0121 | 0,0121 | ||||||

| SOP / DIR (N/A) | 0,02 | 0,0117 | 0,0117 | ||||||

| SOP / DIR (N/A) | 0,02 | 0,0116 | 0,0116 | ||||||

| CDSCMBX / DCR (N/A) | 0,02 | 0,0116 | 0,0116 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,02 | 0,0111 | 0,0111 | ||||||

| OIS / DIR (N/A) | 0,02 | 0,0110 | 0,0110 | ||||||

| US38375BM666 / GNMA CMO IO | 0,02 | 0,00 | 0,0109 | -0,0006 | |||||

| SOP / DIR (N/A) | 0,02 | 0,0107 | 0,0107 | ||||||

| SOP / DIR (N/A) | 0,02 | 0,0106 | 0,0106 | ||||||

| US3617K4VB00 / GII30 | 0,02 | 0,00 | 0,0103 | -0,0002 | |||||

| US3140JUFY52 / FN30 | 0,02 | 0,00 | 0,0100 | -0,0002 | |||||

| US38376RF359 / GNMA CMO IO | 0,02 | -16,67 | 0,0095 | -0,0019 | |||||

| US3140JS4K28 / FN30 | 0,02 | -16,67 | 0,0093 | -0,0020 | |||||

| CDSCMBX / DCR (N/A) | 0,02 | 0,0093 | 0,0093 | ||||||

| US3137ALYB93 / FHLMC CMO IO | 0,02 | -6,25 | 0,0092 | -0,0006 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0,02 | 0,0092 | 0,0092 | ||||||

| JH North America Holdings, Inc. / DBT (US46593WAA36) | 0,02 | 0,0091 | 0,0091 | ||||||

| SOP / DIR (N/A) | 0,01 | 0,0082 | 0,0082 | ||||||

| CDSCMBX / DCR (N/A) | 0,01 | 0,0081 | 0,0081 | ||||||

| US46631QAT94 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,01 | -7,14 | 0,0079 | -0,0007 | |||||

| CDSCMBX / DCR (N/A) | 0,01 | 0,0078 | 0,0078 | ||||||

| US097023CN34 / Boeing Co/The | 0,01 | 0,00 | 0,0078 | 0,0001 | |||||

| US38379LWF92 / GNMA CMO IO | 0,01 | -14,29 | 0,0074 | -0,0015 | |||||

| CDSCMBX / DCR (N/A) | 0,01 | 0,0073 | 0,0073 | ||||||

| US3617LEPL22 / GII30 | 0,01 | -8,33 | 0,0072 | -0,0002 | |||||

| US3140JXZG65 / FN30 | 0,01 | 0,00 | 0,0065 | -0,0001 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,01 | 0,0061 | 0,0061 | ||||||

| Euro-Bobl / DIR (DE000F1NGF61) | 0,01 | 0,0061 | 0,0061 | ||||||

| US3136FEMW97 / FNMA CMO IO | 0,01 | 0,00 | 0,0060 | -0,0004 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,01 | 0,0056 | 0,0056 | ||||||

| CDSCMBX / DCR (N/A) | 0,01 | 0,0046 | 0,0046 | ||||||

| SOP / DIR (N/A) | 0,01 | 0,0044 | 0,0044 | ||||||

| US15089QAP90 / Celanese US Holdings LLC | 0,01 | -93,00 | 0,0044 | -0,0565 | |||||

| US3137AUD483 / FHLMC CMO IO | 0,01 | -12,50 | 0,0042 | -0,0008 | |||||

| IRS / DIR (N/A) | 0,01 | 0,0034 | 0,0034 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,01 | 0,0031 | 0,0031 | ||||||

| US3136FCZ907 / FNMA CMO IO | 0,00 | 0,00 | 0,0026 | -0,0002 | |||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0023 | 0,0023 | ||||||

| IRS / DIR (N/A) | 0,00 | 0,0021 | 0,0021 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,00 | 0,0017 | 0,0017 | ||||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0016 | 0,0016 | ||||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0015 | 0,0015 | ||||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0015 | 0,0015 | ||||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0014 | 0,0014 | ||||||

| IRS / DIR (N/A) | 0,00 | 0,0012 | 0,0012 | ||||||

| US3140JKL870 / FN30 | 0,00 | -50,00 | 0,0012 | -0,0000 | |||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0011 | 0,0011 | ||||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0010 | 0,0010 | ||||||

| IRS / DIR (N/A) | 0,00 | 0,0010 | 0,0010 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,00 | 0,0009 | 0,0009 | ||||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0008 | 0,0008 | ||||||

| IRS / DIR (N/A) | 0,00 | 0,0008 | 0,0008 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,00 | 0,0005 | 0,0005 | ||||||

| IRS / DIR (N/A) | 0,00 | 0,0004 | 0,0004 | ||||||

| CDSCMBX / DCR (N/A) | 0,00 | 0,0004 | 0,0004 | ||||||

| SOP / DIR (N/A) | 0,00 | 0,0003 | 0,0003 | ||||||

| US31325UPS95 / FHLMC CMO IO | 0,00 | 0,0003 | -0,0002 | ||||||

| US38380FAU03 / GNMA CMO IO | 0,00 | -100,00 | 0,0002 | -0,0005 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,00 | 0,0001 | 0,0001 | ||||||

| US88631FAA66 / COLLATERALIZED DEBT OBLIGATION | 0,00 | 0,0000 | 0,0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0000 | -0,0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0000 | -0,0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0000 | -0,0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0000 | -0,0000 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0001 | -0,0001 | ||||||

| OIS / DIR (N/A) | -0,00 | -0,0001 | -0,0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0001 | -0,0001 | ||||||

| CDSCMBX / DCR (N/A) | -0,00 | -0,0001 | -0,0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0001 | -0,0001 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0002 | -0,0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0002 | -0,0002 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0003 | -0,0003 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0003 | -0,0003 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0004 | -0,0004 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0004 | -0,0004 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0004 | -0,0004 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0005 | -0,0005 | ||||||

| CDSCMBX / DCR (N/A) | -0,00 | -0,0005 | -0,0005 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0006 | -0,0006 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0009 | -0,0009 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0010 | -0,0010 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0010 | -0,0010 | ||||||

| CDSCMBX / DCR (N/A) | -0,00 | -0,0010 | -0,0010 | ||||||

| CDSCMBX / DCR (N/A) | -0,00 | -0,0010 | -0,0010 | ||||||

| CDSCMBX / DCR (N/A) | -0,00 | -0,0011 | -0,0011 | ||||||

| CDSCMBX / DCR (N/A) | -0,00 | -0,0011 | -0,0011 | ||||||

| SOP / DIR (N/A) | -0,00 | -0,0012 | -0,0012 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0012 | -0,0012 | ||||||

| CDSCMBX / DCR (N/A) | -0,00 | -0,0013 | -0,0013 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0014 | -0,0014 | ||||||

| CDSCMBX / DCR (N/A) | -0,00 | -0,0015 | -0,0015 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0015 | -0,0015 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0016 | -0,0016 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0017 | -0,0017 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0018 | -0,0018 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0018 | -0,0018 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0025 | -0,0025 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0026 | -0,0026 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,00 | -0,0027 | -0,0027 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0037 | -0,0037 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0038 | -0,0038 | ||||||

| OIS / DIR (N/A) | -0,01 | -0,0047 | -0,0047 | ||||||

| U.S. Treasury 2 Year Notes / DIR (N/A) | -0,01 | -0,0048 | -0,0048 | ||||||

| IRS / DIR (N/A) | -0,01 | -0,0052 | -0,0052 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0060 | -0,0060 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0062 | -0,0062 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0062 | -0,0062 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0066 | -0,0066 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0067 | -0,0067 | ||||||

| IRS / DIR (N/A) | -0,01 | -0,0076 | -0,0076 | ||||||

| IRS / DIR (N/A) | -0,01 | -0,0076 | -0,0076 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0081 | -0,0081 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0087 | -0,0087 | ||||||

| IRS / DIR (N/A) | -0,01 | -0,0089 | -0,0089 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,01 | -0,0090 | -0,0090 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,02 | -0,0101 | -0,0101 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,02 | -0,0149 | -0,0149 | ||||||

| IRS / DIR (N/A) | -0,03 | -0,0157 | -0,0157 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,03 | -0,0174 | -0,0174 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,03 | -0,0194 | -0,0194 | ||||||

| CDSCMBX / DCR (N/A) | -0,03 | -0,0206 | -0,0206 | ||||||

| OIS / DIR (N/A) | -0,04 | -0,0251 | -0,0251 | ||||||

| OIS / DIR (N/A) | -0,05 | -0,0281 | -0,0281 | ||||||

| CDSCMBX / DCR (N/A) | -0,05 | -0,0313 | -0,0313 | ||||||

| CDSCMBX / DCR (N/A) | -0,05 | -0,0324 | -0,0324 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | -0,06 | -0,0359 | -0,0359 | ||||||

| IRS / DIR (N/A) | -0,07 | -0,0395 | -0,0395 | ||||||

| CDSCMBX / DCR (N/A) | -0,07 | -0,0417 | -0,0417 | ||||||

| SOP / DIR (N/A) | -0,20 | -0,1189 | -0,1189 | ||||||

| OIS / DIR (N/A) | -0,55 | -0,3271 | -0,3271 | ||||||

| OIS / DIR (N/A) | -0,63 | -0,3752 | -0,3752 | ||||||

| EW / Edwards Lifesciences Corporation | -0,93 | -194,80 | -0,5572 | -1,1445 | |||||

| EW / Edwards Lifesciences Corporation | -2,87 | 208,83 | -1,7196 | -1,1624 |