Statistiques de base

| Valeur du portefeuille | $ 1 218 782 243 |

| Positions actuelles | 989 |

Dernières positions, performances, ASG (à partir des dépôts 13F, 13D)

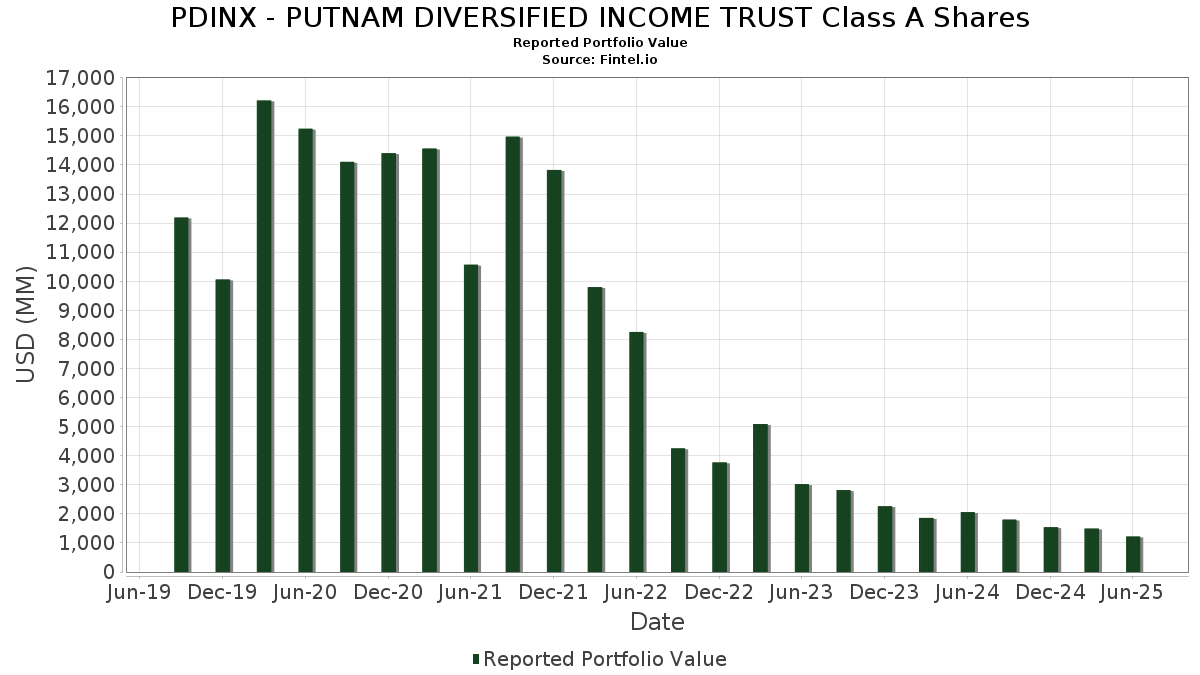

PDINX - PUTNAM DIVERSIFIED INCOME TRUST Class A Shares a déclaré un total de 989 positions dans ses derniers dépôts auprès de la SEC. La valeur la plus récente du portefeuille est calculée à 1 218 782 243 USD. Les actifs sous gestion réels (ASG) sont cette valeur plus les liquidités (qui ne sont pas divulguées). Les principales positions de PDINX - PUTNAM DIVERSIFIED INCOME TRUST Class A Shares sont SHORT TERM INV FUND (US:US74676P6640) , Uniform Mortgage-Backed Security, TBA (US:US01F0526727) , Ginnie Mae (US:US21H0526788) , Ginnie Mae (US:US21H0426799) , and Uniform Mortgage-Backed Security, TBA (US:US01F0606750) . Les nouvelles positions de PDINX - PUTNAM DIVERSIFIED INCOME TRUST Class A Shares incluent Uniform Mortgage-Backed Security, TBA (US:US01F0526727) , Ginnie Mae (US:US21H0526788) , Ginnie Mae (US:US21H0426799) , Uniform Mortgage-Backed Security, TBA (US:US01F0606750) , and Uniform Mortgage-Backed Security, TBA (US:US01F0226757) .

Meilleures augmentations ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 83,99 | 8,1549 | 7,3434 | ||

| 113,12 | 113,12 | 10,9832 | 1,2575 | |

| 7,61 | 0,7393 | 0,7393 | ||

| 6,82 | 0,6626 | 0,6626 | ||

| 14,93 | 1,4493 | 0,6279 | ||

| 5,42 | 0,5264 | 0,5264 | ||

| 6,30 | 0,6120 | 0,5168 | ||

| 5,01 | 0,4860 | 0,4860 | ||

| 4,70 | 0,4563 | 0,4563 | ||

| 4,65 | 0,4519 | 0,4519 |

Principales baisses ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 22,36 | 2,1707 | -11,3983 | ||

| 7,23 | 0,7018 | -9,3473 | ||

| 0,98 | 0,0952 | -2,1631 | ||

| -16,26 | -1,5790 | -1,6741 | ||

| 23,93 | 2,3238 | -1,5870 | ||

| 0,98 | 0,0952 | -0,5168 | ||

| 0,20 | 0,0199 | -0,3378 | ||

| 0,50 | 0,0482 | -0,2943 | ||

| 2,27 | 0,2209 | -0,1959 | ||

| -1,24 | -0,1206 | -0,1206 |

Déclarations 13F et dépôts de fonds

Ce formulaire a été déposé le 2025-08-26 pour la période de déclaration 2025-06-30. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau pour débloquer les données premium et exporter vers Excel ![]() .

.

| Titre | Type | Prix moyen de l'action | Actions (en millions) |

ΔActions (%) |

ΔActions (%) |

Valeur ($ en millions) |

Portefeuille (%) |

ΔPortefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US74676P6640 / SHORT TERM INV FUND | 113,12 | 13,21 | 113,12 | 13,21 | 10,9832 | 1,2575 | |||

| US01F0526727 / Uniform Mortgage-Backed Security, TBA | 83,99 | 846,29 | 8,1549 | 7,3434 | |||||

| US21H0526788 / Ginnie Mae | 32,05 | 0,95 | 3,1119 | 0,2093 | |||||

| US21H0426799 / Ginnie Mae | 23,93 | -44,05 | 2,3238 | -1,5870 | |||||

| US01F0606750 / Uniform Mortgage-Backed Security, TBA | 22,36 | -84,94 | 2,1707 | -11,3983 | |||||

| FLUD / Franklin Templeton ETF Trust - Franklin Ultra Short Bond ETF | 0,69 | 4,23 | 17,32 | 4,32 | 1,6820 | 0,0657 | |||

| US01F0226757 / Uniform Mortgage-Backed Security, TBA | 14,93 | 66,17 | 1,4493 | 0,6279 | |||||

| US30711XCR35 / CORP CMO | 8,24 | -2,60 | 0,7998 | -0,0234 | |||||

| TRGP / Targa Resources Corp. | 7,61 | 0,7393 | 0,7393 | ||||||

| US01F0626717 / Uniform Mortgage-Backed Security, TBA | 7,23 | -93,42 | 0,7018 | -9,3473 | |||||

| U.S. Treasury Bills / STIV (US912797MS31) | 6,82 | 0,6626 | 0,6626 | ||||||

| US3137G0HM48 / CORP CMO | 6,50 | -2,32 | 0,6307 | -0,0166 | |||||

| EW / Edwards Lifesciences Corporation | 6,30 | 543,16 | 0,6120 | 0,5168 | |||||

| US30711XCH52 / CORP CMO | 6,26 | -3,57 | 0,6081 | -0,0241 | |||||

| US46647PDW32 / JPMorgan Chase & Co | 6,19 | -0,18 | 0,6008 | -0,0025 | |||||

| US87264ABV61 / T-Mobile USA Inc | 5,87 | 1,28 | 0,5703 | 0,0058 | |||||

| US02146QAD51 / CORP CMO | 5,66 | -1,58 | 0,5495 | -0,0103 | |||||

| US35564KUL15 / STACR_22-HQA1 | 5,61 | -1,14 | 0,5449 | -0,0077 | |||||

| A1DC34 / Agree Realty Corporation - Depositary Receipt (Common Stock) | 5,42 | 0,5264 | 0,5264 | ||||||

| US30711XBQ60 / CORP CMO | 5,23 | -2,24 | 0,5078 | -0,0129 | |||||

| US01F0306781 / UMBS TBA | 5,19 | 1,70 | 0,5042 | 0,0374 | |||||

| U1DR34 / UDR, Inc. - Depositary Receipt (Common Stock) | 5,01 | 0,4860 | 0,4860 | ||||||

| US3137FWKE98 / FHLMC CMO IO | 4,76 | -3,35 | 0,4617 | -0,0172 | |||||

| A3KMYN / Air Lease Corporation - Preferred Stock | 4,70 | 0,4563 | 0,4563 | ||||||

| US20600GU123 / Conagra Foods, Inc. | 4,65 | 0,4519 | 0,4519 | ||||||

| US35563GAB59 / Freddie Mac Multifamily Structured Credit Risk | 4,65 | -0,81 | 0,4517 | -0,0048 | |||||

| US3137G0GZ69 / CORP CMO | 4,59 | -2,96 | 0,4454 | -0,0147 | |||||

| US35565MBE30 / CORP CMO | 4,39 | -0,66 | 0,4261 | -0,0039 | |||||

| US61747YFA82 / Morgan Stanley | 4,31 | 0,37 | 0,4189 | 0,0005 | |||||

| A1VB34 / AvalonBay Communities, Inc. - Depositary Receipt (Common Stock) | 4,08 | 0,3964 | 0,3964 | ||||||

| OIS / DIR (N/A) | 4,08 | 0,3960 | 0,3960 | ||||||

| US17312EAE68 / Citigroup Mortgage Loan Trust, Inc. | 4,04 | -0,47 | 0,3922 | -0,0028 | |||||

| SOP / DIR (N/A) | 3,97 | 0,3851 | 0,3851 | ||||||

| XS2287912450 / Verisure Midholding AB | 3,84 | 9,25 | 0,3729 | 0,0308 | |||||

| US38382LMH14 / GNMA CMO IO | 3,79 | -7,22 | 0,3681 | -0,0296 | |||||

| US38382QX212 / GNMA CMO IO | 3,66 | -1,32 | 0,3557 | -0,0056 | |||||

| US00914AAT97 / AIR LEASE CORPORATION | 3,60 | 0,45 | 0,3491 | 0,0007 | |||||

| Boston Properties LP / STIV (US10113BU898) | 3,59 | 0,3485 | 0,3485 | ||||||

| A1RE34 / Alexandria Real Estate Equities, Inc. - Depositary Receipt (Common Stock) | 3,45 | 0,3351 | 0,3351 | ||||||

| US29277EU100 / ENERGY TRANSFER PARTNERS | 3,36 | 0,3262 | 0,3262 | ||||||

| 01626P148 / Alimentation Couche-Tard Inc | 3,33 | 0,3234 | 0,3234 | ||||||

| V1MC34 / Vulcan Materials Company - Depositary Receipt (Common Stock) | 3,31 | 0,3218 | 0,3218 | ||||||

| DUKB34 / Duke Energy Corporation - Depositary Receipt (Common Stock) | 3,31 | 0,3216 | 0,3216 | ||||||

| A1VB34 / AvalonBay Communities, Inc. - Depositary Receipt (Common Stock) | 3,31 | 0,3210 | 0,3210 | ||||||

| US501797AL82 / L Brands Inc | 3,30 | 2,42 | 0,3201 | 0,0068 | |||||

| US38381YL932 / GNMA CMO IO | 3,29 | -1,91 | 0,3194 | -0,0070 | |||||

| US3137FUAM68 / Freddie Mac REMICS | 3,14 | -1,63 | 0,3047 | -0,0058 | |||||

| US34410WU185 / FMC CORP | 3,13 | 0,3038 | 0,3038 | ||||||

| US04010LBE20 / Ares Capital Corp. | 3,12 | 0,13 | 0,3031 | -0,0004 | |||||

| US71713UAW27 / Pharmacia LLC | 3,08 | 0,13 | 0,2992 | -0,0004 | |||||

| ORLY / O'Reilly Automotive, Inc. - Depositary Receipt (Common Stock) | 3,08 | 0,2989 | 0,2989 | ||||||

| US63861CAE93 / Nationstar Mortgage Holdings Inc | 3,02 | 1,58 | 0,2931 | 0,0039 | |||||

| RTX / RTX Corporation - Depositary Receipt (Common Stock) | 3,01 | 0,2926 | 0,2926 | ||||||

| US00206RGL06 / AT&T Inc | 2,99 | 0,67 | 0,2901 | 0,0012 | |||||

| US06051GLC14 / BANK OF AMERICA CORP | 2,99 | 0,13 | 0,2900 | -0,0003 | |||||

| US03027XAX84 / AMERICAN TOWER CORP SR UNSECURED 01/27 2.75 | 2,97 | 0,85 | 0,2887 | 0,0017 | |||||

| 01626P148 / Alimentation Couche-Tard Inc | 2,96 | 0,2875 | 0,2875 | ||||||

| US21H0506723 / Ginnie Mae | 2,95 | 0,2862 | 0,2862 | ||||||

| White Cap Supply Holdings LLC, First Lien, CME Term Loan, C / LON (US96350TAH32) | 2,92 | 0,2831 | 0,2831 | ||||||

| FCFS / FirstCash Holdings, Inc. | 2,90 | 2,22 | 0,2820 | 0,0054 | |||||

| US49272YAB92 / Kevlar SpA | 2,90 | 1,22 | 0,2816 | 0,0027 | |||||

| US41161PLQ45 / CORP CMO | 2,89 | -6,90 | 0,2804 | -0,0216 | |||||

| US07401AAX54 / CORP CMO | 2,88 | -1,61 | 0,2796 | -0,0052 | |||||

| BBD.A / Bombardier Inc. | 2,87 | 4,59 | 0,2789 | 0,0116 | |||||

| US1248EPCQ45 / CCO Holdings LLC / CCO Holdings Capital Corp | 2,87 | 58,77 | 0,2786 | 0,1027 | |||||

| US61690FAS20 / Morgan Stanley Bank of America Merrill Lynch Trust 2015-C22 | 2,85 | 0,42 | 0,2770 | 0,0005 | |||||

| Jefferson Capital Holdings LLC / DBT (US472481AB63) | 2,84 | -0,63 | 0,2759 | -0,0025 | |||||

| US59523UAA51 / Mid-America Apartments LP | 2,83 | 0,2749 | 0,2749 | ||||||

| US95000U3E14 / Wells Fargo & Co. | 2,81 | 0,54 | 0,2732 | 0,0007 | |||||

| Marriott International, Inc. / STIV (US57163TUM97) | 2,81 | 0,2730 | 0,2730 | ||||||

| US87724RAJ14 / Taylor Morrison Communities Inc | 2,80 | 3,66 | 0,2721 | 0,0090 | |||||

| LSTAR Commercial Mortgage Trust, Series 2017-5, Class A5 / ABS-MBS (US54910TAJ16) | 2,78 | 0,65 | 0,2702 | 0,0011 | |||||

| US38380QEG38 / GNMA CMO IO | 2,77 | -2,74 | 0,2685 | -0,0083 | |||||

| 01626P148 / Alimentation Couche-Tard Inc | 2,75 | 0,2671 | 0,2671 | ||||||

| US32052MAE12 / FIRST HORIZON ALTERNATIVE MORT FHAMS 2006 AA6 2A1 | 2,74 | -2,83 | 0,2664 | -0,0084 | |||||

| THC / Tenet Healthcare Corporation | 2,74 | 1,97 | 0,2664 | 0,0045 | |||||

| US49461MAA80 / Kinetik Holdings LP | 2,73 | 1,90 | 0,2655 | 0,0043 | |||||

| US83283WAE30 / Smyrna Ready Mix Concrete LLC | 2,73 | 1,15 | 0,2649 | 0,0024 | |||||

| US576485AF30 / Matador Resources Co | 2,72 | 0,70 | 0,2636 | 0,0012 | |||||

| US92332YAB74 / Venture Global LNG, Inc. | 2,71 | 2,42 | 0,2634 | 0,0056 | |||||

| US69331CAJ71 / PG&E Corp | 2,68 | -0,81 | 0,2605 | -0,0028 | |||||

| US900123DJ66 / Turkey Government International Bond | 2,68 | -5,38 | 0,2598 | -0,0154 | |||||

| O1TI34 / Otis Worldwide Corporation - Depositary Receipt (Common Stock) | 2,65 | 0,2573 | 0,2573 | ||||||

| US17323CAN74 / Citigroup Commercial Mortgage Trust 2015-GC27 | 2,61 | -4,42 | 0,2538 | -0,0124 | |||||

| USP5015VAQ97 / REPUBLIC OF GUATEMALA 6.600000% 06/13/2036 | 2,61 | -19,48 | 0,2537 | -0,0622 | |||||

| N1RG34 / NRG Energy, Inc. - Depositary Receipt (Common Stock) | 2,61 | 278,66 | 0,2534 | 0,1863 | |||||

| BBCMS Mortgage Trust, Series 2024-5C29, Class XA / ABS-MBS (US05555PAD42) | 2,58 | -5,46 | 0,2507 | -0,0151 | |||||

| US927804GB45 / Virginia Electric & Power Co | 2,56 | 1,30 | 0,2490 | 0,0026 | |||||

| US366651AG25 / Gartner Inc | 2,55 | 0,95 | 0,2471 | 0,0017 | |||||

| Sherwin Williams Co. (The) / STIV (US82434TUU23) | 2,54 | 0,2467 | 0,2467 | ||||||

| US925650AC72 / VICI Properties LP | 2,54 | 1,40 | 0,2462 | 0,0028 | |||||

| US59523UAA51 / Mid-America Apartments LP | 2,53 | 0,2454 | 0,2454 | ||||||

| US12515DAU81 / CD 2017-CD4 Mortgage Trust | 2,52 | 3,36 | 0,2451 | 0,0074 | |||||

| US12629NAJ46 / COMM 2015-DC1 Mortgage Trust | 2,52 | -1,25 | 0,2450 | -0,0037 | |||||

| US02146QAC78 / CORP CMO | 2,52 | -1,33 | 0,2447 | -0,0039 | |||||

| XS1631415400 / Ivory Coast Government International Bond | 2,52 | 2,15 | 0,2442 | 0,0046 | |||||

| US29278NAG88 / Energy Transfer Operating LP | 2,51 | 1,21 | 0,2442 | 0,0024 | |||||

| US718172DA46 / Philip Morris International Inc | 2,51 | 0,93 | 0,2433 | 0,0016 | |||||

| US35563XBE13 / Freddie Mac Stacr Trust 2018-HQA2 | 2,51 | -0,52 | 0,2432 | -0,0019 | |||||

| SOP / DIR (N/A) | 2,49 | 0,2418 | 0,2418 | ||||||

| Hyundai Capital America / DBT (US44891ADG94) | 2,49 | 1,26 | 0,2416 | 0,0024 | |||||

| Saluda Grade Alternative Mortgage Trust, Series 2024-RTL5, Class A1 / ABS-MBS (US795935AA37) | 2,47 | -0,12 | 0,2396 | -0,0008 | |||||

| Penske Truck Leasing Co. LP / STIV (US70962AUE45) | 2,43 | 0,2362 | 0,2362 | ||||||

| Jane Street Group / JSG Finance, Inc. / DBT (US47077WAE84) | 2,42 | 0,2352 | 0,2352 | ||||||

| XS2264555744 / Serbia International Bond | 2,41 | 2,42 | 0,2341 | 0,0050 | |||||

| DIRECTV Financing LLC, First Lien, 2024 Refinancing CME Term Loan, B / LON (US25460HAD44) | 2,41 | -1,87 | 0,2339 | -0,0050 | |||||

| SOP / DIR (N/A) | 2,40 | 0,2326 | 0,2326 | ||||||

| M1TT34 / Marriott International, Inc. - Depositary Receipt (Common Stock) | 2,39 | 0,2319 | 0,2319 | ||||||

| US3136B1S470 / FNMA CMO IO | 2,37 | 1,63 | 0,2297 | 0,0031 | |||||

| US01741RAL69 / Allegheny Technologies, Inc. | 2,35 | 2,80 | 0,2279 | 0,0057 | |||||

| US78419CAD65 / SG Commercial Mortgage Securities Trust 2016-C5 | 2,34 | 0,47 | 0,2269 | 0,0005 | |||||

| Carnival Corp., First Lien, 2025 Repricing Advance CME Term Loan / LON (XAP2121YAY40) | 2,34 | 0,2267 | 0,2267 | ||||||

| US36253GAK85 / GS Mortgage Securities Trust 2014-GC24 | 2,28 | 0,66 | 0,2211 | 0,0009 | |||||

| XS1944412748 / Oman Government International Bond | 2,27 | -46,89 | 0,2209 | -0,1959 | |||||

| Bell Canada Holdings, Inc. / STIV (US07787PU225) | 2,25 | 0,2189 | 0,2189 | ||||||

| US3136BQKK44 / FNMA CMO IO | 2,25 | -3,22 | 0,2186 | -0,0078 | |||||

| RTX / RTX Corporation - Depositary Receipt (Common Stock) | 2,25 | 0,2184 | 0,2184 | ||||||

| US00002MAA71 / A&D Mortgage Trust, Series 2023-NQM4, Class A1 | 2,24 | -4,52 | 0,2175 | -0,0109 | |||||

| Waste Pro USA, Inc. / DBT (US94107JAC71) | 2,24 | 710,51 | 0,2172 | 0,1903 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 2,24 | 0,2171 | 0,2171 | ||||||

| AAdvantage Loyalty IP Ltd., First Lien, CME Term Loan / LON (US02376CBS35) | 2,23 | 0,2170 | 0,2170 | ||||||

| US38381BDC54 / GNMA CMO IO | 2,23 | 1,74 | 0,2161 | 0,0031 | |||||

| US983133AC37 / Wynn Resorts Finance LLC / Wynn Resorts Capital Corp | 2,22 | 387,69 | 0,2155 | 0,1712 | |||||

| CQP Holdco LP, First Lien, Initial CME Term Loan / LON (US12657QAE35) | 2,21 | 0,27 | 0,2143 | 0,0001 | |||||

| BANK, Series 2024-BNK48, Class XA / ABS-MBS (US06541GAN79) | 2,19 | -2,36 | 0,2127 | -0,0057 | |||||

| US060335AB23 / Banijay Entertainment SASU | 2,18 | 0,88 | 0,2117 | 0,0013 | |||||

| US3137G0HZ50 / CORP CMO | 2,17 | -1,85 | 0,2108 | -0,0046 | |||||

| US35640YAL11 / CORP. NOTE | 2,14 | 0,61 | 0,2079 | 0,0008 | |||||

| US88167AAR23 / Teva Pharmaceutical Finance Netherlands III BV | 2,12 | 1,63 | 0,2061 | 0,0027 | |||||

| US12532BAD91 / CFCRE Commercial Mortgage Trust 2016-C7 | 2,12 | 0,81 | 0,2058 | 0,0012 | |||||

| XS2010026305 / Hungary Government International Bond | 2,11 | 67,91 | 0,2048 | 0,0825 | |||||

| HRI / Herc Holdings Inc. | 2,08 | 0,2021 | 0,2021 | ||||||

| US94989WAS61 / Wells Fargo Commercial Mortgage Trust 2015-C31 | 2,07 | 0,34 | 0,2011 | 0,0002 | |||||

| US401494AX79 / GOVERNMENT BOND | 2,07 | 36,21 | 0,2006 | 0,0530 | |||||

| US08263DAA46 / Benteler International AG | 2,04 | 0,20 | 0,1979 | -0,0001 | |||||

| US38380LJS34 / GNMA CMO IO | 2,03 | -3,43 | 0,1969 | -0,0075 | |||||

| US94989VAD10 / Wells Fargo Commercial Mortgage Trust 2015-NXS3 | 2,02 | 0,30 | 0,1958 | 0,0002 | |||||

| US38378GHA94 / GNMA CMO IO | 2,00 | -3,06 | 0,1938 | -0,0066 | |||||

| US3622NAAE07 / CORP CMO | 1,99 | -2,97 | 0,1933 | -0,0063 | |||||

| US71654QDB59 / Petroleos Mexicanos | 1,97 | 16,21 | 0,1914 | 0,0263 | |||||

| XAC0787FAB85 / Bausch + Lomb Corp | 1,95 | 0,1893 | 0,1893 | ||||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 1,94 | 2,59 | 0,1882 | 0,0043 | |||||

| US362348AS37 / ASSET BACKED SECURITY | 1,92 | -1,39 | 0,1866 | -0,0031 | |||||

| GTLS.PRB / Chart Industries, Inc. - Preferred Stock | 1,92 | 0,1860 | 0,1860 | ||||||

| US95000LBE20 / Wells Fargo Commercial Mortgage Trust 2016-C33 | 1,91 | -0,10 | 0,1853 | -0,0006 | |||||

| US35563FAB76 / FHLMC Multifamily Structured Pass-Through Certificates, Series 2021-MN1, Class M2 | 1,87 | -1,32 | 0,1816 | -0,0029 | |||||

| US168863DY16 / Chile Government International Bond | 1,87 | 0,86 | 0,1812 | 0,0011 | |||||

| US842587DS35 / Southern Co. (The) | 1,85 | 0,93 | 0,1795 | 0,0013 | |||||

| US38376MSQ14 / GNMA CMO IO | 1,83 | -7,57 | 0,1778 | -0,0150 | |||||

| US105756CC23 / Brazilian Government International Bond | 1,83 | 0,1778 | 0,1778 | ||||||

| Protective Life Global Funding / DBT (US74368CBV54) | 1,83 | 0,61 | 0,1774 | 0,0006 | |||||

| CSTM / Constellium SE | 1,82 | 4,07 | 0,1763 | 0,0065 | |||||

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust / DBT (US00774MBL81) | 1,81 | 1,12 | 0,1754 | 0,0015 | |||||

| Benchmark Mortgage Trust, Series 2024-V10, Class XA / ABS-MBS (US08163UAD19) | 1,79 | -3,82 | 0,1739 | -0,0073 | |||||

| US59523UAA51 / Mid-America Apartments LP | 1,79 | 0,1737 | 0,1737 | ||||||

| BANK5, Series 2024-5YR10, Class XA / ABS-MBS (US06604AAH77) | 1,78 | -3,99 | 0,1729 | -0,0077 | |||||

| XS1953057061 / Egypt Government International Bond | 1,77 | 50,34 | 0,1714 | 0,0571 | |||||

| US20753VBT44 / CORP CMO | 1,75 | -0,11 | 0,1702 | -0,0006 | |||||

| US02146QAA13 / CORP CMO | 1,75 | -0,46 | 0,1695 | -0,0012 | |||||

| US12769GAB68 / Caesars Entertainment, Inc. | 1,74 | 3,69 | 0,1694 | 0,0056 | |||||

| CCO / Clear Channel Outdoor Holdings, Inc. | 1,74 | 43,74 | 0,1685 | 0,0510 | |||||

| USY6886MAE04 / Petronas Capital Ltd | 1,73 | 1,95 | 0,1676 | 0,0028 | |||||

| US38379FFD69 / GNMA CMO IO | 1,72 | -3,64 | 0,1670 | -0,0068 | |||||

| SOP / DIR (N/A) | 1,71 | 0,1664 | 0,1664 | ||||||

| US195325EG61 / Colombia Government International Bond | 1,70 | 0,53 | 0,1655 | 0,0004 | |||||

| US83001AAD46 / Six Flags Entertainment Corp | 1,70 | 2,35 | 0,1647 | 0,0034 | |||||

| US76774LAC19 / Ritchie Bros Holdings Inc | 1,69 | 0,47 | 0,1645 | 0,0003 | |||||

| US3136B2XF48 / FNMA CMO IO | 1,69 | -7,83 | 0,1645 | -0,0145 | |||||

| XS1953916290 / Republic of Uzbekistan Bond | 1,69 | -19,64 | 0,1641 | -0,0406 | |||||

| XS2231188876 / Vmed O2 UK Financing I PLC | 1,67 | 13,03 | 0,1626 | 0,0184 | |||||

| Cloud Software Group, Inc., First Lien, Initial Dollar CME Term Loan, B / LON (US88632NBF69) | 1,66 | 0,1614 | 0,1614 | ||||||

| BMO Mortgage Trust, Series 2024-5C6, Class XA / ABS-MBS (US05593QAD60) | 1,64 | -5,57 | 0,1597 | -0,0099 | |||||

| Zegona Finance plc / DBT (US98927UAA51) | 1,64 | 0,80 | 0,1594 | 0,0009 | |||||

| Philippines Government Bond / DBT (US718286DG92) | 1,64 | 19,74 | 0,1591 | 0,0259 | |||||

| US02146BAA44 / CORP CMO | 1,64 | -3,65 | 0,1589 | -0,0064 | |||||

| US257867BA88 / Rr Donnelley & Sons Bond | 1,63 | 41,83 | 0,1584 | 0,0464 | |||||

| KMIC34 / Kinder Morgan, Inc. - Depositary Receipt (Common Stock) | 1,63 | 0,74 | 0,1583 | 0,0008 | |||||

| US81180WBM29 / Seagate HDD Cayman | 1,62 | 0,19 | 0,1573 | -0,0001 | |||||

| USY20721AL30 / Indonesia Government International Bond | 1,61 | 0,56 | 0,1559 | 0,0004 | |||||

| US35564PAC23 / Freddie Mac Stacr Trust 2019-FTR1 | 1,60 | 0,31 | 0,1550 | 0,0001 | |||||

| Panama Government Bond / DBT (US698299BX19) | 1,59 | 55,02 | 0,1543 | 0,0545 | |||||

| FR001400F2R8 / Air France-KLM | 1,59 | 9,30 | 0,1541 | 0,0128 | |||||

| US17318UAH77 / COMMERCIAL MORTGAGE BACKED SECURITIES | 1,59 | 3,52 | 0,1541 | 0,0049 | |||||

| IRB Holding Corp., First Lien, 2024 Second Replacement CME Term Loan, B / LON (US44988LAL18) | 1,57 | 0,38 | 0,1522 | 0,0002 | |||||

| US61767FBF71 / Morgan Stanley Capital I Trust, Series 2016-UB11, Class C | 1,56 | 0,91 | 0,1514 | 0,0010 | |||||

| US040114HS26 / Argentine Republic Government International Bond | 1,55 | 9,17 | 0,1504 | 0,0124 | |||||

| US38380LAD55 / GNMA CMO IO | 1,55 | -9,59 | 0,1503 | -0,0163 | |||||

| US857691AH24 / Station Casinos LLC | 1,55 | 4,25 | 0,1502 | 0,0057 | |||||

| US20754BAF85 / CAS_22-R02 | 1,54 | -0,13 | 0,1492 | -0,0006 | |||||

| US227046AB51 / Crocs Inc | 1,53 | 2,14 | 0,1484 | 0,0027 | |||||

| US026932AC79 / CORP CMO | 1,52 | -2,00 | 0,1478 | -0,0034 | |||||

| US92840VAH50 / VISTRA OPERATIONS CO LLC 4.375% 05/01/2029 144A | 1,52 | 2,63 | 0,1477 | 0,0034 | |||||

| US64072UAK88 / CSC Holdings, LLC, Term Loan | 1,52 | 3,26 | 0,1477 | 0,0043 | |||||

| USP3579ECB13 / Dominican Republic International Bond | 1,52 | 79,20 | 0,1472 | 0,0648 | |||||

| US3136BQKJ70 / FNMA CMO IO | 1,52 | -4,11 | 0,1471 | -0,0067 | |||||

| US12624QAT04 / COMM 2012-CCRE4 MORTGAGE TRUST SER 2012-CR4 CL AM REGD 3.25100000 | 1,51 | 0,1464 | 0,1464 | ||||||

| US11134LAH24 / Broadcom Corp / Broadcom Cayman Finance Ltd | 1,51 | 0,47 | 0,1461 | 0,0003 | |||||

| US428102AE79 / Hess Midstream Operations LP | 1,50 | 2,25 | 0,1457 | 0,0028 | |||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | 1,50 | 0,1455 | 0,1455 | ||||||

| US3136APW659 / FNMA CMO IO | 1,49 | -5,02 | 0,1451 | -0,0081 | |||||

| US61767YBE95 / Morgan Stanley Capital I Trust, Series 2018-H3, Class C | 1,49 | 0,40 | 0,1447 | 0,0002 | |||||

| US577081BF84 / Mattel Inc | 1,49 | 1,09 | 0,1443 | 0,0013 | |||||

| US69007TAB08 / Outfront Media Capital LLC / Outfront Media Capital Corp | 1,48 | 1,23 | 0,1435 | 0,0014 | |||||

| US38380FA225 / Government National Mortgage Association | 1,48 | -3,59 | 0,1434 | -0,0056 | |||||

| ECPG / Encore Capital Group, Inc. | 1,46 | 0,1421 | 0,1421 | ||||||

| GNMA, Series 2024-32 / ABS-MBS (US38381J2J58) | 1,46 | -2,34 | 0,1418 | -0,0038 | |||||

| XS0240295575 / Iraq International Bond | 1,45 | 68,88 | 0,1408 | 0,0572 | |||||

| US28504KAA51 / Electricite de France SA | 1,45 | 0,28 | 0,1405 | 0,0001 | |||||

| US94988QAU58 / Wells Fargo Commercial Mortgage Trust 2013-LC12 | 1,44 | -0,62 | 0,1398 | -0,0012 | |||||

| US03674XAS53 / ANTERO RESOURCES CORP 5.375% 03/01/2030 144A | 1,44 | 2,50 | 0,1393 | 0,0031 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 1,43 | 27,68 | 0,1389 | 0,0299 | |||||

| US201723AR41 / Commercial Metals Co | 1,42 | 1,80 | 0,1375 | 0,0020 | |||||

| US77586RAK68 / Romanian Government International Bond | 1,41 | 0,1371 | 0,1371 | ||||||

| US12591YBD67 / COMM 2014-UBS3 MORTGAGE TRUST COMM 2014-UBS3 AM | 1,40 | -10,30 | 0,1361 | -0,0160 | |||||

| US16678XAB01 / CORP CMO | 1,40 | -1,55 | 0,1357 | -0,0025 | |||||

| US3136AP4N93 / FNMA CMO IO | 1,39 | -4,08 | 0,1347 | -0,0062 | |||||

| 743424AA1 / Proofpoint, Inc. 1.25% Convertible Bond due 2018-12-15 | 1,38 | -0,14 | 0,1339 | -0,0005 | |||||

| MPT Operating Partnership LP / MPT Finance Corp. / DBT (US55342UAQ76) | 1,38 | 53,51 | 0,1337 | 0,0464 | |||||

| Nouryon Finance BV, First Lien, Term Loan, B / LON (N/A) | 1,37 | 0,1332 | 0,1332 | ||||||

| US195325EL56 / Colombia Government International Bond | 1,37 | -12,80 | 0,1329 | -0,0200 | |||||

| Sinclair Television Group, Inc. / DBT (US829259BH26) | 1,36 | 28,56 | 0,1325 | 0,0292 | |||||

| US00928QAT85 / Aircastle Ltd | 1,36 | -0,07 | 0,1325 | -0,0004 | |||||

| XS1807300105 / KazMunayGas National Co JSC | 1,36 | 31,09 | 0,1323 | 0,0311 | |||||

| US073685AD12 / Beacon Roofing Supply Inc 4.875% 11/01/2025 144a Bond | 1,36 | 0,1318 | 0,1318 | ||||||

| US35563PLU11 / Seasoned Credit Risk Transfer Trust Series 2019-3 | 1,36 | -5,37 | 0,1317 | -0,0078 | |||||

| USP75744AL92 / PARAGUAY | 1,36 | 184,07 | 0,1316 | 0,0851 | |||||

| Vistra Operations Co. LLC / DBT (US92840VAR33) | 1,34 | 3,78 | 0,1305 | 0,0044 | |||||

| WEC US Holdings, Inc., First Lien, Initial CME Term Loan / LON (US92943LAC46) | 1,34 | 0,1303 | 0,1303 | ||||||

| US55759VAB45 / MADISON IAQ LLC | 1,34 | 0,98 | 0,1301 | 0,0009 | |||||

| GA Global Funding Trust / DBT (US36143L2N47) | 1,34 | 0,38 | 0,1299 | 0,0002 | |||||

| US389376AZ77 / Gray Television Inc | 1,33 | 5,62 | 0,1296 | 0,0066 | |||||

| CDI / DCR (N/A) | 1,33 | 0,1296 | 0,1296 | ||||||

| Caesars Entertainment, Inc., First Lien, CME Term Loan, B1 / LON (US12768EAH99) | 1,33 | 0,1290 | 0,1290 | ||||||

| US23329PAB67 / DNB Bank ASA | 1,33 | 0,1290 | 0,1290 | ||||||

| XS2201851172 / Romanian Government International Bond | 1,33 | 2,23 | 0,1289 | 0,0026 | |||||

| US38378HK703 / GNMA CMO IO | 1,33 | -0,60 | 0,1289 | -0,0011 | |||||

| BANK5, Series 2024-5YR7, Class XA / ABS-MBS (US06211UBR59) | 1,33 | -5,89 | 0,1289 | -0,0084 | |||||

| US73928RAB24 / Power Finance Corp Ltd | 1,32 | 28,95 | 0,1285 | 0,0286 | |||||

| Alliant Holdings Intermediate LLC, First Lien, Initial CME Term Loan / LON (US01881UAM71) | 1,32 | 0,61 | 0,1285 | 0,0005 | |||||

| Panama Government Bond / DBT (US698299BY91) | 1,32 | 327,51 | 0,1283 | 0,0981 | |||||

| Phoenix Newco, Inc., First Lien, Sixth Amendment CME Term Loan / LON (US71911KAE47) | 1,32 | 0,00 | 0,1278 | -0,0003 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 1,31 | 0,38 | 0,1270 | 0,0001 | |||||

| Cogent Communications Group LLC / Cogent Finance, Inc. / DBT (US19240WAB54) | 1,30 | 0,1264 | 0,1264 | ||||||

| US46641JAE64 / COMMERCIAL MORTGAGE BACKED SECURITIES | 1,29 | 1,09 | 0,1257 | 0,0010 | |||||

| Quikrete Holdings, Inc., First Lien, CME Term Loan, B2 / LON (US74839XAK54) | 1,29 | 0,70 | 0,1254 | 0,0005 | |||||

| USP3699PGK77 / Costa Rica Government International Bond | 1,29 | 218,02 | 0,1251 | 0,0856 | |||||

| Phoenix Guarantor, Inc., First Lien, CME Term Loan, B5 / LON (US71913BAK89) | 1,29 | 0,70 | 0,1250 | 0,0006 | |||||

| US126192AL71 / COMMERCIAL MORTGAGE BACKED SECURITIES | 1,29 | 3,79 | 0,1249 | 0,0042 | |||||

| US87264ACA16 / T-MOBILE USA INC 2.05% 02/15/2028 | 1,29 | 1,18 | 0,1248 | 0,0012 | |||||

| US928668BN15 / VOLKSWAGEN GROUP AMER FIN LLC 1.625% 11/24/2027 144A | 1,29 | 1,34 | 0,1248 | 0,0013 | |||||

| US88947EAU47 / Toll Brothers Finance Corp | 1,28 | 1,83 | 0,1244 | 0,0019 | |||||

| US045054AJ25 / Ashtead Capital Inc | 1,28 | 1,43 | 0,1239 | 0,0015 | |||||

| McAfee Corp., First Lien, CME Term Loan, B1 / LON (US57906HAF47) | 1,27 | 0,1236 | 0,1236 | ||||||

| Scientific Games Holdings LP, First Lien, 2024 Refinancing Dollar CME Term Loan / LON (US80875CAE75) | 1,27 | 0,24 | 0,1235 | -0,0000 | |||||

| US36264FAL58 / GSK Consumer Healthcare Capital US LLC | 1,27 | 1,19 | 0,1235 | 0,0012 | |||||

| Allied Universal Holdco LLC / DBT (US019576AD90) | 1,27 | 3,17 | 0,1233 | 0,0035 | |||||

| US06051GGC78 / Bank of America Corp | 1,27 | 0,55 | 0,1233 | 0,0003 | |||||

| US12592KBE38 / Commercial Mortgage Trust, Series 2014-UBS5, Class AM | 1,27 | -4,15 | 0,1233 | -0,0056 | |||||

| XS2113615228 / Gabon Government International Bond | 1,27 | 20,86 | 0,1233 | 0,0210 | |||||

| Aviation Capital Group LLC / DBT (US05369AAQ40) | 1,27 | 1,04 | 0,1232 | 0,0010 | |||||

| GEHC34 / GE HealthCare Technologies Inc. - Depositary Receipt (Common Stock) | 1,26 | 1,12 | 0,1227 | 0,0011 | |||||

| RHP Hotel Properties LP / RHP Finance Corp. / DBT (US749571AK15) | 1,26 | 3,03 | 0,1224 | 0,0033 | |||||

| US00973RAL78 / Aker BP ASA | 1,26 | 0,48 | 0,1222 | 0,0004 | |||||

| XS1319820897 / Southern Gas Corridor CJSC | 1,26 | 26,97 | 0,1221 | 0,0257 | |||||

| US210385AB64 / CONSTELLATION ENERGY GENERATION | 1,26 | 0,72 | 0,1221 | 0,0006 | |||||

| US30190AAC80 / F&G Annuities & Life Inc | 1,26 | 0,40 | 0,1221 | 0,0002 | |||||

| US715638DF60 / Peruvian Government International Bond | 1,26 | -33,32 | 0,1221 | -0,0615 | |||||

| Miter Brands Acquisition Holdco, Inc. / MIWD Borrower LLC / DBT (US60672JAA79) | 1,26 | 3,54 | 0,1221 | 0,0038 | |||||

| US30040WAT53 / Eversource Energy | 1,26 | 0,40 | 0,1221 | 0,0002 | |||||

| US64952WFD02 / NEW YORK LIFE GLOBAL FUNDING 144A LIFE SR SEC 1ST LIEN 4.9% 06-13-28 | 1,26 | 0,64 | 0,1219 | 0,0005 | |||||

| MSI / Motorola Solutions, Inc. - Depositary Receipt (Common Stock) | 1,26 | 0,56 | 0,1219 | 0,0004 | |||||

| Athene Global Funding / DBT (US04685A3Q28) | 1,25 | 0,64 | 0,1218 | 0,0005 | |||||

| South Bow USA Infrastructure Holdings LLC / DBT (US83007CAC64) | 1,25 | 1,13 | 0,1218 | 0,0010 | |||||

| US00135TAD63 / AIB Group PLC | 1,25 | 0,24 | 0,1218 | -0,0000 | |||||

| US12803RAA23 / CaixaBank SA | 1,25 | 0,16 | 0,1216 | -0,0000 | |||||

| US87612GAE17 / Targa Resources Corp | 1,25 | 0,56 | 0,1215 | 0,0004 | |||||

| US264399DK95 / Duke Energy Corp 6.000% Senior Notes 12/01/28 | 1,25 | 0,48 | 0,1215 | 0,0003 | |||||

| US29450YAA73 / EquipmentShare.com, Inc. | 1,25 | 2,04 | 0,1212 | 0,0020 | |||||

| US103304BV23 / BOYD GAMING CORP 4.75% 06/15/2031 144A | 1,25 | 3,92 | 0,1211 | 0,0043 | |||||

| US38376RA632 / GNMA CMO IO | 1,25 | -15,92 | 0,1210 | -0,0233 | |||||

| US694308KL02 / Pacific Gas and Electric Co | 1,24 | 0,24 | 0,1208 | 0,0000 | |||||

| Chobani LLC, First Lien, 2025 New CME Term Loan / LON (US17026YAK55) | 1,24 | 0,1207 | 0,1207 | ||||||

| US45827MAA53 / Intelligent Packaging Ltd Finco Inc / Intelligent Packaging Ltd Co-Issuer LLC | 1,24 | 2,73 | 0,1204 | 0,0029 | |||||

| US74166MAE66 / PRIME SECSRVC BRW / FINANC | 1,24 | 0,16 | 0,1202 | -0,0002 | |||||

| XS1508675508 / Saudi Government International Bond | 1,24 | 0,32 | 0,1202 | 0,0001 | |||||

| US44701QBE17 / Huntsman International LLC | 1,23 | -1,12 | 0,1198 | -0,0016 | |||||

| SOP / DIR (N/A) | 1,23 | 0,1196 | 0,1196 | ||||||

| US09739DAD21 / Boise Cascade Co | 1,23 | 2,85 | 0,1191 | 0,0030 | |||||

| US77289KAA34 / Rockcliff Energy II LLC | 1,23 | 3,11 | 0,1190 | 0,0034 | |||||

| US48020RAB15 / Jones Deslauriers Insurance Management Inc | 1,23 | 0,91 | 0,1189 | 0,0008 | |||||

| US038522AQ17 / Aramark Services Inc | 1,22 | 1,50 | 0,1187 | 0,0014 | |||||

| US040114HT09 / Argentine Republic Government International Bond | 1,22 | -22,51 | 0,1180 | -0,0346 | |||||

| Acrisure LLC / Acrisure Finance, Inc. / DBT (US00489LAL71) | 1,21 | 1,51 | 0,1179 | 0,0015 | |||||

| Hunter Douglas, Inc., First Lien, CME Term Loan, B1 / LON (XAN8137FAE06) | 1,21 | 0,1174 | 0,1174 | ||||||

| US12630BAE83 / Commercial Mortgage Trust, Series 2013-CR13, Class D | 1,21 | 1,51 | 0,1172 | 0,0014 | |||||

| US12592GAG82 / Commercial Mortgage Trust, Series 2014-CR19, Class D | 1,21 | -30,29 | 0,1171 | -0,0513 | |||||

| Medline Borrower LP, First Lien, Dollar Incremental CME Term Loan / LON (US58503UAF03) | 1,21 | 0,1170 | 0,1170 | ||||||

| AES Andes SA / DBT (US00111VAD91) | 1,19 | 85,40 | 0,1160 | 0,0532 | |||||

| US917288BA96 / Uruguay Government International Bond | 1,19 | 1,19 | 0,1155 | 0,0011 | |||||

| US71677HAL96 / PetSmart, Inc., Term Loan B | 1,19 | 0,34 | 0,1154 | 0,0001 | |||||

| XS1602130947 / LEVI STRAUSS 3.375 3/27 | 1,18 | 9,33 | 0,1150 | 0,0095 | |||||

| US105756BB58 / Brazilian Government International Bond | 1,18 | 1,82 | 0,1142 | 0,0017 | |||||

| Aris Water Holdings LLC / DBT (US04041NAA00) | 1,17 | 0,1133 | 0,1133 | ||||||

| TEX / Terex Corporation | 1,16 | 219,51 | 0,1129 | 0,0775 | |||||

| US38381BW424 / GNMA CMO IO | 1,16 | -1,94 | 0,1127 | -0,0025 | |||||

| XS2582981952 / Transnet SOC Ltd | 1,16 | 26,39 | 0,1126 | 0,0233 | |||||

| GNMA, Series 2020-13, Class AI / ABS-MBS (US38382CCP41) | 1,16 | -3,34 | 0,1124 | -0,0042 | |||||

| US31556PAB31 / Fertitta Entertainment LLC, Term Loan B | 1,15 | 7,45 | 0,1121 | 0,0075 | |||||

| US3136B47K84 / FNMA CMO IO | 1,15 | -2,04 | 0,1117 | -0,0027 | |||||

| Clydesdale Acquisition Holdings, Inc. / DBT (US18972EAD76) | 1,15 | 61,97 | 0,1117 | 0,0425 | |||||

| US38379T5K14 / GNMA CMO IO | 1,15 | -5,67 | 0,1116 | -0,0070 | |||||

| US03938LAP94 / Arcelormittal Sa Luxembourg Notes Cr Sen 7% 10/15/39 | 1,15 | 1,50 | 0,1114 | 0,0014 | |||||

| Chobani LLC / Chobani Finance Corp., Inc. / DBT (US17027NAC65) | 1,14 | 0,1109 | 0,1109 | ||||||

| US38380BAR69 / GNMA CMO IO | 1,14 | 0,62 | 0,1103 | 0,0003 | |||||

| Novelis Corp. / DBT (US670001AL04) | 1,14 | 161,52 | 0,1103 | 0,0680 | |||||

| Beach Acquisition Bidco LLC / DBT (US07337JAC18) | 1,13 | 0,1100 | 0,1100 | ||||||

| XS2264871828 / Ivory Coast Government International Bond | 1,13 | -7,60 | 0,1099 | -0,0094 | |||||

| OneSky Flight LLC / DBT (US68278CAA36) | 1,13 | 97,90 | 0,1098 | 0,0541 | |||||

| US023608AQ57 / Ameren Corp | 1,13 | 0,89 | 0,1098 | 0,0007 | |||||

| Rocket Cos., Inc. / DBT (US77311WAB72) | 1,13 | 0,1094 | 0,1094 | ||||||

| Buffalo Energy Mexico Holdings / Buffalo Energy Infrastructure / Buffalo Energy / DBT (US11952AAA07) | 1,12 | 23,81 | 0,1091 | 0,0208 | |||||

| XS2360598630 / Republic of Cameroon International Bond | 1,12 | 32,58 | 0,1086 | 0,0264 | |||||

| XS2406607171 / Teva Pharmaceutical Finance Netherlands II BV | 1,12 | 11,24 | 0,1086 | 0,0108 | |||||

| US36198EAP07 / GS MTG SECS TR 2013-GC13 AS CSTR 07/10/2046 144A | 1,11 | -7,40 | 0,1081 | -0,0089 | |||||

| XS2335148024 / Constellium SE | 1,11 | 12,20 | 0,1081 | 0,0115 | |||||

| Filtration Group Corp., First Lien, 2025 Incremental Dollar CME Term Loan / LON (US31732FAV85) | 1,11 | 0,1080 | 0,1080 | ||||||

| J.P. Morgan Mortgage Trust, Series 2025-2, Class A11 / ABS-MBS (US46593NAY13) | 1,11 | -5,85 | 0,1078 | -0,0070 | |||||

| Montenegro Government Bond / DBT (XS3037625400) | 1,11 | 30,78 | 0,1078 | 0,0252 | |||||

| US948565AD85 / Weekley Homes LLC / Weekley Finance Corp | 1,11 | 2,02 | 0,1077 | 0,0019 | |||||

| US146869AL63 / Carvana Co. | 1,10 | 0,1072 | 0,1072 | ||||||

| Flash Charm, Inc., First Lien, CME Term Loan, B2 / LON (US45168RAT05) | 1,10 | 0,1067 | 0,1067 | ||||||

| FCT / Fincantieri S.p.A. | 1,10 | 0,1066 | 0,1066 | ||||||

| US89364MCA09 / TRANSDIGM INC | 1,10 | 0,27 | 0,1063 | -0,0000 | |||||

| USP3699PGJ05 / Costa Rica Government International Bond | 1,09 | 0,56 | 0,1055 | 0,0003 | |||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 1,09 | 0,84 | 0,1055 | 0,0007 | |||||

| US46643ABL61 / JPMBB Commercial Mortgage Securities Trust 2014-C23 | 1,08 | -2,52 | 0,1053 | -0,0030 | |||||

| US38375UJ688 / Government National Mortgage Association | 1,08 | -4,08 | 0,1051 | -0,0047 | |||||

| US105756CF53 / Brazilian Government International Bond | 1,07 | 2,00 | 0,1042 | 0,0017 | |||||

| XS2706258436 / Energo-Pro A/S | 1,07 | 33,83 | 0,1042 | 0,0262 | |||||

| US92676XAG25 / Viking Cruises Ltd | 1,07 | 0,85 | 0,1041 | 0,0006 | |||||

| WestJet Loyalty LP, First Lien, Initial CME Term Loan / LON (XAC9763HAB33) | 1,07 | 3,68 | 0,1040 | 0,0035 | |||||

| XS2172965282 / Bahrain Government International Bond | 1,06 | -0,47 | 0,1033 | -0,0007 | |||||

| SOP / DIR (N/A) | 1,06 | 0,1032 | 0,1032 | ||||||

| XS2607736407 / SK Hynix, Inc. | 1,06 | 56,95 | 0,1031 | 0,0372 | |||||

| US12591KAG04 / COMM 2013-CCRE12 Mortgage Trust | 1,06 | 0,28 | 0,1029 | 0,0001 | |||||

| US38378UXE27 / GNMA CMO IO | 1,06 | 0,86 | 0,1027 | 0,0006 | |||||

| EMRLD Borrower LP, First Lien, Second Amendment Incremental CME Term Loan / LON (US26872NAD12) | 1,05 | 0,1023 | 0,1023 | ||||||

| Petronas Capital Ltd. / DBT (US716743AV14) | 1,05 | 35,96 | 0,1021 | 0,0268 | |||||

| US12527DAG51 / COMMERCIAL MORTGAGE BACKED SECURITIES | 1,05 | 0,87 | 0,1017 | 0,0006 | |||||

| Wells Fargo Commercial Mortgage Trust, Series 2024-5C1, Class XA / ABS-MBS (US95003VAD01) | 1,04 | -5,87 | 0,1012 | -0,0065 | |||||

| US35563MBE57 / FREDDIE MAC STACR TRUST 2019-HQA1 SER 2019-HQA1 CL B2 V/R REGD 144A P/P 13.95800000 | 1,04 | 0,88 | 0,1006 | 0,0006 | |||||

| US12636LAY65 / CSAIL Commercial Mortgage Trust, Series 2016-C5, Class A5 | 1,03 | -4,61 | 0,1004 | -0,0051 | |||||

| US097023CM50 / Boing Company (The) 2.70%, Due 02/01/2027 | 1,03 | 0,78 | 0,1001 | 0,0005 | |||||

| XS2580269426 / Serbia International Bond | 1,02 | 12,53 | 0,0995 | 0,0108 | |||||

| Raizen Fuels Finance SA / DBT (US75102XAF33) | 1,02 | 0,0994 | 0,0994 | ||||||

| US38376VGU52 / GNMA CMO IO | 1,02 | -2,76 | 0,0993 | -0,0030 | |||||

| C2AC34 / CACI International Inc - Depositary Receipt (Common Stock) | 1,02 | 0,0993 | 0,0993 | ||||||

| US3136B5RP25 / FNMA CMO IO | 1,02 | 3,56 | 0,0990 | 0,0032 | |||||

| CommScope, Inc., First Lien, Initial CME Term Loan / LON (N/A) | 1,02 | 0,0989 | 0,0989 | ||||||

| US38379NRH79 / GNMA CMO IO | 1,01 | 0,10 | 0,0985 | -0,0001 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 1,01 | 0,0984 | 0,0984 | ||||||

| Fortress Intermediate 3, Inc., First Lien, Initial CME Term Loan / LON (US34966LAB09) | 1,01 | 0,0982 | 0,0982 | ||||||

| US105756BW95 / Brazilian Government International Bond | 1,01 | 0,40 | 0,0977 | 0,0001 | |||||

| US91087BAM28 / Mexico Government International Bond | 1,01 | 26,86 | 0,0977 | 0,0205 | |||||

| SUN / Sunoco LP - Limited Partnership | 1,01 | 42,35 | 0,0976 | 0,0289 | |||||

| XHR LP / DBT (US98372MAE57) | 1,00 | 375,83 | 0,0976 | 0,0770 | |||||

| US89115A2V36 / Toronto-Dominion Bank/The | 1,00 | 0,00 | 0,0970 | -0,0002 | |||||

| DVAI34 / DaVita Inc. - Depositary Receipt (Common Stock) | 1,00 | 0,0966 | 0,0966 | ||||||

| US513075BW03 / Lamar Media Corp | 0,99 | 0,0965 | 0,0965 | ||||||

| US279158AN94 / Ecopetrol SA | 0,99 | -44,64 | 0,0963 | -0,0780 | |||||

| US12631DAG88 / COMM 2014-CCRE17 Mortgage Trust | 0,99 | -2,08 | 0,0960 | -0,0023 | |||||

| XS2079842642 / Egypt Government International Bond | 0,99 | 8,57 | 0,0960 | 0,0073 | |||||

| XS1717011982 / Nigeria Government International Bond | 0,98 | 3,36 | 0,0956 | 0,0029 | |||||

| EW / Edwards Lifesciences Corporation | 0,98 | -96,03 | 0,0952 | -2,1631 | |||||

| EW / Edwards Lifesciences Corporation | 0,98 | -84,45 | 0,0952 | -0,5168 | |||||

| US07336AAG22 / BBCMS Mortgage Trust 2022-C14 | 0,98 | -3,45 | 0,0951 | -0,0036 | |||||

| XS2391395154 / EGYPT GOVERNMENT INTERNATIONAL BOND MTN 7.300000% 09/30/2033 | 0,98 | 7,47 | 0,0950 | 0,0064 | |||||

| US12620BAR15 / CPM Holdings, Inc. 2023 Term Loan | 0,98 | -0,71 | 0,0948 | -0,0009 | |||||

| XS2291692890 / Chile Government International Bond | 0,98 | 212,50 | 0,0947 | 0,0642 | |||||

| US71568QAE70 / Perusahaan Listrik Negara PT | 0,97 | 27,70 | 0,0940 | 0,0202 | |||||

| US71654QDC33 / Petroleos Mexicanos | 0,97 | -52,55 | 0,0939 | -0,1043 | |||||

| XS2446175577 / Angolan Government International Bond | 0,96 | 2,66 | 0,0936 | 0,0022 | |||||

| Endo Finance Holdings, Inc., First Lien, 2024 Refinancing CME Term Loan / LON (US29280UAD54) | 0,96 | 0,0935 | 0,0935 | ||||||

| US46645LAY39 / JPMBB Commercial Mortgage Securities Trust 2016-C1 | 0,96 | 0,52 | 0,0932 | 0,0002 | |||||

| US38375UB255 / GNMA CMO IO | 0,95 | -13,22 | 0,0924 | -0,0144 | |||||

| US3136AA5P68 / FNMA CMO IO | 0,95 | -1,45 | 0,0923 | -0,0016 | |||||

| XS2445169985 / Nigeria Government International Bond | 0,95 | 4,40 | 0,0922 | 0,0036 | |||||

| US46591ABG94 / JPMDB Commercial Mortgage Securities Trust 2018-C8 | 0,94 | 2,39 | 0,0915 | 0,0019 | |||||

| US57767XAA81 / Mav Acquisition Corp | 0,94 | 3,07 | 0,0913 | 0,0024 | |||||

| Benin Government Bond / DBT (US08205QAA67) | 0,94 | -32,57 | 0,0913 | -0,0445 | |||||

| McGraw-Hill Education, Inc. / DBT (US58064LAA26) | 0,94 | 3,76 | 0,0912 | 0,0031 | |||||

| US46643ABJ16 / JPMBB Commercial Mortgage Securities Trust 2014-C23 | 0,94 | -0,11 | 0,0910 | -0,0003 | |||||

| US345397A860 / Ford Motor Credit Co LLC | 0,92 | 1,21 | 0,0892 | 0,0008 | |||||

| CCO / Clear Channel Outdoor Holdings, Inc. | 0,91 | 0,0888 | 0,0888 | ||||||

| BBCMS Mortgage Trust, Series 2024-C26, Class XA / ABS-MBS (US05555AAF21) | 0,91 | -2,14 | 0,0888 | -0,0021 | |||||

| XS1807299331 / KazMunayGas National Co JSC | 0,91 | -1,20 | 0,0881 | -0,0012 | |||||

| USP3579ECF27 / Dominican Republic International Bond | 0,90 | 1,57 | 0,0878 | 0,0011 | |||||

| US455780BX36 / Indonesia Government International Bond | 0,90 | 51,00 | 0,0877 | 0,0295 | |||||

| SNOWD / Snowflake Inc. - Depositary Receipt (Common Stock) | 0,90 | 31,19 | 0,0870 | 0,0205 | |||||

| TRITOB / Trinidad & Tobago Government International Bond | 0,89 | 0,68 | 0,0865 | 0,0004 | |||||

| US46639NAX93 / JPMBB Commercial Mortgage Securities Trust, Series 2013-C12, Class D | 0,89 | -0,11 | 0,0862 | -0,0003 | |||||

| US38379LX920 / GNMA CMO IO | 0,89 | -9,88 | 0,0859 | -0,0097 | |||||

| USY7138AAD29 / Pertamina Persero PT | 0,88 | 1,62 | 0,0853 | 0,0011 | |||||

| US3137HANZ52 / FHLMC CMO IO | 0,86 | 3,98 | 0,0837 | 0,0030 | |||||

| Crescent Energy Finance LLC / DBT (US45344LAG86) | 0,86 | 0,0836 | 0,0836 | ||||||

| XS2681940297 / Webuild SpA | 0,86 | 8,61 | 0,0834 | 0,0064 | |||||

| US38378P4B16 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION GNR 2014-4 BI | 0,86 | -3,60 | 0,0834 | -0,0033 | |||||

| US94989XBC83 / Wells Fargo Commercial Mortgage Trust, Series 2015-NXS4, Class A4 | 0,85 | 0,23 | 0,0830 | 0,0001 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 0,85 | -14,69 | 0,0830 | -0,0145 | |||||

| Seagate Data Storage Technology Pte. Ltd. / DBT (US81180LAA35) | 0,84 | 0,0820 | 0,0820 | ||||||

| US65249BAA70 / News Corp | 0,84 | -42,95 | 0,0818 | -0,0619 | |||||

| US77586TAE64 / Romanian Government International Bond | 0,84 | 123,94 | 0,0818 | 0,0451 | |||||

| Quikrete Holdings, Inc. / DBT (US74843PAB67) | 0,84 | 3,57 | 0,0817 | 0,0027 | |||||

| US38382AQY46 / GNMA CMO IO | 0,83 | -1,31 | 0,0807 | -0,0012 | |||||

| US38375UG460 / GNMA CMO IO | 0,82 | -9,46 | 0,0800 | -0,0085 | |||||

| US38378JL673 / GNMA CMO IO | 0,82 | -3,87 | 0,0796 | -0,0034 | |||||

| TK Elevator Midco GmbH, First Lien, CME Term Loan, B1 / LON (XAD9000BAJ17) | 0,82 | 0,0793 | 0,0793 | ||||||

| US36253GAS12 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,82 | 53,48 | 0,0792 | 0,0275 | |||||

| US55316HAB15 / GENESEE+WYOMING INC TERM LOAN | 0,82 | 0,0792 | 0,0792 | ||||||

| US3137B5SA29 / Freddie Mac REMICS | 0,82 | -0,97 | 0,0792 | -0,0009 | |||||

| US46590TAD72 / JPMDB Commercial Mortgage Securities Trust 2017-C5 | 0,81 | 0,25 | 0,0788 | -0,0000 | |||||

| US836205AW44 / Republic of South Africa Government International Bond | 0,81 | 1,63 | 0,0786 | 0,0011 | |||||

| US92937EAH71 / WFRBS 13-C11 C FRN 03-15-45 | 0,81 | 0,50 | 0,0784 | 0,0002 | |||||

| US38379PE947 / GNMA CMO IO | 0,80 | -4,97 | 0,0780 | -0,0043 | |||||

| USY20721BQ18 / Indonesia Government International Bond | 0,80 | 0,63 | 0,0780 | 0,0003 | |||||

| US46643PBK57 / JPMBB Commercial Mortgage Securities Trust 2014-C25 | 0,80 | 0,13 | 0,0778 | -0,0001 | |||||

| Standard Building Solutions, Inc. / DBT (US853191AA25) | 0,79 | 2,45 | 0,0771 | 0,0017 | |||||

| US195325DS19 / Colombia Government International Bond | 0,78 | 1,56 | 0,0760 | 0,0010 | |||||

| XS2318315921 / Asian Infrastructure Investment Bank/The | 0,78 | 4,42 | 0,0757 | 0,0031 | |||||

| FIEMEX Energia - Banco Actinver SA Institucion de Banca Multiple / DBT (US05974EAA82) | 0,78 | 2,51 | 0,0755 | 0,0017 | |||||

| US12629NAH89 / COMM 2015-DC1 Mortgage Trust | 0,78 | 12,28 | 0,0755 | 0,0081 | |||||

| US46590XAN66 / CORP. NOTE | 0,77 | 1,57 | 0,0752 | 0,0010 | |||||

| US94989TBB98 / Wells Fargo Commercial Mortgage Trust 2015-LC22 | 0,77 | 0,26 | 0,0749 | 0,0000 | |||||

| XS2580270275 / Serbia International Bond | 0,77 | 62,24 | 0,0747 | 0,0286 | |||||

| XAC0787FAG72 / BAUSCH + LOMB CORP | 0,77 | 0,00 | 0,0744 | -0,0001 | |||||

| Seagate HDD Cayman / DBT (US81180WBL46) | 0,77 | -9,36 | 0,0743 | -0,0079 | |||||

| Dominican Republic Government Bond / DBT (US25714PFB94) | 0,76 | -30,70 | 0,0741 | -0,0331 | |||||

| US38379EW992 / GNMA CMO IO | 0,76 | -9,60 | 0,0741 | -0,0081 | |||||

| IHS / IHS Holding Limited | 0,76 | 1,61 | 0,0737 | 0,0010 | |||||

| USY6972HLP91 / Philippine Government International Bond | 0,76 | -1,82 | 0,0735 | -0,0015 | |||||

| SOP / DIR (N/A) | 0,75 | 0,0730 | 0,0730 | ||||||

| US38378P2J69 / GNMA CMO IO | 0,75 | 1,35 | 0,0729 | 0,0008 | |||||

| XS2021212332 / Cellnex Telecom SA | 0,75 | 30,66 | 0,0729 | 0,0170 | |||||

| US3136ARFT00 / FNMA CMO IO | 0,75 | -6,37 | 0,0728 | -0,0051 | |||||

| Ambipar Lux SARL / DBT (US02319WAB72) | 0,75 | 23,64 | 0,0727 | 0,0138 | |||||

| US90932LAH06 / United Airlines Inc | 0,74 | 59,78 | 0,0721 | 0,0413 | |||||

| G2WR34 / Guidewire Software, Inc. - Depositary Receipt (Common Stock) | 0,74 | 13,13 | 0,0720 | 0,0082 | |||||

| US85205TAR14 / Spirit AeroSystems Inc | 0,74 | 0,0720 | 0,0720 | ||||||

| US817477AH51 / Serbia International Bond | 0,74 | 2,22 | 0,0717 | 0,0014 | |||||

| XS2010028939 / Republic of Armenia International Bond | 0,74 | 73,58 | 0,0715 | 0,0302 | |||||

| Bulgaria Government Bond / DBT (XS2890436087) | 0,73 | -0,54 | 0,0713 | -0,0006 | |||||

| US38380UMS95 / Government National Mortgage Association | 0,73 | 0,55 | 0,0707 | 0,0003 | |||||

| D2AS34 / DoorDash, Inc. - Depositary Receipt (Common Stock) | 0,73 | 0,0705 | 0,0705 | ||||||

| TRT061124T11 / Turkey Government Bond | 0,72 | 1,70 | 0,0697 | 0,0010 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 0,72 | 17,16 | 0,0696 | 0,0100 | |||||

| US455780DJ24 / Indonesia Government International Bond | 0,71 | 2,30 | 0,0693 | 0,0014 | |||||

| Morgan Stanley Bank of America Merrill Lynch Trust, Series 2015-C25, Class AS / ABS-MBS (US61765TAK97) | 0,71 | 2,32 | 0,0685 | 0,0013 | |||||

| US29245JAJ16 / Empresa Nacional del Petroleo | 0,70 | 0,00 | 0,0684 | -0,0002 | |||||

| I1LM34 / Illumina, Inc. - Depositary Receipt (Common Stock) | 0,70 | 0,29 | 0,0678 | -0,0000 | |||||

| US17312EAC03 / ASSET BACKED SECURITY | 0,69 | -0,43 | 0,0674 | -0,0005 | |||||

| USP3579EBE60 / Dominican Republic International Bond | 0,69 | -47,46 | 0,0674 | -0,0612 | |||||

| US55024UAF66 / Lumentum Holdings Inc | 0,69 | 11,87 | 0,0669 | 0,0070 | |||||

| US12592LBP67 / COMM 2014-CCRE20 Mortgage Trust | 0,69 | -0,58 | 0,0668 | -0,0006 | |||||

| F1MC34 / FMC Corporation - Depositary Receipt (Common Stock) | 0,69 | 0,0667 | 0,0667 | ||||||

| SOP / DIR (N/A) | 0,69 | 0,0667 | 0,0667 | ||||||

| U1AI34 / Under Armour, Inc. - Depositary Receipt (Common Stock) | 0,69 | 0,0665 | 0,0665 | ||||||

| US38382TD275 / GNMA CMO IO | 0,68 | -8,24 | 0,0660 | -0,0061 | |||||

| XS2199272662 / Jordan Government International Bond | 0,68 | -21,97 | 0,0655 | -0,0187 | |||||

| USG9066FAA96 / TRIP.COM GROUP LTD | 0,67 | -5,20 | 0,0655 | -0,0038 | |||||

| US92938CAL19 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,67 | -24,89 | 0,0654 | -0,0218 | |||||

| US36257UAN72 / GS Mortgage Securities Trust 2019-GC42 | 0,67 | -5,27 | 0,0646 | -0,0038 | |||||

| Beach Acquisition Bidco LLC / DBT (XS3109433477) | 0,67 | 0,0646 | 0,0646 | ||||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,66 | 352,05 | 0,0641 | 0,0499 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,66 | 0,31 | 0,0636 | 0,0001 | |||||

| FR0013521085 / Accor SA | 0,65 | 12,95 | 0,0635 | 0,0071 | |||||

| MSTRD / Strategy Inc - Depositary Receipt (Common Stock) | 0,65 | 124,14 | 0,0632 | 0,0353 | |||||

| Flutter Financing BV, First Lien, 2024 Refinancing CME Term Loan, B / LON (XAN3313EAG51) | 0,65 | 0,0630 | 0,0630 | ||||||

| US893647BS53 / TransDigm Inc | 0,65 | 1,41 | 0,0630 | 0,0008 | |||||

| US85205TAN00 / Spirit AeroSystems Inc | 0,65 | -0,62 | 0,0627 | -0,0005 | |||||

| SOP / DIR (N/A) | 0,64 | 0,0626 | 0,0626 | ||||||

| US89383JAA60 / Transocean Poseidon Ltd | 0,64 | 0,78 | 0,0626 | 0,0003 | |||||

| US61764PBZ45 / Morgan Stanley Bank of America Merrill Lynch Trust 2014 C19 | 0,64 | -12,79 | 0,0623 | -0,0093 | |||||

| PPL Capital Funding, Inc. / DBT (US69352PAS20) | 0,64 | -3,47 | 0,0621 | -0,0024 | |||||

| US22550L2M24 / Credit Suisse AG/New York NY | 0,63 | 0,16 | 0,0613 | -0,0000 | |||||

| SOP / DIR (N/A) | 0,62 | 0,0605 | 0,0605 | ||||||

| USP01012BX31 / El Salvador Government International Bond | 0,62 | 1,96 | 0,0605 | 0,0010 | |||||

| US38376R2S43 / GNMA CMO IO | 0,62 | -10,65 | 0,0604 | -0,0073 | |||||

| XS2343113101 / International Consolidated Airlines Group SA | 0,62 | 25,51 | 0,0603 | 0,0121 | |||||

| D1DG34 / Datadog, Inc. - Depositary Receipt (Common Stock) | 0,62 | 9,93 | 0,0602 | 0,0053 | |||||

| MMYT / MakeMyTrip Limited | 0,62 | 0,0602 | 0,0602 | ||||||

| US38376R2Q86 / GNMA CMO IO | 0,62 | -19,97 | 0,0600 | -0,0151 | |||||

| US84921RAB69 / Spotify USA Inc | 0,62 | 84,73 | 0,0600 | 0,0274 | |||||

| US38379EAL65 / GNMA CMO IO | 0,61 | 1,83 | 0,0594 | 0,0010 | |||||

| US31325URK42 / FHLMC, STRIPS, Series 311, Class S1 | 0,61 | 3,57 | 0,0592 | 0,0019 | |||||

| US35565LBE56 / Freddie Mac Stacr Remic Trust 2020-HQA2 | 0,61 | 1,17 | 0,0589 | 0,0005 | |||||

| L1YV34 / Live Nation Entertainment, Inc. - Depositary Receipt (Common Stock) | 0,60 | 5,04 | 0,0587 | 0,0027 | |||||

| US06054ABC27 / BANC OF AMERICA COMMERCIAL MORTGAGE TRUST FRN 09/15/2048 2015-UBS7 B | 0,60 | 148,96 | 0,0583 | 0,0347 | |||||

| US35565XBE94 / CORP CMO | 0,59 | -0,67 | 0,0577 | -0,0005 | |||||

| Waystar Technologies, Inc., First Lien, Initial CME Term Loan / LON (US63939WAM55) | 0,59 | 0,0575 | 0,0575 | ||||||

| U.S. Treasury Bills / STIV (US912797QP55) | 0,59 | 0,0574 | 0,0574 | ||||||

| USP1850NAA92 / Braskem Idesa SAPI | 0,59 | 20,94 | 0,0573 | 0,0098 | |||||

| US61690AAG94 / Morgan Stanley Bank of America Merrill Lynch Trust 2015-C27 | 0,59 | 0,51 | 0,0569 | 0,0001 | |||||

| N2ET34 / Cloudflare, Inc. - Depositary Receipt (Common Stock) | 0,59 | 0,0568 | 0,0568 | ||||||

| US38376RX683 / GNMA CMO IO | 0,58 | -10,70 | 0,0567 | -0,0070 | |||||

| XS2214238441 / Ecuador Government International Bond | 0,58 | 48,22 | 0,0567 | 0,0184 | |||||

| XS2333569056 / Meituan | 0,58 | 0,34 | 0,0566 | -0,0000 | |||||

| N2TN34 / Nutanix, Inc. - Depositary Receipt (Common Stock) | 0,58 | 19,30 | 0,0565 | 0,0090 | |||||

| US737446AT14 / CONV. NOTE | 0,58 | 57,03 | 0,0564 | 0,0204 | |||||

| PCG.PRX / PG&E Corporation - Preferred Security | 0,58 | -18,99 | 0,0564 | -0,0134 | |||||

| ITRI / Itron, Inc. | 0,58 | 0,0563 | 0,0563 | ||||||

| US91087BAQ32 / Mexico Government International Bond | 0,58 | -49,69 | 0,0561 | -0,0557 | |||||

| JD / JD.com, Inc. - Depositary Receipt (Common Stock) | 0,58 | 0,0559 | 0,0559 | ||||||

| US05492JAZ57 / Barclays Commercial Mortgage Trust 2019-C5 | 0,57 | 0,89 | 0,0553 | 0,0003 | |||||

| Integer Holdings Corp. / DBT (US45826HAC34) | 0,57 | 57,34 | 0,0552 | 0,0200 | |||||

| US377320AA45 / Glatfelter Corp | 0,57 | 0,0550 | 0,0550 | ||||||

| US02043QAB32 / CONV. NOTE | 0,57 | 52,56 | 0,0550 | 0,0188 | |||||

| US38376RV786 / GNMA CMO IO | 0,57 | -17,40 | 0,0549 | -0,0117 | |||||

| D1LR34 / Digital Realty Trust, Inc. - Depositary Receipt (Common Stock) | 0,56 | 6,05 | 0,0545 | 0,0030 | |||||

| US38378GNB04 / GNMA CMO IO | 0,56 | -0,89 | 0,0542 | -0,0006 | |||||

| XS2066744231 / Carnival PLC | 0,55 | 39,20 | 0,0538 | 0,0150 | |||||

| CDSCMBX / DCR (N/A) | 0,55 | 0,0538 | 0,0538 | ||||||

| PG Polaris BidCo SARL, First Lien, Initial CME Term Loan / LON (US91728NAB55) | 0,55 | 0,18 | 0,0537 | -0,0001 | |||||

| US38375UZV50 / GNMA CMO IO | 0,55 | -14,33 | 0,0534 | -0,0091 | |||||

| US3136A1D440 / FNMA CMO IO | 0,55 | -2,31 | 0,0533 | -0,0014 | |||||

| Glatfelter Corp., First Lien, CME Term Loan / LON (US89458XAB38) | 0,55 | 0,0532 | 0,0532 | ||||||

| SOP / DIR (N/A) | 0,54 | 0,0527 | 0,0527 | ||||||

| CLF / Cleveland-Cliffs Inc. | 0,54 | -10,00 | 0,0525 | -0,0059 | |||||

| Stonex Escrow Issuer LLC / DBT (US86189AAA79) | 0,54 | 0,0525 | 0,0525 | ||||||

| US428102AF45 / Hess Midstream Operations LP | 0,54 | 2,47 | 0,0525 | 0,0012 | |||||

| US718286CG02 / Philippine Government International Bond | 0,54 | 1,12 | 0,0525 | 0,0005 | |||||

| Ahead DB Holdings LLC, First Lien, CME Term Loan, B3 / LON (US00866HAH84) | 0,54 | 0,0523 | 0,0523 | ||||||

| MFA Trust, Series 2024-NPL1, Class A1 / ABS-MBS (US58004YAA73) | 0,53 | -4,64 | 0,0519 | -0,0026 | |||||

| US38376R4R42 / GNMA CMO IO | 0,53 | -7,47 | 0,0518 | -0,0043 | |||||

| US62548QAD34 / Multifamily Connecticut Avenue Securities Trust 2020-01 | 0,53 | -1,12 | 0,0517 | -0,0007 | |||||

| US92939HBB06 / WFRBS Commercial Mortgage Trust 2014-C23 | 0,53 | 0,57 | 0,0514 | 0,0001 | |||||

| US3136BCLU21 / FNMA CMO IO | 0,53 | -1,87 | 0,0512 | -0,0010 | |||||

| US3137FYLH76 / FHLMC CMO IO | 0,52 | 0,97 | 0,0507 | 0,0004 | |||||

| XS2234571771 / Bulgaria Government International Bond | 0,52 | -26,62 | 0,0507 | -0,0185 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0,52 | 0,0500 | 0,0500 | ||||||

| US35565EAE23 / CORP CMO | 0,51 | 2,40 | 0,0497 | 0,0011 | |||||

| USP30179BK34 / COMISION FEDERAL DE ELECTRICIDAD 3.875000% 07/26/2033 | 0,51 | 3,24 | 0,0496 | 0,0014 | |||||

| US911365BN33 / United Rentals North America Inc | 0,51 | 3,25 | 0,0494 | 0,0015 | |||||

| US40637HAF64 / CONV. NOTE | 0,51 | -11,03 | 0,0494 | -0,0062 | |||||

| US38379AYU86 / GNMA CMO IO | 0,51 | 3,26 | 0,0493 | 0,0015 | |||||

| US38376RC877 / GNMA CMO IO | 0,51 | -15,95 | 0,0492 | -0,0094 | |||||

| O2NS34 / ON Semiconductor Corporation - Depositary Receipt (Common Stock) | 0,51 | 7,20 | 0,0492 | 0,0032 | |||||

| US88632QAE35 / Picard Midco, Inc. | 0,50 | 3,70 | 0,0490 | 0,0017 | |||||

| BMO Mortgage Trust, Series 2024-5C8, Class XA / ABS-MBS (US09661XAD03) | 0,50 | -4,91 | 0,0489 | -0,0027 | |||||

| Banijay Entertainment SAS, First Lien, CME Term Loan, B3 / LON (XAF6456UAE38) | 0,50 | 0,0488 | 0,0488 | ||||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,50 | 2,47 | 0,0484 | 0,0010 | |||||

| US38376RAE62 / GNMA CMO IO | 0,50 | -10,59 | 0,0484 | -0,0059 | |||||

| USP75744AJ47 / Paraguay Government International Bond | 0,50 | 2,47 | 0,0483 | 0,0011 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 0,50 | -85,90 | 0,0482 | -0,2943 | |||||

| Bulgaria Government Bond / DBT (XS2890420834) | 0,50 | 0,0481 | 0,0481 | ||||||

| SOP / DIR (N/A) | 0,49 | 0,0478 | 0,0478 | ||||||

| COIN / Coinbase Global, Inc. - Depositary Receipt (Common Stock) | 0,49 | 43,15 | 0,0477 | 0,0143 | |||||

| US836205BC70 / Republic of South Africa Government International Bond | 0,49 | 0,0476 | 0,0476 | ||||||

| US35563PCF45 / Seasoned Credit Risk Transfer Trust Series 2017-3 | 0,48 | -3,97 | 0,0471 | -0,0021 | |||||

| XS2602742285 / Jordan Government International Bond | 0,48 | 78,89 | 0,0469 | 0,0206 | |||||

| XS0864259717 / Morocco Government International Bond | 0,48 | 0,21 | 0,0468 | -0,0000 | |||||

| Benin Government Bond / DBT (US08205QAC24) | 0,48 | 153,16 | 0,0467 | 0,0282 | |||||

| US3136A9C486 / FNMA CMO IO | 0,48 | -1,64 | 0,0466 | -0,0009 | |||||

| US30711XDN12 / CORP CMO | 0,48 | -2,05 | 0,0465 | -0,0011 | |||||

| US01741RAN26 / ATI Inc | 0,48 | 1,71 | 0,0463 | 0,0006 | |||||

| US35563WBE30 / STACR Trust 2018-DNA3 | 0,47 | 0,43 | 0,0458 | 0,0001 | |||||

| US69007TAG94 / Outfront Media Capital LLC / Outfront Media Capital Corp | 0,47 | 1,73 | 0,0458 | 0,0006 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0,47 | 0,0454 | 0,0454 | ||||||

| US94989WBB28 / Wells Fargo Commercial Mortgage Trust | 0,47 | 0,0452 | 0,0452 | ||||||

| US279158AS81 / Ecopetrol SA | 0,46 | -32,85 | 0,0451 | -0,0222 | |||||

| SOP / DIR (N/A) | 0,46 | 0,0450 | 0,0450 | ||||||

| US760942BA98 / Uruguay Government International Bond | 0,46 | -0,43 | 0,0450 | -0,0002 | |||||

| US82452JAD19 / SHIFT4 PAYMENTS INC | 0,46 | 5,96 | 0,0449 | 0,0024 | |||||

| SOP / DIR (N/A) | 0,46 | 0,0447 | 0,0447 | ||||||

| MSTRD / Strategy Inc - Depositary Receipt (Common Stock) | 0,46 | 23,31 | 0,0442 | 0,0082 | |||||

| XS2083302419 / Angolan Government International Bond | 0,45 | 2,25 | 0,0441 | 0,0009 | |||||

| XS2278994418 / BENIN INTL GOV BOND 4.875000% 01/19/2032 | 0,45 | 233,09 | 0,0441 | 0,0308 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0,45 | 0,0439 | 0,0439 | ||||||

| US30711XDY76 / Fannie Mae Connecticut Avenue Securities | 0,45 | -1,75 | 0,0436 | -0,0009 | |||||

| Rivian Automotive, Inc. / DBT (US76954AAB98) | 0,45 | 46,41 | 0,0435 | 0,0138 | |||||

| US902252AB17 / Tyler Technologies Inc | 0,45 | 0,68 | 0,0435 | 0,0003 | |||||

| XS2384701020 / Nigeria Government International Bond | 0,45 | 5,67 | 0,0435 | 0,0023 | |||||

| SE / Sea Limited - Depositary Receipt (Common Stock) | 0,45 | 20,92 | 0,0432 | 0,0074 | |||||

| US143658BV39 / CONV. NOTE | 0,44 | 31,75 | 0,0432 | 0,0103 | |||||

| US470160AV46 / Jamaica Government International Bond | 0,44 | 1,63 | 0,0424 | 0,0006 | |||||

| USP75744AB11 / Paraguay Government International Bond | 0,43 | 1,17 | 0,0420 | 0,0004 | |||||

| BOX / Box, Inc. | 0,43 | 6,93 | 0,0420 | 0,0026 | |||||

| C1MS34 / CMS Energy Corporation - Depositary Receipt (Common Stock) | 0,43 | -4,00 | 0,0420 | -0,0018 | |||||

| Quikrete Holdings, Inc. / DBT (US74843PAA84) | 0,43 | 2,13 | 0,0420 | 0,0008 | |||||

| US3137ASB788 / FHLMC CMO IO | 0,43 | -3,79 | 0,0420 | -0,0018 | |||||

| BBCMS Mortgage Trust, Series 2024-5C31, Class XA / ABS-MBS (US07336YAG08) | 0,43 | -5,10 | 0,0416 | -0,0023 | |||||

| OIS / DIR (N/A) | 0,43 | 0,0416 | 0,0416 | ||||||

| XS2305842903 / Nexi SpA | 0,43 | 9,46 | 0,0416 | 0,0035 | |||||

| CDSCMBX / DCR (N/A) | 0,43 | 0,0413 | 0,0413 | ||||||

| SOP / DIR (N/A) | 0,42 | 0,0412 | 0,0412 | ||||||

| US38376RBE53 / GNMA CMO IO | 0,42 | -17,16 | 0,0408 | -0,0086 | |||||

| TransDigm, Inc. / DBT (US893647BV82) | 0,42 | 2,20 | 0,0408 | 0,0008 | |||||

| Pertamina Hulu Energi PT / DBT (US74448WAA27) | 0,42 | 0,0407 | 0,0407 | ||||||

| US38376RHE99 / GNMA CMO IO | 0,42 | -18,16 | 0,0407 | -0,0091 | |||||

| US20753TAC71 / CONNECTICUT AVENUE SECURITIES TRUST 2019-R04 SER 2019-R04 CL 2B1 V/R REGD 144A P/P 7.26838000 | 0,42 | -1,41 | 0,0407 | -0,0007 | |||||

| US836205AV60 / Republic of South Africa Government International Bond | 0,42 | -39,19 | 0,0407 | -0,0265 | |||||

| US89386MAA62 / Transocean Titan Financing Ltd | 0,42 | 0,0406 | 0,0406 | ||||||

| RHP Hotel Properties LP / RHP Finance Corp. / DBT (US749571AL97) | 0,42 | 0,0405 | 0,0405 | ||||||

| US62547NAB55 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,42 | -3,49 | 0,0403 | -0,0016 | |||||

| US09061GAK76 / CONV. NOTE | 0,41 | 0,00 | 0,0403 | -0,0001 | |||||

| US836205BB97 / Republic of South Africa Government International Bond | 0,41 | -29,83 | 0,0403 | -0,0172 | |||||

| XS2291692890 / Chile Government International Bond | 0,41 | -32,30 | 0,0401 | -0,0193 | |||||

| US05464CAB72 / CONV. NOTE | 0,41 | 36,67 | 0,0398 | 0,0106 | |||||

| US46590XAL01 / JBS USA LUX SA/JBS USA Food Co./JBS USA Finance, Inc. | 0,41 | -67,77 | 0,0397 | -0,0836 | |||||

| G1PI34 / Global Payments Inc. - Depositary Receipt (Common Stock) | 0,41 | -5,12 | 0,0397 | -0,0023 | |||||

| XS2366832496 / Benin Government International Bond | 0,40 | 13,20 | 0,0392 | 0,0044 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,40 | 10,14 | 0,0391 | 0,0035 | |||||

| XS2270576965 / Morocco Government International Bond | 0,40 | 2,04 | 0,0390 | 0,0007 | |||||

| US19688JAC18 / CORP CMO | 0,40 | 0,25 | 0,0389 | 0,0000 | |||||

| US698299BL70 / Panama Government International Bond | 0,40 | 6,10 | 0,0389 | 0,0022 | |||||

| US538034BA63 / CONV. NOTE | 0,40 | 10,56 | 0,0387 | 0,0036 | |||||

| XS2211997239 / STMicroelectronics NV | 0,40 | 5,31 | 0,0386 | 0,0018 | |||||

| US94988XAC02 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,40 | 4,21 | 0,0385 | 0,0015 | |||||

| US3137FVT288 / FHLMC CMO IO | 0,40 | -10,84 | 0,0384 | -0,0047 | |||||

| US91087BAX82 / Mexico Government International Bond | 0,40 | 1,02 | 0,0384 | 0,0003 | |||||

| US819047AB70 / CONVERTIBLE ZERO | 0,39 | 15,88 | 0,0383 | 0,0052 | |||||

| US71643VAB18 / Petroleos Mexicanos | 0,39 | 19,94 | 0,0380 | 0,0063 | |||||

| US3137FTQF70 / FHLMC CMO IO | 0,39 | -1,79 | 0,0375 | -0,0008 | |||||

| HRI / Herc Holdings Inc. | 0,39 | 2,39 | 0,0374 | 0,0007 | |||||

| US38376RG266 / GNMA CMO IO | 0,38 | -14,67 | 0,0373 | -0,0065 | |||||

| US195325BK01 / Colombia Government International Bond | 0,38 | -59,53 | 0,0372 | -0,0547 | |||||

| US38376RK474 / GNMA CMO IO | 0,38 | -13,44 | 0,0370 | -0,0058 | |||||

| US05492JAE29 / BARCLAYS COMMERCIAL MORTGAGE CSTR 11/15/2052 144A | 0,38 | 3,01 | 0,0366 | 0,0010 | |||||

| US95041AAB44 / WELLTOWER OP LLC | 0,38 | 0,00 | 0,0364 | -0,0001 | |||||

| US531229AQ58 / CONV. NOTE | 0,37 | 9,36 | 0,0363 | 0,0030 | |||||

| D1EX34 / DexCom, Inc. - Depositary Receipt (Common Stock) | 0,37 | 5,13 | 0,0359 | 0,0017 | |||||

| Jazz Investments I Ltd. / DBT (US472145AG66) | 0,37 | -4,43 | 0,0357 | -0,0017 | |||||

| US12591VAK70 / Commercial Mortgage Trust, Series 2014-CR16, Class C | 0,37 | 0,27 | 0,0357 | 0,0000 | |||||

| Hess Midstream Operations LP / DBT (US428102AH01) | 0,37 | 1,11 | 0,0355 | 0,0003 | |||||

| US46644YAU47 / JPMBB Commercial Mortgage Securities Trust 2015-C31 | 0,36 | -67,30 | 0,0354 | -0,0730 | |||||

| US12668AEV35 / CORP CMO | 0,36 | -1,89 | 0,0354 | -0,0007 | |||||

| US05492JAA07 / Barclays Commercial Mortgage Trust 2019-C5 | 0,36 | 2,27 | 0,0351 | 0,0007 | |||||

| MTH / Meritage Homes Corporation | 0,36 | -0,55 | 0,0351 | -0,0003 | |||||

| LEG Properties BV / DBT (DE000A3L21D1) | 0,36 | 13,52 | 0,0351 | 0,0041 | |||||

| SOP / DIR (N/A) | 0,36 | 0,0349 | 0,0349 | ||||||

| US35566ABE82 / CORP CMO | 0,36 | 1,14 | 0,0346 | 0,0003 | |||||

| SOP / DIR (N/A) | 0,36 | 0,0346 | 0,0346 | ||||||

| E2XA34 / Exact Sciences Corporation - Depositary Receipt (Common Stock) | 0,36 | 6,61 | 0,0346 | 0,0021 | |||||

| BLDR / Builders FirstSource, Inc. | 0,36 | 0,0345 | 0,0345 | ||||||

| SOP / DIR (N/A) | 0,35 | 0,0344 | 0,0344 | ||||||

| M2KS34 / MKS Inc. - Depositary Receipt (Common Stock) | 0,35 | 9,63 | 0,0343 | 0,0030 | |||||

| US94419LAP67 / CONV. NOTE | 0,35 | 16,61 | 0,0341 | 0,0048 | |||||

| US589889AA22 / Merit Medical Systems Inc | 0,35 | -8,22 | 0,0337 | -0,0031 | |||||

| JH North America Holdings, Inc. / DBT (US46593WAB19) | 0,35 | 0,0336 | 0,0336 | ||||||

| OSIS / OSI Systems, Inc. | 0,34 | 11,36 | 0,0334 | 0,0033 | |||||

| Clarios Global LP, First Lien, Amendment No. 6 Dollar CME Term Loan / LON (XAC8000CAP86) | 0,34 | 0,0333 | 0,0333 | ||||||

| US12667GZ303 / CORP CMO | 0,34 | -2,01 | 0,0332 | -0,0008 | |||||

| W1EL34 / Welltower Inc. - Depositary Receipt (Common Stock) | 0,34 | 0,90 | 0,0326 | 0,0003 | |||||

| M1CH34 / Microchip Technology Incorporated - Depositary Receipt (Common Stock) | 0,34 | 0,0326 | 0,0326 | ||||||

| Benchmark Mortgage Trust, Series 2024-V11, Class XA / ABS-MBS (US081921BA52) | 0,33 | -5,13 | 0,0324 | -0,0018 | |||||

| US00971TAL52 / CONV. NOTE | 0,33 | -0,60 | 0,0323 | -0,0002 | |||||

| ACA / Arcosa, Inc. | 0,33 | 2,47 | 0,0323 | 0,0007 | |||||

| US516544AB96 / CONV. NOTE | 0,33 | -10,08 | 0,0321 | -0,0036 | |||||

| Shift4 Payments LLC / Shift4 Payments Finance Sub, Inc. / DBT (XS3068797078) | 0,33 | 0,0320 | 0,0320 | ||||||

| US200474BF05 / COMM Mortgage Trust | 0,33 | 0,31 | 0,0318 | 0,0001 | |||||

| US05493NAA00 / BDS 2021-FL9 Ltd | 0,32 | -48,57 | 0,0315 | -0,0299 | |||||

| CHEF / The Chefs' Warehouse, Inc. | 0,32 | -2,71 | 0,0314 | -0,0010 | |||||

| US31325VB941 / FHLMC, STRIPS, Series 326, Class S2 | 0,32 | -1,53 | 0,0313 | -0,0006 | |||||

| US31398PJU49 / FNMA CMO IO | 0,32 | 1,58 | 0,0313 | 0,0004 | |||||

| US92676XAG25 / Viking Cruises Ltd | 0,31 | -70,90 | 0,0303 | -0,0738 | |||||

| US95002BAL71 / Wells Fargo Commercial Mortgage Trust 2019-C53 | 0,31 | 3,33 | 0,0302 | 0,0009 | |||||

| US35565WBE12 / Freddie Mac STACR REMIC Trust 2020-DNA3 | 0,31 | -0,64 | 0,0301 | -0,0003 | |||||

| Uzbekneftegaz JSC / DBT (US91825MAC73) | 0,31 | 0,0300 | 0,0300 | ||||||

| CYBR / CyberArk Software Ltd. | 0,31 | 0,0300 | 0,0300 | ||||||

| SOP / DIR (N/A) | 0,31 | 0,0298 | 0,0298 | ||||||

| US3137ALYB93 / FHLMC CMO IO | 0,30 | -4,72 | 0,0295 | -0,0015 | |||||

| 5290 / Vertex Corporation | 0,30 | -10,12 | 0,0294 | -0,0034 | |||||

| US26142RAB06 / DraftKings, Inc. | 0,30 | 2,72 | 0,0293 | 0,0007 | |||||

| US38379BYV43 / GNMA CMO IO | 0,29 | -7,55 | 0,0286 | -0,0024 | |||||

| US29786AAN63 / CONV. NOTE | 0,29 | 1,03 | 0,0285 | 0,0002 | |||||

| XS2523390867 / Lenovo Group Ltd | 0,29 | -11,01 | 0,0283 | -0,0035 | |||||

| US12634NAY40 / Csail 2015-C2 Commercial Mortgage Trust | 0,29 | -0,34 | 0,0282 | -0,0002 | |||||

| US35564LBE65 / CORP CMO | 0,29 | 0,00 | 0,0281 | -0,0000 | |||||

| US38382FGP36 / GNMA CMO IO | 0,29 | -4,62 | 0,0281 | -0,0014 | |||||

| US3434125080 / FLUOR CORP PC 6.5% PERP | 0,29 | 23,81 | 0,0278 | 0,0052 | |||||

| US38375UYG92 / GNMA CMO IO | 0,29 | -12,58 | 0,0277 | -0,0041 | |||||

| US38382GXV93 / GNMA CMO IO | 0,29 | 6,74 | 0,0277 | 0,0017 | |||||

| SOP / DIR (N/A) | 0,29 | 0,0277 | 0,0277 | ||||||

| PRGS / Progress Software Corporation | 0,28 | 10,08 | 0,0276 | 0,0025 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0,28 | 0,0276 | 0,0276 | ||||||

| US92339LAA08 / VERDE PURCHASER LLC 10.5% 11/30/2030 144A | 0,28 | 2,18 | 0,0274 | 0,0005 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 0,28 | 0,0273 | 0,0273 | ||||||

| US12635QBL32 / COMM 2015-CCRE27 Mortgage Trust | 0,28 | 0,36 | 0,0271 | 0,0001 | |||||

| AVNT / Avient Corporation | 0,28 | 1,84 | 0,0270 | 0,0004 | |||||

| US08265TAD19 / CONV. NOTE | 0,27 | 4,18 | 0,0266 | 0,0010 | |||||

| WESCO Distribution, Inc. / DBT (US95081QAS30) | 0,27 | 3,01 | 0,0266 | 0,0007 | |||||

| CX / CEMEX, S.A.B. de C.V. - Preferred Security | 0,27 | 0,0265 | 0,0265 | ||||||

| USP7808BAA54 / Petroleos del Peru SA | 0,27 | -49,25 | 0,0264 | -0,0256 | |||||

| US38376VFR33 / GNMA CMO IO | 0,27 | 0,75 | 0,0262 | 0,0001 | |||||

| DTRS / DIR (N/A) | 0,27 | 0,0261 | 0,0261 | ||||||

| SOP / DIR (N/A) | 0,27 | 0,0260 | 0,0260 | ||||||

| Hims & Hers Health, Inc. / DBT (US433000AA43) | 0,27 | 0,0258 | 0,0258 | ||||||

| US61772TBN37 / Morgan Stanley Capital I Trust 2021-L7 | 0,26 | -4,35 | 0,0257 | -0,0012 | |||||

| ASND / Ascendis Pharma A/S - Depositary Receipt (Common Stock) | 0,26 | 5,65 | 0,0254 | 0,0013 | |||||

| Rexford Industrial Realty LP / DBT (US76169XAE40) | 0,26 | -1,14 | 0,0254 | -0,0003 | |||||

| Ghana Government Bond / DBT (US374422AP83) | 0,26 | 9,70 | 0,0253 | 0,0021 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0,26 | 0,78 | 0,0252 | 0,0001 | |||||

| US665531AJ80 / CONV. NOTE | 0,25 | -0,78 | 0,0247 | -0,0003 | |||||

| US12592XBG07 / COMM 15-CR22 B FRN 03-10-48/03-12-25 | 0,25 | -2,32 | 0,0246 | -0,0007 | |||||

| WK / Workiva Inc. | 0,25 | -0,40 | 0,0244 | -0,0002 | |||||

| US20753VBE74 / Connecticut Avenue Securities Trust 2020-SBT1 | 0,25 | -0,40 | 0,0241 | -0,0002 | |||||

| SOP / DIR (N/A) | 0,25 | 0,0241 | 0,0241 | ||||||

| US61762DAG60 / Morgan Stanley Bank of America Merrill Lynch Trust 2013-C9 | 0,24 | 1,24 | 0,0237 | 0,0002 | |||||

| Ukraine Government Bond / DBT (US903724CC46) | 0,24 | -6,56 | 0,0236 | -0,0017 | |||||

| B2UR34 / Burlington Stores, Inc. - Depositary Receipt (Common Stock) | 0,24 | -2,02 | 0,0235 | -0,0006 | |||||

| US38380XSS70 / GNMA CMO IO | 0,24 | -3,98 | 0,0235 | -0,0010 | |||||

| US61762XAC11 / Morgan Stanley Bank of America Merrill Lynch Trust, Series 2013-C12, Class D | 0,24 | 2,56 | 0,0234 | 0,0005 | |||||

| SOP / DIR (N/A) | 0,24 | 0,0232 | 0,0232 | ||||||

| US38380YYA71 / GNMA CMO IO | 0,24 | -2,47 | 0,0231 | -0,0006 | |||||

| PSN / Parsons Corporation | 0,23 | 6,36 | 0,0228 | 0,0014 | |||||

| XS2010027709 / Eskom Holdings SOC Ltd | 0,23 | 1,74 | 0,0227 | 0,0003 | |||||

| XS1864523300 / Eskom Holdings SOC Ltd | 0,23 | 1,75 | 0,0226 | 0,0003 | |||||

| Ukraine Government Bond / DBT (US903724CB62) | 0,23 | -3,73 | 0,0226 | -0,0009 | |||||

| US89177JAB44 / Towd Point Mortgage Trust 2019-2 | 0,23 | 0,00 | 0,0225 | -0,0000 | |||||

| US3137FJK993 / FHLMC CMO IO | 0,23 | 3,60 | 0,0224 | 0,0007 | |||||

| USP5178RAC27 / Honduras Government International Bond | 0,23 | 1,32 | 0,0224 | 0,0003 | |||||

| US23305YAM12 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,23 | -0,43 | 0,0223 | -0,0002 | |||||

| R2GE34 / Repligen Corporation - Depositary Receipt (Common Stock) | 0,23 | 1,79 | 0,0222 | 0,0003 | |||||

| US35563PKR90 / CORP CMO | 0,23 | 0,44 | 0,0222 | 0,0001 | |||||

| XS1493296500 / Spectrum Brands, Inc. | 0,23 | 0,0221 | 0,0221 | ||||||

| Ghana Government Bond / DBT (US374422AM52) | 0,23 | 7,14 | 0,0219 | 0,0015 | |||||

| SOP / DIR (N/A) | 0,23 | 0,0219 | 0,0219 | ||||||

| US46643ABK88 / JPMBB Commercial Mortgage Securities Trust | 0,23 | -3,02 | 0,0219 | -0,0007 | |||||

| US38375U6A37 / GNMA CMO IO | 0,22 | -9,54 | 0,0212 | -0,0023 | |||||

| US3137FQNN92 / FHLMC CMO IO | 0,22 | 0,93 | 0,0212 | 0,0001 | |||||

| US852234AK99 / CONV. NOTE | 0,22 | 1,41 | 0,0211 | 0,0002 | |||||

| HRI / Herc Holdings Inc. | 0,21 | 0,0208 | 0,0208 | ||||||

| Adient Global Holdings Ltd. / DBT (US00687YAD76) | 0,21 | 8,85 | 0,0204 | 0,0017 | |||||

| US20754BAB71 / Connecticut Avenue Securities Trust 2022-R02 | 0,20 | -94,45 | 0,0199 | -0,3378 | |||||

| HCXY / Hercules Capital, Inc. - Corporate Bond/Note | 0,20 | -1,45 | 0,0199 | -0,0004 | |||||

| US89176VAC63 / Towd Point Mortgage Trust 2018-5 | 0,20 | 1,00 | 0,0198 | 0,0002 | |||||

| Core Scientific, Inc. / DBT (US21874AAE64) | 0,20 | 29,03 | 0,0195 | 0,0044 | |||||

| US836205AY00 / Republic of South Africa Government International Bond | 0,20 | -74,42 | 0,0194 | -0,0564 | |||||

| Verde Purchaser LLC, First Lien, Second Refinancing CME Term Loan / LON (US92338TAB26) | 0,20 | 0,51 | 0,0193 | 0,0001 | |||||

| DE000A286LP0 / QIAGEN NV | 0,20 | 1,56 | 0,0190 | 0,0002 | |||||

| US20754RAJ59 / Connecticut Avenue Securities Trust, Series 2021-R01, Class 1B2 | 0,19 | 0,52 | 0,0188 | -0,0000 | |||||

| US95002MAY57 / Wells Fargo Commercial Mortgage Trust, Series 2019-C52, Class XA | 0,19 | -4,95 | 0,0187 | -0,0010 | |||||

| HAE / Haemonetics Corporation | 0,19 | 4,37 | 0,0186 | 0,0008 | |||||

| US679295AF24 / CONV. NOTE | 0,19 | 0,00 | 0,0185 | -0,0000 | |||||

| SOP / DIR (N/A) | 0,19 | 0,0183 | 0,0183 | ||||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AB20) | 0,18 | 0,0179 | 0,0179 | ||||||

| Ukraine Government Bond / DBT (US903724CA89) | 0,18 | -4,21 | 0,0177 | -0,0008 | |||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AA47) | 0,18 | 0,0177 | 0,0177 | ||||||

| US12635FAT12 / CSAIL 2015-C3 Commercial Mortgage Trust | 0,18 | 0,0176 | 0,0176 | ||||||

| US71654QDE98 / Petroleos Mexicanos | 0,18 | 6,51 | 0,0176 | 0,0011 | |||||

| SOP / DIR (N/A) | 0,18 | 0,0172 | 0,0172 | ||||||

| BANK5, Series 2024-5YR12, Class XA / ABS-MBS (US06644XBM74) | 0,18 | -5,38 | 0,0172 | -0,0010 | |||||

| US12668AY901 / CORP CMO | 0,18 | -5,41 | 0,0171 | -0,0010 | |||||

| US02146BAB27 / CORP CMO | 0,17 | -4,40 | 0,0170 | -0,0007 | |||||

| US92930RAK86 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,17 | -5,95 | 0,0170 | -0,0011 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,17 | 0,0170 | 0,0170 | ||||||

| XS1619155564 / Senegal Government International Bond | 0,17 | -11,86 | 0,0167 | -0,0023 | |||||

| US46639YAC12 / COMMERCIAL MORTGAGE BACKED SECURITIES | 0,17 | 0,00 | 0,0163 | -0,0000 | |||||

| US17330VAA44 / CMLTI_22-A | 0,16 | -1,85 | 0,0155 | -0,0004 | |||||

| MARA / MARA Holdings, Inc. | 0,16 | 20,45 | 0,0155 | 0,0025 | |||||

| US30711XDB73 / Fannie Mae Connecticut Avenue Securities | 0,16 | -2,48 | 0,0153 | -0,0004 | |||||

| XS2214237807 / Ecuador Government International Bond | 0,15 | 45,54 | 0,0144 | 0,0045 | |||||

| OIS / DIR (N/A) | 0,15 | 0,0143 | 0,0143 | ||||||

| SOP / DIR (N/A) | 0,15 | 0,0141 | 0,0141 | ||||||

| US71654QCC42 / Petroleos Mexicanos Bond | 0,14 | 5,88 | 0,0141 | 0,0007 | |||||

| US38381XBN57 / GNMA CMO IO | 0,14 | -2,72 | 0,0139 | -0,0004 | |||||

| SOP / DIR (N/A) | 0,14 | 0,0138 | 0,0138 | ||||||

| US38381XK399 / GNMA CMO IO | 0,14 | -1,40 | 0,0137 | -0,0002 | |||||

| DVAI34 / DaVita Inc. - Depositary Receipt (Common Stock) | 0,14 | 0,0135 | 0,0135 | ||||||

| US35563KBE91 / CORP CMO | 0,14 | 0,00 | 0,0133 | -0,0001 | |||||

| US94989NAL10 / Wells Fargo Commercial Mortgage Trust 2015-C30 | 0,14 | 0,00 | 0,0132 | -0,0001 | |||||

| US38381AKY19 / GNMA CMO IO | 0,14 | 0,00 | 0,0132 | 0,0000 | |||||

| US38380CH714 / GNMA CMO IO | 0,13 | -2,90 | 0,0130 | -0,0005 | |||||

| US12625FBA30 / COMM 2013-CCRE7 Mortgage Trust | 0,13 | -2,21 | 0,0130 | -0,0003 | |||||

| IRS / DIR (N/A) | 0,13 | 0,0129 | 0,0129 | ||||||

| CDSCMBX / DCR (N/A) | 0,13 | 0,0129 | 0,0129 | ||||||

| SOP / DIR (N/A) | 0,13 | 0,0128 | 0,0128 | ||||||

| OIS / DIR (N/A) | 0,13 | 0,0127 | 0,0127 | ||||||

| US46643AAG85 / JPMBB Commercial Mortgage Securities Trust, Series 2014-C23, Class D | 0,13 | -1,53 | 0,0125 | -0,0003 | |||||

| US20754WAC91 / CORP CMO | 0,13 | 0,00 | 0,0125 | -0,0000 | |||||

| SOP / DIR (N/A) | 0,13 | 0,0124 | 0,0124 | ||||||

| US38379LWF92 / GNMA CMO IO | 0,13 | -16,45 | 0,0124 | -0,0025 | |||||

| US92939FAY51 / WFRBS Commercial Mortgage Trust 2014-C21 | 0,12 | 0,00 | 0,0118 | -0,0000 | |||||

| SOP / DIR (N/A) | 0,12 | 0,0117 | 0,0117 | ||||||

| SOP / DIR (N/A) | 0,12 | 0,0114 | 0,0114 | ||||||

| American Airlines, Inc., First Lien, 2025 Incremental CME Term Loan / LON (US02376CBT18) | 0,12 | 0,0113 | 0,0113 | ||||||

| US977852AD45 / CONV. NOTE | 0,11 | 14,43 | 0,0109 | 0,0013 | |||||

| US26156FAA12 / Dresdner Funding Trust I | 0,11 | 0,92 | 0,0107 | 0,0001 | |||||

| Ukraine Government Bond / DBT (US903724CF76) | 0,11 | -16,00 | 0,0102 | -0,0019 | |||||

| Ukraine Government Bond / DBT (US903724CE02) | 0,10 | -3,77 | 0,0099 | -0,0004 | |||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,10 | -72,88 | 0,0096 | -0,0259 | |||||

| US61759FAU57 / CORP CMO | 0,10 | -2,04 | 0,0094 | -0,0002 | |||||

| OIS / DIR (N/A) | 0,09 | 0,0088 | 0,0088 | ||||||

| Ukraine Government Bond / DBT (US903724CG59) | 0,09 | -16,82 | 0,0087 | -0,0018 | |||||

| US3136B5A545 / FNMA CMO IO | 0,09 | 0,00 | 0,0086 | 0,0001 | |||||

| US3136ANRR02 / FNMA CMO IO | 0,09 | -6,52 | 0,0084 | -0,0006 | |||||

| N1WL34 / Newell Brands Inc. - Depositary Receipt (Common Stock) | 0,08 | 0,0081 | 0,0081 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,08 | 0,0079 | 0,0079 | ||||||

| JH North America Holdings, Inc. / DBT (US46593WAA36) | 0,08 | 0,0078 | 0,0078 | ||||||

| US3136ANX694 / FNMA CMO IO | 0,08 | -1,23 | 0,0078 | -0,0001 | |||||

| US097023CN34 / Boeing Co/The | 0,08 | 1,30 | 0,0077 | 0,0001 | |||||

| US36250GAT22 / GS Mortgage Securities Trust 2015-GC30 | 0,08 | -86,75 | 0,0075 | -0,0491 | |||||

| Ghana Government Bond / DBT (US374422AN36) | 0,08 | 8,57 | 0,0075 | 0,0006 | |||||

| CDSCMBX / DCR (N/A) | 0,08 | 0,0074 | 0,0074 | ||||||

| CDSCMBX / DCR (N/A) | 0,08 | 0,0074 | 0,0074 | ||||||

| US803607AD25 / CONV. NOTE | 0,07 | -65,26 | 0,0072 | -0,0135 | |||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,07 | 0,0066 | 0,0066 | ||||||

| US36202EXV63 / Ginnie Mae II Pool | 0,07 | -2,90 | 0,0066 | -0,0002 | |||||

| CDSCMBX / DCR (N/A) | 0,07 | 0,0064 | 0,0064 | ||||||

| US3136FCZ907 / FNMA CMO IO | 0,06 | -5,97 | 0,0062 | -0,0004 | |||||

| US92922F4V78 / CORP CMO | 0,06 | -4,55 | 0,0062 | -0,0003 | |||||

| CDSCMBX / DCR (N/A) | 0,06 | 0,0055 | 0,0055 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,06 | 0,0055 | 0,0055 | ||||||

| CDSCMBX / DCR (N/A) | 0,05 | 0,0053 | 0,0053 | ||||||

| US3136FEMW97 / FNMA CMO IO | 0,05 | -5,26 | 0,0053 | -0,0003 | |||||

| US46639YAX58 / JP Morgan Chase Commercial Mortgage Securities Trust, Series 2013-LC11, Class D | 0,05 | -10,34 | 0,0051 | -0,0006 | |||||

| CDSCMBX / DCR (N/A) | 0,05 | 0,0051 | 0,0051 | ||||||

| US3137AUD483 / FHLMC CMO IO | 0,05 | -16,39 | 0,0050 | -0,0009 | |||||

| CDSCMBX / DCR (N/A) | 0,05 | 0,0049 | 0,0049 | ||||||

| SOP / DIR (N/A) | 0,04 | 0,0041 | 0,0041 | ||||||

| Ghana Government Bond / DBT (US374422AL79) | 0,04 | 2,44 | 0,0041 | 0,0001 | |||||

| US15089QAP90 / Celanese US Holdings LLC | 0,04 | -92,83 | 0,0039 | -0,0491 | |||||

| CDSCMBX / DCR (N/A) | 0,04 | 0,0035 | 0,0035 | ||||||

| US31392DQ475 / FNMA CMO IO | 0,04 | 2,94 | 0,0034 | 0,0001 | |||||

| Ukraine Government Bond / DBT (US903724CD29) | 0,03 | -8,11 | 0,0033 | -0,0003 | |||||

| CDSCMBX / DCR (N/A) | 0,03 | 0,0031 | 0,0031 | ||||||

| Forward Foreign Currency Contract / DFE (N/A) | 0,03 | 0,0031 | 0,0031 | ||||||