Statistiques de base

| Valeur du portefeuille | $ 307 189 735 |

| Positions actuelles | 1 005 |

Dernières positions, performances, ASG (à partir des dépôts 13F, 13D)

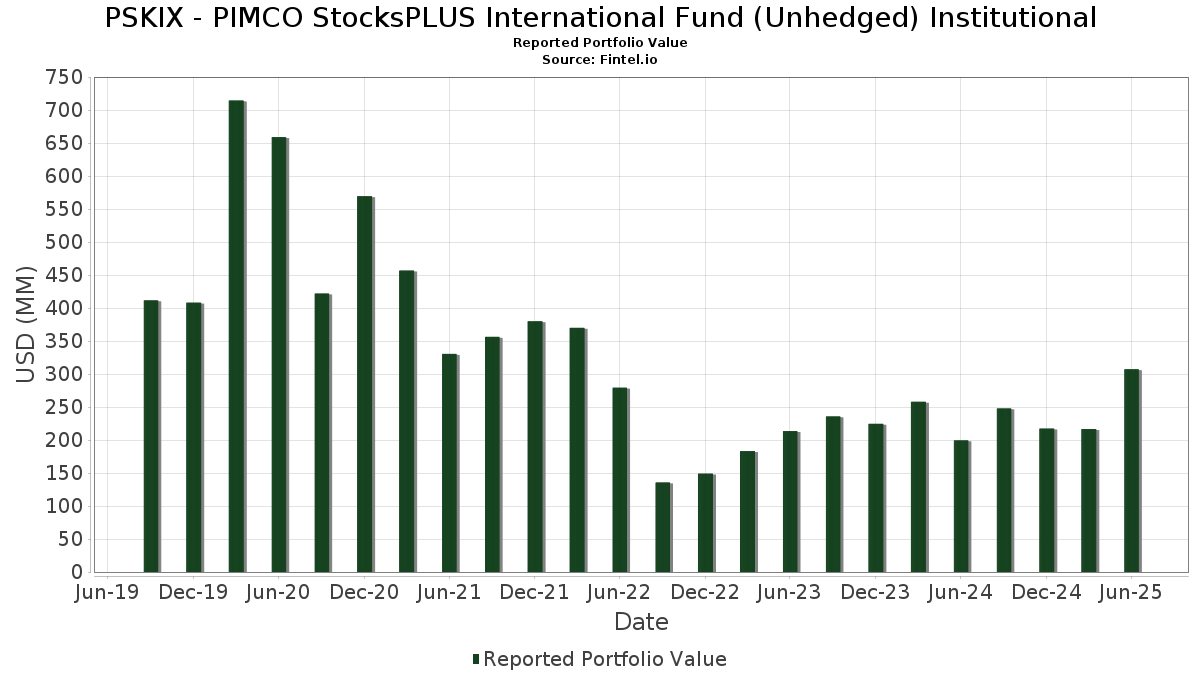

PSKIX - PIMCO StocksPLUS International Fund (Unhedged) Institutional a déclaré un total de 1 005 positions dans ses derniers dépôts auprès de la SEC. La valeur la plus récente du portefeuille est calculée à 307 189 735 USD. Les actifs sous gestion réels (ASG) sont cette valeur plus les liquidités (qui ne sont pas divulguées). Les principales positions de PSKIX - PIMCO StocksPLUS International Fund (Unhedged) Institutional sont PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , Uniform Mortgage-Backed Security, TBA (US:US01F0526800) , and UMBS TBA (US:US01F0406854) . Les nouvelles positions de PSKIX - PIMCO StocksPLUS International Fund (Unhedged) Institutional incluent PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , Uniform Mortgage-Backed Security, TBA (US:US01F0526800) , and UMBS TBA (US:US01F0406854) .

Meilleures augmentations ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 20,17 | 11,4581 | 8,5123 | ||

| 12,00 | 6,8174 | 6,8174 | ||

| 12,00 | 6,8174 | 6,8174 | ||

| 12,00 | 6,8174 | 6,8174 | ||

| 11,94 | 6,7846 | 6,7846 | ||

| 17,87 | 10,1519 | 6,2039 | ||

| 4,94 | 2,8048 | 5,6357 | ||

| 9,21 | 5,2323 | 5,2323 | ||

| 24,25 | 13,7772 | 2,0607 | ||

| 4,02 | 2,2816 | 1,9538 |

Principales baisses ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| -5,40 | -3,0684 | -3,1197 | ||

| 0,09 | 0,0523 | -0,6470 | ||

| 1,63 | 0,9269 | -0,5001 | ||

| 1,63 | 0,9269 | -0,5001 | ||

| 1,63 | 0,9269 | -0,5001 | ||

| 3,91 | 2,2206 | -0,3250 | ||

| 3,69 | 2,0935 | -0,3131 | ||

| 1,24 | 0,7038 | -0,2044 | ||

| 1,84 | 1,0480 | -0,2038 | ||

| 1,96 | 1,1146 | -0,1983 |

Déclarations 13F et dépôts de fonds

Ce formulaire a été déposé le 2025-08-29 pour la période de déclaration 2025-06-30. Cet investisseur n'a pas divulgué les titres comptabilisés en actions, les colonnes relatives aux actions dans le tableau ci-dessous sont donc omises. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau pour débloquer les données premium et exporter vers Excel ![]() .

.

| Titre | Type | ΔActions (%) |

Valeur ($ en millions) |

Portefeuille (%) |

ΔPortefeuille (%) |

|

|---|---|---|---|---|---|---|

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 24,25 | 35,40 | 13,7772 | 2,0607 | ||

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 20,17 | 296,54 | 11,4581 | 8,5123 | ||

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 17,87 | 162,16 | 10,1519 | 6,2039 | ||

| CITIGROUP REPO REPO 5807 / RA (000000000) | 12,00 | 6,8174 | 6,8174 | |||

| CITIGROUP REPO REPO 5807 / RA (000000000) | 12,00 | 6,8174 | 6,8174 | |||

| CITIGROUP REPO REPO 5807 / RA (000000000) | 12,00 | 6,8174 | 6,8174 | |||

| TREASURY BILL 07/25 0.00000 / DBT (US912797NX17) | 11,94 | 6,7846 | 6,7846 | |||

| NDDUEAFE TRS EQUITY FEDL01+31.5 *BULLET* / DE (000000000) | 9,21 | 5,2323 | 5,2323 | |||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 5,89 | 42,30 | 3,3489 | 0,9499 | ||

| US01F0406854 / UMBS TBA | 4,94 | -135,01 | 2,8048 | 5,6357 | ||

| US01F0506844 / UMBS TBA | 4,80 | 83,94 | 2,7267 | 1,2155 | ||

| US01F0426811 / UMBS TBA | 4,02 | 610,62 | 2,2816 | 1,9538 | ||

| US23242EAL39 / COUNTRYWIDE ASSET BACKED CERTI CWL 2006 13 MV1 | 3,91 | 0,44 | 2,2206 | -0,3250 | ||

| TSY INFL IX N/B 07/34 1.875 / DBT (US91282CLE92) | 3,69 | 0,19 | 2,0935 | -0,3131 | ||

| US01F0306781 / UMBS TBA | 3,20 | 1,8192 | 1,8192 | |||

| FNMA POOL BZ4146 FN 06/32 FIXED 5.14 / ABS-MBS (US3140NYTC52) | 3,18 | 1,8082 | 1,8082 | |||

| US21H0406734 / Ginnie Mae | 3,18 | 1,8068 | 1,8068 | |||

| US715638BY77 / REPUBLIC OF PERU SR UNSECURED 144A 08/32 6.15 | 2,80 | 6,78 | 1,5925 | -0,1249 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 2,45 | 1,3940 | 1,3940 | |||

| FNMA POOL FA1296 FN 08/51 FIXED VAR / ABS-MBS (US3140W1NN98) | 2,32 | 1,3166 | 1,3166 | |||

| FNMA POOL FA1296 FN 08/51 FIXED VAR / ABS-MBS (US3140W1NN98) | 2,32 | 1,3166 | 1,3166 | |||

| FNMA POOL FA1296 FN 08/51 FIXED VAR / ABS-MBS (US3140W1NN98) | 2,32 | 1,3166 | 1,3166 | |||

| US21H0506806 / GNMA | 2,31 | 1,3109 | 1,3109 | |||

| RFRF USD SF+26.161/1.2* 9/16/23-28Y* CME / DIR (EZ31ZKH6CSJ5) | 2,24 | 3,51 | 1,2734 | -0,1430 | ||

| RFRF USD SF+26.161/1.2* 9/16/23-28Y* CME / DIR (EZ31ZKH6CSJ5) | 2,24 | 3,51 | 1,2734 | -0,1430 | ||

| RFRF USD SF+26.161/1.2* 9/16/23-28Y* CME / DIR (EZ31ZKH6CSJ5) | 2,24 | 3,51 | 1,2734 | -0,1430 | ||

| TSY INFL IX N/B 04/29 2.125 / DBT (US91282CKL45) | 2,13 | 0,76 | 1,2103 | -0,1733 | ||

| US78485KAE55 / STWD 2022-FL3 Ltd | 1,99 | -0,05 | 1,1299 | -0,1715 | ||

| US TREASURY N/B 05/44 4.625 / DBT (US912810UB25) | 1,96 | -2,29 | 1,1146 | -0,1983 | ||

| FNMA POOL FS2937 FN 04/43 FIXED VAR / ABS-MBS (US3140XJHP17) | 1,92 | 1,0890 | 1,0890 | |||

| US912810TS78 / United States Treasury Note/Bond | 1,88 | -2,14 | 1,0660 | -0,1884 | ||

| US55027YAD04 / LUMINENT MORTGAGE TRUST LUM 2006 6 A1 | 1,84 | -3,61 | 1,0480 | -0,2038 | ||

| FNMA POOL BM7581 FN 09/31 VARIABLE / ABS-MBS (US3140JCM768) | 1,73 | 0,81 | 0,9842 | -0,1398 | ||

| RFR USD SOFR/1.75000 06/15/22-10Y CME / DIR (EZQ6DKJXZ1C9) | 1,63 | -25,22 | 0,9269 | -0,5001 | ||

| RFR USD SOFR/1.75000 06/15/22-10Y CME / DIR (EZQ6DKJXZ1C9) | 1,63 | -25,22 | 0,9269 | -0,5001 | ||

| RFR USD SOFR/1.75000 06/15/22-10Y CME / DIR (EZQ6DKJXZ1C9) | 1,63 | -25,22 | 0,9269 | -0,5001 | ||

| US92926SAE63 / WaMu Asset-Backed Certificates WaMu Series | 1,45 | -0,34 | 0,8216 | -0,1281 | ||

| US912810TT51 / United States Treasury Note/Bond | 1,43 | -3,05 | 0,8122 | -0,1526 | ||

| US00217VAC46 / AREIT CRE TRUST AREIT 2022 CRE7 AS 144A | 1,30 | -0,15 | 0,7393 | -0,1132 | ||

| US55284JAC36 / MF1 2022-FL8 Ltd | 1,30 | -0,61 | 0,7372 | -0,1167 | ||

| US00217VAA89 / AREIT 2022-CRE7 LLC | 1,24 | -10,81 | 0,7038 | -0,2044 | ||

| FED HM LN PC POOL SD7399 FR 12/54 FIXED 4.5 / ABS-MBS (US3132DVGG41) | 1,04 | -0,67 | 0,5937 | -0,0941 | ||

| US05377RFV15 / AESOP_22-5A | 1,01 | -0,40 | 0,5727 | -0,0894 | ||

| US87229WAS08 / TCI SYMPHONY CLO TSYMP 2016 1A BR2 144A | 1,01 | 0,50 | 0,5716 | -0,0835 | ||

| US02660LAA89 / American Home Mortgage Assets Trust | 0,95 | -3,55 | 0,5411 | -0,1051 | ||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0,93 | 0,5265 | 0,5265 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0,92 | 0,5221 | 0,5221 | |||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 0,92 | 0,5211 | 0,5211 | |||

| USP78024AG45 / Peruvian Government International Bond | 0,91 | 7,58 | 0,5162 | -0,0362 | ||

| FNMA POOL BM7579 FN 10/29 VARIABLE / ABS-MBS (US3140JCM503) | 0,90 | 1,01 | 0,5134 | -0,0719 | ||

| FNMA POOL BM7579 FN 10/29 VARIABLE / ABS-MBS (US3140JCM503) | 0,90 | 1,01 | 0,5134 | -0,0719 | ||

| FNMA POOL BM7579 FN 10/29 VARIABLE / ABS-MBS (US3140JCM503) | 0,90 | 1,01 | 0,5134 | -0,0719 | ||

| BACARDI MARTINI B V / DBT (US05634EU340) | 0,89 | 0,5054 | 0,5054 | |||

| US61753EAC49 / MORGAN STANLEY CAPITAL INC MSAC 2007 HE2 A2C | 0,87 | 0,23 | 0,4918 | -0,0733 | ||

| HCA INC DISC COML PAPER 4/A2 Y 08/25 ZCP / DBT (US40412BVN09) | 0,86 | 0,4907 | 0,4907 | |||

| VOLKSWAGEN GROUP OF AM / DBT (US92866BU298) | 0,86 | 0,4885 | 0,4885 | |||

| VOLKSWAGEN GROUP OF AM / DBT (US92866BU298) | 0,86 | 0,4885 | 0,4885 | |||

| VOLKSWAGEN GROUP OF AM / DBT (US92866BU298) | 0,86 | 0,4885 | 0,4885 | |||

| RTX / RTX Corporation - Depositary Receipt (Common Stock) | 0,86 | 0,4876 | 0,4876 | |||

| RTX / RTX Corporation - Depositary Receipt (Common Stock) | 0,86 | 0,4876 | 0,4876 | |||

| RTX / RTX Corporation - Depositary Receipt (Common Stock) | 0,86 | 0,4876 | 0,4876 | |||

| CDX ITRAXX XOV42 5Y 35-100% SP JPM / DCR (EZ2BLZ4YH9B3) | 0,85 | 0,4855 | 0,4855 | |||

| ENBRIDGE (US) INC / DBT (US29251UUB24) | 0,85 | 0,4822 | 0,4822 | |||

| ENBRIDGE (US) INC / DBT (US29251UUB24) | 0,85 | 0,4822 | 0,4822 | |||

| ENBRIDGE (US) INC / DBT (US29251UUB24) | 0,85 | 0,4822 | 0,4822 | |||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0,85 | 0,4820 | 0,4820 | |||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0,85 | 0,4820 | 0,4820 | |||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0,85 | 0,4820 | 0,4820 | |||

| US17330VAA44 / CMLTI_22-A | 0,85 | -2,20 | 0,4811 | -0,0853 | ||

| FNMA POOL BS9867 FN 11/30 FIXED 5.3 / ABS-MBS (US3140LL6D83) | 0,84 | 0,72 | 0,4750 | -0,0684 | ||

| 4020 / Saudi Real Estate Company | 0,84 | 1,58 | 0,4744 | -0,0639 | ||

| 4020 / Saudi Real Estate Company | 0,84 | 1,58 | 0,4744 | -0,0639 | ||

| 4020 / Saudi Real Estate Company | 0,84 | 1,58 | 0,4744 | -0,0639 | ||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 0,83 | 8,59 | 0,4740 | -0,0287 | ||

| ALBACORE EURO CLO ALBAC 1A AR 144A / ABS-CBDO (XS2368816109) | 0,82 | 8,86 | 0,4676 | -0,0274 | ||

| US525931AB72 / Lendbuzz Securitization Trust 2023-3 | 0,81 | 0,4621 | 0,4621 | |||

| HERTZ VEHICLE FINANCING LLC HERTZ 2024 1A A 144A / ABS-O (US42806MCK36) | 0,81 | 0,25 | 0,4620 | -0,0688 | ||

| US48251JAN37 / KKR FINANCIAL CLO LTD KKR 18 BR 144A | 0,80 | 0,12 | 0,4559 | -0,0683 | ||

| GUGGENHEIM CLO LTD GUGG 2022 2A A1R 144A / ABS-CBDO (US40172PAL67) | 0,80 | -0,25 | 0,4537 | -0,0696 | ||

| US07386HXZ99 / BEAR STEARNS ALT A TRUST BALTA 2005 9 21A1 | 0,80 | -0,75 | 0,4526 | -0,0722 | ||

| FCT / Fincantieri S.p.A. | 0,79 | 9,85 | 0,4502 | -0,0216 | ||

| XS2373706519 / Carlyle Euro CLO 2019-2 DAC | 0,79 | 8,37 | 0,4490 | -0,0279 | ||

| US3622M8AE61 / GSAMP TRUST GSAMP 2006 HE8 A2D | 0,78 | 0,65 | 0,4409 | -0,0638 | ||

| XS2683120211 / Avon Finance No.4 PLC | 0,77 | 0,91 | 0,4397 | -0,0619 | ||

| US81879MAV19 / SG MORTGAGE SECURITIES TRUST SGMS 2006 FRE1 A2B | 0,76 | 0,26 | 0,4340 | -0,0642 | ||

| US1266735Z13 / COUNTRYWIDE ASSET BACKED CERTI CWL 2005 8 M6 | 0,76 | 0,13 | 0,4335 | -0,0648 | ||

| FNMA POOL CB9627 FN 12/54 FIXED 4.5 / ABS-MBS (US3140QVVV30) | 0,75 | -1,31 | 0,4287 | -0,0712 | ||

| US16165AAD63 / CHASEFLEX TRUST CFLX 2007 3 2A1 | 0,74 | -0,40 | 0,4201 | -0,0655 | ||

| US68389FKR46 / OPTION ONE MORTGAGE LOAN TRUST OOMLT 2006 1 M1 | 0,73 | -4,33 | 0,4144 | -0,0846 | ||

| ARCANO EURO CLO ARCAN 2A B / ABS-CBDO (XS3109623846) | 0,71 | 0,4015 | 0,4015 | |||

| ARCANO EURO CLO ARCAN 2A B / ABS-CBDO (XS3109623846) | 0,71 | 0,4015 | 0,4015 | |||

| ARCANO EURO CLO ARCAN 2A B / ABS-CBDO (XS3109623846) | 0,71 | 0,4015 | 0,4015 | |||

| CARLYLE GLOBAL MARKET STRATEGI CGMSE 2025 1A A1 144A / ABS-CBDO (XS3065225669) | 0,71 | 0,4015 | 0,4015 | |||

| FREDDIE MAC FHR 5473 FA / ABS-MBS (US3137HHFU01) | 0,70 | -3,96 | 0,4003 | -0,0798 | ||

| 5831 / Shizuoka Financial Group,Inc. | 0,70 | 0,3987 | 0,3987 | |||

| 5831 / Shizuoka Financial Group,Inc. | 0,70 | 0,3987 | 0,3987 | |||

| 5831 / Shizuoka Financial Group,Inc. | 0,70 | 0,3987 | 0,3987 | |||

| EXETER AUTOMOBILE RECEIVABLES EART 2024 5A B / ABS-O (US30165BAE39) | 0,70 | 0,14 | 0,3974 | -0,0596 | ||

| EXETER AUTOMOBILE RECEIVABLES EART 2024 5A B / ABS-O (US30165BAE39) | 0,70 | 0,14 | 0,3974 | -0,0596 | ||

| EXETER AUTOMOBILE RECEIVABLES EART 2024 5A B / ABS-O (US30165BAE39) | 0,70 | 0,14 | 0,3974 | -0,0596 | ||

| US02148DAA81 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2007 HY3 1A1 | 0,69 | -1,30 | 0,3897 | -0,0645 | ||

| ZAG000125980 / Republic of South Africa Government Bond | 0,68 | 8,24 | 0,3885 | -0,0246 | ||

| US040104TG69 / Argent Securities Trust 2006-W4 | 0,66 | -0,75 | 0,3751 | -0,0602 | ||

| FREDDIE MAC FHR 5513 MF / ABS-MBS (US3137HKEX87) | 0,66 | -5,18 | 0,3746 | -0,0803 | ||

| US004421QH97 / ACE SECURITIES CORP. ACE 2005 SD2 M4 | 0,65 | 0,47 | 0,3684 | -0,0541 | ||

| US21H0426799 / Ginnie Mae | 0,64 | 0,3644 | 0,3644 | |||

| US17309TAC27 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2006 NC2 A2B | 0,63 | -0,47 | 0,3575 | -0,0559 | ||

| FNMA POOL BZ2582 FN 12/29 FIXED 4.3 / ABS-MBS (US3140NW2Q77) | 0,61 | 1,00 | 0,3440 | -0,0481 | ||

| US42806MBS70 / Hertz Vehicle Financing III LLC | 0,60 | -0,17 | 0,3427 | -0,0524 | ||

| US36361UAQ31 / GALLATIN LOAN MANAGEMENT, LLC GALL 2017 1A B1R 144A | 0,60 | 0,00 | 0,3416 | -0,0519 | ||

| EXETER AUTOMOBILE RECEIVABLES EART 2024 5A C / ABS-O (US30165BAF04) | 0,60 | 0,17 | 0,3414 | -0,0509 | ||

| EXETER AUTOMOBILE RECEIVABLES EART 2024 5A C / ABS-O (US30165BAF04) | 0,60 | 0,17 | 0,3414 | -0,0509 | ||

| EXETER AUTOMOBILE RECEIVABLES EART 2024 5A C / ABS-O (US30165BAF04) | 0,60 | 0,17 | 0,3414 | -0,0509 | ||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 0,59 | 0,51 | 0,3347 | -0,0490 | ||

| PALMER SQUARE EUROPEAN LOAN FU PSTET 2025 2A B 144A / ABS-CBDO (XS3070649523) | 0,59 | 0,3346 | 0,3346 | |||

| INVESCO EURO CLO INVSC 3A AR / ABS-CBDO (XS2867986593) | 0,59 | 8,70 | 0,3340 | -0,0193 | ||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 0,58 | 0,86 | 0,3319 | -0,0472 | ||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 0,58 | 0,86 | 0,3319 | -0,0472 | ||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 0,58 | 0,86 | 0,3319 | -0,0472 | ||

| US61753KAA43 / MORGAN STANLEY CAPITAL INC MSAC 2007 HE5 A1 | 0,58 | 0,17 | 0,3303 | -0,0496 | ||

| US02151RAC79 / Alternative Loan Trust 2007-OH2 | 0,58 | 0,00 | 0,3281 | -0,0499 | ||

| POLAND GOVERNMENT BOND BONDS 07/29 4.75 / DBT (PL0000116760) | 0,55 | 9,49 | 0,3150 | -0,0161 | ||

| TRINITY SQUARE TRINI 2021 1A AR 144A / ABS-MBS (XS2783078087) | 0,55 | 0,73 | 0,3149 | -0,0454 | ||

| US62956BAA70 / NYMT Loan Trust 2022-SP1 | 0,54 | -1,99 | 0,3089 | -0,0538 | ||

| CORDATUS CLO PLC CORDA 24A A 144A / ABS-CBDO (XS2511416906) | 0,53 | 4,58 | 0,2986 | -0,0299 | ||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 0,52 | 1,17 | 0,2951 | -0,0411 | ||

| US59024LAD38 / MERRILL LYNCH MORTGAGE INVESTO MLMI 2007 HE2 A2C | 0,52 | -0,76 | 0,2950 | -0,0473 | ||

| US93363TAD46 / WaMu Mortgage Pass-Through Certificates Series 2006-AR11 Trust | 0,51 | -2,10 | 0,2917 | -0,0516 | ||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 0,51 | 1,40 | 0,2877 | -0,0394 | ||

| JACKSON NATL LIFE GLOBAL JACKSON NATL LIFE GLOBAL / DBT (US46849LUZ20) | 0,50 | 0,00 | 0,2865 | -0,0437 | ||

| CARVANA AUTO RECEIVABLES TRUST CRVNA 2025 N1 B 144A / ABS-O (US14688XAD93) | 0,50 | 0,40 | 0,2863 | -0,0420 | ||

| CARVANA AUTO RECEIVABLES TRUST CRVNA 2025 N1 B 144A / ABS-O (US14688XAD93) | 0,50 | 0,40 | 0,2863 | -0,0420 | ||

| CARVANA AUTO RECEIVABLES TRUST CRVNA 2025 N1 B 144A / ABS-O (US14688XAD93) | 0,50 | 0,40 | 0,2863 | -0,0420 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2025 1 B 144A / ABS-O (US69544NAC11) | 0,50 | -0,20 | 0,2857 | -0,0434 | ||

| US694308KK29 / Pacific Gas and Electric Co | 0,50 | -3,65 | 0,2852 | -0,0555 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2025 2 B 144A / ABS-O (US69545GAC50) | 0,50 | 0,20 | 0,2847 | -0,0425 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2025 4 A2 144A / ABS-O (US69547DAB29) | 0,50 | 0,2847 | 0,2847 | |||

| PAGAYA AI DEBT SELECTION TRUST PAID 2025 4 A2 144A / ABS-O (US69547DAB29) | 0,50 | 0,2847 | 0,2847 | |||

| PAGAYA AI DEBT SELECTION TRUST PAID 2025 4 A2 144A / ABS-O (US69547DAB29) | 0,50 | 0,2847 | 0,2847 | |||

| JAMESTOWN CLO LTD JTWN 2022 18A AR 144A / ABS-CBDO (US47047RAN61) | 0,50 | 0,00 | 0,2845 | -0,0427 | ||

| AIMCO AIMCO 2015 AA AR3 144A / ABS-CBDO (US00900LAY02) | 0,50 | 0,00 | 0,2845 | -0,0427 | ||

| MADISON PARK FUNDING LTD MDPK 2021 39A AR 144A / ABS-CBDO (US55821LAJ35) | 0,50 | 0,00 | 0,2845 | -0,0429 | ||

| US87241EAQ89 / TCW CLO 2019-1 AMR Ltd | 0,50 | 0,20 | 0,2845 | -0,0423 | ||

| 37 CAPITAL CLO LTD PUTNM 2021 1A AR 144A / ABS-CBDO (US88430TAQ40) | 0,50 | 0,20 | 0,2843 | -0,0427 | ||

| SYMPHONY CLO LTD SYMP 2020 22A A1AR 144A / ABS-CBDO (US87167GCH11) | 0,50 | 0,00 | 0,2843 | -0,0433 | ||

| SYMPHONY CLO LTD SYMP 2020 22A A1AR 144A / ABS-CBDO (US87167GCH11) | 0,50 | 0,00 | 0,2843 | -0,0433 | ||

| SYMPHONY CLO LTD SYMP 2020 22A A1AR 144A / ABS-CBDO (US87167GCH11) | 0,50 | 0,00 | 0,2843 | -0,0433 | ||

| ARES STRATEGIC INCOME FU SR UNSECURED 144A 09/28 5.45 / DBT (US04020EAL11) | 0,50 | 0,2843 | 0,2843 | |||

| US59022QAD43 / MERRILL LYNCH MORTGAGE INVESTO MLMI 2006 HE5 A2C | 0,49 | -1,40 | 0,2800 | -0,0468 | ||

| US61747YEC57 / Morgan Stanley | 0,49 | 1,04 | 0,2756 | -0,0389 | ||

| US45668GAD43 / INDYMAC INDX MORTGAGE LOAN TRU INDX 2006 AR14 1A3A | 0,48 | -4,77 | 0,2724 | -0,0567 | ||

| US68389FGK49 / OPTION ONE MORTGAGE LOAN TRUST OOMLT 2005 1 M1 | 0,48 | -5,57 | 0,2704 | -0,0588 | ||

| US693984AA42 / PRKCM Trust, Series 2023-AFC3, Class A1 | 0,47 | -6,15 | 0,2692 | -0,0608 | ||

| US74923HAK77 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2007 QS4 3A1 | 0,47 | -3,48 | 0,2684 | -0,0520 | ||

| FHLMC MULTIFAMILY STRUCTURED P FHMS Q034 APT2 / ABS-MBS (US3137HLY301) | 0,47 | 0,2665 | 0,2665 | |||

| MX0SGO0000M6 / Mexican Udibonos | 0,44 | 11,87 | 0,2521 | -0,0070 | ||

| NDDUEAFE TRS EQUITY FEDL01+30 ULO / DE (000000000) | 0,44 | 0,2516 | 0,2516 | |||

| US3136A5JJ66 / FANNIE MAE FNR 2012 31 NL | 0,43 | 0,23 | 0,2471 | -0,0366 | ||

| US12667FWU55 / ALTERNATIVE LOAN TRUST 2004-27CB CWALT 2004-27CB A1 | 0,42 | -3,94 | 0,2362 | -0,0464 | ||

| US05377RHL15 / Avis Budget Rental Car Funding AESOP LLC | 0,41 | 0,24 | 0,2337 | -0,0349 | ||

| XS2303818954 / TAURUS CMBS TAURS 2021 UK1A A 144A | 0,41 | 6,53 | 0,2319 | -0,0192 | ||

| RFR USD SOFR/3.50000 12/18/24-30Y CME / DIR (EZ4089K4KC85) | 0,41 | 42,11 | 0,2301 | 0,0437 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 0,40 | 0,50 | 0,2296 | -0,0338 | ||

| US902613AP31 / UBS Group AG | 0,40 | 0,50 | 0,2287 | -0,0332 | ||

| US925650AB99 / VICI Properties LP | 0,40 | 0,50 | 0,2286 | -0,0333 | ||

| US3137ASAN41 / FREDDIE MAC FHR 4077 EP | 0,40 | 0,75 | 0,2283 | -0,0327 | ||

| US48252KAC36 / KKR FINANCIAL CLO LTD KKR 21 B 144A | 0,40 | 0,25 | 0,2281 | -0,0342 | ||

| US89289EBA10 / TRALEE CDO LTD TRAL 2019 6A AJR 144A | 0,40 | 0,00 | 0,2275 | -0,0346 | ||

| US46625HRY89 / JPMorgan Chase & Co. | 0,40 | 0,51 | 0,2254 | -0,0329 | ||

| XS2305369709 / CORDATUS CLO PLC CORDA 7A ARR 144A | 0,40 | -8,14 | 0,2248 | -0,0571 | ||

| US3128MMWV14 / Freddie Mac Gold Pool | 0,39 | -5,08 | 0,2228 | -0,0474 | ||

| US89173UAA51 / Towd Point Mortgage Trust 2017-4 | 0,39 | -10,16 | 0,2212 | -0,0626 | ||

| US04012MAM10 / ARGENT SECURITIES INC. ARSI 2006 M1 A1 | 0,39 | -1,02 | 0,2202 | -0,0360 | ||

| US63942AAA43 / Navient Private Education Loan Trust 2020-I | 0,39 | -5,17 | 0,2193 | -0,0469 | ||

| US05592XAD21 / BMW Vehicle Owner Trust, Series 2023-A, Class A3 | 0,38 | -20,42 | 0,2150 | -0,0958 | ||

| US66988XAD66 / NovaStar Mortgage Funding Trust, Series 2006-4, Class A2D | 0,38 | -3,84 | 0,2137 | -0,0424 | ||

| US83612NAC92 / Soundview Home Loan Trust 2007-WMC1 | 0,37 | -0,53 | 0,2121 | -0,0337 | ||

| FED HM LN PC POOL RJ0136 FR 12/53 FIXED 4.5 / ABS-MBS (US3142GQEJ75) | 0,35 | -0,29 | 0,1978 | -0,0309 | ||

| US06738ECE32 / Barclays PLC | 0,34 | 1,80 | 0,1935 | -0,0256 | ||

| PEP01000C5I0 / BONOS DE TESORERIA | 0,34 | 6,96 | 0,1925 | -0,0144 | ||

| US92540BAA70 / CORP CMO | 0,33 | -8,49 | 0,1900 | -0,0492 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2024 8 A 144A / ABS-O (US69544QAA85) | 0,33 | -16,12 | 0,1895 | -0,0707 | ||

| US89175MAA18 / Towd Point Mortgage Trust 2018-3 | 0,32 | -5,54 | 0,1841 | -0,0404 | ||

| US40430FAA03 / HSI ASSET SECURITIZATION CORPO HASC 2007 HE1 1A1 | 0,32 | -0,62 | 0,1811 | -0,0288 | ||

| RFR USD SOFR/2.75000 06/21/23-30Y CME / DIR (EZM2L9TGLT92) | 0,31 | 0,96 | 0,1787 | -0,0253 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2024 2 C 144A / ABS-O (US694961AC78) | 0,31 | -15,26 | 0,1768 | -0,0638 | ||

| SAGB / Republic of South Africa Government Bond | 0,31 | 6,51 | 0,1767 | -0,0148 | ||

| US36267FAE88 / GLS AUTO SELECT RECEIVABLES TR GSAR 2023 1A A3 144A | 0,30 | -0,66 | 0,1721 | -0,0269 | ||

| US71429MAC91 / Perrigo Finance Unlimited Co | 0,30 | 3,15 | 0,1677 | -0,0200 | ||

| US040104EN75 / ARGENT SECURITIES INC. ARSI 2003 W10 M1 | 0,29 | -1,01 | 0,1665 | -0,0273 | ||

| US06051GJS93 / Bank of America Corp | 0,29 | 0,69 | 0,1657 | -0,0235 | ||

| US83612TAD46 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2007 OPT1 2A3 | 0,29 | -0,68 | 0,1651 | -0,0264 | ||

| US033295AA45 / Anchorage Credit Funding 14 Ltd., Series 2021-14A, Class A | 0,28 | -0,36 | 0,1588 | -0,0246 | ||

| FNMA POOL CB9448 FN 11/54 FIXED 4.5 / ABS-MBS (US3140QVQA57) | 0,28 | -1,07 | 0,1581 | -0,0259 | ||

| FNMA POOL CB9448 FN 11/54 FIXED 4.5 / ABS-MBS (US3140QVQA57) | 0,28 | -1,07 | 0,1581 | -0,0259 | ||

| FNMA POOL CB9448 FN 11/54 FIXED 4.5 / ABS-MBS (US3140QVQA57) | 0,28 | -1,07 | 0,1581 | -0,0259 | ||

| US12668KAA16 / COUNTRYWIDE ASSET BACKED CERTI CWL 2007 5 1A | 0,27 | -1,81 | 0,1541 | -0,0267 | ||

| US715638BE14 / Peruvian Government International Bond | 0,27 | -15,62 | 0,1536 | -0,0558 | ||

| US3133KQPE07 / Freddie Mac Pool | 0,27 | 0,00 | 0,1529 | -0,0237 | ||

| US288547AA09 / ELLINGTON LOAN ACQUISITION TRUST 2007-2 SER 2007-2 CL A1 V/R REGD 144A P/P 2.75800000 | 0,26 | -2,22 | 0,1501 | -0,0266 | ||

| US74143FAA75 / PRET_21-RN2 | 0,25 | -8,36 | 0,1434 | -0,0367 | ||

| RFR USD SOFR/3.00000 06/21/23-10Y CME / DIR (EZVCRM3XZB08) | 0,25 | -38,02 | 0,1427 | -0,1222 | ||

| RFR USD SOFR/3.00000 06/21/23-10Y CME / DIR (EZVCRM3XZB08) | 0,25 | -38,02 | 0,1427 | -0,1222 | ||

| RFR USD SOFR/3.00000 06/21/23-10Y CME / DIR (EZVCRM3XZB08) | 0,25 | -38,02 | 0,1427 | -0,1222 | ||

| US68402BAA44 / OPTION ONE MORTGAGE LOAN TRUST OOMLT 2007 3 1A1 | 0,25 | -1,61 | 0,1396 | -0,0235 | ||

| ZAG000077470 / Republic of South Africa Government Bond | 0,24 | 7,49 | 0,1388 | -0,0102 | ||

| US76089RAA23 / Research-Driven Pagaya Motor Asset Trust 2023-3 | 0,24 | -16,96 | 0,1338 | -0,0514 | ||

| NDDUEAFE TRS EQUITY FEDL01+33 CBK / DE (000000000) | 0,23 | 0,1327 | 0,1327 | |||

| US93362FAD50 / WaMu Mortgage Pass-Through Certificates Series 2006-AR8 Trust | 0,23 | -7,20 | 0,1320 | -0,0316 | ||

| US68403HAA05 / Option One Mortgage Loan Trust, Series 2007-5, Class 1A1 | 0,23 | -1,73 | 0,1293 | -0,0223 | ||

| IRS EUR 2.25000 09/17/25-30Y LCH / DIR (EZV4L1QCFM97) | 0,23 | 51,01 | 0,1280 | 0,0299 | ||

| US25151UAA51 / Deutsche Alt-A Securities Mortgage Loan Trust Series 2007-AR2 | 0,22 | -0,90 | 0,1256 | -0,0207 | ||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0,22 | 1,40 | 0,1235 | -0,0167 | ||

| US00441XAA28 / ACE SECURITIES CORP. ACE 2006 NC2 A1 | 0,22 | -2,26 | 0,1228 | -0,0223 | ||

| US07274EAL74 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.5% 11-21-33 | 0,21 | 1,90 | 0,1219 | -0,0156 | ||

| CDX ITRAXX XOV42 5Y 35-100% SP BPS / DCR (EZ2BLZ4YH9B3) | 0,21 | 0,1214 | 0,1214 | |||

| CDX ITRAXX XOV42 5Y 35-100% SP BPS / DCR (EZ2BLZ4YH9B3) | 0,21 | 0,1214 | 0,1214 | |||

| US86358BAT98 / STRUCTURED ASSET SECURITIES CO SASC 2007 WF1 A6 | 0,21 | -5,91 | 0,1180 | -0,0263 | ||

| NMR / Nomura Holdings, Inc. - Depositary Receipt (Common Stock) | 0,21 | 0,49 | 0,1176 | -0,0167 | ||

| S1MF34 / Sumitomo Mitsui Financial Group, Inc. - Depositary Receipt (Common Stock) | 0,21 | 0,49 | 0,1174 | -0,0169 | ||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 0,21 | 0,49 | 0,1170 | -0,0170 | ||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 0,21 | 0,49 | 0,1170 | -0,0170 | ||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 0,21 | 0,49 | 0,1170 | -0,0170 | ||

| CITIBANK NA CITIBANK NA / DBT (US17325FBK30) | 0,20 | 0,99 | 0,1160 | -0,0162 | ||

| CITIBANK NA CITIBANK NA / DBT (US17325FBK30) | 0,20 | 0,99 | 0,1160 | -0,0162 | ||

| CITIBANK NA CITIBANK NA / DBT (US17325FBK30) | 0,20 | 0,99 | 0,1160 | -0,0162 | ||

| US06738EBY05 / Barclays PLC | 0,20 | 0,49 | 0,1159 | -0,0169 | ||

| US404280DZ92 / HSBC HOLDINGS PLC REGD V/R 5.88700000 | 0,20 | -0,49 | 0,1153 | -0,0177 | ||

| FCT / Fincantieri S.p.A. | 0,20 | 0,1151 | 0,1151 | |||

| FCT / Fincantieri S.p.A. | 0,20 | 0,1151 | 0,1151 | |||

| FCT / Fincantieri S.p.A. | 0,20 | 0,1151 | 0,1151 | |||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,20 | 0,50 | 0,1146 | -0,0169 | ||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,20 | 1,01 | 0,1139 | -0,0157 | ||

| MFG / Mizuho Financial Group, Inc. - Depositary Receipt (Common Stock) | 0,20 | 0,1136 | 0,1136 | |||

| T MOBILE USA INC T MOBILE USA INC / DBT (US87264ADL61) | 0,20 | 1,02 | 0,1129 | -0,0156 | ||

| T MOBILE USA INC T MOBILE USA INC / DBT (US87264ADL61) | 0,20 | 1,02 | 0,1129 | -0,0156 | ||

| T MOBILE USA INC T MOBILE USA INC / DBT (US87264ADL61) | 0,20 | 1,02 | 0,1129 | -0,0156 | ||

| US68403FAA49 / OPTION ONE MORTGAGE LOAN TRUST OOMLT 2007 4 1A1 | 0,19 | -2,02 | 0,1107 | -0,0190 | ||

| US345397YT41 / Ford Motor Credit Co. LLC | 0,19 | 1,58 | 0,1097 | -0,0151 | ||

| TRT061124T11 / Turkey Government Bond | 0,19 | -2,06 | 0,1080 | -0,0192 | ||

| MX0SGO0000K0 / Mexican Udibonos | 0,18 | 11,39 | 0,1004 | -0,0031 | ||

| US07387QAA85 / BEAR STEARNS ALT A TRUST BALTA 2006 8 1A1 | 0,18 | -1,12 | 0,1003 | -0,0168 | ||

| TRT061124T11 / Turkey Government Bond | 0,18 | -2,22 | 0,1000 | -0,0184 | ||

| TRT061124T11 / Turkey Government Bond | 0,18 | -2,22 | 0,1000 | -0,0184 | ||

| TRT061124T11 / Turkey Government Bond | 0,18 | -2,22 | 0,1000 | -0,0184 | ||

| US02150GAN88 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2007 11T1 A12 | 0,17 | 0,00 | 0,0950 | -0,0146 | ||

| MX0MGO0001F1 / Mexican Bonos | 0,16 | -56,96 | 0,0937 | -0,1561 | ||

| US073870AA51 / BEAR STEARNS ALT A TRUST BALTA 2007 2 1A1 | 0,16 | -0,62 | 0,0908 | -0,0140 | ||

| US74923GAC78 / RESIDENTIAL ACCREDIT LOANS, IN RALI 2007 QA1 A3 | 0,16 | -1,87 | 0,0896 | -0,0154 | ||

| R2037 / South Africa - Sovereign or Government Agency Debt | 0,16 | 8,28 | 0,0894 | -0,0056 | ||

| US76089EAA10 / RESEARCH DRIVEN PAGAYA MOTOR A RPM 2022 1A A 144A | 0,15 | -12,50 | 0,0840 | -0,0261 | ||

| NDDUEAFE TRS EQUITY SOFR+29 MYI / DE (000000000) | 0,15 | 0,0838 | 0,0838 | |||

| US31418CS476 / Fannie Mae Pool | 0,14 | -1,40 | 0,0802 | -0,0138 | ||

| CZECH / Czech Republic Government Bond | 0,14 | 10,57 | 0,0773 | -0,0037 | ||

| R2032 / South Africa - Corporate Bond/Note | 0,13 | 7,20 | 0,0766 | -0,0054 | ||

| IRS AUD 4.50000 09/20/23-10Y LCH / DIR (EZGXS4F4YYN6) | 0,13 | 101,59 | 0,0726 | 0,0308 | ||

| IRS AUD 4.50000 09/20/23-10Y LCH / DIR (EZGXS4F4YYN6) | 0,13 | 101,59 | 0,0726 | 0,0308 | ||

| IRS AUD 4.50000 09/20/23-10Y LCH / DIR (EZGXS4F4YYN6) | 0,13 | 101,59 | 0,0726 | 0,0308 | ||

| US61748HTG64 / MORGAN STANLEY MORTGAGE LOAN T MSM 2005 11AR A1 | 0,13 | -1,56 | 0,0718 | -0,0122 | ||

| US96041AAC09 / WESTLAKE AUTOMOBILE RECEIVABLES TRUST 2023-4 SER 2023-4A CL A2 REGD 144A P/P 6.23000000 | 0,12 | -62,04 | 0,0700 | -0,1425 | ||

| US31418CYL26 / Federal National Mortgage Association | 0,12 | -2,40 | 0,0697 | -0,0124 | ||

| US81377AAE29 / SECURITIZED ASSET BACKED RECEI SABR 2006 HE2 A2D | 0,11 | -0,88 | 0,0645 | -0,0102 | ||

| US05533JBE29 / BCAP LLC TRUST BCAP 2010 RR11 5A3 144A | 0,11 | -4,27 | 0,0637 | -0,0134 | ||

| US76088LAA61 / RPM_21-2A | 0,11 | -13,71 | 0,0611 | -0,0202 | ||

| CDX ITRAXX XOV42 5Y 35-100% SP BOA / DCR (EZ2BLZ4YH9B3) | 0,11 | 0,0607 | 0,0607 | |||

| CRB SECURITIZATION TRUST CRB 2023 1 A 144A / ABS-O (US12670DAA37) | 0,10 | -46,32 | 0,0581 | -0,0665 | ||

| E1IX34 / Edison International - Depositary Receipt (Common Stock) | 0,10 | 0,00 | 0,0577 | -0,0086 | ||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,10 | 0,00 | 0,0574 | -0,0086 | ||

| SCE.PRK / SCE Trust V - Preferred Security | 0,10 | 0,00 | 0,0572 | -0,0085 | ||

| EXTRA SPACE STORAGE LP COMPANY GUAR 06/35 5.4 / DBT (US30225VAU17) | 0,10 | 1,01 | 0,0571 | -0,0079 | ||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 1 A3 144A / ABS-O (US17331QAD88) | 0,10 | 0,00 | 0,0571 | -0,0088 | ||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 1 A3 144A / ABS-O (US17331QAD88) | 0,10 | 0,00 | 0,0571 | -0,0088 | ||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 1 A3 144A / ABS-O (US17331QAD88) | 0,10 | 0,00 | 0,0571 | -0,0088 | ||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0,10 | 1,01 | 0,0569 | -0,0080 | ||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0,10 | 1,01 | 0,0569 | -0,0080 | ||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0,10 | 1,01 | 0,0569 | -0,0080 | ||

| PROLOGIS LP SR UNSECURED 01/35 5 / DBT (US74340XCN93) | 0,10 | 1,01 | 0,0568 | -0,0081 | ||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0,10 | -1,00 | 0,0563 | -0,0091 | ||

| HOST HOTELS + RESORTS LP SR UNSECURED 04/35 5.5 / DBT (US44107TBC99) | 0,10 | 1,02 | 0,0563 | -0,0079 | ||

| HOST HOTELS + RESORTS LP SR UNSECURED 04/35 5.5 / DBT (US44107TBC99) | 0,10 | 1,02 | 0,0563 | -0,0079 | ||

| HOST HOTELS + RESORTS LP SR UNSECURED 04/35 5.5 / DBT (US44107TBC99) | 0,10 | 1,02 | 0,0563 | -0,0079 | ||

| MX0SGO0000F0 / Mexican Udibonos | 0,10 | 11,49 | 0,0555 | -0,0019 | ||

| US87264ABF12 / CORP. NOTE | 0,10 | 2,11 | 0,0552 | -0,0075 | ||

| FNMA POOL CB9634 FN 12/54 FIXED 4.5 / ABS-MBS (US3140QVV434) | 0,09 | -1,05 | 0,0539 | -0,0085 | ||

| FNMA POOL CB9634 FN 12/54 FIXED 4.5 / ABS-MBS (US3140QVV434) | 0,09 | -1,05 | 0,0539 | -0,0085 | ||

| FNMA POOL CB9634 FN 12/54 FIXED 4.5 / ABS-MBS (US3140QVV434) | 0,09 | -1,05 | 0,0539 | -0,0085 | ||

| US86362TAA51 / Structured Adjustable Rate Mortgage Loan Trust Series 2007-1 | 0,09 | -3,09 | 0,0537 | -0,0101 | ||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0,09 | -4,12 | 0,0531 | -0,0110 | ||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0,09 | -4,12 | 0,0531 | -0,0110 | ||

| PCG.PRD / Pacific Gas and Electric Company - Preferred Stock | 0,09 | -4,12 | 0,0531 | -0,0110 | ||

| US3138EGSJ46 / FNMA 5.50% #AL0520 6/41 | 0,09 | -2,13 | 0,0526 | -0,0093 | ||

| BRSTNCLTN7Z6 / BRAZIL LTN BRL 0.0% 07-01-25 | 0,09 | -91,48 | 0,0523 | -0,6470 | ||

| US46630GAH83 / JP MORGAN MORTGAGE TRUST 2007-A1 | 0,09 | -9,37 | 0,0497 | -0,0137 | ||

| US694308JQ18 / PACIFIC GAS + ELECTRIC 1ST MORTGAGE 07/40 4.5 | 0,08 | -2,35 | 0,0474 | -0,0082 | ||

| US90931GAA76 / United Airlines 2020-1 Class A Pass Through Trust | 0,08 | -5,81 | 0,0461 | -0,0107 | ||

| US3128M6YJ19 / Freddie Mac Gold Pool | 0,08 | -2,50 | 0,0445 | -0,0082 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,08 | 0,0434 | 0,0434 | |||

| US83612PAA84 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2007 1 1A1 | 0,08 | -3,85 | 0,0430 | -0,0086 | ||

| PROLOGIS LP SR UNSECURED 02/33 4.2 / DBT (CA74340XCP48) | 0,07 | 5,80 | 0,0420 | -0,0037 | ||

| RFR USD SOFR/1.75000 06/15/22-30Y CME / DIR (EZ2TNCR649W7) | 0,07 | -2,67 | 0,0418 | -0,0074 | ||

| RFR USD SOFR/3.70000 02/20/24-25Y LCH / DIR (EZRM7DK4X894) | 0,07 | 55,32 | 0,0418 | 0,0107 | ||

| RFR USD SOFR/3.70000 02/20/24-25Y LCH / DIR (EZRM7DK4X894) | 0,07 | 55,32 | 0,0418 | 0,0107 | ||

| RFR USD SOFR/3.70000 02/20/24-25Y LCH / DIR (EZRM7DK4X894) | 0,07 | 55,32 | 0,0418 | 0,0107 | ||

| US07388HAP47 / Bear Stearns Asset-Backed Securities I Trust, Series 2006-HE7, Class 2A2 | 0,07 | -4,00 | 0,0412 | -0,0079 | ||

| US3138EHPD85 / FNMA 30YR | 0,07 | -1,47 | 0,0384 | -0,0066 | ||

| US75971EAF34 / RENAISSANCE HOME EQUITY LOAN T RAMC 2006 3 AF3 | 0,07 | -2,94 | 0,0380 | -0,0066 | ||

| 317U7IQA6 PIMCO SWAPTION 3.75 CALL USD 2025103 / DIR (000000000) | 0,07 | 0,0375 | 0,0375 | |||

| NDDUEAFE TRS EQUITY SOFR+19 ULO / DE (000000000) | 0,07 | 0,0373 | 0,0373 | |||

| NDDUEAFE TRS EQUITY SOFR+26.5 ULO / DE (000000000) | 0,07 | 0,0370 | 0,0370 | |||

| NDDUEAFE TRS EQUITY SOFR+26.5 ULO / DE (000000000) | 0,07 | 0,0370 | 0,0370 | |||

| NDDUEAFE TRS EQUITY SOFR+26.5 ULO / DE (000000000) | 0,07 | 0,0370 | 0,0370 | |||

| US76088TAA97 / RPM 22-3 A 144A 5.38% 11-25-30 | 0,06 | -43,64 | 0,0354 | -0,0371 | ||

| US3622X7AE69 / GSR Mortgage Loan Trust, Series 2006-9F, Class 3A1 | 0,06 | -1,64 | 0,0346 | -0,0057 | ||

| US16678RDU86 / CHEVY CHASE MORTGAGE FUNDING C CCMFC 2005 3A A2 144A | 0,06 | -1,69 | 0,0331 | -0,0059 | ||

| US 10YR ULTRA FUT SEP25 XCBT 20250919 / DIR (000000000) | 0,06 | 0,0329 | 0,0329 | |||

| US751152AB50 / RALI 2006 QA7 2A1 | 0,05 | -3,64 | 0,0305 | -0,0059 | ||

| US126670KJ66 / COUNTRYWIDE ASSET BACKED CERTI CWL 2005 AB4 1A | 0,05 | -3,64 | 0,0303 | -0,0062 | ||

| US45661LAC28 / INDX 2006 AR27 1A3 | 0,05 | -3,64 | 0,0303 | -0,0062 | ||

| US 5YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 0,05 | 0,0302 | 0,0302 | |||

| IRS AUD 4.50000 06/18/25-10Y LCH / DIR (EZ3K0DGVSD24) | 0,05 | 0,0297 | 0,0297 | |||

| IRS AUD 4.50000 06/18/25-10Y LCH / DIR (EZ3K0DGVSD24) | 0,05 | 0,0297 | 0,0297 | |||

| IRS AUD 4.50000 06/18/25-10Y LCH / DIR (EZ3K0DGVSD24) | 0,05 | 0,0297 | 0,0297 | |||

| US3140GQ6E16 / FNMA POOL BH2668 FN 09/47 FIXED 3.5 | 0,05 | 0,00 | 0,0273 | -0,0043 | ||

| US32056JAE47 / FIRST HORIZON MORTGAGE PASS TH FHASI 2007 AR3 2A2 | 0,05 | -6,00 | 0,0269 | -0,0060 | ||

| US31418CUA07 / Fannie Mae Pool | 0,04 | -2,22 | 0,0254 | -0,0043 | ||

| US 2YR NOTE (CBT) SEP25 XCBT 20250930 / DIR (000000000) | 0,04 | 0,0251 | 0,0251 | |||

| US91680YAY77 / UPSTART STRUCTURED PASS THROUG USPTT 2022 2A A 144A | 0,04 | -18,87 | 0,0249 | -0,0102 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,04 | 0,0239 | 0,0239 | |||

| FNMA POOL AJ7522 FN 01/27 FIXED 3 / ABS-MBS (US3138E0LC13) | 0,04 | -18,00 | 0,0234 | -0,0098 | ||

| FNMA POOL AJ7522 FN 01/27 FIXED 3 / ABS-MBS (US3138E0LC13) | 0,04 | -18,00 | 0,0234 | -0,0098 | ||

| FNMA POOL AJ7522 FN 01/27 FIXED 3 / ABS-MBS (US3138E0LC13) | 0,04 | -18,00 | 0,0234 | -0,0098 | ||

| US36184NBT72 / GNMA POOL AM2750 GN 04/45 FIXED 3.5 | 0,04 | -26,42 | 0,0226 | -0,0126 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,04 | 0,0207 | 0,0207 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,04 | 0,0207 | 0,0207 | |||

| US126680AA57 / Alternative Loan Trust 2007-OA7 | 0,04 | 0,00 | 0,0206 | -0,0032 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,04 | 0,0199 | 0,0199 | |||

| US933637AE07 / WAMU MORTGAGE PASS THROUGH CER WAMU 2006 AR18 2A3 | 0,03 | -5,71 | 0,0189 | -0,0043 | ||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,03 | 0,0184 | 0,0184 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,03 | 0,0184 | 0,0184 | |||

| US924933AA27 / Veros Auto Receivables Trust, Series 2023-1, Class A | 0,03 | -66,30 | 0,0179 | -0,0424 | ||

| CITIZENS AUTO RECEIVABLES TRUS CITZN 2024 1 A2A 144A / ABS-O (US17331QAB23) | 0,03 | -57,53 | 0,0177 | -0,0301 | ||

| US36183BCF31 / GNMA POOL AJ5470 GN 09/44 FIXED 3.5 | 0,03 | 0,00 | 0,0177 | -0,0030 | ||

| US3138EKSM86 / Fannie Mae Pool | 0,03 | -3,33 | 0,0169 | -0,0029 | ||

| US3140H4B452 / Federal National Mortgage Association, Inc. | 0,03 | -6,45 | 0,0169 | -0,0034 | ||

| US31418CV272 / FANNIE MAE 3.50% 04/01/2048 FNL FNCL | 0,03 | -3,33 | 0,0168 | -0,0029 | ||

| US31410FVW21 / Fnma Pl 888129 5.537 Due 02/01/37 Bond | 0,03 | -3,33 | 0,0166 | -0,0031 | ||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 0,03 | 0,0166 | 0,0166 | |||

| RFR USD SOFR/4.0535* 09/02/25-27Y* LCH / DIR (EZRQXB0T6JR0) | 0,03 | 0,0163 | 0,0163 | |||

| US3140Q9HE67 / FNMA POOL CA2028 FN 04/48 FIXED 3.5 | 0,03 | 0,00 | 0,0163 | -0,0025 | ||

| US3137ADX446 / FREDDIE MAC FHR 3898 AF | 0,03 | -3,57 | 0,0154 | -0,0033 | ||

| US3138ELCT86 / Fannie Mae Pool | 0,03 | -3,70 | 0,0152 | -0,0029 | ||

| US36186SMU95 / GNMA POOL AN8471 GN 06/45 FIXED 3.5 | 0,03 | 0,00 | 0,0150 | -0,0025 | ||

| US31418CWS96 / Fannie Mae Pool | 0,03 | 0,00 | 0,0150 | -0,0026 | ||

| RFR USD SOFR/4.04638 09/02/25-27Y* LCH / DIR (EZRQXB0T6JR0) | 0,03 | 0,0148 | 0,0148 | |||

| US3140H1FD75 / FNMA POOL BJ0163 FN 12/47 FIXED 3.5 | 0,03 | 0,00 | 0,0144 | -0,0023 | ||

| BOUGHT TWD SOLD USD 20250709 / DFE (000000000) | 0,02 | 0,0141 | 0,0141 | |||

| US31418CXM18 / Fannie Mae Pool | 0,02 | -4,17 | 0,0134 | -0,0023 | ||

| US36169EAB65 / GECU Auto Receivables Trust 2023-1 | 0,02 | -79,65 | 0,0134 | -0,0607 | ||

| US3140H5MJ76 / FNMA POOL BJ3960 FN 01/48 FIXED 3.5 | 0,02 | 0,00 | 0,0132 | -0,0021 | ||

| US38375BC592 / GOVERNMENT NATIONAL MORTGAGE A GNR 2012 H31 FT | 0,02 | -18,52 | 0,0131 | -0,0046 | ||

| US3140HBJZ29 / FNMA POOL BJ9279 FN 02/48 FIXED 3.5 | 0,02 | -8,33 | 0,0127 | -0,0031 | ||

| US92977YBR18 / WACHOVIA MORTGAGE LOAN TRUST, WMLT 2005 B 4A1 | 0,02 | 0,00 | 0,0127 | -0,0022 | ||

| US3140H5NN79 / FNMA POOL BJ3996 FN 02/48 FIXED 3.5 | 0,02 | 0,00 | 0,0123 | -0,0019 | ||

| US31418CZG22 / Federal National Mortgage Association | 0,02 | 0,00 | 0,0122 | -0,0021 | ||

| US36184KHZ30 / GNMA POOL AM0248 GN 03/45 FIXED 3.5 | 0,02 | 0,00 | 0,0117 | -0,0020 | ||

| US34706CAA71 / FORT CRE 2022-FL3 ISSUER LLC SER 2022-FL3 CL A V/R REGD 144A P/P 1.90000000 | 0,02 | -93,81 | 0,0111 | -0,1900 | ||

| RFR USD SOFR/3.84199 12/02/24-4Y* LCH / DIR (EZSGM4VHBMV4) | 0,02 | 100,00 | 0,0108 | 0,0046 | ||

| US3140H5LT67 / FNMA POOL BJ3937 FN 01/48 FIXED 3.5 | 0,02 | -5,26 | 0,0108 | -0,0017 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,02 | 0,0105 | 0,0105 | |||

| US31415P6P80 / FNMA POOL 985678 FN 10/36 FIXED 5.5 | 0,02 | 0,00 | 0,0098 | -0,0019 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,02 | 0,0097 | 0,0097 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,02 | 0,0097 | 0,0097 | |||

| US31412NEZ50 / FNMA POOL 929952 FN 08/36 FIXED 5.5 | 0,02 | -5,88 | 0,0093 | -0,0020 | ||

| US17306SAA15 / Citigroup Mortgage Loan Trust, Series 2006-AR3, Class 1A1A | 0,02 | 0,00 | 0,0093 | -0,0015 | ||

| RFR USD SOFR/3.50000 12/20/23-10Y CME / DIR (EZ4G8FZQ8LF2) | 0,01 | -36,36 | 0,0084 | -0,0064 | ||

| US31413DRT62 / FNMA POOL 942498 FN 08/37 FIXED 6 | 0,01 | 0,00 | 0,0080 | -0,0014 | ||

| US36295GWA65 / GNMA POOL 670341 GN 08/37 FIXED 6 | 0,01 | -7,14 | 0,0079 | -0,0013 | ||

| US36178CLZ40 / GNMA POOL AA4844 GN 06/42 FIXED 3.5 | 0,01 | -18,75 | 0,0079 | -0,0026 | ||

| US3138EKW351 / Fannie Mae Pool | 0,01 | -7,14 | 0,0078 | -0,0014 | ||

| US3138EGE266 / FNMA POOL AL0152 FN 06/40 FIXED VAR | 0,01 | 0,00 | 0,0076 | -0,0014 | ||

| US88339FAA12 / Theorem Funding Trust 2022-2 | 0,01 | -68,29 | 0,0076 | -0,0198 | ||

| ZCS BRL 13.3537 05/12/25-01/02/29 CME / DIR (EZSPJ72GL6V3) | 0,01 | 0,0076 | 0,0076 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,01 | 0,0074 | 0,0074 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,01 | 0,0074 | 0,0074 | |||

| US31402DP797 / Fannie Mae Pool | 0,01 | -7,69 | 0,0073 | -0,0014 | ||

| US3140H5N645 / FNMA POOL BJ4012 FN 02/48 FIXED 3.5 | 0,01 | 0,00 | 0,0073 | -0,0012 | ||

| INF SWAP US IT 2.4525 07/20/22-30Y LCH / DIR (000000000) | 0,01 | 0,0069 | 0,0069 | |||

| INF SWAP US IT 2.4525 07/20/22-30Y LCH / DIR (000000000) | 0,01 | 0,0069 | 0,0069 | |||

| INF SWAP US IT 2.4525 07/20/22-30Y LCH / DIR (000000000) | 0,01 | 0,0069 | 0,0069 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0069 | 0,0069 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0066 | 0,0066 | |||

| US36296UNU06 / Ginnie Mae I Pool | 0,01 | -8,33 | 0,0066 | -0,0016 | ||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0066 | 0,0066 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0065 | 0,0065 | |||

| US31412QXQ71 / FNMA POOL 932287 FN 12/39 FIXED 5.5 | 0,01 | 0,00 | 0,0063 | -0,0010 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0063 | 0,0063 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0063 | 0,0063 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0060 | 0,0060 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0060 | 0,0060 | |||

| US92925CDA71 / WaMu Mortgage Pass-Through Certificates Series 2006-AR3 Trust | 0,01 | 0,00 | 0,0060 | -0,0011 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0059 | 0,0059 | |||

| US59020UH324 / MERRILL LYNCH MORTGAGE INVESTO MLMI 2005 A7 2A1 | 0,01 | 0,00 | 0,0058 | -0,0010 | ||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0,01 | 0,0057 | 0,0057 | |||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0,01 | 0,0057 | 0,0057 | |||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0,01 | 0,0057 | 0,0057 | |||

| US3140H5M324 / FNMA POOL BJ3977 FN 01/48 FIXED 3.5 | 0,01 | 0,00 | 0,0057 | -0,0009 | ||

| US3620A2UY01 / GNMA POOL 717099 GN 05/39 FIXED 5 | 0,01 | -10,00 | 0,0056 | -0,0010 | ||

| US31419AVJ32 / Fannie Mae Pool | 0,01 | 0,00 | 0,0056 | -0,0010 | ||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0054 | 0,0054 | |||

| BOUGHT AUD SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0054 | 0,0054 | |||

| US31413TVD17 / FNMA POOL 955212 FN 12/37 FIXED 5.5 | 0,01 | 0,00 | 0,0053 | -0,0009 | ||

| BOUGHT BRL SOLD USD 20250804 / DFE (000000000) | 0,01 | 0,0053 | 0,0053 | |||

| EZ897ZSH5V50 / HOCHTIEF AG SNR SE SP JPM | 0,01 | -27,27 | 0,0049 | -0,0028 | ||

| US31406PG783 / FNMA POOL 815722 FN 04/35 FIXED 5.5 | 0,01 | 0,00 | 0,0046 | -0,0008 | ||

| US31412N6Z49 / FNMA POOL 930688 FN 03/39 FIXED 5.5 | 0,01 | 0,00 | 0,0046 | -0,0007 | ||

| ZCS BRL 13.2914 05/08/25-01/02/29 CME / DIR (EZYLW2ZWVNG8) | 0,01 | 0,0045 | 0,0045 | |||

| US31419JSV16 / Fannie Mae Pool Fn Ae7731 Bond | 0,01 | -12,50 | 0,0045 | -0,0008 | ||

| US126673W657 / COUNTRYWIDE ASSET BACKED CERTI CWL 2005 6 M5 | 0,01 | -80,56 | 0,0044 | -0,0195 | ||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0044 | 0,0044 | |||

| US3138ARNJ91 / Fannie Mae Pool | 0,01 | -12,50 | 0,0043 | -0,0010 | ||

| US36185BRF57 / GNMA POOL AM8586 GN 06/45 FIXED 3.5 | 0,01 | 0,00 | 0,0042 | -0,0007 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,01 | 0,0041 | 0,0041 | |||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0040 | 0,0040 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0040 | 0,0040 | |||

| US36184BZF74 / Ginnie Mae I Pool | 0,01 | 0,00 | 0,0039 | -0,0006 | ||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0,01 | 0,0038 | 0,0038 | |||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0,01 | 0,0038 | 0,0038 | |||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0,01 | 0,0038 | 0,0038 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0038 | 0,0038 | |||

| BOUGHT PEN SOLD USD 20251031 / DFE (000000000) | 0,01 | 0,0037 | 0,0037 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0036 | 0,0036 | |||

| US31396XNT71 / FANNIE MAE FNR 2007 96 AF | 0,01 | 0,00 | 0,0035 | -0,0007 | ||

| US23245PAA93 / ALTERNATIVE LOAN TRUST 2006-OA22 | 0,01 | -16,67 | 0,0034 | -0,0006 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0034 | 0,0034 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0034 | 0,0034 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,01 | 0,0034 | 0,0034 | |||

| US31397KC909 / Freddie Mac REMICS | 0,01 | -16,67 | 0,0033 | -0,0006 | ||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0031 | 0,0031 | |||

| EZW8XKN63668 / GENERAL ELECTRIC COMPANY SNR S* ICE | 0,01 | -16,67 | 0,0030 | -0,0011 | ||

| US36184BZJ96 / GNMA POOL AL5245 GN 03/45 FIXED 3.5 | 0,01 | 0,00 | 0,0029 | -0,0005 | ||

| US36180DSZ14 / Ginnie Mae I Pool | 0,01 | 0,00 | 0,0029 | -0,0005 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0028 | 0,0028 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0028 | 0,0028 | |||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0027 | 0,0027 | |||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0027 | 0,0027 | |||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0027 | 0,0027 | |||

| US929227XB72 / WAMU MORTGAGE PASS-THROUGH CERTIFICATES SERIES 2002-AR17 SER 2002-AR17 CL 1A V/R REGD 3.52644500 | 0,00 | 0,00 | 0,0026 | -0,0005 | ||

| US31418TWY99 / FNMA POOL AD6062 FN 07/40 FIXED 5.5 | 0,00 | 0,00 | 0,0026 | -0,0005 | ||

| US36241KZ350 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0025 | -0,0004 | ||

| VOLKSWAGEN INTERNATIONAL FINA SNR SE ICE / DCR (EZ7728G77FY7) | 0,00 | 0,0025 | 0,0025 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0024 | 0,0024 | |||

| GOLDMAN SACHS GROUP INC SNR S* ICE / DCR (EZC75LZ075F3) | 0,00 | 0,0023 | 0,0023 | |||

| GOLDMAN SACHS GROUP INC SNR S* ICE / DCR (EZC75LZ075F3) | 0,00 | 0,0023 | 0,0023 | |||

| GOLDMAN SACHS GROUP INC SNR S* ICE / DCR (EZC75LZ075F3) | 0,00 | 0,0023 | 0,0023 | |||

| BOUGHT TRY SOLD USD 20250729 / DFE (000000000) | 0,00 | 0,0023 | 0,0023 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0023 | 0,0023 | |||

| RFR GBP SONIO/4.32000 10/20/23-10Y LCH / DIR (EZ49Z4HPK8R0) | 0,00 | 200,00 | 0,0022 | 0,0012 | ||

| RFR GBP SONIO/4.32000 10/20/23-10Y LCH / DIR (EZ49Z4HPK8R0) | 0,00 | 200,00 | 0,0022 | 0,0012 | ||

| RFR GBP SONIO/4.32000 10/20/23-10Y LCH / DIR (EZ49Z4HPK8R0) | 0,00 | 200,00 | 0,0022 | 0,0012 | ||

| RFR USD SOFR/3.93300 01/06/25-10Y LCH / DIR (EZK6LHB5L486) | 0,00 | 50,00 | 0,0022 | 0,0005 | ||

| US761118HU52 / RALI SERIES 2005-QO2 TRUST RALI 2005-QO2 A1 | 0,00 | 0,00 | 0,0022 | -0,0004 | ||

| US31297MW954 / FED HM LN PC POOL A32472 FG 04/35 FIXED 5.5 | 0,00 | -25,00 | 0,0022 | -0,0004 | ||

| US12668BDE02 / Alternative Loan Trust, Series 2005-76, Class 2A1 | 0,00 | 0,00 | 0,0021 | -0,0004 | ||

| US31397KE319 / FHLMC, Series 3360, Class FC | 0,00 | 0,00 | 0,0019 | -0,0004 | ||

| RFR USD SOFR/4.10000 01/21/25-10Y LCH / DIR (EZ7J947QTC64) | 0,00 | 50,00 | 0,0019 | 0,0001 | ||

| RFR USD SOFR/4.09000 01/22/25-10Y LCH / DIR (EZFR659WJHH9) | 0,00 | 50,00 | 0,0019 | 0,0001 | ||

| RFR USD SOFR/4.09000 01/22/25-10Y LCH / DIR (EZFR659WJHH9) | 0,00 | 50,00 | 0,0019 | 0,0001 | ||

| RFR USD SOFR/4.09000 01/22/25-10Y LCH / DIR (EZFR659WJHH9) | 0,00 | 50,00 | 0,0019 | 0,0001 | ||

| US07387QAX88 / Bear Stearns ALT-A Trust, Series 2006-8, Class 3A1 | 0,00 | 0,00 | 0,0019 | -0,0004 | ||

| US31397KL827 / Freddie Mac REMICS | 0,00 | 0,00 | 0,0019 | -0,0004 | ||

| US31418P3W39 / FNMA POOL AD2612 FN 11/36 FIXED 5.5 | 0,00 | 0,00 | 0,0018 | -0,0003 | ||

| US31394FHD06 / FNMA, Series 2005-79, Class NF | 0,00 | 0,00 | 0,0018 | -0,0004 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0018 | 0,0018 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0018 | 0,0018 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0018 | 0,0018 | |||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0018 | 0,0018 | |||

| RFR USD SOFR/4.07100 01/15/25-10Y LCH / DIR (EZZWCBP8MVY9) | 0,00 | 200,00 | 0,0018 | 0,0005 | ||

| US36177MGP14 / GNMA POOL 792905 GN 01/42 FIXED 3.5 | 0,00 | 0,00 | 0,0017 | -0,0004 | ||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0017 | 0,0017 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0017 | 0,0017 | |||

| US3138ABYE34 / Fannie Mae Pool | 0,00 | -33,33 | 0,0017 | -0,0003 | ||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0017 | 0,0017 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0016 | 0,0016 | |||

| US36178NB656 / Government National Mortgage Association | 0,00 | 0,00 | 0,0016 | -0,0003 | ||

| US31410FVY86 / Fannie Mae Pool | 0,00 | 0,00 | 0,0016 | -0,0003 | ||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0016 | 0,0016 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0016 | 0,0016 | |||

| RFR USD SOFR/4.01300 01/15/25-10Y LCH / DIR (EZZWCBP8MVY9) | 0,00 | 100,00 | 0,0015 | 0,0002 | ||

| US3138EK2L88 / FNMA POOL AL3478 FN 05/41 FIXED VAR | 0,00 | 0,00 | 0,0015 | -0,0003 | ||

| US31416J5B39 / FNMA POOL AA1741 FN 01/39 FIXED 5.5 | 0,00 | 0,00 | 0,0015 | -0,0002 | ||

| US46628KAT79 / JP Morgan Mortgage Trust, Series 2006-A3, Class 6A1 | 0,00 | 0,00 | 0,0015 | -0,0002 | ||

| RFR USD SOFR/3.86000 11/14/24-10Y LCH / DIR (EZCMSCQLNL34) | 0,00 | 100,00 | 0,0014 | 0,0006 | ||

| TRT061124T11 / Turkey Government Bond | 0,00 | 0,00 | 0,0014 | -0,0003 | ||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0,00 | 0,0014 | 0,0014 | |||

| US31407YXM64 / FNMA POOL 844984 FN 05/35 FIXED 5.5 | 0,00 | 0,00 | 0,0014 | -0,0003 | ||

| EZRG1QWTVHG4 / BRITISH TELECOMMUNICATIONS PL SNR SE ICE | 0,00 | 0,00 | 0,0014 | -0,0000 | ||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0014 | 0,0014 | |||

| US83162CSN47 / United States Small Business Administration | 0,00 | -33,33 | 0,0014 | -0,0007 | ||

| BOUGHT CHF SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0013 | 0,0013 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0013 | 0,0013 | |||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0012 | 0,0012 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0012 | 0,0012 | |||

| US31412XES99 / Fannie Mae Pool | 0,00 | 0,00 | 0,0012 | -0,0004 | ||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0,00 | 0,0012 | 0,0012 | |||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0,00 | 0,0012 | 0,0012 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0012 | 0,0012 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0012 | 0,0012 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0011 | 0,0011 | |||

| US3622MAAB76 / GSAMP Trust 2007-FM1 | 0,00 | 0,00 | 0,0011 | -0,0002 | ||

| BOUGHT KRW SOLD USD 20250710 / DFE (000000000) | 0,00 | 0,0011 | 0,0011 | |||

| BOUGHT KRW SOLD USD 20250710 / DFE (000000000) | 0,00 | 0,0011 | 0,0011 | |||

| BOUGHT KRW SOLD USD 20250710 / DFE (000000000) | 0,00 | 0,0011 | 0,0011 | |||

| US31402QV573 / FNMA POOL 735136 FN 01/35 FIXED VAR | 0,00 | -50,00 | 0,0010 | -0,0004 | ||

| US31415MM284 / Fannie Mae Pool | 0,00 | 0,00 | 0,0010 | -0,0002 | ||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0010 | 0,0010 | |||

| RFR USD SOFR/3.89600 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0,00 | 0,0009 | 0,0006 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0009 | 0,0009 | |||

| US31394FAF27 / FANNIE MAE FNR 2005 75 AF | 0,00 | 0,00 | 0,0009 | -0,0002 | ||

| RFR USD SOFR/3.89000 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0,00 | 0,0009 | 0,0006 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0009 | 0,0009 | |||

| US31416AVY36 / Fannie Mae Pool | 0,00 | 0,00 | 0,0009 | -0,0002 | ||

| US31409BBV80 / FNMA POOL 865952 FN 03/36 FIXED 5.5 | 0,00 | 0,00 | 0,0009 | -0,0001 | ||

| RFR USD SOFR/3.88000 01/13/25-10Y LCH / DIR (EZB2C5X6RDC5) | 0,00 | 0,0009 | 0,0003 | |||

| RFR USD SOFR/3.98235 12/02/24-2Y* LCH / DIR (EZ1P2MZR4KH2) | 0,00 | -66,67 | 0,0008 | -0,0011 | ||

| US31371PCJ75 / Fannie Mae Pool | 0,00 | 0,00 | 0,0008 | -0,0002 | ||

| OIS MXN TIIE1/7.76000 04/09/25-4Y* CME / DIR (EZ8RRKWFNPF8) | 0,00 | 0,0008 | 0,0008 | |||

| US55275TAB44 / Mastr Asset Backed Securities Trust 2007-WMC1 | 0,00 | 0,00 | 0,0008 | -0,0001 | ||

| US31412V5F13 / FNMA POOL 936546 FN 07/37 FIXED 6 | 0,00 | 0,00 | 0,0008 | -0,0001 | ||

| BOUGHT TWD SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0008 | 0,0008 | |||

| US31411JF432 / FNMA POOL 909287 FN 01/37 FIXED 5.5 | 0,00 | 0,00 | 0,0008 | -0,0001 | ||

| US31409AJ429 / FNMA POOL 865283 FN 02/36 FIXED 5.5 | 0,00 | 0,00 | 0,0008 | -0,0001 | ||

| US362341RT83 / GSR MORTGAGE LOAN TRUST GSR 2005 AR6 1A1 | 0,00 | 0,00 | 0,0008 | -0,0005 | ||

| IRS EUR 2.45000 05/05/25-10Y LCH / DIR (EZCDFQCSBVM0) | 0,00 | 0,0008 | 0,0008 | |||

| BOUGHT EUR SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0008 | 0,0008 | |||

| BOUGHT EUR SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0008 | 0,0008 | |||

| BOUGHT EUR SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0008 | 0,0008 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0008 | 0,0008 | |||

| RFR USD SOFR/3.86600 11/14/24-10Y LCH / DIR (EZCMSCQLNL34) | 0,00 | 0,00 | 0,0008 | -0,0001 | ||

| US31410GF992 / Fannie Mae Pool | 0,00 | 0,00 | 0,0007 | -0,0001 | ||

| RFR USD SOFR/3.85000 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0,00 | 0,0007 | 0,0004 | |||

| RFR USD SOFR/3.85500 11/19/24-10Y LCH / DIR (EZVRNR667250) | 0,00 | 0,0007 | 0,0007 | |||

| US12669F6Z19 / CWMBS, Inc. | 0,00 | 0,00 | 0,0007 | -0,0001 | ||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0007 | 0,0007 | |||

| US83612TAB89 / Soundview Home Loan Trust, Series 2007-OPT1, Class 2A1 | 0,00 | 0,00 | 0,0007 | -0,0001 | ||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0007 | 0,0007 | |||

| RFR USD SOFR/3.84000 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0,00 | 0,0007 | 0,0003 | |||

| RFR USD SOFR/3.84000 01/08/25-10Y LCH / DIR (EZKP2JSHK8F5) | 0,00 | 0,0007 | 0,0003 | |||

| US31415P3Z99 / Fannie Mae Pool | 0,00 | 0,00 | 0,0006 | -0,0001 | ||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | |||

| US86363DAH44 / Structured Asset Mortgage Investments II Trust 2007-AR2 | 0,00 | 0,00 | 0,0006 | -0,0002 | ||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | |||

| US31416Q6N05 / Fannie Mae Pool | 0,00 | 0,0006 | -0,0001 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| BARCLAYS BANK PLC SNR SE ICE / DCR (EZB88Z42LS80) | 0,00 | -100,00 | 0,0005 | -0,0002 | ||

| BOUGHT NZD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| BOUGHT NZD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| BOUGHT NZD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| US31396WLX29 / Fannie Mae REMICS | 0,00 | 0,0005 | -0,0001 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | |||

| US31397KZG92 / FREDDIE MAC FHR 3376 FD | 0,00 | 0,0005 | -0,0001 | |||

| US36184EA275 / GNMA POOL AL7225 GN 05/45 FIXED 3.5 | 0,00 | 0,0005 | -0,0001 | |||

| US31407HKP00 / Fannie Mae Pool | 0,00 | 0,0005 | -0,0001 | |||

| IRS EUR 2.51000 04/09/25-10Y LCH / DIR (EZTHL4ZCB733) | 0,00 | 0,0004 | 0,0004 | |||

| IRS EUR 2.51000 04/09/25-10Y LCH / DIR (EZTHL4ZCB733) | 0,00 | 0,0004 | 0,0004 | |||

| IRS EUR 2.51000 04/09/25-10Y LCH / DIR (EZTHL4ZCB733) | 0,00 | 0,0004 | 0,0004 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| BOUGHT KRW SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| US31416CBU99 / FNMA POOL 995651 FN 11/37 FIXED VAR | 0,00 | 0,0004 | -0,0001 | |||

| BOUGHT TRY SOLD USD 20251217 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| US65535VLL08 / NOMURA ASSET ACCEPTANCE CORPOR NAA 2005 AP2 A5 | 0,00 | 0,0004 | -0,0001 | |||

| RFR USD SOFR/3.79250 11/19/24-10Y LCH / DIR (EZVRNR667250) | 0,00 | 0,0004 | 0,0004 | |||

| ZCS BRL 13.32 05/08/25-01/02/29 CME / DIR (EZYLW2ZWVNG8) | 0,00 | 0,0004 | 0,0004 | |||

| US31402RCR84 / FNMA POOL 735480 FN 04/35 FIXED VAR | 0,00 | 0,0004 | -0,0001 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | |||

| US36177TAG22 / GNMA POOL 798106 GN 03/42 FIXED 3.5 | 0,00 | 0,0003 | -0,0001 | |||

| US36241KUL06 / Government National Mortgage Association | 0,00 | 0,0003 | -0,0001 | |||

| US31410FCT03 / Federal National Mortgage Association, Inc. | 0,00 | 0,0003 | -0,0001 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT TRY SOLD USD 20250724 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| US362636AT94 / GSR Mortgage Loan Trust | 0,00 | 0,0003 | -0,0001 | |||

| IRS EUR 2.53000 04/23/25-10Y LCH / DIR (EZP376MT1B98) | 0,00 | 0,0003 | 0,0003 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | |||

| US83162CSE48 / United States Small Business Administration | 0,00 | 0,0003 | -0,0001 | |||

| US31410E3F31 / Fannie Mae Pool | 0,00 | 0,0003 | -0,0000 | |||

| RFR USD SOFR/3.75000 05/07/25-10Y LCH / DIR (EZ61ZS50J0P1) | 0,00 | 0,0003 | 0,0003 | |||

| IRS EUR 2.39000 10/01/24-10Y LCH / DIR (EZHK1QM5FKM1) | 0,00 | -100,00 | 0,0003 | -0,0015 | ||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| US83162CRL99 / United States Small Business Administration | 0,00 | 0,0002 | -0,0001 | |||

| US31410KNN09 / Fannie Mae Pool | 0,00 | 0,0002 | -0,0000 | |||

| US31396WTU08 / Fannie Mae REMICS | 0,00 | 0,0002 | -0,0000 | |||

| US31415YFZ79 / FNMA POOL 993084 FN 12/38 FIXED 5.5 | 0,00 | 0,0002 | -0,0001 | |||

| BANK OF AMERICA CORPORATION SNR S* ICE / DCR (EZHYVHXCW214) | 0,00 | 0,0002 | -0,0001 | |||

| BANK OF AMERICA CORPORATION SNR S* ICE / DCR (EZHYVHXCW214) | 0,00 | -100,00 | 0,0002 | -0,0001 | ||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| US31408GY922 / FNMA POOL 851336 FN 02/36 FIXED 5.5 | 0,00 | 0,0002 | -0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| IRS EUR 2.55000 04/16/25-10Y LCH / DIR (EZ15F0SX71M6) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT PEN SOLD USD 20250825 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT PEN SOLD USD 20250825 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT PEN SOLD USD 20250825 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| US3128LDVR21 / FED HM LN PC POOL A79624 FG 07/38 FIXED 5.5 | 0,00 | 0,0002 | -0,0000 | |||

| US31419ARE90 / Fannie Mae Pool | 0,00 | 0,0002 | -0,0000 | |||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| US31419A3K17 / Fannie Mae Pool | 0,00 | 0,0002 | -0,0000 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT ILS SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| IRS EUR 2.61000 03/24/25-10Y LCH / DIR (EZPS73SKDR02) | 0,00 | 0,0001 | 0,0004 | |||

| IRS EUR 2.61000 03/24/25-10Y LCH / DIR (EZPS73SKDR02) | 0,00 | 0,0001 | 0,0004 | |||

| IRS EUR 2.61000 03/24/25-10Y LCH / DIR (EZPS73SKDR02) | 0,00 | 0,0001 | 0,0004 | |||

| US12669GHG91 / COUNTRYWIDE HOME LOANS CWHL 2004 HYB9 1A1 | 0,00 | 0,0001 | -0,0000 | |||

| US31403DDX49 / Fannie Mae Pool | 0,00 | 0,0001 | -0,0000 | |||

| BOUGHT CNH SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| US362341XG98 / GSR Mortgage Loan Trust 2005-AR7 | 0,00 | 0,0001 | -0,0000 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT PEN SOLD USD 20250917 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| SOLD INR BOUGHT USD 20250820 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| SOLD INR BOUGHT USD 20250820 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| SOLD INR BOUGHT USD 20250820 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT PEN SOLD USD 20250707 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| US31412MNZ76 / FNMA POOL 929308 FN 04/38 FIXED 5.5 | 0,00 | 0,0001 | -0,0000 | |||

| BOUGHT TRY SOLD USD 20250701 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT TRY SOLD USD 20250701 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT TRY SOLD USD 20250701 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| US31409EN803 / FNMA POOL 869015 FN 05/36 FIXED 5.5 | 0,00 | 0,0001 | -0,0000 | |||

| BOUGHT TRY SOLD USD 20250718 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT TRY SOLD USD 20250718 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT TRY SOLD USD 20250718 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| US3128M5R934 / Freddie Mac Gold Pool | 0,00 | 0,0001 | -0,0000 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| US3128P7KG77 / FED HM LN PC POOL C91195 FG 07/28 FIXED 5.5 | 0,00 | 0,0001 | -0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| US31385XQ592 / Federal National Mortgage Association, Inc. | 0,00 | 0,0001 | -0,0000 | |||

| SOLD HKD BOUGHT USD 20250716 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| US31410FYE95 / UMBS, 30 Year | 0,00 | 0,0001 | -0,0000 | |||

| BOUGHT TRY SOLD USD 20250813 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| US31413TJV52 / FNMA POOL 954876 FN 11/37 FIXED 6 | 0,00 | 0,0001 | -0,0000 | |||

| BOUGHT TWD SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| US31408AEN63 / Fannie Mae Pool | 0,00 | 0,0001 | -0,0000 | |||

| US31407RTA22 / FNMA POOL 838545 FN 10/35 FIXED 5.5 | 0,00 | 0,0001 | -0,0000 | |||

| US31403DBL29 / FNMA POOL 745343 FN 03/36 FIXED VAR | 0,00 | 0,0001 | -0,0000 | |||

| US31407FHF09 / FNMA POOL 829230 FN 08/35 FIXED 5.5 | 0,00 | 0,0001 | -0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | |||

| US31411DS750 / FNMA POOL 905142 FN 02/37 FIXED 5.5 | 0,00 | 0,0001 | -0,0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US31391WFK27 / FNMA POOL 678870 FN 01/33 FIXED 5.5 | 0,00 | 0,0000 | -0,0000 | |||

| US466247LZ44 / JP MORGAN MORTGAGE TRUST 2005-A1 SER 2005-A1 CL 6T1 V/R REGD 4.64499200 | 0,00 | 0,0000 | -0,0000 | |||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US31404ABA16 / FNMA POOL 762433 FN 01/34 FIXED 5.5 | 0,00 | 0,0000 | -0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT TRY SOLD USD 20250807 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT TRY SOLD USD 20250807 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT TRY SOLD USD 20250807 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US31400BZL34 / FNMA POOL 683047 FN 02/33 FIXED 5.5 | 0,00 | 0,0000 | -0,0000 | |||

| BOUGHT KRW SOLD USD 20250708 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US31418V3Z34 / FNMA POOL AD8015 FN 07/25 FIXED 4 | 0,00 | 0,0000 | -0,0002 | |||

| US31418T2H98 / Fannie Mae Pool | 0,00 | 0,0000 | -0,0001 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US31368HL352 / Fannie Mae Pool | 0,00 | 0,0000 | -0,0000 | |||

| US31400JSC44 / Fannie Mae Pool | 0,00 | 0,0000 | -0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT SGD SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT THB SOLD USD 20250716 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT JPY SOLD USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT PLN SOLD USD 20250718 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| BOUGHT IDR SOLD USD 20250714 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| SOLD SEK BOUGHT USD 20250804 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| V / Visa Inc. | 0,00 | -100,00 | -0,0708 | |||

| BOUGHT SEK SOLD USD 20250702 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| 31750QN05 PIMCO CDSOPT PUT USD 0.85 20250716 / DCR (EZ967XY50V92) | -0,00 | -0,0000 | 0,0003 | |||

| 31750QN05 PIMCO CDSOPT PUT USD 0.85 20250716 / DCR (EZ967XY50V92) | -0,00 | -0,0000 | 0,0003 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| 31750QMA4 PIMCO CDSOPT PUT USD 1.0 20250716 / DCR (EZ967XY50V92) | -0,00 | -0,0000 | 0,0003 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| 31750QMB2 PIMCO CDSOPT PUT USD 0.9 20250716 / DCR (EZ967XY50V92) | -0,00 | -0,0000 | 0,0003 | |||

| 31750QN88 PIMCO CDSOPT PUT USD 0.85 20250716 / DCR (EZ967XY50V92) | -0,00 | -0,0000 | 0,0003 | |||

| SOLD ZAR BOUGHT USD 20250723 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD ILS BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD TRY BOUGHT USD 20250729 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD TRY BOUGHT USD 20250729 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| BOUGHT TWD SOLD USD 20250820 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD KRW BOUGHT USD 20250714 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD KRW BOUGHT USD 20250714 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD KRW BOUGHT USD 20250714 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD DKK BOUGHT USD 20250804 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD DKK BOUGHT USD 20250804 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD SGD BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD TRY BOUGHT USD 20250718 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| IRS EUR 2.28000 03/04/25-5Y LCH / DIR (EZQH3P2675Q7) | -0,00 | -0,0001 | -0,0004 | |||

| IRS EUR 2.28000 03/04/25-5Y LCH / DIR (EZQH3P2675Q7) | -0,00 | -0,0001 | -0,0004 | |||

| IRS EUR 2.28000 03/04/25-5Y LCH / DIR (EZQH3P2675Q7) | -0,00 | -0,0001 | -0,0004 | |||

| SOLD KRW BOUGHT USD 20250708 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD KRW BOUGHT USD 20250708 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD KRW BOUGHT USD 20250708 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD ILS BOUGHT USD 20250709 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD ILS BOUGHT USD 20250709 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD ILS BOUGHT USD 20250709 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD SGD BOUGHT USD 20250805 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | |||

| SOLD MXN BOUGHT USD 20250917 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | |||

| ZCS BRL 14.0087 05/12/25-01/04/27 CME / DIR (EZHTRBH6Z688) | -0,00 | -0,0002 | -0,0002 | |||

| SOLD TRY BOUGHT USD 20250724 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | |||

| SOLD TRY BOUGHT USD 20250724 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | |||

| SOLD TRY BOUGHT USD 20250724 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | |||

| ZCS BRL 13.9255 05/08/25-01/04/27 CME / DIR (EZ6MPDHN98L0) | -0,00 | -0,0002 | -0,0002 | |||

| ZCS BRL 13.9255 05/08/25-01/04/27 CME / DIR (EZ6MPDHN98L0) | -0,00 | -0,0002 | -0,0002 | |||

| ZCS BRL 13.9255 05/08/25-01/04/27 CME / DIR (EZ6MPDHN98L0) | -0,00 | -0,0002 | -0,0002 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | |||

| BOUGHT INR SOLD USD 20250820 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | |||

| SOLD TRY BOUGHT USD 20250707 / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | |||

| SOFTBANK GROUP CORP SNR JP SP GST / DCR (EZ1K1NTX2WN0) | -0,00 | -0,0002 | -0,0000 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| SOLD TRY BOUGHT USD 20250725 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| SOLD PLN BOUGHT USD 20250710 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| SOLD SEK BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| SOLD THB BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| SOLD PEN BOUGHT USD 20250717 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| IRS EUR 2.38000 12/31/24-10Y LCH / DIR (EZT9L1T84284) | -0,00 | -100,00 | -0,0003 | 0,0013 | ||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | |||

| IRS EUR 2.52000 03/27/25-10Y LCH / DIR (EZ84ZR69LPH2) | -0,00 | -100,00 | -0,0004 | 0,0004 | ||

| SOLD TRY BOUGHT USD 20250729 / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | |||

| SOLD TRY BOUGHT USD 20251217 / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | |||

| SOLD TRY BOUGHT USD 20251217 / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | |||

| SOLD TRY BOUGHT USD 20251217 / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | |||

| RFR GBP SONIO/3.93000 01/06/25-10Y LCH / DIR (EZTXWKTD4706) | -0,00 | -100,00 | -0,0004 | 0,0013 | ||

| RFR GBP SONIO/3.93000 01/06/25-10Y LCH / DIR (EZTXWKTD4706) | -0,00 | -100,00 | -0,0004 | 0,0013 | ||

| RFR GBP SONIO/3.93000 01/06/25-10Y LCH / DIR (EZTXWKTD4706) | -0,00 | -100,00 | -0,0004 | 0,0013 | ||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0005 | -0,0005 | |||

| SOLD AUD BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0005 | -0,0005 | |||

| SOLD KRW BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0005 | -0,0005 | |||

| SOLD NZD BOUGHT USD 20250804 / DFE (000000000) | -0,00 | -0,0005 | -0,0005 | |||

| SOLD TRY BOUGHT USD 20250729 / DFE (000000000) | -0,00 | -0,0005 | -0,0005 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0006 | -0,0006 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0006 | -0,0006 | |||

| SOLD CNH BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0006 | -0,0006 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0006 | -0,0006 | |||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0,00 | -0,0007 | -0,0007 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0007 | -0,0007 | |||

| IRS EUR 2.67000 04/03/24-10Y LCH / DIR (EZNZ7GSWY0V5) | -0,00 | 0,00 | -0,0007 | 0,0004 | ||

| IRS EUR 2.67000 04/03/24-10Y LCH / DIR (EZNZ7GSWY0V5) | -0,00 | 0,00 | -0,0007 | 0,0004 | ||

| IRS EUR 2.67000 04/03/24-10Y LCH / DIR (EZNZ7GSWY0V5) | -0,00 | 0,00 | -0,0007 | 0,0004 | ||

| SOLD BRL BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0007 | -0,0007 | |||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0007 | -0,0007 | |||

| RFR USD SOFR/4.00000 02/26/25-10Y LCH / DIR (EZ02007F7Y72) | -0,00 | -0,0007 | -0,0001 | |||

| IRS EUR 2.46000 03/13/25-10Y LCH / DIR (EZYS5KMNTTM6) | -0,00 | 0,00 | -0,0007 | 0,0004 | ||

| SOLD TRY BOUGHT USD 20250717 / DFE (000000000) | -0,00 | -0,0007 | -0,0007 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0007 | -0,0007 | |||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0008 | -0,0008 | |||

| SOLD TWD BOUGHT USD 20250820 / DFE (000000000) | -0,00 | -0,0008 | -0,0008 | |||

| RFR USD SOFR/3.87000 03/05/25-10Y LCH / DIR (EZMZ9H14KX59) | -0,00 | -0,0008 | -0,0003 | |||

| RFR USD SOFR/3.87000 03/05/25-10Y LCH / DIR (EZMZ9H14KX59) | -0,00 | -0,0008 | -0,0003 | |||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0,00 | -0,0009 | -0,0009 | |||

| SOLD BRL BOUGHT USD 20251002 / DFE (000000000) | -0,00 | -0,0009 | -0,0009 | |||

| SOLD NZD BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0009 | -0,0009 | |||

| RFR USD SOFR/4.25000 12/20/23-2Y CME / DIR (EZM7XR6RB2D5) | -0,00 | -200,00 | -0,0009 | -0,0016 | ||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0009 | -0,0009 | |||

| SOLD CNH BOUGHT USD 20250716 / DFE (000000000) | -0,00 | -0,0009 | -0,0009 | |||

| SOLD ZAR BOUGHT USD 20250723 / DFE (000000000) | -0,00 | -0,0009 | -0,0009 | |||

| IRS EUR 2.40000 04/09/25-5Y LCH / DIR (EZVHX3M64G11) | -0,00 | -0,0009 | -0,0009 | |||

| IRS EUR 2.40000 04/09/25-5Y LCH / DIR (EZVHX3M64G11) | -0,00 | -0,0009 | -0,0009 | |||