Statistiques de base

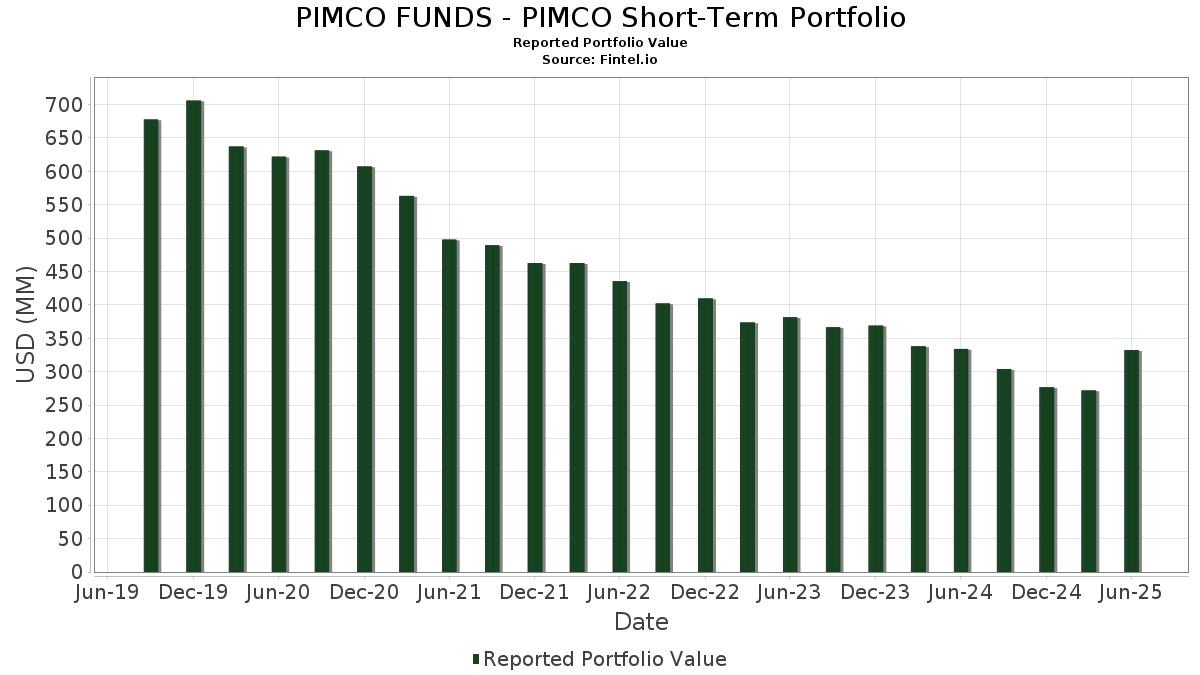

| Valeur du portefeuille | $ 332 332 364 |

| Positions actuelles | 873 |

Dernières positions, performances, ASG (à partir des dépôts 13F, 13D)

PIMCO FUNDS - PIMCO Short-Term Portfolio a déclaré un total de 873 positions dans ses derniers dépôts auprès de la SEC. La valeur la plus récente du portefeuille est calculée à 332 332 364 USD. Les actifs sous gestion réels (ASG) sont cette valeur plus les liquidités (qui ne sont pas divulguées). Les principales positions de PIMCO FUNDS - PIMCO Short-Term Portfolio sont Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , Ginnie Mae (US:US21H0426799) , and UMBS 15YR TBA(REG B) 3.0 UMBS TBA 07-01-35 (US:US01F0304703) . Les nouvelles positions de PIMCO FUNDS - PIMCO Short-Term Portfolio incluent Uniform Mortgage-Backed Security, TBA (US:US01F0606834) , Uniform Mortgage-Backed Security, TBA (US:US01F0626899) , PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , Ginnie Mae (US:US21H0426799) , and UMBS 15YR TBA(REG B) 3.0 UMBS TBA 07-01-35 (US:US01F0304703) .

Meilleures augmentations ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 3,73 | 2,1168 | 4,3565 | ||

| 27,82 | 15,7961 | 3,5589 | ||

| 6,06 | 3,4399 | 3,4399 | ||

| 14,36 | 8,1541 | 3,0254 | ||

| 16,39 | 9,3091 | 2,9692 | ||

| 6,56 | 3,7264 | 1,2873 | ||

| 1,61 | 0,9129 | 0,9129 | ||

| 1,61 | 0,9129 | 0,9129 | ||

| 1,50 | 0,8541 | 0,8541 | ||

| 1,50 | 0,8541 | 0,8541 |

Principales baisses ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| -0,37 | -0,2112 | -15,0253 | ||

| -0,10 | -0,0543 | -4,8147 | ||

| -1,94 | -1,0989 | -2,5353 | ||

| 0,58 | 0,3297 | -1,3968 | ||

| -1,19 | -0,6766 | -0,6766 | ||

| -1,19 | -0,6766 | -0,6766 | ||

| 3,46 | 1,9657 | -0,3261 | ||

| 3,46 | 1,9657 | -0,3261 | ||

| -5,31 | -3,0137 | -0,3116 | ||

| -0,39 | -0,2228 | -0,2228 |

Déclarations 13F et dépôts de fonds

Ce formulaire a été déposé le 2025-08-28 pour la période de déclaration 2025-06-30. Cet investisseur n'a pas divulgué les titres comptabilisés en actions, les colonnes relatives aux actions dans le tableau ci-dessous sont donc omises. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau pour débloquer les données premium et exporter vers Excel ![]() .

.

| Titre | Type | ΔActions (%) |

Valeur ($ en millions) |

Portefeuille (%) |

ΔPortefeuille (%) |

|

|---|---|---|---|---|---|---|

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 27,82 | 17,09 | 15,7961 | 3,5589 | ||

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 16,39 | 33,20 | 9,3091 | 2,9692 | ||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 14,36 | 62,08 | 8,1541 | 3,0254 | ||

| US21H0426799 / Ginnie Mae | 12,92 | -2,90 | 7,3387 | 0,4827 | ||

| US01F0304703 / UMBS 15YR TBA(REG B) 3.0 UMBS TBA 07-01-35 | 12,49 | 3,08 | 7,0936 | 0,8511 | ||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 12,19 | -4,92 | 6,9211 | 0,3176 | ||

| US01F0506844 / UMBS TBA | 6,56 | 38,59 | 3,7264 | 1,2873 | ||

| US01F0306781 / UMBS TBA | 6,06 | 3,4399 | 3,4399 | |||

| RFR USD SOFR/1.75000 06/15/22-30Y LCH / DIR (EZ2TNCR649W7) | 4,98 | -2,58 | 2,8258 | -0,1311 | ||

| RFR USD SOFR/1.75000 06/15/22-30Y LCH / DIR (EZ2TNCR649W7) | 4,98 | -2,58 | 2,8258 | -0,1311 | ||

| TCW LTD TCW 2024 1A A1 144A / ABS-CBDO (US87252MAC73) | 4,01 | 0,02 | 2,2752 | -0,0432 | ||

| TCW LTD TCW 2024 1A A1 144A / ABS-CBDO (US87252MAC73) | 4,01 | 0,02 | 2,2752 | -0,0432 | ||

| US912810QZ49 / United States Treas Bds Bond | 3,81 | -2,01 | 2,1607 | -0,0875 | ||

| US21H0326700 / GNMA2 30YR TBA(REG C) 3.5 TBA 07-01-50 | 3,73 | -177,65 | 2,1168 | 4,3565 | ||

| RFRF USD SF+26.161/0.50 9/16/23-5Y* CME / DIR (EZTP4L47M699) | 3,46 | -12,58 | 1,9657 | -0,3261 | ||

| RFRF USD SF+26.161/0.50 9/16/23-5Y* CME / DIR (EZTP4L47M699) | 3,46 | -12,58 | 1,9657 | -0,3261 | ||

| US06051GDM87 / Banc of America Funding 2005-D Trust | 2,99 | -5,74 | 1,6976 | -0,1380 | ||

| US89177HAA05 / Towd Point Mortgage Trust, Series 2019-HY2, Class A1 | 2,96 | -7,15 | 1,6820 | -0,1650 | ||

| US912810TM09 / United States Treasury Note/Bond | 2,83 | -2,18 | 1,6064 | -0,0681 | ||

| US126673AW27 / CWABS INC ASSET-BACKED CERTIFICATES TRUST 2004-6 CWL 2004-6 1A1 | 2,80 | -3,81 | 1,5926 | -0,0950 | ||

| RFRF USD SF+26.161/1.2* 9/17/23-7Y* CME / DIR (EZ9PFGBJFFW1) | 2,77 | -9,93 | 1,5720 | -0,2070 | ||

| RFRF USD SF+26.161/1.2* 9/17/23-7Y* CME / DIR (EZ9PFGBJFFW1) | 2,77 | -9,93 | 1,5720 | -0,2070 | ||

| US21H0306827 / Ginnie Mae | 2,56 | 1,42 | 1,4564 | 0,1540 | ||

| US93363TAB89 / WaMu Mortgage Pass-Through Certificates Series 2006-AR11 Trust | 2,33 | -1,31 | 1,3250 | -0,0438 | ||

| US52474XAA37 / LEGACY MORTGAGE ASSET TRUST SER 2021-GS3 CL A1 V/R REGD 144A P/P 0.00000000 | 2,31 | -2,74 | 1,3123 | -0,0634 | ||

| US62955RAA32 / NEW YORK MORTGAGE TRUST 08/51 1.6696 | 2,30 | -4,17 | 1,3041 | -0,0830 | ||

| GS MORTGAGE BACKED SECURITIES GSMBS 2024 RPL4 A1 144A / ABS-MBS (US362948AA98) | 2,23 | -2,11 | 1,2673 | -0,0522 | ||

| GS MORTGAGE BACKED SECURITIES GSMBS 2024 RPL4 A1 144A / ABS-MBS (US362948AA98) | 2,23 | -2,11 | 1,2673 | -0,0522 | ||

| US64828XAA19 / NEW RESIDENTIAL MORTGAGE LOAN TRUST 2020-RPL1 SER 2020-RPL1 CL A1 V/R REGD 144A P/P 2.75000000 | 2,17 | -4,11 | 1,2336 | -0,0780 | ||

| US67114BAA52 / OBX 2021-NQM1 Trust | 2,15 | -2,10 | 1,2191 | -0,0503 | ||

| US74143JAA97 / PRET 2021-RN3 LLC | 2,09 | -4,08 | 1,1891 | -0,0749 | ||

| US912810TL26 / TREASURY BOND | 2,01 | -2,99 | 1,1426 | -0,0584 | ||

| US36261WAA53 / GS MORTGAGE BACKED SECURITIES GSMBS 2021 RPL1 A1 144A | 1,96 | -3,55 | 1,1126 | -0,0635 | ||

| US78443CCL63 / SLM Private Credit Student Loan Trust 2006-A | 1,84 | -4,36 | 1,0474 | -0,0688 | ||

| US3128MJ3H14 / Freddie Mac Gold Pool | 1,83 | -1,67 | 1,0384 | -0,0380 | ||

| MADISON PARK FUNDING LTD MDPK 2020 46A ARR 144A / ABS-CBDO (US55822AAW71) | 1,70 | 0,59 | 0,9664 | -0,0125 | ||

| MADISON PARK FUNDING LTD MDPK 2020 46A ARR 144A / ABS-CBDO (US55822AAW71) | 1,70 | 0,59 | 0,9664 | -0,0125 | ||

| US64830NAA90 / New Residential Mortgage Loan Trust 2019-RPL3 | 1,67 | -5,32 | 0,9496 | -0,0727 | ||

| MERCEDES BENZ AUTO LEASE TRUST MBALT 2025 A A2A / ABS-O (US58768YAB11) | 1,61 | 0,9129 | 0,9129 | |||

| MERCEDES BENZ AUTO LEASE TRUST MBALT 2025 A A2A / ABS-O (US58768YAB11) | 1,61 | 0,9129 | 0,9129 | |||

| US61770YAA38 / Morgan Stanley Capital I Trust 2020-CNP | 1,57 | 2,14 | 0,8932 | 0,0020 | ||

| US55819MAN65 / Madison Park Funding XXXV Ltd | 1,55 | -3,98 | 0,8774 | -0,0540 | ||

| TOWD POINT MORTGAGE TRUST TPMT 2024 5 A1A 144A / ABS-MBS (US891944AA82) | 1,54 | -4,42 | 0,8719 | -0,0580 | ||

| TOWD POINT MORTGAGE TRUST TPMT 2024 5 A1A 144A / ABS-MBS (US891944AA82) | 1,54 | -4,42 | 0,8719 | -0,0580 | ||

| US69381AAA97 / PRPM 2023-RCF1 LLC SER 2023-RCF1 CL A1 V/R REGD 144A P/P 4.00000000 | 1,51 | -4,74 | 0,8568 | -0,0596 | ||

| NISSAN AUTO RECEIVABLES OWNER NAROT 2025 A A2A / ABS-O (US65481GAB14) | 1,50 | 0,8541 | 0,8541 | |||

| NISSAN AUTO RECEIVABLES OWNER NAROT 2025 A A2A / ABS-O (US65481GAB14) | 1,50 | 0,8541 | 0,8541 | |||

| DRIVE AUTO RECEIVABLES TRUST DRIVE 2025 1 A2 / ABS-O (US262102AB26) | 1,50 | 0,8531 | 0,8531 | |||

| DRIVE AUTO RECEIVABLES TRUST DRIVE 2025 1 A2 / ABS-O (US262102AB26) | 1,50 | 0,8531 | 0,8531 | |||

| US362341RX95 / GSR Mortgage Loan Trust, Series 2005-AR6, Class 2A1 | 1,39 | -3,33 | 0,7911 | -0,0432 | ||

| US66987XDE22 / NOVASTAR HOME EQUITY LOAN NHEL 2003 4 A1 | 1,36 | -8,04 | 0,7738 | -0,0840 | ||

| US75971FAD50 / RENAISSANCE HOME EQUITY LOAN T RAMC 2007 3 AF1 | 1,27 | -1,47 | 0,7239 | -0,0250 | ||

| US36257CAG24 / GS Mortgage Securities Corp Trust 2017-GPTX | 1,16 | 27,31 | 0,6566 | 0,1307 | ||

| US64034QAB41 / Nelnet Student Loan Trust | 1,14 | -7,23 | 0,6489 | -0,0643 | ||

| US03881BAE39 / Arbor Multifamily Mortgage Securities Trust 2020-MF1 | 1,11 | 1,37 | 0,6293 | -0,0035 | ||

| US87276WAA18 / TPG Real Estate Finance Issuer LTD | 1,09 | -4,95 | 0,6215 | -0,0453 | ||

| US1266714L71 / Countrywide Asset-Backed Certificates | 1,06 | -5,93 | 0,6037 | -0,0507 | ||

| LENDMARK FUNDING TRUST LFT 2024 1A A 144A / ABS-O (US52603DAA19) | 1,02 | 0,20 | 0,5778 | -0,0097 | ||

| LENDMARK FUNDING TRUST LFT 2024 1A A 144A / ABS-O (US52603DAA19) | 1,02 | 0,20 | 0,5778 | -0,0097 | ||

| SPACE COAST CREDIT UNION SCCU 2024 1A A3 144A / ABS-O (US78436RAE09) | 1,01 | -0,30 | 0,5713 | -0,0128 | ||

| SPACE COAST CREDIT UNION SCCU 2024 1A A3 144A / ABS-O (US78436RAE09) | 1,01 | -0,30 | 0,5713 | -0,0128 | ||

| BRYANT PARK FUNDING LTD BRYPK 2024 22A A1 144A / ABS-CBDO (US11766CAA27) | 1,00 | 0,10 | 0,5694 | -0,0103 | ||

| BRYANT PARK FUNDING LTD BRYPK 2024 22A A1 144A / ABS-CBDO (US11766CAA27) | 1,00 | 0,10 | 0,5694 | -0,0103 | ||

| LCM LTD PARTNERSHIP LCM 31A AR 144A / ABS-CBDO (US50201QAL86) | 1,00 | 0,20 | 0,5682 | -0,0100 | ||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2021 17A AR 144A / ABS-CBDO (US04942FAL31) | 1,00 | 0,40 | 0,5678 | -0,0087 | ||

| ATLAS SENIOR LOAN FUND LTD ATCLO 2021 17A AR 144A / ABS-CBDO (US04942FAL31) | 1,00 | 0,40 | 0,5678 | -0,0087 | ||

| VENTURE CDO LTD VENTR 2021 44A A1NR 144A / ABS-CBDO (US92332KAQ40) | 1,00 | 0,10 | 0,5672 | -0,0100 | ||

| VENTURE CDO LTD VENTR 2021 44A A1NR 144A / ABS-CBDO (US92332KAQ40) | 1,00 | 0,10 | 0,5672 | -0,0100 | ||

| LCM LTD PARTNERSHIP LCM 36A A1R 144A / ABS-CBDO (US50190LAL27) | 1,00 | 0,10 | 0,5659 | -0,0102 | ||

| LCM LTD PARTNERSHIP LCM 36A A1R 144A / ABS-CBDO (US50190LAL27) | 1,00 | 0,10 | 0,5659 | -0,0102 | ||

| CENTERBRIDGE CREDIT FUNDING LT CBCF 2021 1A A 144A / ABS-CBDO (US15186PAA66) | 0,96 | 1,37 | 0,5465 | -0,0030 | ||

| CENTERBRIDGE CREDIT FUNDING LT CBCF 2021 1A A 144A / ABS-CBDO (US15186PAA66) | 0,96 | 1,37 | 0,5465 | -0,0030 | ||

| US03329TAG94 / Anchorage Credit Funding 4 Ltd. | 0,95 | 2,59 | 0,5405 | 0,0039 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2015 1A ARE 144A / ABS-CBDO (US033296AS36) | 0,95 | -0,63 | 0,5372 | -0,0144 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2015 1A ARE 144A / ABS-CBDO (US033296AS36) | 0,95 | -0,63 | 0,5372 | -0,0144 | ||

| US36179W5D62 / Ginnie Mae II Pool | 0,93 | 0,5288 | 0,5288 | |||

| US86359LEW54 / STRUCTURED ASSET MORTGAGE INVE SAMI 2004 AR6 A2 | 0,92 | -0,65 | 0,5203 | -0,0136 | ||

| ATLX TRUST ATLX 2024 RPL2 A1 144A / ABS-MBS (US049919AA13) | 0,91 | -2,26 | 0,5154 | -0,0223 | ||

| ATLX TRUST ATLX 2024 RPL2 A1 144A / ABS-MBS (US049919AA13) | 0,91 | -2,26 | 0,5154 | -0,0223 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2020 10A AV 144A / ABS-CBDO (US03332AAA88) | 0,89 | 1,03 | 0,5028 | -0,0044 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2020 10A AV 144A / ABS-CBDO (US03332AAA88) | 0,89 | 1,03 | 0,5028 | -0,0044 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2015 2A ARV 144A / ABS-CBDO (US03329LAS07) | 0,88 | 1,26 | 0,5020 | -0,0037 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2015 2A ARV 144A / ABS-CBDO (US03329LAS07) | 0,88 | 1,26 | 0,5020 | -0,0037 | ||

| US89177BAA35 / Towd Point Mortgage Trust 2019-1 | 0,87 | -3,33 | 0,4949 | -0,0268 | ||

| US92922F7P73 / WAMU_05-AR17 | 0,87 | -0,34 | 0,4947 | -0,0112 | ||

| MFRA TRUST MFRA 2024 RPL1 A1 144A / ABS-MBS (US55287AAA34) | 0,87 | -3,67 | 0,4919 | -0,0287 | ||

| MFRA TRUST MFRA 2024 RPL1 A1 144A / ABS-MBS (US55287AAA34) | 0,87 | -3,67 | 0,4919 | -0,0287 | ||

| US12663TAA79 / CSMC_22-RPL4 | 0,86 | -3,25 | 0,4897 | -0,0261 | ||

| US83206NAB38 / SMB PRIVATE EDUCATION LOAN TRUST 2022-B SER 2022-B CL A1B V/R REGD 144A P/P 1.83000000 | 0,86 | -5,08 | 0,4880 | -0,0360 | ||

| US93363DAB38 / WaMu Mortgage Pass-Through Certificates Series 2006-AR9 Trust | 0,86 | -0,58 | 0,4860 | -0,0123 | ||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2025 2A A2 144A / ABS-O (US78398HAB42) | 0,85 | 0,4835 | 0,4835 | |||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2025 2A A2 144A / ABS-O (US78398HAB42) | 0,85 | 0,4835 | 0,4835 | |||

| BRIDGECREST LENDING AUTO SECUR BLAST 2025 2 A2 / ABS-O (US10807HAB24) | 0,85 | 0,4827 | 0,4827 | |||

| BRIDGECREST LENDING AUTO SECUR BLAST 2025 2 A2 / ABS-O (US10807HAB24) | 0,85 | 0,4827 | 0,4827 | |||

| GUGGENHEIM CLO LTD GUGG 2022 2A A1R 144A / ABS-CBDO (US40172PAL67) | 0,85 | -0,24 | 0,4818 | -0,0102 | ||

| BAIN CAPITAL CREDIT CLO, LIMIT BCC 2019 4A A1RR 144A / ABS-CBDO (US05684AAY55) | 0,85 | -0,24 | 0,4812 | -0,0108 | ||

| BDS LTD BDS 2025 FL14 A 144A / ABS-CBDO (US072921AA78) | 0,85 | -0,12 | 0,4810 | -0,0103 | ||

| BDS LTD BDS 2025 FL14 A 144A / ABS-CBDO (US072921AA78) | 0,85 | -0,12 | 0,4810 | -0,0103 | ||

| US92922F4M79 / WaMu Mortgage Pass-Through Certificates Series 2005-AR13 Trust | 0,84 | -4,64 | 0,4791 | -0,0327 | ||

| WIND RIVER CLO LTD WINDR 2016 1KRA A1R3 144A / ABS-CBDO (US97314DAN84) | 0,84 | -0,47 | 0,4786 | -0,0114 | ||

| WIND RIVER CLO LTD WINDR 2016 1KRA A1R3 144A / ABS-CBDO (US97314DAN84) | 0,84 | -0,47 | 0,4786 | -0,0114 | ||

| VERDELITE STATIC CLO LTD BVSTAT 2024 1A A 144A / ABS-CBDO (US92338VAA98) | 0,84 | -5,94 | 0,4769 | -0,0399 | ||

| VERDELITE STATIC CLO LTD BVSTAT 2024 1A A 144A / ABS-CBDO (US92338VAA98) | 0,84 | -5,94 | 0,4769 | -0,0399 | ||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2024 RPL3 A1A 144A / ABS-MBS (US161917AB58) | 0,83 | -1,77 | 0,4725 | -0,0178 | ||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2024 RPL3 A1A 144A / ABS-MBS (US161917AB58) | 0,83 | -1,77 | 0,4725 | -0,0178 | ||

| US31395A3J20 / Freddie Mac Structured Pass-Through Certificates | 0,83 | -2,93 | 0,4711 | -0,0237 | ||

| US36242DFP33 / GSR Mortgage Loan Trust 2004-11 | 0,83 | -1,66 | 0,4697 | -0,0172 | ||

| VERUS SECURITIZATION TRUST VERUS 2024 6 A1 144A / ABS-MBS (US92540JAA07) | 0,82 | -7,06 | 0,4639 | -0,0446 | ||

| RFR USD SOFR/3.25000 06/18/25-10Y LCH / DIR (EZXZ4DC8KGZ4) | 0,81 | 0,4604 | 0,4604 | |||

| RFR USD SOFR/3.25000 06/18/25-10Y LCH / DIR (EZXZ4DC8KGZ4) | 0,81 | 0,4604 | 0,4604 | |||

| US19421UAB08 / COLLEGE AVE STUDENT LOANS CASL 2019 A A2 144A | 0,81 | -4,38 | 0,4593 | -0,0300 | ||

| AFFIRM MASTER TRUST AFRMT 2025 1A A 144A / ABS-O (US00833BAA61) | 0,81 | 0,25 | 0,4580 | -0,0078 | ||

| AFFIRM MASTER TRUST AFRMT 2025 1A A 144A / ABS-O (US00833BAA61) | 0,81 | 0,25 | 0,4580 | -0,0078 | ||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2024 3A A3 144A / ABS-O (US78436XAC11) | 0,80 | 0,00 | 0,4563 | -0,0087 | ||

| SFS AUTO RECEIVABLES SECURITIZ SFAST 2024 3A A3 144A / ABS-O (US78436XAC11) | 0,80 | 0,00 | 0,4563 | -0,0087 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2019 9A AV 144A / ABS-CBDO (US03330HAA59) | 0,80 | -9,27 | 0,4561 | -0,0565 | ||

| ANCHORAGE CREDIT FUNDING LTD. ANCHF 2019 9A AV 144A / ABS-CBDO (US03330HAA59) | 0,80 | -9,27 | 0,4561 | -0,0565 | ||

| HONDA AUTO RECEIVABLES OWNER T HAROT 2024 4 A3 / ABS-O (US43816DAC92) | 0,80 | 0,38 | 0,4555 | -0,0074 | ||

| HONDA AUTO RECEIVABLES OWNER T HAROT 2024 4 A3 / ABS-O (US43816DAC92) | 0,80 | 0,38 | 0,4555 | -0,0074 | ||

| NISSAN AUTO RECEIVABLES OWNER NAROT 2024 B A3 / ABS-O (US65479WAD65) | 0,80 | 0,25 | 0,4554 | -0,0078 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2025 4 A2 144A / ABS-O (US69547DAB29) | 0,80 | 0,4552 | 0,4552 | |||

| PAGAYA AI DEBT SELECTION TRUST PAID 2025 4 A2 144A / ABS-O (US69547DAB29) | 0,80 | 0,4552 | 0,4552 | |||

| M+T BANK AUTO RECEIVABLES TRUS MTBAT 2025 1A A2A 144A / ABS-O (US55287XAB10) | 0,80 | 0,13 | 0,4549 | -0,0087 | ||

| SANTANDER DRIVE AUTO RECEIVABL SDART 2024 5 A3 / ABS-O (US802920AD01) | 0,80 | -0,12 | 0,4548 | -0,0090 | ||

| SANTANDER DRIVE AUTO RECEIVABL SDART 2024 5 A3 / ABS-O (US802920AD01) | 0,80 | -0,12 | 0,4548 | -0,0090 | ||

| ARES CLO LTD ARES 2013 2A AR3 144A / ABS-CBDO (US00190YBP97) | 0,80 | 0,38 | 0,4548 | -0,0068 | ||

| ARES CLO LTD ARES 2013 2A AR3 144A / ABS-CBDO (US00190YBP97) | 0,80 | 0,38 | 0,4548 | -0,0068 | ||

| BRIDGECREST LENDING AUTO SECUR BLAST 2024 4 A3 / ABS-O (US10806EAC84) | 0,80 | -0,12 | 0,4546 | -0,0094 | ||

| BRIDGECREST LENDING AUTO SECUR BLAST 2024 4 A3 / ABS-O (US10806EAC84) | 0,80 | -0,12 | 0,4546 | -0,0094 | ||

| LAD AUTO RECEIVABLES TRUST LADAR 2025 1A A2 144A / ABS-O (US505712AB53) | 0,80 | 0,13 | 0,4543 | -0,0086 | ||

| LAD AUTO RECEIVABLES TRUST LADAR 2025 1A A2 144A / ABS-O (US505712AB53) | 0,80 | 0,13 | 0,4543 | -0,0086 | ||

| PARALLEL LTD PARL 2021 1A AR 144A / ABS-CBDO (US69916HAL42) | 0,80 | 0,13 | 0,4535 | -0,0081 | ||

| PARALLEL LTD PARL 2021 1A AR 144A / ABS-CBDO (US69916HAL42) | 0,80 | 0,13 | 0,4535 | -0,0081 | ||

| PRP ADVISORS, LLC PRPM 2024 RCF5 A1 144A / ABS-MBS (US69381JAA07) | 0,78 | -4,39 | 0,4454 | -0,0294 | ||

| PRP ADVISORS, LLC PRPM 2024 RCF5 A1 144A / ABS-MBS (US69381JAA07) | 0,78 | -4,39 | 0,4454 | -0,0294 | ||

| US29425AAD54 / Citigroup Commercial Mortgage Trust 2015-GC33 | 0,78 | -12,43 | 0,4443 | -0,0727 | ||

| TESLA SUSTAINABLE ENERGY TRUST TSET 2024 1A A2 144A / ABS-O (US88164AAB08) | 0,78 | -3,36 | 0,4410 | -0,0238 | ||

| TESLA SUSTAINABLE ENERGY TRUST TSET 2024 1A A2 144A / ABS-O (US88164AAB08) | 0,78 | -3,36 | 0,4410 | -0,0238 | ||

| NMLT TRUST NLT 2023 1 A1 144A / ABS-MBS (US62917MAA18) | 0,77 | -1,66 | 0,4361 | -0,0160 | ||

| NMLT TRUST NLT 2023 1 A1 144A / ABS-MBS (US62917MAA18) | 0,77 | -1,66 | 0,4361 | -0,0160 | ||

| OCTANE RECEIVABLES TRUST OCTL 2024 3A A2 144A / ABS-O (US67571GAB86) | 0,76 | -4,86 | 0,4336 | -0,0308 | ||

| OCTANE RECEIVABLES TRUST OCTL 2024 3A A2 144A / ABS-O (US67571GAB86) | 0,76 | -4,86 | 0,4336 | -0,0308 | ||

| PRP ADVISORS, LLC PRPM 2024 RCF4 A1 144A / ABS-MBS (US74448JAA16) | 0,76 | -6,16 | 0,4329 | -0,0371 | ||

| US78443CCB81 / SLM Private Credit Student Loan Trust 2005-B | 0,74 | -6,69 | 0,4200 | -0,0386 | ||

| US12667GL923 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 27 1A3 | 0,73 | -0,68 | 0,4167 | -0,0106 | ||

| US83206NAA54 / SMB Private Education Loan Trust 2022-B | 0,73 | -4,10 | 0,4126 | -0,0256 | ||

| NISSAN AUTO RECEIVABLES OWNER NAROT 2024 B A2A / ABS-O (US65479WAB00) | 0,71 | -10,64 | 0,4057 | -0,0573 | ||

| NISSAN AUTO RECEIVABLES OWNER NAROT 2024 B A2A / ABS-O (US65479WAB00) | 0,71 | -10,64 | 0,4057 | -0,0573 | ||

| US98162JAA43 / Worldwide Plaza Trust 2017-WWP | 0,71 | 2,75 | 0,4037 | 0,0034 | ||

| FIRST HELP FINANCIAL LLC FHF 2024 3A A2 144A / ABS-O (US30339EAB48) | 0,71 | -11,49 | 0,4031 | -0,0611 | ||

| PORSCHE INNOVATIVE LEASE OWNER PILOT 2025 1A A2A 144A / ABS-O (US73329KAB26) | 0,70 | 0,3984 | 0,3984 | |||

| PORSCHE INNOVATIVE LEASE OWNER PILOT 2025 1A A2A 144A / ABS-O (US73329KAB26) | 0,70 | 0,3984 | 0,3984 | |||

| GOVERNMENT NATIONAL MORTGAGE A GNR 2019 H11 FM / ABS-MBS (US38380LVB60) | 0,70 | -8,53 | 0,3961 | -0,0452 | ||

| US63941CAB90 / NAVIENT STUDENT LOAN TRUST NAVSL 2019 D A2A 144A | 0,69 | -5,98 | 0,3932 | -0,0333 | ||

| US31418CU779 / FANNIE MAE 3.50% 03/01/2048 FNMA | 0,68 | -2,03 | 0,3845 | -0,0160 | ||

| US78449XAA00 / SMB PRIVATE EDUCATION LOAN TRUST 2020-B 1.29% 07/15/2053 144A | 0,67 | -8,32 | 0,3818 | -0,0429 | ||

| SOFI CONSUMER LOAN PROGRAM TRU SCLP 2025 1 A 144A / ABS-O (US83406YAA91) | 0,67 | -21,53 | 0,3791 | -0,1133 | ||

| SOFI CONSUMER LOAN PROGRAM TRU SCLP 2025 1 A 144A / ABS-O (US83406YAA91) | 0,67 | -21,53 | 0,3791 | -0,1133 | ||

| HONDA AUTO RECEIVABLES OWNER T HAROT 2024 4 A2 / ABS-O (US43816DAB10) | 0,67 | -16,75 | 0,3785 | -0,0847 | ||

| HONDA AUTO RECEIVABLES OWNER T HAROT 2024 4 A2 / ABS-O (US43816DAB10) | 0,67 | -16,75 | 0,3785 | -0,0847 | ||

| US542514HN71 / Long Beach Mortgage Loan Trust 2004-4 | 0,64 | -2,14 | 0,3644 | -0,0149 | ||

| US92925CBB72 / WaMu Mortgage Pass-Through Certificates Series 2005-AR19 Trust | 0,64 | -4,63 | 0,3629 | -0,0254 | ||

| FNMA TBA 30 YR 7 SINGLE FAMILY MORTGAGE / ABS-MBS (US01F0706907) | 0,63 | 0,3570 | 0,3570 | |||

| FNMA TBA 30 YR 7 SINGLE FAMILY MORTGAGE / ABS-MBS (US01F0706907) | 0,63 | 0,3570 | 0,3570 | |||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2024 9 A11 144A / ABS-MBS (US16160QAX25) | 0,61 | -10,12 | 0,3484 | -0,0466 | ||

| CHASE MORTGAGE FINANCE CORPORA CHASE 2024 9 A11 144A / ABS-MBS (US16160QAX25) | 0,61 | -10,12 | 0,3484 | -0,0466 | ||

| US01F0226831 / FEDERAL NATIONAL MORTGAGE ASSOCIATION 30YR TBA AUG | 0,58 | -82,69 | 0,3297 | -1,3968 | ||

| US31393RG383 / FHLMC STRUCTURED PASS THROUGH FSPC T 56 2AF | 0,56 | -1,92 | 0,3200 | -0,0128 | ||

| US02150PAB40 / Alternative Loan Trust 2007-OA6 | 0,56 | -1,06 | 0,3186 | -0,0100 | ||

| US95002EBB20 / WELLS FARGO TR 2013-LC12 2.725% 02/15/2053 | 0,55 | 1,47 | 0,3135 | -0,0018 | ||

| US12669F6Z19 / CWMBS, Inc. | 0,53 | -3,12 | 0,3000 | -0,0156 | ||

| RFRF USD SF+26.161/1.7* 7/15/23-7Y* CME / DIR (EZMBPFMCJ2B0) | 0,52 | -18,31 | 0,2966 | -0,0734 | ||

| RFRF USD SF+26.161/1.7* 7/15/23-7Y* CME / DIR (EZMBPFMCJ2B0) | 0,52 | -18,31 | 0,2966 | -0,0734 | ||

| US881561RD83 / TERWIN MORTGAGE TRUST TMTS 2005 6HE M5 | 0,52 | -15,33 | 0,2947 | -0,0607 | ||

| US21H0226892 / Ginnie Mae | 0,51 | 0,99 | 0,2895 | 0,0294 | ||

| US92943AAA25 / WSTN_23-MAUI | 0,51 | -0,39 | 0,2882 | -0,0064 | ||

| TESLA AUTO LEASE TRUST TESLA 2024 B A2A 144A / ABS-O (US881934AB92) | 0,50 | -28,61 | 0,2867 | -0,1224 | ||

| TESLA AUTO LEASE TRUST TESLA 2024 B A2A 144A / ABS-O (US881934AB92) | 0,50 | -28,61 | 0,2867 | -0,1224 | ||

| US21H0506806 / GNMA | 0,49 | 0,2788 | 0,2788 | |||

| US19424KAB98 / COLLEGE AVE STUDENT LOANS CASL 2021 A A2 144A | 0,48 | -4,16 | 0,2754 | -0,0174 | ||

| BRIDGECREST LENDING AUTO SECUR BLAST 2024 4 A2 / ABS-O (US10806EAB02) | 0,48 | -31,56 | 0,2710 | -0,1326 | ||

| BRIDGECREST LENDING AUTO SECUR BLAST 2024 4 A2 / ABS-O (US10806EAB02) | 0,48 | -31,56 | 0,2710 | -0,1326 | ||

| US78449VAB27 / SMB Private Education Loan Trust 2020-PT-A | 0,48 | -6,85 | 0,2708 | -0,0251 | ||

| US3138WDD655 / FNMA POOL AS3724 FN 11/44 FIXED 3.5 | 0,47 | -2,11 | 0,2644 | -0,0106 | ||

| MADISON PARK FUNDING LTD MDPK 2021 49A AR 144A / ABS-CBDO (US55820VAL71) | 0,45 | 0,22 | 0,2552 | -0,0043 | ||

| MADISON PARK FUNDING LTD MDPK 2021 49A AR 144A / ABS-CBDO (US55820VAL71) | 0,45 | 0,22 | 0,2552 | -0,0043 | ||

| AG TRUST AG 2024 NLP A 144A / ABS-MBS (US00792MAA18) | 0,43 | 0,23 | 0,2436 | -0,0045 | ||

| US19423DAB64 / COLLEGE AVE STUDENT LOANS 2018-A LLC CASL 2018-A A2 | 0,42 | -5,80 | 0,2397 | -0,0199 | ||

| US61748HGR66 / Morgan Stanley Mortgage Loan Trust 2004-11AR | 0,42 | -2,58 | 0,2357 | -0,0115 | ||

| US03764QBC50 / Apidos CLO XV | 0,41 | -1,92 | 0,2318 | -0,0093 | ||

| US3138L6BR82 / Fannie Mae Pool | 0,41 | 0,49 | 0,2311 | -0,0038 | ||

| SOFI CONSUMER LOAN PROGRAM TRU SCLP 2025 2 A 144A / ABS-O (US83407HAA59) | 0,40 | 0,2276 | 0,2276 | |||

| SOFI CONSUMER LOAN PROGRAM TRU SCLP 2025 2 A 144A / ABS-O (US83407HAA59) | 0,40 | 0,2276 | 0,2276 | |||

| US63941UAA16 / Navient Private Education Refi Loan Trust 2020-G | 0,39 | -7,08 | 0,2238 | -0,0218 | ||

| US12515HAZ82 / CD 2017-CD5 Mortgage Trust | 0,39 | 1,30 | 0,2220 | -0,0017 | ||

| GLS AUTO SELECT RECEIVABLES TR GSAR 2024 3A A2 144A / ABS-O (US37989EAC03) | 0,38 | -13,51 | 0,2184 | -0,0387 | ||

| GLS AUTO SELECT RECEIVABLES TR GSAR 2024 3A A2 144A / ABS-O (US37989EAC03) | 0,38 | -13,51 | 0,2184 | -0,0387 | ||

| SANTANDER DRIVE AUTO RECEIVABL SDART 2024 5 A2 / ABS-O (US802920AC28) | 0,38 | -40,16 | 0,2177 | -0,1528 | ||

| SANTANDER DRIVE AUTO RECEIVABL SDART 2024 5 A2 / ABS-O (US802920AC28) | 0,38 | -40,16 | 0,2177 | -0,1528 | ||

| US31381R4L52 / FNMA, Other | 0,37 | -1,07 | 0,2109 | -0,0063 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2024 10 A 144A / ABS-O (US69544MAA71) | 0,37 | -36,33 | 0,2093 | -0,1257 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2024 10 A 144A / ABS-O (US69544MAA71) | 0,37 | -36,33 | 0,2093 | -0,1257 | ||

| US939336X813 / WaMu Mortgage Pass-Through Certificates Series 2005-AR1 Trust | 0,37 | -4,17 | 0,2092 | -0,0135 | ||

| US59981TAC99 / MILL CITY MORTGAGE LOAN TRUST 2019-GS2 SER 2019-GS2 CL A1 V/R REGD 144A P/P 2.75000000 | 0,36 | -9,39 | 0,2033 | -0,0254 | ||

| US45254NPU53 / Impac CMB Trust, Series 2005-5, Class A1 | 0,35 | -5,93 | 0,1983 | -0,0168 | ||

| GREENSKY HOME IMPROVEMENT ISSU GSKY 2024 2 A2 144A / ABS-O (US39571XAB01) | 0,34 | -36,65 | 0,1958 | -0,1191 | ||

| GREENSKY HOME IMPROVEMENT ISSU GSKY 2024 2 A2 144A / ABS-O (US39571XAB01) | 0,34 | -36,65 | 0,1958 | -0,1191 | ||

| US05608XAA00 / BXMT LTD BXMT 2020 FL3 A 144A | 0,34 | -2,56 | 0,1950 | -0,0091 | ||

| US20267WAA36 / Commonbond Student Loan Trust 2020-A-GS | 0,34 | -2,62 | 0,1906 | -0,0087 | ||

| RFRF USD SF+26.161/1.7* 12/21/16-10Y LCH / DIR (EZ78XQS0BTY4) | 0,33 | -32,80 | 0,1899 | -0,0983 | ||

| RFRF USD SF+26.161/1.7* 12/21/16-10Y LCH / DIR (EZ78XQS0BTY4) | 0,33 | -32,80 | 0,1899 | -0,0983 | ||

| FLAGSHIP CREDIT AUTO TRUST FCAT 2024 3 A 144A / ABS-O (US33843YAA55) | 0,33 | -17,12 | 0,1898 | -0,0437 | ||

| FLAGSHIP CREDIT AUTO TRUST FCAT 2024 3 A 144A / ABS-O (US33843YAA55) | 0,33 | -17,12 | 0,1898 | -0,0437 | ||

| US63890BAB27 / NAVIENT STUDENT LOAN TRUST 2018-EA NAVSL 2018-EA A2 | 0,33 | -26,17 | 0,1878 | -0,0709 | ||

| US552757AA45 / MFA 2020-NQM3 Trust | 0,33 | -10,63 | 0,1866 | -0,0264 | ||

| US46652DAA37 / JP Morgan Chase Commercial Mortgage Securities Corp | 0,31 | -5,44 | 0,1782 | -0,0136 | ||

| US19423DAA81 / COLLEGE AVE STUDENT LOANS 2018-A LLC CASL 2018-A A1 | 0,31 | -6,31 | 0,1776 | -0,0154 | ||

| US41161PG725 / HARBORVIEW MORTGAGE LOAN TRUST HVMLT 2006 BU1 2A1A | 0,31 | 0,00 | 0,1743 | -0,0038 | ||

| US004375CG41 / Accredited Mortgage Loan Trust, Series 2004-4, Class M1 | 0,30 | -7,60 | 0,1732 | -0,0177 | ||

| US3140J9UZ29 / FNMA POOL BM5099 FN 07/48 FIXED VAR | 0,30 | -1,63 | 0,1719 | -0,0062 | ||

| US19424KAA16 / College Ave Student Loans 2021-A LLC | 0,30 | -5,03 | 0,1716 | -0,0130 | ||

| US21H0526788 / Ginnie Mae | 0,30 | -56,77 | 0,1706 | -0,1871 | ||

| US95000AAU16 / Wells Fargo & Company | 0,30 | 0,34 | 0,1693 | -0,0027 | ||

| US95001WBB37 / Wells Fargo Commercial Mortgage Trust 2019-C49 | 0,29 | 1,03 | 0,1671 | -0,0018 | ||

| RFRF USD SF+26.161/3.00 9/19/23-3Y* CME / DIR (EZ5KQYKN8LY5) | 0,29 | 60,11 | 0,1666 | 0,0601 | ||

| US3140MNN361 / Federal National Mortgage Association, Inc. | 0,29 | -1,71 | 0,1634 | -0,0059 | ||

| US3140X6S931 / FANNIE MAE POOL UMBS P#FM3243 3.50000000 | 0,27 | -2,17 | 0,1537 | -0,0065 | ||

| US31412YTJ19 / FNMA POOL 938953 FN 08/37 FLOATING VAR | 0,27 | -1,47 | 0,1529 | -0,0052 | ||

| RFRF USD SF+26.161/2.00 8/12/23-7Y* CME / DIR (EZXZXW7G14V3) | 0,27 | -20,94 | 0,1524 | -0,0439 | ||

| RFRF USD SF+26.161/2.00 8/12/23-7Y* CME / DIR (EZXZXW7G14V3) | 0,27 | -20,94 | 0,1524 | -0,0439 | ||

| US92922F3K23 / WAMU MORTGAGE PASS THROUGH CER WAMU 2005 AR12 1A5 | 0,26 | -2,94 | 0,1501 | -0,0074 | ||

| US12489WJP05 / Credit-Based Asset Servicing & Securitization LLC, Series 2004-CB4, Class A5 | 0,26 | -6,18 | 0,1469 | -0,0125 | ||

| US07389QAL23 / BEAR STEARNS ASSET BACKED SECU BSABS 2007 SD1 21A1 | 0,22 | -2,19 | 0,1271 | -0,0051 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2024 7 A 144A / ABS-O (US69545AAA25) | 0,21 | -15,10 | 0,1183 | -0,0239 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2024 7 A 144A / ABS-O (US69545AAA25) | 0,21 | -15,10 | 0,1183 | -0,0239 | ||

| US87241EAQ89 / TCW CLO 2019-1 AMR Ltd | 0,20 | 0,50 | 0,1137 | -0,0019 | ||

| US89173UAA51 / Towd Point Mortgage Trust 2017-4 | 0,19 | -10,19 | 0,1105 | -0,0150 | ||

| US78449UAB44 / SMB Private Education Loan Trust 2020-A | 0,19 | -10,23 | 0,1100 | -0,0146 | ||

| US50189XAA37 / LCM LOAN INCOME FUND I LTD SER 1A CL A V/R REGD 144A P/P 6.61775000 | 0,19 | -34,69 | 0,1093 | -0,0609 | ||

| US12596WAC82 / CSAIL 2019-C16 Commercial Mortgage Trust | 0,19 | 1,60 | 0,1079 | -0,0005 | ||

| US43708AAD46 / INDYMAC HOME EQUITY LOAN ASSET INHEL 2002 A AF4 | 0,19 | -3,08 | 0,1076 | -0,0059 | ||

| US21H0406734 / Ginnie Mae | 0,19 | 0,54 | 0,1056 | 0,0104 | ||

| US22541QFE70 / CREDIT SUISSE FIRST BOSTON MOR CSFB 2003 AR18 3A1 | 0,19 | -2,12 | 0,1056 | -0,0043 | ||

| US45661VAA44 / IndyMac INDX Mortgage Loan Trust 2006-AR12 | 0,18 | -2,70 | 0,1025 | -0,0046 | ||

| US3128NKHZ28 / FED HM LN PC POOL 1J2948 FH 09/37 FLOATING VAR | 0,18 | -1,65 | 0,1022 | -0,0034 | ||

| REACH FINANCIAL LLC REACH 2024 1A A 144A / ABS-O (US75526PAA93) | 0,18 | -41,14 | 0,1005 | -0,0729 | ||

| REACH FINANCIAL LLC REACH 2024 1A A 144A / ABS-O (US75526PAA93) | 0,18 | -41,14 | 0,1005 | -0,0729 | ||

| US3133BBF535 / Federal Home Loan Mortgage Corporation | 0,18 | -1,13 | 0,0994 | -0,0032 | ||

| US78471CAB54 / SOFI PROFESSIONAL LOAN PROGRAM 2017-D LLC SOFI 2017-D A2FX | 0,17 | -21,82 | 0,0979 | -0,0294 | ||

| US83192CAB37 / SMB Private Education Loan Trust 2019-B | 0,17 | -10,42 | 0,0979 | -0,0136 | ||

| US31395HHV50 / Freddie Mac Structured Pass-Through Certificates | 0,17 | -2,84 | 0,0972 | -0,0049 | ||

| US05532WBS35 / BCAP LLC TRUST BCAP 2010 RR3 4A5 144A | 0,17 | -2,89 | 0,0959 | -0,0044 | ||

| US3133BANT43 / Federal Home Loan Mortgage Corporation | 0,17 | -1,18 | 0,0957 | -0,0032 | ||

| US31404CGB00 / FNMA POOL 764394 FN 03/34 FLOATING VAR | 0,17 | -2,34 | 0,0951 | -0,0039 | ||

| US576433PQ33 / MASTR ADJUSTABLE RATE MORTGAGE MARM 2004 7 2A1 | 0,16 | -1,80 | 0,0932 | -0,0038 | ||

| WOODWARD CAPITAL MANAGEMENT RCKT 2024 CES5 A1A 144A / ABS-MBS (US74938KAA51) | 0,16 | -8,43 | 0,0929 | -0,0104 | ||

| WOODWARD CAPITAL MANAGEMENT RCKT 2024 CES5 A1A 144A / ABS-MBS (US74938KAA51) | 0,16 | -8,43 | 0,0929 | -0,0104 | ||

| US542514GM08 / Long Beach Mortgage Loan Trust, Series 2004-3, Class M1 | 0,16 | -0,62 | 0,0918 | -0,0025 | ||

| US76112BBS88 / RESIDENTIAL ASSET MORTGAGE PRO RAMP 2004 SL3 A4 | 0,15 | -9,09 | 0,0857 | -0,0100 | ||

| US92922FAV04 / WAMU MORTGAGE PASS THROUGH CER WAMU 2003 AR8 B2 | 0,15 | -2,63 | 0,0844 | -0,0036 | ||

| RFR USD SOFR/3.56673 09/02/25-4Y* LCH / DIR (EZNQ4Z4QT3L7) | 0,15 | 0,0844 | 0,0844 | |||

| RFR USD SOFR/3.56673 09/02/25-4Y* LCH / DIR (EZNQ4Z4QT3L7) | 0,15 | 0,0844 | 0,0844 | |||

| GREENSKY HOME IMPROVEMENT ISSU GSKY 2024 1 A2 144A / ABS-O (US39571MAB46) | 0,15 | -43,08 | 0,0843 | -0,0665 | ||

| US31411N6Y83 / FNMA POOL 912687 FN 05/37 FLOATING VAR | 0,15 | -1,36 | 0,0828 | -0,0028 | ||

| US3140JANZ71 / FNMA POOL BM5807 FN 04/48 FIXED VAR | 0,14 | -2,05 | 0,0818 | -0,0032 | ||

| US48251JAL70 / KKR CLO 18 Ltd | 0,14 | -32,69 | 0,0798 | -0,0409 | ||

| US31409U6W01 / FNMA POOL 879385 FN 12/35 FLOATING VAR | 0,14 | -1,43 | 0,0784 | -0,0028 | ||

| US30166TAD54 / Exeter Automobile Receivables Trust 2023-4 | 0,13 | -59,15 | 0,0765 | -0,1137 | ||

| RFRF USD SF+26.161/2.00 9/10/23-6Y* CME / DIR (EZRYHL92YXM0) | 0,13 | -10,67 | 0,0762 | -0,0111 | ||

| RFRF USD SF+26.161/2.00 9/10/23-6Y* CME / DIR (EZRYHL92YXM0) | 0,13 | -10,67 | 0,0762 | -0,0111 | ||

| US78443CCU62 / SLM Private Credit Student Loan Trust 2006-B | 0,13 | -4,38 | 0,0747 | -0,0051 | ||

| US63940YAB20 / Navient Private Education Refi Loan Trust 2019-C | 0,13 | -13,42 | 0,0736 | -0,0131 | ||

| US07384MZV70 / BEAR STEARNS ARM TRUST 2003-8 BSARM 2003-8 4A1 | 0,13 | -1,53 | 0,0735 | -0,0025 | ||

| RFRF USD SF+26.161/1.50 9/18/23-6Y* CME / DIR (EZGBCVNDZ8C6) | 0,13 | -11,19 | 0,0724 | -0,0103 | ||

| RFRF USD SF+26.161/1.50 9/18/23-6Y* CME / DIR (EZGBCVNDZ8C6) | 0,13 | -11,19 | 0,0724 | -0,0103 | ||

| RFRF USD SF+26.161/2.00 9/10/23-6Y* CME / DIR (EZ2FT1HSMJX3) | 0,13 | -21,38 | 0,0711 | -0,0212 | ||

| RFRF USD SF+26.161/2.00 9/10/23-6Y* CME / DIR (EZ2FT1HSMJX3) | 0,13 | -21,38 | 0,0711 | -0,0212 | ||

| US31393XFT90 / FNMA, Grantor Trust, Whole Loan, Series 2004-T1, Class 1A2 | 0,12 | -5,47 | 0,0693 | -0,0052 | ||

| US576433JG25 / MASTR Adjustable Rate Mortgages Trust 2004-10 | 0,12 | -1,63 | 0,0693 | -0,0020 | ||

| US31381JU758 / FANNIE MAE 4.757% 09/01/2037 FAR FNARM | 0,12 | -1,63 | 0,0690 | -0,0024 | ||

| US552757AC01 / MFA 2020-NQM3 Trust | 0,12 | -10,61 | 0,0671 | -0,0094 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2023 3 AB 144A / ABS-O (US69548BAC37) | 0,12 | -43,54 | 0,0671 | -0,0539 | ||

| PAGAYA AI DEBT SELECTION TRUST PAID 2023 3 AB 144A / ABS-O (US69548BAC37) | 0,12 | -43,54 | 0,0671 | -0,0539 | ||

| US552757AB28 / MFRA TRUST MFRA 2020 NQM3 A2 144A | 0,12 | -10,69 | 0,0669 | -0,0094 | ||

| US92922FW460 / CORP CMO | 0,12 | -0,85 | 0,0667 | -0,0018 | ||

| US85573EAA55 / Starwood Mortgage Residential Trust 2020-INV | 0,12 | -15,44 | 0,0655 | -0,0138 | ||

| US552754AA14 / MFA 2020-NQM1 TRUST SER 2020-NQM1 CL A1 V/R REGD 144A P/P 0.00000000 | 0,11 | -8,87 | 0,0642 | -0,0080 | ||

| US31410UGH95 / FNMA POOL 897600 FN 11/36 FLOATING VAR | 0,11 | -1,75 | 0,0641 | -0,0022 | ||

| US073868BE01 / BEAR STEARNS ALT A TRUST BALTA 2006 6 32A1 | 0,11 | -1,75 | 0,0639 | -0,0024 | ||

| US86359AYX52 / Structured Asset Securities Corp Mortgage Pass-Through Ctfs Ser 2003-22A | 0,11 | -0,91 | 0,0619 | -0,0023 | ||

| US59020UVJ14 / Merrill Lynch Mortgage Investors Trust, Series 2005-1, Class 2A2 | 0,11 | -1,85 | 0,0607 | -0,0020 | ||

| US466247WQ26 / JP MORGAN MORTGAGE TRUST JPMMT 2005 A7 2A3 | 0,11 | 0,00 | 0,0603 | -0,0016 | ||

| US3133TSQG11 / Freddie Mac Structured Pass-Through Certificates | 0,11 | -11,76 | 0,0597 | -0,0093 | ||

| US31413YWD92 / FNMA POOL 959744 FN 11/47 FLOATING VAR | 0,10 | 0,00 | 0,0593 | -0,0014 | ||

| RFRF USD SF+26.161/1.4* 09/07/23-8Y CME / DIR (EZBB8XR0NRT7) | 0,10 | -12,71 | 0,0588 | -0,0099 | ||

| RFRF USD SF+26.161/1.4* 09/07/23-8Y CME / DIR (EZBB8XR0NRT7) | 0,10 | -12,71 | 0,0588 | -0,0099 | ||

| US89177XAA54 / TOWD POINT MORTGAGE TRUST 2019-HY3 SER 2019-HY3 CL A1A V/R REGD 144A P/P 2.70800000 | 0,10 | -9,01 | 0,0578 | -0,0069 | ||

| US3128QPUG59 / FED HM LN PC POOL 1B7432 FH 11/34 FLOATING VAR | 0,10 | -2,88 | 0,0577 | -0,0027 | ||

| CARMAX SELECT RECEIVABLES TRUS CMXS 2024 A A3 / ABS-O (US14319FAD50) | 0,10 | 0,00 | 0,0574 | -0,0011 | ||

| US31336CNW90 / FED HM LN PC POOL 972205 FH 03/36 FLOATING VAR | 0,10 | -1,96 | 0,0573 | -0,0018 | ||

| US85573MAA71 / STARWOOD MORTGAGE RESIDENTIAL STAR 2020 3 A1 144A | 0,10 | -9,17 | 0,0563 | -0,0069 | ||

| US07384MB277 / BEAR STEARNS ADJUSTABLE RATE M BSARM 2003 9 1A2 | 0,10 | 0,00 | 0,0563 | -0,0016 | ||

| US07387QAX88 / Bear Stearns ALT-A Trust, Series 2006-8, Class 3A1 | 0,10 | -3,96 | 0,0556 | -0,0032 | ||

| RFR USD SOFR/3.75000 12/20/23-5Y LCH / DIR (EZQ1LP9YKNN9) | 0,10 | 361,90 | 0,0555 | 0,0430 | ||

| RFR USD SOFR/3.75000 12/20/23-5Y LCH / DIR (EZQ1LP9YKNN9) | 0,10 | 361,90 | 0,0555 | 0,0430 | ||

| RFRF USD SF+26.161/1.00 9/16/23-7Y* CME / DIR (EZ4FYS5F94M8) | 0,10 | -8,57 | 0,0547 | -0,0065 | ||

| RFRF USD SF+26.161/1.00 9/16/23-7Y* CME / DIR (EZ4FYS5F94M8) | 0,10 | -8,57 | 0,0547 | -0,0065 | ||

| US589929V218 / Merrill Lynch Mortgage Investors Trust Series MLCC 2003-D | 0,10 | -7,77 | 0,0543 | -0,0057 | ||

| US01F0224778 / UMBS TBA | 0,09 | 3,33 | 0,0530 | 0,0065 | ||

| US46630GAJ40 / JP Morgan Mortgage Trust 2007-A1 | 0,09 | -9,80 | 0,0525 | -0,0068 | ||

| US36225CLH78 / GNMA II POOL 080327 G2 10/29 FLOATING VAR | 0,09 | -8,91 | 0,0524 | -0,0062 | ||

| RFR USD SOFR/3.57234 09/02/25-4Y* LCH / DIR (EZNQ4Z4QT3L7) | 0,09 | 0,0523 | 0,0523 | |||

| RFR USD SOFR/3.57234 09/02/25-4Y* LCH / DIR (EZNQ4Z4QT3L7) | 0,09 | 0,0523 | 0,0523 | |||

| RFR USD SOFR/3.70520 09/02/25-7Y* LCH / DIR (EZ3JC37DJDV5) | 0,09 | 0,0499 | 0,0499 | |||

| US31349TVP38 / FED HM LN PC POOL 782422 FH 09/34 FLOATING VAR | 0,09 | -3,37 | 0,0493 | -0,0027 | ||

| UPSTART PASS THROUGH TRUST UPSPT 2022 SB1 A 144A / ABS-O (US91682PAA66) | 0,09 | -21,10 | 0,0492 | -0,0141 | ||

| UPSTART PASS THROUGH TRUST UPSPT 2022 SB1 A 144A / ABS-O (US91682PAA66) | 0,09 | -21,10 | 0,0492 | -0,0141 | ||

| US161630AB47 / CHASE MORTGAGE FINANCE CORPORA CHASE 2007 A1 1A2 | 0,09 | -2,27 | 0,0490 | -0,0022 | ||

| RFR USD SOFR/3.67951 09/02/25-7Y* LCH / DIR (EZ3JC37DJDV5) | 0,09 | 0,0489 | 0,0489 | |||

| RFR USD SOFR/3.67951 09/02/25-7Y* LCH / DIR (EZ3JC37DJDV5) | 0,09 | 0,0489 | 0,0489 | |||

| US3133BBPP85 / Federal Home Loan Mortgage Corporation | 0,09 | -2,30 | 0,0487 | -0,0019 | ||

| US576433DY94 / MASTR ADJUSTABLE RATE MORTGAGE MARM 2003 3 1A1 | 0,08 | 0,00 | 0,0460 | -0,0014 | ||

| US22541Q2A91 / CREDIT SUISSE FIRST BOSTON MOR CSFB 2003 AR30 2A1 | 0,08 | -2,44 | 0,0456 | -0,0020 | ||

| US31407EV420 / FNMA POOL 828735 FN 11/33 FLOATING VAR | 0,08 | -1,27 | 0,0443 | -0,0019 | ||

| US3128QPGM83 / FED HM LN PC POOL 1B7053 FH 04/36 FLOATING VAR | 0,08 | -1,28 | 0,0439 | -0,0014 | ||

| US42704RAA95 / HERA COMMERCIAL MORTGAGE LTD HERA 2021 FL1 A 144A | 0,08 | 0,00 | 0,0439 | -0,0007 | ||

| US31395M2F53 / Freddie Mac Structured Pass-Through Certificates | 0,08 | -3,75 | 0,0438 | -0,0025 | ||

| US63941FAC05 / Navient Private Education Refi Loan Trust 2020-A | 0,08 | -8,43 | 0,0436 | -0,0047 | ||

| US31392XUX47 / FHLMC, REMIC, Series 2525, Class AM | 0,08 | -6,17 | 0,0434 | -0,0036 | ||

| US31393BX754 / Fannie Mae Trust 2003-W6 | 0,08 | -3,80 | 0,0433 | -0,0029 | ||

| RFR USD SOFR/3.6942* 09/02/25-7Y* LCH / DIR (EZSCMPYF3PP3) | 0,08 | 0,0432 | 0,0432 | |||

| US3128QPUK61 / FED HM LN PC POOL 1B7435 FH 08/35 FLOATING VAR | 0,08 | -1,32 | 0,0428 | -0,0016 | ||

| US36179RPM50 / GNMA II POOL MA3128 G2 09/45 FLOATING VAR | 0,07 | -6,58 | 0,0408 | -0,0035 | ||

| US576433PD20 / MASTR Adjustable Rate Mortgages Trust 2004-6 | 0,07 | -6,67 | 0,0401 | -0,0037 | ||

| US36179RV224 / GNMA II POOL MA3333 G2 12/45 FLOATING VAR | 0,07 | -1,45 | 0,0387 | -0,0018 | ||

| US86359AMR13 / STRUCTURED ASSET SECURITIES CO SASC 2003 6A 2A1 | 0,06 | -3,08 | 0,0359 | -0,0017 | ||

| US46630GAW50 / JP MORGAN MORTGAGE TRUST JPMMT 2007 A1 5A6 | 0,06 | -4,62 | 0,0357 | -0,0023 | ||

| US576433QU36 / MASTR Adjustable Rate Mortgages Trust 2004-8 | 0,06 | -1,59 | 0,0356 | -0,0014 | ||

| US31402CN653 / FNMA POOL 725013 FN 04/33 FLOATING VAR | 0,06 | -3,12 | 0,0355 | -0,0016 | ||

| US3133KYXK09 / Freddie Mac Pool | 0,06 | 0,00 | 0,0352 | -0,0011 | ||

| US31413BD653 / FNMA POOL 940325 FN 02/35 FLOATING VAR | 0,06 | -1,61 | 0,0351 | -0,0013 | ||

| US36225CSN73 / G2 80524 | 0,06 | -3,17 | 0,0349 | -0,0020 | ||

| RFR USD SOFR/3.67444 09/02/25-7Y* LCH / DIR (EZ3JC37DJDV5) | 0,06 | 0,0347 | 0,0347 | |||

| US36179RJ427 / GNMA II POOL MA2983 G2 07/45 FLOATING VAR | 0,06 | 0,00 | 0,0342 | -0,0008 | ||

| US64830TAD00 / NRZT 2020-1A A1B | 0,06 | -3,23 | 0,0341 | -0,0021 | ||

| US863579BZ00 / STRUCTURED ADJUSTABLE RATE MOR SARM 2004 13 A3 | 0,06 | -1,67 | 0,0336 | -0,0012 | ||

| US3132D9MZ45 / FREDDIE MAC POOL UMBS P#SC0376 4.00000000 | 0,06 | -7,81 | 0,0336 | -0,0040 | ||

| US86359LGE39 / STRUCTURED ASSET MORTGAGE INVESTMENTS II TRUST 200 SAMI 2004-AR8 A1 | 0,06 | -1,69 | 0,0332 | -0,0014 | ||

| US31405PRS10 / Fannie Mae Pool | 0,06 | -1,69 | 0,0331 | -0,0016 | ||

| US85573EAC12 / Starwood Mortgage Residential Trust 2020-INV | 0,06 | -14,71 | 0,0330 | -0,0070 | ||

| US85573EAB39 / STARWOOD MORTGAGE RESIDENTIAL STAR 2020 INV1 A2 144A | 0,06 | -14,71 | 0,0329 | -0,0069 | ||

| US07384YGX85 / BEAR STEARNS ASSET BACKED SECU BSABS 2003 1 A1 | 0,06 | -5,08 | 0,0321 | -0,0026 | ||

| US3128NC2K96 / FED HM LN PC POOL 1G0778 FH 03/36 FLOATING VAR | 0,06 | -1,75 | 0,0321 | -0,0011 | ||

| US31385WZU60 / FANNIE MAE 3.589% 04/01/2040 FAR FNARM | 0,05 | -3,64 | 0,0304 | -0,0016 | ||

| US31381JRV60 / FANNIE MAE 4.155% 10/01/2035 FNMA | 0,05 | -1,85 | 0,0302 | -0,0013 | ||

| CARMAX SELECT RECEIVABLES TRUS CMXS 2024 A A2A / ABS-O (US14319FAB94) | 0,05 | -31,08 | 0,0295 | -0,0136 | ||

| CARMAX SELECT RECEIVABLES TRUS CMXS 2024 A A2A / ABS-O (US14319FAB94) | 0,05 | -31,08 | 0,0295 | -0,0136 | ||

| CARMAX SELECT RECEIVABLES TRUS CMXS 2024 A A2B / ABS-O (US14319FAC77) | 0,05 | -31,08 | 0,0294 | -0,0135 | ||

| CARMAX SELECT RECEIVABLES TRUS CMXS 2024 A A2B / ABS-O (US14319FAC77) | 0,05 | -31,08 | 0,0294 | -0,0135 | ||

| US92922FEB04 / WAMU Mortgage Pass-Through Certificates Trust, Series 2003-AR10, Class A7 | 0,05 | -3,77 | 0,0293 | -0,0014 | ||

| US31409FVH80 / FNMA POOL 870116 FN 09/35 FLOATING VAR | 0,05 | -1,92 | 0,0292 | -0,0009 | ||

| US76111XG987 / RFMSI Series 2006-SA1 Trust | 0,05 | -2,00 | 0,0282 | -0,0008 | ||

| US31349SUX97 / FED HM LN PC POOL 781498 FH 01/34 FLOATING VAR | 0,05 | -2,00 | 0,0282 | -0,0011 | ||

| US31400H5W99 / FANNIE MAE 3.703% 03/01/2033 FAR FNARM | 0,05 | -2,00 | 0,0281 | -0,0013 | ||

| US31418EGF16 / Fannie Mae Pool | 0,05 | -2,00 | 0,0281 | -0,0010 | ||

| US31392GVX05 / FANNIEMAE WHOLE LOAN FNW 2003 W1 1A1 | 0,05 | -2,00 | 0,0278 | -0,0012 | ||

| US007036QH22 / Adjustable Rate Mortgage Trust 2005-8 | 0,05 | -2,04 | 0,0278 | -0,0009 | ||

| RFR USD SOFR/3.25000 12/20/23-30Y LCH / DIR (EZ3BPZ7JX2D9) | 0,05 | 20,00 | 0,0278 | 0,0044 | ||

| RFR USD SOFR/3.25000 12/20/23-30Y LCH / DIR (EZ3BPZ7JX2D9) | 0,05 | 20,00 | 0,0278 | 0,0044 | ||

| US31406YTJ90 / FNMA POOL 824153 FN 06/34 FLOATING VAR | 0,05 | -5,88 | 0,0277 | -0,0022 | ||

| EZ4YGY9ZBMF1 / CMBX.NA.AAA.12 SP SAL | 0,05 | -580,00 | 0,0277 | 0,0335 | ||

| US313398VT33 / FSPC T-35 A V/R 9/25/31 1.84800000 | 0,05 | -16,07 | 0,0270 | -0,0055 | ||

| CMBX.NA.AAA.10 SP GST / DCR (000000000) | 0,05 | 0,0267 | 0,0267 | |||

| CMBX.NA.AAA.10 SP GST / DCR (000000000) | 0,05 | 0,0267 | 0,0267 | |||

| US466247YS63 / JP MORGAN MORTGAGE TRUST JPMMT 2005 A8 2A6 | 0,05 | 0,00 | 0,0264 | -0,0008 | ||

| RFRF USD SF+26.161/1.3* 9/22/23-5Y* CME / DIR (EZBJCCT971J0) | 0,05 | -11,76 | 0,0257 | -0,0040 | ||

| RFRF USD SF+26.161/1.3* 9/22/23-5Y* CME / DIR (EZBJCCT971J0) | 0,05 | -11,76 | 0,0257 | -0,0040 | ||

| US3133KYXC82 / UMBS, 20 Year | 0,04 | 0,00 | 0,0250 | -0,0009 | ||

| US32051GDX07 / FIRST HORIZON MORTGAGE PASS TH FHASI 2004 FL1 2A1 | 0,04 | -2,27 | 0,0248 | -0,0008 | ||

| US05948XTL54 / BANC OF AMERICA MORTGAGE 2003-H TRUST | 0,04 | 0,00 | 0,0248 | -0,0005 | ||

| US3133BASY82 / Federal Home Loan Mortgage Corporation | 0,04 | -2,27 | 0,0247 | -0,0010 | ||

| US3128JNXL43 / FED HM LN PC POOL 1B3482 FH 07/37 FLOATING VAR | 0,04 | 0,00 | 0,0241 | -0,0008 | ||

| US31407K6Q79 / FNMA POOL 833479 FN 09/35 FLOATING VAR | 0,04 | -2,44 | 0,0231 | -0,0009 | ||

| US3138YEGY72 / Fannie Mae Pool | 0,04 | -4,76 | 0,0227 | -0,0016 | ||

| CPS AUTO TRUST CPS 2024 C A 144A / ABS-O (US223920AA78) | 0,04 | -30,91 | 0,0219 | -0,0105 | ||

| CPS AUTO TRUST CPS 2024 C A 144A / ABS-O (US223920AA78) | 0,04 | -30,91 | 0,0219 | -0,0105 | ||

| US3133TKPF11 / FHLMC STRUCTURED PASS THROUGH FSPC T 16 A | 0,04 | -2,63 | 0,0215 | -0,0008 | ||

| US61746WA750 / MORGAN STANLEY DEAN WITTER CAP MSDWC 2003 NC2 M1 | 0,04 | -10,00 | 0,0208 | -0,0026 | ||

| US31418EFC93 / FNMA POOL MA4662 FN 07/42 FIXED 4 | 0,04 | -2,70 | 0,0206 | -0,0008 | ||

| US929227XB72 / WAMU MORTGAGE PASS-THROUGH CERTIFICATES SERIES 2002-AR17 SER 2002-AR17 CL 1A V/R REGD 3.52644500 | 0,04 | 0,00 | 0,0205 | -0,0009 | ||

| US31404MPT98 / FNMA POOL 772734 FN 03/34 FLOATING VAR | 0,04 | -2,78 | 0,0203 | -0,0008 | ||

| US07384MZS42 / Bear Stearns ARM Trust 2003-8 | 0,04 | -2,78 | 0,0203 | -0,0009 | ||

| US81744FGZ45 / Sequoia Mortgage Trust, Series 2005-2, Class A2 | 0,04 | -2,78 | 0,0202 | -0,0010 | ||

| US3128NCHJ69 / FED HM LN PC POOL 1G0233 FH 05/35 FLOATING VAR | 0,03 | -2,86 | 0,0197 | -0,0008 | ||

| US863579NA21 / STRUCTURED ADJUSTABLE RATE MOR SARM 2005 4 6A3 | 0,03 | -8,11 | 0,0196 | -0,0023 | ||

| RFR USD SOFR/3.25000 03/19/25-7Y LCH / DIR (EZXW94GLV2L5) | 0,03 | -29,79 | 0,0191 | -0,0083 | ||

| RFR USD SOFR/3.25000 03/19/25-7Y LCH / DIR (EZXW94GLV2L5) | 0,03 | -29,79 | 0,0191 | -0,0083 | ||

| US3128NGC296 / Federal Home Loan Mortgage Corporation | 0,03 | -2,94 | 0,0191 | -0,0008 | ||

| US31418EMN75 / Federal National Mortgage Association, Inc. | 0,03 | -2,94 | 0,0191 | -0,0007 | ||

| RFR USD SOFR/3.00000 03/19/25-5Y LCH / DIR (EZ9JNZJCQVZ3) | 0,03 | -20,00 | 0,0187 | -0,0046 | ||

| RFR USD SOFR/3.00000 03/19/25-5Y LCH / DIR (EZ9JNZJCQVZ3) | 0,03 | -20,00 | 0,0187 | -0,0046 | ||

| US59020USJ50 / MERRILL LYNCH MORTGAGE INVESTORS TRUST SERIES MLMI MLMI 2005-A2 A2 | 0,03 | -3,03 | 0,0185 | -0,0011 | ||

| US31405MA231 / FANNIE MAE 3.443% 07/01/2034 FNMA ARM | 0,03 | 0,00 | 0,0183 | -0,0008 | ||

| US32051GPJ84 / FIRST HORIZON ALTERNATIVE MORT FHAMS 2005 AA5 1A1 | 0,03 | 0,00 | 0,0179 | -0,0006 | ||

| RFRF USD SF+26.161/2.0* 8/09/23-9Y* CME / DIR (EZYBN0P9F1K0) | 0,03 | -13,89 | 0,0177 | -0,0035 | ||

| RFRF USD SF+26.161/2.0* 8/09/23-9Y* CME / DIR (EZYBN0P9F1K0) | 0,03 | -13,89 | 0,0177 | -0,0035 | ||

| US126694HQ49 / CHL Mortgage Pass-Through Trust, Series 2005-25, Class A11 | 0,03 | -3,23 | 0,0176 | -0,0005 | ||

| US31389L4R78 / FNMA POOL 629132 FN 05/32 FLOATING VAR | 0,03 | -3,23 | 0,0173 | -0,0008 | ||

| RFRF USD SF+26.161/0.9* 8/06/23-3Y* CME / DIR (EZRY3SP5T516) | 0,03 | -14,71 | 0,0169 | -0,0030 | ||

| US31406L3G17 / FANNIE MAE 3.538% 01/01/2036 FNMA ARM | 0,03 | -3,33 | 0,0169 | -0,0006 | ||

| US17307GY692 / Citigroup Mortgage Loan Trust, Series 2005-12, Class 2A1 | 0,03 | -14,71 | 0,0169 | -0,0034 | ||

| US12669GA765 / CHL Mortgage Pass-Through Trust, Series 2005-HYB3, Class 2A1A | 0,03 | -12,12 | 0,0168 | -0,0024 | ||

| US32051D4S87 / First Horizon Alternative Mortgage Securities Trust 2004-AA2 | 0,03 | 0,00 | 0,0166 | -0,0007 | ||

| US31295NLN65 / FED HM LN PC POOL 789333 FH 04/32 FLOATING VAR | 0,03 | -3,45 | 0,0161 | -0,0009 | ||

| US31403CWW71 / FANNIE MAE 3.375% 03/01/2035 FAR FNARM | 0,03 | -24,32 | 0,0160 | -0,0057 | ||

| US3140XLCS56 / FANNIE MAE POOL UMBS P#FS4580 4.00000000 | 0,03 | 0,00 | 0,0160 | -0,0004 | ||

| US31402RPT04 / FANNIE MAE 3.269% 10/01/2034 FNMA ARM | 0,03 | 0,00 | 0,0159 | -0,0006 | ||

| US3128Q2C921 / FED HM LN PC POOL 1L0096 FH 02/35 FLOATING VAR | 0,03 | -3,57 | 0,0157 | -0,0006 | ||

| US31404SCY90 / FNMA POOL 776887 FN 02/34 FLOATING VAR | 0,03 | -3,57 | 0,0157 | -0,0006 | ||

| US31403KDN00 / FNMA POOL 750809 FN 11/33 FLOATING VAR | 0,03 | -7,14 | 0,0153 | -0,0012 | ||

| US31407EZZ95 / FNMA POOL 828860 FN 05/35 FLOATING VAR | 0,03 | 0,00 | 0,0149 | -0,0006 | ||

| US31396L4T48 / FNMA, REMIC, Series 2006-118, Class A2 | 0,03 | -7,41 | 0,0147 | -0,0013 | ||

| US31409GR320 / FNMA POOL 870906 FN 12/36 FLOATING VAR | 0,03 | 0,00 | 0,0144 | -0,0005 | ||

| US36229RLG29 / GSR MORTGAGE LOAN TRUST GSR 2004 2F 4A1 | 0,03 | -7,41 | 0,0144 | -0,0014 | ||

| US31413FYF34 / FNMA POOL 944510 FN 07/37 FLOATING VAR | 0,03 | 0,00 | 0,0144 | -0,0005 | ||

| US31348MWV52 / FED HM LN PC POOL 765160 FH 09/30 FLOATING VAR | 0,03 | -3,85 | 0,0143 | -0,0012 | ||

| US31404Q5M78 / Fannie Mae Pool | 0,03 | -3,85 | 0,0143 | -0,0010 | ||

| US3128HDZB88 / FED HM LN PC POOL 847038 FH 01/30 FLOATING VAR | 0,03 | -7,41 | 0,0143 | -0,0014 | ||

| US31349SEZ20 / FED HM LN PC POOL 781052 FH 11/33 FLOATING VAR | 0,03 | -26,47 | 0,0142 | -0,0055 | ||

| US36242D4W09 / GSR Mortgage Loan Trust 2005-AR3 | 0,02 | -4,00 | 0,0139 | -0,0008 | ||

| US31401G4N18 / FANNIE MAE 4.145% 07/01/2033 FNMA ARM | 0,02 | 0,00 | 0,0138 | -0,0006 | ||

| US31336CL350 / FED HM LN PC POOL 972146 FH 04/34 FLOATING VAR | 0,02 | -11,11 | 0,0138 | -0,0021 | ||

| US3140H3YY67 / FNMA POOL BJ2526 FN 12/47 FIXED 3.5 | 0,02 | 0,00 | 0,0134 | -0,0003 | ||

| RFR USD SOFR/3.75000 12/18/24-2Y LCH / DIR (EZHML4QNCYC1) | 0,02 | -11,54 | 0,0133 | -0,0019 | ||

| US29445FAH10 / EQUIFIRST MORTGAGE LOAN TRUST EMLT 2003 2 3A3 | 0,02 | 0,00 | 0,0132 | -0,0007 | ||

| US31403NSL28 / FANNIE MAE 3.489% 11/01/2033 FAR FNARM | 0,02 | -4,35 | 0,0131 | -0,0006 | ||

| US31404ECQ70 / FANNIE MAE 3.752% 02/01/2034 FNMA ARM | 0,02 | 0,00 | 0,0126 | -0,0006 | ||

| US17307GW951 / Citigroup Mortgage Loan Trust 2005-11 | 0,02 | -4,55 | 0,0124 | -0,0004 | ||

| US17307GXP89 / Citigroup Mortgage Loan Trust Inc | 0,02 | -8,70 | 0,0123 | -0,0014 | ||

| US31406DJP24 / FNMA POOL 806770 FN 11/34 FLOATING VAR | 0,02 | 0,00 | 0,0122 | -0,0005 | ||

| US31402TQD09 / Fannie Mae Pool | 0,02 | 0,00 | 0,0121 | -0,0005 | ||

| RFRF USD SF+26.161/1.9* 02/09/22-10Y LCH / DIR (EZ9TV9KD87J7) | 0,02 | -16,67 | 0,0119 | -0,0024 | ||

| RFRF USD SF+26.161/1.9* 02/09/22-10Y LCH / DIR (EZ9TV9KD87J7) | 0,02 | -16,67 | 0,0119 | -0,0024 | ||

| US07384MC754 / BEAR STEARNS ADJUSTABLE RATE M BSARM 2003 9 3A3 | 0,02 | 0,00 | 0,0116 | -0,0004 | ||

| US31405MA561 / FNMA POOL 793028 FN 07/34 FLOATING VAR | 0,02 | 0,00 | 0,0114 | -0,0005 | ||

| US3138W9B746 / FNMA POOL AS0061 FN 08/28 FIXED 3 | 0,02 | -9,52 | 0,0113 | -0,0014 | ||

| US12669FBQ54 / COUNTRYWIDE HOME LOANS CWHL 2003 56 5A1 | 0,02 | -13,64 | 0,0113 | -0,0016 | ||

| US32051GDV41 / FIRST HORIZON MORTGAGE PASS TH FHASI 2004 FL1 1A1 | 0,02 | 0,00 | 0,0112 | -0,0003 | ||

| RFR USD SOFR/2.30000 01/17/24-2Y LCH / DIR (EZ7DPVG1XS64) | 0,02 | 5,56 | 0,0112 | 0,0007 | ||

| RFR USD SOFR/2.30000 01/17/24-2Y LCH / DIR (EZ7DPVG1XS64) | 0,02 | 5,56 | 0,0112 | 0,0007 | ||

| US31406AV669 / FNMA POOL 804437 FN 12/34 FLOATING VAR | 0,02 | -5,00 | 0,0112 | -0,0004 | ||

| US05948XT502 / BANC OF AMERICA MORTGAGE SECUR BOAMS 2004 A 3A1 | 0,02 | -9,52 | 0,0112 | -0,0011 | ||

| US16162WPJ26 / Chase Mortgage Finance Trust, Series 2005-A1, Class 3A1 | 0,02 | 0,00 | 0,0110 | -0,0003 | ||

| US31390STH49 / FNMA POOL 654952 FN 07/42 FLOATING VAR | 0,02 | -9,52 | 0,0110 | -0,0014 | ||

| US31403A5J04 / FNMA POOL 743449 FN 10/33 FLOATING VAR | 0,02 | -5,26 | 0,0106 | -0,0005 | ||

| US36185MBL54 / GMAC MORTGAGE CORPORATION LOAN TRUST | 0,02 | 0,00 | 0,0106 | -0,0003 | ||

| US576433WL62 / MASTR ADJUSTABLE RATE MORTGAGES TRUST 2004-13 MARM 2004-13 3A7A | 0,02 | 0,00 | 0,0104 | -0,0005 | ||

| US589929S412 / MLCC MORTGAGE INVESTORS INC MLCC 2003 C A1 | 0,02 | -5,26 | 0,0104 | -0,0011 | ||

| US31402DKS89 / FNMA POOL 725805 FN 09/34 FLOATING VAR | 0,02 | 0,00 | 0,0099 | -0,0004 | ||

| US93363DAA54 / WaMu Mortgage Pass-Through Certificates Series 2006-AR9 Trust | 0,02 | 0,00 | 0,0099 | -0,0005 | ||

| US36225CA890 / GNMA II POOL 080030 G2 01/27 FLOATING VAR | 0,02 | -23,81 | 0,0094 | -0,0029 | ||

| US36225CV524 / GNMA II POOL 080635 G2 09/32 FLOATING VAR | 0,02 | -5,88 | 0,0094 | -0,0007 | ||

| US31371MQL45 / FNMA POOL 256159 FN 02/36 FLOATING VAR | 0,02 | 0,00 | 0,0093 | -0,0003 | ||

| US41161PLR28 / HARBORVIEW MORTGAGE LOAN TRUST 2005-2 SER 2005-2 CL 2A1A V/R REGD 2.17325000 | 0,02 | -6,25 | 0,0091 | -0,0006 | ||

| US31384WE718 / FNMA POOL 535758 FN 03/30 FLOATING VAR | 0,02 | -16,67 | 0,0090 | -0,0014 | ||

| RFR USD SOFR/3.75000 06/20/24-10Y LCH / DIR (EZ52H44WTW83) | 0,02 | -400,00 | 0,0090 | 0,0123 | ||

| RFR USD SOFR/3.75000 06/20/24-10Y LCH / DIR (EZ52H44WTW83) | 0,02 | -400,00 | 0,0090 | 0,0123 | ||

| US31393JPL60 / Freddie Mac REMICS | 0,02 | -21,05 | 0,0090 | -0,0022 | ||

| US16162WPE39 / CHASE MORTGAGE FINANCE CORPORA CHASE 2005 A1 2A2 | 0,02 | 0,00 | 0,0089 | -0,0002 | ||

| US542514BQ66 / LONG BEACH MORTGAGE LOAN TRUST LBMLT 2001 4 2A1 | 0,02 | 0,00 | 0,0089 | -0,0001 | ||

| US07384M5Y44 / BEAR STEARNS ADJUSTABLE RATE M BSARM 2004 10 12A5 | 0,02 | 0,00 | 0,0087 | -0,0002 | ||

| US59020UAA34 / MLMI 2004 A1 1A | 0,02 | 0,00 | 0,0087 | -0,0001 | ||

| US31405GQ379 / FNMA POOL 788974 FN 04/34 FLOATING VAR | 0,02 | 0,00 | 0,0086 | -0,0003 | ||

| US05948XYD73 / BANC OF AMERICA MORTGAGE SECUR BOAMS 2003 J 2A2 | 0,01 | 0,00 | 0,0083 | -0,0003 | ||

| CMBX.NA.AAA.11 SP SAL / DCR (000000000) | 0,01 | 0,0082 | 0,0082 | |||

| CMBX.NA.AAA.11 SP SAL / DCR (000000000) | 0,01 | 0,0082 | 0,0082 | |||

| US589929G367 / Merrill Lynch Mortgage Investors Trust, Series 2003-A, Class 2A2 | 0,01 | -6,67 | 0,0082 | -0,0009 | ||

| US126670LE60 / CHL Mortgage Pass-Through Trust 2005-HYB9 | 0,01 | 0,00 | 0,0082 | -0,0005 | ||

| US863579AQ10 / Structured Adjustable Rate Mortgage Loan Trust, Series 2004-12, Class 3A2 | 0,01 | -23,53 | 0,0078 | -0,0022 | ||

| US36225CXP66 / GNMA II POOL 080685 G2 04/33 FLOATING VAR | 0,01 | 0,00 | 0,0076 | -0,0004 | ||

| CMBX.NA.AAA.10 SP SAL / DCR (000000000) | 0,01 | 0,0075 | 0,0075 | |||

| US31407ANB34 / FANNIE MAE 3.445% 11/01/2033 FAR FNARM | 0,01 | -7,69 | 0,0072 | -0,0003 | ||

| US36225CVW36 / GNMA II POOL 080628 G2 08/32 FLOATING VAR | 0,01 | -7,69 | 0,0072 | -0,0005 | ||

| US31406Q7B74 / FNMA POOL 817290 FN 06/35 FLOATING VAR | 0,01 | 0,00 | 0,0072 | -0,0003 | ||

| US17307GEB05 / CITIGROUP MORTGAGE LOAN TRUST CMLTI 2004 HYB2 1A | 0,01 | 0,00 | 0,0072 | -0,0002 | ||

| US3133KYXR51 / Freddie Mac Pool | 0,01 | -7,69 | 0,0072 | -0,0004 | ||

| US939335N683 / Washington Mutual MSC Mortgage Pass-Through Certificates Series 2002-AR1 Trust | 0,01 | -20,00 | 0,0072 | -0,0020 | ||

| US86359AS462 / STRUCTURED ASSET SECURITIES CO SASC 2003 26A 2A | 0,01 | 0,00 | 0,0072 | -0,0002 | ||

| US31385HU597 / FANNIE MAE 3.25% 05/01/2036 FNMA ARM | 0,01 | -7,69 | 0,0070 | -0,0011 | ||

| US31390WRA26 / FNMA | 0,01 | 0,00 | 0,0070 | -0,0003 | ||

| US45660N2Y00 / IndyMac INDX Mortgage Loan Trust, Series 2004-AR10, Class 2A2A | 0,01 | 0,00 | 0,0070 | -0,0002 | ||

| US07384M4J85 / Bear Stearns ARM Trust 2004-10 | 0,01 | 9,09 | 0,0069 | 0,0000 | ||

| US31403GWC22 / Fannie Mae Pool | 0,01 | 0,00 | 0,0068 | -0,0003 | ||

| US31374GRC32 / Fannie Mae Pool | 0,01 | -8,33 | 0,0067 | -0,0006 | ||

| US31406H3D75 / FNMA | 0,01 | -15,38 | 0,0066 | -0,0010 | ||

| US3133KYYA18 / Federal Home Loan Mortgage Corporation | 0,01 | 0,00 | 0,0065 | -0,0001 | ||

| US3128QS2Z80 / FED HM LN PC POOL 1G2592 FH 12/36 FLOATING VAR | 0,01 | 0,00 | 0,0065 | -0,0003 | ||

| US31403H3P37 / FNMA POOL 749706 FN 11/33 FLOATING VAR | 0,01 | 0,00 | 0,0065 | -0,0003 | ||

| US939336P801 / Washington Mutual MSC Mortgage Pass-Through Certificates Series 2004-RA1 Trust | 0,01 | 0,00 | 0,0065 | -0,0001 | ||

| US3140H3W856 / FNMA POOL BJ2470 FN 12/47 FIXED 3.5 | 0,01 | 0,00 | 0,0064 | -0,0003 | ||

| US31409UUP82 / FNMA POOL 879090 FN 05/36 FLOATING VAR | 0,01 | 0,00 | 0,0064 | -0,0002 | ||

| US31295NEY04 / Freddie Mac Non Gold Pool | 0,01 | -35,29 | 0,0064 | -0,0036 | ||

| US36225CK709 / GNMA II POOL 080317 G2 09/29 FLOATING VAR | 0,01 | 0,00 | 0,0064 | -0,0005 | ||

| US07384MTN29 / Bear Stearns ARM Trust 2003-1 | 0,01 | 0,00 | 0,0064 | -0,0003 | ||

| US576438AD71 / MASTR ADJUSTABLE RATE MORTGAGE MARM 2006 2 3A1 | 0,01 | -8,33 | 0,0063 | -0,0011 | ||

| US31407X3X76 / FNMA POOL 844214 FN 11/35 FLOATING VAR | 0,01 | 0,00 | 0,0061 | -0,0002 | ||

| US126694AN80 / COUNTRYWIDE HOME LOANS CWHL 2005 19 2A2 | 0,01 | 0,00 | 0,0061 | -0,0002 | ||

| US31392DUF76 / FANNIEMAE WHOLE LOAN FNW 2002 W4 A4 | 0,01 | 0,00 | 0,0060 | -0,0003 | ||

| US31392DUA89 / FANNIEMAE WHOLE LOAN FNW 2002 W4 A5 | 0,01 | -9,09 | 0,0060 | -0,0007 | ||

| US31392ADL98 / Fannie Mae REMICS | 0,01 | -9,09 | 0,0059 | -0,0005 | ||

| US31403GZT20 / FNMA POOL 748754 FN 10/33 FIXED 7 | 0,01 | 0,00 | 0,0059 | -0,0004 | ||

| US576433GC48 / MASTR Adjustable Rate Mortgages Trust 2003-6 | 0,01 | 0,00 | 0,0058 | -0,0003 | ||

| US31407YHH53 / FNMA POOL 844532 FN 11/35 FLOATING VAR | 0,01 | 0,00 | 0,0058 | -0,0002 | ||

| US65535VPU60 / NAA 2005-AR5 2A1 | 0,01 | -10,00 | 0,0057 | -0,0002 | ||

| US05949AGR59 / BANK OF AMERICA MORRTGAGE SECURITIES | 0,01 | -10,00 | 0,0057 | -0,0001 | ||

| US31346VHH50 / FED HM LN PC POOL 390232 FH 01/30 FLOATING VAR | 0,01 | -10,00 | 0,0057 | -0,0004 | ||

| US31394BZ641 / FANNIEMAE WHOLE LOAN FNW 2004 W15 1A1 | 0,01 | -10,00 | 0,0056 | -0,0003 | ||

| US31358SNY36 / Fannie Mae REMICS | 0,01 | -18,18 | 0,0056 | -0,0012 | ||

| US36242DBM48 / GSR Mortgage Loan Trust 2004-9 | 0,01 | 0,00 | 0,0056 | -0,0001 | ||

| US31401L6D00 / FNMA POOL 711968 FN 05/33 FLOATING VAR | 0,01 | 0,00 | 0,0055 | -0,0002 | ||

| US31339LN716 / FREDDIE MAC FHR 2395 FA | 0,01 | -10,00 | 0,0055 | -0,0006 | ||

| US31349UMJ42 / FED HM LN PC POOL 783061 FH 03/35 FLOATING VAR | 0,01 | 0,00 | 0,0052 | -0,0002 | ||

| US36228F4R42 / GSR MORTGAGE LOAN TRUST GSR 2004 7 3A1 | 0,01 | 0,00 | 0,0052 | -0,0002 | ||

| US007036DN37 / Adjustable Rate Mortgage Trust 2004-4 | 0,01 | 0,00 | 0,0052 | -0,0002 | ||

| US3133TJN583 / FREDDIE MAC FHR 2130 FD | 0,01 | 0,00 | 0,0052 | -0,0004 | ||

| US759950AG37 / RENAISSANCE HOME EQUITY LOAN T RAMC 2002 2 A | 0,01 | 0,00 | 0,0052 | -0,0001 | ||

| US31408FPH63 / FNMA ARM 5.16% 9/35 #850124 | 0,01 | 0,00 | 0,0052 | -0,0001 | ||

| US31385CDK62 / FNMA | 0,01 | -11,11 | 0,0050 | -0,0003 | ||

| US05948XR290 / BANC OF AMERICA MORTGAGE SECUR BOAMS 2003 L 2A2 | 0,01 | 0,00 | 0,0050 | -0,0002 | ||

| US17307GW530 / Citigroup Mortgage Loan Trust 2005-11 | 0,01 | 0,00 | 0,0050 | -0,0001 | ||

| US31348UHU60 / FED HM LN PC POOL 865643 FH 04/30 FLOATING VAR | 0,01 | -20,00 | 0,0050 | -0,0009 | ||

| US31371MFZ59 / FNMA POOL 255884 FN 08/35 FLOATING VAR | 0,01 | 0,00 | 0,0050 | -0,0002 | ||

| US31404EQE94 / FANNIE MAE 3.736% 03/01/2034 FAR FNARM | 0,01 | 0,00 | 0,0049 | -0,0002 | ||

| US07384MS784 / BEAR STEARNS ARM TRUST 2004-5 BSARM 2004-5 2A | 0,01 | 0,00 | 0,0049 | -0,0001 | ||

| US86358HUT49 / Structured Asset Mortgage Investments Trust 2003-AR3 | 0,01 | 0,00 | 0,0049 | -0,0002 | ||

| US31402CVD19 / FNMA POOL 725212 FN 03/33 FLOATING VAR | 0,01 | 0,00 | 0,0048 | -0,0002 | ||

| US81743VAA17 / SEQUOIA MORTGAGE TRUST 10 SEMT 10 1A | 0,01 | -27,27 | 0,0048 | -0,0017 | ||

| US31378A3P93 / FANNIE MAE 3.341% 11/01/2026 FAR FNARM | 0,01 | -11,11 | 0,0047 | -0,0009 | ||

| US31358SSV42 / Fannie Mae REMICS | 0,01 | 0,00 | 0,0047 | -0,0004 | ||

| US81744FCG00 / Sequoia Mortgage Trust 2004-6 | 0,01 | 0,00 | 0,0046 | -0,0004 | ||

| US3128M6PE23 / Freddie Mac Gold Pool | 0,01 | 0,00 | 0,0046 | -0,0003 | ||

| US31336CLM37 / FED HM LN PC POOL 972132 FH 11/33 FLOATING VAR | 0,01 | 0,00 | 0,0046 | -0,0004 | ||

| US31406QGB77 / FNMA | 0,01 | 0,00 | 0,0046 | -0,0002 | ||

| US31402QUH28 / FNMA POOL 735084 FN 02/34 FLOATING VAR | 0,01 | -11,11 | 0,0046 | -0,0007 | ||

| US466285AK96 / J.P. MORGAN ALTERNATIVE LOAN T JPALT 2006 A6 2A1 | 0,01 | 0,00 | 0,0046 | -0,0001 | ||

| RFRF USD SF+26.161/1.2* 9/15/23-3Y* CME / DIR (EZ8H8SK9HY04) | 0,01 | -12,50 | 0,0044 | -0,0007 | ||

| RFRF USD SF+26.161/1.2* 9/15/23-3Y* CME / DIR (EZ8H8SK9HY04) | 0,01 | -12,50 | 0,0044 | -0,0007 | ||

| US31393CX406 / FNMA, Series 2003-W8, Class 3F2 | 0,01 | -12,50 | 0,0044 | -0,0003 | ||

| US31402QX488 / FANNIE MAE 3.339% 01/01/2035 FAR FNARM | 0,01 | -22,22 | 0,0043 | -0,0011 | ||

| US31407A7K18 / Fannie Mae Pool | 0,01 | 0,00 | 0,0042 | -0,0002 | ||

| US31339NE851 / FREDDIE MAC FHR 2413 FB | 0,01 | -12,50 | 0,0042 | -0,0005 | ||

| US74160MDL37 / Prime Mortgage Trust 2004-CL1 | 0,01 | -12,50 | 0,0042 | -0,0006 | ||

| US31574PAA30 / Ellington Financial Mortgage Trust 2020-1 | 0,01 | -50,00 | 0,0042 | -0,0041 | ||

| US3128NC6C35 / Freddie Mac Non Gold Pool | 0,01 | -36,36 | 0,0042 | -0,0025 | ||

| US31410GDL41 / FANNIE MAE 3.608% 02/01/2035 FAR FNARM | 0,01 | 0,00 | 0,0042 | -0,0003 | ||

| US22541NAD12 / Home Equity Asset Trust | 0,01 | 0,00 | 0,0042 | -0,0001 | ||

| US22541QUQ36 / CREDIT SUISSE FIRST BOSTON MOR CSFB 2003 AR24 4A1 | 0,01 | 0,00 | 0,0041 | -0,0005 | ||

| US3128QLQU85 / FED HM LN PC POOL 1H2567 FH 09/35 FLOATING VAR | 0,01 | 0,00 | 0,0040 | -0,0002 | ||

| US12669F6Y44 / COUNTRYWIDE HOME LOANS CWHL 2004 22 A2 | 0,01 | 0,00 | 0,0040 | -0,0002 | ||

| US31404JS976 / FNMA POOL 770144 FN 02/34 FLOATING VAR | 0,01 | -14,29 | 0,0039 | -0,0002 | ||

| US31391XDM83 / FNMA POOL 679708 FN 09/41 FLOATING VAR | 0,01 | -14,29 | 0,0039 | -0,0003 | ||

| US78448WAB19 / SMB Private Education Loan Trust 2017-A | 0,01 | -60,00 | 0,0038 | -0,0049 | ||

| US31392HGV96 / FANNIE MAE FNR 2002 95 FK | 0,01 | -14,29 | 0,0038 | -0,0003 | ||

| US45660UAT60 / IndyMac ARM Trust 2001-H2 | 0,01 | 0,00 | 0,0037 | -0,0002 | ||

| US31392CKL71 / FANNIE MAE FNR 2002 15 FA | 0,01 | 0,00 | 0,0036 | -0,0004 | ||

| US05949CHX74 / Banc of America Mortgage 2005-I Trust | 0,01 | 0,00 | 0,0036 | -0,0001 | ||

| US3128QGDW93 / FED HM LN PC POOL 1N0117 FH 12/35 FLOATING VAR | 0,01 | 0,00 | 0,0036 | -0,0001 | ||

| US31393BW764 / FANNIE MAE WHOLE LOAN | 0,01 | 0,00 | 0,0035 | -0,0003 | ||

| US81743PAA49 / SEMT_03-1 | 0,01 | 0,00 | 0,0035 | -0,0003 | ||

| US86359A4Z37 / STRUCTURED ASSET SECURITIES CO SASC 2003 34A 3A1 | 0,01 | -16,67 | 0,0034 | -0,0001 | ||

| US31358SH879 / FANNIE MAE REMICS SER 2000-47 CL FD V/R 2.56838000 | 0,01 | -28,57 | 0,0033 | -0,0011 | ||

| 3 MONTH SOFR FUT JUN25 XCME 20250916 / DIR (000000000) | 0,01 | 0,0033 | 0,0033 | |||

| 3 MONTH SOFR FUT JUN25 XCME 20250916 / DIR (000000000) | 0,01 | 0,0033 | 0,0033 | |||

| US31409JLH13 / FANNIE MAE 4.475% 06/01/2036 FNMA ARM | 0,01 | 0,00 | 0,0033 | -0,0001 | ||

| US31406WEF77 / FANNIE MAE 4.384% 06/01/2035 FNMA ARM | 0,01 | 0,00 | 0,0033 | -0,0001 | ||

| US31410GEU31 / FNMA POOL 888547 FN 06/37 FLOATING VAR | 0,01 | 0,00 | 0,0032 | -0,0001 | ||

| US31393T7H31 / Fannie Mae REMICS | 0,01 | -28,57 | 0,0032 | -0,0009 | ||

| US31371LLA51 / FANNIE MAE 3.50% 12/01/2033 FAR FNARM | 0,01 | -16,67 | 0,0032 | -0,0003 | ||

| US3128QLRA13 / Freddie Mac Non Gold Pool | 0,01 | 0,00 | 0,0032 | -0,0001 | ||

| US31402RTV14 / FNMA POOL 735964 FN 10/35 FLOATING VAR | 0,01 | 0,00 | 0,0032 | -0,0001 | ||

| US31295NJV10 / FED HM LN PC POOL 789276 FH 04/32 FLOATING VAR | 0,01 | 0,00 | 0,0031 | -0,0001 | ||

| US31385HN329 / FANNIE MAE 3.981% 05/01/2036 FAR FNARM | 0,01 | -16,67 | 0,0031 | -0,0004 | ||

| US31389F3V26 / FNMA POOL 624612 FN 04/28 FLOATING VAR | 0,01 | -16,67 | 0,0031 | -0,0004 | ||

| US12667G5V16 / COUNTRYWIDE ALTERNATIVE LOAN T CWALT 2005 43 2A1 | 0,01 | 0,00 | 0,0031 | -0,0001 | ||

| US3128JRHJ84 / FED HM LN PC POOL 847433 FH 07/35 FLOATING VAR | 0,01 | 0,00 | 0,0030 | -0,0003 | ||

| US31390RWU30 / FNMA POOL 654159 FN 10/32 FLOATING VAR | 0,01 | 0,00 | 0,0030 | -0,0001 | ||

| US31400SJE00 / FNMA POOL 696061 FN 04/33 FLOATING VAR | 0,01 | 0,00 | 0,0030 | -0,0001 | ||

| US83611MAQ15 / Soundview Home Loan Trust, Series 2003-2, Class A2 | 0,01 | -50,00 | 0,0030 | -0,0031 | ||

| US3128NCCU69 / FED HM LN PC POOL 1G0083 FH 03/35 FLOATING VAR | 0,01 | 0,00 | 0,0029 | -0,0001 | ||

| US31392C6T69 / FANNIE MAE FNR 2002 25 FX | 0,01 | 0,00 | 0,0029 | -0,0002 | ||

| US31339D7C66 / FREDDIE MAC FHR 2417 FY | 0,01 | 0,00 | 0,0028 | -0,0003 | ||

| US31406DG672 / FANNIE MAE 3.42% 11/01/2034 FAR FNARM | 0,01 | 0,00 | 0,0028 | -0,0001 | ||

| RFR USD SOFR/3.75000 06/20/24-10Y CME / DIR (EZ52H44WTW83) | 0,00 | -180,00 | 0,0028 | 0,0061 | ||

| RFR USD SOFR/3.75000 06/20/24-10Y CME / DIR (EZ52H44WTW83) | 0,00 | -180,00 | 0,0028 | 0,0061 | ||

| US31385HZV76 / FNMA POOL 545356 FN 11/31 FLOATING VAR | 0,00 | -20,00 | 0,0028 | -0,0003 | ||

| US3133TLPG76 / FREDDIE MAC FHR 2177 FA | 0,00 | -20,00 | 0,0028 | -0,0006 | ||

| US939336G495 / WASHINGTON MUTUAL MSC MORTGAGE WAMMS 2003 AR3 2A2 | 0,00 | 0,00 | 0,0028 | -0,0000 | ||

| US31393USE46 / FANNIE MAE FNR 2003 124 F | 0,00 | -20,00 | 0,0027 | -0,0002 | ||

| US31393UMM26 / FANNIE MAE FNR 2003 118 FD | 0,00 | 0,00 | 0,0026 | -0,0002 | ||

| US31400YDR45 / FNMA POOL 701312 FN 08/33 FLOATING VAR | 0,00 | 0,00 | 0,0026 | -0,0001 | ||

| RFR USD SOFR/3.25000 06/18/25-7Y LCH / DIR (EZNM897HLTQ3) | 0,00 | 0,0026 | 0,0026 | |||

| RFR USD SOFR/3.25000 06/18/25-7Y LCH / DIR (EZNM897HLTQ3) | 0,00 | 0,0026 | 0,0026 | |||

| US31392CQ311 / FANNIE MAE FNR 2002 34 FE | 0,00 | -20,00 | 0,0025 | -0,0005 | ||

| US31406MER34 / FANNIE MAE 3.661% 01/01/2035 FNMA ARM | 0,00 | 0,00 | 0,0024 | -0,0001 | ||

| US31411SM868 / FNMA POOL 913983 FN 02/37 FLOATING VAR | 0,00 | 0,00 | 0,0024 | -0,0001 | ||

| US31401Y6R15 / FNMA POOL 722780 FN 09/33 FLOATING VAR | 0,00 | 0,00 | 0,0024 | -0,0001 | ||

| US31405ARU96 / FNMA POOL 783599 FN 04/35 FLOATING VAR | 0,00 | 0,00 | 0,0024 | -0,0001 | ||

| US31393FGG54 / Freddie Mac REMICS | 0,00 | 0,00 | 0,0024 | -0,0001 | ||

| US31358SVW87 / FANNIE MAE FNR 2000 38 F | 0,00 | 0,00 | 0,0023 | -0,0003 | ||

| US31402RBC25 / FANNIE MAE 3.894% 02/01/2035 FNMA ARM | 0,00 | -25,00 | 0,0022 | -0,0001 | ||

| US31359V6Z11 / FANNIE MAE FNR 1999 37 F | 0,00 | -25,00 | 0,0022 | -0,0003 | ||

| US36228F4P85 / GSR Mortgage Loan Trust 2004-7 | 0,00 | 0,00 | 0,0022 | -0,0001 | ||

| US31395B6R90 / Fannie Mae REMICS | 0,00 | 0,00 | 0,0022 | -0,0001 | ||

| US76111JZ721 / RESIDENTIAL FUNDING MTG SEC I RFMSI 2003 S9 A1 | 0,00 | 0,00 | 0,0022 | -0,0001 | ||

| US31342AYG83 / FED HM LN PC POOL 780711 FH 07/33 FLOATING VAR | 0,00 | 0,00 | 0,0022 | -0,0001 | ||

| US31400QX813 / FNMA POOL 694703 FN 04/33 FLOATING VAR | 0,00 | 0,00 | 0,0022 | -0,0001 | ||

| US31404J2J30 / FNMA | 0,00 | 0,00 | 0,0021 | -0,0001 | ||

| US31408GJF54 / FANNIE MAE 3.509% 12/01/2035 FNMA ARM | 0,00 | -25,00 | 0,0021 | -0,0003 | ||

| US22541NNN56 / CREDIT SUISSE FIRST BOSTON MOR CSFB 2002 AR28 1A2 | 0,00 | 0,00 | 0,0021 | -0,0001 | ||

| US5899294G05 / MERRILL LYNCH MORTGAGE INVESTO MLMI 2003 A6 1A | 0,00 | 0,00 | 0,0020 | -0,0001 | ||

| US31407MSF31 / FANNIE MAE 3.634% 07/01/2035 FNMA ARM | 0,00 | 0,00 | 0,0020 | -0,0001 | ||

| US9393357P40 / WAMU 02-AR9 1A V/R 8/25/42 3.72644500 | 0,00 | 0,00 | 0,0019 | -0,0001 | ||

| US576433GH35 / MASTR ADJUSTABLE RATE MORTGAGE MARM 2003 6 4A2 | 0,00 | 0,00 | 0,0018 | -0,0001 | ||

| US31393YU521 / FNGT 2004-T3 1A1 6% 2/25/44 6.00000000 | 0,00 | 0,00 | 0,0018 | -0,0001 | ||

| US31385WXC80 / FANNIE MAE 3.563% 01/01/2033 FNMA | 0,00 | 0,00 | 0,0016 | -0,0001 | ||

| US31405U6G90 / Fannie Mae Pool | 0,00 | 0,00 | 0,0016 | -0,0001 | ||

| US161630AC20 / Chase Mortgage Finance Trust Series 2007-A1 | 0,00 | 0,00 | 0,0016 | -0,0001 | ||

| US073873AA90 / BEAR STEARNS ALT A TRUST BALTA 2006 5 1A1 | 0,00 | 0,00 | 0,0016 | -0,0001 | ||

| US31418EHF07 / Fannie Mae Pool | 0,00 | 0,00 | 0,0016 | -0,0001 | ||

| US3133TLPF93 / FREDDIE MAC FHR 2177 F | 0,00 | -33,33 | 0,0016 | -0,0004 | ||

| US3128JRHC32 / FED HM LN PC POOL 847427 FH 09/34 FLOATING VAR | 0,00 | 0,00 | 0,0016 | -0,0001 | ||

| US31406GD557 / Fannie Mae Pool | 0,00 | 0,00 | 0,0015 | -0,0001 | ||

| US31392WJU53 / FREDDIE MAC FHR 2509 ZQ | 0,00 | 0,00 | 0,0015 | -0,0001 | ||

| US31392KGB61 / FREDDIE MAC FHR 2451 FB | 0,00 | 0,00 | 0,0015 | -0,0001 | ||

| US31402DLH16 / FNMA ARM 3.99% 5/34 #725828 | 0,00 | 0,00 | 0,0015 | -0,0001 | ||

| US31359QF339 / FANNIE MAE FNR 1997 65 FK | 0,00 | -33,33 | 0,0015 | -0,0003 | ||

| US74160MDK53 / PRIME MORTGAGE TRUST | 0,00 | 0,00 | 0,0014 | -0,0002 | ||

| US94982DAA46 / Wells Fargo Mortgage Backed Securities Trust, Series 2005-AR14, Class A1 | 0,00 | 0,00 | 0,0014 | -0,0001 | ||

| US31407UMR58 / Fannie Mae Pool | 0,00 | 0,00 | 0,0014 | -0,0001 | ||

| US31391MKY83 / FNMA POOL 670911 FN 12/32 FLOATING VAR | 0,00 | -66,67 | 0,0014 | -0,0022 | ||

| US3128NCY406 / FED HM LN PC POOL 1G0731 FH 02/36 FLOATING VAR | 0,00 | 0,00 | 0,0014 | -0,0001 | ||

| US466247K778 / JP Morgan Mortgage Trust 2006-A2 | 0,00 | 0,00 | 0,0014 | -0,0001 | ||

| 3 MONTH SOFR FUT SEP25 XCME 20251216 / DIR (000000000) | 0,00 | 0,0013 | 0,0013 | |||

| 3 MONTH SOFR FUT SEP25 XCME 20251216 / DIR (000000000) | 0,00 | 0,0013 | 0,0013 | |||

| US31402DLJ71 / Fannie Mae Pool | 0,00 | 0,00 | 0,0013 | -0,0000 | ||

| US31392JY294 / FNMA, REMIC, Series 2003-21, Class FK | 0,00 | 0,00 | 0,0013 | -0,0001 | ||

| US3128NCTE45 / FED HM LN PC POOL 1G0549 FH 06/35 FLOATING VAR | 0,00 | 0,00 | 0,0012 | -0,0001 | ||

| US07384MYS50 / Bear Stearns ARM Trust, Series 2003-7, Class 3A | 0,00 | 0,00 | 0,0012 | -0,0000 | ||

| US31393XGQ43 / FANNIEMAE WHOLE LOAN FNW 2004 W2 2A2 | 0,00 | 0,00 | 0,0012 | -0,0001 | ||

| US31342AB577 / FED HM LN PC POOL 780060 FH 12/32 FLOATING VAR | 0,00 | 0,00 | 0,0012 | -0,0001 | ||

| US31407XWM90 / FANNIE MAE 3.456% 11/01/2035 FNMA ARM | 0,00 | 0,00 | 0,0012 | -0,0000 | ||

| US31390NJT00 / FANNIE MAE 2.145% 06/01/2032 FAR FNARM | 0,00 | 0,00 | 0,0012 | -0,0001 | ||

| RFR USD SOFR/3.55016 03/01/24-7Y* LCH / DIR (EZBKXTPHC9Q8) | 0,00 | -91,30 | 0,0012 | -0,0127 | ||

| US3128LUKS48 / FED HM LN PC POOL 1J0305 FH 02/37 FLOATING VAR | 0,00 | 0,00 | 0,0011 | -0,0000 | ||

| US31418EJZ43 / Fannie Mae Pool | 0,00 | 0,00 | 0,0011 | -0,0000 | ||

| US31389AZQ92 / FNMA POOL 620051 FN 08/32 FLOATING VAR | 0,00 | 0,00 | 0,0011 | -0,0001 | ||

| US3133TAC429 / FREDDIE MAC FHR 1968 FC | 0,00 | -50,00 | 0,0011 | -0,0005 | ||

| US3128QJUA20 / FED HM LN PC POOL 1G1477 FH 01/37 FLOATING VAR | 0,00 | 0,00 | 0,0011 | -0,0000 | ||

| US36228FNB84 / GSR MORTGAGE LOAN TRUST | 0,00 | 0,00 | 0,0010 | -0,0000 | ||

| US31404XJD75 / FNMA POOL 781560 FN 10/34 FLOATING VAR | 0,00 | 0,00 | 0,0010 | -0,0001 | ||

| US31390S3K53 / FANNIE MAE 3.519% 05/01/2032 FNMA ARM | 0,00 | 0,00 | 0,0010 | -0,0001 | ||

| US44328AAB61 / HSI Asset Securitization Corp Trust 2006-HE1 | 0,00 | 0,00 | 0,0010 | -0,0000 | ||

| US466247AZ62 / JP MORGAN MORTGAGE TRUST 2003-A2 SER 2003-A2 CL 3A1 V/R REGD 3.76336000 | 0,00 | -66,67 | 0,0010 | -0,0009 | ||

| US31401CCQ42 / FNMA POOL 703979 FN 05/33 FLOATING VAR | 0,00 | 0,00 | 0,0010 | -0,0001 | ||

| US3133TAG222 / FREDDIE MAC FHR 1980 Z | 0,00 | 0,00 | 0,0009 | -0,0002 | ||

| US31407MSU08 / FANNIE MAE 3.687% 07/01/2035 FAR FNARM | 0,00 | 0,00 | 0,0009 | -0,0000 | ||

| US31402DRT99 / FNMA POOL 725998 FN 11/34 FLOATING VAR | 0,00 | 0,00 | 0,0009 | -0,0000 | ||

| US3128NVMC33 / FED HM LN PC POOL 1K1255 FH 11/36 FLOATING VAR | 0,00 | 0,00 | 0,0009 | -0,0000 | ||

| US3128QLRW33 / Freddie Mac Non Gold Pool | 0,00 | 0,00 | 0,0009 | -0,0000 | ||

| US31406NL937 / FNMA POOL 814952 FN 04/35 FLOATING VAR | 0,00 | 0,00 | 0,0009 | -0,0000 | ||

| US313920QJ21 / FNMA, REMIC, Series 2001-38, Class FB | 0,00 | -50,00 | 0,0009 | -0,0004 | ||

| US31385WXE47 / FANNIE MAE 3.442% 01/01/2033 FAR FNARM | 0,00 | 0,00 | 0,0008 | -0,0000 | ||

| US31411DCZ06 / FNMA POOL 904688 FN 12/36 FLOATING VAR | 0,00 | 0,00 | 0,0008 | -0,0002 | ||

| RFR USD SOFR/3.54542 03/01/24-7Y* LCH / DIR (EZBKXTPHC9Q8) | 0,00 | -95,65 | 0,0008 | -0,0131 | ||

| US31384QRC95 / FNMA POOL 530683 FN 07/29 FLOATING VAR | 0,00 | 0,00 | 0,0008 | -0,0001 | ||

| US31408JAX90 / FANNIE MAE 3.809% 01/01/2036 FAR FNARM | 0,00 | 0,00 | 0,0007 | -0,0000 | ||

| US525ESC6Y09 / ESC LEHMAN BRTH HLDH PROD | 0,00 | -50,00 | 0,0007 | -0,0007 | ||

| US3133TJFT51 / FREDDIE MAC FHR 2129 F | 0,00 | 0,00 | 0,0007 | -0,0001 | ||

| US3128Q2FY42 / Freddie Mac Non Gold Pool | 0,00 | 0,00 | 0,0007 | -0,0000 | ||

| US31385WTG41 / FNMA POOL 555051 FN 11/32 FLOATING VAR | 0,00 | 0,00 | 0,0007 | -0,0001 | ||

| US31396L4R81 / FNMA, REMIC, Series 2006-118, Class A1 | 0,00 | 0,00 | 0,0007 | -0,0000 | ||

| US3128NGBF16 / FED HM LN PC POOL 1H1238 FH 12/34 FLOATING VAR | 0,00 | 0,00 | 0,0007 | -0,0000 | ||

| US3128S4AA56 / FED HM LN PC POOL 1Q0001 FH 01/36 FLOATING VAR | 0,00 | 0,00 | 0,0007 | -0,0003 | ||

| US36229RJJ95 / GSR MORTGAGE LOAN TRUST GSR 2003 1 A2 | 0,00 | 0,00 | 0,0007 | -0,0000 | ||

| US3128NCB370 / FED HM LN PC POOL 1G0058 FH 01/35 FLOATING VAR | 0,00 | 0,00 | 0,0007 | -0,0000 | ||

| US31392RUA75 / FREDDIE MAC FHR 2490 FB | 0,00 | 0,00 | 0,0007 | -0,0004 | ||

| US31392EVN74 / Fannie Mae REMICS | 0,00 | 0,00 | 0,0006 | -0,0000 | ||

| US31386G7J63 / FNMA | 0,00 | 0,00 | 0,0006 | -0,0000 | ||

| US939336PL10 / Washington Mutual MSC Mortgage Pass-Through Certificates Series 2003-AR1 Trust | 0,00 | 0,00 | 0,0006 | -0,0000 | ||

| US31406L2T47 / FNMA POOL 813586 FN 03/35 FLOATING VAR | 0,00 | -100,00 | 0,0006 | -0,0000 | ||

| US3128JMN943 / FED HM LN PC POOL 1B2315 FH 09/35 FLOATING VAR | 0,00 | -100,00 | 0,0006 | -0,0000 | ||

| US36225CMN38 / Ginnie Mae II Pool | 0,00 | -100,00 | 0,0006 | -0,0001 | ||

| US31406MEP77 / Fannie Mae Pool | 0,00 | 0,0005 | -0,0000 | |||

| US31410FWC57 / FNMA | 0,00 | -100,00 | 0,0005 | -0,0002 | ||

| US31396J4X04 / FREDDIE MAC REMICS | 0,00 | 0,0005 | -0,0000 | |||

| US31400AMS41 / Fannie Mae Pool | 0,00 | 0,0005 | -0,0000 | |||

| US31336CLF85 / FED HM LN PC POOL 972126 FH 08/33 FLOATING VAR | 0,00 | 0,0005 | -0,0000 | |||

| US31410F3M54 / FNMA | 0,00 | 0,0005 | -0,0000 | |||

| US31402RTX79 / FNMA POOL 735966 FN 10/33 FLOATING VAR | 0,00 | 0,0005 | -0,0000 | |||

| US31404GV406 / Fannie Mae Pool | 0,00 | 0,0005 | -0,0000 | |||

| US31404WPZ31 / FANNIE MAE 4.402% 06/01/2034 FNMA ARM | 0,00 | 0,0004 | -0,0000 | |||

| US3128NVLF72 / FED HM LN PC POOL 1K1226 FH 02/36 FLOATING VAR | 0,00 | 0,0004 | -0,0000 | |||

| US31402CUL44 / FANNIE MAE 3.853% 07/01/2033 FAR FNARM | 0,00 | -100,00 | 0,0004 | -0,0002 | ||

| US3133T83D73 / FREDDIE MAC FHR 1885 FA | 0,00 | -100,00 | 0,0004 | -0,0002 | ||

| US31391MFS70 / FNMA POOL 670777 FN 11/32 FLOATING VAR | 0,00 | 0,0004 | -0,0002 | |||

| US3128QJ4L75 / FED HM LN PC POOL 1G1727 FH 07/35 FLOATING VAR | 0,00 | 0,0004 | -0,0000 | |||

| US31391MLM37 / FNMA POOL 670932 FN 01/33 FLOATING VAR | 0,00 | 0,0004 | -0,0000 | |||

| US31400HFH12 / Fannie Mae Pool | 0,00 | 0,0004 | -0,0000 | |||

| US31387UEQ04 / FNMA POOL 594243 FN 12/30 FLOATING VAR | 0,00 | 0,0004 | -0,0000 | |||

| US3128QJ5H54 / FED HM LN PC POOL 1G1748 FH 09/35 FLOATING VAR | 0,00 | 0,0003 | -0,0000 | |||

| US31407CEH60 / FNMA POOL 826436 FN 07/35 FLOATING VAR | 0,00 | -100,00 | 0,0003 | -0,0011 | ||

| US31342AXG92 / FED HM LN PC POOL 780679 FH 07/33 FLOATING VAR | 0,00 | 0,0003 | -0,0000 | |||

| US466247EH29 / JP MORGAN MORTGAGE TRUST JPMMT 2004 A4 2A2 | 0,00 | 0,0003 | -0,0000 | |||

| US31378C4V17 / FANNIE MAE 2.145% 07/01/2027 FNMA ARM | 0,00 | 0,0003 | -0,0001 | |||

| US31339NC798 / Freddie Mac REMICS | 0,00 | 0,0003 | -0,0001 | |||

| US31402TAD72 / FNMA POOL 737204 FN 08/33 FLOATING VAR | 0,00 | 0,0003 | -0,0000 | |||

| US17307GKZ09 / Citigroup Mortgage Loan Trust Inc | 0,00 | 0,0003 | -0,0000 | |||

| US31349UB562 / FHLMC | 0,00 | 0,0003 | -0,0000 | |||

| US31403CZ879 / FNMA POOL 745167 FN 01/36 FLOATING VAR | 0,00 | 0,0002 | -0,0000 | |||

| US31389AZ221 / FNMA | 0,00 | 0,0002 | -0,0000 | |||

| US31389AZ551 / FANNIE MAE 2.145% 01/01/2038 FAR FNARM | 0,00 | 0,0002 | -0,0000 | |||

| RFR USD SOFR/3.75000 12/18/24-10Y LCH / DIR (EZ7K2W20N534) | 0,00 | 0,0002 | 0,0004 | |||

| RFR USD SOFR/3.75000 12/18/24-10Y LCH / DIR (EZ7K2W20N534) | 0,00 | 0,0002 | 0,0004 | |||

| US36202K3W33 / GNMA II POOL 008913 G2 07/26 FLOATING VAR | 0,00 | 0,0002 | -0,0001 | |||

| US31408XS689 / FNMA POOL 863741 FN 12/35 FLOATING VAR | 0,00 | 0,0002 | -0,0000 | |||

| US69547MAD83 / PAID_22-3 | 0,00 | -100,00 | 0,0002 | -0,0351 | ||

| US31406KA266 / FANNIE MAE 4.307% 04/01/2035 FNMA ARM | 0,00 | 0,0002 | -0,0000 | |||

| US05948XBS99 / BANC OF AMERICA MORTGAGE SECUR BOAMS 2003 D 2A1 | 0,00 | 0,0002 | -0,0000 | |||

| US31407CD950 / FNMA POOL 826428 FN 07/35 FLOATING VAR | 0,00 | 0,0002 | -0,0000 | |||

| US31403DUV99 / FNMA POOL 745896 FN 09/36 FLOATING VAR | 0,00 | 0,0002 | -0,0000 | |||

| US31385XCM74 / FNMA POOL 555476 FN 04/33 FLOATING VAR | 0,00 | 0,0001 | -0,0000 | |||

| US31342ASB60 / FED HM LN PC POOL 780514 FH 05/33 FLOATING VAR | 0,00 | 0,0001 | -0,0000 | |||

| RFR USD SOFR/3.52500 03/02/23-7Y LCH / DIR (EZMHJQBYLCQ2) | 0,00 | 0,0001 | 0,0005 | |||

| RFR USD SOFR/3.52500 03/02/23-7Y LCH / DIR (EZMHJQBYLCQ2) | 0,00 | 0,0001 | 0,0005 | |||

| US3133THXQ54 / FREDDIE MAC FHR 2115 C | 0,00 | 0,0001 | -0,0000 | |||

| US939335N840 / Washington Mutual Mortgage Securities Corp. | 0,00 | 0,0001 | -0,0000 | |||

| US3128JRCM68 / FED HM LN PC POOL 847276 FH 04/34 FLOATING VAR | 0,00 | 0,0001 | -0,0000 | |||

| US07384MSH69 / Bear Stearns ARM Trust 2002-11 | 0,00 | 0,0001 | -0,0000 | |||

| US31349TWL15 / Freddie Mac Non Gold Pool | 0,00 | 0,0001 | -0,0000 | |||

| US07384MUM27 / BEAR STEARNS ADJUSTABLE RATE M BSARM 2003 3 2A2 | 0,00 | 0,0001 | -0,0000 | |||

| US07384MYY29 / BEAR STEARNS ADJUSTABLE RATE M BSARM 2003 7 8A | 0,00 | 0,0000 | -0,0000 | |||

| CMBX.NA.AAA.9 SP GST / DCR (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| US31403DLG24 / FNMA POOL 745627 FN 04/36 FLOATING VAR | 0,00 | 0,0000 | -0,0000 | |||

| US07386HXZ99 / BEAR STEARNS ALT A TRUST BALTA 2005 9 21A1 | 0,00 | 0,0000 | -0,0000 | |||