Statistiques de base

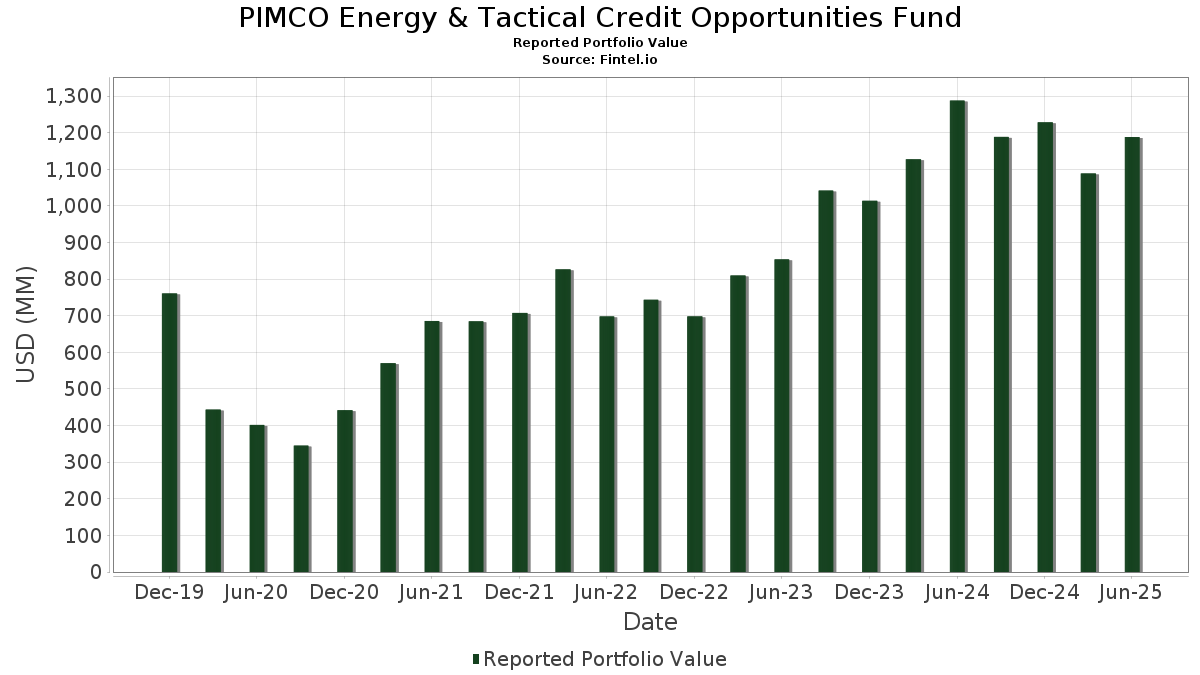

| Valeur du portefeuille | $ 1 188 384 970 |

| Positions actuelles | 429 |

Dernières positions, performances, ASG (à partir des dépôts 13F, 13D)

PIMCO Energy & Tactical Credit Opportunities Fund a déclaré un total de 429 positions dans ses derniers dépôts auprès de la SEC. La valeur la plus récente du portefeuille est calculée à 1 188 384 970 USD. Les actifs sous gestion réels (ASG) sont cette valeur plus les liquidités (qui ne sont pas divulguées). Les principales positions de PIMCO Energy & Tactical Credit Opportunities Fund sont VENTURE GLOBAL HOLDINGS CLS A EQTYVG921 (US:902NJP004) , PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , CIT Mortgage Loan Trust 2007-1 (US:US12559QAH56) , MPLX LP - Limited Partnership (US:MPLX) , and Energy Transfer LP - Limited Partnership (US:ET) . Les nouvelles positions de PIMCO Energy & Tactical Credit Opportunities Fund incluent PIMCO PRV SHORT TERM FLT III MUTUAL FUND (US:US72201W1541) , CIT Mortgage Loan Trust 2007-1 (US:US12559QAH56) , BSABS 2007-HE1 2M1 (US:US07389UAT60) , CXHE 2006-A M4 (US:US15231AAH95) , and HarborView Mortgage Loan Trust 2006-1 (US:US41161PA603) .

Meilleures augmentations ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 15,70 | 244,59 | 20,4419 | 6,6765 | |

| 138,07 | 11,5393 | 2,4658 | ||

| 9,21 | 0,7699 | 0,7699 | ||

| 8,02 | 0,6704 | 0,6704 | ||

| 9,85 | 0,8229 | 0,5438 | ||

| 8,06 | 0,6736 | 0,3794 | ||

| 5,32 | 0,4447 | 0,3466 | ||

| 5,71 | 0,4770 | 0,3279 | ||

| 3,71 | 0,3101 | 0,3101 | ||

| 3,66 | 0,3058 | 0,3058 |

Principales baisses ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| -50,47 | -4,2184 | -4,2184 | ||

| -42,82 | -3,5784 | -3,5784 | ||

| 2,42 | 43,80 | 3,6608 | -2,2864 | |

| -26,84 | -2,2433 | -2,2433 | ||

| -23,87 | -1,9953 | -1,9953 | ||

| 1,15 | 35,62 | 2,9770 | -1,9837 | |

| -22,29 | -1,8630 | -1,8630 | ||

| -19,83 | -1,6573 | -1,6573 | ||

| 0,92 | 47,16 | 3,9418 | -1,5330 | |

| -18,04 | -1,5079 | -1,5079 |

Déclarations 13F et dépôts de fonds

Ce formulaire a été déposé le 2025-08-29 pour la période de déclaration 2025-06-30. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau pour débloquer les données premium et exporter vers Excel ![]() .

.

| Titre | Type | Prix moyen de l'action | Actions (en millions) |

ΔActions (%) |

ΔActions (%) |

Valeur ($ en millions) |

Portefeuille (%) |

ΔPortefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 902NJP004 / VENTURE GLOBAL HOLDINGS CLS A EQTYVG921 | 15,70 | 0,00 | 244,59 | 55,78 | 20,4419 | 6,6765 | |||

| US72201W1541 / PIMCO PRV SHORT TERM FLT III MUTUAL FUND | 138,07 | 33,41 | 11,5393 | 2,4658 | |||||

| US12559QAH56 / CIT Mortgage Loan Trust 2007-1 | 69,42 | -0,52 | 5,8019 | -0,3159 | |||||

| MPLX / MPLX LP - Limited Partnership | 0,92 | -21,53 | 47,16 | -24,47 | 3,9418 | -1,5330 | |||

| ET / Energy Transfer LP - Limited Partnership | 2,42 | -33,79 | 43,80 | -35,43 | 3,6608 | -2,2864 | |||

| ENB / Enbridge Inc. | 0,79 | -12,52 | 36,04 | -10,37 | 3,0122 | -0,5134 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 1,15 | -30,69 | 35,62 | -37,05 | 2,9770 | -1,9837 | |||

| US07389UAT60 / BSABS 2007-HE1 2M1 | 21,49 | 0,07 | 1,7964 | -0,0866 | |||||

| TRP / TC Energy Corporation | 0,37 | -23,87 | 18,10 | -21,30 | 1,5125 | -0,5034 | |||

| BEAR STEARNS ASSET BACKED SECU BSABS 2005 AQ2 M2 / ABS-MBS (US0738792W72) | 17,56 | -1,85 | 1,4674 | -0,1010 | |||||

| US15231AAH95 / CXHE 2006-A M4 | 14,94 | 0,15 | 1,2484 | -0,0592 | |||||

| CITIGROUP MORTGAGE LOAN TRUST CMLTI 2018 RP1 M2 144A / ABS-MBS (US17326QAC78) | 14,89 | 1,50 | 1,2442 | -0,0417 | |||||

| US41161PA603 / HarborView Mortgage Loan Trust 2006-1 | 13,05 | -0,53 | 1,0909 | -0,0596 | |||||

| WES / Western Midstream Partners, LP - Limited Partnership | 0,34 | 7,26 | 13,03 | 1,35 | 1,0889 | -0,0382 | |||

| US07400HAA14 / Bear Stearns Mortgage Funding Trust 2006-AR3 | 12,51 | -0,02 | 1,0454 | -0,0514 | |||||

| TWITTER INC TERM LOAN / LON (US90184NAG34) | 9,85 | 209,23 | 0,8229 | 0,5438 | |||||

| US362334PF56 / GSAMP Trust, Series 2006-FM1, Class A1 | 9,70 | -0,11 | 0,8104 | -0,0407 | |||||

| US73316TAD46 / POPLR 2006-E M1 | 9,29 | 0,64 | 0,7767 | -0,0329 | |||||

| US81377XAA00 / Securitized Asset Backed Receivables LLC Trust 2006-WM4 | 9,21 | 0,7699 | 0,7699 | ||||||

| US362334EE01 / GSAMP Trust 2006-NC1 | 9,08 | 0,08 | 0,7590 | -0,0367 | |||||

| MF1 MULTIFAMILY HOUSING MORTGA MF1 2024 FL14 A 144A / ABS-CBDO (US55416AAA79) | 9,04 | 0,24 | 0,7554 | -0,0351 | |||||

| US91889FAC59 / Valaris Ltd | 8,06 | 140,17 | 0,6736 | 0,3794 | |||||

| ALIGNED DATA CENTERS INTER LP 2024 TERM LOAN / LON (BA000JN59) | 8,02 | 0,6704 | 0,6704 | ||||||

| HESM / Hess Midstream LP | 0,21 | -49,37 | 7,97 | -53,90 | 0,6658 | -0,8490 | |||

| LC AHAB US BIDCO LLC TERM LOAN B / LON (US50180PAB76) | 7,96 | 61,02 | 0,6653 | 0,2318 | |||||

| VMED O2 UK FINANCING I VMED O2 UK FINANCING I / DBT (US92858RAD26) | 7,91 | 3,67 | 0,6608 | -0,0079 | |||||

| W1EC34 / WEC Energy Group, Inc. - Depositary Receipt (Common Stock) | 7,91 | 0,06 | 0,6607 | -0,0319 | |||||

| SUN / Sunoco LP - Limited Partnership | 0,15 | -48,90 | 7,84 | -52,83 | 0,6552 | -0,8021 | |||

| FREDDIE MAC SCRT SCRT 2019 3 BXS / ABS-MBS (US35563PMB21) | 7,62 | 5,05 | 0,6366 | 0,0009 | |||||

| US863576EJ91 / STRUCTURED ASSET SECURITIES CORP MORTGAGE L SER 2006-GEL1 CL M3 V/R REGD 144A P/P 2.41825000 | 7,36 | -3,65 | 0,6149 | -0,0547 | |||||

| US30247DAA90 / First Franklin Mortgage Loan Trust 2006-FF13 | 7,26 | -1,36 | 0,6065 | -0,0385 | |||||

| OCS GROUP HOLDINGS LTD GBP TERM LOAN B / LON (BA000BQB0) | 6,85 | 6,15 | 0,5726 | 0,0067 | |||||

| 53219LAH2 / LifePoint Health, Inc. Bond | 6,57 | 1,69 | 0,5493 | -0,0174 | |||||

| BOPARAN FINANCE PLC SR SECURED 144A 11/29 9.375 / DBT (XS2928675060) | 6,42 | 14,43 | 0,5361 | 0,0446 | |||||

| VARSITY BRANDS INC 2025 TERM LOAN / LON (US92227QAF37) | 6,29 | 1,68 | 0,5258 | -0,0167 | |||||

| US82983MAB63 / Sitio Royalties Operating Partnership LP | 6,29 | 1,73 | 0,5254 | -0,0164 | |||||

| 743424AA1 / Proofpoint, Inc. 1.25% Convertible Bond due 2018-12-15 | 6,08 | 0,13 | 0,5082 | -0,0242 | |||||

| US126670MK12 / Countrywide Asset-Backed Certificates | 5,91 | 0,66 | 0,4942 | -0,0208 | |||||

| CENTRAL PARENT INC 2024 TERM LOAN B / LON (US15477BAE74) | 5,91 | -24,37 | 0,4941 | -0,1912 | |||||

| PANAMA INFRASTRUCTURE SR SECURED 144A 04/32 0.00000 / DBT (US69828QAD97) | 5,91 | 0,91 | 0,4935 | -0,0195 | |||||

| US83613FAC59 / SOUNDVIEW HOME EQUITY LOAN TRU SVHE 2007 OPT5 2A2 | 5,82 | 19,55 | 0,4861 | 0,0595 | |||||

| FR0014000O87 / Ubisoft Entertainment SA | 5,74 | 43,04 | 0,4798 | 0,1279 | |||||

| US65505PAA57 / Noble Finance II LLC | 5,71 | 235,65 | 0,4770 | 0,3279 | |||||

| US18972EAB11 / Clydesdale Acquisition Holdings, Inc. | 5,63 | 0,86 | 0,4705 | -0,0189 | |||||

| US12543DBG43 / CHS/Community Health Systems Inc | 5,62 | 3,12 | 0,4695 | -0,0081 | |||||

| KRAKEN OIL + GAS PARTNER KRAKEN OIL + GAS PARTNER / DBT (US50076PAA66) | 5,60 | 0,61 | 0,4684 | -0,0200 | |||||

| JETBLUE AIRWAYS/LOYALTY JETBLUE AIRWAYS/LOYALTY / DBT (US476920AA15) | 5,55 | -1,47 | 0,4638 | -0,0299 | |||||

| COREWEAVE CMPTE ACQU CO II LLC 2024 DELAYED DRAW TERM LOAN / LON (BA0004JK4) | 5,53 | 1,88 | 0,4619 | -0,0137 | |||||

| P2OD34 / Insulet Corporation - Depositary Receipt (Common Stock) | 5,32 | 375,85 | 0,4447 | 0,3466 | |||||

| US87168TAB70 / Syniverse Holdings, Inc. 2022 Term Loan | 5,26 | -3,51 | 0,4394 | -0,0383 | |||||

| HARP FINCO LIMITED GBP TERM LOAN / LON (BA0008GH5) | 5,21 | 6,40 | 0,4351 | 0,0061 | |||||

| FREDDIE MAC SCRT SCRT 2024 2 BXS 144A / ABS-MBS (US35563PYJ29) | 5,19 | 0,97 | 0,4341 | -0,0169 | |||||

| FTAIM / FTAI Aviation Ltd. - Preferred Stock | 5,18 | 1,89 | 0,4330 | -0,0128 | |||||

| US74166NAA28 / ADT Corp/The | 5,09 | 2,79 | 0,4255 | -0,0088 | |||||

| US753272AA11 / Rand Parent LLC | 5,02 | 1,35 | 0,4200 | -0,0147 | |||||

| APRO LLC 2024 TERM LOAN B / LON (US03834XAP87) | 4,95 | -9,32 | 0,4140 | -0,0649 | |||||

| US12433UAQ85 / BX TRUST 2018-GW SER 2018-GW CL F V/R REGD 144A P/P 4.18538000 | 4,94 | -1,04 | 0,4129 | -0,0248 | |||||

| US87169DAB10 / Syneos Health (INC Research/inVentiv Health) T/L B (09/23) | 4,91 | 3,02 | 0,4102 | -0,0074 | |||||

| DATABRICKS INC LAST OUT TERM LOAN / LON (BA000D206) | 4,88 | 0,25 | 0,4078 | -0,0189 | |||||

| US35563PPP89 / Seasoned Credit Risk Transfer Trust Series 2020-1 | 4,86 | 3,85 | 0,4062 | -0,0041 | |||||

| US73108RAB42 / Polaris Newco LLC USD Term Loan B | 4,83 | 1,43 | 0,4036 | -0,0138 | |||||

| MODENA BUYER LLC TERM LOAN / LON (US60753DAC83) | 4,80 | -0,76 | 0,4015 | -0,0229 | |||||

| US70069FLZ89 / PPSI 2005-WCW3 M4 | 4,77 | 1,45 | 0,3987 | -0,0135 | |||||

| ASCENT RESOURCES/ARU FIN SR UNSECURED 144A 10/32 6.625 / DBT (US04364VAX10) | 4,58 | 2,21 | 0,3830 | -0,0100 | |||||

| US46650GAG55 / J.P. Morgan Chase Commercial Mortgage SecuritiesTrust 2018-MINN | 4,56 | 2,71 | 0,3807 | -0,0082 | |||||

| BDO USA P C 2024 TERM LOAN A / LON (BA000BL33) | 4,48 | -0,27 | 0,3746 | -0,0194 | |||||

| US893830BL24 / Transocean Inc | 4,44 | -1,09 | 0,3707 | -0,0225 | |||||

| US12116LAE92 / Burford Capital Global Finance LLC | 4,32 | -0,09 | 0,3611 | -0,0181 | |||||

| US36261NAA54 / GYP Holdings III Corp | 4,31 | 7,13 | 0,3605 | 0,0074 | |||||

| US00442EAH80 / ACE SECURITIES CORP. ACE 2006 NC3 A2D | 4,31 | -2,56 | 0,3600 | -0,0276 | |||||

| 948FWKII5 / STEENBOK LUX FINCO 2 SARL 2023 EUR PIK TL A2 RESTRUCTURE | 4,29 | 6,45 | 0,3590 | 0,0052 | |||||

| JP MORGAN MORTGAGE ACQUISITION JPMAC 2006 CH1 M8 / ABS-MBS (US46629TAN00) | 4,29 | 0,73 | 0,3586 | -0,0148 | |||||

| PDM / Piedmont Realty Trust, Inc. | 4,22 | 1,42 | 0,3523 | -0,0121 | |||||

| US362334AA25 / ASSET BACKED SECURITY | 4,18 | -1,32 | 0,3493 | -0,0221 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 4,15 | 2,27 | 0,3471 | -0,0089 | |||||

| US90290PAS39 / U.S. Renal Care, Inc., 1st Lien Term Loan C | 4,13 | 1,25 | 0,3448 | -0,0125 | |||||

| GSAA HOME EQUITY TRUST GSAA 2006 16 A3A / ABS-MBS (US362256AC35) | 4,10 | -1,89 | 0,3423 | -0,0237 | |||||

| US45827MAA53 / Intelligent Packaging Ltd Finco Inc / Intelligent Packaging Ltd Co-Issuer LLC | 4,00 | 2,70 | 0,3343 | -0,0072 | |||||

| GOLDEN STATE FOOD LLC TERM LOAN B / LON (US38121NAC74) | 3,99 | -0,08 | 0,3338 | -0,0167 | |||||

| GBT US III LLC 2025 TERM LOAN B / LON (US36154HAC43) | 3,99 | 0,40 | 0,3336 | -0,0150 | |||||

| PHOENIX GUARANTOR INC 2024 TERM LOAN B / LON (US71913BAK89) | 3,99 | 0,73 | 0,3333 | -0,0138 | |||||

| PROJECT ALPHA INTMDT HLDNG INC 2024 1ST LIEN TERM LOAN B / LON (US74339DAN84) | 3,98 | 0,45 | 0,3329 | -0,0148 | |||||

| FR0013524865 / Auchan Holding SA | 3,98 | 10,67 | 0,3328 | 0,0173 | |||||

| MTDR / Matador Resources Company | 3,98 | 1,76 | 0,3327 | -0,0103 | |||||

| PRIMO BRANDS CORPORATION 2025 TERM LOAN B / LON (US89678QAD88) | 3,97 | 0,76 | 0,3317 | -0,0136 | |||||

| SUBCALIDORA 2 2024 EUR TERM LOAN / LON (BA0007DG2) | 3,95 | 8,93 | 0,3303 | 0,0122 | |||||

| HOWARD MIDSTREAM ENERGY HOWARD MIDSTREAM ENERGY / DBT (US442722AC80) | 3,89 | 2,66 | 0,3254 | -0,0071 | |||||

| US35563PBM05 / Seasoned Credit Risk Transfer Trust Series 2017-2 | 3,88 | -3,02 | 0,3243 | -0,0265 | |||||

| US92047WAG69 / Valvoline Inc | 3,81 | 4,16 | 0,3181 | -0,0022 | |||||

| POSEIDON BIDCO SASU 2023 EUR TERM LOAN B / LON (953RGXII1) | 3,79 | 5,54 | 0,3170 | 0,0019 | |||||

| US45688CAB37 / Ingevity Corp | 3,72 | 10,67 | 0,3111 | 0,0162 | |||||

| PRS / Promotora de Informaciones, S.A. | 3,71 | 0,3101 | 0,3101 | ||||||

| RESIDENTIAL ASSET MORTGAGE PRO RAMP 2004 RS1 MII2 / ABS-MBS (US760985N986) | 3,71 | -0,16 | 0,3100 | -0,0157 | |||||

| TRUIST INSURANCE HOLDINGS LLC 2024 TERM LOAN B / LON (US89788VAG77) | 3,71 | 0,68 | 0,3097 | -0,0130 | |||||

| SIXTH STREET LENDING PAR SR UNSECURED 144A 07/30 6.125 / DBT (US829932AE25) | 3,67 | 1,19 | 0,3065 | -0,0113 | |||||

| US74922GBA13 / RALI Series 2006-QS14 Trust | 3,66 | 0,3058 | 0,3058 | ||||||

| US362351AB48 / GSAA Home Equity Trust 2006-20 | 3,66 | -1,88 | 0,3055 | -0,0210 | |||||

| DCLI BIDCO LLC 2ND MORTGAGE 144A 11/29 7.75 / DBT (US233104AA67) | 3,65 | -1,62 | 0,3050 | -0,0202 | |||||

| 69511JD28 / PACIFICORP | 3,65 | 2,65 | 0,3048 | -0,0067 | |||||

| US87251RAK95 / TGP Holdings III (Traeger Grills) T/L (6/21) | 3,64 | 56,08 | 0,3039 | 0,0997 | |||||

| US55275NAA90 / MASTR Adjustable Rate Mortgages Trust 2006-OA2 | 3,60 | 0,3012 | 0,3012 | ||||||

| AAT / American Assets Trust, Inc. | 3,60 | -0,08 | 0,3009 | -0,0149 | |||||

| CIA / Champion Iron Limited | 3,55 | 0,2968 | 0,2968 | ||||||

| UNICORN BAY HKD FIXED TERM LOAN A / LON (BA00077Z7) | 3,40 | -11,96 | 0,2843 | -0,0545 | |||||

| US31187LAG86 / FleetPride, Inc. | 3,40 | -0,82 | 0,2840 | -0,0164 | |||||

| US62886EAZ16 / NCR CORPORATION NEW 5.25% 10/01/2030 144A | 3,37 | 0,15 | 0,2817 | -0,0134 | |||||

| US437084VR49 / HEAT 2006-4 M1 | 3,35 | 0,06 | 0,2798 | -0,0136 | |||||

| US46650GAJ94 / J.P. Morgan Chase Commercial Mortgage SecuritiesTrust 2018-MINN | 3,33 | -2,43 | 0,2781 | -0,0209 | |||||

| US76113AAK79 / RACS 2006-KS1 M4 | 3,32 | -0,54 | 0,2771 | -0,0152 | |||||

| US86359PAC41 / Structured Asset Securities Corporation Mortgage Loan Trust | 3,31 | -1,02 | 0,2768 | -0,0165 | |||||

| ILLUMINATE BUYER LLC 2024 1ST LIEN TERM LOAN B / LON (US45232UAG31) | 3,30 | 0,30 | 0,2756 | -0,0127 | |||||

| US958102AR62 / Western Digital Corp | 3,28 | 0,2738 | 0,2738 | ||||||

| US720198AE09 / Piedmont Operating Partnership LP | 3,23 | 2,18 | 0,2701 | -0,0072 | |||||

| US46630BAA44 / JP Morgan Mortgage Acquisition Trust 2006-WMC4 | 3,21 | -0,53 | 0,2685 | -0,0146 | |||||

| ASURION LLC 2025 TERM LOAN B13 / LON (US04649VBE92) | 3,21 | 0,2683 | 0,2683 | ||||||

| US75103AAA34 / Raising Cane's Restaurants LLC | 3,17 | 1 387,79 | 0,2649 | 0,2437 | |||||

| LADDER CAP FIN LLLP/CORP COMPANY GUAR 144A 07/31 7 / DBT (US505742AR75) | 3,14 | 1,88 | 0,2623 | -0,0078 | |||||

| US71677KAA60 / PetSmart Inc / PetSmart Finance Corp | 3,12 | 4,20 | 0,2610 | -0,0018 | |||||

| YINSON PRODUCTION FINANC SR SECURED 144A REGS 05/29 9.6 / DBT (NO0013215509) | 3,12 | -0,67 | 0,2607 | -0,0146 | |||||

| BEAR STEARNS ASSET BACKED SECU BSABS 2006 HE8 2M2 / ABS-MBS (US07388JAT25) | 3,10 | -0,23 | 0,2592 | -0,0133 | |||||

| CAESARS ENTERTAIN INC CAESARS ENTERTAIN INC / DBT (US12769GAC42) | 3,08 | 2,94 | 0,2574 | -0,0049 | |||||

| US12564NAG79 / CLNY Trust 2019-IKPR | 3,03 | 0,66 | 0,2536 | -0,0107 | |||||

| RAISING CANES RESTAURANTS LLC 2024 TERM LOAN B / LON (US75101XAP24) | 3,01 | 0,2519 | 0,2519 | ||||||

| XS2576550672 / Thames Water Utilities Finance plc | 3,01 | -3,65 | 0,2513 | -0,0223 | |||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 3,01 | 0,2512 | 0,2512 | ||||||

| EPIC CRUDE SERVICES LP 2024 TERM LOAN B / LON (US29428XAG51) | 3,00 | -24,98 | 0,2510 | -0,1000 | |||||

| FLORA FOOD MANAGEMENT BV SR SECURED 144A 07/29 6.875 / DBT (XS2849520908) | 2,99 | 8,87 | 0,2502 | 0,0091 | |||||

| ADVISOR GROUP INC 2024 TERM LOAN B / LON (US00775KAK43) | 2,99 | 0,71 | 0,2497 | -0,0104 | |||||

| WATERBRIDGE MIDSTREAM OPR LLC 2024 TERM LOAN B / LON (US94120YAD58) | 2,98 | -25,56 | 0,2487 | -0,1018 | |||||

| CHOBANI LLC 2025 REPRICED TERM LOAN B / LON (US17026YAK55) | 2,97 | 0,10 | 0,2482 | -0,0120 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 2,96 | 10,34 | 0,2472 | 0,0122 | |||||

| COTIVITI CORPORATION 2024 TERM LOAN / LON (US22164MAB37) | 2,95 | 1,44 | 0,2468 | -0,0084 | |||||

| ABSLT DE 2024 LLC CLN 2024 1 05/33 1 / DBT (US00401BAB62) | 2,95 | 1,87 | 0,2464 | -0,0074 | |||||

| TREASURY BILL 09/25 0.00000 / DBT (US912797PW16) | 2,93 | 0,2452 | 0,2452 | ||||||

| US05610FAF45 / BX Commercial Mortgage Trust 2022-AHP | 2,93 | 2,23 | 0,2451 | -0,0064 | |||||

| CLOVER HOLDINGS 2 LLC FIXED TERM LOAN B / LON (US18914DAC20) | 2,93 | 0,2451 | 0,2451 | ||||||

| US05508WAB19 / B&G Foods, Inc. | 2,92 | 0,2438 | 0,2438 | ||||||

| TIDL WSTE + RCYLNG HOLDIG LLC TERM LOAN B / LON (US88636PAK75) | 2,91 | 0,28 | 0,2435 | -0,0113 | |||||

| US92676XAG25 / Viking Cruises Ltd | 2,91 | 0,2432 | 0,2432 | ||||||

| GTN / Gray Media, Inc. | 2,90 | 0,2426 | 0,2426 | ||||||

| US362334FK51 / GSAA Home Equity Trust 2006-4 | 2,89 | -1,60 | 0,2418 | -0,0160 | |||||

| US650929AA08 / Newfold Digital Holdings Group Inc | 2,87 | -7,93 | 0,2398 | -0,0334 | |||||

| XS0093312550 / ANGLIAN WAT FIN | 2,86 | 7,39 | 0,2392 | 0,0055 | |||||

| S2TW34 / Starwood Property Trust, Inc. - Depositary Receipt (Common Stock) | 2,84 | 2,60 | 0,2376 | -0,0053 | |||||

| US14835JAQ31 / CAST and CREW TERM B INCR 1LN 12/30/2028 | 2,83 | -2,11 | 0,2364 | -0,0169 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 2,81 | 12,11 | 0,2346 | 0,0151 | |||||

| STRUCTURED ASSET SECURITIES CO SASC 2007 TC1 M5 144A / ABS-MBS (US86364GAG82) | 2,79 | 0,65 | 0,2333 | -0,0098 | |||||

| US84748EAF79 / SPECIALTY BUILDING TERM B 1LN 10/15/2028 | 2,78 | 0,2322 | 0,2322 | ||||||

| XS2591021113 / Yorkshire Water Finance PLC | 2,73 | 7,73 | 0,2283 | 0,0060 | |||||

| DRYDEN SENIOR LOAN FUND DRSLF 2025 123A SUB 144A / ABS-CBDO (US26253PAC77) | 2,73 | 1,53 | 0,2279 | -0,0075 | |||||

| US00252FAL58 / AAMES MORTGAGE INVESTMENT TRUS AMIT 2004 1 M7 | 2,71 | 1,69 | 0,2263 | -0,0071 | |||||

| GFL ENVIRONMENTAL INC 2025 TERM LOAN B / LON (US36257SAB88) | 2,71 | 0,2261 | 0,2261 | ||||||

| RAVEN ACQUISITION HOLDINGS LLC TERM LOAN B / LON (US75419XAC83) | 2,70 | 0,86 | 0,2257 | -0,0090 | |||||

| FRONTIER COMMUNICATIONS CORP 2025 TERM LOAN B / LON (US35906EAU47) | 2,69 | -0,15 | 0,2249 | -0,0113 | |||||

| GATEWY CSINS + ENTRTINMNT LTD 2024 TERM LOAN B / LON (BA000DCX3) | 2,65 | -1,16 | 0,2212 | -0,0136 | |||||

| NORTHUMBRIAN WATER FIN COMPANY GUAR REGS 02/31 4.5 / DBT (XS2585804946) | 2,64 | 8,72 | 0,2210 | 0,0078 | |||||

| DYE + DURHAM LTD 04/29 8.625 / DBT (US267486AA63) | 2,62 | 1,51 | 0,2188 | -0,0073 | |||||

| DIVERSIFIED GAS + OIL CO SR SECURED 144A REGS 04/29 9.7 / DBT (NO0013513606) | 2,58 | 133,09 | 0,2155 | 0,1185 | |||||

| US17326QAA13 / Citigroup Mortgage Loan Trust Inc | 2,58 | -13,93 | 0,2154 | -0,0471 | |||||

| COLLEGE AVE STUDENT LOANS CASL 2024 A R 144A / ABS-O (US19424R1086) | 2,57 | -3,13 | 0,2149 | -0,0178 | |||||

| MITER BRANDS ACQUISITION 04/32 6.75 / DBT (US60672JAA79) | 2,57 | 3,47 | 0,2144 | -0,0029 | |||||

| PRIMO / TRITON WATER HLD COMPANY GUAR 144A 04/29 6.25 / DBT (US74168RAC79) | 2,52 | 0,96 | 0,2106 | -0,0082 | |||||

| MI WINDOWS AND DOORS LLC 2024 TERM LOAN B2 / LON (US55336CAK80) | 2,48 | 1,68 | 0,2076 | -0,0066 | |||||

| US195325EM30 / Colombia Government International Bond | 2,48 | -0,28 | 0,2074 | -0,0108 | |||||

| US59981TAL98 / MILL CITY MORTGAGE LOAN TRUST 2019-GS2 SER 2019-GS2 CL M3 V/R REGD 144A P/P 3.25000000 | 2,45 | 0,53 | 0,2046 | -0,0089 | |||||

| US71360HAB33 / PERATON CORP | 2,44 | 5,48 | 0,2043 | 0,0012 | |||||

| IRB / IRB Infrastructure Developers Limited | 2,41 | -0,70 | 0,2013 | -0,0113 | |||||

| DYE AND DURHAM CORPORATION 2024 USD TERM LOAN B / LON (XAC3117CAB00) | 2,40 | 0,34 | 0,2003 | -0,0091 | |||||

| GLOBAL MEDICAL RESPONSE INC 2024 PIK TERM LOAN / LON (US00169QAG47) | 2,38 | 0,42 | 0,1990 | -0,0089 | |||||

| APEX CREDIT CLO LLC APEXC 2021 2A SUB 144A / ABS-CBDO (US58406DAC39) | 2,34 | -14,90 | 0,1957 | -0,0456 | |||||

| US026930AA57 / American Home Mortgage Assets Trust 2007-2 | 2,30 | 0,1926 | 0,1926 | ||||||

| TENEO HOLDINGS LLC 2024 TERM LOAN B / LON (US88033CAM10) | 2,30 | -0,43 | 0,1919 | -0,0050 | |||||

| US59980MAK71 / MILL CITY MORTGAGE LOAN TRUST 2018-2 SER 2018-2 CL B1 V/R REGD 144A P/P 3.75000000 | 2,28 | 0,48 | 0,1907 | -0,0083 | |||||

| US12564NAN21 / CLNY TRUST 2019-IKPR SER 2019-IKPR CL E V/R REGD 144A P/P 0.00000000 | 2,27 | 0,80 | 0,1898 | -0,0077 | |||||

| QUIKRETE HOLDINGS INC SR SECURED 144A 03/32 6.375 / DBT (US74843PAA84) | 2,26 | 2,17 | 0,1892 | -0,0051 | |||||

| DUN + BRADSTREET CORPOR THE 2025 TERM LOAN / LON (BA000K739) | 2,25 | 0,1880 | 0,1880 | ||||||

| DEUTSCHE BANK REPO REPO / RA (000000000) | 2,20 | 0,1839 | 0,1839 | ||||||

| US35563PEX33 / Seasoned Credit Risk Transfer Trust Series 2018-1 | 2,19 | 8,79 | 0,1832 | 0,0066 | |||||

| JP MORGAN MORTGAGE ACQUISITION JPMAC 2006 WMC3 A1MZ / ABS-MBS (US46629KAB52) | 2,19 | -2,49 | 0,1831 | -0,0139 | |||||

| USN6000DAA11 / Mong Duong Finance Holdings BV | 2,19 | -10,41 | 0,1827 | -0,0312 | |||||

| US12656TAB44 / CSMC 2021-RPL2Trust | 2,15 | -2,68 | 0,1793 | -0,0140 | |||||

| STONEPEAK NILE PARENT LLC TERM LOAN B / LON (US86184XAB01) | 2,11 | 0,72 | 0,1763 | -0,0073 | |||||

| RAVEN ACQUISITION HOLDIN SR SECURED 144A 11/31 6.875 / DBT (US75420NAA19) | 2,11 | 2,98 | 0,1760 | -0,0033 | |||||

| RESIDENTIAL ASSET SECURITIES C RASC 2005 EMX2 M6 / ABS-MBS (US76110W2M78) | 2,10 | -10,30 | 0,1754 | -0,0298 | |||||

| NOMURA ASSET ACCEPTANCE CORPOR NAA 2006 AF2 1A5 / ABS-MBS (US65536VAE74) | 2,10 | -2,60 | 0,1751 | -0,0135 | |||||

| US36256BAC46 / GS MORTGAGE-BACKED SECURITIES TRUST 2018-RPL1 SER 2018-RPL1 CL A1A REGD 144A P/P 3.75000000 | 2,08 | -4,37 | 0,1736 | -0,0168 | |||||

| US02156LAH42 / Altice France SA/France | 2,08 | 0,1734 | 0,1734 | ||||||

| KGS / Kodiak Gas Services, Inc. | 2,07 | 1,47 | 0,1730 | -0,0059 | |||||

| ELO SACA SR UNSECURED REGS 04/28 5.875 / DBT (FR001400PIA0) | 2,03 | 0,1698 | 0,1698 | ||||||

| SPRUCE BIDCO II INC TERM LOAN / LON (BA000FPP1) | 2,00 | -0,55 | 0,1668 | -0,0092 | |||||

| US83611DAD03 / Soundview Home Loan Trust 2006-NLC1 | 1,97 | -1,89 | 0,1645 | -0,0114 | |||||

| US16165YAS19 / CHASEFLEX TRUST CFLX 2007 M1 2AV3 | 1,94 | 0,1624 | 0,1624 | ||||||

| CHARLES RIVER RE LTD SR UNSECURED 144A 05/31 VAR / DBT (US159873AA63) | 1,93 | -0,41 | 0,1616 | -0,0086 | |||||

| US45660LXM61 / RESIDENTIAL ASSET SECURITIZATI RAST 2005 A10 A3 | 1,92 | -0,83 | 0,1604 | -0,0093 | |||||

| US00191PAB94 / APS Resecuritization Trust, Class 1M | 1,91 | 5,05 | 0,1599 | 0,0002 | |||||

| US195325EL56 / Colombia Government International Bond | 1,91 | -0,05 | 0,1599 | -0,0079 | |||||

| RESIDENTIAL ACCREDIT LOANS, IN RALI 2006 QS12 2A4 / ABS-MBS (US751151AH48) | 1,90 | 0,16 | 0,1585 | -0,0075 | |||||

| XAD7001LAC72 / SCUR-Alpha 1503 GmbH USD Term Loan B1 | 1,88 | 1,08 | 0,1567 | -0,0060 | |||||

| US362341BT57 / GSAMP TRUST GSAMP 2005 HE3 M4 | 1,85 | -3,14 | 0,1548 | -0,0129 | |||||

| US29279UAB26 / ENDURE DIGITAL INC TLB 3.5 | 1,84 | 3,08 | 0,1536 | -0,0027 | |||||

| US66988XAD66 / NovaStar Mortgage Funding Trust, Series 2006-4, Class A2D | 1,83 | -3,90 | 0,1526 | -0,0140 | |||||

| WELLS FARGO HOME EQUITY TRUST WFHET 2004 2 M7 / ABS-MBS (US94980GAU58) | 1,74 | -0,91 | 0,1456 | -0,0085 | |||||

| QUIKRETE HOLDINGS INC 2025 TERM LOAN B / LON (US74839XAL38) | 1,70 | 0,71 | 0,1417 | -0,0058 | |||||

| US17310VAB62 / Citigroup Mortgage Loan Trust 2006-HE3 | 1,68 | 0,1404 | 0,1404 | ||||||

| US52525BAC63 / Lehman XS Trust Series 2007-16N | 1,61 | 0,1345 | 0,1345 | ||||||

| XS2438026366 / Thames Water Utilities Finance PLC | 1,60 | -3,39 | 0,1334 | -0,0115 | |||||

| US61744CJY30 / MSAC 2004-HE9 M6 | 1,53 | 0,07 | 0,1279 | -0,0062 | |||||

| US3622EUAA40 / GSAA Home Equity Trust 2007-2 | 1,53 | -2,74 | 0,1275 | -0,0100 | |||||

| US89175TAA60 / Towd Point Mortgage Trust 2018-4 | 1,52 | -3,85 | 0,1273 | -0,0116 | |||||

| WIN WASTE INNOVATIONS HOLDINC 2025 INCREMENTAL TERM LOAN / LON (US38723BAL53) | 1,51 | 0,87 | 0,1258 | -0,0050 | |||||

| US59024VAF67 / Merrill Lynch First Franklin Mortgage Loan Trust Series 2007-3 | 1,50 | 0,1257 | 0,1257 | ||||||

| CITIGROUP MORTGAGE LOAN TRUST CMLTI 2004 OPT1 M6 / ABS-MBS (US17307GJN97) | 1,47 | 0,75 | 0,1228 | -0,0050 | |||||

| 964NDFII9 / COMEXPOSIUM 2019 EUR TERM LOAN B | 1,44 | 11,32 | 0,1200 | 0,0069 | |||||

| CHRD / Chord Energy Corporation | 1,43 | 2,73 | 0,1196 | -0,0026 | |||||

| TREASURY BILL 08/25 0.00000 / DBT (US912797PQ48) | 1,38 | 0,1149 | 0,1149 | ||||||

| US805564QV62 / Saxon Asset Securities Trust, Series 2004-3, Class M1 | 1,33 | -5,67 | 0,1112 | -0,0124 | |||||

| AVENIR ISSUER IV IRLND SR SECURED REGS 10/27 6 / DBT (XS2933572856) | 1,31 | -36,78 | 0,1098 | -0,0724 | |||||

| US320277AF35 / First Franklin Mortgage Loan Trust 2006-FF7 | 1,30 | 1,09 | 0,1085 | -0,0041 | |||||

| US83612KAD37 / Soundview Home Loan Trust, Series 2007-OPT3, Class 2A3 | 1,28 | -27,49 | 0,1072 | -0,0478 | |||||

| XS1555168365 / THAMES WATER UTC | 1,28 | -4,90 | 0,1071 | -0,0111 | |||||

| US16165YAU64 / Aircraft Lease Securitisation Limited | 1,26 | 0,1049 | 0,1049 | ||||||

| MERRILL LYNCH MORTGAGE INVESTO MLMI 2004 WMC4 M2 / ABS-MBS (US59020UDG76) | 1,24 | -6,04 | 0,1040 | -0,0121 | |||||

| US48242WAC01 / KBR Inc | 1,22 | 1,16 | 0,1022 | -0,0038 | |||||

| US46629QAG10 / JP Morgan Mortgage Acquisition Trust 2006-CH2 | 1,19 | -1,90 | 0,0994 | -0,0069 | |||||

| TRT061124T11 / Turkey Government Bond | 1,17 | -4,51 | 0,0974 | -0,0096 | |||||

| RENAISSANCE HOME EQUITY LOAN T RAMC 2004 1 AV1 / ABS-MBS (US759950CA49) | 1,16 | 0,09 | 0,0972 | -0,0047 | |||||

| US12668BEK52 / Alternative Loan Trust | 1,16 | -2,20 | 0,0968 | -0,0070 | |||||

| TREASURY BILL 10/25 0.00000 / DBT (US912797RD17) | 1,14 | 0,0957 | 0,0957 | ||||||

| FREDDIE MAC SCRT SCRT 2019 4 BXS 144A / ABS-MBS (US35563PNE50) | 1,11 | 4,04 | 0,0927 | -0,0008 | |||||

| TREASURY BILL 07/25 0.00000 / DBT (US912797NX17) | 1,08 | 0,0903 | 0,0903 | ||||||

| DATABRICKS INC DELAYED DRAW TERM LOAN / LON (BA000D1C1) | 1,08 | 0,19 | 0,0903 | -0,0042 | |||||

| US542514HD99 / LONG BEACH MORTGAGE LOAN TRUST LBMLT 2004 5 M1 | 1,07 | 0,38 | 0,0894 | -0,0040 | |||||

| US86359B2K67 / Structured Asset Securities Corp Mortgage Loan Trust 2005-2XS | 1,07 | 1,81 | 0,0893 | -0,0027 | |||||

| WINSTON RE LTD UNSECURED 144A 02/31 VAR / DBT (US975660AA93) | 1,06 | 0,00 | 0,0884 | -0,0044 | |||||

| WINSTON RE LTD UNSECURED 144A 02/31 VAR / DBT (US975660AB76) | 1,05 | 0,19 | 0,0879 | -0,0041 | |||||

| ARIS WATER HOLDINGS LLC COMPANY GUAR 144A 04/30 7.25 / DBT (US04041NAA00) | 1,03 | 0,0863 | 0,0863 | ||||||

| CLYDESDALE ACQUISITION SR SECURED 144A 04/32 6.75 / DBT (US18972EAD76) | 1,03 | 1,89 | 0,0858 | -0,0025 | |||||

| US81377NAB01 / Securitized Asset Backed Receivables LLC Trust 2007-BR3 | 1,00 | -2,35 | 0,0834 | -0,0061 | |||||

| ASPIRE BAKERIES HOLDINGS LLC TERM LOAN / LON (BA00008X6) | 1,00 | -0,30 | 0,0832 | -0,0044 | |||||

| ITT HOLDINGS LLC 2024 TERM LOAN B / LON (US45070BAJ44) | 0,98 | -67,21 | 0,0818 | -0,1797 | |||||

| US466317AA25 / J.P. MORGAN CHASE COMMERCIAL MORTGAGE SECURI SER 2022-NLP CL A V/R REGD 144A P/P 1.28650000 | 0,97 | 0,84 | 0,0807 | -0,0032 | |||||

| US46649JAN81 / J.P. Morgan Chase Commercial Mortgage Securities Trust 2018-ASH8 | 0,94 | -0,95 | 0,0787 | -0,0046 | |||||

| FR0013510179 / Auchan Holding SA | 0,93 | 9,79 | 0,0778 | 0,0034 | |||||

| COLLEGE AVE STUDENT LOANS CASL 2024 A D 144A / ABS-O (US19424RAE80) | 0,91 | -3,10 | 0,0759 | -0,0063 | |||||

| TREASURY BILL 09/25 0.00000 / DBT (US912797PX98) | 0,89 | 0,0745 | 0,0745 | ||||||

| SOFTBANK VISION FUND II TRANCHE B1 TERM LOAN / LON (BA000KP88) | 0,89 | 0,0741 | 0,0741 | ||||||

| US12652FAN24 / CSMC Trust 2017-CALI | 0,87 | -16,12 | 0,0730 | -0,0184 | |||||

| ANGEL OAK MORTGAGE TRUST AOMT 2023 7 A1 144A / ABS-MBS (US03466DAA00) | 0,85 | -3,75 | 0,0708 | -0,0063 | |||||

| GSAA HOME EQUITY TRUST GSAA 2006 20 A4A / ABS-MBS (US362351AE86) | 0,85 | -2,20 | 0,0708 | -0,0051 | |||||

| US16165YAR36 / ChaseFlex Trust Series 2007-M1 | 0,84 | 0,0703 | 0,0703 | ||||||

| US442722AB08 / Howard Midstream Energy Partners LLC | 0,84 | 0,72 | 0,0702 | -0,0029 | |||||

| US02156TAB08 / Altice France Holding SA | 0,84 | 18,61 | 0,0699 | 0,0081 | |||||

| STRUCTURED ASSET SECURITIES CO SASC 2005 NC2 M8 / ABS-MBS (US86359DCU90) | 0,83 | 0,60 | 0,0697 | -0,0030 | |||||

| GCAT GCAT 2023 NQM4 A1 144A / ABS-MBS (US36171FAA12) | 0,83 | -1,18 | 0,0697 | -0,0043 | |||||

| CHEPLAPHARM ARZNEIMITTEL CHEPLAPHARM ARZNEIMITTEL / DBT (XS3087221043) | 0,83 | 0,0695 | 0,0695 | ||||||

| US92540CAA53 / Verus Securitization Trust 2023-INV3 | 0,79 | -5,27 | 0,0662 | -0,0071 | |||||

| 945BLZII6 / COMEXPOSIUM 2019 EUR REVOLVER | 0,79 | -37,17 | 0,0662 | -0,0443 | |||||

| US073871BB09 / BALTA 2006-4 23A4 | 0,77 | -1,03 | 0,0646 | -0,0038 | |||||

| US12627HAK68 / CSAB Mortgage-Backed Trust 2006-2 | 0,77 | 0,0644 | 0,0644 | ||||||

| US69380TAA97 / PRPM 2023-NQM3 Trust | 0,77 | -5,30 | 0,0643 | -0,0069 | |||||

| XS2138128314 / ALTICE FRANCE HOLDING S.A. | 0,76 | 28,40 | 0,0639 | 0,0117 | |||||

| LU2445093128 / INTELSAT EMERGENCE SA | 0,02 | 0,00 | 0,73 | 2,37 | 0,0614 | -0,0015 | |||

| US69380GAA76 / PRKCM 2023-AFC4 TRUST SER 2023-AFC4 CL A1 S/UP REGD 144A P/P 7.22500000 | 0,73 | -7,67 | 0,0614 | -0,0084 | |||||

| TOUCAN FINCO LTD/CAN/US SR SECURED 144A 05/30 9.5 / DBT (US89157UAA51) | 0,72 | 0,0599 | 0,0599 | ||||||

| BEACH ACQUISITION BIDCO LLC USD TERM LOAN B / LON (BA000LM14) | 0,70 | 0,0589 | 0,0589 | ||||||

| US46629BAD10 / JP MORGAN MORTGAGE ACQUISITION JPMAC 2006 CW2 AF4 | 0,69 | -1,43 | 0,0577 | -0,0037 | |||||

| ONSLOW BAY FINANCIAL LLC OBX 2023 NQM10 A1 144A / ABS-MBS (US67449CAA99) | 0,68 | -7,83 | 0,0571 | -0,0079 | |||||

| INTEGRITY RE LTD SR UNSECURED 144A 06/26 VAR / DBT (US45833UAL52) | 0,68 | -3,28 | 0,0567 | -0,0048 | |||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,67 | 0,0561 | 0,0561 | ||||||

| US36255WAA36 / GS Mortgage Securities Corp II | 0,67 | -14,12 | 0,0560 | -0,0123 | |||||

| ACE SECURITIES CORP. ACE 2007 HE5 A2B / ABS-MBS (US000797AC45) | 0,67 | -1,04 | 0,0559 | -0,0033 | |||||

| GSAA HOME EQUITY TRUST GSAA 2006 2 2A5 / ABS-MBS (US362334AB08) | 0,67 | 0,45 | 0,0557 | -0,0024 | |||||

| US55286LAA08 / MFA 2023-NQM4 Trust | 0,66 | -9,18 | 0,0554 | -0,0086 | |||||

| US54251RAE36 / Long Beach Mortgage Loan Trust | 0,65 | 2,68 | 0,0545 | -0,0011 | |||||

| INTEGRITY RE LTD SR UNSECURED 144A 06/26 VAR / DBT (US45833UAM36) | 0,65 | -4,30 | 0,0540 | -0,0051 | |||||

| COLLEGE AVE STUDENT LOANS CASL 2024 A C 144A / ABS-O (US19424RAD08) | 0,64 | 1,42 | 0,0537 | -0,0019 | |||||

| MPT OPER PARTNERSP/FINL SR SECURED 144A 02/32 8.5 / DBT (US55342UAQ76) | 0,63 | 2,78 | 0,0525 | -0,0011 | |||||

| US00442JAE47 / ACE Securities Corp Home Equity Loan Trust Series 2007-ASAP1 | 0,63 | -0,16 | 0,0524 | -0,0026 | |||||

| VERUS SECURITIZATION TRUST VERUS 2023 8 A1 144A / ABS-MBS (US92540DAA37) | 0,62 | -12,32 | 0,0518 | -0,0102 | |||||

| SNAP / Snap Inc. - Depositary Receipt (Common Stock) | 0,62 | 2,67 | 0,0515 | -0,0012 | |||||

| E1IX34 / Edison International - Depositary Receipt (Common Stock) | 0,61 | 0,33 | 0,0509 | -0,0024 | |||||

| TREASURY BILL 09/25 0.00000 / DBT (US912797PY71) | 0,59 | 0,0496 | 0,0496 | ||||||

| US02151CAR79 / Alternative Loan Trust, Series 2007-15CB, Class A7 | 0,58 | -2,02 | 0,0486 | -0,0034 | |||||

| US45660LXN45 / RESIDENTIAL ASSET SECURITIZATI RAST 2005 A10 A4 | 0,57 | -0,86 | 0,0480 | -0,0028 | |||||

| XAF6628DAN49 / Numericable U.S. LLC, Term Loan B14 | 0,54 | 0,74 | 0,0454 | -0,0018 | |||||

| COUNTRYWIDE ASSET BACKED CERTI CWL 2005 11 AF5A / ABS-MBS (US126670CK22) | 0,54 | -3,06 | 0,0450 | -0,0037 | |||||

| STONEPEAK NILE PARENT SR SECURED 144A 03/32 7.25 / DBT (US861932AA97) | 0,53 | 3,92 | 0,0443 | -0,0004 | |||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 0,52 | 1,98 | 0,0431 | -0,0013 | |||||

| US35563PBK49 / Seasoned Credit Risk Transfer Trust Series 2017-2 | 0,50 | 0,20 | 0,0418 | -0,0019 | |||||

| MF1 MULTIFAMILY HOUSING MORTGA MF1 2025 FL17 A 144A / ABS-CBDO (US55287HAA86) | 0,50 | 0,20 | 0,0417 | -0,0020 | |||||

| US78457JAA07 / SMRT, Series 2022-MINI, Class A | 0,50 | 0,40 | 0,0417 | -0,0019 | |||||

| BDS LTD BDS 2025 FL14 A 144A / ABS-CBDO (US072921AA78) | 0,50 | -0,20 | 0,0416 | -0,0021 | |||||

| BOUGHT BRL SOLD USD 20250702 / DFE (000000000) | 0,49 | 0,0412 | 0,0412 | ||||||

| SPRUCE BIDCO II INC REVOLVER / LON (BA000FL00) | 0,45 | -0,66 | 0,0376 | -0,0021 | |||||

| PFP III PFP 2024 11 A 144A / ABS-MBS (US69291WAA09) | 0,44 | -9,80 | 0,0370 | -0,0060 | |||||

| US64352VFD82 / New Century Home Equity Loan Trust 2003-6 | 0,44 | -6,57 | 0,0369 | -0,0045 | |||||

| US61749WAM91 / Morgan Stanley Mortgage Loan Trust 2006-11 | 0,43 | -5,07 | 0,0361 | -0,0037 | |||||

| US45660L6K06 / Residential Asset Securitization Trust 2006-A1 | 0,43 | -1,39 | 0,0356 | -0,0022 | |||||

| US152314LQ15 / Centex Home Equity Loan Trust 2004-D | 0,43 | -1,85 | 0,0356 | -0,0024 | |||||

| THAMES SSNM 144A UNFUNDED COMM / DBT (955RVLII8) | 0,43 | 0,0356 | 0,0356 | ||||||

| WASTE PRO USA INC SR UNSECURED 144A 02/33 7 / DBT (US94107JAC71) | 0,42 | 3,48 | 0,0348 | -0,0005 | |||||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,42 | 0,0347 | 0,0347 | ||||||

| A2XO34 / Axon Enterprise, Inc. - Depositary Receipt (Common Stock) | 0,41 | 1,73 | 0,0345 | -0,0010 | |||||

| US35563PBN87 / Seasoned Credit Risk Transfer Trust Series 2017-2 | 0,41 | -2,38 | 0,0343 | -0,0025 | |||||

| TREASURY BILL 10/25 0.00000 / DBT (US912797RC34) | 0,40 | 0,0330 | 0,0330 | ||||||

| US251093S844 / City of Detroit MI | 0,39 | -2,75 | 0,0325 | -0,0026 | |||||

| US80556YAC93 / SAXON ASSET SECURITIES TRUST SAST 2007 2 A2B | 0,37 | 0,0307 | 0,0307 | ||||||

| US69380RAA32 / PRPM 2023-RCF2 LLC 4% 11/25/2053 144A | 0,36 | -5,00 | 0,0302 | -0,0032 | |||||

| US35563PUB39 / Seasoned Credit Risk Transfer Trust Series 2020-3 | 0,34 | 11,33 | 0,0288 | 0,0016 | |||||

| CITADEL LP SR UNSECURED 144A 01/30 6 / DBT (US17288XAD66) | 0,31 | 1,64 | 0,0259 | -0,0008 | |||||

| TIDEWATER INC SR UNSECURED 144A 07/30 9.125 / DBT (US88642RAE99) | 0,31 | 0,0258 | 0,0258 | ||||||

| US57645TAB35 / MASTR ADJUSTABLE RATE MORTGAGE MARM 2007 HF2 A2 | 0,31 | 0,0257 | 0,0257 | ||||||

| CREDIT OPPORTUNITIES PARTNERS 2025A SR UNSECD NT TRANCHE B / DBT (955SEVII3) | 0,30 | 0,0253 | 0,0253 | ||||||

| US29279XAA81 / ENDURANCE ACQ MERGER 6% 02/15/2029 144A | 0,29 | -2,67 | 0,0244 | -0,0019 | |||||

| PAA US TRS EQUITY FEDL01+60 BOA / DE (000000000) | 0,29 | 0,0244 | 0,0244 | ||||||

| US76112B2D12 / RESIDENTIAL ASSET MORTGAGE PRO RAMP 2006 RS2 A3A | 0,28 | -4,38 | 0,0238 | -0,0023 | |||||

| US12569RAB42 / CIM Trust 2023-R1 | 0,27 | -2,84 | 0,0230 | -0,0018 | |||||

| BOUGHT MXN SOLD USD 20250917 / DFE (000000000) | 0,27 | 0,0227 | 0,0227 | ||||||

| SPRUCE BIDCO II INC JPY TERM LOAN / LON (BA000FPQ9) | 0,27 | 3,47 | 0,0224 | -0,0003 | |||||

| US61750FAB67 / MORGAN STANLEY CAPITAL INC MSAC 2006 HE6 A2FP | 0,27 | -1,11 | 0,0223 | -0,0014 | |||||

| SPRUCE BIDCO II INC CAD TERM LOAN / LON (BA000FPR7) | 0,27 | 5,16 | 0,0222 | 0,0000 | |||||

| THAMES WATER SUPER SEN SR SECURED 144A 10/27 9.75 / DBT (XS3017976054) | 0,26 | 0,0218 | 0,0218 | ||||||

| WINSTON RE LTD UNSECURED 144A 02/28 VAR / DBT (US975660AC59) | 0,25 | 1,60 | 0,0212 | -0,0007 | |||||

| VERAISON RE LTD UNSECURED 144A 03/33 VAR / DBT (US92335TAE91) | 0,25 | 0,00 | 0,0209 | -0,0011 | |||||

| BOUGHT GBP SOLD USD 20250702 / DFE (000000000) | 0,24 | 0,0203 | 0,0203 | ||||||

| US83612HAD08 / SOUNDVIEW HOME LOAN TRUST 2006-3 SER 2006-3 CL A4 V/R REGD 1.95800000 | 0,24 | -3,20 | 0,0203 | -0,0017 | |||||

| AG TRUST AG 2024 NLP A 144A / ABS-MBS (US00792MAA18) | 0,24 | 0,00 | 0,0199 | -0,0010 | |||||

| THAMES WATER SUPER SEN SR SECURED 144A 10/27 9.75 / DBT (XS3060649830) | 0,24 | 0,0198 | 0,0198 | ||||||

| DUN + BRADSTREET CORPOR THE 2025 REVOLVER / LON (BA000K747) | 0,23 | 0,0188 | 0,0188 | ||||||

| PAA US TRS EQUITY FEDL01+60 *BULLET* FAR / DE (000000000) | 0,22 | 0,0187 | 0,0187 | ||||||

| US513075BW03 / Lamar Media Corp | 0,20 | 2,54 | 0,0169 | -0,0004 | |||||

| CZECHOSLOVAK GROUP CZECHOSLOVAK GROUP / DBT (XS3105190147) | 0,20 | 0,0169 | 0,0169 | ||||||

| DK CROWN HOLDINGS INC 2025 TERM LOAN B / LON (BA000GCV0) | 0,20 | 0,00 | 0,0166 | -0,0008 | |||||

| RAVEN ACQUISITION HOLDINGS LLC DELAYED DRAW TERM LOAN / LON (US75419XAD66) | 0,19 | 1,05 | 0,0162 | -0,0006 | |||||

| US32027NMK45 / FFML 2004-FF10 M2 | 0,17 | -0,58 | 0,0144 | -0,0008 | |||||

| BOUGHT BRL SOLD USD 20250903 / DFE (000000000) | 0,17 | 0,0142 | 0,0142 | ||||||

| US68373BAA98 / OPEN TR 2023-AIR TSFR1M+308.92 10/15/2028 144A | 0,13 | -39,44 | 0,0108 | -0,0080 | |||||

| SOFTBANK VISION FUND II TRANCHE B2 TERM LOAN / LON (BA000KP70) | 0,11 | 0,0095 | 0,0095 | ||||||

| TRT061124T11 / Turkey Government Bond | 0,11 | -2,68 | 0,0092 | -0,0007 | |||||

| XAF6628DAP96 / ALTICE FRANCE S A 2023 EUR EXTENDED TL B11 | 0,11 | 9,28 | 0,0089 | 0,0003 | |||||

| US947075AU14 / Weatherford International Ltd | 0,10 | -96,62 | 0,0086 | -0,2586 | |||||

| 743424AA1 / Proofpoint, Inc. 1.25% Convertible Bond due 2018-12-15 | 0,10 | 0,0084 | 0,0084 | ||||||

| TREASURY BILL 10/25 0.00000 / DBT (US912797RB50) | 0,10 | 0,0083 | 0,0083 | ||||||

| US86359B7L95 / Structured Asset Securities Corp. Mortgage Loan Trust 2005-7XS | 0,10 | 0,0081 | 0,0081 | ||||||

| HSI ASSET SECURITIZATION CORPO HASC 2007 NC1 A1 / ABS-MBS (US40430TAA07) | 0,07 | -1,43 | 0,0058 | -0,0004 | |||||

| NFE / New Fortress Energy Inc. | 0,02 | 0,00 | 0,06 | -58,04 | 0,0051 | -0,0075 | |||

| THAMES WATER UTIL LTD SR SECURED 144A 03/27 0.00000 / DBT (XS3002255787) | 0,06 | 12,00 | 0,0047 | 0,0002 | |||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,05 | 0,0042 | 0,0042 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,05 | 0,0040 | 0,0040 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,04 | 0,0037 | 0,0037 | ||||||

| BOUGHT TRY SOLD USD 20250806 / DFE (000000000) | 0,04 | 0,0033 | 0,0033 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,04 | 0,0033 | 0,0033 | ||||||

| BOUGHT CAD SOLD USD 20250702 / DFE (000000000) | 0,04 | 0,0029 | 0,0029 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,02 | 0,0019 | 0,0019 | ||||||

| US81375WHH25 / Securitized Asset Backed Receivables LLC Trust 2006-CB1 | 0,02 | 0,00 | 0,0013 | -0,0001 | |||||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0009 | 0,0009 | ||||||

| BOUGHT DKK SOLD USD 20250702 / DFE (000000000) | 0,01 | 0,0008 | 0,0008 | ||||||

| SOLD HKD BOUGHT USD 20250716 / DFE (000000000) | 0,01 | 0,0005 | 0,0005 | ||||||

| BOUGHT TRY SOLD USD 20250724 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | ||||||

| BOUGHT EUR SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | ||||||

| BOUGHT TRY SOLD USD 20250701 / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| RFR USD SOFR/3.75000 06/20/24-10Y CME / DIR (EZ52H44WTW83) | 0,00 | 0,0001 | 0,0001 | ||||||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| BOUGHT JPY SOLD USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| BOUGHT CAD SOLD USD 20250805 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | 0,00 | 0,0000 | 0,0000 | ||||||

| SOLD JPY BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | ||||||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | ||||||

| SOLD TRY BOUGHT USD 20250701 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | ||||||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | ||||||

| SOLD MXN BOUGHT USD 20250917 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | ||||||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | ||||||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | ||||||

| SOLD BRL BOUGHT USD 20250702 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | ||||||

| SOLD JPY BOUGHT USD 20250804 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | ||||||

| SOLD TRY BOUGHT USD 20250724 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | ||||||

| SOLD TRY BOUGHT USD 20250718 / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | ||||||

| SOLD TRY BOUGHT USD 20250707 / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | ||||||

| SOLD DKK BOUGHT USD 20250804 / DFE (000000000) | -0,01 | -0,0008 | -0,0008 | ||||||

| SOLD DKK BOUGHT USD 20250804 / DFE (000000000) | -0,01 | -0,0009 | -0,0009 | ||||||

| SOLD TRY BOUGHT USD 20250806 / DFE (000000000) | -0,03 | -0,0026 | -0,0026 | ||||||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | -0,07 | -0,0061 | -0,0061 | ||||||

| SOLD DKK BOUGHT USD 20250702 / DFE (000000000) | -0,08 | -0,0068 | -0,0068 | ||||||

| SOLD BRL BOUGHT USD 20250702 / DFE (000000000) | -0,17 | -0,0144 | -0,0144 | ||||||

| SOLD GBP BOUGHT USD 20250804 / DFE (000000000) | -0,24 | -0,0204 | -0,0204 | ||||||

| SOLD GBP BOUGHT USD 20250702 / DFE (000000000) | -0,38 | -0,0315 | -0,0315 | ||||||

| SOLD CAD BOUGHT USD 20250805 / DFE (000000000) | -0,42 | -0,0349 | -0,0349 | ||||||

| WES US TRS EQUITY SOFR+60 *BULLET* GST / DE (000000000) | -0,44 | -0,0366 | -0,0366 | ||||||

| WES US TRS EQUITY FEDL01+60 *BULLET* FAR / DE (000000000) | -0,45 | -0,0376 | -0,0376 | ||||||

| SOLD CAD BOUGHT USD 20250702 / DFE (000000000) | -0,48 | -0,0400 | -0,0400 | ||||||

| PAA US TRS EQUITY SOFR+60 *BULLET* GST / DE (000000000) | -0,59 | -0,0494 | -0,0494 | ||||||

| SOLD EUR BOUGHT USD 20250804 / DFE (000000000) | -0,67 | -0,0561 | -0,0561 | ||||||

| REVERSE REPO CREDIT AGRICOLE 03/14 VAR / RA (000000000) | -0,90 | -0,0749 | -0,0749 | ||||||

| ET US TRS EQUITY SOFR+60 *BULLET* GST / DE (000000000) | -1,01 | -0,0845 | -0,0845 | ||||||

| REVERSE REPO CREDIT AGRICOLE 03/14 VAR / RA (000000000) | -1,10 | -0,0922 | -0,0922 | ||||||

| CA CARBON ALLOW 25DEC25 IFED 20251224 / DCO (000000000) | -1,36 | -0,1134 | -0,1134 | ||||||

| EPD US TRS EQUITY SOFR+60 *BULLET* GST / DE (000000000) | -1,38 | -0,1155 | -0,1155 | ||||||

| MPLX US TRS EQUITY SOFR+60 *BULLET* GST / DE (000000000) | -1,44 | -0,1204 | -0,1204 | ||||||

| SOLD EUR BOUGHT USD 20250702 / DFE (000000000) | -1,59 | -0,1327 | -0,1327 | ||||||

| CCA VINTAGE 2026 DEC26 IFED 20261224 / DCO (000000000) | -1,64 | -0,1374 | -0,1374 | ||||||

| REVERSE REPO BARCLAYS REVERSE REPO / RA (000000000) | -2,41 | -0,2018 | -0,2018 | ||||||

| REVERSE REPO/F. H. DEACON HOD 12/15 FIXED 2.079 / RA (000000000) | -2,43 | -0,2031 | -0,2031 | ||||||

| REVERSE REPO MERRILL LYNCH / RA (000000000) | -2,52 | -0,2103 | -0,2103 | ||||||

| REVERSE REPO TORONTO DOMINIO / RA (000000000) | -3,14 | -0,2628 | -0,2628 | ||||||

| REVERSE REPO DEUTSCHE REVERSE REPO / RA (000000000) | -3,98 | -0,3328 | -0,3328 | ||||||

| REVERSE REPO CREDIT AGRICOLE 03/14 VAR / RA (000000000) | -4,11 | -0,3432 | -0,3432 | ||||||

| REVERSE REPO CIBC / RA (000000000) | -4,39 | -0,3671 | -0,3671 | ||||||

| REVERSE REPO MORGAN STANLEY / RA (000000000) | -6,93 | -0,5789 | -0,5789 | ||||||

| REVERSE REPO DEUTSCHE REVERSE REPO / RA (000000000) | -7,28 | -0,6084 | -0,6084 | ||||||

| REVERSE REPO SOCIETE GENERALE REVERSE REPO / RA (000000000) | -7,78 | -0,6498 | -0,6498 | ||||||

| REVERSE REPO THE BANK OF NOVA REVERSE REPO / RA (000000000) | -10,90 | -0,9109 | -0,9109 | ||||||

| REVERSE REPO THE BANK OF NOVA REVERSE REPO / RA (000000000) | -10,90 | -0,9109 | -0,9109 | ||||||

| REVERSE REPO DEUTSCHE REVERSE REPO / RA (000000000) | -12,23 | -1,0224 | -1,0224 | ||||||

| REVERSE REPO DEUTSCHE REVERSE REPO / RA (000000000) | -14,67 | -1,2262 | -1,2262 | ||||||

| REVERSE REPO SOCIETE GENERALE REVERSE REPO / RA (000000000) | -16,54 | -1,3821 | -1,3821 | ||||||

| REVERSE REPO WELLS FARGO REVERSE REPO / RA (000000000) | -17,45 | -1,4582 | -1,4582 | ||||||

| REVERSE REPO CREDIT AGRICOLE 03/14 VAR / RA (000000000) | -17,60 | -1,4706 | -1,4706 | ||||||

| REVERSE REPO SOCIETE GENERALE REVERSE REPO / RA (000000000) | -18,04 | -1,5079 | -1,5079 | ||||||

| REVERSE REPO SOCIETE GENERALE REVERSE REPO / RA (000000000) | -18,04 | -1,5079 | -1,5079 | ||||||

| REVERSE REPO SOCIETE GENERALE REVERSE REPO / RA (000000000) | -19,83 | -1,6573 | -1,6573 | ||||||

| REVERSE REPO/F. H. DEACON HOD 12/15 FIXED 2.079 / RA (000000000) | -22,29 | -1,8630 | -1,8630 | ||||||

| REVERSE REPO BANK OF NEW YORK / RA (000000000) | -23,87 | -1,9953 | -1,9953 | ||||||

| REVERSE REPO BANK OF NEW YORK / RA (000000000) | -26,84 | -2,2433 | -2,2433 | ||||||

| REVERSE REPO SOCIETE GENERALE REVERSE REPO / RA (000000000) | -42,82 | -3,5784 | -3,5784 | ||||||

| REVERSE REPO/F. H. DEACON HOD 12/15 FIXED 2.079 / RA (000000000) | -50,47 | -4,2184 | -4,2184 |