Statistiques de base

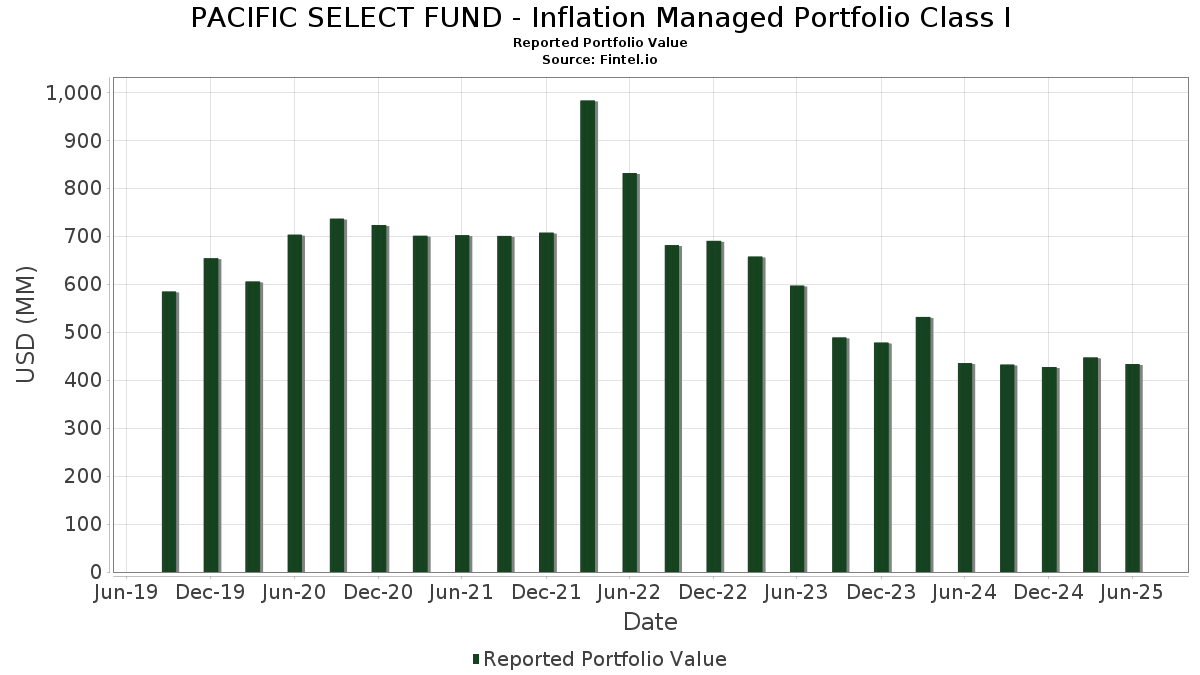

| Valeur du portefeuille | $ 433 551 301 |

| Positions actuelles | 314 |

Dernières positions, performances, ASG (à partir des dépôts 13F, 13D)

PACIFIC SELECT FUND - Inflation Managed Portfolio Class I a déclaré un total de 314 positions dans ses derniers dépôts auprès de la SEC. La valeur la plus récente du portefeuille est calculée à 433 551 301 USD. Les actifs sous gestion réels (ASG) sont cette valeur plus les liquidités (qui ne sont pas divulguées). Les principales positions de PACIFIC SELECT FUND - Inflation Managed Portfolio Class I sont US TREASURY I/L 2.375% 10-15-28 (US:US91282CJH51) , Usa Treasury Bonds 3 5/8% Tii 30yr Bd 4/15/28 (US:US912810FD55) , United States Treasury Inflation Indexed Bonds (US:US91282CHP95) , United States Treasury Inflation Indexed Bonds (US:US91282CFR79) , and United States Treasury Inflation Indexed Bonds (US:US9128283R96) . Les nouvelles positions de PACIFIC SELECT FUND - Inflation Managed Portfolio Class I incluent US TREASURY I/L 2.375% 10-15-28 (US:US91282CJH51) , Usa Treasury Bonds 3 5/8% Tii 30yr Bd 4/15/28 (US:US912810FD55) , United States Treasury Inflation Indexed Bonds (US:US91282CHP95) , United States Treasury Inflation Indexed Bonds (US:US91282CFR79) , and United States Treasury Inflation Indexed Bonds (US:US9128283R96) .

Meilleures augmentations ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 10,11 | 2,8921 | 2,8921 | ||

| 5,85 | 1,6720 | 1,6720 | ||

| 6,84 | 1,9550 | 1,1965 | ||

| 7,94 | 2,2719 | 1,1446 | ||

| 2,84 | 0,8130 | 0,8130 | ||

| 11,37 | 3,2522 | 0,5674 | ||

| 1,81 | 0,5181 | 0,5181 | ||

| 1,72 | 0,4907 | 0,4907 | ||

| 1,70 | 0,4852 | 0,4852 | ||

| 1,64 | 0,4692 | 0,4692 |

Principales baisses ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 2,63 | 0,7530 | -2,2888 | ||

| -7,00 | -2,0024 | -2,2624 | ||

| 1,58 | 0,4521 | -1,8458 | ||

| 0,74 | 0,2102 | -1,8235 | ||

| 0,36 | 0,1040 | -0,6121 | ||

| -1,51 | -0,4326 | -0,4326 | ||

| -1,14 | -0,3260 | -0,3260 | ||

| -1,14 | -0,3253 | -0,3253 | ||

| -0,82 | -0,2354 | -0,2354 | ||

| 7,53 | 2,1538 | -0,2310 |

Déclarations 13F et dépôts de fonds

Ce formulaire a été déposé le 2025-08-18 pour la période de déclaration 2025-06-30. Cet investisseur n'a pas divulgué les titres comptabilisés en actions, les colonnes relatives aux actions dans le tableau ci-dessous sont donc omises. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau pour débloquer les données premium et exporter vers Excel ![]() .

.

| Titre | Type | ΔActions (%) |

Valeur ($ en millions) |

Portefeuille (%) |

ΔPortefeuille (%) |

|

|---|---|---|---|---|---|---|

| US91282CJH51 / US TREASURY I/L 2.375% 10-15-28 | 23,62 | 0,62 | 6,7562 | 0,1281 | ||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CLE92) | 17,23 | 0,25 | 4,9284 | 0,0754 | ||

| US912810FD55 / Usa Treasury Bonds 3 5/8% Tii 30yr Bd 4/15/28 | 15,09 | 0,15 | 4,3150 | 0,0616 | ||

| US91282CHP95 / United States Treasury Inflation Indexed Bonds | 13,96 | 0,53 | 3,9920 | 0,0718 | ||

| US91282CFR79 / United States Treasury Inflation Indexed Bonds | 12,94 | 0,56 | 3,7010 | 0,0680 | ||

| US9128283R96 / United States Treasury Inflation Indexed Bonds | 12,22 | 0,87 | 3,4963 | 0,0748 | ||

| US91282CEZ05 / U.S. Treasury Inflation Linked Notes | 11,54 | 0,88 | 3,3005 | 0,0709 | ||

| US912810FH69 / Usa Treasury Notes 3 7/8% 30yr Notes 04/15/2029 | 11,43 | 0,30 | 3,2686 | 0,0517 | ||

| US912828ZZ63 / United States Treasury Inflation Indexed Bonds | 11,41 | 1,25 | 3,2619 | 0,0818 | ||

| US01F0606834 / Uniform Mortgage-Backed Security, TBA | 11,37 | 19,41 | 3,2522 | 0,5674 | ||

| US91282CGK18 / U.S. Treasury Inflation Linked Notes | 11,22 | 0,71 | 3,2098 | 0,0635 | ||

| Ginnie Mae II Pool / ABS-MBS (US3618N5PE30) | 10,11 | 2,8921 | 2,8921 | |||

| US912828Z377 / United States Treasury Inflation Indexed Bonds | 9,82 | 1,28 | 2,8077 | 0,0709 | ||

| US912828S505 / United States Treasury Inflation Indexed Bonds | 9,71 | 0,55 | 2,7780 | 0,0507 | ||

| US01F0426811 / UMBS TBA | 9,56 | 1,39 | 2,7347 | 0,0760 | ||

| US01F0526800 / Uniform Mortgage-Backed Security, TBA | 9,49 | 1,30 | 2,7146 | 0,0733 | ||

| US912828Y388 / United States Treasury Inflation Indexed Bonds | 8,40 | 0,91 | 2,4016 | 0,0523 | ||

| US01F0626899 / Uniform Mortgage-Backed Security, TBA | 8,25 | 1,35 | 2,3592 | 0,0649 | ||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CLV18) | 7,94 | 98,92 | 2,2719 | 1,1446 | ||

| JP1120241K56 / Japanese Government CPI Linked Bond | 7,85 | 5,57 | 2,2459 | 0,1460 | ||

| US9128282L36 / United States Treasury Inflation Indexed Bonds | 7,83 | 0,75 | 2,2389 | 0,0451 | ||

| US912810RF75 / United States Treasury Inflation Indexed Bonds | 7,53 | -10,86 | 2,1538 | -0,2310 | ||

| US91282CDC29 / UNITED STATES TREASURY INFLATION INDEXED BONDS 0.12500000 | 7,08 | 0,60 | 2,0249 | 0,0379 | ||

| US91282CDX65 / United States Treasury Inflation Indexed Bonds | 7,03 | 1,11 | 2,0109 | 0,0476 | ||

| US91282CCA71 / United States Treasury Inflation Indexed Bonds | 6,90 | 0,52 | 1,9722 | 0,0358 | ||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CML27) | 6,84 | 154,47 | 1,9550 | 1,1965 | ||

| US9128285W63 / United States Treasury Inflation Indexed Bonds | 6,63 | 0,96 | 1,8964 | 0,0424 | ||

| US91282CBF77 / United States Treasury Inflation Indexed Bonds | 6,28 | 1,29 | 1,7968 | 0,0456 | ||

| US912810QV35 / United States Treasury Inflation Indexed Bonds | 5,90 | -0,57 | 1,6884 | 0,0121 | ||

| US36179W7L60 / Ginnie Mae II Pool | 5,85 | 1,6720 | 1,6720 | |||

| US91282CEJ62 / United States Treasury Inflation Indexed Bonds | 5,79 | 0,68 | 1,6547 | 0,0324 | ||

| US912810RL44 / United States Treasury Inflation Indexed Bonds | 5,45 | -2,89 | 1,5574 | -0,0256 | ||

| US912810PZ57 / United States Treasury Inflation Indexed Bonds | 5,44 | 0,55 | 1,5558 | 0,0286 | ||

| US912810RW09 / United States Treasury Inflation Indexed Bonds | 5,11 | -3,31 | 1,4617 | -0,0307 | ||

| FR0013519253 / French Republic Government Bond OAT | 5,00 | 9,71 | 1,4286 | 0,1431 | ||

| US912810RR14 / United States Treasury Inflation Indexed Bonds | 4,86 | -12,25 | 1,3891 | -0,1738 | ||

| US9128287D64 / United States Treasury Inflation Indexed Bonds | 4,46 | 1,25 | 1,2753 | 0,0320 | ||

| US912810SB52 / United States Treasury Inflation Indexed Bonds | 4,12 | -3,36 | 1,1776 | -0,0252 | ||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CJY84) | 3,93 | 0,31 | 1,1248 | 0,0178 | ||

| US912810RA88 / United States Treasury Inflation Indexed Bonds | 3,25 | -2,40 | 0,9291 | -0,0107 | ||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CKL45) | 3,20 | 0,60 | 0,9139 | 0,0171 | ||

| US912810SG40 / United States Treasury Inflation Indexed Bonds | 2,96 | -3,71 | 0,8473 | -0,0213 | ||

| U.S. Treasury Inflation-Indexed Notes / DBT (US91282CNB36) | 2,84 | 0,8130 | 0,8130 | |||

| US912810PV44 / United States Treasury Inflation Indexed Bonds | 2,79 | 0,65 | 0,7980 | 0,0151 | ||

| US912810QP66 / United States Treasury Inflation Indexed Bonds | 2,74 | -6,87 | 0,7837 | -0,0471 | ||

| U.S. Treasury Inflation-Indexed Bonds / DBT (US912810TY47) | 2,68 | -3,67 | 0,7666 | -0,0190 | ||

| US912828N712 / United States Treasury Inflation Indexed Bonds | 2,63 | -75,57 | 0,7530 | -2,2888 | ||

| US38382YB360 / Government National Mortgage Association | 2,38 | -0,13 | 0,6804 | 0,0078 | ||

| US912810TP30 / US TREASURY I/L 1.5% 02-15-53 | 2,31 | -3,87 | 0,6606 | -0,0177 | ||

| CA135087VS05 / Canadian Government Real Return Bond | 2,16 | 5,22 | 0,6166 | 0,0379 | ||

| Barings Euro CLO 2021-2 DAC / ABS-CBDO (XS2369918813) | 1,99 | 9,32 | 0,5705 | 0,0555 | ||

| US912810SM18 / US TII .25 02/15/2050 (TIPS) | 1,99 | -3,92 | 0,5685 | -0,0156 | ||

| JGBI / JAPAN GOVT CPI LINKED BONDS 03/28 0.1 | 1,88 | 4,67 | 0,5382 | 0,0308 | ||

| U.S. Treasury Inflation-Indexed Bonds / DBT (US912810UH94) | 1,87 | 41,06 | 0,5346 | 0,1604 | ||

| Ginnie Mae II Pool / ABS-MBS (US36180AB691) | 1,81 | 0,5181 | 0,5181 | |||

| RFR USD SOFR/2.86500 02/13/24-30Y LCH / DIR (000000000) | 1,72 | 0,4907 | 0,4907 | |||

| IT0005387052 / Italy Buoni Poliennali Del Tesoro | 1,70 | 11,38 | 0,4872 | 0,0553 | ||

| Navesink CLO 2 Ltd / ABS-CBDO (US63942YAA29) | 1,70 | 0,12 | 0,4864 | 0,0070 | ||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,70 | 0,4852 | 0,4852 | |||

| IRS EUR 0.19700 11/08/22-30Y LCH / DIR (000000000) | 1,64 | 0,4692 | 0,4692 | |||

| US3137FKAX42 / FREDDIE MAC FHR 4851 PF | 1,60 | 0,4581 | 0,4581 | |||

| EW / Edwards Lifesciences Corporation | 1,58 | -87,43 | 0,4521 | -1,8458 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 1,41 | -5,17 | 0,4041 | -0,0166 | ||

| FMCC / Federal Home Loan Mortgage Corporation | 1,39 | 0,3973 | 0,3973 | |||

| FR0014001N38 / French Republic | 1,37 | 10,64 | 0,3928 | 0,0423 | ||

| US912810SV17 / United States Treasury Inflation Indexed Bonds | 1,35 | -4,32 | 0,3862 | -0,0124 | ||

| IRS EUR 2.25000 09/17/25-30Y LCH / DIR (000000000) | 1,35 | 0,3854 | 0,3854 | |||

| XS2395965416 / Harvest CLO XXII DAC | 1,33 | 6,67 | 0,3797 | 0,0284 | ||

| Ginnie Mae II Pool / ABS-MBS (US3618N5GK90) | 1,28 | 0,3648 | 0,3648 | |||

| US41161PSK02 / HarborView Mortgage Loan Trust 2005-9 | 1,21 | -4,05 | 0,3458 | -0,0100 | ||

| XS2346593242 / Madison Park Euro Funding IX DAC | 1,18 | 9,09 | 0,3364 | 0,0319 | ||

| CVC Cordatus Opportunity Loan Fund-R DAC / ABS-CBDO (XS3020835339) | 1,15 | 6,57 | 0,3296 | 0,0243 | ||

| US912810QF84 / United States Treasury Inflation Indexed Bonds | 1,13 | -1,40 | 0,3229 | -0,0003 | ||

| US912828V491 / United States Treasury Inflation Indexed Bonds | 1,10 | 0,64 | 0,3147 | 0,0060 | ||

| RFRF USD SOFR/2.23650 11/21/23-30Y LCH / DIR (000000000) | 1,03 | 0,2940 | 0,2940 | |||

| XS2339017928 / CARLYLE GLOBAL MARKET STRATEGI CGMSE 2014 2A AR1 144A | 1,01 | -10,87 | 0,2887 | -0,0311 | ||

| Trinitas Clo VII Ltd / ABS-CBDO (US89641CAU53) | 1,00 | -0,40 | 0,2849 | 0,0026 | ||

| US12489WLH50 / Credit-Based Asset Servicing & Securitization LLC | 0,92 | -3,04 | 0,2643 | -0,0048 | ||

| US21H0326700 / GNMA2 30YR TBA(REG C) 3.5 TBA 07-01-50 | 0,91 | 0,2601 | 0,2601 | |||

| IRS EUR 0.19500 11/04/22-30Y LCH / DIR (000000000) | 0,91 | 0,2598 | 0,2598 | |||

| IRS EUR 0.19000 11/04/22-30Y LCH / DIR (000000000) | 0,88 | 0,2519 | 0,2519 | |||

| US ULTRA BOND CBT SEP25 / DIR (000000000) | 0,80 | 0,2299 | 0,2299 | |||

| US91282CGW55 / United States Treasury Inflation Indexed Bonds | 0,75 | 0,81 | 0,2137 | 0,0044 | ||

| XS1850277838 / Tikehau CLO IV BV | 0,74 | -15,10 | 0,2125 | -0,0343 | ||

| US912810FS25 / United States Treasury Inflation Indexed Bonds | 0,74 | -89,80 | 0,2102 | -1,8235 | ||

| US3137BY3C20 / Freddie Mac REMICS | 0,73 | -3,30 | 0,2098 | -0,0044 | ||

| Italy Buoni Poliennali Del Tesoro / DBT (IT0005588881) | 0,73 | 13,33 | 0,2091 | 0,0269 | ||

| US04542BJY92 / ABFC 2004-OPT5 Trust | 0,69 | -3,92 | 0,1966 | -0,0053 | ||

| US054980AA58 / BDS 2022-FL11 LLC | 0,67 | -6,84 | 0,1909 | -0,0115 | ||

| Adagio CLO VIII DAC / ABS-CBDO (XS2054620070) | 0,64 | -14,78 | 0,1832 | -0,0289 | ||

| US437084JV98 / HOME EQUITY ASSET TRUST HEAT 2005 2 M6 | 0,63 | -3,82 | 0,1800 | -0,0048 | ||

| INF SWAP US IT 2.31125 02/24/21-10Y LCH / DIR (000000000) | 0,62 | 0,1783 | 0,1783 | |||

| US59020URP20 / MERRILL LYNCH MORTGAGE INVESTO MLMI 2005 NC1 M1 | 0,61 | 0,33 | 0,1754 | 0,0027 | ||

| Dunedin Park CLO DAC / ABS-CBDO (XS2401572685) | 0,59 | 8,70 | 0,1679 | 0,0153 | ||

| US55285AAA51 / MF1 2022-FL9 LLC SER 2022-FL9 CL A V/R REGD 144A P/P 2.96000000 | 0,57 | -4,55 | 0,1624 | -0,0054 | ||

| US885220FE80 / TMST 2004-2 A1 | 0,57 | -2,07 | 0,1623 | -0,0012 | ||

| US38380LJY02 / Government National Mortgage Association | 0,54 | -1,29 | 0,1538 | 0,0003 | ||

| XS2347648961 / ARES EUROPEAN CLO ARESE 10A AR 144A | 0,52 | -3,68 | 0,1498 | -0,0037 | ||

| US36179W5D62 / Ginnie Mae II Pool | 0,51 | 18,24 | 0,1464 | 0,0240 | ||

| US83609GBN43 / Sound Point CLO IX Ltd | 0,51 | -12,02 | 0,1446 | -0,0175 | ||

| US26250UAQ85 / Dryden XXVI Senior Loan Fund | 0,51 | -15,55 | 0,1445 | -0,0244 | ||

| Canyon CLO 2020-1 Ltd / ABS-CBDO (US13876LAW72) | 0,50 | 0,40 | 0,1432 | 0,0026 | ||

| US38382Y5C34 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION SER 2023-H11 CL FC V/R 6.10000000 | 0,49 | -1,79 | 0,1412 | -0,0007 | ||

| US53946PAA84 / LoanCore 2022-CRE7 Issuer Ltd | 0,49 | -5,93 | 0,1409 | -0,0068 | ||

| US05493LAA44 / BANC OF AMERICA MERRILL LYNCH BAMLL 2021 JACX A 144A | 0,48 | 0,42 | 0,1368 | 0,0021 | ||

| US004421EW92 / ACE Securities Corp Home Equity Loan Trust Series 2004-OP1 | 0,48 | -1,25 | 0,1360 | 0,0001 | ||

| US3132HTBH86 / Freddie Mac Strips | 0,46 | -2,77 | 0,1308 | -0,0020 | ||

| TRS R SOFRRATE+17/91282CDX6 MYC / DIR (000000000) | 0,45 | 0,1301 | 0,1301 | |||

| US87277JAA97 / TRTX 2022-FL5 Issuer Ltd | 0,44 | -8,11 | 0,1266 | -0,0092 | ||

| US912810TE82 / United States Treasury Inflation Indexed Bonds | 0,43 | -4,65 | 0,1233 | -0,0046 | ||

| XS2357554679 / SEGOVIA EUROPEAN CLO 6 2019 SEGOV 2019 6A AR 144A | 0,43 | 9,18 | 0,1224 | 0,0115 | ||

| US060505FL38 / Bank of America Corp | 0,42 | 0,97 | 0,1194 | 0,0026 | ||

| US78442GLL85 / SLM Student Loan Trust 2004-3 | 0,42 | -2,35 | 0,1188 | -0,0011 | ||

| US17320XAC83 / CMLTI 2013-A B1 | 0,40 | -0,25 | 0,1147 | 0,0011 | ||

| US36179XQT62 / Ginnie Mae II Pool | 0,39 | 0,1118 | 0,1118 | |||

| US91282CCM10 / United States Treasury Inflation Indexed Bonds | 0,36 | -85,69 | 0,1040 | -0,6121 | ||

| US33835NAA90 / 522 FUNDING CLO LTD MORGN 2018 3A AR 144A | 0,36 | -23,11 | 0,1019 | -0,0290 | ||

| XS2330054953 / OAK HILL EUROPEAN CREDIT PARTN OHECP 2018 7A AR 144A | 0,35 | -5,72 | 0,0992 | -0,0045 | ||

| XS2353412633 / DRYDEN EURO CLO DRYD 2017 52A AR 144A | 0,34 | 4,32 | 0,0969 | 0,0053 | ||

| INF SWAP US IT 2.41875 03/05/21-5Y LCH / DIR (000000000) | 0,33 | 0,0954 | 0,0954 | |||

| US38375UZZ64 / Government National Mortgage Association | 0,33 | -6,76 | 0,0949 | -0,0053 | ||

| US61744CNC63 / Morgan Stanley ABS Capital I Inc Trust 2005-HE2 | 0,33 | -4,36 | 0,0943 | -0,0029 | ||

| US74923EAA64 / Rad CLO 5 Ltd | 0,31 | -15,98 | 0,0874 | -0,0151 | ||

| DGZ / DB Gold Short ETN | 0,30 | 0,0857 | 0,0857 | |||

| US26251LAC81 / Dryden 64 CLO Ltd 2.79 | 0,30 | -23,58 | 0,0844 | -0,0248 | ||

| TRS R SOFRRATE+17/91282CCM1 MYC / DIR (000000000) | 0,28 | 0,0790 | 0,0790 | |||

| FMCC / Federal Home Loan Mortgage Corporation | 0,28 | -9,84 | 0,0789 | -0,0075 | ||

| US04018LAJ44 / ARES CLO LTD ARES 2018 50A AR 144A | 0,27 | -30,41 | 0,0774 | -0,0323 | ||

| INF SWAP US IT 2.31375 02/26/21-5Y LCH / DIR (000000000) | 0,26 | 0,0751 | 0,0751 | |||

| US36361UAL44 / Gallatin CLO VIII 2017-1 Ltd | 0,23 | -1,31 | 0,0648 | 0,0000 | ||

| DK0009403727 / JYSKE REALKREDIT A/S COVERED 10/53 1.5 | 0,22 | 10,00 | 0,0630 | 0,0064 | ||

| US64830HAA23 / NEW RESIDENTIAL MORTGAGE LOAN TRUST 2019-RPL2 SER 2019-RPL2 CL A1 V/R REGD 144A P/P 3.25000000 | 0,22 | -4,78 | 0,0629 | -0,0022 | ||

| US92916MAF86 / VOYA CLO LTD VOYA 2017 1A A1R 144A | 0,20 | -24,71 | 0,0567 | -0,0177 | ||

| RFR USD SOFR/3.50000 06/20/24-30Y CME / DIR (000000000) | 0,18 | 0,0513 | 0,0513 | |||

| US3137F4BX98 / Freddie Mac REMICS | 0,18 | -9,64 | 0,0510 | -0,0047 | ||

| US92558NAJ19 / Vibrant CLO XI Ltd | 0,18 | -22,12 | 0,0506 | -0,0134 | ||

| US67576FAA75 / Octagon Investment Partners 18-R Ltd | 0,18 | -17,76 | 0,0504 | -0,0101 | ||

| DK0009528424 / NYKREDIT REALKREDIT AS COVERED REGS 10/53 1.5 | 0,17 | 8,92 | 0,0491 | 0,0047 | ||

| 3MO EURO EURIBOR SEP26 / DIR (000000000) | 0,17 | 0,0483 | 0,0483 | |||

| XS0308666493 / EUROSAIL PLC ESAIL 2007 3X A3A REGS | 0,17 | -6,67 | 0,0483 | -0,0027 | ||

| US17309PAS56 / Citigroup Mortgage Loan Trust 2006-AMC1 | 0,17 | -5,08 | 0,0481 | -0,0022 | ||

| INF SWAP US IT 1.89 08/27/20-7Y LCH / DIR (000000000) | 0,17 | 0,0478 | 0,0478 | |||

| US31396V4Q81 / Fannie Mae REMICS | 0,17 | -1,19 | 0,0476 | 0,0000 | ||

| INF SWAP US IT 2.7675 05/13/21-5Y LCH / DIR (000000000) | 0,16 | 0,0471 | 0,0471 | |||

| US 10YR ULTRA FUT SEP25 / DIR (000000000) | 0,16 | 0,0471 | 0,0471 | |||

| TSTAT 2022-1 Ltd / ABS-CBDO (US872899AY55) | 0,16 | -42,61 | 0,0469 | -0,0333 | ||

| IRS EUR 2.87880 06/12/23-9Y* LCH / DIR (000000000) | 0,16 | 0,0461 | 0,0461 | |||

| INF SWAP US IT 1.7975 08/25/20-7Y LCH / DIR (000000000) | 0,16 | 0,0449 | 0,0449 | |||

| US92914RAY80 / Voya CLO 2014-4 Ltd | 0,15 | -11,63 | 0,0435 | -0,0051 | ||

| US 10YR NOTE (CBT)SEP25 / DIR (000000000) | 0,15 | 0,0419 | 0,0419 | |||

| US912810PS15 / United States Treasury Inflation Indexed Bonds | 0,15 | 0,00 | 0,0416 | 0,0006 | ||

| INF SWAP EM NI 2.7 04/15/23 -30Y LCH / DIR (000000000) | 0,14 | 0,0393 | 0,0393 | |||

| EURO-BUND FUTURE SEP25 / DIR (000000000) | 0,14 | 0,0390 | 0,0390 | |||

| CH1214797172 / Credit Suisse Group AG | 0,13 | 9,09 | 0,0380 | 0,0036 | ||

| US75970NAA54 / Renaissance Home Equity Loan Trust 2002-3 | 0,13 | 0,00 | 0,0376 | 0,0004 | ||

| US86359LPD54 / Structured Asset Mortgage Investments II Trust 2005-AR5 | 0,13 | -2,99 | 0,0374 | -0,0006 | ||

| US83162CRL99 / United States Small Business Administration | 0,13 | -19,50 | 0,0366 | -0,0083 | ||

| US31394VL730 / Fannie Mae REMICS | 0,12 | -3,91 | 0,0355 | -0,0008 | ||

| INF SWAP EM NI 2.763 09/15/23-30Y LCH / DIR (000000000) | 0,12 | 0,0354 | 0,0354 | |||

| US12551JAL08 / CIFC FUNDING LTD CIFC 2017 4A A1R 144A | 0,12 | -23,60 | 0,0352 | -0,0102 | ||

| US03464LAA44 / ANGEL OAK MORTGAGE TRUST 2020-4 AOMT 2020-4 A1 | 0,12 | -7,63 | 0,0348 | -0,0024 | ||

| DK0002050871 / Nordea Kredit Realkreditaktieselskab | 0,12 | 9,09 | 0,0345 | 0,0032 | ||

| EURO-OAT FUTURE SEP25 / DIR (000000000) | 0,12 | 0,0344 | 0,0344 | |||

| INF SWAP US IT 2.703 05/25/21-5Y LCH / DIR (000000000) | 0,12 | 0,0343 | 0,0343 | |||

| US67113DAW48 / OZLM XXIV Ltd | 0,12 | -23,87 | 0,0339 | -0,0099 | ||

| CH0517825276 / Credit Suisse Group AG | 0,11 | 10,68 | 0,0328 | 0,0034 | ||

| US77587UAL61 / ROMARK CLO LTD RMRK 2017 1A A1R 144A | 0,11 | -37,21 | 0,0311 | -0,0176 | ||

| US36290PAS65 / GSMPS Mortgage Loan Trust 2003-3 | 0,11 | -7,69 | 0,0311 | -0,0021 | ||

| US16678RBL06 / Chevy Chase Funding LLC Mortgage-Backed Certificates Series 2004-A | 0,11 | -1,82 | 0,0310 | -0,0002 | ||

| USG53506AK06 / LCM LTD PARTNERSHIP | 0,10 | -54,67 | 0,0292 | -0,0345 | ||

| US928563AC98 / VMware Inc | 0,10 | 1,02 | 0,0284 | 0,0006 | ||

| RFR JPY MUTK/0.50000 12/15/21-10Y LCH / DIR (000000000) | 0,10 | 0,0279 | 0,0279 | |||

| US80317LAJ26 / Saranac Clo VI Ltd | 0,10 | -14,29 | 0,0276 | -0,0042 | ||

| INF SWAP US IT 2.813 05/14/21-5Y LCH / DIR (000000000) | 0,09 | 0,0270 | 0,0270 | |||

| US80557BAA26 / Saxon Asset Securities Trust 2007-3 | 0,09 | -4,35 | 0,0254 | -0,0008 | ||

| US437084CE47 / Home Equity Asset Trust | 0,07 | -5,63 | 0,0194 | -0,0006 | ||

| INF SWAP EM NI 2.736 10/15/23-30Y LCH / DIR (000000000) | 0,07 | 0,0191 | 0,0191 | |||

| US31406UN797 / Fannie Mae Pool | 0,07 | -1,52 | 0,0188 | -0,0001 | ||

| US61744CFR25 / Morgan Stanley ABS Capital I Inc Trust 2004-NC7 | 0,06 | 0,00 | 0,0185 | 0,0001 | ||

| US92331AAU88 / Venture XXVIII CLO Ltd | 0,06 | -42,00 | 0,0167 | -0,0117 | ||

| DK0002050012 / NORDEA KREDIT REALKREDIT /DKK/ REGD 1.50000000 | 0,05 | 8,00 | 0,0157 | 0,0014 | ||

| XS1713075973 / BLACK DIAMOND CLO BLACK 2017 2A A1 144A | 0,05 | -38,64 | 0,0155 | -0,0096 | ||

| US29880YAJ82 / EUROSAIL PLC ESAIL 2007 3A A3C 144A | 0,05 | -7,14 | 0,0151 | -0,0008 | ||

| INF SWAP EM NI 2.59 12/15/22-30Y LCH / DIR (000000000) | 0,05 | 0,0148 | 0,0148 | |||

| US07384M4J85 / Bear Stearns ARM Trust 2004-10 | 0,05 | 2,00 | 0,0148 | 0,0005 | ||

| US31406KBE91 / Fannie Mae Pool | 0,05 | 0,00 | 0,0144 | 0,0001 | ||

| US69702HAA68 / Palmer Square Loan Funding Ltd | 0,05 | -58,33 | 0,0144 | -0,0197 | ||

| US14889DAJ72 / Catamaran CLO 2014-1 Ltd | 0,05 | -38,16 | 0,0135 | -0,0082 | ||

| US86359LDX47 / Structured Asset Mortgage Investments II Trust 2004-AR5 | 0,05 | -8,00 | 0,0133 | -0,0011 | ||

| GB00H240B223 / LME Nickel Base Metal | 0,04 | 0,0124 | 0,0124 | |||

| AUST 10Y BOND FUT SEP25 / DIR (000000000) | 0,04 | 0,0120 | 0,0120 | |||

| RFR JPY MUTK/0.55000 09/14/23-5Y LCH / DIR (000000000) | 0,04 | 0,0115 | 0,0115 | |||

| DK0004619624 / Realkredit Danmark A/S | 0,04 | 8,33 | 0,0113 | 0,0011 | ||

| INF SWAP GB NI 3.5 08/15/24-10Y LCH / DIR (000000000) | 0,04 | 0,0109 | 0,0109 | |||

| US36242DUL53 / GSR Mortgage Loan Trust 2005-AR1 | 0,04 | -2,70 | 0,0105 | 0,0001 | ||

| INF SWAP US IT 2.645 09/10/21-7Y LCH / DIR (000000000) | 0,04 | 0,0101 | 0,0101 | |||

| US585525FC72 / Mellon Residential Funding Corp Mor Pas Thr Cer Ser 01 Tbc1 | 0,03 | -2,94 | 0,0095 | -0,0003 | ||

| INF SWAP US IT 2.573 08/26/21-7Y LCH / DIR (000000000) | 0,03 | 0,0091 | 0,0091 | |||

| US48250LAW90 / KKR FINANCIAL CLO LTD 07/30 1 | 0,03 | -39,22 | 0,0090 | -0,0055 | ||

| INF SWAP EM NI 2.682 10/15/23-30Y LCH / DIR (000000000) | 0,03 | 0,0085 | 0,0085 | |||

| DK0002050442 / Nordea Kredit Realkreditaktieselskab | 0,03 | 11,54 | 0,0084 | 0,0009 | ||

| RFR JPY MUT+5.89/0.3000 09/20/17-10Y LCH / DIR (000000000) | 0,03 | 0,0084 | 0,0084 | |||

| EURO-BTP FUTURE SEP25 / DIR (000000000) | 0,03 | 0,0083 | 0,0083 | |||

| DK0002051093 / Nordea Kredit Realkreditaktieselskab | 0,03 | 8,33 | 0,0075 | 0,0007 | ||

| US31408DB455 / Fannie Mae Pool | 0,03 | 0,00 | 0,0075 | -0,0000 | ||

| US31336CLR24 / Freddie Mac Non Gold Pool | 0,03 | -3,85 | 0,0073 | -0,0002 | ||

| US585525EN47 / MRFC Mortgage Pass-Through Trust Series 2000-TBC3 | 0,03 | -7,41 | 0,0072 | -0,0005 | ||

| US81743WAA99 / Sequoia Mortgage Trust 5 | 0,03 | -3,85 | 0,0072 | -0,0003 | ||

| US46630GAA31 / JP Morgan Mortgage Trust 2007-A1 | 0,02 | -4,00 | 0,0071 | -0,0000 | ||

| US3133TSQG11 / Freddie Mac Structured Pass-Through Certificates | 0,02 | -11,11 | 0,0069 | -0,0008 | ||

| US86359B7K13 / Structured Asset Securities Corp Mortgage Loan Trust 2005-7XS | 0,02 | -41,03 | 0,0067 | -0,0043 | ||

| INF SWAP EM NI 3.0 05/15/22-5Y LCH / DIR (000000000) | 0,02 | 0,0065 | 0,0065 | |||

| US31406DAF33 / Fannie Mae Pool | 0,02 | 0,00 | 0,0061 | -0,0001 | ||

| XS2068932222 / HSBC BANK PLC WARRANT | 0,02 | 0,0060 | 0,0060 | |||

| US31407XUZ22 / Fannie Mae Pool | 0,02 | 0,00 | 0,0051 | -0,0000 | ||

| US31405YPX30 / Fannie Mae Pool | 0,02 | -11,11 | 0,0048 | -0,0003 | ||

| INF SWAP EM NI 2.965 05/15/22-5Y LCH / DIR (000000000) | 0,02 | 0,0045 | 0,0045 | |||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 0,01 | 0,0041 | 0,0041 | |||

| INF SWAP GB NI 3.466 09/15/24-10Y LCH / DIR (000000000) | 0,01 | 0,0041 | 0,0041 | |||

| US31394ANT96 / Fannie Mae REMICS | 0,01 | 0,00 | 0,0032 | -0,0001 | ||

| DK0009532020 / Nykredit Realkredit AS | 0,01 | 0,00 | 0,0031 | 0,0003 | ||

| XS2068932222 / HSBC BANK PLC WARRANT | 0,01 | 0,0030 | 0,0030 | |||

| US31405U6G90 / Fannie Mae Pool | 0,01 | -10,00 | 0,0028 | -0,0000 | ||

| US86359BGF22 / Structured Adjustable Rate Mortgage Loan Trust | 0,01 | 0,00 | 0,0027 | -0,0001 | ||

| INF SWAP EM NI 1.636 06/15/25-2Y LCH / DIR (000000000) | 0,01 | 0,0022 | 0,0022 | |||

| US22616CAJ27 / Crestline Denali CLO XV Ltd | 0,01 | -84,21 | 0,0019 | -0,0090 | ||

| US31408DC859 / Fannie Mae Pool | 0,01 | 0,00 | 0,0018 | -0,0000 | ||

| INF SWAP US IT 3.323 04/23/25-1Y LCH / DIR (000000000) | 0,01 | 0,0017 | 0,0017 | |||

| US31391Q7B45 / Fannie Mae Pool | 0,01 | -16,67 | 0,0017 | -0,0000 | ||

| US05401AAR23 / Avolon Holdings Funding Ltd | 0,01 | 0,00 | 0,0016 | 0,0000 | ||

| US31408B5A26 / Fannie Mae Pool | 0,01 | 0,00 | 0,0015 | -0,0000 | ||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,01 | 0,0015 | 0,0015 | |||

| US31405PRS10 / Fannie Mae Pool | 0,01 | 0,00 | 0,0015 | -0,0000 | ||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0,01 | 0,0014 | 0,0014 | |||

| US17307GW530 / Citigroup Mortgage Loan Trust 2005-11 | 0,00 | 0,00 | 0,0012 | 0,0000 | ||

| DGZ / DB Gold Short ETN | 0,00 | 0,0011 | 0,0011 | |||

| INF SWAP US IT 3.3 06/04/2025-1Y LCH / DIR (000000000) | 0,00 | 0,0011 | 0,0011 | |||

| TRS R SOFRRATE+17/912828V49 MYC / DIR (000000000) | 0,00 | 0,0010 | 0,0010 | |||

| INF SWAP EM NI 3.13 05/15/22-5Y LCH / DIR (000000000) | 0,00 | 0,0008 | 0,0008 | |||

| RFR USD SOFR/4.25000 12/20/23-2Y CME / DIR (000000000) | 0,00 | 0,0007 | 0,0007 | |||

| DK0009399784 / JYSKE REALKREDIT A/S COVERED 10/43 0.5 | 0,00 | 0,00 | 0,0005 | 0,0000 | ||

| US31396WTU08 / Fannie Mae REMICS | 0,00 | 0,00 | 0,0005 | -0,0000 | ||

| XS2068932222 / HSBC BANK PLC WARRANT | 0,00 | 0,0004 | 0,0004 | |||

| DK0009292559 / REALKREDIT DANMARK COVERED 07/47 2.5 | 0,00 | 0,00 | 0,0003 | 0,0000 | ||

| INF SWAP EM NI 2.6 05/15/22-10Y LCH / DIR (000000000) | 0,00 | 0,0002 | 0,0002 | |||

| US36225CBA36 / Ginnie Mae II Pool | 0,00 | 0,0002 | -0,0000 | |||

| US36202K2K04 / Ginnie Mae II Pool | 0,00 | 0,0002 | -0,0001 | |||

| US36225CAN65 / Ginnie Mae II Pool | 0,00 | 0,0002 | -0,0000 | |||

| XS2068932222 / HSBC BANK PLC WARRANT | 0,00 | 0,0002 | 0,0002 | |||

| GB00H240B223 / LME Nickel Base Metal | 0,00 | 0,0001 | 0,0001 | |||

| US3128NC6C35 / Freddie Mac Non Gold Pool | 0,00 | 0,0001 | -0,0001 | |||

| US36225CA221 / Ginnie Mae II Pool | 0,00 | 0,0001 | -0,0000 | |||

| DK0009798803 / NYKREDIT REALKREDIT AS COVERED REGS 10/47 2.5 | 0,00 | 0,0001 | 0,0000 | |||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0001 | 0,0001 | |||

| DK0009382707 / JYSKE REALKREDIT A/S COVERED 10/47 2.5 | 0,00 | 0,0000 | 0,0000 | |||

| DK0002044551 / NORDEA KREDIT REALKREDIT COVERED REGS 10/50 1 | 0,00 | 0,0000 | 0,0000 | |||

| NDASS / NORDEA KREDIT REALKREDIT COVERED 10/47 2.5 | 0,00 | 0,0000 | 0,0000 | |||

| DK0009522815 / NYKREDIT REALKREDIT AS COVERED REGS 10/50 1 | 0,00 | 0,0000 | 0,0000 | |||

| US36202KTG03 / Ginnie Mae II Pool | 0,00 | 0,0000 | -0,0000 | |||

| DK0002047141 / Nordea Kredit Realkreditaktieselskab | 0,00 | 0,0000 | 0,0000 | |||

| INF SWAP EM NI 2.4875 05/15/22-15Y LCH / DIR (000000000) | 0,00 | 0,0000 | 0,0000 | |||

| DK0009527376 / Nykredit Realkredit A/S, Series 01E | 0,00 | 0,0000 | 0,0000 | |||

| DK0009527293 / NYKREDIT REALKREDIT AS COVERED REGS 10/53 1 | 0,00 | 0,0000 | 0,0000 | |||

| DK0004619384 / REALKREDIT DANMARK COVERED REGS 10/53 1.5 | 0,00 | 0,0000 | 0,0000 | |||

| DK0002044718 / NORDEA KREDIT REALKREDIT COVERED 10/50 1 | 0,00 | 0,0000 | 0,0000 | |||

| DK0004616281 / REALKREDIT DKK SR SEC SF COVERED 1.0% 10-01-53 | 0,00 | 0,0000 | 0,0000 | |||

| DK0009397739 / JYSKE REALKREDIT A/S COVERED 10/50 1 | 0,00 | 0,0000 | 0,0000 | |||

| DK0002050368 / Nordea Kredit Realkreditaktieselskab | 0,00 | 0,0000 | 0,0000 | |||

| DK0009524431 / NYKREDIT REALKREDIT AS COVERED REGS 10/50 1 | 0,00 | 0,0000 | 0,0000 | |||

| DK0009403131 / JYSKE REALKREDIT A/S COVERED 10/53 1 | 0,00 | 0,0000 | 0,0000 | |||

| DK0004612454 / REALKREDIT DANMARK A/S COVERED 10/50 1 | 0,00 | 0,0000 | 0,0000 | |||

| DK0009527103 / NYKREDIT REALKREDIT AS COVERED REGS 10/43 0.5 | 0,00 | 0,0000 | 0,0000 | |||

| DK0009403644 / JYSKE REALKREDIT A/S COVERED 10/53 1.5 | 0,00 | 0,0000 | 0,0000 | |||

| DK0004619467 / Realkredit Danmark A/S | 0,00 | 0,0000 | 0,0000 | |||

| DK0009397069 / JYSKE REALKREDIT A/S COVERED REGS 10/50 1 | 0,00 | 0,0000 | 0,0000 | |||

| DK0004616018 / Realkredit Danmark A/S | 0,00 | 0,0000 | 0,0000 | |||

| DK0009527616 / NYKREDIT REALKREDIT AS COVERED REGS 10/53 1.5 | 0,00 | 0,0000 | 0,0000 | |||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,00 | -0,0001 | -0,0001 | |||

| GB00H240B223 / LME Nickel Base Metal | -0,00 | -0,0001 | -0,0001 | |||

| EURO-SCHATZ FUT SEP25 / DIR (000000000) | -0,00 | -0,0003 | -0,0003 | |||

| INF SWAP EM NI 2.421 05/15/22-30Y LCH / DIR (000000000) | -0,00 | -0,0004 | -0,0004 | |||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,00 | -0,0004 | -0,0004 | |||

| JPN 10Y BOND(OSE) SEP25 / DIR (000000000) | -0,00 | -0,0006 | -0,0006 | |||

| INF SWAP US IT 2.842 02/13/25-1Y LCH / DIR (000000000) | -0,00 | -0,0010 | -0,0010 | |||

| INF SWAP US IT 2.82 02/05/25-1Y LCH / DIR (000000000) | -0,00 | -0,0010 | -0,0010 | |||

| DGZ / DB Gold Short ETN | -0,00 | -0,0011 | -0,0011 | |||

| AUST 3YR BOND FUT SEP25 / DIR (000000000) | -0,00 | -0,0011 | -0,0011 | |||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,01 | -0,0015 | -0,0015 | |||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,01 | -0,0018 | -0,0018 | |||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,01 | -0,0023 | -0,0023 | |||

| INF SWAP EM NI 2.034 09/15/24-10Y LCH / DIR (000000000) | -0,01 | -0,0023 | -0,0023 | |||

| GB00H240B223 / LME Nickel Base Metal | -0,01 | -0,0024 | -0,0024 | |||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0,01 | -0,0025 | -0,0025 | |||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0,01 | -0,0025 | -0,0025 | |||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,01 | -0,0032 | -0,0032 | |||

| EURO-BOBL FUTURE SEP25 / DIR (000000000) | -0,01 | -0,0036 | -0,0036 | |||

| INF SWAP US IT 2.70 01/14/25-1Y LCH / DIR (000000000) | -0,01 | -0,0036 | -0,0036 | |||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,01 | -0,0037 | -0,0037 | |||

| INF SWAP US IT 2.38 10/15/24-1Y LCH / DIR (000000000) | -0,01 | -0,0039 | -0,0039 | |||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | -0,01 | -0,0041 | -0,0041 | |||

| XS2068932222 / HSBC BANK PLC WARRANT | -0,02 | -0,0051 | -0,0051 | |||

| XS2068932222 / HSBC BANK PLC WARRANT | -0,02 | -0,0060 | -0,0060 | |||

| INF SWAP US IT 2.208 10/07/24-1Y LCH / DIR (000000000) | -0,02 | -0,0065 | -0,0065 | |||

| 317U80OA6 PIMCO FPPSWAPTION 2.5 PUT EUR / DIR (000000000) | -0,02 | -0,0069 | -0,0069 | |||

| INF SWAP US IT 2.033 09/23/24-1Y LCH / DIR (000000000) | -0,03 | -0,0076 | -0,0076 | |||

| INF SWAP US IT 1.98 09/19/24-1Y LCH / DIR (000000000) | -0,03 | -0,0080 | -0,0080 | |||

| INF SWAP EM NI 2.049 08/15/24-10Y LCH / DIR (000000000) | -0,03 | -0,0080 | -0,0080 | |||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,03 | -0,0082 | -0,0082 | |||

| 3175RWRC3 INF CAP FWD EU JUN35 3 CALL / DIR (000000000) | -0,03 | -0,0083 | -0,0083 | |||

| IRS EUR 2.12000 09/03/25-2Y LCH / DIR (000000000) | -0,03 | -0,0097 | -0,0097 | |||

| GB00H240B223 / LME Nickel Base Metal | -0,04 | -0,0124 | -0,0124 | |||

| 317U80NA7 PIMCO FPPSWAPTION 2.5 CALL EUR / DIR (000000000) | -0,05 | -0,0135 | -0,0135 | |||

| EURO-BUXL 30Y BND SEP25 / DIR (000000000) | -0,07 | -0,0190 | -0,0190 | |||

| 317U7XUA8 PIMCO FPPSWAPTION 2.35 PUT EUR / DIR (000000000) | -0,08 | -0,0242 | -0,0242 | |||

| 317U7XVA7 PIMCO FPPSWAPTION 2.35 CALL EUR / DIR (000000000) | -0,11 | -0,0311 | -0,0311 | |||

| INF SWAP US IT 1.8825 11/20/19-10Y LCH / DIR (000000000) | -0,11 | -0,0324 | -0,0324 | |||

| 3MO EURO EURIBOR SEP25 / DIR (000000000) | -0,13 | -0,0366 | -0,0366 | |||

| RFR GBP SONIO/3.50000 03/19/25-5Y LCH / DIR (000000000) | -0,14 | -0,0404 | -0,0404 | |||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | -0,16 | -0,0454 | -0,0454 | |||

| RFR USD SOFR/3.08500 02/13/24-10Y LCH / DIR (000000000) | -0,20 | -0,0564 | -0,0564 | |||

| RFR USD SOFR/4.10000 09/02/25-27Y* LCH / DIR (000000000) | -0,23 | -0,0648 | -0,0648 | |||

| DGZ / DB Gold Short ETN | -0,30 | -0,0856 | -0,0856 | |||

| INF SWAP US IT 1.954 06/03/19-10Y LCH / DIR (000000000) | -0,36 | -0,1039 | -0,1039 | |||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | -0,52 | -0,1496 | -0,1496 | |||

| INF SWAP US IT 1.76 11/04/19-10Y LCH / DIR (000000000) | -0,54 | -0,1544 | -0,1544 | |||

| RFRF USD SOFR/2.34000 11/21/23-5Y LCH / DIR (000000000) | -0,63 | -0,1796 | -0,1796 | |||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0,68 | -0,1933 | -0,1933 | |||

| US LONG BOND(CBT) SEP25 / DIR (000000000) | -0,82 | -0,2354 | -0,2354 | |||

| INF SWAP US IT 1.9975 07/25/19-10Y LCH / DIR (000000000) | -1,14 | -0,3253 | -0,3253 | |||

| INF SWAP EM NI 1.38 03/15/21-10Y LCH / DIR (000000000) | -1,14 | -0,3260 | -0,3260 | |||

| IRS EUR 2.25000 09/17/25-10Y LCH / DIR (000000000) | -1,51 | -0,4326 | -0,4326 | |||

| US21H0326700 / GNMA2 30YR TBA(REG C) 3.5 TBA 07-01-50 | -7,00 | -870,19 | -2,0024 | -2,2624 |