Statistiques de base

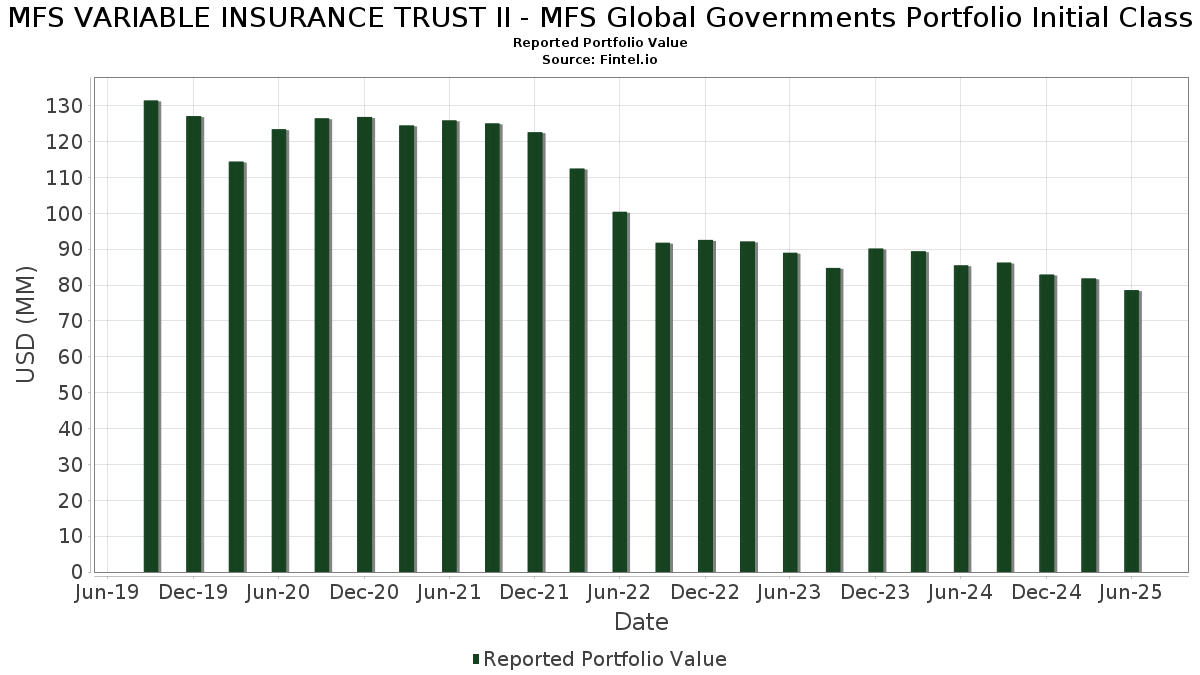

| Valeur du portefeuille | $ 78 568 228 |

| Positions actuelles | 202 |

Dernières positions, performances, ASG (à partir des dépôts 13F, 13D)

MFS VARIABLE INSURANCE TRUST II - MFS Global Governments Portfolio Initial Class a déclaré un total de 202 positions dans ses derniers dépôts auprès de la SEC. La valeur la plus récente du portefeuille est calculée à 78 568 228 USD. Les actifs sous gestion réels (ASG) sont cette valeur plus les liquidités (qui ne sont pas divulguées). Les principales positions de MFS VARIABLE INSURANCE TRUST II - MFS Global Governments Portfolio Initial Class sont United States Treasury Note/Bond (US:US912828X885) , U.S. Treasury Notes 2.875%, due 08/15/2028 (US:US9128284V99) , United States Treasury Note/Bond (US:US91282CAE12) , Japan Government Ten Year Bond (JP:JP1103421G35) , and United States Treas Bds Bond (US:US912810QC53) . Les nouvelles positions de MFS VARIABLE INSURANCE TRUST II - MFS Global Governments Portfolio Initial Class incluent United States Treasury Note/Bond (US:US912828X885) , U.S. Treasury Notes 2.875%, due 08/15/2028 (US:US9128284V99) , United States Treasury Note/Bond (US:US91282CAE12) , Japan Government Ten Year Bond (JP:JP1103421G35) , and United States Treas Bds Bond (US:US912810QC53) .

Meilleures augmentations ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 3,23 | 4,0910 | 4,0910 | ||

| 2,35 | 2,9692 | 2,9692 | ||

| 5,62 | 7,1049 | 2,9112 | ||

| 2,05 | 2,5884 | 2,5884 | ||

| 2,47 | 2,47 | 3,1267 | 2,2319 | |

| 1,75 | 2,2148 | 2,2148 | ||

| 1,18 | 1,4861 | 1,4861 | ||

| 1,13 | 1,4324 | 1,4324 | ||

| 1,01 | 1,2730 | 1,2730 | ||

| 0,55 | 0,6947 | 0,6947 |

Principales baisses ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 2,78 | 3,5192 | -3,0381 | ||

| 1,12 | 1,4199 | -2,1444 | ||

| 0,88 | 1,1141 | -1,0587 | ||

| 0,32 | 0,4001 | -0,8617 | ||

| 1,06 | 1,3346 | -0,4704 | ||

| 0,44 | 0,5560 | -0,4678 | ||

| 0,39 | 0,4956 | -0,3834 | ||

| 0,53 | 0,6722 | -0,3213 | ||

| 0,51 | 0,6440 | -0,2313 | ||

| 0,29 | 0,3706 | -0,1874 |

Déclarations 13F et dépôts de fonds

Ce formulaire a été déposé le 2025-08-25 pour la période de déclaration 2025-06-30. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau pour débloquer les données premium et exporter vers Excel ![]() .

.

| Titre | Type | Prix moyen de l'action | Actions (en millions) |

ΔActions (%) |

ΔActions (%) |

Valeur ($ en millions) |

Portefeuille (%) |

ΔPortefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US912828X885 / United States Treasury Note/Bond | 6,25 | 0,66 | 7,9065 | 0,3325 | |||||

| US9128284V99 / U.S. Treasury Notes 2.875%, due 08/15/2028 | 6,15 | 0,79 | 7,7840 | 0,3376 | |||||

| US91282CAE12 / United States Treasury Note/Bond | 5,62 | 63,33 | 7,1049 | 2,9112 | |||||

| JP1103421G35 / Japan Government Ten Year Bond | 4,99 | 4,40 | 6,3060 | 0,4812 | |||||

| US912810QC53 / United States Treas Bds Bond | 3,67 | -1,37 | 4,6448 | 0,1043 | |||||

| Italy Buoni Poliennali Del Tesoro / DBT (IT0005654642) | 3,23 | 4,0910 | 4,0910 | ||||||

| JP1201741LA9 / Japan Government Twenty Year Bond | 3,18 | 11,60 | 4,0280 | 0,5479 | |||||

| IT0005566408 / BTPS | 2,78 | -48,26 | 3,5192 | -3,0381 | |||||

| GR0124036709 / Hellenic Republic Government Bond | 2,68 | 10,18 | 3,3943 | 0,4244 | |||||

| US55291X1090 / MFS Institutional Money Market Portfolio | 2,47 | 236,90 | 2,47 | 237,24 | 3,1267 | 2,2319 | |||

| JP1300031000 / JAPAN GOVT 30-YR | 2,35 | 2,9692 | 2,9692 | ||||||

| AMI / Aurelia Metals Limited | 2,11 | 10,00 | 2,6718 | 0,3302 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 2,05 | 2,5884 | 2,5884 | ||||||

| US91282CBT71 / United States Treasury Note/Bond - When Issued | 2,03 | 0,75 | 2,5657 | 0,1105 | |||||

| US912810QY73 / United States Treas Bds Bond | 2,02 | -2,09 | 2,5492 | 0,0395 | |||||

| US912810SF66 / Us Treasury Bond | 1,89 | -2,57 | 2,3948 | 0,0249 | |||||

| US91282CGM73 / United States Treasury Note/Bond | 1,80 | 25,07 | 2,2786 | 0,5218 | |||||

| Italy Buoni Poliennali Del Tesoro / DBT (IT0005631608) | 1,79 | 13,89 | 2,2622 | 0,3471 | |||||

| AU0000274706 / AUSTRALIAN GOVERNMENT /AUD/ REGD REG S SER 168 3.50000000 | 1,75 | 2,2148 | 2,2148 | ||||||

| US912810TT51 / United States Treasury Note/Bond | 1,70 | -3,08 | 2,1487 | 0,0114 | |||||

| GR0114029540 / Hellenic Republic Government Bond | 1,43 | 11,14 | 1,8059 | 0,2394 | |||||

| ADANIENSOL / Adani Energy Solutions Limited | 1,18 | 1,4861 | 1,4861 | ||||||

| EU000A285VM2 / EUROPEAN UNION SR UNSECURED REGS 07/35 0.0000 | 1,13 | 1,4324 | 1,4324 | ||||||

| GB00BL68HH02 / United Kingdom Gilt | 1,12 | -61,60 | 1,4199 | -2,1444 | |||||

| ADANIENSOL / Adani Energy Solutions Limited | 1,06 | -28,72 | 1,3346 | -0,4704 | |||||

| FR0013313582 / French Republic Government Bond OAT | 1,01 | 1,2730 | 1,2730 | ||||||

| SGB / Sweden Government Bond | 0,91 | -5,91 | 1,1491 | 0,3665 | |||||

| CA135087N266 / Canada Government Bond | 0,88 | -50,59 | 1,1141 | -1,0587 | |||||

| ES00000121S7 / Spain Government Bond | 0,82 | 10,58 | 1,0319 | 0,1327 | |||||

| JP1300681LA7 / Japan Government Thirty Year Bond | 0,71 | -16,61 | 0,8963 | -0,1393 | |||||

| SE0017830730 / SWEDEN KINGDOM OF 1.75% 11/11/2033 144A REGS | 0,57 | 10,06 | 0,7198 | 0,0886 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 0,55 | 0,6947 | 0,6947 | ||||||

| JP1201021860 / Japan Government Twenty Year Bond | 0,54 | 0,6833 | 0,6833 | ||||||

| US912810RK60 / United States Treas Bds Bond | 0,53 | -34,77 | 0,6722 | -0,3213 | |||||

| Croatia Government International Bond / DBT (XS2997390153) | 0,51 | -29,01 | 0,6440 | -0,2313 | |||||

| US917288BM35 / Uruguay Government International Bond | 0,44 | -47,68 | 0,5560 | -0,4678 | |||||

| SERBIA / Serbia International Bond | 0,43 | 11,14 | 0,5435 | 0,0722 | |||||

| JP1400101H56 / Japan Government Forty Year Bond | 0,41 | 3,85 | 0,5123 | 0,0363 | |||||

| GB00B6RNH572 / United Kingdom Gilt | 0,39 | -45,69 | 0,4956 | -0,3834 | |||||

| FI4000426051 / Finland T-Bill | 0,32 | -69,44 | 0,4001 | -0,8617 | |||||

| GB00B54QLM75 / United Kingdom Gilt | 0,30 | 6,32 | 0,3838 | 0,0355 | |||||

| Italy Buoni Poliennali Del Tesoro / DBT (IT0005611741) | 0,29 | -35,89 | 0,3706 | -0,1874 | |||||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 0,29 | 0,3675 | 0,3675 | ||||||

| US682142AK00 / OMERS FINANCE TRUST REGD 144A P/P 5.50000000 | 0,26 | 0,38 | 0,3337 | 0,0131 | |||||

| Province of Alberta Canada / DBT (US013051ET04) | 0,25 | 0,81 | 0,3151 | 0,0127 | |||||

| Albania Government International Bond / DBT (XS3004338557) | 0,24 | 12,32 | 0,3004 | 0,0431 | |||||

| XS2170852847 / Synlab Bondco PLC | 0,20 | 1,51 | 0,2563 | 0,0133 | |||||

| CA135087P998 / CANADA-GOV'T | 0,20 | 0,2524 | 0,2524 | ||||||

| GB00BBJNQY21 / United Kingdom Gilt | 0,16 | 6,58 | 0,2051 | 0,0186 | |||||

| US20848FAA84 / Conservation Fund | 0,15 | 0,68 | 0,1887 | 0,0078 | |||||

| US83162CVK60 / United States Small Business Administration | 0,12 | 0,85 | 0,1510 | 0,0068 | |||||

| AmeriCredit Automobile Receivables Trust 2024-1 / ABS-O (US023947AC87) | 0,11 | -36,78 | 0,1400 | -0,0725 | |||||

| US03882KAN28 / Arbor Multifamily Mortgage Securities Trust 2020-MF1 | 0,09 | -4,08 | 0,1193 | -0,0013 | |||||

| US3137H5DT14 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,09 | -3,09 | 0,1192 | 0,0009 | |||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,09 | 0,1130 | 0,1130 | ||||||

| US3137FV5Q11 / FHLMC, Multifamily Structured Pass-Through Certificates, Series K113, Class X1 | 0,08 | -3,80 | 0,0962 | -0,0013 | |||||

| US3137H4CH10 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,07 | -2,86 | 0,0861 | 0,0007 | |||||

| US3137H4BT66 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,07 | -2,90 | 0,0851 | 0,0007 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,07 | 0,0833 | 0,0833 | ||||||

| SBNA Auto Receivables Trust 2025-SF1 / ABS-O (US78437XAB29) | 0,05 | 0,0632 | 0,0632 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,05 | 0,0615 | 0,0615 | ||||||

| US 10YR NOTE (CBT)SEP25 / DIR (000000000) | 0,04 | 0,0568 | 0,0568 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,04 | 0,0543 | 0,0543 | ||||||

| US442851AG63 / Howard University | 0,04 | 0,00 | 0,0527 | 0,0023 | |||||

| US88581EAF88 / 3650R 2021-PF1 Commercial Mortgage Trust | 0,04 | -4,88 | 0,0498 | -0,0003 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,04 | 0,0488 | 0,0488 | ||||||

| US3137H3EZ17 / Freddie Mac Multifamily Structured Pass Through Certificates | 0,03 | -3,12 | 0,0400 | 0,0001 | |||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,03 | 0,0400 | 0,0400 | ||||||

| PURCHASED KRW / SOLD USD / DFE (000000000) | 0,03 | 0,0354 | 0,0354 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,03 | 0,0331 | 0,0331 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,03 | 0,0327 | 0,0327 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0,02 | 0,0313 | 0,0313 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,02 | 0,0312 | 0,0312 | ||||||

| EURO-SCHATZ FUT SEP25 / DIR (000000000) | 0,02 | 0,0260 | 0,0260 | ||||||

| LONG GILT FUTURE SEP25 / DIR (000000000) | 0,02 | 0,0259 | 0,0259 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 0,02 | -5,26 | 0,0232 | -0,0006 | |||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0,02 | 0,0229 | 0,0229 | ||||||

| US3137F62R74 / FHLMC Multifamily Structured Pass-Through Certificates, Series K118, Class XAM | 0,02 | -5,56 | 0,0222 | -0,0001 | |||||

| US3137H4SM31 / FHLMC REMIC TRUST | 0,02 | 0,00 | 0,0218 | -0,0000 | |||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,02 | 0,0196 | 0,0196 | ||||||

| EURO-BUXL 30Y BND SEP25 / DIR (000000000) | 0,01 | 0,0175 | 0,0175 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,01 | 0,0158 | 0,0158 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,01 | 0,0152 | 0,0152 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,01 | 0,0149 | 0,0149 | ||||||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | 0,01 | 0,0123 | 0,0123 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,01 | 0,0115 | 0,0115 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,01 | 0,0107 | 0,0107 | ||||||

| PURCHASED DKK / SOLD USD / DFE (000000000) | 0,01 | 0,0087 | 0,0087 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0,01 | 0,0077 | 0,0077 | ||||||

| PURCHASED INR / SOLD USD / DFE (000000000) | 0,01 | 0,0071 | 0,0071 | ||||||

| Long: BM11746 IRS USD R V 12MUSCPI SM11746_FLO CCPINFLATIONZERO / Short: BM11746 IRS USD P F 2.75500 SM11746_FIX CCPINFLATIONZERO / DIR (000000000) | 0,01 | 0,0068 | 0,0068 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,00 | 0,0063 | 0,0063 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0062 | 0,0062 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | 0,00 | 0,0057 | 0,0057 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,00 | 0,0050 | 0,0050 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0048 | 0,0048 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | 0,00 | 0,0046 | 0,0046 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0,00 | 0,0045 | 0,0045 | ||||||

| US83162CQA44 / United States Small Business Administration, Series 2006-20A, Class 1 | 0,00 | 0,00 | 0,0045 | 0,0002 | |||||

| PURCHASED SEK / SOLD USD / DFE (000000000) | 0,00 | 0,0044 | 0,0044 | ||||||

| JPN 10Y BOND(OSE) SEP25 / DIR (000000000) | 0,00 | 0,0043 | 0,0043 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0,00 | 0,0040 | 0,0040 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,00 | 0,0039 | 0,0039 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,00 | 0,0039 | 0,0039 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0036 | 0,0036 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0,00 | 0,0034 | 0,0034 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,00 | 0,0029 | 0,0029 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,00 | 0,0027 | 0,0027 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0,00 | 0,0027 | 0,0027 | ||||||

| US ULTRA BOND CBT SEP25 / DIR (000000000) | 0,00 | 0,0025 | 0,0025 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0023 | 0,0023 | ||||||

| BNP / BNP Paribas SA | 0,00 | 0,0022 | 0,0022 | ||||||

| PURCHASED CAD / SOLD USD / DFE (000000000) | 0,00 | 0,0020 | 0,0020 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0,00 | 0,0015 | 0,0015 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,00 | 0,0015 | 0,0015 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,00 | 0,0015 | 0,0015 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,00 | 0,0013 | 0,0013 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | 0,00 | 0,0008 | 0,0008 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,00 | 0,0007 | 0,0007 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,00 | 0,0007 | 0,0007 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | 0,00 | 0,0006 | 0,0006 | ||||||

| PURCHASED CAD / SOLD USD / DFE (000000000) | 0,00 | 0,0005 | 0,0005 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | 0,00 | 0,0004 | 0,0004 | ||||||

| EURO-BOBL FUTURE SEP25 / DIR (000000000) | 0,00 | 0,0004 | 0,0004 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,00 | 0,0004 | 0,0004 | ||||||

| PURCHASED CAD / SOLD USD / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | ||||||

| PURCHASED CAD / SOLD USD / DFE (000000000) | 0,00 | 0,0003 | 0,0003 | ||||||

| US83162CPV99 / Small Business Administration Participation Certs | 0,00 | 0,0001 | -0,0001 | ||||||

| PURCHASED SEK / SOLD USD / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| PURCHASED CAD / SOLD USD / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| DGZ / DB Gold Short ETN | 0,00 | 0,0001 | 0,0001 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | -0,00 | -0,0000 | -0,0000 | ||||||

| DGZ / DB Gold Short ETN | -0,00 | -0,0001 | -0,0001 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,00 | -0,0002 | -0,0002 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0,00 | -0,0004 | -0,0004 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | -0,00 | -0,0005 | -0,0005 | ||||||

| PURCHASED USD / SOLD DKK / DFE (000000000) | -0,00 | -0,0006 | -0,0006 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,00 | -0,0007 | -0,0007 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0,00 | -0,0007 | -0,0007 | ||||||

| BNP / BNP Paribas SA | -0,00 | -0,0008 | -0,0008 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,00 | -0,0009 | -0,0009 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | -0,00 | -0,0011 | -0,0011 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | -0,00 | -0,0011 | -0,0011 | ||||||

| PURCHASED USD / SOLD DKK / DFE (000000000) | -0,00 | -0,0011 | -0,0011 | ||||||

| DGZ / DB Gold Short ETN | -0,00 | -0,0013 | -0,0013 | ||||||

| DGZ / DB Gold Short ETN | -0,00 | -0,0013 | -0,0013 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | -0,00 | -0,0015 | -0,0015 | ||||||

| BNP / BNP Paribas SA | -0,00 | -0,0015 | -0,0015 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,00 | -0,0016 | -0,0016 | ||||||

| PURCHASED USD / SOLD AUD / DFE (000000000) | -0,00 | -0,0019 | -0,0019 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | -0,00 | -0,0020 | -0,0020 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,00 | -0,0024 | -0,0024 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0,00 | -0,0029 | -0,0029 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,00 | -0,0032 | -0,0032 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0,00 | -0,0035 | -0,0035 | ||||||

| PURCHASED USD / SOLD SEK / DFE (000000000) | -0,00 | -0,0038 | -0,0038 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0,00 | -0,0039 | -0,0039 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,00 | -0,0040 | -0,0040 | ||||||

| EURO-BTP FUTURE SEP25 / DIR (000000000) | -0,00 | -0,0042 | -0,0042 | ||||||

| PURCHASED NOK / SOLD USD / DFE (000000000) | -0,00 | -0,0043 | -0,0043 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,00 | -0,0045 | -0,0045 | ||||||

| PURCHASED USD / SOLD CAD / DFE (000000000) | -0,00 | -0,0048 | -0,0048 | ||||||

| PURCHASED USD / SOLD SEK / DFE (000000000) | -0,00 | -0,0051 | -0,0051 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,01 | -0,0067 | -0,0067 | ||||||

| PURCHASED USD / SOLD AUD / DFE (000000000) | -0,01 | -0,0067 | -0,0067 | ||||||

| PURCHASED USD / SOLD AUD / DFE (000000000) | -0,01 | -0,0068 | -0,0068 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0,01 | -0,0070 | -0,0070 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,01 | -0,0071 | -0,0071 | ||||||

| DGZ / DB Gold Short ETN | -0,01 | -0,0074 | -0,0074 | ||||||

| PURCHASED USD / SOLD AUD / DFE (000000000) | -0,01 | -0,0078 | -0,0078 | ||||||

| PURCHASED USD / SOLD CHF / DFE (000000000) | -0,01 | -0,0080 | -0,0080 | ||||||

| PURCHASED USD / SOLD SEK / DFE (000000000) | -0,01 | -0,0081 | -0,0081 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,01 | -0,0082 | -0,0082 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0,01 | -0,0090 | -0,0090 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,01 | -0,0092 | -0,0092 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,01 | -0,0092 | -0,0092 | ||||||

| PURCHASED USD / SOLD AUD / DFE (000000000) | -0,01 | -0,0099 | -0,0099 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,01 | -0,0123 | -0,0123 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0,01 | -0,0124 | -0,0124 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,01 | -0,0138 | -0,0138 | ||||||

| DGZ / DB Gold Short ETN | -0,01 | -0,0158 | -0,0158 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,01 | -0,0158 | -0,0158 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0,01 | -0,0174 | -0,0174 | ||||||

| PURCHASED USD / SOLD AUD / DFE (000000000) | -0,02 | -0,0195 | -0,0195 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0,02 | -0,0196 | -0,0196 | ||||||

| SHORT EURO-BTP FU SEP25 / DIR (000000000) | -0,02 | -0,0220 | -0,0220 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0,02 | -0,0221 | -0,0221 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | -0,02 | -0,0234 | -0,0234 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0,02 | -0,0253 | -0,0253 | ||||||

| EURO-BUND FUTURE SEP25 / DIR (000000000) | -0,02 | -0,0278 | -0,0278 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0,02 | -0,0287 | -0,0287 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,02 | -0,0302 | -0,0302 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,03 | -0,0375 | -0,0375 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,03 | -0,0434 | -0,0434 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,04 | -0,0491 | -0,0491 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0,05 | -0,0579 | -0,0579 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,05 | -0,0587 | -0,0587 | ||||||

| PURCHASED JPY / SOLD USD / DFE (000000000) | -0,05 | -0,0617 | -0,0617 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,09 | -0,1192 | -0,1192 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,09 | -0,1197 | -0,1197 |