Statistiques de base

| Valeur du portefeuille | $ 1 774 806 814 |

| Positions actuelles | 549 |

Dernières positions, performances, ASG (à partir des dépôts 13F, 13D)

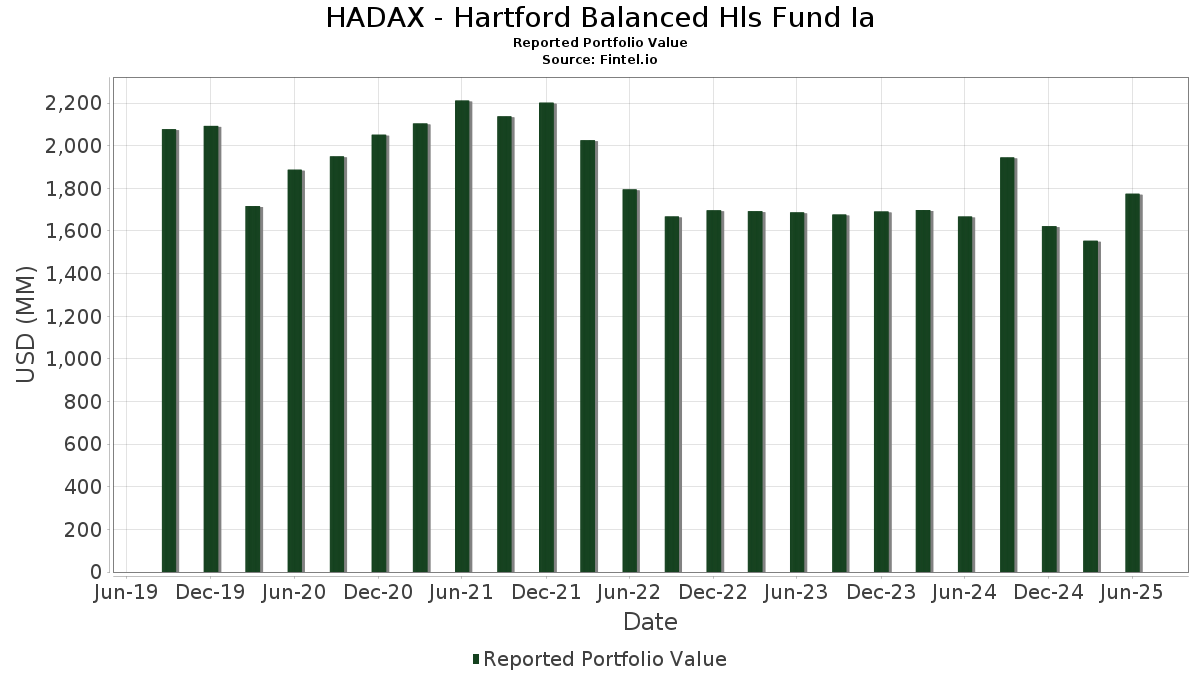

HADAX - Hartford Balanced Hls Fund Ia a déclaré un total de 549 positions dans ses derniers dépôts auprès de la SEC. La valeur la plus récente du portefeuille est calculée à 1 774 806 814 USD. Les actifs sous gestion réels (ASG) sont cette valeur plus les liquidités (qui ne sont pas divulguées). Les principales positions de HADAX - Hartford Balanced Hls Fund Ia sont Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Alphabet Inc. (US:GOOG) , Broadcom Inc. (US:AVGO) , and JPMorgan Chase & Co. (US:JPM) . Les nouvelles positions de HADAX - Hartford Balanced Hls Fund Ia incluent NVIDIA Corporation (US:NVDA) , Gilead Sciences, Inc. (US:GILD) , Antero Resources Corporation (US:AR) , Us Treasury Bond (US:US912810PW27) , and United States Treasury Note/Bond (US:US912810TW80) .

Meilleures augmentations ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 0,37 | 58,61 | 3,5898 | 3,5898 | |

| 0,18 | 19,55 | 1,1972 | 1,1972 | |

| 0,36 | 14,63 | 0,8962 | 0,8962 | |

| 14,22 | 0,8712 | 0,8712 | ||

| 13,31 | 0,8153 | 0,8153 | ||

| 0,18 | 91,86 | 5,6259 | 0,7603 | |

| 0,16 | 43,49 | 2,6635 | 0,7380 | |

| 0,10 | 11,08 | 0,6789 | 0,6789 | |

| 8,54 | 0,5233 | 0,5233 | ||

| 8,54 | 0,5233 | 0,5233 |

Principales baisses ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 0,06 | 19,88 | 1,2175 | -0,6710 | |

| 0,04 | 15,67 | 0,9596 | -0,3451 | |

| 0,16 | 15,12 | 0,9260 | -0,3417 | |

| 0,12 | 13,40 | 0,8205 | -0,3119 | |

| 0,15 | 13,90 | 0,8516 | -0,3099 | |

| 0,23 | 12,43 | 0,7615 | -0,3053 | |

| 1,68 | 0,1029 | -0,2939 | ||

| 1,68 | 0,1029 | -0,2939 | ||

| 3,75 | 0,2297 | -0,2847 | ||

| 3,75 | 0,2297 | -0,2847 |

Déclarations 13F et dépôts de fonds

Ce formulaire a été déposé le 2025-08-25 pour la période de déclaration 2025-06-30. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau pour débloquer les données premium et exporter vers Excel ![]() .

.

| Titre | Type | Prix moyen de l'action | Actions (en millions) |

ΔActions (%) |

ΔActions (%) |

Valeur ($ en millions) |

Portefeuille (%) |

ΔPortefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0,18 | -9,66 | 91,86 | 19,71 | 5,6259 | 0,7603 | |||

| NVDA / NVIDIA Corporation | 0,37 | 58,61 | 3,5898 | 3,5898 | |||||

| GOOG / Alphabet Inc. | 0,32 | 4,15 | 57,61 | 18,25 | 3,5281 | 0,4393 | |||

| AVGO / Broadcom Inc. | 0,16 | -13,02 | 43,49 | 43,21 | 2,6635 | 0,7380 | |||

| JPM / JPMorgan Chase & Co. | 0,10 | -1,85 | 30,08 | 16,01 | 1,8425 | 0,1981 | |||

| LLY / Eli Lilly and Company | 0,03 | 2,36 | 25,20 | -3,39 | 1,5433 | -0,1105 | |||

| CRM / Salesforce, Inc. | 0,08 | -1,84 | 21,11 | -0,26 | 1,2928 | -0,0491 | |||

| UNH / UnitedHealth Group Incorporated | 0,06 | 12,06 | 19,88 | -33,25 | 1,2175 | -0,6710 | |||

| GILD / Gilead Sciences, Inc. | 0,18 | 19,55 | 1,1972 | 1,1972 | |||||

| CSCO / Cisco Systems, Inc. | 0,28 | -16,33 | 19,51 | -5,94 | 1,1950 | -0,1202 | |||

| SNPS / Synopsys, Inc. | 0,03 | 11,90 | 17,77 | 33,77 | 1,0886 | 0,2461 | |||

| MET / MetLife, Inc. | 0,22 | -1,85 | 17,45 | -1,69 | 1,0688 | -0,0567 | |||

| KKR / KKR & Co. Inc. | 0,13 | -1,85 | 16,93 | 12,94 | 1,0371 | 0,0865 | |||

| EMR / Emerson Electric Co. | 0,12 | 6,18 | 16,38 | 29,13 | 1,0030 | 0,1988 | |||

| TRGP / Targa Resources Corp. | 0,09 | 21,28 | 16,12 | 5,31 | 0,9870 | 0,0167 | |||

| ACN / Accenture plc | 0,05 | -1,85 | 15,94 | -5,98 | 0,9760 | -0,0988 | |||

| ELV / Elevance Health, Inc. | 0,04 | -14,85 | 15,67 | -23,85 | 0,9596 | -0,3451 | |||

| TYIA / Johnson Controls International plc | 0,15 | -20,02 | 15,61 | 5,45 | 0,9560 | 0,0174 | |||

| ABNB / Airbnb, Inc. | 0,12 | 13,01 | 15,57 | 25,19 | 0,9539 | 0,1651 | |||

| NXPI / NXP Semiconductors N.V. | 0,07 | -1,85 | 15,46 | 12,84 | 0,9468 | 0,0781 | |||

| UBER / Uber Technologies, Inc. | 0,16 | -40,94 | 15,12 | -24,37 | 0,9260 | -0,3417 | |||

| ADBE / Adobe Inc. | 0,04 | -1,84 | 15,09 | -0,99 | 0,9243 | -0,0422 | |||

| LPLA / LPL Financial Holdings Inc. | 0,04 | 6,24 | 14,99 | 21,78 | 0,9178 | 0,1375 | |||

| AR / Antero Resources Corporation | 0,36 | 14,63 | 0,8962 | 0,8962 | |||||

| U.S. Treasury Notes / DBT (US91282CMV09) | 14,22 | 0,8712 | 0,8712 | ||||||

| LHX / L3Harris Technologies, Inc. | 0,06 | -1,85 | 14,08 | 17,62 | 0,8621 | 0,1033 | |||

| MS / Morgan Stanley | 0,10 | -1,85 | 13,96 | 18,50 | 0,8551 | 0,1081 | |||

| AOS / Amdocs Limited | 0,15 | -23,88 | 13,90 | -24,10 | 0,8516 | -0,3099 | |||

| CCI / Crown Castle Inc. | 0,14 | 15,73 | 13,87 | 14,06 | 0,8496 | 0,0785 | |||

| PFE / Pfizer Inc. | 0,57 | -1,85 | 13,81 | -6,10 | 0,8460 | -0,0868 | |||

| RJF / Raymond James Financial, Inc. | 0,09 | -1,85 | 13,66 | 8,38 | 0,8369 | 0,0374 | |||

| NDAQ / Nasdaq, Inc. | 0,15 | -1,85 | 13,65 | 15,70 | 0,8359 | 0,0879 | |||

| BSX / Boston Scientific Corporation | 0,12 | -29,55 | 13,40 | -24,98 | 0,8205 | -0,3119 | |||

| PCAR / PACCAR Inc | 0,14 | 16,47 | 13,37 | 13,71 | 0,8188 | 0,0733 | |||

| U.S. Treasury Notes / DBT (US91282CNG23) | 13,31 | 0,8153 | 0,8153 | ||||||

| MTB / M&T Bank Corporation | 0,07 | -1,85 | 13,22 | 6,53 | 0,8096 | 0,0227 | |||

| SPGI / S&P Global Inc. | 0,02 | -15,27 | 13,12 | -12,07 | 0,8037 | -0,1426 | |||

| GLW / Corning Incorporated | 0,25 | -1,85 | 12,94 | 12,76 | 0,7928 | 0,0649 | |||

| KDP / Keurig Dr Pepper Inc. | 0,39 | 8,50 | 12,94 | 4,82 | 0,7926 | 0,0097 | |||

| ICE / Intercontinental Exchange, Inc. | 0,07 | -9,55 | 12,82 | -3,80 | 0,7853 | -0,0598 | |||

| COP / ConocoPhillips | 0,14 | -1,85 | 12,60 | -16,13 | 0,7717 | -0,1809 | |||

| IDEXY / Industria de Diseño Textil, S.A. - Depositary Receipt (Common Stock) | 0,24 | 14,36 | 12,44 | 19,81 | 0,7619 | 0,1036 | |||

| CNC / Centene Corporation | 0,23 | -17,34 | 12,43 | -26,09 | 0,7615 | -0,3053 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0,06 | -1,84 | 12,32 | -3,67 | 0,7548 | -0,0564 | |||

| MMM / 3M Company | 0,08 | -27,46 | 12,16 | -24,80 | 0,7450 | -0,2806 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0,17 | -1,85 | 12,01 | -6,68 | 0,7355 | -0,0805 | |||

| XYZ / Block, Inc. | 0,17 | -1,85 | 11,70 | 22,72 | 0,7163 | 0,1120 | |||

| SBUX / Starbucks Corporation | 0,12 | -1,85 | 11,33 | -8,31 | 0,6941 | -0,0896 | |||

| ALGN / Align Technology, Inc. | 0,06 | -1,85 | 11,25 | 16,97 | 0,6893 | 0,0793 | |||

| ARES / Ares Management Corporation | 0,06 | -1,84 | 11,20 | 15,96 | 0,6862 | 0,0735 | |||

| EW / Edwards Lifesciences Corporation | 0,14 | -10,28 | 11,19 | -3,18 | 0,6856 | -0,0475 | |||

| MIDD / The Middleby Corporation | 0,08 | 8,55 | 11,17 | 2,85 | 0,6843 | -0,0045 | |||

| NTAP / NetApp, Inc. | 0,10 | 11,08 | 0,6789 | 0,6789 | |||||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0,18 | -23,64 | 11,07 | -21,56 | 0,6780 | -0,2168 | |||

| KVUE / Kenvue Inc. | 0,53 | -1,85 | 11,03 | -14,33 | 0,6752 | -0,1408 | |||

| U.S. Treasury Notes / DBT (US91282CLS88) | 10,54 | 0,03 | 0,6453 | -0,0226 | |||||

| U.S. Treasury Notes / DBT (US91282CLS88) | 10,54 | 0,03 | 0,6453 | -0,0226 | |||||

| EG / Everest Group, Ltd. | 0,03 | -1,85 | 10,47 | -8,18 | 0,6410 | -0,0818 | |||

| FFIV / F5, Inc. | 0,04 | -18,50 | 10,43 | -9,91 | 0,6388 | -0,0953 | |||

| HRB / H&R Block, Inc. | 0,19 | -16,12 | 10,38 | -16,15 | 0,6358 | -0,1493 | |||

| BA. / BAE Systems plc | 0,40 | -26,25 | 10,37 | -5,21 | 0,6351 | -0,0586 | |||

| TSCO / Tractor Supply Company | 0,19 | -1,85 | 10,25 | -6,00 | 0,6280 | -0,0636 | |||

| GNTX / Gentex Corporation | 0,46 | -1,85 | 10,05 | -7,36 | 0,6158 | -0,0724 | |||

| ROG / Roche Holding AG | 0,03 | -1,85 | 9,74 | -2,66 | 0,5967 | -0,0379 | |||

| U.S. Treasury Notes / DBT (US91282CLY56) | 9,68 | 0,03 | 0,5928 | -0,0207 | |||||

| GLPI / Gaming and Leisure Properties, Inc. | 0,21 | -1,85 | 9,68 | -9,98 | 0,5927 | -0,0890 | |||

| AXTA / Axalta Coating Systems Ltd. | 0,31 | -1,85 | 9,32 | -12,15 | 0,5711 | -0,1019 | |||

| U.S. Treasury Notes / DBT (US91282CMZ13) | 8,54 | 0,5233 | 0,5233 | ||||||

| U.S. Treasury Notes / DBT (US91282CMZ13) | 8,54 | 0,5233 | 0,5233 | ||||||

| U.S. Treasury Notes / DBT (US91282CMP31) | 8,46 | 449,97 | 0,5184 | 0,4208 | |||||

| U.S. Treasury Notes / DBT (US91282CMU26) | 8,08 | 0,4951 | 0,4951 | ||||||

| U.S. Treasury Notes / DBT (US91282CMU26) | 8,08 | 0,4951 | 0,4951 | ||||||

| U.S. Treasury Notes / DBT (US91282CMH15) | 7,53 | 0,12 | 0,4609 | -0,0157 | |||||

| U.S. Treasury Notes / DBT (US91282CMH15) | 7,53 | 0,12 | 0,4609 | -0,0157 | |||||

| U.S. Treasury Notes / DBT (US91282CND91) | 7,46 | 0,4570 | 0,4570 | ||||||

| U.S. Treasury Notes / DBT (US91282CND91) | 7,46 | 0,4570 | 0,4570 | ||||||

| US912810PW27 / Us Treasury Bond | 7,27 | -4,56 | 0,4452 | -0,0377 | |||||

| U.S. Treasury Notes / DBT (US91282CMY48) | 7,24 | 0,4435 | 0,4435 | ||||||

| U.S. Treasury Notes / DBT (US91282CNC19) | 7,03 | 0,4306 | 0,4306 | ||||||

| U.S. Treasury Notes / DBT (US91282CKD29) | 6,81 | 0,58 | 0,4170 | -0,0122 | |||||

| U.S. Treasury Notes / DBT (US91282CKT70) | 6,73 | 0,55 | 0,4121 | -0,0122 | |||||

| U.S. Treasury Notes / DBT (US91282CMM00) | 6,63 | -32,09 | 0,4059 | -0,2129 | |||||

| U.S. Treasury Notes / DBT (US91282CMM00) | 6,63 | -32,09 | 0,4059 | -0,2129 | |||||

| U.S. Treasury Notes / DBT (US91282CLK52) | 6,43 | 0,77 | 0,3941 | -0,0108 | |||||

| U.S. Treasury Notes / DBT (US91282CMA61) | 6,23 | 0,70 | 0,3815 | -0,0108 | |||||

| U.S. Treasury Notes / DBT (US91282CMA61) | 6,23 | 0,70 | 0,3815 | -0,0108 | |||||

| U.S. Treasury Notes / DBT (US91282CJW29) | 5,96 | 0,62 | 0,3650 | -0,0105 | |||||

| U.S. Treasury Notes / DBT (US91282CLC37) | 5,77 | 0,68 | 0,3535 | -0,0100 | |||||

| US912810TW80 / United States Treasury Note/Bond | 5,60 | -2,22 | 0,3429 | -0,0202 | |||||

| US912810TM09 / United States Treasury Note/Bond | 5,51 | -2,20 | 0,3375 | -0,0198 | |||||

| US912810TU25 / United States Treasury Note/Bond | 5,46 | -9,62 | 0,3343 | -0,0486 | |||||

| US91282CJR34 / United States Treasury Note/Bond - When Issued | 5,26 | -25,85 | 0,3221 | -0,1276 | |||||

| U.S. Treasury Notes / DBT (US91282CKG59) | 5,20 | 0,62 | 0,3183 | -0,0092 | |||||

| U.S. Treasury Notes / DBT (US91282CKG59) | 5,20 | 0,62 | 0,3183 | -0,0092 | |||||

| U.S. Treasury Notes / DBT (US91282CLN91) | 5,13 | 0,82 | 0,3144 | -0,0084 | |||||

| U.S. Treasury Notes / DBT (US91282CLR06) | 5,10 | 0,69 | 0,3126 | -0,0088 | |||||

| U.S. Treasury Notes / DBT (US91282CLR06) | 5,10 | 0,69 | 0,3126 | -0,0088 | |||||

| U.S. Treasury Notes / DBT (US91282CMD01) | 4,72 | -21,40 | 0,2888 | -0,0916 | |||||

| U.S. Treasury Notes / DBT (US91282CMD01) | 4,72 | -21,40 | 0,2888 | -0,0916 | |||||

| US912810TQ13 / United States Treasury Note/Bond | 4,70 | -2,19 | 0,2878 | -0,0168 | |||||

| FBIN / Fortune Brands Innovations, Inc. | 0,09 | -36,89 | 4,69 | -46,63 | 0,2873 | -0,2701 | |||

| US912828Z781 / United States Treasury Note/Bond | 4,35 | 0,72 | 0,2662 | -0,0074 | |||||

| US912810TS78 / United States Treasury Note/Bond | 4,24 | -2,15 | 0,2598 | -0,0151 | |||||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 4,08 | 0,2498 | 0,2498 | ||||||

| US91282CJP77 / United States Treasury Note/Bond | 3,98 | 0,05 | 0,2439 | -0,0085 | |||||

| US912810TV08 / US TREASURY N/B 4.75% 11-15-53 | 3,92 | -4,97 | 0,2401 | -0,0215 | |||||

| US912810TL26 / TREASURY BOND | 3,88 | -4,10 | 0,2376 | -0,0189 | |||||

| U.S. Treasury Notes / DBT (US91282CKP58) | 3,77 | 0,51 | 0,2308 | -0,0069 | |||||

| U.S. Treasury Notes / DBT (US91282CKP58) | 3,77 | 0,51 | 0,2308 | -0,0069 | |||||

| US912810TK43 / U.S. Treasury Bonds | 3,77 | -2,10 | 0,2307 | -0,0133 | |||||

| U.S. Treasury Notes / DBT (US91282CLW90) | 3,75 | -53,78 | 0,2297 | -0,2847 | |||||

| U.S. Treasury Notes / DBT (US91282CLW90) | 3,75 | -53,78 | 0,2297 | -0,2847 | |||||

| U.S. Treasury Bonds / DBT (US912810TZ12) | 3,74 | -2,20 | 0,2288 | -0,0134 | |||||

| U.S. Treasury Bonds / DBT (US912810TZ12) | 3,74 | -2,20 | 0,2288 | -0,0134 | |||||

| U.S. Treasury Bonds / DBT (US912810UF39) | 3,64 | -7,56 | 0,2231 | -0,0268 | |||||

| US912810RK60 / United States Treas Bds Bond | 3,64 | -53,03 | 0,2229 | -0,2685 | |||||

| US912810TG31 / U.S. Treasury Bonds | 3,63 | -3,07 | 0,2221 | -0,0151 | |||||

| U.S. Treasury Bonds / DBT (US912810UG12) | 3,55 | -9,72 | 0,2172 | -0,0319 | |||||

| U.S. Treasury Bonds / DBT (US912810UG12) | 3,55 | -9,72 | 0,2172 | -0,0319 | |||||

| U.S. Treasury Notes / DBT (US91282CMG32) | 3,52 | 0,69 | 0,2154 | -0,0061 | |||||

| U.S. Treasury Notes / DBT (US91282CMG32) | 3,52 | 0,69 | 0,2154 | -0,0061 | |||||

| U.S. Treasury Notes / DBT (US91282CLG41) | 3,51 | 0,37 | 0,2151 | -0,0067 | |||||

| U.S. Treasury Notes / DBT (US91282CLP40) | 3,49 | 0,14 | 0,2137 | -0,0072 | |||||

| U.S. Treasury Bonds / DBT (US912810UK24) | 3,37 | 0,2061 | 0,2061 | ||||||

| U.S. Treasury Bonds / DBT (US912810UK24) | 3,37 | 0,2061 | 0,2061 | ||||||

| U.S. Treasury Bonds / DBT (US912810UA42) | 3,36 | -16,27 | 0,2055 | -0,0486 | |||||

| US378272BP27 / Glencore Funding LLC | 3,30 | -12,12 | 0,2020 | -0,0360 | |||||

| US912810TN81 / United States Treasury Note/Bond | 3,28 | -3,08 | 0,2006 | -0,0137 | |||||

| RFR Trust 2025-SGRM / ABS-MBS (US74984NAA28) | 3,25 | -23,67 | 0,1990 | -0,0709 | |||||

| RFR Trust 2025-SGRM / ABS-MBS (US74984NAA28) | 3,25 | -23,67 | 0,1990 | -0,0709 | |||||

| U.S. Treasury Bonds / DBT (US912810UD80) | 3,01 | -2,21 | 0,1845 | -0,0108 | |||||

| U.S. Treasury Bonds / DBT (US912810UD80) | 3,01 | -2,21 | 0,1845 | -0,0108 | |||||

| U.S. Treasury Bonds / DBT (US912810UC08) | 3,00 | -15,38 | 0,1840 | -0,0411 | |||||

| U.S. Treasury Bonds / DBT (US912810UC08) | 3,00 | -15,38 | 0,1840 | -0,0411 | |||||

| US22550L2M24 / Credit Suisse AG/New York NY | 2,95 | 0,17 | 0,1808 | -0,0061 | |||||

| US529043AF83 / LXP INDUSTRIAL TRUST 6.75% 11/15/2028 | 2,88 | 0,10 | 0,1762 | -0,0060 | |||||

| US91282CGQ87 / United States Treasury Note/Bond | 2,88 | 0,77 | 0,1761 | -0,0049 | |||||

| US22535WAJ62 / Credit Agricole SA | 2,87 | 0,56 | 0,1759 | -0,0052 | |||||

| U.S. Treasury Notes / DBT (US91282CLQ23) | 2,86 | 0,39 | 0,1749 | -0,0055 | |||||

| U.S. Treasury Notes / DBT (US91282CLQ23) | 2,86 | 0,39 | 0,1749 | -0,0055 | |||||

| U.S. Treasury Bonds / DBT (US912810UJ50) | 2,84 | 20,31 | 0,1738 | 0,0243 | |||||

| U.S. Treasury Notes / DBT (US91282CKX82) | 2,75 | 0,62 | 0,1683 | -0,0048 | |||||

| US04685A2V22 / Athene Global Funding | 2,66 | 1,10 | 0,1631 | -0,0039 | |||||

| JBS USA Holding Lux Sarl/ JBS USA Food Co/ JBS Lux Co Sarl / DBT (US47214BAC28) | 2,60 | 1,09 | 0,1590 | -0,0038 | |||||

| JBS USA Holding Lux Sarl/ JBS USA Food Co/ JBS Lux Co Sarl / DBT (US47214BAC28) | 2,60 | 1,09 | 0,1590 | -0,0038 | |||||

| U.S. Treasury Bonds / DBT (US912810UE63) | 2,59 | -32,55 | 0,1588 | -0,0849 | |||||

| U.S. Treasury Bonds / DBT (US912810UE63) | 2,59 | -32,55 | 0,1588 | -0,0849 | |||||

| US20271AAL17 / Commonwealth Bank of Australia | 2,58 | 0,47 | 0,1582 | -0,0048 | |||||

| US76134KAA25 / Retained Vantage Data Centers Issuer LLC | 2,56 | 0,79 | 0,1570 | -0,0042 | |||||

| U.S. Treasury Bonds / DBT (US912810UL07) | 2,51 | 0,1536 | 0,1536 | ||||||

| US03027WAM47 / American Tower Trust #1 | 2,45 | 0,08 | 0,1501 | -0,0052 | |||||

| U.S. Treasury Notes / DBT (US91282CMT52) | 2,42 | 0,1482 | 0,1482 | ||||||

| U.S. Treasury Notes / DBT (US91282CMT52) | 2,42 | 0,1482 | 0,1482 | ||||||

| US912810TT51 / United States Treasury Note/Bond | 2,41 | -3,10 | 0,1475 | -0,0100 | |||||

| US452151LF83 / ILLINOIS ST | 2,39 | -6,83 | 0,1463 | -0,0163 | |||||

| Bank of America Corp / DBT (US06051GML04) | 2,34 | 1,08 | 0,1431 | -0,0034 | |||||

| US06051GLS65 / Bank of America Corp | 2,33 | 0,52 | 0,1429 | -0,0043 | |||||

| US91282CHU80 / United States Treasury Note/Bond | 2,32 | -0,09 | 0,1419 | -0,0051 | |||||

| US14040HCZ64 / Capital One Financial Corp | 2,28 | 0,93 | 0,1394 | -0,0036 | |||||

| US68389XBZ78 / Oracle Corp | 2,27 | -14,31 | 0,1391 | -0,0289 | |||||

| US09261BAG59 / Blackstone Holdings Finance Co LLC | 2,26 | 1,21 | 0,1382 | -0,0032 | |||||

| US46590XAY22 / JBS USA LUX SA / JBS USA Food Co. / JBS USA Finance, Inc. | 2,14 | 0,1309 | 0,1309 | ||||||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 2,13 | 0,90 | 0,1303 | -0,0034 | |||||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 2,13 | 0,90 | 0,1303 | -0,0034 | |||||

| Sammons Financial Group Global Funding / DBT (US79587J2C65) | 2,11 | 0,1294 | 0,1294 | ||||||

| Sammons Financial Group Global Funding / DBT (US79587J2C65) | 2,11 | 0,1294 | 0,1294 | ||||||

| 4020 / Saudi Real Estate Company | 2,09 | 1,16 | 0,1279 | -0,0030 | |||||

| US912810TR95 / United States Treasury Note/Bond | 2,09 | -38,44 | 0,1279 | -0,0872 | |||||

| US912828YQ73 / U.S. Treasury Notes | 2,05 | 0,64 | 0,1258 | -0,0036 | |||||

| GEHC34 / GE HealthCare Technologies Inc. - Depositary Receipt (Common Stock) | 2,03 | 0,1242 | 0,1242 | ||||||

| Brighthouse Financial Global Funding / DBT (US10921U2L15) | 2,01 | 0,90 | 0,1231 | -0,0032 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 1,98 | -4,81 | 0,1213 | -0,0106 | |||||

| Abu Dhabi Developmental Holding Co PJSC / DBT (US00402D2C80) | 1,96 | 1,03 | 0,1200 | -0,0030 | |||||

| XS2262961076 / ZF Finance GmbH | 1,91 | 0,1172 | 0,1172 | ||||||

| US361841AS80 / GLP Capital LP / GLP Financing II Inc | 1,91 | 0,63 | 0,1170 | -0,0033 | |||||

| PRET 2025-RPL2 Trust / ABS-MBS (US69392LAA26) | 1,91 | -1,95 | 0,1170 | -0,0065 | |||||

| PRET 2025-RPL2 Trust / ABS-MBS (US69392LAA26) | 1,91 | -1,95 | 0,1170 | -0,0065 | |||||

| US186108CK02 / Cleveland Electric Illuminating Co. (The) | 1,91 | 1,06 | 0,1168 | -0,0028 | |||||

| CA21037X1345 / CONSTELLATION SOFTWARE INC | 1,90 | -33,87 | 0,1165 | -0,0659 | |||||

| CA21037X1345 / CONSTELLATION SOFTWARE INC | 1,90 | -33,87 | 0,1165 | -0,0659 | |||||

| GEHC34 / GE HealthCare Technologies Inc. - Depositary Receipt (Common Stock) | 1,86 | 0,1142 | 0,1142 | ||||||

| GEHC34 / GE HealthCare Technologies Inc. - Depositary Receipt (Common Stock) | 1,86 | 0,1142 | 0,1142 | ||||||

| U.S. Treasury Bonds / DBT (US912810TX63) | 1,83 | -3,17 | 0,1121 | -0,0078 | |||||

| US49338CAB90 / KeySpan Gas East Corp. | 1,83 | 0,27 | 0,1120 | -0,0037 | |||||

| Athene Global Funding / DBT (US04685A3X78) | 1,83 | 0,16 | 0,1120 | -0,0037 | |||||

| Athene Global Funding / DBT (US04685A3X78) | 1,83 | 0,16 | 0,1120 | -0,0037 | |||||

| U.S. Treasury Notes / DBT (US91282CNF40) | 1,81 | 0,1106 | 0,1106 | ||||||

| U.S. Treasury Notes / DBT (US91282CNF40) | 1,81 | 0,1106 | 0,1106 | ||||||

| U.S. Treasury Notes / DBT (US91282CKN01) | 1,80 | 0,67 | 0,1102 | -0,0031 | |||||

| U.S. Treasury Notes / DBT (US91282CKN01) | 1,80 | 0,67 | 0,1102 | -0,0031 | |||||

| Greensaif Pipelines Bidco Sarl / DBT (US39541EAE32) | 1,80 | 19,35 | 0,1100 | 0,0146 | |||||

| Greensaif Pipelines Bidco Sarl / DBT (US39541EAE32) | 1,80 | 19,35 | 0,1100 | 0,0146 | |||||

| US912810SX72 / UNITED STATES TREASURY BOND 2.375% 05/15/2051 | 1,76 | -3,03 | 0,1080 | -0,0073 | |||||

| US95000U3G61 / Wells Fargo & Co | 1,76 | 0,51 | 0,1078 | -0,0032 | |||||

| US458140BL39 / Intel Corp | 1,70 | 1,61 | 0,1042 | -0,0019 | |||||

| GA Global Funding Trust / DBT (US36143L2S34) | 1,70 | 0,00 | 0,1042 | -0,0036 | |||||

| US161175CA05 / Charter Communications Operating LLC / Charter Communications Operating Capital | 1,69 | 211,23 | 0,1035 | 0,0691 | |||||

| U.S. Treasury Notes / DBT (US91282CLB53) | 1,68 | -73,15 | 0,1029 | -0,2939 | |||||

| U.S. Treasury Notes / DBT (US91282CLB53) | 1,68 | -73,15 | 0,1029 | -0,2939 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 1,66 | 1,16 | 0,1017 | -0,0024 | |||||

| S56431109 / Northam Platinum Holdings Ltd | 1,66 | 1,16 | 0,1017 | -0,0024 | |||||

| US05369AAL52 / Aviation Capital Group LLC | 1,66 | 0,73 | 0,1017 | -0,0028 | |||||

| US38383DY695 / Government National Mortgage Association | 1,65 | -2,59 | 0,1012 | -0,0063 | |||||

| US06051GGR48 / Bank Of America C Var 28 Bond | 1,59 | 0,63 | 0,0971 | -0,0028 | |||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 1,58 | 2,13 | 0,0967 | -0,0013 | |||||

| US86765BAQ23 / Sunoco Logistics Partners Operations LP | 1,56 | 83,84 | 0,0955 | 0,0417 | |||||

| US00206RBH49 / AT&T Inc | 1,55 | 0,26 | 0,0950 | -0,0031 | |||||

| ACA / Crédit Agricole S.A. | 1,54 | 0,39 | 0,0944 | -0,0029 | |||||

| U.S. Treasury Notes / DBT (US91282CME83) | 1,52 | 0,07 | 0,0934 | -0,0032 | |||||

| Prologis Targeted US Logistics Fund LP / DBT (US74350LAC81) | 1,51 | -30,25 | 0,0925 | -0,0448 | |||||

| Prologis Targeted US Logistics Fund LP / DBT (US74350LAC81) | 1,51 | -30,25 | 0,0925 | -0,0448 | |||||

| AU3FN0029609 / AAI Ltd | 1,50 | 1,35 | 0,0921 | -0,0020 | |||||

| US95000U2Z51 / Wells Fargo & Co. | 1,49 | 0,47 | 0,0913 | -0,0028 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 1,49 | 0,34 | 0,0910 | -0,0029 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 1,49 | 0,34 | 0,0910 | -0,0029 | |||||

| Whistler Pipeline LLC / DBT (US96337RAA05) | 1,47 | 0,34 | 0,0901 | -0,0029 | |||||

| Extra Space Storage LP / DBT (US30225VAU17) | 1,46 | 1,11 | 0,0893 | -0,0021 | |||||

| Extra Space Storage LP / DBT (US30225VAU17) | 1,46 | 1,11 | 0,0893 | -0,0021 | |||||

| US912810RZ30 / United States Treas Bds Bond | 1,45 | -2,55 | 0,0889 | -0,0055 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 1,43 | 0,92 | 0,0876 | -0,0023 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 1,43 | 0,92 | 0,0876 | -0,0023 | |||||

| Protective Life Global Funding / DBT (US74368CCB81) | 1,42 | 0,57 | 0,0869 | -0,0026 | |||||

| Protective Life Global Funding / DBT (US74368CCB81) | 1,42 | 0,57 | 0,0869 | -0,0026 | |||||

| Public Service Co of Oklahoma / DBT (US744533BS89) | 1,40 | 0,0860 | 0,0860 | ||||||

| Henneman Trust / DBT (US425911AA21) | 1,40 | 0,0859 | 0,0859 | ||||||

| Henneman Trust / DBT (US425911AA21) | 1,40 | 0,0859 | 0,0859 | ||||||

| U.S. Treasury Notes / DBT (US91282CNE74) | 1,37 | 0,0840 | 0,0840 | ||||||

| US254709AT53 / Discover Financial Services | 1,36 | 1,65 | 0,0833 | -0,0015 | |||||

| US36321PAD24 / Galaxy Pipeline Assets Bidco Ltd | 1,36 | 0,67 | 0,0831 | -0,0024 | |||||

| US91086QAS75 / Mexico Government International Bond | 1,34 | 1,52 | 0,0821 | -0,0016 | |||||

| US88240TAA97 / Texas Electric Market Stabilization Funding N LLC | 1,34 | 0,15 | 0,0820 | -0,0027 | |||||

| US71781LBH15 / Philadelphia Authority for Industrial Development | 1,33 | -0,52 | 0,0813 | -0,0033 | |||||

| Foundry JV Holdco LLC / DBT (US350930AC75) | 1,32 | 1,23 | 0,0807 | -0,0018 | |||||

| Athene Global Funding / DBT (US04685A3Q28) | 1,32 | 0,61 | 0,0806 | -0,0023 | |||||

| Athene Global Funding / DBT (US04685A3Q28) | 1,32 | 0,61 | 0,0806 | -0,0023 | |||||

| Mars Inc / DBT (US571676BC81) | 1,31 | 17,50 | 0,0802 | 0,0096 | |||||

| Mars Inc / DBT (US571676BC81) | 1,31 | 17,50 | 0,0802 | 0,0096 | |||||

| Wheels Fleet Lease Funding 1 LLC / ABS-O (US96328GBT31) | 1,28 | -3,17 | 0,0786 | -0,0054 | |||||

| US43732VAA44 / Home Partners of America 2021-2 Trust | 1,27 | 1,36 | 0,0779 | -0,0017 | |||||

| U.S. Treasury Bonds / DBT (US912810UB25) | 1,27 | -2,23 | 0,0778 | -0,0046 | |||||

| RGA Global Funding / DBT (US76209PAG81) | 1,25 | 0,72 | 0,0767 | -0,0021 | |||||

| US38141GGM06 / Goldman Sachs Gpoup Inc. 6.25% Senior Notes 02/01/41 | 1,23 | 1,40 | 0,0753 | -0,0016 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 1,22 | 0,41 | 0,0748 | -0,0023 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 1,22 | 0,41 | 0,0748 | -0,0023 | |||||

| STAB / Standard Chartered PLC - Preferred Security | 1,22 | 1,25 | 0,0746 | -0,0017 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 1,22 | 1,08 | 0,0744 | -0,0018 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 1,21 | 0,25 | 0,0742 | -0,0024 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 1,21 | 0,25 | 0,0742 | -0,0024 | |||||

| US91282CJN20 / US TREASURY N/B 4.375% 11-30-28 | 1,20 | -73,83 | 0,0738 | -0,2180 | |||||

| US29374LAB62 / Enterprise Fleet Financing 2023-3 LLC | 1,17 | -12,98 | 0,0719 | -0,0136 | |||||

| US638961AA02 / Navient Private Education Refi Loan Trust 2023-A | 1,17 | -4,42 | 0,0715 | -0,0060 | |||||

| US500945AC45 / Kubota Credit Owner Trust, Series 2023-2A, Class A3 | 1,16 | -0,09 | 0,0713 | -0,0026 | |||||

| AU3FN0029609 / AAI Ltd | 1,15 | 0,0705 | 0,0705 | ||||||

| AU3FN0029609 / AAI Ltd | 1,15 | 0,0705 | 0,0705 | ||||||

| US225401BG25 / UBS Group AG | 1,13 | 0,99 | 0,0691 | -0,0017 | |||||

| US29449WAB37 / Equitable Financial Life Global Funding | 1,13 | 0,99 | 0,0689 | -0,0017 | |||||

| US816851BM02 / Sempra Energy | 1,11 | 2,30 | 0,0681 | -0,0008 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 1,11 | 0,73 | 0,0680 | -0,0019 | |||||

| XS2262961076 / ZF Finance GmbH | 1,08 | 0,0664 | 0,0664 | ||||||

| Belrose Funding Trust II / DBT (US08079KAA25) | 1,06 | 0,0651 | 0,0651 | ||||||

| Belrose Funding Trust II / DBT (US08079KAA25) | 1,06 | 0,0651 | 0,0651 | ||||||

| US030288AC89 / American Transmission Systems Inc | 1,06 | 2,43 | 0,0647 | -0,0007 | |||||

| Foundry JV Holdco LLC / DBT (US350930AJ29) | 1,05 | 1,06 | 0,0645 | -0,0016 | |||||

| U.S. Treasury Notes / DBT (US91282CKU44) | 1,05 | 0,67 | 0,0644 | -0,0018 | |||||

| U.S. Treasury Notes / DBT (US91282CKU44) | 1,05 | 0,67 | 0,0644 | -0,0018 | |||||

| STAB / Standard Chartered PLC - Preferred Security | 1,05 | 0,38 | 0,0641 | -0,0020 | |||||

| RGA Global Funding / DBT (US76209PAE34) | 1,04 | 0,58 | 0,0638 | -0,0019 | |||||

| US91282CCZ23 / United States Treasury Note/Bond | 1,04 | 0,78 | 0,0637 | -0,0017 | |||||

| Enterprise Products Operating LLC / DBT (US29379VCL53) | 1,03 | 0,0629 | 0,0629 | ||||||

| Enterprise Products Operating LLC / DBT (US29379VCL53) | 1,03 | 0,0629 | 0,0629 | ||||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 1,03 | 0,89 | 0,0628 | -0,0016 | |||||

| U.S. Treasury Notes / DBT (US91282CMC28) | 1,02 | 0,59 | 0,0624 | -0,0018 | |||||

| Whistler Pipeline LLC / DBT (US96337RAB87) | 1,01 | 0,80 | 0,0621 | -0,0017 | |||||

| US30225VAR87 / Extra Space Storage LP | 0,99 | 1,44 | 0,0605 | -0,0013 | |||||

| US91282CJG78 / U.S. Treasury Notes | 0,97 | 0,72 | 0,0596 | -0,0017 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0,97 | 0,52 | 0,0595 | -0,0018 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0,97 | 0,52 | 0,0595 | -0,0018 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,95 | 0,95 | 0,0584 | -0,0015 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,95 | 0,95 | 0,0584 | -0,0015 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0,95 | 0,64 | 0,0580 | -0,0016 | |||||

| US91282CDF59 / U.S. Treasury Notes | 0,95 | 1,18 | 0,0579 | -0,0013 | |||||

| Greensaif Pipelines Bidco Sarl / DBT (US39541EAD58) | 0,93 | -0,11 | 0,0569 | -0,0021 | |||||

| Greensaif Pipelines Bidco Sarl / DBT (US39541EAD58) | 0,93 | -0,11 | 0,0569 | -0,0021 | |||||

| US743820AC66 / Providence St Joseph Health Obligated Group | 0,93 | 0,00 | 0,0569 | -0,0020 | |||||

| U.S. Treasury Notes / DBT (US91282CLH24) | 0,93 | 0,00 | 0,0568 | -0,0020 | |||||

| US19828TAE64 / COLUMBIA PIPELINES OPERATING CO LLC 144A LIFE SR UNSEC 6.497% 08-15-43 | 0,90 | 28,59 | 0,0554 | 0,0108 | |||||

| ATHS / Athene Holding Ltd. - Corporate Bond/Note | 0,88 | 0,0541 | 0,0541 | ||||||

| ATHS / Athene Holding Ltd. - Corporate Bond/Note | 0,88 | 0,0541 | 0,0541 | ||||||

| U.S. Treasury Notes / DBT (US91282CLD10) | 0,88 | 0,80 | 0,0541 | -0,0015 | |||||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 0,88 | 1,15 | 0,0541 | -0,0012 | |||||

| US91282CJK80 / US TREASURY N/B 4.625% 11-15-26 | 0,87 | 0,00 | 0,0536 | -0,0019 | |||||

| US626207YF57 / MUNI ELEC AUTH OF GEORGIA | 0,87 | -2,81 | 0,0530 | -0,0034 | |||||

| US91282CES61 / U.S. Treasury Notes | 0,86 | 0,94 | 0,0526 | -0,0013 | |||||

| US88258MAA36 / TEXAS NATURAL GAS SECURITIZTN FIN CORP REVENUE | 0,84 | -3,80 | 0,0511 | -0,0040 | |||||

| U.S. Treasury Notes / DBT (US91282CLU35) | 0,83 | 0,73 | 0,0510 | -0,0014 | |||||

| Glencore Funding LLC / DBT (US378272BS65) | 0,83 | 0,86 | 0,0506 | -0,0013 | |||||

| Glencore Funding LLC / DBT (US378272BS65) | 0,83 | 0,86 | 0,0506 | -0,0013 | |||||

| US74730DAC74 / Qatar Petroleum | 0,82 | 1,36 | 0,0501 | -0,0011 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 0,82 | 0,62 | 0,0500 | -0,0015 | |||||

| US46647PAX42 / JPMorgan Chase & Co | 0,81 | 0,88 | 0,0494 | -0,0013 | |||||

| US53079EBG89 / LIBERTY MUTUAL GROUP INC COMPANY GUAR 144A 02/29 4.569 | 0,81 | 0,88 | 0,0493 | -0,0013 | |||||

| Penske Truck Leasing Co Lp / PTL Finance Corp / DBT (US709599CB81) | 0,79 | 1,15 | 0,0486 | -0,0012 | |||||

| US00206RKJ04 / AT&T Inc | 0,78 | -27,61 | 0,0480 | -0,0207 | |||||

| Beacon Funding Trust / DBT (US073952AB93) | 0,77 | -0,64 | 0,0473 | -0,0020 | |||||

| US373334KR13 / GEORGIA POWER COMPANY | 0,77 | 0,78 | 0,0473 | -0,0013 | |||||

| US96328GBG10 / Wheels Fleet Lease Funding 1 LLC | 0,77 | -16,12 | 0,0472 | -0,0110 | |||||

| Mutual of Omaha Cos Global Funding / DBT (US62829D2F60) | 0,77 | 1,59 | 0,0471 | -0,0009 | |||||

| US91282CHW47 / US TREASURY N/B 4.125000% 08/31/2030 | 0,77 | 0,79 | 0,0469 | -0,0013 | |||||

| US91282CJQ50 / United States Treasury Note/Bond - When Issued | 0,75 | 0,94 | 0,0462 | -0,0012 | |||||

| US12530MAE57 / CF Hippolyta LLC | 0,75 | 0,95 | 0,0456 | -0,0012 | |||||

| GPJA / Georgia Power Company - Preferred Security | 0,74 | 1,51 | 0,0454 | -0,0009 | |||||

| GPJA / Georgia Power Company - Preferred Security | 0,74 | 1,51 | 0,0454 | -0,0009 | |||||

| US452024GT30 / Illinois Municipal Electric Agency | 0,74 | 2,07 | 0,0452 | -0,0006 | |||||

| US91282CJC64 / United States Treasury Note/Bond | 0,74 | -0,14 | 0,0451 | -0,0016 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 0,73 | 0,97 | 0,0446 | -0,0011 | |||||

| US91282CFY21 / TREASURY NOTE | 0,69 | 0,88 | 0,0421 | -0,0012 | |||||

| US46647PBD78 / JPMorgan Chase & Co | 0,69 | 1,18 | 0,0420 | -0,0010 | |||||

| US68389XAW56 / Oracle Corp. | 0,68 | 0,0419 | 0,0419 | ||||||

| Foundry JV Holdco LLC / DBT (US350930AG89) | 0,68 | 1,94 | 0,0419 | -0,0007 | |||||

| US373334JW27 / Georgia Power Company 4.3% 03/15/42 | 0,65 | 0,62 | 0,0400 | -0,0012 | |||||

| US00206RJZ64 / AT and T INC 3.5% 06/01/2041 | 0,65 | 1,73 | 0,0396 | -0,0007 | |||||

| US22822VBC46 / Crown Castle Inc | 0,63 | 1,94 | 0,0386 | -0,0006 | |||||

| US91282CGZ86 / UNITED STATES TREASURY NOTE/BOND - WHEN ISSUED | 0,63 | 0,81 | 0,0384 | -0,0010 | |||||

| US91282CHF14 / United States Treasury Note/Bond | 0,62 | 0,82 | 0,0379 | -0,0010 | |||||

| US06051GLU12 / Bank of America Corp | 0,61 | 1,17 | 0,0371 | -0,0009 | |||||

| US38937LAC54 / Gray Oak Pipeline LLC | 0,60 | 0,84 | 0,0369 | -0,0010 | |||||

| JBS USA Holding Lux Sarl / JBS USA Foods Group Holdings Inc / JBS USA Food Co / DBT (US472140AJ19) | 0,60 | 0,0367 | 0,0367 | ||||||

| JBS USA Holding Lux Sarl / JBS USA Foods Group Holdings Inc / JBS USA Food Co / DBT (US472140AJ19) | 0,60 | 0,0367 | 0,0367 | ||||||

| US74730DAE31 / Qatar Petroleum | 0,57 | -1,54 | 0,0352 | -0,0018 | |||||

| US46647PBL94 / JPMorgan Chase & Co | 0,57 | 1,80 | 0,0347 | -0,0006 | |||||

| US91282CFC01 / U.S. Treasury Notes | 0,57 | 1,07 | 0,0346 | -0,0009 | |||||

| Glencore Funding LLC / DBT (US378272BV94) | 0,55 | -59,40 | 0,0338 | -0,0523 | |||||

| US59259YGF07 / MET TRANSPRTN AUTH NY REVENUE | 0,54 | -37,12 | 0,0332 | -0,0215 | |||||

| U.S. Treasury Notes / DBT (US91282CLJ89) | 0,54 | 0,75 | 0,0331 | -0,0009 | |||||

| U.S. Treasury Notes / DBT (US91282CLJ89) | 0,54 | 0,75 | 0,0331 | -0,0009 | |||||

| US78403DAT72 / SBA Tower Trust | 0,52 | 0,97 | 0,0320 | -0,0008 | |||||

| Protective Life Global Funding / DBT (US74368CCC64) | 0,52 | 0,0316 | 0,0316 | ||||||

| US539830AZ28 / Lockheed Martin Corp. 4.85% 09/15/2041 | 0,51 | -1,91 | 0,0314 | -0,0018 | |||||

| US91282CGS44 / United States Treasury Note/Bond | 0,51 | 0,79 | 0,0311 | -0,0008 | |||||

| US15200KLG49 / CENTERPOINT ENERGY RESOU | 0,51 | 0,59 | 0,0311 | -0,0009 | |||||

| US15200KLG49 / CENTERPOINT ENERGY RESOU | 0,51 | 0,59 | 0,0311 | -0,0009 | |||||

| US91282CDL28 / UNITED STATES TREASURY NOTE 1.50000000 | 0,49 | 1,23 | 0,0302 | -0,0007 | |||||

| US91282CHR51 / U.S. Treasury Notes | 0,49 | 0,83 | 0,0299 | -0,0008 | |||||

| US74456QBA31 / Public Service Electric & Gas Co. | 0,47 | 0,21 | 0,0290 | -0,0009 | |||||

| C1FG34 / Citizens Financial Group, Inc. - Depositary Receipt (Common Stock) | 0,47 | 0,86 | 0,0289 | -0,0008 | |||||

| C1FG34 / Citizens Financial Group, Inc. - Depositary Receipt (Common Stock) | 0,47 | 0,86 | 0,0289 | -0,0008 | |||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 0,47 | 1,29 | 0,0288 | -0,0006 | |||||

| US8575093013 / State Street Navigator Securities Lending Government Money Market Portfolio | 0,47 | 0,47 | 0,0286 | 0,0286 | |||||

| Bank of New York Mellon/The / DBT (US06405LAH42) | 0,47 | 0,0286 | 0,0286 | ||||||

| SBUX / Starbucks Corporation - Depositary Receipt (Common Stock) | 0,46 | 0,0282 | 0,0282 | ||||||

| US73358XCN03 / PORT AUTH OF NEW YORK & NEW JE PORT AUTHORITY OF NEW YORK & NEW JERSEY | 0,46 | -2,13 | 0,0281 | -0,0016 | |||||

| US30225VAK35 / Extra Space Storage LP | 0,45 | 1,12 | 0,0276 | -0,0006 | |||||

| BRO / Brown & Brown, Inc. | 0,44 | 0,0269 | 0,0269 | ||||||

| US33851MAB81 / Flagstar Mortgage Trust 2021-9INV | 0,44 | -3,10 | 0,0268 | -0,0018 | |||||

| US19828TAC09 / CORPORATE BONDS | 0,43 | -1,37 | 0,0265 | -0,0014 | |||||

| Lincoln Financial Global Funding / DBT (US53359KAB70) | 0,43 | 0,0262 | 0,0262 | ||||||

| Pricoa Global Funding I / DBT (US74153WCX56) | 0,42 | 0,0258 | 0,0258 | ||||||

| FCT / Fincantieri S.p.A. | 0,42 | 0,48 | 0,0257 | -0,0007 | |||||

| US026874DR53 / AMERICAN INTERNATIONAL GRP INC 3.4% 06/30/2030 | 0,42 | 1,72 | 0,0255 | -0,0005 | |||||

| U.S. Treasury Notes / DBT (US91282CJT99) | 0,41 | 0,00 | 0,0252 | -0,0009 | |||||

| US88732JAJ79 / Time Warner Cable 6.55% Guaranteed Notes 5/1/37 | 0,41 | 4,09 | 0,0250 | 0,0001 | |||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 0,41 | 0,0249 | 0,0249 | ||||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 0,41 | 0,0249 | 0,0249 | ||||||

| US12530MAA36 / CF Hippolyta LLC, Series 2020-1, Class A1 | 0,41 | 0,25 | 0,0249 | -0,0008 | |||||

| US59259YBY41 / MET TRANSPRTN AUTH NY REVENUE | 0,41 | -0,98 | 0,0248 | -0,0011 | |||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 0,40 | 0,0244 | 0,0244 | ||||||

| ENB.PRN / Enbridge Inc. - Preferred Security | 0,40 | 0,0244 | 0,0244 | ||||||

| AIG / American International Group, Inc. - Depositary Receipt (Common Stock) | 0,40 | 0,0243 | 0,0243 | ||||||

| AIG / American International Group, Inc. - Depositary Receipt (Common Stock) | 0,40 | 0,0243 | 0,0243 | ||||||

| US643821AA93 / New Economy Assets Phase 1 Sponsor LLC, Series 2021-1, Class A1 | 0,40 | -18,56 | 0,0242 | -0,0066 | |||||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 0,37 | 1,36 | 0,0229 | -0,0005 | |||||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 0,37 | 1,36 | 0,0229 | -0,0005 | |||||

| Mars Inc / DBT (US571676BB09) | 0,37 | 0,00 | 0,0224 | -0,0008 | |||||

| Mars Inc / DBT (US571676BB09) | 0,37 | 0,00 | 0,0224 | -0,0008 | |||||

| US48542RSV77 / Kansas Development Finance Authority | 0,36 | -1,63 | 0,0222 | -0,0012 | |||||

| CNO Global Funding / DBT (US18977W2G46) | 0,36 | 0,56 | 0,0219 | -0,0007 | |||||

| CNO Global Funding / DBT (US18977W2G46) | 0,36 | 0,56 | 0,0219 | -0,0007 | |||||

| US92928QAF54 / WEA FINANCE LLC 144A LIFE SR UNSEC 3.5% 06-15-29 | 0,34 | 1,52 | 0,0205 | -0,0005 | |||||

| US912810TH14 / United States Treasury Note/Bond | 0,33 | -2,08 | 0,0203 | -0,0012 | |||||

| US100743AK97 / Boston Gas Co | 0,32 | 0,63 | 0,0197 | -0,0006 | |||||

| US91282CEV90 / United States Treasury Note/Bond | 0,32 | 0,95 | 0,0196 | -0,0005 | |||||

| Foundry JV Holdco LLC / DBT (US350930AB92) | 0,32 | 0,95 | 0,0195 | -0,0005 | |||||

| Foundry JV Holdco LLC / DBT (US350930AB92) | 0,32 | 0,95 | 0,0195 | -0,0005 | |||||

| US026874DP97 / American International Group Inc | 0,31 | 0,64 | 0,0192 | -0,0005 | |||||

| US35563PLH00 / Seasoned Credit Risk Transfer Trust Series 2019-3 | 0,31 | -3,41 | 0,0191 | -0,0014 | |||||

| Columbia Pipelines Holding Co LLC / DBT (US19828AAC18) | 0,31 | 1,65 | 0,0189 | -0,0004 | |||||

| US36241KJL35 / Ginnie Mae I Pool | 0,30 | -9,09 | 0,0184 | -0,0025 | |||||

| US46647PBM77 / JPMorgan Chase & Co | 0,30 | 1,36 | 0,0183 | -0,0004 | |||||

| US22822VBB62 / CROWN CASTLE INC | 0,30 | 0,68 | 0,0182 | -0,0005 | |||||

| US78403DAP50 / SBA Tower Trust | 0,30 | 1,03 | 0,0181 | -0,0005 | |||||

| US78433LAA44 / SCE REC FUND | 0,29 | -7,12 | 0,0176 | -0,0020 | |||||

| US22822VAR24 / SR UNSECURED 07/30 3.3 | 0,28 | 1,82 | 0,0172 | -0,0002 | |||||

| US88732JAN81 / Time Warner Cable 7.3% Senior Notes 7/1/38 | 0,27 | 3,82 | 0,0167 | 0,0001 | |||||

| Glencore Funding LLC / DBT (US378272CB22) | 0,27 | 0,38 | 0,0164 | -0,0005 | |||||

| U.S. Treasury Notes / DBT (US91282CLM19) | 0,25 | 0,79 | 0,0156 | -0,0004 | |||||

| US29278NAR44 / ENERGY TRANSFER OPERATNG COMPANY GUAR 05/50 5 | 0,25 | -0,81 | 0,0151 | -0,0007 | |||||

| US708696BZ13 / Pennsylvania Electric Co. | 0,23 | 0,87 | 0,0142 | -0,0004 | |||||

| CA21037X1345 / CONSTELLATION SOFTWARE INC | 0,23 | 0,00 | 0,0140 | -0,0005 | |||||

| US373334JS15 / Georgia Power Co 4.75% Senior Notes 09/01/40 | 0,23 | 0,44 | 0,0140 | -0,0004 | |||||

| US00206RBK77 / AT&T Inc. Bond | 0,22 | 0,0136 | 0,0136 | ||||||

| US22822VAL53 / Crown Castle International Corp | 0,22 | 1,38 | 0,0135 | -0,0003 | |||||

| Pricoa Global Funding I / DBT (US74153WCW73) | 0,22 | 0,0133 | 0,0133 | ||||||

| Pricoa Global Funding I / DBT (US74153WCW73) | 0,22 | 0,0133 | 0,0133 | ||||||

| US33851JAC36 / FSMT 18-3INV A3 144A FRN 05-25-48 | 0,22 | -3,14 | 0,0133 | -0,0009 | |||||

| US14855MAA62 / Castlelake Aircraft Securitization Trust, Series 2019-1A, Class A | 0,22 | -23,21 | 0,0132 | -0,0046 | |||||

| US01400EAF07 / ALCON FINANCE CORP | 0,20 | -0,50 | 0,0122 | -0,0005 | |||||

| US49803XAA19 / Kite Realty Group, L.P. | 0,20 | 0,0120 | 0,0120 | ||||||

| US12530MAL90 / SORT 22-1 A1 144A 5.97% 08-15-62/02-16-27 | 0,20 | -0,51 | 0,0120 | -0,0004 | |||||

| US167725AF79 / CHICAGO IL TRANSIT AUTH SALES & TRANSFER TAX RECPTS REVENUE | 0,19 | 0,54 | 0,0115 | -0,0004 | |||||

| US20754RAB24 / Connecticut Avenue Securities Trust 2021-R01 | 0,18 | -9,90 | 0,0112 | -0,0016 | |||||

| US29278NAF06 / Energy Transfer Operating LP | 0,18 | 0,55 | 0,0112 | -0,0003 | |||||

| CAON34 / Capital One Financial Corporation - Depositary Receipt (Common Stock) | 0,18 | 2,25 | 0,0112 | -0,0002 | |||||

| US12529UAF75 / CFMT 2021-AL1 LLC CFMT 2021-AL1 B | 0,18 | -34,57 | 0,0108 | -0,0063 | |||||

| U.S. Treasury Notes / DBT (US91282CMK44) | 0,17 | 0,58 | 0,0107 | -0,0003 | |||||

| U.S. Treasury Notes / DBT (US91282CMK44) | 0,17 | 0,58 | 0,0107 | -0,0003 | |||||

| Trans-Allegheny Interstate Line Co / DBT (US893045AF16) | 0,17 | 0,0106 | 0,0106 | ||||||

| US63111XAL55 / Nasdaq Inc | 0,17 | 0,60 | 0,0103 | -0,0003 | |||||

| US44040JAA60 / Horizon Aircraft Finance III Ltd., Series 2019-2, Class A | 0,17 | -5,65 | 0,0103 | -0,0010 | |||||

| Ohio Edison Co / DBT (US677347CJ38) | 0,17 | 0,0102 | 0,0102 | ||||||

| US78433LAB27 / SCE Recovery Funding LLC, Series A-2 | 0,16 | -1,20 | 0,0101 | -0,0005 | |||||

| US86944BAG86 / Sutter Health | 0,16 | 1,94 | 0,0097 | -0,0002 | |||||

| US92928QAH11 / WEA Finance LLC | 0,16 | 0,65 | 0,0095 | -0,0003 | |||||

| US889184AD90 / Toledo Hospital/The | 0,15 | -0,65 | 0,0095 | -0,0004 | |||||

| US91282CFT36 / United States Treasury Note/Bond | 0,15 | 0,67 | 0,0093 | -0,0003 | |||||

| US59166BAA98 / Metlife Securitization Trust, Series 2017-1A, Class A | 0,15 | -3,29 | 0,0090 | -0,0006 | |||||

| US010392FQ67 / Alabama Power Co Senior Note C Allable M/w 2.45 3/30/2022 Bond | 0,12 | 0,84 | 0,0074 | -0,0002 | |||||

| STARR / START Ireland | 0,11 | -3,51 | 0,0068 | -0,0005 | |||||

| US14040HDC60 / Capital One Financial Corp | 0,11 | 1,89 | 0,0066 | -0,0001 | |||||

| US00206RKB77 / AT&T INC 3.850000% 06/01/2060 | 0,10 | 0,99 | 0,0063 | -0,0002 | |||||

| BRO / Brown & Brown, Inc. | 0,10 | 0,0062 | 0,0062 | ||||||

| BRO / Brown & Brown, Inc. | 0,10 | 0,0062 | 0,0062 | ||||||

| US38122NB769 / GOLDEN ST TOBACCO SECURITIZATI GLDGEN 06/46 FIXED 3 | 0,10 | -13,04 | 0,0062 | -0,0012 | |||||

| US89173UAA51 / Towd Point Mortgage Trust 2017-4 | 0,10 | -10,00 | 0,0061 | -0,0009 | |||||

| US38937LAB71 / Gray Oak Pipeline LLC | 0,10 | 1,04 | 0,0060 | -0,0001 | |||||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | 0,09 | 0,0057 | 0,0057 | ||||||

| US 5YR NOTE (CBT) SEP25 / DIR (000000000) | 0,09 | 0,0057 | 0,0057 | ||||||

| US86765BAV18 / Sunoco Logistics Partners Operations LP | 0,09 | -1,08 | 0,0057 | -0,0002 | |||||

| US78433LAC00 / SCE Recovery Funding LLC, Series A-3 | 0,08 | -2,38 | 0,0050 | -0,0003 | |||||

| US591894CE82 / Metropolitan Edison Co | 0,08 | 0,00 | 0,0047 | -0,0001 | |||||

| US22822VAW19 / Crown Castle International Corp | 0,07 | 1,41 | 0,0045 | -0,0001 | |||||

| MAACH / MACH 1 Cayman 2019-1 Ltd | 0,07 | -16,67 | 0,0043 | -0,0010 | |||||

| US44040HAA05 / Horizon Aircraft Finance II Ltd | 0,07 | -24,73 | 0,0043 | -0,0016 | |||||

| US90932NAA19 / United Airlines Pass Through Trust, Series 2018-1, Class B | 0,07 | 0,00 | 0,0041 | -0,0001 | |||||

| US30711XCT90 / CORP CMO | 0,06 | -14,29 | 0,0037 | -0,0007 | |||||

| US708696CA52 / Pennsylvania Electric Co | 0,06 | 0,00 | 0,0037 | -0,0001 | |||||

| US00206RKA94 / AT&T Inc | 0,06 | 0,00 | 0,0037 | -0,0001 | |||||

| MAPSL / MAPSL 2019-1A A | 0,05 | -5,66 | 0,0031 | -0,0003 | |||||

| US23503CAP23 / DALLAS-FORT WORTH TX INTERNATIONAL ARPT REVENUE | 0,05 | -2,04 | 0,0030 | -0,0001 | |||||

| US097023CW33 / BOEING CO 5.805 5/50 | 0,05 | -94,92 | 0,0030 | -0,0569 | |||||

| US22822VAT89 / CROWN CASTLE INTL CORP SR UNSECURED 01/31 2.25 | 0,04 | 2,38 | 0,0027 | -0,0000 | |||||

| US36291TEA25 / Ginnie Mae I Pool | 0,04 | -2,38 | 0,0026 | -0,0001 | |||||

| US36241KJ669 / Ginnie Mae I Pool | 0,03 | -10,53 | 0,0021 | -0,0003 | |||||

| US36202XDC83 / Ginnie Mae I Pool | 0,03 | -3,03 | 0,0020 | -0,0001 | |||||

| US14856GAA85 / CASTLELAKE AIRCRAFT STRUCTURED TRUST 2021-1 CLAST 2021-1A A | 0,03 | -50,79 | 0,0019 | -0,0021 | |||||

| US36241KJQ22 / Ginnie Mae I Pool | 0,03 | -11,76 | 0,0019 | -0,0003 | |||||

| US 10YR NOTE (CBT)SEP25 / DIR (000000000) | 0,03 | 0,0018 | 0,0018 | ||||||

| US 10YR NOTE (CBT)SEP25 / DIR (000000000) | 0,03 | 0,0018 | 0,0018 | ||||||

| US89176EAA82 / Towd Point Mortgage Trust 2018-1 | 0,03 | -17,65 | 0,0017 | -0,0004 | |||||

| US36241KJT60 / Ginnie Mae I Pool | 0,03 | -10,34 | 0,0016 | -0,0002 | |||||

| US03464VAA26 / Angel Oak Mortgage Trust 2019-6 | 0,03 | -13,33 | 0,0016 | -0,0003 | |||||

| US36241L4W38 / Government National Mortgage Association | 0,03 | -3,85 | 0,0015 | -0,0001 | |||||

| US36210GL858 / Ginnie Mae I Pool | 0,02 | -5,88 | 0,0010 | -0,0001 | |||||

| US36291PBY16 / Ginnie Mae I Pool | 0,02 | 0,00 | 0,0010 | -0,0001 | |||||

| US59259YDK29 / Metropolitan Transportation Authority | 0,02 | 0,00 | 0,0009 | -0,0000 | |||||

| US 10YR ULTRA FUT SEP25 / DIR (000000000) | 0,01 | 0,0009 | 0,0009 | ||||||

| US36209Y3R77 / Ginnie Mae I Pool | 0,01 | -7,14 | 0,0008 | -0,0001 | |||||

| US36210HTZ54 / Ginnie Mae I Pool | 0,01 | -8,33 | 0,0007 | -0,0001 | |||||

| US38374L5Z07 / GOVERNMENT NATIONAL MORTGAGE ASSOCIATION | 0,01 | -16,67 | 0,0007 | -0,0001 | |||||

| US36208YYL72 / Ginnie Mae I Pool | 0,01 | 0,00 | 0,0006 | -0,0000 | |||||

| US36225BZ436 / Ginnie Mae I Pool | 0,01 | -10,00 | 0,0006 | -0,0001 | |||||

| US36211J6D44 / Ginnie Mae I Pool | 0,01 | 0,00 | 0,0005 | -0,0000 | |||||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | 0,01 | 0,0005 | 0,0005 | ||||||

| US36211XJM92 / Ginnie Mae I Pool | 0,01 | 0,00 | 0,0004 | -0,0000 | |||||

| US36212DLN74 / Ginnie Mae I Pool | 0,01 | -14,29 | 0,0004 | -0,0000 | |||||

| US36201MNR96 / Government National Mortgage Association | 0,01 | 0,00 | 0,0004 | -0,0001 | |||||

| US36211BWL43 / Ginnie Mae I Pool | 0,01 | 0,00 | 0,0003 | -0,0000 | |||||

| US36205RH267 / Ginnie Mae I Pool | 0,01 | 0,00 | 0,0003 | -0,0000 | |||||

| US36209ND663 / Ginnie Mae I Pool | 0,01 | 0,00 | 0,0003 | -0,0000 | |||||

| US36208RDC51 / Ginnie Mae I Pool | 0,00 | -20,00 | 0,0003 | -0,0001 | |||||

| US36209AE486 / GINNIE MAE I POOL GN 465555 | 0,00 | -20,00 | 0,0003 | -0,0000 | |||||

| US36209LE855 / Ginnie Mae I Pool | 0,00 | -20,00 | 0,0003 | -0,0000 | |||||

| US36292CK527 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0003 | -0,0000 | |||||

| US36292CQT44 / Ginnie Mae I Pool | 0,00 | -20,00 | 0,0003 | -0,0001 | |||||

| US36208TKE90 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0003 | -0,0000 | |||||

| US36208RXQ28 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0003 | -0,0000 | |||||

| US36208L5U79 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0002 | -0,0000 | |||||

| US36208L6F93 / Ginnie Mae I Pool | 0,00 | -25,00 | 0,0002 | -0,0000 | |||||

| US36210BMP75 / Ginnie Mae I Pool | 0,00 | -25,00 | 0,0002 | -0,0000 | |||||

| US36211JFZ57 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0002 | -0,0000 | |||||

| US36209WFS61 / Ginnie Mae I Pool | 0,00 | -25,00 | 0,0002 | -0,0000 | |||||

| US36241KJR05 / Ginnie Mae I Pool | 0,00 | -25,00 | 0,0002 | -0,0000 | |||||

| US36209L3X27 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0002 | -0,0000 | |||||

| US36209AEN63 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0002 | -0,0000 | |||||

| US36209YA245 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0002 | -0,0000 | |||||

| US36209KTC26 / Ginnie Mae I Pool | 0,00 | -33,33 | 0,0002 | -0,0000 | |||||

| US36201MSC72 / GOVT NATL MORTG ASSN 6.00% 11/15/2032 GNMA SF | 0,00 | -33,33 | 0,0002 | -0,0000 | |||||

| US36209LFV36 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US36208TAX81 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US36210GHX51 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US36209VNE01 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US36209RPP28 / Ginnie Mae I Pool | 0,00 | -50,00 | 0,0001 | -0,0000 | |||||

| US36209T6P92 / Ginnie Mae I Pool | 0,00 | -50,00 | 0,0001 | -0,0000 | |||||

| US36208PTY42 / Ginnie Mae I Pool | 0,00 | -50,00 | 0,0001 | -0,0000 | |||||

| US36209WSU70 / Ginnie Mae I Pool | 0,00 | -50,00 | 0,0001 | -0,0000 | |||||

| US36210RUA66 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US36208QSB31 / Government National Mortgage Association | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US36207V2C91 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US36202WG456 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US36209TZZ55 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US36209J5T41 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US36207MUA25 / Ginnie Mae I Pool | 0,00 | 0,00 | 0,0001 | -0,0000 | |||||

| US36209T6M61 / Ginnie Mae I Pool | 0,00 | -100,00 | 0,0001 | -0,0000 | |||||

| US36212B5E98 / Ginnie Mae I Pool | 0,00 | 0,0001 | -0,0000 | ||||||

| US36207JXM07 / Ginnie Mae I Pool | 0,00 | -100,00 | 0,0001 | -0,0000 | |||||

| US36241KJ743 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36202XJT54 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36212FZN76 / GNMA 8.00% 8/30 #532749 | 0,00 | 0,0000 | -0,0000 | ||||||

| US59980CAA18 / MILL CITY MORTGAGE LOAN TRUST 2017-3 MCMLT 2017-3 A1 | 0,00 | -100,00 | 0,0000 | -0,0007 | |||||

| US36241KFR41 / GINNIE MAE I POOL GN 781976 | 0,00 | 0,0000 | -0,0000 | ||||||

| US36225BFK98 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36241KJS87 / GINNIE MAE I POOL GN 782073 | 0,00 | 0,0000 | -0,0000 | ||||||

| US36211XWJ17 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36225A2B56 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36209RLM33 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US3128HDPZ66 / FREDDIE MAC NON GOLD POOL FH 846740 | 0,00 | 0,0000 | -0,0000 | ||||||

| US36211EZJ09 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36208V4H50 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36225AZG83 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36209J6E62 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36210RUV04 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36200RLS93 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36207FZ799 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36217GGC50 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36208WDL46 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36209KKX53 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36208LXB88 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US38374L5Y32 / Gnma Ii 05-41 Pa Bond Agncy CMO Other | 0,00 | 0,0000 | -0,0000 | ||||||

| US36209RGC16 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36211SVV68 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36209ENE85 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36209N5E81 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36213XJ547 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36209AD645 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36212FYQ17 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36211UFX54 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US38374L5X58 / Government National Mortgage Association | 0,00 | 0,0000 | -0,0000 | ||||||

| US36208VX260 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36207AFH05 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 | ||||||

| US36206W4N21 / Ginnie Mae I Pool | 0,00 | 0,0000 | -0,0000 |