Statistiques de base

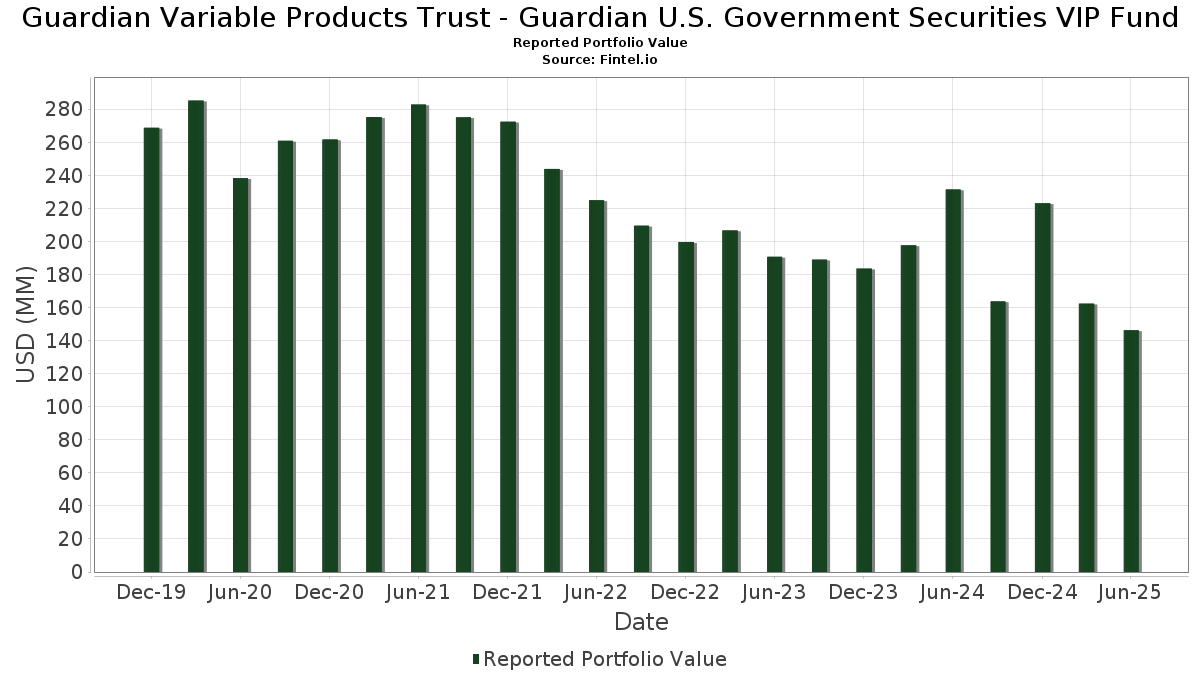

| Valeur du portefeuille | $ 146 284 806 |

| Positions actuelles | 167 |

Dernières positions, performances, ASG (à partir des dépôts 13F, 13D)

Guardian Variable Products Trust - Guardian U.S. Government Securities VIP Fund a déclaré un total de 167 positions dans ses derniers dépôts auprès de la SEC. La valeur la plus récente du portefeuille est calculée à 146 284 806 USD. Les actifs sous gestion réels (ASG) sont cette valeur plus les liquidités (qui ne sont pas divulguées). Les principales positions de Guardian Variable Products Trust - Guardian U.S. Government Securities VIP Fund sont U.S. Treasury Notes (US:US91282CET45) , United States Treasury Note/Bond (US:US91282CHX20) , U.S. Treasury Notes (US:US91282CJG78) , US TREASURY N/B 4.125000% 08/31/2030 (US:US91282CHW47) , and UNITED STATES TREASURY NOTE 1.50000000 (US:US91282CDL28) . Les nouvelles positions de Guardian Variable Products Trust - Guardian U.S. Government Securities VIP Fund incluent U.S. Treasury Notes (US:US91282CET45) , United States Treasury Note/Bond (US:US91282CHX20) , U.S. Treasury Notes (US:US91282CJG78) , US TREASURY N/B 4.125000% 08/31/2030 (US:US91282CHW47) , and UNITED STATES TREASURY NOTE 1.50000000 (US:US91282CDL28) .

Meilleures augmentations ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 5,36 | 3,7792 | 3,7792 | ||

| 4,85 | 3,4188 | 3,4188 | ||

| 4,32 | 3,0481 | 3,0481 | ||

| 3,26 | 2,3001 | 2,3001 | ||

| 4,12 | 2,9017 | 2,2527 | ||

| 2,65 | 1,8662 | 1,8662 | ||

| 2,61 | 1,8423 | 1,8423 | ||

| 2,18 | 1,5354 | 1,5354 | ||

| 1,77 | 1,2505 | 1,2505 | ||

| 1,66 | 1,1710 | 1,1710 |

Principales baisses ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 3,79 | 2,6738 | -15,2407 | ||

| 4,82 | 3,3958 | -10,0327 | ||

| 5,23 | 3,6855 | -9,5449 | ||

| 5,58 | 3,9362 | -8,4532 | ||

| 2,52 | 1,7793 | -3,8492 | ||

| 5,02 | 3,5397 | -3,7747 | ||

| 7,69 | 5,4240 | -3,0714 | ||

| 1,64 | 1,1578 | -2,0438 | ||

| 0,18 | 0,1292 | -0,0133 |

Déclarations 13F et dépôts de fonds

Ce formulaire a été déposé le 2025-08-15 pour la période de déclaration 2025-06-30. Cet investisseur n'a pas divulgué les titres comptabilisés en actions, les colonnes relatives aux actions dans le tableau ci-dessous sont donc omises. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau pour débloquer les données premium et exporter vers Excel ![]() .

.

| Titre | Type | ΔActions (%) |

Valeur ($ en millions) |

Portefeuille (%) |

ΔPortefeuille (%) |

|

|---|---|---|---|---|---|---|

| U.S. Treasury Notes / DBT (US91282CMG32) | 7,69 | -41,45 | 5,4240 | -3,0714 | ||

| U.S. Treasury Notes / DBT (US91282CMH15) | 5,58 | -70,86 | 3,9362 | -8,4532 | ||

| US91282CET45 / U.S. Treasury Notes | 5,36 | 3,7792 | 3,7792 | |||

| U.S. Treasury Notes / DBT (US91282CKD29) | 5,23 | -78,26 | 3,6855 | -9,5449 | ||

| U.S. Treasury Notes / DBT (US91282CLK52) | 5,02 | -58,30 | 3,5397 | -3,7747 | ||

| U.S. Treasury Notes / DBT (US91282CLR06) | 4,85 | 3,4188 | 3,4188 | |||

| U.S. Treasury Notes / DBT (US91282CKT70) | 4,82 | -79,38 | 3,3958 | -10,0327 | ||

| U.S. Treasury Notes / DBT (US91282CKZ31) | 4,32 | 3,0481 | 3,0481 | |||

| U.S. Treasury Notes / DBT (US91282CMP31) | 4,12 | 310,27 | 2,9017 | 2,2527 | ||

| US91282CHX20 / United States Treasury Note/Bond | 3,79 | -88,90 | 2,6738 | -15,2407 | ||

| U.S. Treasury Notes / DBT (US91282CLL36) | 3,26 | 2,3001 | 2,3001 | |||

| US91282CJG78 / U.S. Treasury Notes | 3,10 | 94,41 | 2,1828 | 1,1530 | ||

| US91282CHW47 / US TREASURY N/B 4.125000% 08/31/2030 | 2,65 | 1,8662 | 1,8662 | |||

| U.S. Treasury Notes / DBT (US91282CKX82) | 2,61 | 1,8423 | 1,8423 | |||

| U.S. Treasury Notes / DBT (US91282CLW90) | 2,52 | -71,02 | 1,7793 | -3,8492 | ||

| U.S. Treasury Notes / DBT (US91282CLF67) | 2,44 | 0,21 | 1,7215 | 0,1460 | ||

| US91282CDL28 / UNITED STATES TREASURY NOTE 1.50000000 | 2,18 | 1,5354 | 1,5354 | |||

| US01F0524748 / Uniform Mortgage-Backed Security, TBA | 1,77 | 1,2505 | 1,2505 | |||

| U.S. Treasury Notes / DBT (US91282CMM00) | 1,66 | 1,1710 | 1,1710 | |||

| US91282CGQ87 / United States Treasury Note/Bond | 1,64 | -66,83 | 1,1578 | -2,0438 | ||

| Uniform Mortgage-Backed Security, TBA / ABS-MBS (US01F0604771) | 1,32 | 0,9337 | 0,9337 | |||

| US01F0504781 / Fannie Mae or Freddie Mac | 1,32 | 0,9331 | 0,9331 | |||

| US95000U3D31 / Wells Fargo & Co | 1,25 | 0,8786 | 0,8786 | |||

| US14919LAC81 / Cathedral Lake VI Ltd | 1,20 | 0,25 | 0,8480 | 0,0725 | ||

| US172967PA33 / CITIGROUP INC | 1,20 | 0,8452 | 0,8452 | |||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1,11 | 0,7809 | 0,7809 | |||

| Mars Inc / DBT (US571676AZ85) | 1,09 | 0,7666 | 0,7666 | |||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 1,06 | 0,7454 | 0,7454 | |||

| Birch Grove CLO 8 Ltd / ABS-CBDO (US09077TAA34) | 1,00 | 0,00 | 0,7077 | 0,0591 | ||

| Voya CLO 2019-1 Ltd / ABS-CBDO (US92917NAY40) | 1,00 | 0,10 | 0,7057 | 0,0593 | ||

| FIXED INC CLEARING CORP.REPO / RA (000000000) | 0,97 | 0,6871 | 0,6871 | |||

| US07274EAK91 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.375% 11-21-30 | 0,97 | 0,6866 | 0,6866 | |||

| US902613AK44 / UBS Group AG | 0,95 | 0,6731 | 0,6731 | |||

| US46647PCU84 / JPMorgan Chase & Co | 0,95 | 0,6677 | 0,6677 | |||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0,94 | 0,6594 | 0,6594 | |||

| US64952WEZ23 / New York Life Global Funding | 0,93 | 20,00 | 0,6562 | 0,1549 | ||

| Northwestern Mutual Global Funding / DBT (US66815L2S71) | 0,91 | 0,6450 | 0,6450 | |||

| US90353TAK60 / Uber Technologies Inc | 0,91 | 0,6418 | 0,6418 | |||

| US345397C353 / Ford Motor Credit Co LLC | 0,91 | 0,6414 | 0,6414 | |||

| US29365TAH77 / Entergy Texas Inc. | 0,82 | 0,5756 | 0,5756 | |||

| US91282CDY49 / United States Treasury Note/Bond | 0,78 | 0,5519 | 0,5519 | |||

| US05401AAJ07 / Avolon Holdings Funding Ltd | 0,77 | 0,5402 | 0,5402 | |||

| US226373AT56 / Crestwood Midstream Partners LP | 0,75 | 0,5321 | 0,5321 | |||

| SOLV / Solventum Corporation | 0,75 | 0,5276 | 0,5276 | |||

| C1FG34 / Citizens Financial Group, Inc. - Depositary Receipt (Common Stock) | 0,74 | 0,5222 | 0,5222 | |||

| Glencore Funding LLC / DBT (US378272BZ09) | 0,74 | 0,5183 | 0,5183 | |||

| Evergy Missouri West Inc / DBT (US30037EAB92) | 0,71 | 0,5017 | 0,5017 | |||

| US38141GYJ74 / Goldman Sachs Group Inc/The | 0,68 | 0,4815 | 0,4815 | |||

| HMC / Honda Motor Co., Ltd. - Depositary Receipt (Common Stock) | 0,66 | 0,4643 | 0,4643 | |||

| US55354GAK67 / MSCI Inc | 0,64 | 0,4538 | 0,4538 | |||

| US00928QAU58 / Aircastle Ltd | 0,64 | 0,4505 | 0,4505 | |||

| US06051GHM42 / Bank of America Corp | 0,64 | 61,01 | 0,4486 | 0,1930 | ||

| VICI / VICI Properties Inc. | 0,63 | 0,4466 | 0,4466 | |||

| US11135FBT75 / Broadcom, Inc. | 0,63 | 0,4433 | 0,4433 | |||

| US708696BY48 / Pennsylvania Electric Co. | 0,61 | 0,4301 | 0,4301 | |||

| US68785CAC55 / Oscar U.S. Funding XV LLC | 0,60 | -0,17 | 0,4259 | 0,0347 | ||

| US09626QBC06 / BlueMountain CLO 2014-2 Ltd | 0,60 | 0,34 | 0,4227 | 0,0363 | ||

| US05635JAB61 / Bacardi Ltd / Bacardi-Martini BV | 0,60 | 0,4223 | 0,4223 | |||

| R1OL34 / Rollins, Inc. - Depositary Receipt (Common Stock) | 0,58 | 0,4124 | 0,4124 | |||

| XS1040508167 / Imperial Brands Finance plc | 0,58 | 0,4120 | 0,4120 | |||

| D1TE34 / DTE Energy Company - Depositary Receipt (Common Stock) | 0,56 | 0,3963 | 0,3963 | |||

| Athene Global Funding / DBT (US04685A4D06) | 0,56 | 0,3922 | 0,3922 | |||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0,55 | 0,3887 | 0,3887 | |||

| US68389XCN30 / Oracle Corp | 0,55 | 0,3879 | 0,3879 | |||

| NVT / Nvent Finance Sarl | 0,55 | 0,3868 | 0,3868 | |||

| US62928CAA09 / NGPL PipeCo LLC | 0,54 | 0,3839 | 0,3839 | |||

| US361841AH26 / GLP Capital LP / GLP Financing II Inc | 0,54 | 0,3839 | 0,3839 | |||

| US06738EAP07 / Barclays PLC | 0,54 | 0,3836 | 0,3836 | |||

| Foundry JV Holdco LLC / DBT (US350930AF07) | 0,54 | 0,3774 | 0,3774 | |||

| US44891ACB17 / Hyundai Capital America | 0,53 | 0,3767 | 0,3767 | |||

| US25466AAN19 / Discover Bank | 0,53 | 0,3756 | 0,3756 | |||

| US91324PEV04 / UnitedHealth Group Inc | 0,53 | 0,3730 | 0,3730 | |||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,52 | 0,3697 | 0,3697 | |||

| US780153AW20 / Royal Caribbean Cruises Ltd | 0,51 | 0,3605 | 0,3605 | |||

| Palmer Square CLO 2020-3 Ltd / ABS-CBDO (US69701RAY36) | 0,50 | 0,3530 | 0,3530 | |||

| US025816DH90 / American Express Co. | 0,49 | 20,88 | 0,3473 | 0,0836 | ||

| US143658BQ44 / Carnival Corp | 0,49 | 0,3450 | 0,3450 | |||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,49 | 20,84 | 0,3438 | 0,0829 | ||

| US95000U2S19 / Wells Fargo & Co | 0,49 | 0,3431 | 0,3431 | |||

| US89788MAP77 / Truist Financial Corp | 0,48 | 0,3350 | 0,3350 | |||

| US115236AC57 / Brown & Brown, Inc. | 0,47 | 0,3326 | 0,3326 | |||

| US745310AJ12 / PUGET ENERGY INC NEW 4.1% 06/15/2030 144A | 0,47 | 0,3297 | 0,3297 | |||

| US491674BN65 / Kentucky Utilities Co | 0,47 | 0,3282 | 0,3282 | |||

| US573874AP91 / Marvell Technology Inc | 0,46 | 0,3265 | 0,3265 | |||

| US845467AR03 / CORP. NOTE | 0,46 | 0,3254 | 0,3254 | |||

| US00914AAT97 / AIR LEASE CORPORATION | 0,46 | 0,3246 | 0,3246 | |||

| BMO 2024-5C5 Mortgage Trust / ABS-MBS (US05593RAC60) | 0,46 | 0,3230 | 0,3230 | |||

| US22822VAR24 / SR UNSECURED 07/30 3.3 | 0,46 | 0,3226 | 0,3226 | |||

| NWE / NorthWestern Energy Group, Inc. | 0,46 | 0,3220 | 0,3220 | |||

| US00135TAD63 / AIB Group PLC | 0,46 | 0,3214 | 0,3214 | |||

| US609935AA97 / Monongahela Power Co. | 0,45 | 0,3201 | 0,3201 | |||

| US418751AL75 / HAT HOLDINGS I LLC/HAT REGD 144A P/P 8.00000000 | 0,45 | 0,3191 | 0,3191 | |||

| Sutter Health / DBT (US86944BAP85) | 0,45 | 0,3165 | 0,3165 | |||

| US212015AS02 / Continental Resources Inc/OK | 0,44 | 0,3080 | 0,3080 | |||

| US95000HBF82 / Wells Fargo Commercial Mortgage Trust 2016-LC24 | 0,41 | 0,99 | 0,2891 | 0,0264 | ||

| US61747YFA82 / Morgan Stanley | 0,41 | 0,25 | 0,2869 | 0,0248 | ||

| GXO / GXO Logistics, Inc. | 0,40 | 0,2836 | 0,2836 | |||

| US05369AAK79 / Aviation Capital Group LLC | 0,38 | 0,2706 | 0,2706 | |||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 0,38 | 0,2692 | 0,2692 | |||

| US366651AC11 / Gartner Inc | 0,38 | 0,2671 | 0,2671 | |||

| US46590XAU00 / JBS USA LUX SA / JBS USA Food Co / JBS USA Finance Inc | 0,38 | 0,2663 | 0,2663 | |||

| P1EG34 / Public Service Enterprise Group Incorporated - Depositary Receipt (Common Stock) | 0,38 | 0,2662 | 0,2662 | |||

| US50212YAC84 / LPL Holdings, Inc. | 0,38 | 0,2651 | 0,2651 | |||

| US469814AB34 / Jacobs Engineering Group Inc | 0,37 | 0,2639 | 0,2639 | |||

| HCA Inc / DBT (US404119CT49) | 0,37 | 0,2638 | 0,2638 | |||

| RIO TINTO FIN USA PLC / DBT (US76720AAT34) | 0,37 | 0,2632 | 0,2632 | |||

| JBS USA Holding Lux Sarl / JBS USA Foods Group Holdings Inc / JBS USA Food Co / DBT (US472140AE22) | 0,37 | 0,2628 | 0,2628 | |||

| Columbia Pipelines Holding Co LLC / DBT (US19828AAD90) | 0,37 | 0,2628 | 0,2628 | |||

| US87264ABV61 / T-Mobile USA Inc | 0,37 | 0,2621 | 0,2621 | |||

| US636180BP52 / National Fuel Gas Co | 0,37 | 0,2611 | 0,2611 | |||

| US01882YAE68 / ALLIANT ENERGY FINANCE LLC | 0,37 | 0,2608 | 0,2608 | |||

| Idaho Power Co / DBT (US45138LBK89) | 0,37 | 0,2606 | 0,2606 | |||

| R2RX34 / Regal Rexnord Corporation - Depositary Receipt (Common Stock) | 0,37 | 0,2601 | 0,2601 | |||

| 01626P148 / Alimentation Couche-Tard Inc | 0,37 | 0,2600 | 0,2600 | |||

| US09951LAA17 / Booz Allen Hamilton Inc | 0,37 | 0,2599 | 0,2599 | |||

| US054989AA67 / BAT CAPITAL CORP 6.343000% 08/02/2030 | 0,37 | 0,2598 | 0,2598 | |||

| US10921U2E71 / Brighthouse Financial Global Funding | 0,37 | 0,2592 | 0,2592 | |||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 0,37 | 0,2585 | 0,2585 | |||

| US46647PBP09 / JPMORGAN CHASE and CO 2.956/VAR 05/13/2031 | 0,36 | 0,2568 | 0,2568 | |||

| Liberty Utilities Co / DBT (US531542AB48) | 0,36 | 0,2560 | 0,2560 | |||

| Parallel 2023-1 Ltd / ABS-CBDO (US69915NAJ72) | 0,36 | 0,2538 | 0,2538 | |||

| US15135BAV36 / CENTENE CORP 3.375% 02/15/2030 | 0,36 | 0,2532 | 0,2532 | |||

| US55279HAW07 / Manufacturers & Traders Trust Co | 0,32 | 0,2226 | 0,2226 | |||

| US91159HJP64 / US Bancorp | 0,32 | 0,2222 | 0,2222 | |||

| Siemens Funding BV / DBT (US82622RAD89) | 0,31 | 0,2198 | 0,2198 | |||

| GA Global Funding Trust / DBT (US36143L2T17) | 0,31 | 0,2172 | 0,2172 | |||

| Mercedes-Benz Finance North America LLC / DBT (US58769JBE64) | 0,31 | 0,2161 | 0,2161 | |||

| US314382AA01 / Fells Point Funding Trust | 0,31 | 0,2160 | 0,2160 | |||

| US452327AP42 / Illumina Inc | 0,31 | 0,2153 | 0,2153 | |||

| 2914 / Japan Tobacco Inc. | 0,30 | 0,2147 | 0,2147 | |||

| US55903VBA08 / Warnermedia Holdings Inc | 0,30 | 0,2085 | 0,2085 | |||

| Nuveen LLC / DBT (US67080LAD73) | 0,30 | 0,2084 | 0,2084 | |||

| HSY / The Hershey Company - Depositary Receipt (Common Stock) | 0,29 | 0,2076 | 0,2076 | |||

| US01F0524821 / Uniform Mortgage-Backed Security, TBA | 0,29 | 0,2074 | 0,2074 | |||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 0,29 | 0,2051 | 0,2051 | |||

| US875484AL13 / Tanger Properties LP | 0,29 | 0,2022 | 0,2022 | |||

| Toyota Auto Loan Extended Note Trust 2025-1 / ABS-O (US891950AA59) | 0,28 | 0,1999 | 0,1999 | |||

| US69047QAB86 / Ovintiv Inc | 0,28 | 0,1986 | 0,1986 | |||

| US034863AW07 / Anglo American Capital PLC | 0,28 | 0,1968 | 0,1968 | |||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 0,27 | 0,1930 | 0,1930 | |||

| MSBAM / ABS-MBS (US61778GAE61) | 0,25 | 0,1758 | 0,1758 | |||

| US25731VAA26 / DOMINION ENERGY SOUTH CAROLINA INC | 0,25 | 0,1744 | 0,1744 | |||

| US23345MAA53 / DT MIDSTREAM INC 4.125% 06/15/2029 144A | 0,24 | 0,1704 | 0,1704 | |||

| US517834AE74 / Las Vegas Sands Corp | 0,24 | 0,1689 | 0,1689 | |||

| Rentokil Terminix Funding LLC / DBT (US760130AB09) | 0,23 | 0,1638 | 0,1638 | |||

| LPL Holdings Inc / DBT (US50212YAL83) | 0,23 | 0,1632 | 0,1632 | |||

| P1SA34 / Public Storage - Depositary Receipt (Common Stock) | 0,23 | 0,1597 | 0,1597 | |||

| R1EG34 / Regency Centers Corporation - Depositary Receipt (Common Stock) | 0,22 | 0,1561 | 0,1561 | |||

| Uniform Mortgage-Backed Security, TBA / ABS-MBS (US01F0604854) | 0,22 | 0,1537 | 0,1537 | |||

| US030288AC89 / American Transmission Systems Inc | 0,21 | 0,1507 | 0,1507 | |||

| BBCMS Mortgage Trust 2025-5C34 / ABS-MBS (US07337BAC81) | 0,21 | 0,1469 | 0,1469 | |||

| US034863BD17 / Anglo American Capital PLC | 0,20 | 0,1433 | 0,1433 | |||

| US75886FAE79 / Regeneron Pharmaceuticals Inc | 0,20 | 0,1427 | 0,1427 | |||

| US025537AY74 / AMERICAN ELECTRIC POWER REGD 5.20000000 | 0,20 | 0,1389 | 0,1389 | |||

| Capital Power US Holdings Inc / DBT (US14041TAB44) | 0,20 | 0,1375 | 0,1375 | |||

| US95003LAA89 / WELLS FARGO COMMERCIAL MORTGAGE TRUST SER 2021-SAVE CL A V/R REGD 144A P/P 1.30000000 | 0,18 | -16,82 | 0,1292 | -0,0133 | ||

| US92840VAQ59 / Vistra Operations Co. LLC | 0,16 | 0,1163 | 0,1163 | |||

| US90931GAA76 / United Airlines 2020-1 Class A Pass Through Trust | 0,16 | 0,1158 | 0,1158 | |||

| US87612BBN10 / CORP. NOTE | 0,15 | 0,1036 | 0,1036 | |||

| KMIC34 / Kinder Morgan, Inc. - Depositary Receipt (Common Stock) | 0,15 | 0,1031 | 0,1031 | |||

| US35805BAE83 / FRESENIUS MEDICAL CARE US FIN III | 0,13 | 0,0930 | 0,0930 | |||

| PSEG Power LLC / DBT (US69362BBE11) | 0,12 | 0,0849 | 0,0849 | |||

| US01F0504864 / Uniform Mortgage-Backed Security, TBA | 0,11 | 0,0788 | 0,0788 | |||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 0,09 | 0,0666 | 0,0666 | |||

| BRO / Brown & Brown, Inc. | 0,07 | 0,0525 | 0,0525 | |||

| US 2YR NOTE (CBT) SEP25 / DIR (000000000) | 0,04 | 0,0262 | 0,0262 | |||

| BRO / Brown & Brown, Inc. | 0,04 | 0,0259 | 0,0259 |