Statistiques de base

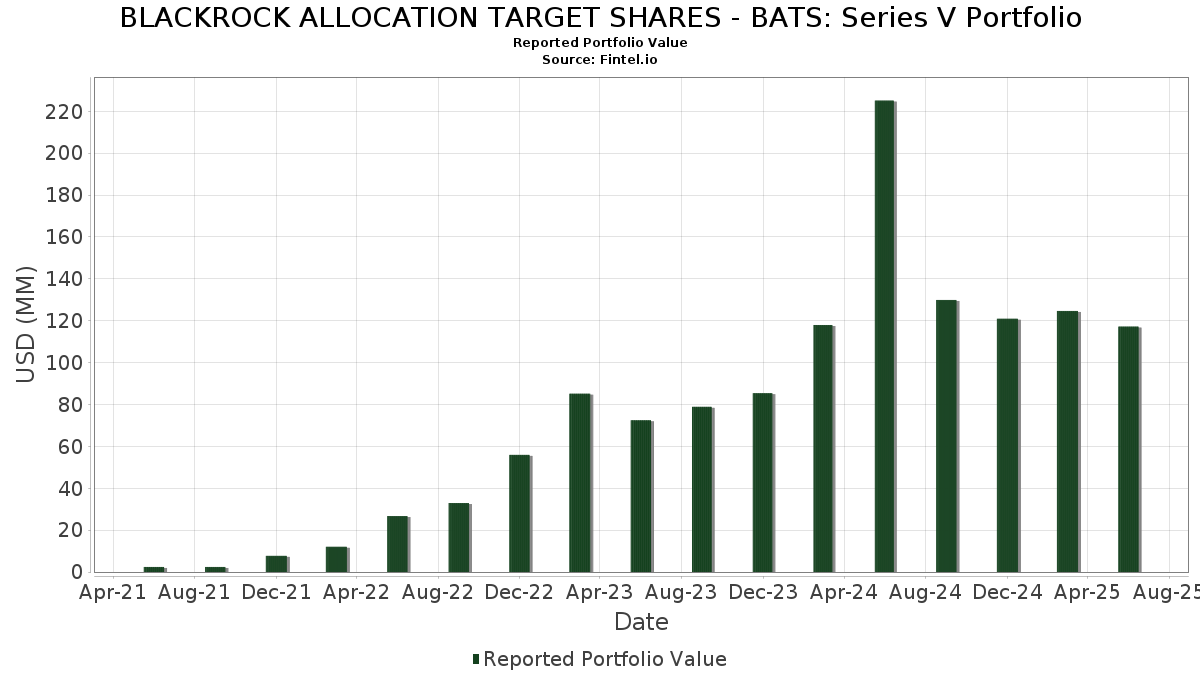

| Valeur du portefeuille | $ 117 202 817 |

| Positions actuelles | 80 |

Dernières positions, performances, ASG (à partir des dépôts 13F, 13D)

BLACKROCK ALLOCATION TARGET SHARES - BATS: Series V Portfolio a déclaré un total de 80 positions dans ses derniers dépôts auprès de la SEC. La valeur la plus récente du portefeuille est calculée à 117 202 817 USD. Les actifs sous gestion réels (ASG) sont cette valeur plus les liquidités (qui ne sont pas divulguées). Les principales positions de BLACKROCK ALLOCATION TARGET SHARES - BATS: Series V Portfolio sont CHARLOTTE ETC HLTH-E (US:US160853VA29) , Harris County Health Facilities Development Corp. (Methodist Hospital), Series 2008 A-2, Ref. VRD RB (US:US41315RGV06) , MET TRANSPRTN AUTH NY DEDICATED TAX FUND DV&DP (US:US59259N8Q99) , NEW YORK CITY NY MUNI WTR FIN AUTH WTR & SWR SYS REVENUE (US:US64972GC444) , and State of Louisiana, Series 2023 A-2 (US:US546475VW13) . Les nouvelles positions de BLACKROCK ALLOCATION TARGET SHARES - BATS: Series V Portfolio incluent CHARLOTTE ETC HLTH-E (US:US160853VA29) , Harris County Health Facilities Development Corp. (Methodist Hospital), Series 2008 A-2, Ref. VRD RB (US:US41315RGV06) , MET TRANSPRTN AUTH NY DEDICATED TAX FUND DV&DP (US:US59259N8Q99) , NEW YORK CITY NY MUNI WTR FIN AUTH WTR & SWR SYS REVENUE (US:US64972GC444) , and State of Louisiana, Series 2023 A-2 (US:US546475VW13) .

Meilleures augmentations ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 4,20 | 3,5924 | 3,5924 | ||

| 3,56 | 3,0493 | 3,0493 | ||

| 3,50 | 2,9937 | 2,9937 | ||

| 3,00 | 2,5660 | 2,5660 | ||

| 3,00 | 2,5660 | 2,5660 | ||

| 3,00 | 2,5660 | 2,5660 | ||

| 2,90 | 2,4805 | 2,4805 | ||

| 2,94 | 2,5147 | 2,2591 | ||

| 2,40 | 2,0528 | 1,8190 | ||

| 2,00 | 1,7108 | 1,7108 |

Principales baisses ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 0,10 | 0,0855 | -1,7082 | ||

| 1,33 | 1,1376 | -1,5619 | ||

| 1,30 | 1,1119 | -1,4045 | ||

| 2,00 | 1,7107 | -1,0919 | ||

| 0,40 | 0,3421 | -0,9527 | ||

| 0,80 | 0,6843 | -0,8407 | ||

| 0,55 | 0,4697 | -0,0098 |

Déclarations 13F et dépôts de fonds

Ce formulaire a été déposé le 2025-08-26 pour la période de déclaration 2025-06-30. Cet investisseur n'a pas divulgué les titres comptabilisés en actions, les colonnes relatives aux actions dans le tableau ci-dessous sont donc omises. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau pour débloquer les données premium et exporter vers Excel ![]() .

.

| Titre | Type | ΔActions (%) |

Valeur ($ en millions) |

Portefeuille (%) |

ΔPortefeuille (%) |

|

|---|---|---|---|---|---|---|

| County of King WA Sewer Revenue / DBT (US495290ET12) | 4,20 | 3,5924 | 3,5924 | |||

| Northampton County General Purpose Authority / DBT (US66353RDJ05) | 3,80 | 18,75 | 3,2503 | 0,6936 | ||

| US160853VA29 / CHARLOTTE ETC HLTH-E | 3,70 | 85,00 | 3,1648 | 1,6113 | ||

| US41315RGV06 / Harris County Health Facilities Development Corp. (Methodist Hospital), Series 2008 A-2, Ref. VRD RB | 3,60 | 282,98 | 3,0792 | 0,2762 | ||

| US59259N8Q99 / MET TRANSPRTN AUTH NY DEDICATED TAX FUND DV&DP | 3,56 | 3,0493 | 3,0493 | |||

| New Hampshire Business Finance Authority / DBT (US63610BAD73) | 3,50 | 2,9937 | 2,9937 | |||

| US546475VW13 / State of Louisiana, Series 2023 A-2 | 3,00 | 2,5660 | 2,5660 | |||

| US64971WE639 / NEW YORK CITY NY TRANSITIONAL FIN AUTH REVENUE | 3,00 | 2,5660 | 2,5660 | |||

| US64972GC444 / NEW YORK CITY NY MUNI WTR FIN AUTH WTR & SWR SYS REVENUE | 3,00 | 2,5660 | 2,5660 | |||

| US60528ACB89 / Mississippi Business Finance Corp. (Chevron USA, Inc.), Series 2010 K, VRD RB | 2,97 | 40,43 | 2,5404 | 0,8505 | ||

| US915260CN13 / University of Wisconsin Hospitals & Clinics | 2,94 | 880,00 | 2,5147 | 2,2591 | ||

| US64972GRG19 / NEW YORK CITY NY MUNI WTR FIN AUTH WTR & SWR SYS REVENUE | 2,90 | 38,10 | 2,4805 | 0,8026 | ||

| US040507QB45 / Arizona (State of) Health Facilities Authority (Banner Health), Series 2015 C, Ref. VRD RB | 2,90 | 2,4805 | 2,4805 | |||

| US45203HYX42 / ILLINOIS ST FIN AUTH REVENUE ILLINOIS FINANCE AUTHORITY | 2,90 | 52,63 | 2,4805 | 0,9624 | ||

| US60528ACC62 / Mississippi Business Finance Corp. (Chevron USA, Inc.), Series 2010 L, VRD RB | 2,60 | 420,00 | 2,2239 | 1,5914 | ||

| US63968MQD47 / Nebraska Investment Finance Authority, Single Family Housing Revenue Bonds, Variable Demand Series 2017C | 2,52 | 0,00 | 2,1597 | 0,1423 | ||

| US64966MSD29 / NEW YORK NY NYC 10/46 ADJUSTABLE VAR | 2,40 | 1 100,00 | 2,0528 | 1,8190 | ||

| US882724QQ32 / Texas GO VRDO | 2,12 | -4,51 | 1,8090 | 0,0393 | ||

| US837031ZX42 / South Carolina (State of) Jobs-Economic Development Authority (Port Royal Village Apartments), Series 2021, VRD RB | 2,10 | 0,00 | 1,7962 | 0,1184 | ||

| US97689QCF19 / WI HSG and EDA HO 2016 C Q=RC V7 | 2,10 | 51,08 | 1,7962 | 0,6856 | ||

| US658909JV92 / NORTH DAKOTA ST HSG FIN AGY NDSHSG 07/36 FLOATING VAR | 2,02 | 0,00 | 1,7278 | 0,1139 | ||

| AUSTIN TEX UTIL SYS REV 3.0 03SEP25 / DBT (US05248NXK17) | 2,00 | 1,7108 | 1,7108 | |||

| LINCOLN NEB ELEC SYS RE 3.0 04AUG25 / DBT (US53427TGY01) | 2,00 | 1,7107 | 1,7107 | |||

| US673588DL06 / Oakland University Board of Trustees, Series 2008, Ref. VRD RB | 2,00 | 1 112,12 | 1,7107 | 1,5165 | ||

| US64971XKU18 / NEW YORK CITY NY TRANSITIONALF NYCGEN 08/39 ADJUSTABLE VAR | 2,00 | -41,18 | 1,7107 | -1,0919 | ||

| Illinois Finance Authority / DBT (US45200BHQ41) | 1,90 | 1,6209 | 1,6209 | |||

| Wyoming Community Development Authority / DBT (US98322QTB31) | 1,80 | 0,00 | 1,5396 | 0,1015 | ||

| US414009PV67 / Harris County Cultural Education Facilities Finance Corp | 1,65 | -2,94 | 1,4113 | 0,0531 | ||

| US83712EHB39 / SC ST HSG FIN & DEV | 1,41 | 0,00 | 1,2018 | 0,0792 | ||

| MASSACHUSETTSSTWTRR3.0506AUG25 / DBT (US57604YBJ38) | 1,40 | 1,1976 | 1,1976 | |||

| US196632BH51 / Colorado Springs (City of), CO, Series 2006 B, VRD RB | 1,40 | 1,1975 | 1,1975 | |||

| US72317BAD47 / PINELLAS CNTY FL HSG FIN AUTH MF HSG REVENUE | 1,40 | 0,00 | 1,1975 | 0,0789 | ||

| US60528ABZ66 / Mississippi Business Finance Corp. (Chevron U.S.A., Inc.), Series 2010 I, VRD IDR | 1,33 | -59,39 | 1,1376 | -1,5619 | ||

| US613347RK17 / MONTGOMERY CNTY MD HSG OPPNTYS COMMN MFH & RECONSTR DEV REV | 1,30 | 0,00 | 1,1119 | 0,0733 | ||

| US603786FP49 / MINNEAPOLIS MINN REV ADJ MATURITY DATE 01 DEC 2040 | 1,30 | 1 200,00 | 1,1119 | -1,4045 | ||

| US57583R6H31 / Massachusetts Development Finance Agency | 1,25 | 0,00 | 1,0692 | 0,0705 | ||

| US462467RZ65 / IOWA ST FIN AUTH SF MTGE REVEN IOWA FINANCE AUTHORITY | 1,20 | 0,00 | 1,0264 | 0,0676 | ||

| US83756CA219 / South Dakota Housing Development Authority | 1,02 | 0,00 | 0,8767 | 0,0578 | ||

| State of North Carolina / DBT (US658268EX17) | 1,02 | 0,8682 | 0,8682 | |||

| Township of Maplewood NJ / DBT (US565624NG47) | 1,00 | -0,20 | 0,8575 | 0,0549 | ||

| Township of Egg Harbor NJ / DBT (US282305HW43) | 1,00 | -0,20 | 0,8563 | 0,0546 | ||

| Schodack Central School District / DBT (US806891KM87) | 1,00 | -0,20 | 0,8556 | 0,0549 | ||

| UNIVERSITYTEXUNIVRE3.0523JUL25 / DBT (US91514TAF12) | 1,00 | 0,8555 | 0,8555 | |||

| UNIVERSITY TEX PERM UN 2.98 21OCT25 / DBT (US91514CPH87) | 1,00 | 0,8554 | 0,8554 | |||

| UNIVERSITY TEX PERM UN 2.85 01JUL25 / DBT (US91514CME83) | 1,00 | 0,8553 | 0,8553 | |||

| UNIVERSITY TEX PERM UN 2.85 01JUL25 / DBT (US91514CMN82) | 1,00 | 0,8553 | 0,8553 | |||

| US009730PA41 / AKRON BATH HOSP DIST | 1,00 | 0,00 | 0,8553 | 0,0564 | ||

| MASSACHUSETTS BAY TRANS 3.0 10JUL25 / DBT (US57559JAY91) | 1,00 | 0,8553 | 0,8553 | |||

| MASSACHUSETTS BAY TRAN 2.97 10JUL25 / DBT (US57559GBP37) | 1,00 | 0,8553 | 0,8553 | |||

| US303823LR74 / Fairfax County Industrial Development Authority, Virginia Health Care | 0,94 | 0,00 | 0,8040 | 0,0530 | ||

| Plano Independent School District / DBT (US727199D730) | 0,91 | -0,54 | 0,7809 | 0,0474 | ||

| US64986MYY55 / NEW YORK ST HSG FIN AGY | 0,90 | 0,00 | 0,7698 | 0,0507 | ||

| Mississippi Development Bank / DBT (US60534XE777) | 0,86 | 0,7399 | 0,7399 | |||

| US64970HCH57 / New York City NY Housing Development Corp. Multi-Family Rental Housing Revenue (90 West Street) VRDO | 0,85 | 0,7270 | 0,7270 | |||

| US882721RM79 / State of Texas | 0,80 | 0,6843 | 0,6843 | |||

| US59261AM532 / MET TRANSPRTN AUTH NY REVENUE | 0,80 | -56,76 | 0,6843 | -0,8407 | ||

| DuPage County Forest Preserve District / DBT (US262651VF63) | 0,78 | -0,51 | 0,6674 | 0,0402 | ||

| US45470YBB65 / INDIANA ST FIN AUTH HLTH SYS REVENUE | 0,75 | 0,00 | 0,6415 | 0,0423 | ||

| Cook County Community Consolidated School District No 64 Park Ridge-Niles / DBT (US213669KR40) | 0,75 | -0,53 | 0,6385 | 0,0386 | ||

| US20775B8C34 / CONNECTICUT ST HSG FIN AUTH HS REGD V/R B/E 1.57000000 | 0,72 | 0,00 | 0,6201 | 0,0409 | ||

| City of Mesa AZ Utility System Revenue / DBT (US5905452S79) | 0,69 | 0,5900 | 0,5900 | |||

| Honeoye Falls-Lima Central School District / DBT (US438209MJ48) | 0,61 | 0,5186 | 0,5186 | |||

| US462467UA77 / IOWA ST FIN AUTH SF MTGE REVENUE | 0,55 | 0,4704 | 0,4704 | |||

| US709225JD92 / PA TPK REV 23B L=TD V7 | 0,55 | 0,4704 | 0,4704 | |||

| Tennessee Housing Development Agency / DBT (US88046KPP56) | 0,55 | -8,50 | 0,4697 | -0,0098 | ||

| New York City Housing Development Corp / DBT (US64972KKK06) | 0,53 | 0,4491 | 0,4491 | |||

| Lewisville Independent School District / DBT (US52882PHB76) | 0,51 | 0,4386 | 0,4386 | |||

| City of Hamilton OH / DBT (US407756P829) | 0,50 | -0,20 | 0,4296 | 0,0273 | ||

| UNIVERSITY TEX UNIV REV 3.0 30SEP25 / DBT (US91514YFR99) | 0,50 | 0,4277 | 0,4277 | |||

| US97689QNE25 / WISCONSIN ST HSG & ECON DEV AU WISCONSIN HOUSING & ECONOMIC DEVELOPMENT AUTHORITY | 0,50 | 0,4277 | 0,4277 | |||

| US0118326M90 / Alaska Housing Finance Corp., Series 2001, RB | 0,49 | 0,4234 | 0,4234 | |||

| US60528ABR41 / MS BUS FIN-VR-B-CHEVR | 0,48 | 45,45 | 0,4106 | 0,0221 | ||

| Borough of Pompton Lakes NJ / DBT (US732233DB43) | 0,40 | 0,3456 | 0,3456 | |||

| City of Miamisburg OH / DBT (US593864MK43) | 0,40 | 0,00 | 0,3440 | 0,0221 | ||

| US362848RR67 / City of Gainesville FL Utilities System Revenue | 0,40 | -63,64 | 0,3421 | -0,9527 | ||

| US792070BH64 / SAINT LUCIE CNTY FL POLL CONTROL REVENUE DV&DP | 0,40 | 0,00 | 0,3421 | 0,0225 | ||

| Essex County Improvement Authority / DBT (US296807MM90) | 0,36 | 0,3039 | 0,3039 | |||

| US574215RC51 / Maryland Health & Higher Educational Facilities Authority | 0,30 | 50,00 | 0,2566 | 0,0917 | ||

| Port Washington-Saukville School District/WI / DBT (US735587JQ11) | 0,10 | 0,0869 | 0,0869 | |||

| US882723YT06 / TEXAS ST | 0,10 | -95,55 | 0,0855 | -1,7082 |