Statistiques de base

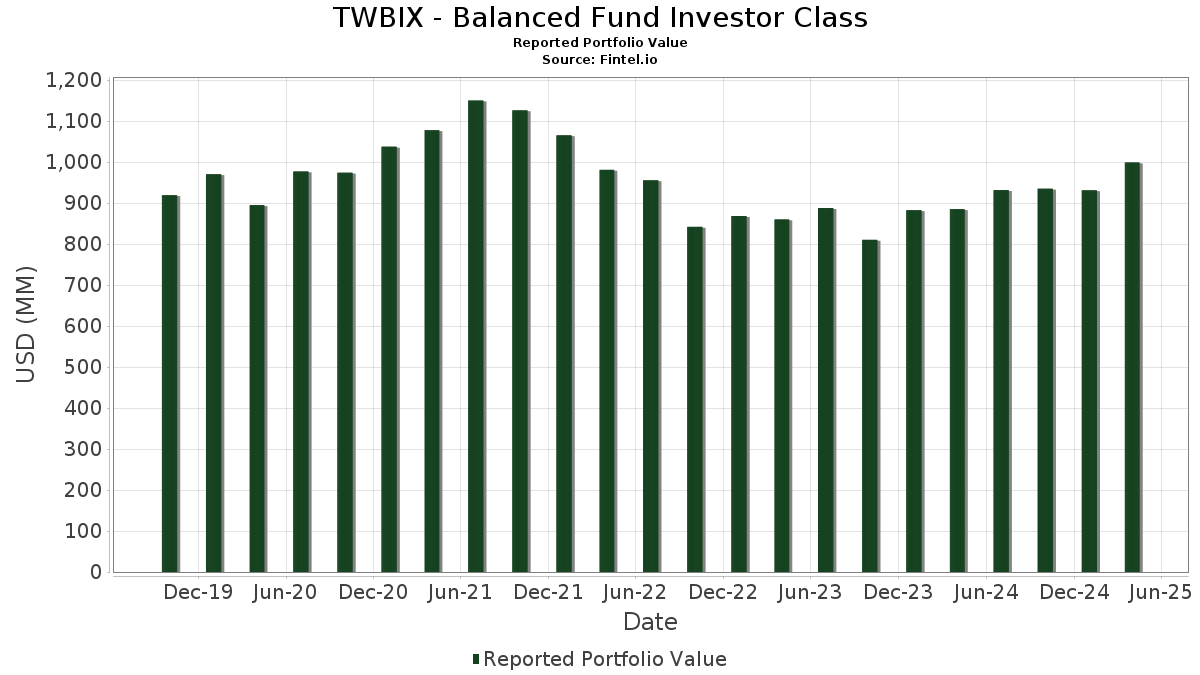

| Valeur du portefeuille | $ 999 033 943 |

| Positions actuelles | 901 |

Dernières positions, performances, ASG (à partir des dépôts 13F, 13D)

TWBIX - Balanced Fund Investor Class a déclaré un total de 901 positions dans ses derniers dépôts auprès de la SEC. La valeur la plus récente du portefeuille est calculée à 999 033 943 USD. Les actifs sous gestion réels (ASG) sont cette valeur plus les liquidités (qui ne sont pas divulguées). Les principales positions de TWBIX - Balanced Fund Investor Class sont Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , Alphabet Inc. (US:GOOGL) , and Amazon.com, Inc. (US:AMZN) . Les nouvelles positions de TWBIX - Balanced Fund Investor Class incluent Uniform Mortgage-Backed Security, TBA (US:US01F0506505) , FNMA TBA 30 YR 5.5 SINGLE FAMILY MORTGAGE (US:US01F0526560) , United States Treasury Note/Bond (US:US91282CGQ87) , U.S. Treasury Notes (US:US91282CJG78) , and United States Treasury Note/Bond (US:US912810TW80) .

Meilleures augmentations ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 13,90 | 1,6353 | 1,6353 | ||

| 0,02 | 8,41 | 0,9892 | 0,7236 | |

| 4,88 | 0,5743 | 0,5743 | ||

| 8,87 | 1,0433 | 0,5020 | ||

| 0,02 | 3,17 | 0,3728 | 0,3728 | |

| 0,00 | 3,66 | 0,4311 | 0,3697 | |

| 6,59 | 0,7747 | 0,3683 | ||

| 4,48 | 0,5265 | 0,3458 | ||

| 0,03 | 2,86 | 0,3368 | 0,3368 | |

| 0,01 | 2,63 | 0,3097 | 0,3097 |

Principales baisses ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 0,11 | 23,24 | 2,7345 | -0,9560 | |

| 4,04 | 0,4757 | -0,9173 | ||

| 1,74 | 1,74 | 0,2046 | -0,8932 | |

| 0,24 | 25,60 | 3,0120 | -0,6798 | |

| 2,33 | 0,2739 | -0,6243 | ||

| 3,49 | 0,4102 | -0,5570 | ||

| 0,12 | 18,98 | 2,2331 | -0,4870 | |

| 0,02 | 6,97 | 0,8205 | -0,4654 | |

| 0,10 | 17,54 | 2,0639 | -0,4268 | |

| 0,02 | 12,16 | 1,4308 | -0,2937 |

Déclarations 13F et dépôts de fonds

Ce formulaire a été déposé le 2025-06-27 pour la période de déclaration 2025-04-30. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau pour débloquer les données premium et exporter vers Excel ![]() .

.

| Titre | Type | Prix moyen de l'action | Actions (en millions) |

ΔActions (%) |

ΔActions (%) |

Valeur ($ en millions) |

Portefeuille (%) |

ΔPortefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0,10 | 0,00 | 39,82 | -4,77 | 4,6845 | 0,1420 | |||

| NVDA / NVIDIA Corporation | 0,24 | -16,95 | 25,60 | -24,66 | 3,0120 | -0,6798 | |||

| AAPL / Apple Inc. | 0,11 | -24,01 | 23,24 | -31,58 | 2,7345 | -0,9560 | |||

| GOOGL / Alphabet Inc. | 0,12 | -2,60 | 18,98 | -24,19 | 2,2331 | -0,4870 | |||

| AMZN / Amazon.com, Inc. | 0,10 | -1,38 | 17,54 | -23,48 | 2,0639 | -0,4268 | |||

| US01F0506505 / Uniform Mortgage-Backed Security, TBA | 13,90 | 1,6353 | 1,6353 | ||||||

| META / Meta Platforms, Inc. | 0,02 | -3,82 | 12,16 | -23,38 | 1,4308 | -0,2937 | |||

| AVGO / Broadcom Inc. | 0,06 | -5,11 | 11,80 | -17,46 | 1,3879 | -0,1648 | |||

| MA / Mastercard Incorporated | 0,02 | 4,34 | 10,07 | 2,95 | 1,1848 | 0,1221 | |||

| JPM / JPMorgan Chase & Co. | 0,04 | -3,57 | 8,92 | -11,75 | 1,0497 | -0,0487 | |||

| US01F0526560 / FNMA TBA 30 YR 5.5 SINGLE FAMILY MORTGAGE | 8,87 | 84,40 | 1,0433 | 0,5020 | |||||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0,02 | 272,65 | 8,41 | 243,89 | 0,9892 | 0,7236 | |||

| HD / The Home Depot, Inc. | 0,02 | 0,00 | 7,79 | -12,51 | 0,9161 | -0,0507 | |||

| LLY / Eli Lilly and Company | 0,01 | 0,00 | 7,77 | 10,84 | 0,9141 | 0,1525 | |||

| UNH / UnitedHealth Group Incorporated | 0,02 | 0,00 | 7,46 | -24,15 | 0,8781 | -0,1910 | |||

| NEE / NextEra Energy, Inc. | 0,11 | 0,00 | 7,44 | -6,54 | 0,8756 | 0,0105 | |||

| TSLA / Tesla, Inc. | 0,02 | -15,51 | 6,97 | -41,08 | 0,8205 | -0,4654 | |||

| PG / The Procter & Gamble Company | 0,04 | 11,52 | 6,67 | 9,23 | 0,7841 | 0,1212 | |||

| US91282CGQ87 / United States Treasury Note/Bond | 6,59 | 76,02 | 0,7747 | 0,3683 | |||||

| JCI / Johnson Controls International plc | 0,07 | 0,00 | 6,09 | 7,57 | 0,7168 | 0,1014 | |||

| CDNS / Cadence Design Systems, Inc. | 0,02 | 0,00 | 6,02 | 0,03 | 0,7080 | 0,0545 | |||

| TJX / The TJX Companies, Inc. | 0,05 | 0,00 | 6,01 | 3,12 | 0,7073 | 0,0739 | |||

| SPGI / S&P Global Inc. | 0,01 | 0,00 | 5,92 | -4,08 | 0,6961 | 0,0258 | |||

| MS / Morgan Stanley | 0,05 | 0,00 | 5,85 | -16,63 | 0,6883 | -0,0740 | |||

| LIN / Linde plc | 0,01 | 0,00 | 5,63 | 1,59 | 0,6618 | 0,0603 | |||

| EQIX / Equinix, Inc. | 0,01 | 2,95 | 5,50 | -3,01 | 0,6475 | 0,0310 | |||

| US91282CJG78 / U.S. Treasury Notes | 5,37 | -28,16 | 0,6321 | -0,1804 | |||||

| IBM / International Business Machines Corporation | 0,02 | 9,68 | 5,24 | 3,72 | 0,6165 | 0,0677 | |||

| ADI / Analog Devices, Inc. | 0,03 | 10,64 | 5,24 | 1,79 | 0,6159 | 0,0571 | |||

| ABBV / AbbVie Inc. | 0,03 | 0,00 | 5,22 | 6,08 | 0,6136 | 0,0795 | |||

| BAC / Bank of America Corporation | 0,13 | 6,48 | 5,20 | -8,29 | 0,6116 | -0,0042 | |||

| V / Visa Inc. | 0,01 | 45,18 | 5,13 | 46,77 | 0,6034 | 0,2237 | |||

| US912810TW80 / United States Treasury Note/Bond | 5,05 | 2,04 | 0,5945 | 0,0565 | |||||

| DHR / Danaher Corporation | 0,02 | 0,00 | 4,92 | -10,51 | 0,5791 | -0,0185 | |||

| United States Treasury Note/Bond 4.25 03/31/2029 / DBT (US91282CKG59) | 4,88 | 0,5743 | 0,5743 | ||||||

| ACN / Accenture plc | 0,02 | 31,58 | 4,79 | 2,24 | 0,5640 | 0,0547 | |||

| CI / The Cigna Group | 0,01 | 0,00 | 4,78 | 15,57 | 0,5624 | 0,1131 | |||

| MSI / Motorola Solutions, Inc. | 0,01 | 20,40 | 4,73 | 12,99 | 0,5566 | 0,1017 | |||

| PLD / Prologis, Inc. | 0,05 | -8,43 | 4,62 | -21,53 | 0,5437 | -0,0961 | |||

| SLB / Schlumberger Limited | 0,14 | 0,00 | 4,54 | -17,46 | 0,5336 | -0,0633 | |||

| US91282CHW47 / US TREASURY N/B 4.125000% 08/31/2030 | 4,48 | 176,58 | 0,5265 | 0,3458 | |||||

| COST / Costco Wholesale Corporation | 0,00 | 0,00 | 4,27 | 1,50 | 0,5024 | 0,0453 | |||

| PEP / PepsiCo, Inc. | 0,03 | -12,83 | 4,22 | -21,57 | 0,4966 | -0,0881 | |||

| RF / Regions Financial Corporation | 0,20 | 0,00 | 4,18 | -17,17 | 0,4920 | -0,0565 | |||

| United States Treasury Note/Bond 4.00 12/15/2027 / DBT (US91282CMB45) | 4,04 | -68,47 | 0,4757 | -0,9173 | |||||

| XYL / Xylem Inc. | 0,03 | 29,54 | 4,00 | 25,91 | 0,4705 | 0,1255 | |||

| SYY / Sysco Corporation | 0,06 | 0,00 | 3,93 | -2,09 | 0,4628 | 0,0263 | |||

| MET / MetLife, Inc. | 0,05 | 30,95 | 3,85 | 14,11 | 0,4528 | 0,0863 | |||

| LNG / Cheniere Energy, Inc. | 0,02 | 15,99 | 3,82 | 19,87 | 0,4499 | 0,1033 | |||

| ECL / Ecolab Inc. | 0,02 | 0,00 | 3,79 | 0,48 | 0,4460 | 0,0362 | |||

| ISRG / Intuitive Surgical, Inc. | 0,01 | 0,00 | 3,79 | -9,82 | 0,4454 | -0,0106 | |||

| VZ / Verizon Communications Inc. | 0,09 | 0,00 | 3,77 | 11,87 | 0,4436 | 0,0774 | |||

| ZTS / Zoetis Inc. | 0,02 | 0,00 | 3,74 | -8,47 | 0,4398 | -0,0040 | |||

| AXP / American Express Company | 0,01 | 0,00 | 3,70 | -16,08 | 0,4353 | -0,0437 | |||

| NFLX / Netflix, Inc. | 0,00 | 459,24 | 3,66 | 548,50 | 0,4311 | 0,3697 | |||

| HON / Honeywell International Inc. | 0,02 | 0,00 | 3,62 | -5,92 | 0,4264 | 0,0079 | |||

| ETN / Eaton Corporation plc | 0,01 | -20,78 | 3,59 | -28,57 | 0,4219 | -0,1235 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0,02 | 0,00 | 3,57 | -11,94 | 0,4199 | -0,0205 | |||

| US01F0406516 / Uniform Mortgage-Backed Security, TBA | 3,49 | -62,40 | 0,4102 | -0,5570 | |||||

| WDAY / Workday, Inc. | 0,01 | 0,00 | 3,48 | -6,50 | 0,4093 | 0,0050 | |||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3,47 | 0,32 | 0,4081 | 0,0324 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 3,47 | 0,32 | 0,4081 | 0,0324 | |||||

| TSCO / Tractor Supply Company | 0,07 | 19,88 | 3,43 | 11,65 | 0,4036 | 0,0697 | |||

| AMP / Ameriprise Financial, Inc. | 0,01 | 0,00 | 3,37 | -13,29 | 0,3967 | -0,0259 | |||

| UNP / Union Pacific Corporation | 0,02 | -15,55 | 3,36 | -26,50 | 0,3958 | -0,1015 | |||

| TMO / Thermo Fisher Scientific Inc. | 0,01 | 0,00 | 3,33 | -28,23 | 0,3913 | -0,1122 | |||

| CMI / Cummins Inc. | 0,01 | -16,70 | 3,31 | -31,30 | 0,3889 | -0,1338 | |||

| BLK / BlackRock, Inc. | 0,00 | -17,76 | 3,20 | -30,11 | 0,3764 | -0,1208 | |||

| XPRO / Expro Group Holdings N.V. | 0,02 | 3,17 | 0,3728 | 0,3728 | |||||

| US36179VVX53 / GNMA II, 30 Year | 3,17 | -0,16 | 0,3725 | 0,0279 | |||||

| CMG / Chipotle Mexican Grill, Inc. | 0,06 | 0,00 | 3,16 | -13,42 | 0,3720 | -0,0248 | |||

| PGR / The Progressive Corporation | 0,01 | -30,54 | 3,11 | -20,60 | 0,3661 | -0,0596 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0,01 | 0,00 | 3,11 | 10,37 | 0,3656 | 0,0597 | |||

| BKNG / Booking Holdings Inc. | 0,00 | -43,34 | 3,10 | 7,56 | 0,3647 | 0,0291 | |||

| UBER / Uber Technologies, Inc. | 0,04 | -20,58 | 3,09 | -3,74 | 0,3632 | 0,0147 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0,01 | 0,00 | 3,06 | 3,98 | 0,3594 | 0,0402 | |||

| IDXX / IDEXX Laboratories, Inc. | 0,01 | 17,16 | 2,98 | 20,10 | 0,3500 | 0,0809 | |||

| US36179XFG60 / Ginnie Mae II Pool | 2,94 | -0,98 | 0,3461 | 0,0234 | |||||

| US36179XFH44 / Government National Mortgage Association (GNMA) | 2,86 | -0,97 | 0,3370 | 0,0228 | |||||

| CHD / Church & Dwight Co., Inc. | 0,03 | 2,86 | 0,3368 | 0,3368 | |||||

| US3140QPXM45 / FNMA 30YR UMBS | 2,86 | -4,61 | 0,3359 | 0,0108 | |||||

| ICE / Intercontinental Exchange, Inc. | 0,02 | 10,55 | 2,81 | 16,15 | 0,3301 | 0,0677 | |||

| US3133KPMJ48 / Freddie Mac | 2,78 | -0,22 | 0,3265 | 0,0243 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2,76 | -1,95 | 0,3251 | 0,0189 | |||||

| CRM / Salesforce, Inc. | 0,01 | 0,00 | 2,74 | -21,38 | 0,3229 | -0,0563 | |||

| DE / Deere & Company | 0,01 | 0,00 | 2,72 | -2,72 | 0,3201 | 0,0162 | |||

| ASML / ASML Holding N.V. | 0,00 | 12,16 | 2,71 | 1,50 | 0,3182 | 0,0287 | |||

| United States Treasury Note/Bond 4.25 01/15/2028 / DBT (US91282CMF58) | 2,64 | 1,65 | 0,3110 | 0,0285 | |||||

| US3133KQDW33 / FHLMC 30YR UMBS | 2,64 | -2,04 | 0,3105 | 0,0178 | |||||

| KKR / KKR & Co. Inc. | 0,02 | 0,00 | 2,64 | -31,60 | 0,3104 | -0,1087 | |||

| ADP / Automatic Data Processing, Inc. | 0,01 | 2,63 | 0,3097 | 0,3097 | |||||

| United States Treasury Note/Bond 4.63 02/15/2035 / DBT (US91282CMM00) | 2,59 | 0,3052 | 0,3052 | ||||||

| CRWD / CrowdStrike Holdings, Inc. | 0,01 | -10,93 | 2,56 | -4,02 | 0,3010 | 0,0113 | |||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2,54 | -1,09 | 0,2993 | 0,0198 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2,54 | -1,09 | 0,2993 | 0,0198 | |||||

| PH / Parker-Hannifin Corporation | 0,00 | -25,53 | 2,51 | -36,27 | 0,2948 | -0,1324 | |||

| US91282CJQ50 / United States Treasury Note/Bond - When Issued | 2,49 | 3,19 | 0,2932 | 0,0308 | |||||

| CPRT / Copart, Inc. | 0,04 | 2,48 | 0,2923 | 0,2923 | |||||

| US3140QREQ26 / FN CB5542 | 2,42 | -1,54 | 0,2851 | 0,0177 | |||||

| ANET / Arista Networks Inc | 0,03 | 0,00 | 2,42 | -28,61 | 0,2842 | -0,0834 | |||

| MRK / Merck & Co., Inc. | 0,03 | 0,00 | 2,37 | -13,78 | 0,2783 | -0,0198 | |||

| US36179XHY58 / GINNIE MAE II POOL | 2,35 | -0,76 | 0,2764 | 0,0192 | |||||

| US21H0226553 / Ginnie Mae | 2,33 | -75,67 | 0,2739 | -0,6243 | |||||

| COP / ConocoPhillips | 0,03 | 0,00 | 2,30 | -9,83 | 0,2709 | -0,0065 | |||

| LKQ / LKQ Corporation | 0,06 | 0,00 | 2,28 | 2,20 | 0,2682 | 0,0258 | |||

| CDW / CDW Corporation | 0,01 | 0,00 | 2,15 | -19,36 | 0,2524 | -0,0367 | |||

| US3140QREU38 / FNMA 30YR UMBS | 2,13 | -2,74 | 0,2505 | 0,0126 | |||||

| CL / Colgate-Palmolive Company | 0,02 | 0,00 | 2,12 | 6,33 | 0,2492 | 0,0328 | |||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2,11 | -1,63 | 0,2485 | 0,0152 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2,11 | -1,63 | 0,2485 | 0,0152 | |||||

| URI / United Rentals, Inc. | 0,00 | 23,48 | 2,10 | 2,84 | 0,2469 | 0,0252 | |||

| US3140QS4T57 / FNMA 30YR UMBS | 2,09 | -1,23 | 0,2460 | 0,0159 | |||||

| BLL / Ball Corp. | 0,04 | 0,00 | 2,08 | -6,76 | 0,2452 | 0,0024 | |||

| US3140XF4G30 / FNMA 30YR UMBS SUPER | 2,07 | -0,19 | 0,2431 | 0,0181 | |||||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0,03 | 0,00 | 2,06 | -20,83 | 0,2429 | -0,0403 | |||

| US3132DN3B70 / FR SD1694 | 2,03 | -0,25 | 0,2392 | 0,0178 | |||||

| NOW / ServiceNow, Inc. | 0,00 | 14,91 | 1,99 | 7,75 | 0,2338 | 0,0334 | |||

| FERG / Ferguson Enterprises Inc. | 0,01 | 0,00 | 1,93 | -6,35 | 0,2273 | 0,0032 | |||

| DT / Dynatrace, Inc. | 0,04 | 46,36 | 1,91 | 19,03 | 0,2245 | 0,0504 | |||

| US3140QG5L75 / Fannie Mae Pool | 1,88 | -0,05 | 0,2212 | 0,0168 | |||||

| US3135G05Y50 / Federal National Mortgage Association | 1,87 | 2,19 | 0,2197 | 0,0211 | |||||

| United States Treasury Note/Bond 4.63 05/15/2044 / DBT (US912810UB25) | 1,79 | -23,45 | 0,2102 | -0,0433 | |||||

| GVMXX / State Street Institutional Investment Trust - State Street Institutional US Govt Money Market Fnd Premier Cls | 1,74 | -82,79 | 1,74 | -82,79 | 0,2046 | -0,8932 | |||

| Provident Funding Mortgage Trust 2025-1 5.50 / ABS-MBS (US74388NAC02) | 1,74 | 0,2044 | 0,2044 | ||||||

| Provident Funding Mortgage Trust 2025-1 5.50 / ABS-MBS (US74388NAC02) | 1,74 | 0,2044 | 0,2044 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,72 | -2,27 | 0,2025 | 0,0111 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,72 | -2,27 | 0,2025 | 0,0111 | |||||

| A / Agilent Technologies, Inc. | 0,02 | 0,00 | 1,67 | -28,97 | 0,1961 | -0,0589 | |||

| FDX / FedEx Corporation | 0,01 | 0,00 | 1,66 | -20,59 | 0,1956 | -0,0319 | |||

| United States Treasury Note/Bond 4.50 02/15/2044 / DBT (US912810TZ12) | 1,66 | 2,15 | 0,1955 | 0,0187 | |||||

| US23292FAB13 / LMDC_21-1A | 1,66 | 1,28 | 0,1955 | 0,0172 | |||||

| US3140QN7H91 / FNMA 30YR UMBS | 1,65 | 0,67 | 0,1937 | 0,0160 | |||||

| GEV / GE Vernova Inc. | 0,00 | 0,00 | 1,64 | -0,55 | 0,1931 | 0,0138 | |||

| Elmwood CLO 24 Ltd 5.88 / ABS-CBDO (US290020AN63) | 1,64 | -1,21 | 0,1928 | 0,0126 | |||||

| Elmwood CLO 24 Ltd 5.88 / ABS-CBDO (US290020AN63) | 1,64 | -1,21 | 0,1928 | 0,0126 | |||||

| US21H0526523 / Ginnie Mae | 1,64 | -45,46 | 0,1924 | -0,1567 | |||||

| US3140QN4N96 / FNMA 30YR UMBS | 1,63 | -0,67 | 0,1923 | 0,0135 | |||||

| US3135G05Q27 / Federal National Mortgage Association | 1,63 | 3,10 | 0,1916 | 0,0200 | |||||

| Citigroup Mortgage Loan Trust 2024-CMI1 5.50 / ABS-MBS (US17332DAL82) | 1,60 | -9,25 | 0,1882 | -0,0033 | |||||

| Citigroup Mortgage Loan Trust 2024-CMI1 5.50 / ABS-MBS (US17332DAL82) | 1,60 | -9,25 | 0,1882 | -0,0033 | |||||

| US225313AJ46 / Credit Agricole SA | 1,55 | 14,81 | 1,57 | 13,68 | 0,1848 | 0,0347 | |||

| BMY / Bristol-Myers Squibb Company | 0,03 | 40,72 | 1,54 | 19,84 | 0,1813 | 0,0416 | |||

| JP Morgan Mortgage Trust 2024-11 6.00 / ABS-MBS (US46659AAD63) | 1,52 | -4,94 | 0,1787 | 0,0051 | |||||

| JP Morgan Mortgage Trust 2024-11 6.00 / ABS-MBS (US46659AAD63) | 1,52 | -4,94 | 0,1787 | 0,0051 | |||||

| JP Morgan Mortgage Trust 2024-11 6.00 / ABS-MBS (US46659AAD63) | 1,52 | -4,94 | 0,1787 | 0,0051 | |||||

| US3140MHUV90 / FNMA 30YR UMBS | 1,52 | -0,46 | 0,1786 | 0,0130 | |||||

| US3132DQQF62 / FHLMC 30YR UMBS SUPER | 1,51 | 0,73 | 0,1780 | 0,0148 | |||||

| US3140QFFH79 / FNMA 30YR UMBS | 1,51 | 0,67 | 0,1777 | 0,0147 | |||||

| US3140XHWY92 / Fannie Mae Pool | 1,51 | 0,33 | 0,1772 | 0,0141 | |||||

| US3140QPAJ62 / FNMA 30YR UMBS | 1,48 | 0,47 | 0,1745 | 0,0141 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,48 | -2,89 | 0,1739 | 0,0086 | |||||

| US21H0506566 / Ginnie Mae | 1,47 | 0,1735 | 0,1735 | ||||||

| US3133KL2S53 / FREDDIE MAC POOL UMBS P#RA5285 2.50000000 | 1,47 | 0,75 | 0,1730 | 0,0144 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1,45 | 0,42 | 0,1706 | 0,0137 | |||||

| XS2343014119 / Danske Bank A/S | 1,47 | 212,77 | 1,44 | 212,36 | 0,1695 | 0,1194 | |||

| US3133BPZW13 / FED HM LN PC POOL QF2557 FR 10/52 FIXED 4.5 | 1,44 | -0,62 | 0,1689 | 0,0119 | |||||

| EOG / EOG Resources, Inc. | 0,01 | -35,46 | 1,42 | -43,40 | 0,1676 | -0,1058 | |||

| US3132DPM968 / Freddie Mac Pool | 1,42 | -2,01 | 0,1666 | 0,0095 | |||||

| Provident Funding Mortgage Trust 2024-1 5.50 / ABS-MBS (US74389BAC54) | 1,40 | -4,17 | 0,1650 | 0,0060 | |||||

| Provident Funding Mortgage Trust 2024-1 5.50 / ABS-MBS (US74389BAC54) | 1,40 | -4,17 | 0,1650 | 0,0060 | |||||

| US3622ABQ544 / GNMA2 30YR PLATINUM | 1,40 | 0,00 | 0,1648 | 0,0126 | |||||

| XYZ / Block, Inc. | 0,02 | 0,00 | 1,40 | -35,62 | 0,1646 | -0,0715 | |||

| US3140QS4H10 / FNMA 30YR UMBS | 1,39 | -0,36 | 0,1633 | 0,0119 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,39 | 0,73 | 0,1631 | 0,0136 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,39 | 0,73 | 0,1631 | 0,0136 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,39 | 0,73 | 0,1631 | 0,0136 | |||||

| US912810QQ40 / United States Treas Bds Bond | 1,37 | 2,39 | 0,1611 | 0,0157 | |||||

| US31418EJ844 / Fannie Mae Pool | 1,36 | -1,45 | 0,1602 | 0,0101 | |||||

| JP Morgan Mortgage Trust Series 2025-2 6.00 / ABS-MBS (US46593NAE58) | 1,36 | 0,1602 | 0,1602 | ||||||

| JP Morgan Mortgage Trust Series 2025-2 6.00 / ABS-MBS (US46593NAE58) | 1,36 | 0,1602 | 0,1602 | ||||||

| JP Morgan Mortgage Trust Series 2025-2 6.00 / ABS-MBS (US46593NAE58) | 1,36 | 0,1602 | 0,1602 | ||||||

| US018820AA81 / Allianz SE | 1,40 | 250,00 | 1,35 | 245,38 | 0,1586 | 0,1162 | |||

| US3133AQXM41 / Freddie Mac Pool | 1,34 | 0,07 | 0,1575 | 0,0122 | |||||

| US3133L8JQ92 / Freddie Mac Pool | 1,34 | -1,11 | 0,1574 | 0,0105 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 1,33 | 0,45 | 0,1569 | 0,0127 | |||||

| US91282CJN20 / US TREASURY N/B 4.375% 11-30-28 | 1,33 | 2,23 | 0,1567 | 0,0151 | |||||

| US3132DMJA45 / Freddie Mac Pool | 1,32 | 0,61 | 0,1556 | 0,0128 | |||||

| KMX / CarMax, Inc. | 0,02 | 0,00 | 1,32 | -24,47 | 0,1554 | -0,0346 | |||

| BANK5 2024-5YR7 5.77 / ABS-MBS (US06211UBL89) | 1,32 | 1,15 | 0,1551 | 0,0135 | |||||

| US539439AU36 / Lloyds Banking Group PLC | 1,28 | 213,41 | 1,28 | 209,40 | 0,1511 | 0,1060 | |||

| US3133KPGB85 / FHLMC 30YR UMBS | 1,27 | -1,32 | 0,1498 | 0,0096 | |||||

| NDASS / Nordea Bank Abp | 1,25 | 127,27 | 1,25 | 126,17 | 0,1475 | 0,0872 | |||

| US3140QPSR96 / Fannie Mae Pool | 1,24 | -0,64 | 0,1464 | 0,0103 | |||||

| US91282CJM47 / United States Treasury Note/Bond | 1,23 | 3,01 | 0,1452 | 0,0150 | |||||

| US456837AR44 / ING Groep NV | 1,25 | 127,27 | 1,23 | 124,45 | 0,1448 | 0,0852 | |||

| US643821AB76 / New Economy Assets Phase 1 Sponsor LLC | 1,23 | 0,66 | 0,1446 | 0,0119 | |||||

| United States Treasury Note/Bond 4.13 11/15/2027 / DBT (US91282CLX73) | 1,22 | -44,60 | 0,1430 | -0,0953 | |||||

| United States Treasury Note/Bond 4.13 10/31/2031 / DBT (US91282CLU35) | 1,22 | -38,10 | 0,1430 | -0,0703 | |||||

| US912810RK60 / United States Treas Bds Bond | 1,21 | 2,20 | 0,1422 | 0,0136 | |||||

| United States Treasury Note/Bond 4.13 08/15/2044 / DBT (US912810UD80) | 1,21 | 2,21 | 0,1418 | 0,0136 | |||||

| Subway Funding LLC 6.03 / ABS-MBS (US864300AA61) | 1,20 | -0,08 | 0,1414 | 0,0106 | |||||

| Subway Funding LLC 6.03 / ABS-MBS (US864300AA61) | 1,20 | -0,08 | 0,1414 | 0,0106 | |||||

| Subway Funding LLC 6.03 / ABS-MBS (US864300AA61) | 1,20 | -0,08 | 0,1414 | 0,0106 | |||||

| SWCH Commercial Mortgage Trust 2025-DATA 5.76 / ABS-MBS (US78489CAA71) | 1,19 | 0,1405 | 0,1405 | ||||||

| SWCH Commercial Mortgage Trust 2025-DATA 5.76 / ABS-MBS (US78489CAA71) | 1,19 | 0,1405 | 0,1405 | ||||||

| SWCH Commercial Mortgage Trust 2025-DATA 5.76 / ABS-MBS (US78489CAA71) | 1,19 | 0,1405 | 0,1405 | ||||||

| US3133KMLL71 / Freddie Mac Pool | 1,18 | 0,60 | 0,1385 | 0,0114 | |||||

| US3140XGMP13 / FNMA 30YR UMBS SUPER | 1,14 | 0,53 | 0,1344 | 0,0110 | |||||

| Chase Home Lending Mortgage Trust 2024-9 5.50 / ABS-MBS (US16160QAD60) | 1,14 | -11,85 | 0,1339 | -0,0064 | |||||

| Chase Home Lending Mortgage Trust 2024-9 5.50 / ABS-MBS (US16160QAD60) | 1,14 | -11,85 | 0,1339 | -0,0064 | |||||

| MDB / MongoDB, Inc. | 0,01 | 19,92 | 1,14 | -24,45 | 0,1338 | -0,0298 | |||

| US780097BQ34 / Natwest Group PLC | 1,12 | 173,17 | 1,12 | 171,95 | 0,1313 | 0,0867 | |||

| DECK / Deckers Outdoor Corporation | 0,01 | 0,00 | 1,11 | -37,51 | 0,1310 | -0,0626 | |||

| Oaktree CLO 2024-28 Ltd 6.23 / ABS-CBDO (US67403HAE45) | 1,11 | -1,85 | 0,1309 | 0,0078 | |||||

| Oaktree CLO 2024-28 Ltd 6.23 / ABS-CBDO (US67403HAE45) | 1,11 | -1,85 | 0,1309 | 0,0078 | |||||

| Oaktree CLO 2024-28 Ltd 6.23 / ABS-CBDO (US67403HAE45) | 1,11 | -1,85 | 0,1309 | 0,0078 | |||||

| US71654QCK67 / Petroleos Mexicanos | 1,11 | 205,80 | 0,1302 | 0,0908 | |||||

| GS Mortgage-Backed Securities Trust 2024-PJ1 6.00 / ABS-MBS (US36268VAZ58) | 1,10 | 0,1290 | 0,1290 | ||||||

| GS Mortgage-Backed Securities Trust 2024-PJ1 6.00 / ABS-MBS (US36268VAZ58) | 1,10 | 0,1290 | 0,1290 | ||||||

| GS Mortgage-Backed Securities Trust 2024-PJ1 6.00 / ABS-MBS (US36268VAZ58) | 1,10 | 0,1290 | 0,1290 | ||||||

| US949746TD35 / Wells Fargo & Co | 1,11 | 1,09 | 0,1283 | 0,1283 | |||||

| US36179VQT07 / Ginnie Mae II Pool | 1,09 | -0,55 | 0,1283 | 0,0092 | |||||

| US599191AA16 / Mileage Plus Holdings LLC / Mileage Plus Intellectual Property Assets Ltd | 1,09 | 81,17 | 0,1279 | 0,0627 | |||||

| Towd Point Mortgage Trust 2024-1 4.77 / ABS-MBS (US89182NAA00) | 1,09 | -3,55 | 0,1278 | 0,0055 | |||||

| Towd Point Mortgage Trust 2024-1 4.77 / ABS-MBS (US89182NAA00) | 1,09 | -3,55 | 0,1278 | 0,0055 | |||||

| Towd Point Mortgage Trust 2024-1 4.77 / ABS-MBS (US89182NAA00) | 1,09 | -3,55 | 0,1278 | 0,0055 | |||||

| Chase Home Lending Mortgage Trust 2024-10 6.00 / ABS-MBS (US16159YAD22) | 1,07 | -5,13 | 0,1263 | 0,0034 | |||||

| Chase Home Lending Mortgage Trust 2024-10 6.00 / ABS-MBS (US16159YAD22) | 1,07 | -5,13 | 0,1263 | 0,0034 | |||||

| US55284AAC27 / MF1 Ltd., Series 2021-FL7, Class AS | 1,06 | -0,56 | 0,1244 | 0,0089 | |||||

| BKLN / Invesco Exchange-Traded Fund Trust II - Invesco Senior Loan ETF | 0,05 | -70,77 | 1,05 | -71,25 | 0,1241 | -0,2743 | |||

| US05609DAA37 / BX_23-LIFE | 1,05 | 1,54 | 0,1238 | 0,0112 | |||||

| US3140QGE605 / UMBS, 30 Year | 1,02 | 0,10 | 0,1201 | 0,0093 | |||||

| US36179WJS89 / Ginnie Mae II Pool | 1,02 | -0,88 | 0,1199 | 0,0082 | |||||

| US36179V7E46 / GNMA | 1,01 | -0,30 | 0,1185 | 0,0087 | |||||

| Atlas Warehouse Lending Co LP 6.25 01/15/2030 / DBT (US049463AE27) | 1,00 | 150,50 | 0,1180 | 0,0745 | |||||

| US3140QNN248 / FNMA 30YR UMBS | 1,00 | -0,10 | 0,1173 | 0,0088 | |||||

| US595620AY17 / MidAmerican Energy Co | 0,99 | 24,31 | 0,1167 | 0,0299 | |||||

| US3136BQFV63 / FANNIE MAE FNR 2023 39 AI | 0,99 | -3,43 | 0,1160 | 0,0051 | |||||

| Citigroup Mortgage Loan Trust 2025-2 6.00 / ABS-MBS (US17292BAK26) | 0,96 | 0,1133 | 0,1133 | ||||||

| Citigroup Mortgage Loan Trust 2025-2 6.00 / ABS-MBS (US17292BAK26) | 0,96 | 0,1133 | 0,1133 | ||||||

| US3133BBGS26 / FHLMC 30YR UMBS | 0,96 | -1,64 | 0,1126 | 0,0069 | |||||

| J.P. Morgan Mortgage Trust 2024-10 5.50 / ABS-MBS (US46658LAD38) | 0,95 | -15,12 | 0,1123 | -0,0099 | |||||

| J.P. Morgan Mortgage Trust 2024-10 5.50 / ABS-MBS (US46658LAD38) | 0,95 | -15,12 | 0,1123 | -0,0099 | |||||

| J.P. Morgan Mortgage Trust 2024-10 5.50 / ABS-MBS (US46658LAD38) | 0,95 | -15,12 | 0,1123 | -0,0099 | |||||

| US33938MAA71 / Flexential Issuer 2021-1 | 0,95 | 0,21 | 0,1123 | 0,0088 | |||||

| US91282CBP59 / United States Treasury Note/Bond | 0,93 | 2,52 | 0,1099 | 0,0109 | |||||

| US89117F8Z56 / Toronto-Dominion Bank/The | 0,93 | 0,1098 | 0,1098 | ||||||

| 4020 / Saudi Real Estate Company | 0,93 | 1,98 | 0,1090 | 0,0104 | |||||

| 4020 / Saudi Real Estate Company | 0,93 | 1,98 | 0,1090 | 0,0104 | |||||

| 4020 / Saudi Real Estate Company | 0,93 | 1,98 | 0,1090 | 0,0104 | |||||

| BRAVO Residential Funding Trust 2024 RPL1 3.25 / ABS-MBS (US10568TAA79) | 0,92 | -0,97 | 0,1083 | 0,0072 | |||||

| BRAVO Residential Funding Trust 2024-NQM2 6.29 / ABS-MBS (US10569KAA51) | 0,92 | -8,68 | 0,1077 | -0,0012 | |||||

| BRAVO Residential Funding Trust 2024-NQM2 6.29 / ABS-MBS (US10569KAA51) | 0,92 | -8,68 | 0,1077 | -0,0012 | |||||

| ARM / Arm Holdings plc - Depositary Receipt (Common Stock) | 0,01 | 0,00 | 0,91 | -28,55 | 0,1073 | -0,0313 | |||

| US3132DM5Y73 / FHLMC 30YR UMBS SUPER | 0,91 | -0,77 | 0,1066 | 0,0073 | |||||

| US3140XHCM74 / FNMA 30YR UMBS SUPER | 0,91 | -0,66 | 0,1066 | 0,0075 | |||||

| EFMT 2025-CES2 5.66 / ABS-MBS (US28225GAA22) | 0,91 | 0,1065 | 0,1065 | ||||||

| EFMT 2025-CES2 5.66 / ABS-MBS (US28225GAA22) | 0,91 | 0,1065 | 0,1065 | ||||||

| US81883EAG61 / Shackleton 2017-XI Clo Ltd | 0,90 | -0,11 | 0,1062 | 0,0081 | |||||

| ABNB / Airbnb, Inc. | 0,01 | 0,00 | 0,90 | -7,02 | 0,1059 | 0,0007 | |||

| Sequoia Mortgage Trust 2024-6 6.00 / ABS-MBS (US81743DAL73) | 0,90 | -9,69 | 0,1053 | -0,0024 | |||||

| Sequoia Mortgage Trust 2024-6 6.00 / ABS-MBS (US81743DAL73) | 0,90 | -9,69 | 0,1053 | -0,0024 | |||||

| Sequoia Mortgage Trust 2024-6 6.00 / ABS-MBS (US81743DAL73) | 0,90 | -9,69 | 0,1053 | -0,0024 | |||||

| JP Morgan Mortgage Trust 2024-INV1 6.00 / ABS-MBS (US46658PAD42) | 0,88 | -6,40 | 0,1034 | 0,0014 | |||||

| JP Morgan Mortgage Trust 2024-INV1 6.00 / ABS-MBS (US46658PAD42) | 0,88 | -6,40 | 0,1034 | 0,0014 | |||||

| JP Morgan Mortgage Trust 2024-INV1 6.00 / ABS-MBS (US46658PAD42) | 0,88 | -6,40 | 0,1034 | 0,0014 | |||||

| US92735LAA08 / Vine Energy Holdings, LLC | 0,88 | -4,15 | 0,1032 | 0,0037 | |||||

| US3140QNF319 / FNMA 30YR UMBS | 0,86 | 0,47 | 0,1009 | 0,0083 | |||||

| YETI / YETI Holdings, Inc. | 0,03 | -14,94 | 0,86 | -34,86 | 0,1008 | -0,0420 | |||

| US3133BBGD56 / FHLMC 30YR UMBS | 0,85 | 0,83 | 0,1004 | 0,0084 | |||||

| RCKT Mortgage Trust 2024-CES4 6.15 / ABS-MBS (US74939FAA57) | 0,84 | -5,92 | 0,0991 | 0,0019 | |||||

| RCKT Mortgage Trust 2024-CES4 6.15 / ABS-MBS (US74939FAA57) | 0,84 | -5,92 | 0,0991 | 0,0019 | |||||

| GoldenTree Loan Management US CLO 23 Ltd 6.03 / ABS-CBDO (US38139KAJ88) | 0,83 | -2,58 | 0,0979 | 0,0051 | |||||

| GoldenTree Loan Management US CLO 23 Ltd 6.03 / ABS-CBDO (US38139KAJ88) | 0,83 | -2,58 | 0,0979 | 0,0051 | |||||

| GoldenTree Loan Management US CLO 23 Ltd 6.03 / ABS-CBDO (US38139KAJ88) | 0,83 | -2,58 | 0,0979 | 0,0051 | |||||

| US46647PDX15 / JPMorgan Chase & Co | 0,83 | 1,10 | 0,0976 | 0,0084 | |||||

| Elmwood CLO 37 Ltd 5.99 / ABS-CBDO (US29004UAG31) | 0,83 | -2,47 | 0,0976 | 0,0052 | |||||

| Elmwood CLO 37 Ltd 5.99 / ABS-CBDO (US29004UAG31) | 0,83 | -2,47 | 0,0976 | 0,0052 | |||||

| Madison Park Funding Lxviii Ltd 6.10 / ABS-CBDO (US55822XAG25) | 0,83 | -2,24 | 0,0974 | 0,0053 | |||||

| Madison Park Funding Lxviii Ltd 6.10 / ABS-CBDO (US55822XAG25) | 0,83 | -2,24 | 0,0974 | 0,0053 | |||||

| JP Morgan Mortgage Trust Series 2024-5 6.00 / ABS-MBS (US46658RAF55) | 0,83 | -11,55 | 0,0974 | -0,0043 | |||||

| JP Morgan Mortgage Trust Series 2024-5 6.00 / ABS-MBS (US46658RAF55) | 0,83 | -11,55 | 0,0974 | -0,0043 | |||||

| JP Morgan Mortgage Trust Series 2024-5 6.00 / ABS-MBS (US46658RAF55) | 0,83 | -11,55 | 0,0974 | -0,0043 | |||||

| US61747YFJ91 / Morgan Stanley | 0,83 | 0,85 | 0,0973 | 0,0082 | |||||

| Banque Federative du Credit Mutuel SA 5.54 01/22/2030 / DBT (US06675DCN03) | 0,83 | 2,10 | 0,0973 | 0,0093 | |||||

| US200340AU17 / Comerica Inc | 0,83 | 0,00 | 0,83 | -0,48 | 0,0971 | 0,0070 | |||

| US172967MV07 / Citigroup Inc | 0,84 | 108,13 | 0,82 | 106,78 | 0,0969 | 0,0536 | |||

| Saluda Grade Alternative Mortgage Trust 2024-CES1 6.31 / ABS-MBS (US79581VAA08) | 0,82 | -6,71 | 0,0966 | 0,0010 | |||||

| Saluda Grade Alternative Mortgage Trust 2024-CES1 6.31 / ABS-MBS (US79581VAA08) | 0,82 | -6,71 | 0,0966 | 0,0010 | |||||

| Saluda Grade Alternative Mortgage Trust 2024-CES1 6.31 / ABS-MBS (US79581VAA08) | 0,82 | -6,71 | 0,0966 | 0,0010 | |||||

| US3140N25N79 / FNMA 30YR UMBS | 0,82 | -1,69 | 0,0960 | 0,0058 | |||||

| US3140XDS988 / FN FM9543 | 0,81 | 0,00 | 0,0959 | 0,0074 | |||||

| FWONK / Formula One Group | 0,01 | 0,00 | 0,81 | -7,31 | 0,0956 | 0,0003 | |||

| US55318EAA82 / MIRA Trust 2023-MILE | 0,80 | 0,50 | 0,0942 | 0,0077 | |||||

| US3134A4KX12 / Federal Home Loan Mortgage Corp | 0,80 | 2,45 | 0,0937 | 0,0092 | |||||

| Greensaif Pipelines Bidco Sarl 5.85 02/23/2036 / DBT (US39541EAD58) | 0,79 | 1,15 | 0,0932 | 0,0081 | |||||

| Greensaif Pipelines Bidco Sarl 5.85 02/23/2036 / DBT (US39541EAD58) | 0,79 | 1,15 | 0,0932 | 0,0081 | |||||

| Greensaif Pipelines Bidco Sarl 5.85 02/23/2036 / DBT (US39541EAD58) | 0,79 | 1,15 | 0,0932 | 0,0081 | |||||

| US30334RAA23 / FS 23-4SZN A 144A 7.06626% 11-10-27 | 0,78 | -0,13 | 0,0921 | 0,0070 | |||||

| US3133KNNV19 / Uniform Mortgage-Backed Securities | 0,77 | -0,39 | 0,0910 | 0,0067 | |||||

| US912810TU25 / United States Treasury Note/Bond | 0,77 | 2,12 | 0,0908 | 0,0087 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0,77 | 0,0907 | 0,0907 | ||||||

| US3132DNFZ15 / FHLMC 30YR UMBS SUPER | 0,77 | 0,00 | 0,0905 | 0,0069 | |||||

| Chase Home Lending Mortgage Trust 2024-8 5.50 / ABS-MBS (US16159XAL64) | 0,76 | -15,01 | 0,0894 | -0,0077 | |||||

| Chase Home Lending Mortgage Trust 2024-8 5.50 / ABS-MBS (US16159XAL64) | 0,76 | -15,01 | 0,0894 | -0,0077 | |||||

| Morgan Stanley Residential Mortgage Loan Trust 2025-1 6.00 / ABS-MBS (US617944AE38) | 0,76 | 0,0893 | 0,0893 | ||||||

| Morgan Stanley Residential Mortgage Loan Trust 2025-1 6.00 / ABS-MBS (US617944AE38) | 0,76 | 0,0893 | 0,0893 | ||||||

| Capital Automotive REIT 4.90 / ABS-MBS (US12510HAV24) | 0,75 | 0,00 | 0,0877 | 0,0068 | |||||

| Capital Automotive REIT 4.90 / ABS-MBS (US12510HAV24) | 0,75 | 0,00 | 0,0877 | 0,0068 | |||||

| US36179WG514 / Ginnie Mae II Pool | 0,73 | -1,08 | 0,0863 | 0,0057 | |||||

| RCKT Mortgage Trust 2024-CES8 5.49 / ABS-MBS (US749421AA19) | 0,73 | 0,0860 | 0,0860 | ||||||

| RCKT Mortgage Trust 2024-CES8 5.49 / ABS-MBS (US749421AA19) | 0,73 | 0,0860 | 0,0860 | ||||||

| BANK5 Trust 2024-5YR6 6.23 / ABS-MBS (US066043AB64) | 0,73 | 1,39 | 0,0859 | 0,0076 | |||||

| US665859AS34 / Northern Trust Corp | 0,73 | 0,55 | 0,0859 | 0,0071 | |||||

| J.P. Morgan Mortgage Trust 2024-10 5.50 / ABS-MBS (US46658LAK70) | 0,73 | -19,18 | 0,0854 | -0,0121 | |||||

| J.P. Morgan Mortgage Trust 2024-10 5.50 / ABS-MBS (US46658LAK70) | 0,73 | -19,18 | 0,0854 | -0,0121 | |||||

| J.P. Morgan Mortgage Trust 2024-10 5.50 / ABS-MBS (US46658LAK70) | 0,73 | -19,18 | 0,0854 | -0,0121 | |||||

| US31418DQH88 / FNMA 30YR 2.5% 06/01/2050#MA4055 | 0,72 | 0,42 | 0,0852 | 0,0068 | |||||

| US808513CB92 / Charles Schwab Corp/The | 0,74 | 0,72 | 0,0851 | 0,0851 | |||||

| LPL Holdings Inc 5.15 06/15/2030 / DBT (US50212YAP97) | 0,72 | 0,0850 | 0,0850 | ||||||

| LPL Holdings Inc 5.15 06/15/2030 / DBT (US50212YAP97) | 0,72 | 0,0850 | 0,0850 | ||||||

| LPL Holdings Inc 5.15 06/15/2030 / DBT (US50212YAP97) | 0,72 | 0,0850 | 0,0850 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,72 | -1,10 | 0,0847 | 0,0056 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,72 | -1,10 | 0,0847 | 0,0056 | |||||

| US36186CBY84 / Ally Financial Inc | 0,72 | 0,0842 | 0,0842 | ||||||

| US816851BK46 / Sempra Energy | 0,72 | 0,00 | 0,71 | -0,28 | 0,0838 | 0,0062 | |||

| US912810QE10 / United States Treas Bds Bond | 0,71 | 2,75 | 0,0836 | 0,0084 | |||||

| US505742AP10 / Ladder Capital Finance Holdings LLLP / Ladder Capital Finance Corp | 0,71 | -1,25 | 0,0834 | 0,0053 | |||||

| US3132DWE664 / UMBS | 0,71 | -0,28 | 0,0834 | 0,0062 | |||||

| US67590EAU82 / OCT15 2013-1A BR | 0,70 | -0,14 | 0,0826 | 0,0063 | |||||

| US67590EAU82 / OCT15 2013-1A BR | 0,70 | -0,14 | 0,0826 | 0,0063 | |||||

| US67590EAU82 / OCT15 2013-1A BR | 0,70 | -0,14 | 0,0826 | 0,0063 | |||||

| US808513BK01 / Charles Schwab Corp/The | 0,72 | 0,00 | 0,70 | -0,71 | 0,0821 | 0,0057 | |||

| CyrusOne Data Centers Issuer I LLC 0.00 / ABS-MBS (US23284BAG95) | 0,68 | 1,04 | 0,0798 | 0,0069 | |||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0,67 | 0,0794 | 0,0794 | ||||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0,67 | 0,0794 | 0,0794 | ||||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0,67 | 0,0794 | 0,0794 | ||||||

| US83370RAB42 / Societe Generale SA | 0,69 | 0,67 | 0,0787 | 0,0787 | |||||

| US38141GA468 / Goldman Sachs Group Inc/The | 0,67 | 1,06 | 0,0787 | 0,0068 | |||||

| US3133AUTC27 / Federal Home Loan Mortgage Corporation | 0,67 | -0,89 | 0,0786 | 0,0054 | |||||

| Leland Stanford Junior University/The 4.68 03/01/2035 / DBT (US85440KAE47) | 0,66 | 0,0782 | 0,0782 | ||||||

| Leland Stanford Junior University/The 4.68 03/01/2035 / DBT (US85440KAE47) | 0,66 | 0,0782 | 0,0782 | ||||||

| Antares Holdings LP 6.35 10/23/2029 / DBT (US03666HAH49) | 0,66 | 0,30 | 0,0780 | 0,0061 | |||||

| MFA 2024-NQM1 Trust 6.58 / ABS-MBS (US55286VAA89) | 0,66 | -8,62 | 0,0773 | -0,0008 | |||||

| MFA 2024-NQM1 Trust 6.58 / ABS-MBS (US55286VAA89) | 0,66 | -8,62 | 0,0773 | -0,0008 | |||||

| US10112RBE36 / Boston Properties LP | 0,65 | 17,75 | 0,0765 | 0,0165 | |||||

| RCKT Mortgage Trust 2024-CES1 6.03 / ABS-MBS (US749424AA57) | 0,65 | -8,50 | 0,0760 | -0,0007 | |||||

| RCKT Mortgage Trust 2024-CES1 6.03 / ABS-MBS (US749424AA57) | 0,65 | -8,50 | 0,0760 | -0,0007 | |||||

| 556079AB / Macquarie Bank Ltd/London | 0,65 | 0,00 | 0,64 | -1,23 | 0,0758 | 0,0049 | |||

| JP Morgan Mortgage Trust 2024-11 6.00 / ABS-MBS (US46659AAJ34) | 0,64 | -7,01 | 0,0750 | 0,0005 | |||||

| JP Morgan Mortgage Trust 2024-11 6.00 / ABS-MBS (US46659AAJ34) | 0,64 | -7,01 | 0,0750 | 0,0005 | |||||

| JP Morgan Mortgage Trust 2024-11 6.00 / ABS-MBS (US46659AAJ34) | 0,64 | -7,01 | 0,0750 | 0,0005 | |||||

| US29273VAU44 / Energy Transfer LP | 0,63 | -0,78 | 0,0745 | 0,0051 | |||||

| Towd Point Mortgage Trust 2024-CES3 6.29 / ABS-MBS (US89183EAA91) | 0,63 | -6,65 | 0,0745 | 0,0008 | |||||

| Towd Point Mortgage Trust 2024-CES3 6.29 / ABS-MBS (US89183EAA91) | 0,63 | -6,65 | 0,0745 | 0,0008 | |||||

| Towd Point Mortgage Trust 2024-CES3 6.29 / ABS-MBS (US89183EAA91) | 0,63 | -6,65 | 0,0745 | 0,0008 | |||||

| US912810QS06 / United States Treas Bds Bond | 0,63 | 2,27 | 0,0744 | 0,0072 | |||||

| US3140N24W87 / FNMA 30YR UMBS | 0,63 | -1,72 | 0,0741 | 0,0044 | |||||

| GCAT 2024-INV3 Trust 5.50 / ABS-MBS (US36830FAF36) | 0,63 | -5,56 | 0,0741 | 0,0016 | |||||

| GCAT 2024-INV3 Trust 5.50 / ABS-MBS (US36830FAF36) | 0,63 | -5,56 | 0,0741 | 0,0016 | |||||

| GCAT 2024-INV3 Trust 5.50 / ABS-MBS (US36830FAF36) | 0,63 | -5,56 | 0,0741 | 0,0016 | |||||

| Foundry JV Holdco LLC 5.50 01/25/2031 / DBT (US350930AF07) | 0,63 | 0,0736 | 0,0736 | ||||||

| Chase Home Lending Mortgage Trust Series 2024-6 6.00 / ABS-MBS (US161931AD25) | 0,62 | -11,76 | 0,0733 | -0,0035 | |||||

| Chase Home Lending Mortgage Trust Series 2024-6 6.00 / ABS-MBS (US161931AD25) | 0,62 | -11,76 | 0,0733 | -0,0035 | |||||

| MU / Micron Technology, Inc. - Depositary Receipt (Common Stock) | 0,62 | 0,0733 | 0,0733 | ||||||

| MU / Micron Technology, Inc. - Depositary Receipt (Common Stock) | 0,62 | 0,0733 | 0,0733 | ||||||

| MU / Micron Technology, Inc. - Depositary Receipt (Common Stock) | 0,62 | 0,0733 | 0,0733 | ||||||

| US36167AAA88 / GCAT_21-CM2 | 0,62 | -10,37 | 0,0733 | -0,0021 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 0,62 | 19,54 | 0,0727 | 0,0165 | |||||

| US01627AAB44 / Aligned Data Centers Issuer LLC | 0,61 | 0,00 | 0,0720 | 0,0055 | |||||

| PK Alift Loan Funding 3 LP 5.84 / ABS-MBS (US69291VAB09) | 0,61 | -2,24 | 0,0718 | 0,0040 | |||||

| PK Alift Loan Funding 3 LP 5.84 / ABS-MBS (US69291VAB09) | 0,61 | -2,24 | 0,0718 | 0,0040 | |||||

| PK Alift Loan Funding 3 LP 5.84 / ABS-MBS (US69291VAB09) | 0,61 | -2,24 | 0,0718 | 0,0040 | |||||

| Hotwire Funding LLC 5.89 / ABS-MBS (US44148JAH23) | 0,61 | 0,00 | 0,0716 | 0,0055 | |||||

| Hotwire Funding LLC 5.89 / ABS-MBS (US44148JAH23) | 0,61 | 0,00 | 0,0716 | 0,0055 | |||||

| Hotwire Funding LLC 5.89 / ABS-MBS (US44148JAH23) | 0,61 | 0,00 | 0,0716 | 0,0055 | |||||

| Glencore Funding LLC 5.19 04/01/2030 / DBT (US378272BZ09) | 0,61 | 0,0715 | 0,0715 | ||||||

| Glencore Funding LLC 5.19 04/01/2030 / DBT (US378272BZ09) | 0,61 | 0,0715 | 0,0715 | ||||||

| Glencore Funding LLC 5.19 04/01/2030 / DBT (US378272BZ09) | 0,61 | 0,0715 | 0,0715 | ||||||

| US05565AB286 / BNP Paribas SA | 0,64 | 0,60 | 0,0708 | 0,0708 | |||||

| Rate Mortgage Trust 2024-J1 6.00 / ABS-MBS (US75410PAG54) | 0,60 | -9,08 | 0,0707 | -0,0012 | |||||

| Rate Mortgage Trust 2024-J1 6.00 / ABS-MBS (US75410PAG54) | 0,60 | -9,08 | 0,0707 | -0,0012 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0,60 | -1,16 | 0,0704 | 0,0046 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0,60 | -1,16 | 0,0704 | 0,0046 | |||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 0,60 | -1,16 | 0,0704 | 0,0046 | |||||

| US3140XGST70 / Fannie Mae Pool | 0,60 | 0,00 | 0,0704 | 0,0053 | |||||

| AMT / American Tower Corporation | 0,60 | 33,04 | 0,0702 | 0,0214 | |||||

| US3140XAUZ33 / FNMA 15YR UMBS SUPER | 0,60 | -1,33 | 0,0701 | 0,0046 | |||||

| WBCPM / Westpac Banking Corporation - Preferred Stock | 0,60 | 0,85 | 0,0700 | 0,0059 | |||||

| US912810QD37 / United States Treas Bds Bond | 0,59 | 2,77 | 0,0698 | 0,0070 | |||||

| CAH / Cardinal Health, Inc. - Depositary Receipt (Common Stock) | 0,59 | -3,45 | 0,0691 | 0,0030 | |||||

| CAH / Cardinal Health, Inc. - Depositary Receipt (Common Stock) | 0,59 | -3,45 | 0,0691 | 0,0030 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,58 | 61,73 | 0,0682 | 0,0293 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,58 | 61,73 | 0,0682 | 0,0293 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 0,58 | 61,73 | 0,0682 | 0,0293 | |||||

| US3133KMEZ41 / Freddie Mac Pool | 0,58 | 0,35 | 0,0681 | 0,0054 | |||||

| US05971KAH23 / Banco Santander SA | 0,60 | 0,57 | 0,0668 | 0,0668 | |||||

| Sequoia Mortgage Trust 2024-10 5.50 / ABS-MBS (US81749QAE89) | 0,57 | -10,58 | 0,0667 | -0,0021 | |||||

| Sequoia Mortgage Trust 2024-10 5.50 / ABS-MBS (US81749QAE89) | 0,57 | -10,58 | 0,0667 | -0,0021 | |||||

| Sequoia Mortgage Trust 2024-10 5.50 / ABS-MBS (US81749QAE89) | 0,57 | -10,58 | 0,0667 | -0,0021 | |||||

| US09229CAA71 / Blackbird Capital Aircraft | 0,57 | -1,22 | 0,0665 | 0,0043 | |||||

| US38122NB504 / GOLDEN ST TOBACCO SECURITIZATION CORP CA TOBACCO SETTLEMENT | 0,56 | 1,08 | 0,0664 | 0,0058 | |||||

| DBSG 2024-ALTA A 6.14 / ABS-MBS (US239918AA37) | 0,56 | -0,35 | 0,0663 | 0,0049 | |||||

| DBSG 2024-ALTA A 6.14 / ABS-MBS (US239918AA37) | 0,56 | -0,35 | 0,0663 | 0,0049 | |||||

| US698299BW36 / Republic of Panama | 0,56 | 0,0661 | 0,0661 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,56 | 0,0658 | 0,0658 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,56 | 0,0658 | 0,0658 | ||||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,56 | 0,0658 | 0,0658 | ||||||

| US143658BQ44 / Carnival Corp | 0,56 | 0,00 | 0,0657 | 0,0050 | |||||

| US46115HAU14 / Intesa Sanpaolo SpA | 0,56 | 0,00 | 0,56 | 0,54 | 0,0657 | 0,0053 | |||

| US064159VJ25 / Bank of Nova Scotia/The | 0,56 | 0,00 | 0,55 | 0,00 | 0,0652 | 0,0049 | |||

| Enterprise Fleet Financing 2024-1 LLC 5.23 / ABS-MBS (US29375PAB67) | 0,55 | -11,38 | 0,0651 | -0,0027 | |||||

| Enterprise Fleet Financing 2024-1 LLC 5.23 / ABS-MBS (US29375PAB67) | 0,55 | -11,38 | 0,0651 | -0,0027 | |||||

| US458140BR09 / Intel Corp | 0,55 | 1,48 | 0,0646 | 0,0058 | |||||

| US3132DNXS79 / FHLMC 30YR UMBS SUPER | 0,54 | -0,73 | 0,0640 | 0,0044 | |||||

| Bank of America Corp 5.47 01/23/2035 / DBT (US06051GMA49) | 0,54 | -25,34 | 0,0639 | -0,0151 | |||||

| US316773DB33 / Fifth Third Bancorp | 0,55 | 0,00 | 0,54 | 0,00 | 0,0634 | 0,0049 | |||

| US69120VAU52 / BLUE OWL CREDIT 7.75 1/29 | 0,54 | -0,92 | 0,0631 | 0,0042 | |||||

| Mars Inc 5.20 03/01/2035 / DBT (US571676BA26) | 0,53 | 0,0624 | 0,0624 | ||||||

| Mars Inc 5.20 03/01/2035 / DBT (US571676BA26) | 0,53 | 0,0624 | 0,0624 | ||||||

| US68389XBW48 / ORACLE CORP SR UNSECURED 04/40 3.6 | 0,53 | 0,00 | 0,0621 | 0,0047 | |||||

| US29250NAN57 / Enbridge Inc. Bond | 0,53 | -1,32 | 0,0618 | 0,0040 | |||||

| Switch ABS Issuer LLC 5.44 / ABS-MBS (US871044AE30) | 0,52 | 0,39 | 0,0614 | 0,0049 | |||||

| Switch ABS Issuer LLC 5.44 / ABS-MBS (US871044AE30) | 0,52 | 0,39 | 0,0614 | 0,0049 | |||||

| Switch ABS Issuer LLC 5.44 / ABS-MBS (US871044AE30) | 0,52 | 0,39 | 0,0614 | 0,0049 | |||||

| ARZ Trust 2024-BILT 5.77 / ABS-MBS (US00218TAA25) | 0,52 | 0,78 | 0,0610 | 0,0051 | |||||

| US341081FF99 / Florida Power & Light 4.125% 02/01/42 | 0,52 | -4,95 | 0,0610 | 0,0017 | |||||

| US26884UAE91 / EPR Properties | 0,51 | -1,72 | 0,0605 | 0,0036 | |||||

| SBAC / SBA Communications Corporation | 0,00 | -78,54 | 0,51 | -79,98 | 0,0604 | -0,2381 | |||

| GS Mortgage-Backed Securities Trust 2023-PJ6 6.00 / ABS-MBS (US36268FAZ09) | 0,51 | 0,0603 | 0,0603 | ||||||

| GS Mortgage-Backed Securities Trust 2023-PJ6 6.00 / ABS-MBS (US36268FAZ09) | 0,51 | 0,0603 | 0,0603 | ||||||

| GS Mortgage-Backed Securities Trust 2023-PJ6 6.00 / ABS-MBS (US36268FAZ09) | 0,51 | 0,0603 | 0,0603 | ||||||

| US50155QAL41 / Kyndryl Holdings, Inc. | 0,51 | -5,91 | 0,0599 | 0,0011 | |||||

| AMAT / Applied Materials, Inc. | 0,00 | -65,45 | 0,51 | -71,15 | 0,0598 | -0,1316 | |||

| US0641598N91 / Bank of Nova Scotia/The | 0,51 | -5,93 | 0,0598 | 0,0011 | |||||

| SRLN / SSGA Active Trust - SPDR Blackstone Senior Loan ETF | 0,01 | -71,77 | 0,51 | -72,59 | 0,0597 | -0,1413 | |||

| GCAT 2024-INV2 Trust 6.00 / ABS-MBS (US36170KAF03) | 0,51 | -7,65 | 0,0597 | -0,0000 | |||||

| US3140MKAG72 / FNMA 30YR UMBS | 0,51 | 0,40 | 0,0595 | 0,0048 | |||||

| BRAVO Residential Funding Trust 2024-CES1 6.38 / ABS-MBS (US10570NAA63) | 0,51 | -7,34 | 0,0594 | 0,0002 | |||||

| BRAVO Residential Funding Trust 2024-CES1 6.38 / ABS-MBS (US10570NAA63) | 0,51 | -7,34 | 0,0594 | 0,0002 | |||||

| Palmer Square Loan Funding 2025-1 Ltd 5.52 / ABS-CBDO (US69704CAC10) | 0,50 | 0,0590 | 0,0590 | ||||||

| Palmer Square Loan Funding 2025-1 Ltd 5.52 / ABS-CBDO (US69704CAC10) | 0,50 | 0,0590 | 0,0590 | ||||||

| Palmer Square Loan Funding 2025-1 Ltd 5.52 / ABS-CBDO (US69704CAC10) | 0,50 | 0,0590 | 0,0590 | ||||||

| US911684AD06 / Us Cellular 6.7% Senior Notes 12/15/33 | 0,50 | -1,96 | 0,0588 | 0,0034 | |||||

| US91282CEU18 / United States Treasury Note/Bond | 0,50 | 0,40 | 0,0587 | 0,0047 | |||||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 0,50 | 0,00 | 0,0584 | 0,0044 | |||||

| FR00140066D6 / ENGIE - Loyalty Line 2024 | 0,50 | -1,00 | 0,0584 | 0,0039 | |||||

| FR00140066D6 / ENGIE - Loyalty Line 2024 | 0,50 | -1,00 | 0,0584 | 0,0039 | |||||

| Z1IO34 / Zions Bancorporation, National Association - Depositary Receipt (Common Stock) | 0,49 | -4,08 | 0,0582 | 0,0022 | |||||

| NDSN / Nordson Corporation | 0,49 | 1,87 | 0,0578 | 0,0053 | |||||

| NDSN / Nordson Corporation | 0,49 | 1,87 | 0,0578 | 0,0053 | |||||

| US12433UAA34 / BX TRUST 2018-GW SER 2018-GW CL A V/R REGD 144A P/P 2.56538000 | 0,49 | -0,20 | 0,0577 | 0,0043 | |||||

| Sequoia Mortgage Trust 2024-8 5.50 / ABS-MBS (US81749NAE58) | 0,49 | -7,91 | 0,0576 | -0,0000 | |||||

| Sequoia Mortgage Trust 2024-8 5.50 / ABS-MBS (US81749NAE58) | 0,49 | -7,91 | 0,0576 | -0,0000 | |||||

| Sequoia Mortgage Trust 2024-8 5.50 / ABS-MBS (US81749NAE58) | 0,49 | -7,91 | 0,0576 | -0,0000 | |||||

| US36270XAZ78 / GS Mortgage-Backed Securities Trust 2023-PJ4 | 0,49 | 0,0575 | 0,0575 | ||||||

| US552732AC35 / MFRA_21-INV2 | 0,49 | 0,21 | 0,0575 | 0,0045 | |||||

| CMCS34 / Comcast Corporation - Depositary Receipt (Common Stock) | 0,49 | 0,0574 | 0,0574 | ||||||

| CMCS34 / Comcast Corporation - Depositary Receipt (Common Stock) | 0,49 | 0,0574 | 0,0574 | ||||||

| Chase Home Lending Mortgage Trust 2024-9 5.50 / ABS-MBS (US16160QAK04) | 0,49 | -16,18 | 0,0574 | -0,0058 | |||||

| Chase Home Lending Mortgage Trust 2024-9 5.50 / ABS-MBS (US16160QAK04) | 0,49 | -16,18 | 0,0574 | -0,0058 | |||||

| US3138LSL659 / FNMA 30YR | 0,48 | 1,05 | 0,0565 | 0,0049 | |||||

| Bank of America Corp 5.51 01/24/2036 / DBT (US06051GMM86) | 0,47 | 0,86 | 0,0555 | 0,0047 | |||||

| US720198AG56 / Piedmont Operating Partnership LP | 0,47 | 0,0555 | 0,0555 | ||||||

| PYPL / PayPal Holdings, Inc. - Depositary Receipt (Common Stock) | 0,46 | 0,0545 | 0,0545 | ||||||

| PYPL / PayPal Holdings, Inc. - Depositary Receipt (Common Stock) | 0,46 | 0,0545 | 0,0545 | ||||||

| PYPL / PayPal Holdings, Inc. - Depositary Receipt (Common Stock) | 0,46 | 0,0545 | 0,0545 | ||||||

| US95000U3D31 / Wells Fargo & Co | 0,46 | 1,31 | 0,0545 | 0,0048 | |||||

| US912810TM09 / United States Treasury Note/Bond | 0,46 | 2,22 | 0,0543 | 0,0052 | |||||

| US91324PEW86 / UnitedHealth Group Inc | 0,46 | -3,97 | 0,0541 | 0,0020 | |||||

| IQVIA Inc 6.25 02/01/2029 / DBT (US46266TAF57) | 0,46 | 0,44 | 0,0541 | 0,0043 | |||||

| IQVIA Inc 6.25 02/01/2029 / DBT (US46266TAF57) | 0,46 | 0,44 | 0,0541 | 0,0043 | |||||

| IQVIA Inc 6.25 02/01/2029 / DBT (US46266TAF57) | 0,46 | 0,44 | 0,0541 | 0,0043 | |||||

| US00501BAA70 / ACREC LLC, Series 2023-FL2, Class A | 0,46 | -3,58 | 0,0539 | 0,0022 | |||||

| GXO / GXO Logistics, Inc. | 0,46 | -1,08 | 0,0539 | 0,0036 | |||||

| GXO / GXO Logistics, Inc. | 0,46 | -1,08 | 0,0539 | 0,0036 | |||||

| GXO / GXO Logistics, Inc. | 0,46 | -1,08 | 0,0539 | 0,0036 | |||||

| US31359MGK36 / Federal Ntnl Mo 6.62530 Due 11/15/30 Bond | 0,45 | 2,25 | 0,0535 | 0,0051 | |||||

| Carlyle Global Market Strategies CLO 2013-1 Ltd 6.78 / ABS-CBDO (US14310BAW19) | 0,45 | -0,22 | 0,0530 | 0,0039 | |||||

| Carlyle Global Market Strategies CLO 2013-1 Ltd 6.78 / ABS-CBDO (US14310BAW19) | 0,45 | -0,22 | 0,0530 | 0,0039 | |||||

| TPRY34 / Tapestry, Inc. - Depositary Receipt (Common Stock) | 0,45 | -1,10 | 0,0528 | 0,0035 | |||||

| TPRY34 / Tapestry, Inc. - Depositary Receipt (Common Stock) | 0,45 | -1,10 | 0,0528 | 0,0035 | |||||

| TPRY34 / Tapestry, Inc. - Depositary Receipt (Common Stock) | 0,45 | -1,10 | 0,0528 | 0,0035 | |||||

| US031162DT45 / Amgen Inc | 0,45 | -0,67 | 0,0525 | 0,0037 | |||||

| US025816CH00 / American Express Co | 0,47 | 0,00 | 0,45 | -0,67 | 0,0525 | 0,0037 | |||

| Cousins Properties LP 5.38 02/15/2032 / DBT (US222793AB73) | 0,44 | 0,68 | 0,0523 | 0,0043 | |||||

| US3140XKAQ36 / FNMA 30YR UMBS SUPER | 0,44 | -0,23 | 0,0522 | 0,0039 | |||||

| Sequoia Mortgage Trust 2024-10 5.50 / ABS-MBS (US81749QAL23) | 0,44 | -13,47 | 0,0515 | -0,0034 | |||||

| Sequoia Mortgage Trust 2024-10 5.50 / ABS-MBS (US81749QAL23) | 0,44 | -13,47 | 0,0515 | -0,0034 | |||||

| Sequoia Mortgage Trust 2024-10 5.50 / ABS-MBS (US81749QAL23) | 0,44 | -13,47 | 0,0515 | -0,0034 | |||||

| U1HS34 / Universal Health Services, Inc. - Depositary Receipt (Common Stock) | 0,43 | 0,23 | 0,0511 | 0,0040 | |||||

| Medline Borrower LP/Medline Co-Issuer Inc 6.25 04/01/2029 / DBT (US58506DAA63) | 0,43 | -0,92 | 0,0508 | 0,0035 | |||||

| Medline Borrower LP/Medline Co-Issuer Inc 6.25 04/01/2029 / DBT (US58506DAA63) | 0,43 | -0,92 | 0,0508 | 0,0035 | |||||

| Medline Borrower LP/Medline Co-Issuer Inc 6.25 04/01/2029 / DBT (US58506DAA63) | 0,43 | -0,92 | 0,0508 | 0,0035 | |||||

| US49427RAR30 / KILROY REALTY 2.65 11/33 | 0,43 | -0,92 | 0,0505 | 0,0034 | |||||

| US172967MU24 / CITIGROUP INC JR SUBORDINA 12/99 VAR | 0,44 | 0,00 | 0,43 | -0,70 | 0,0504 | 0,0035 | |||

| US594698SJ24 / MICHIGAN ST STRATEGIC FUND LTD OBLG REVENUE | 0,43 | 0,00 | 0,0501 | 0,0038 | |||||

| US404280BT50 / HSBC Holdings PLC | 0,42 | 0,0499 | 0,0499 | ||||||

| UNH / UnitedHealth Group Incorporated - Depositary Receipt (Common Stock) | 0,42 | 0,00 | 0,0498 | 0,0038 | |||||

| US3133KQE289 / FR RA8253 | 0,42 | -1,64 | 0,0496 | 0,0031 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,42 | -0,71 | 0,0491 | 0,0035 | |||||

| Rate Mortgage Trust 205-J1 5.50 / ABS-MBS (US75410CAE93) | 0,42 | 0,0491 | 0,0491 | ||||||

| Rate Mortgage Trust 205-J1 5.50 / ABS-MBS (US75410CAE93) | 0,42 | 0,0491 | 0,0491 | ||||||

| US36179VMD90 / GNII II 3% 05/20/2050#MA6656 | 0,41 | -0,48 | 0,0485 | 0,0034 | |||||

| US38217TAA34 / Goodgreen 2020-1 Trust | 0,41 | 1,23 | 0,0483 | 0,0042 | |||||

| CH0558521263 / UBS Group AG | 0,42 | 0,41 | 0,0483 | 0,0483 | |||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0,41 | 0,0479 | 0,0479 | ||||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0,41 | 0,0479 | 0,0479 | ||||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0,41 | 0,0479 | 0,0479 | ||||||

| CRH America Finance Inc 5.50 01/09/2035 / DBT (US12636YAF97) | 0,41 | 1,00 | 0,0478 | 0,0041 | |||||

| CRH America Finance Inc 5.50 01/09/2035 / DBT (US12636YAF97) | 0,41 | 1,00 | 0,0478 | 0,0041 | |||||

| XS2479344561 / Skandinaviska Enskilda Banken AB | 0,40 | 100,00 | 0,41 | 99,51 | 0,0477 | 0,0256 | |||

| US045054AR41 / Ashtead Capital, Inc. | 0,40 | 0,00 | 0,0476 | 0,0036 | |||||

| Cisco Systems Inc 4.75 02/24/2030 / DBT (US17275RBX98) | 0,40 | 0,0472 | 0,0472 | ||||||

| Cisco Systems Inc 4.75 02/24/2030 / DBT (US17275RBX98) | 0,40 | 0,0472 | 0,0472 | ||||||

| RCKT Mortgage Trust 2024-CES2 6.14 / ABS-MBS (US74938PAA49) | 0,40 | -7,60 | 0,0472 | -0,0000 | |||||

| RCKT Mortgage Trust 2024-CES2 6.14 / ABS-MBS (US74938PAA49) | 0,40 | -7,60 | 0,0472 | -0,0000 | |||||

| US25746UBM09 / Dominioin Resources Inc. 4.9% Senior Notes 08/01/41 | 0,40 | 66,67 | 0,0471 | 0,0209 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,40 | -1,72 | 0,0471 | 0,0029 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 0,40 | -1,72 | 0,0471 | 0,0029 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0,40 | 1,02 | 0,0468 | 0,0040 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0,40 | 1,02 | 0,0468 | 0,0040 | |||||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 0,40 | -0,75 | 0,0465 | 0,0032 | |||||

| BMY / Bristol-Myers Squibb Company - Depositary Receipt (Common Stock) | 0,40 | -0,75 | 0,0465 | 0,0032 | |||||

| US3140XHR338 / FNMA 30YR UMBS SUPER | 0,39 | -1,50 | 0,0464 | 0,0029 | |||||

| US46115HBB24 / Intesa Sanpaolo SpA | 0,39 | 1,29 | 0,0463 | 0,0042 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0,39 | 103,63 | 0,0463 | 0,0253 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0,39 | 103,63 | 0,0463 | 0,0253 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0,39 | 103,63 | 0,0463 | 0,0253 | |||||

| US251525AX97 / Deutsche Bank AG | 0,40 | 0,00 | 0,39 | -1,51 | 0,0462 | 0,0029 | |||

| Magnetite Xli Ltd 6.09 / ABS-CBDO (US55956AAC99) | 0,39 | -2,73 | 0,0462 | 0,0023 | |||||

| Magnetite Xli Ltd 6.09 / ABS-CBDO (US55956AAC99) | 0,39 | -2,73 | 0,0462 | 0,0023 | |||||

| Chase Home Lending Mortgage Trust Series 2024-2 6.00 / ABS-MBS (US161929BH65) | 0,39 | -6,71 | 0,0458 | 0,0005 | |||||

| Chase Home Lending Mortgage Trust Series 2024-2 6.00 / ABS-MBS (US161929BH65) | 0,39 | -6,71 | 0,0458 | 0,0005 | |||||

| USB / U.S. Bancorp - Depositary Receipt (Common Stock) | 0,39 | 0,0458 | 0,0458 | ||||||

| DUKB34 / Duke Energy Corporation - Depositary Receipt (Common Stock) | 0,39 | -1,02 | 0,0457 | 0,0031 | |||||

| DUKB34 / Duke Energy Corporation - Depositary Receipt (Common Stock) | 0,39 | -1,02 | 0,0457 | 0,0031 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,39 | -1,52 | 0,0457 | 0,0028 | |||||

| Newmont Corp / Newcrest Finance Pty Ltd 5.35 03/15/2034 / DBT (US65163LAR06) | 0,39 | -2,28 | 0,0455 | 0,0025 | |||||

| Newmont Corp / Newcrest Finance Pty Ltd 5.35 03/15/2034 / DBT (US65163LAR06) | 0,39 | -2,28 | 0,0455 | 0,0025 | |||||

| US19828TAB26 / Columbia Pipelines Operating Co LLC | 0,38 | 0,79 | 0,0450 | 0,0037 | |||||

| US16411RAK59 / Cheniere Energy Inc | 0,38 | -7,30 | 0,0449 | 0,0001 | |||||

| Expedia Group Inc 5.40 02/15/2035 / DBT (US30212PBL85) | 0,38 | 0,0446 | 0,0446 | ||||||

| Expedia Group Inc 5.40 02/15/2035 / DBT (US30212PBL85) | 0,38 | 0,0446 | 0,0446 | ||||||

| US62432LAC54 / MVEW_17-2 | 0,38 | -0,27 | 0,0442 | 0,0034 | |||||

| FLO / Flowers Foods, Inc. | 0,37 | 0,0439 | 0,0439 | ||||||

| US174610AU90 / Citizens Financial Group Inc | 0,38 | 55,60 | 0,37 | 55,42 | 0,0439 | 0,0178 | |||

| CARLYLE US CLO 2021-2 LTD 5.87 / ABS-CBDO (US14316KAY10) | 0,37 | 0,0438 | 0,0438 | ||||||

| CARLYLE US CLO 2021-2 LTD 5.87 / ABS-CBDO (US14316KAY10) | 0,37 | 0,0438 | 0,0438 | ||||||

| RATE Mortgage Trust 2024-J3 5.50 / ABS-MBS (US75409UAH59) | 0,37 | -7,75 | 0,0435 | 0,0000 | |||||

| RATE Mortgage Trust 2024-J3 5.50 / ABS-MBS (US75409UAH59) | 0,37 | -7,75 | 0,0435 | 0,0000 | |||||

| Public Service Electric and Gas Co 5.50 03/01/2055 / DBT (US74456QCV68) | 0,37 | 0,0435 | 0,0435 | ||||||

| Public Service Electric and Gas Co 5.50 03/01/2055 / DBT (US74456QCV68) | 0,37 | 0,0435 | 0,0435 | ||||||

| US71654QDB59 / Petroleos Mexicanos | 0,37 | 125,31 | 0,0430 | 0,0254 | |||||

| M1LM34 / Martin Marietta Materials, Inc. - Depositary Receipt (Common Stock) | 0,37 | -40,16 | 0,0430 | -0,0233 | |||||

| M1LM34 / Martin Marietta Materials, Inc. - Depositary Receipt (Common Stock) | 0,37 | -40,16 | 0,0430 | -0,0233 | |||||

| M1LM34 / Martin Marietta Materials, Inc. - Depositary Receipt (Common Stock) | 0,37 | -40,16 | 0,0430 | -0,0233 | |||||

| US534187BA67 / Lincoln National Corp 7.0% Senior Notes 06/15/40 | 0,37 | 0,0429 | 0,0429 | ||||||

| OBX 2024-HYB2 Trust 3.68 / ABS-MBS (US67118RAA68) | 0,36 | -1,90 | 0,0427 | 0,0026 | |||||

| OBX 2024-HYB2 Trust 3.68 / ABS-MBS (US67118RAA68) | 0,36 | -1,90 | 0,0427 | 0,0026 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,36 | -3,49 | 0,0423 | 0,0019 | |||||

| US3140XJQY23 / FNMA 30YR UMBS SUPER | 0,36 | 0,84 | 0,0423 | 0,0035 | |||||

| THL Credit Wind River 2013-2 CLO Ltd 6.10 / ABS-CBDO (US97314CAC47) | 0,36 | -31,62 | 0,0423 | -0,0148 | |||||

| BBCMS Mortgage Trust 2024-5C27 6.01 / ABS-MBS (US05555FAC86) | 0,36 | 1,43 | 0,0418 | 0,0037 | |||||

| US13876GAL23 / CANYON CAPITAL CLO LTD CANYC 2017 1A BR 144A | 0,35 | 0,00 | 0,0413 | 0,0032 | |||||

| US26442RAD35 / Duke Energy Progress LLC | 0,35 | 0,58 | 0,0408 | 0,0033 | |||||

| FR00140063V5 / ELECTRICITE DE FRANCE RT SCRIP 12/31/49 | 0,35 | -0,57 | 0,0408 | 0,0029 | |||||

| FR00140063V5 / ELECTRICITE DE FRANCE RT SCRIP 12/31/49 | 0,35 | -0,57 | 0,0408 | 0,0029 | |||||

| US3140XHN949 / FNMA 30YR UMBS SUPER | 0,34 | -3,91 | 0,0405 | 0,0016 | |||||

| US691205AG35 / Owl Rock Technology Finance Corp | 0,34 | -1,15 | 0,0404 | 0,0027 | |||||

| A1PP34 / AppLovin Corporation - Depositary Receipt (Common Stock) | 0,34 | 0,59 | 0,0404 | 0,0033 | |||||

| US82620KAZ66 / Siemens Financieringsmaatschappij NV | 0,34 | 0,89 | 0,0401 | 0,0034 | |||||

| US25278XAV10 / Diamondback Energy Inc | 0,33 | 0,30 | 0,0393 | 0,0031 | |||||

| OBX 2024-NQM7 Trust 6.24 / ABS-MBS (US67119FAA12) | 0,33 | -8,89 | 0,0386 | -0,0006 | |||||

| OBX 2024-NQM7 Trust 6.24 / ABS-MBS (US67119FAA12) | 0,33 | -8,89 | 0,0386 | -0,0006 | |||||

| OBX 2024-NQM7 Trust 6.24 / ABS-MBS (US67119FAA12) | 0,33 | -8,89 | 0,0386 | -0,0006 | |||||

| Duke Energy Progress LLC 4.35 03/06/2027 / DBT (US26442UAT16) | 0,33 | 0,0384 | 0,0384 | ||||||

| Duke Energy Progress LLC 4.35 03/06/2027 / DBT (US26442UAT16) | 0,33 | 0,0384 | 0,0384 | ||||||

| US13077DKU53 / California State University | 0,33 | -3,27 | 0,0383 | 0,0018 | |||||

| US88033GDS66 / TENET HEALTHCARE CORP | 0,33 | 0,00 | 0,0382 | 0,0028 | |||||

| H / Hyatt Hotels Corporation | 0,32 | 0,0380 | 0,0380 | ||||||

| H / Hyatt Hotels Corporation | 0,32 | 0,0380 | 0,0380 | ||||||

| H / Hyatt Hotels Corporation | 0,32 | 0,0380 | 0,0380 | ||||||

| US29273RBJ77 / Energy Transfer Partners LP | 0,32 | -4,18 | 0,0379 | 0,0015 | |||||

| JBS USA LUX Sarl / JBS USA Food Co / JBS USA Foods Group 5.95 04/20/2035 / DBT (US472140AA00) | 0,31 | -46,14 | 0,0370 | -0,0264 | |||||

| JBS USA LUX Sarl / JBS USA Food Co / JBS USA Foods Group 5.95 04/20/2035 / DBT (US472140AA00) | 0,31 | -46,14 | 0,0370 | -0,0264 | |||||

| JBS USA LUX Sarl / JBS USA Food Co / JBS USA Foods Group 5.95 04/20/2035 / DBT (US472140AA00) | 0,31 | -46,14 | 0,0370 | -0,0264 | |||||

| Mars Inc 5.65 05/01/2045 / DBT (US571676BB09) | 0,31 | 0,0368 | 0,0368 | ||||||

| Mars Inc 5.65 05/01/2045 / DBT (US571676BB09) | 0,31 | 0,0368 | 0,0368 | ||||||

| Rio Tinto Finance USA PLC 5.75 03/14/2055 / DBT (US76720AAV89) | 0,31 | 0,0367 | 0,0367 | ||||||

| Rio Tinto Finance USA PLC 5.75 03/14/2055 / DBT (US76720AAV89) | 0,31 | 0,0367 | 0,0367 | ||||||

| US852060AD48 / Sprint Capital Corp 6.875% Notes 11/15/2028 | 0,31 | 0,97 | 0,0366 | 0,0031 | |||||

| SCF Equipment Leasing 2024-1 LLC 5.56 / ABS-MBS (US783896AD52) | 0,31 | 0,66 | 0,0362 | 0,0030 | |||||

| SCF Equipment Leasing 2024-1 LLC 5.56 / ABS-MBS (US783896AD52) | 0,31 | 0,66 | 0,0362 | 0,0030 | |||||

| SCF Equipment Leasing 2024-1 LLC 5.56 / ABS-MBS (US783896AD52) | 0,31 | 0,66 | 0,0362 | 0,0030 | |||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0,31 | 0,0362 | 0,0362 | ||||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0,31 | 0,0362 | 0,0362 | ||||||

| P1AY34 / Paychex, Inc. - Depositary Receipt (Common Stock) | 0,31 | 0,0362 | 0,0362 | ||||||

| GBDC / Golub Capital BDC, Inc. | 0,31 | 0,00 | 0,0360 | 0,0028 | |||||

| GBDC / Golub Capital BDC, Inc. | 0,31 | 0,00 | 0,0360 | 0,0028 | |||||

| GBDC / Golub Capital BDC, Inc. | 0,31 | 0,00 | 0,0360 | 0,0028 | |||||

| US95000U2M49 / Wells Fargo & Co | 0,30 | -1,94 | 0,0357 | 0,0021 | |||||

| US91282CHY03 / United States Treasury Note/Bond | 0,30 | 0,66 | 0,0357 | 0,0029 | |||||

| Beacon Funding Trust 6.27 08/15/2054 / DBT (US073952AB93) | 0,30 | -5,31 | 0,0357 | 0,0010 | |||||

| US05565AAN37 / BNP Paribas SA | 0,30 | 20,00 | 0,30 | 19,44 | 0,0355 | 0,0080 | |||

| US05581KAF84 / BNP Paribas SA | 0,30 | 1,35 | 0,0354 | 0,0031 | |||||

| Icon Investments Six DAC 6.00 05/08/2034 / DBT (US45115AAC80) | 0,30 | -1,32 | 0,0354 | 0,0023 | |||||

| Icon Investments Six DAC 6.00 05/08/2034 / DBT (US45115AAC80) | 0,30 | -1,32 | 0,0354 | 0,0023 | |||||

| Icon Investments Six DAC 6.00 05/08/2034 / DBT (US45115AAC80) | 0,30 | -1,32 | 0,0354 | 0,0023 | |||||

| US37046US851 / General Motors Financial Co Inc | 0,30 | 0,00 | 0,0352 | 0,0027 | |||||

| US37046US851 / General Motors Financial Co Inc | 0,30 | 0,00 | 0,0352 | 0,0027 | |||||

| US37046US851 / General Motors Financial Co Inc | 0,30 | 0,00 | 0,0352 | 0,0027 | |||||

| US00206RDS85 / AT&T Inc | 0,30 | -5,13 | 0,0349 | 0,0009 | |||||

| Athene Global Funding 5.53 07/11/2031 / DBT (US04685A3Z27) | 0,30 | -0,34 | 0,0349 | 0,0026 | |||||

| Arizona Public Service Co 5.70 08/15/2034 / DBT (US040555DH45) | 0,30 | 0,34 | 0,0349 | 0,0028 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0,30 | 2,42 | 0,0348 | 0,0034 | |||||

| XS2083963236 / Teva Pharmaceutical Finance Netherlands II BV | 0,30 | 2,42 | 0,0348 | 0,0034 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,29 | -4,25 | 0,0345 | 0,0012 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,29 | -4,25 | 0,0345 | 0,0012 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,29 | -4,25 | 0,0345 | 0,0012 | |||||

| US53079EBM57 / Liberty Mutual Group Inc | 0,29 | 0,0345 | 0,0345 | ||||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0,29 | 0,00 | 0,0343 | 0,0026 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0,29 | 0,00 | 0,0343 | 0,0026 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0,29 | 0,00 | 0,0343 | 0,0026 | |||||

| AGCO / AGCO Corporation | 0,29 | -1,02 | 0,0343 | 0,0023 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,29 | 1,05 | 0,0342 | 0,0029 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,29 | 1,05 | 0,0342 | 0,0029 | |||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 0,29 | -2,36 | 0,0340 | 0,0018 | |||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 0,29 | -2,36 | 0,0340 | 0,0018 | |||||

| RCKT Mortgage Trust 2024-CES6 5.34% 09/25/2044 / ABS-MBS (US749410AA46) | 0,29 | -5,26 | 0,0340 | 0,0009 | |||||

| RCKT Mortgage Trust 2024-CES6 5.34% 09/25/2044 / ABS-MBS (US749410AA46) | 0,29 | -5,26 | 0,0340 | 0,0009 | |||||

| HPS Corporate Lending Fund 6.25 09/30/2029 / DBT (US40440VAC90) | 0,29 | 0,0339 | 0,0339 | ||||||

| HPS Corporate Lending Fund 6.25 09/30/2029 / DBT (US40440VAC90) | 0,29 | 0,0339 | 0,0339 | ||||||

| HPS Corporate Lending Fund 6.25 09/30/2029 / DBT (US40440VAC90) | 0,29 | 0,0339 | 0,0339 | ||||||

| VOYA / Voya Financial, Inc. | 0,29 | 34,11 | 0,0338 | 0,0105 | |||||

| RCKT Mortgage Trust 2024-CES3 6.59 / ABS-MBS (US74942AAA16) | 0,29 | -6,54 | 0,0336 | 0,0003 | |||||

| RCKT Mortgage Trust 2024-CES3 6.59 / ABS-MBS (US74942AAA16) | 0,29 | -6,54 | 0,0336 | 0,0003 | |||||

| US05571AAS42 / BPCE SA | 0,28 | 1,44 | 0,0333 | 0,0030 | |||||

| HCA Inc 5.25 03/01/2030 / DBT (US404119CZ09) | 0,28 | 0,0330 | 0,0330 | ||||||

| HCA Inc 5.25 03/01/2030 / DBT (US404119CZ09) | 0,28 | 0,0330 | 0,0330 | ||||||

| HCA Inc 5.25 03/01/2030 / DBT (US404119CZ09) | 0,28 | 0,0330 | 0,0330 | ||||||

| US693304BE65 / PECO Energy Co | 0,28 | -0,71 | 0,0328 | 0,0023 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,28 | -1,07 | 0,0328 | 0,0022 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,28 | -1,07 | 0,0328 | 0,0022 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,28 | -1,07 | 0,0328 | 0,0022 | |||||

| US61747YFD22 / Morgan Stanley | 0,28 | -11,86 | 0,0325 | -0,0015 | |||||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 0,27 | -4,23 | 0,0321 | 0,0012 | |||||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 0,27 | -4,23 | 0,0321 | 0,0012 | |||||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 0,27 | -4,23 | 0,0321 | 0,0012 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0,27 | -2,51 | 0,0321 | 0,0017 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0,27 | -2,51 | 0,0321 | 0,0017 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0,27 | -2,51 | 0,0321 | 0,0017 | |||||

| US857477BX07 / State Street Corp | 0,27 | -0,37 | 0,0319 | 0,0024 | |||||

| US91159HJH49 / US Bancorp | 0,27 | 0,00 | 0,0319 | 0,0024 | |||||

| US345397D427 / FORD MOTOR CREDIT CO LLC REGD 7.20000000 | 0,27 | -2,55 | 0,0315 | 0,0017 | |||||

| US50076QAE61 / Kraft Heinz Foods Co | 0,27 | 0,38 | 0,0314 | 0,0025 | |||||

| Atlas Warehouse Lending Co LP 6.05 01/15/2028 / DBT (US049463AD44) | 0,27 | 0,38 | 0,0314 | 0,0025 | |||||

| ABBVD / AbbVie Inc. - Depositary Receipt (Common Stock) | 0,27 | -1,12 | 0,0313 | 0,0020 | |||||

| K1SG34 / Keysight Technologies, Inc. - Depositary Receipt (Common Stock) | 0,26 | 0,0312 | 0,0312 | ||||||

| K1SG34 / Keysight Technologies, Inc. - Depositary Receipt (Common Stock) | 0,26 | 0,0312 | 0,0312 | ||||||

| K1SG34 / Keysight Technologies, Inc. - Depositary Receipt (Common Stock) | 0,26 | 0,0312 | 0,0312 | ||||||

| SM / SM Energy Company | 0,26 | -1,13 | 0,0309 | 0,0021 | |||||

| OBDC / Blue Owl Capital Corporation | 0,26 | -1,14 | 0,0307 | 0,0020 | |||||

| OBDC / Blue Owl Capital Corporation | 0,26 | -1,14 | 0,0307 | 0,0020 | |||||

| OBDC / Blue Owl Capital Corporation | 0,26 | -1,14 | 0,0307 | 0,0020 | |||||

| Foundry JV Holdco LLC 6.10 01/25/2036 / DBT (US350930AH62) | 0,26 | 0,0302 | 0,0302 | ||||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0,26 | 0,0300 | 0,0300 | ||||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0,26 | 0,0300 | 0,0300 | ||||||

| S1NP34 / Synopsys, Inc. - Depositary Receipt (Common Stock) | 0,26 | 0,0300 | 0,0300 | ||||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 0,25 | -2,31 | 0,0299 | 0,0016 | |||||

| CRBD / Corebridge Financial, Inc. - Preferred Security | 0,25 | -2,31 | 0,0299 | 0,0016 | |||||

| CRBD / Corebridge Financial, Inc. - Preferred Security | 0,25 | -2,31 | 0,0299 | 0,0016 | |||||

| Cisco Systems Inc 5.50 02/24/2055 / DBT (US17275RCA86) | 0,25 | 0,0298 | 0,0298 | ||||||

| Cisco Systems Inc 5.50 02/24/2055 / DBT (US17275RCA86) | 0,25 | 0,0298 | 0,0298 | ||||||

| D1HI34 / D.R. Horton, Inc. - Depositary Receipt (Common Stock) | 0,25 | 0,0297 | 0,0297 | ||||||

| D1HI34 / D.R. Horton, Inc. - Depositary Receipt (Common Stock) | 0,25 | 0,0297 | 0,0297 | ||||||

| US69121KAG94 / Owl Rock Capital Corp | 0,25 | -0,40 | 0,0295 | 0,0022 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0,25 | 0,00 | 0,0292 | 0,0023 | |||||

| CVS / CVS Health Corporation - Depositary Receipt (Common Stock) | 0,25 | 0,00 | 0,0292 | 0,0023 | |||||

| MTH / Meritage Homes Corporation | 0,25 | 0,0289 | 0,0289 | ||||||

| MTH / Meritage Homes Corporation | 0,25 | 0,0289 | 0,0289 | ||||||

| MTH / Meritage Homes Corporation | 0,25 | 0,0289 | 0,0289 | ||||||

| US63859WAF68 / Nationwide Building Society | 0,24 | -57,14 | 0,0286 | -0,0306 | |||||

| US3132DNQ717 / FHLMC 30YR UMBS SUPER | 0,24 | 0,83 | 0,0285 | 0,0025 | |||||

| US898339AA49 / Trust Fibra Uno | 0,24 | 0,0284 | 0,0284 | ||||||

| US67760HNB32 / OH TURNPIKE INFRASTR JR LIEN TAXABLE 20A SF 3.216% 02-15-48 | 0,24 | 0,00 | 0,0282 | 0,0022 | |||||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0,24 | 0,00 | 0,0282 | 0,0021 | |||||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0,24 | 0,00 | 0,0282 | 0,0021 | |||||

| HD / The Home Depot, Inc. - Depositary Receipt (Common Stock) | 0,24 | 0,00 | 0,0282 | 0,0021 | |||||

| US 10yr Ultra Fut Jun25 / DIR (N/A) | 0,24 | 0,0281 | 0,0281 | ||||||

| US665772CX54 / NORTHERN STATES POWER CO (MN) | 0,24 | -0,42 | 0,0279 | 0,0020 | |||||

| Foundry JV Holdco LLC 5.90 01/25/2033 / DBT (US350930AG89) | 0,24 | 0,0279 | 0,0279 | ||||||

| GOODG / Goodgreen 2018-1 3.93 | 0,24 | 0,00 | 0,0277 | 0,0021 | |||||

| C1CI34 / Crown Castle Inc. - Depositary Receipt (Common Stock) | 0,23 | -49,12 | 0,0273 | -0,0221 | |||||

| US26444HAN17 / DUKE ENERGY FLORIDA LLC | 0,23 | 60,99 | 0,0268 | 0,0104 | |||||

| US345105JE16 / FOOTHILL ESTRN TRANSPRTN CORRIDOR AGY CA TOLL ROAD REVENUE | 0,22 | 2,28 | 0,0264 | 0,0025 | |||||

| US71338QAC06 / Pepperdine University | 0,22 | -0,45 | 0,0262 | 0,0019 | |||||

| WEIR / The Weir Group PLC | 0,22 | 0,0261 | 0,0261 | ||||||

| CNO.PRA / CNO Financial Group, Inc. - Corporate Bond/Note | 0,22 | -23,71 | 0,0261 | -0,0054 | |||||

| CNO.PRA / CNO Financial Group, Inc. - Corporate Bond/Note | 0,22 | -23,71 | 0,0261 | -0,0054 | |||||

| DANSKE / Danske Bank A/S | 0,22 | 0,91 | 0,0261 | 0,0023 | |||||

| DANSKE / Danske Bank A/S | 0,22 | 0,91 | 0,0261 | 0,0023 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0,22 | 0,0259 | 0,0259 | ||||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0,22 | 0,0259 | 0,0259 | ||||||

| OBX 2024-HYB1 Trust 3.66 / ABS-MBS (US67448MAA80) | 0,22 | -3,54 | 0,0257 | 0,0012 | |||||

| OBX 2024-HYB1 Trust 3.66 / ABS-MBS (US67448MAA80) | 0,22 | -3,54 | 0,0257 | 0,0012 | |||||

| OBX 2024-HYB1 Trust 3.66 / ABS-MBS (US67448MAA80) | 0,22 | -3,54 | 0,0257 | 0,0012 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0,22 | -1,81 | 0,0256 | 0,0015 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0,22 | -1,81 | 0,0256 | 0,0015 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 0,22 | -1,81 | 0,0256 | 0,0015 | |||||

| Glencore Funding LLC 5.89 04/04/2054 / DBT (US378272BV94) | 0,22 | -7,26 | 0,0255 | 0,0000 | |||||

| Glencore Funding LLC 5.89 04/04/2054 / DBT (US378272BV94) | 0,22 | -7,26 | 0,0255 | 0,0000 | |||||

| Glencore Funding LLC 5.89 04/04/2054 / DBT (US378272BV94) | 0,22 | -7,26 | 0,0255 | 0,0000 | |||||

| US49427RAQ56 / Kilroy Realty LP | 0,22 | 195,89 | 0,0255 | 0,0175 | |||||

| Foundry JV Holdco LLC 6.30 01/25/2039 / DBT (US350930AK91) | 0,22 | 0,0253 | 0,0253 | ||||||

| US95000U3F88 / Wells Fargo & Co. | 0,21 | 0,94 | 0,0253 | 0,0022 | |||||

| US906548CW07 / Union Electric Co | 0,21 | 0,00 | 0,0252 | 0,0019 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0,21 | 1,43 | 0,0251 | 0,0023 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 0,21 | 1,43 | 0,0251 | 0,0023 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,21 | -1,40 | 0,0249 | 0,0016 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 0,21 | -1,40 | 0,0249 | 0,0016 | |||||

| BKH / Black Hills Corporation | 0,21 | 0,00 | 0,0248 | 0,0020 | |||||

| GXO / GXO Logistics, Inc. | 0,21 | -1,87 | 0,0247 | 0,0014 | |||||

| GXO / GXO Logistics, Inc. | 0,21 | -1,87 | 0,0247 | 0,0014 | |||||

| GXO / GXO Logistics, Inc. | 0,21 | -1,87 | 0,0247 | 0,0014 | |||||

| Trust Fibra Uno 7.70 01/23/2032 / DBT (US89834JAB98) | 0,21 | 0,0247 | 0,0247 | ||||||

| Trust Fibra Uno 7.70 01/23/2032 / DBT (US89834JAB98) | 0,21 | 0,0247 | 0,0247 | ||||||

| Trust Fibra Uno 7.70 01/23/2032 / DBT (US89834JAB98) | 0,21 | 0,0247 | 0,0247 | ||||||

| US85172FAN96 / Springleaf Finance Corp Bond | 0,21 | -5,88 | 0,0246 | 0,0005 | |||||

| US55903VBA08 / Warnermedia Holdings Inc | 0,21 | 0,49 | 0,0244 | 0,0020 | |||||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 0,21 | -53,09 | 0,0242 | -0,0234 | |||||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 0,21 | -53,09 | 0,0242 | -0,0234 | |||||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 0,21 | -53,09 | 0,0242 | -0,0234 | |||||

| US458140CJ73 / Intel Corp | 0,21 | 0,49 | 0,0241 | 0,0019 | |||||

| BNP / BNP Paribas SA | 0,20 | 0,99 | 0,0241 | 0,0022 | |||||

| H1UM34 / Humana Inc. - Depositary Receipt (Common Stock) | 0,20 | -1,94 | 0,0239 | 0,0015 | |||||

| H1UM34 / Humana Inc. - Depositary Receipt (Common Stock) | 0,20 | -1,94 | 0,0239 | 0,0015 | |||||

| H1UM34 / Humana Inc. - Depositary Receipt (Common Stock) | 0,20 | -1,94 | 0,0239 | 0,0015 | |||||

| US45687VAB27 / Ingersoll Rand Inc | 0,20 | 0,50 | 0,0238 | 0,0019 | |||||

| US00928QAU58 / Aircastle Ltd | 0,20 | 0,50 | 0,0235 | 0,0019 | |||||

| US361841AH26 / GLP Capital LP / GLP Financing II Inc | 0,20 | -0,50 | 0,0235 | 0,0017 | |||||

| XS1071551474 / Deutsche Bank AG | 0,20 | 0,00 | 0,20 | 0,00 | 0,0233 | 0,0018 | |||

| US59156RAP38 / Metlife Inc. 6.4% Jr Sub 12/15/36 | 0,20 | -2,94 | 0,0233 | 0,0011 | |||||

| US31418DLT71 / Fannie Mae Pool | 0,20 | -0,51 | 0,0232 | 0,0018 | |||||

| US26441CBU80 / Duke Energy Corp | 0,20 | -1,51 | 0,0232 | 0,0015 | |||||

| US36179ME304 / Ginnie Mae II Pool | 0,20 | -0,51 | 0,0231 | 0,0016 | |||||

| Duke Energy Progress LLC 5.55 03/15/2055 / DBT (US26442UAV61) | 0,19 | 0,0228 | 0,0228 | ||||||

| Duke Energy Progress LLC 5.55 03/15/2055 / DBT (US26442UAV61) | 0,19 | 0,0228 | 0,0228 | ||||||

| US05946KAF84 / Banco Bilbao Vizcaya Argentaria SA | 0,20 | 0,00 | 0,19 | 0,00 | 0,0227 | 0,0017 | |||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,19 | 1,59 | 0,0227 | 0,0020 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,19 | 1,59 | 0,0227 | 0,0020 | |||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0,19 | 1,59 | 0,0227 | 0,0020 | |||||

| US808513CH62 / Charles Schwab Corp/The | 0,19 | 1,06 | 0,0225 | 0,0020 | |||||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 0,19 | 0,53 | 0,0223 | 0,0018 | |||||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 0,19 | 0,53 | 0,0223 | 0,0018 | |||||

| INTC / Intel Corporation - Depositary Receipt (Common Stock) | 0,19 | 0,53 | 0,0223 | 0,0018 | |||||

| US88258MAB19 / Texas Natural Gas Securitization Finance Corp. | 0,19 | 2,20 | 0,0220 | 0,0021 | |||||

| US666807BT82 / NORTHROP GRUMMAN CORP SR UNSECURED 05/40 5.15 | 0,18 | -1,62 | 0,0215 | 0,0013 | |||||

| US13063DGE22 / California (State of), Series 2018, Ref. GO Bonds | 0,18 | 8,33 | 0,0215 | 0,0032 | |||||

| US529043AF83 / LXP INDUSTRIAL TRUST 6.75% 11/15/2028 | 0,18 | 1,11 | 0,0215 | 0,0019 | |||||

| US85172FAQ28 / Springleaf Finance Corp 6.625% 01/15/2028 | 0,18 | -2,69 | 0,0214 | 0,0011 | |||||

| US85172FAQ28 / Springleaf Finance Corp 6.625% 01/15/2028 | 0,18 | -2,69 | 0,0214 | 0,0011 | |||||

| US85172FAQ28 / Springleaf Finance Corp 6.625% 01/15/2028 | 0,18 | -2,69 | 0,0214 | 0,0011 | |||||

| US912810QA97 / United States Treas Bds Bond | 0,18 | 2,84 | 0,0214 | 0,0022 | |||||

| Mars Inc 5.70 05/01/2055 / DBT (US571676BC81) | 0,18 | 0,0214 | 0,0214 | ||||||

| Mars Inc 5.70 05/01/2055 / DBT (US571676BC81) | 0,18 | 0,0214 | 0,0214 | ||||||

| Mars Inc 5.70 05/01/2055 / DBT (US571676BC81) | 0,18 | 0,0214 | 0,0214 | ||||||

| US350930AA10 / Foundry JV Holdco LLC | 0,18 | -59,28 | 0,0213 | -0,0268 | |||||

| US10373QBR02 / BP Capital Markets America Inc | 0,18 | -0,55 | 0,0212 | 0,0015 | |||||

| US61747YFH36 / Morgan Stanley | 0,18 | 1,12 | 0,0212 | 0,0018 | |||||

| US816851BA63 / Sempra Energy | 0,17 | 0,58 | 0,0206 | 0,0017 | |||||

| US21871XAS80 / Corebridge Financial Inc | 0,17 | 0,00 | 0,0204 | 0,0016 | |||||

| AUST 10Y BOND FUT Jun25 / DIR (N/A) | 0,17 | 0,0204 | 0,0204 | ||||||

| US020002AS04 / Allstate Corp 5.55% Senior Notes 5/9/35 | 0,17 | -7,03 | 0,0203 | 0,0002 | |||||

| US026874DP97 / American International Group Inc | 0,17 | -1,16 | 0,0201 | 0,0013 | |||||

| Dell International LLC / EMC Corp 5.30 04/01/2032 / DBT (US24703TAN63) | 0,17 | 0,0198 | 0,0198 | ||||||

| Dell International LLC / EMC Corp 5.30 04/01/2032 / DBT (US24703TAN63) | 0,17 | 0,0198 | 0,0198 | ||||||

| US66988AAH77 / NOVANT HEALTH INC UNSEC 3.168% 11-01-51 | 0,16 | -1,23 | 0,0189 | 0,0013 | |||||

| US92538DAD12 / VERUS SECURITIZATION TRUST 2021-R2 SER 2021-R2 CL A3 V/R REGD 144A P/P 1.22700000 | 0,16 | -3,03 | 0,0189 | 0,0009 | |||||

| US92343VFW90 / VERIZON COMMUNICATIONS INC 2.987% 10/30/2056 WI | 0,16 | -52,24 | 0,0189 | -0,0176 | |||||