Statistiques de base

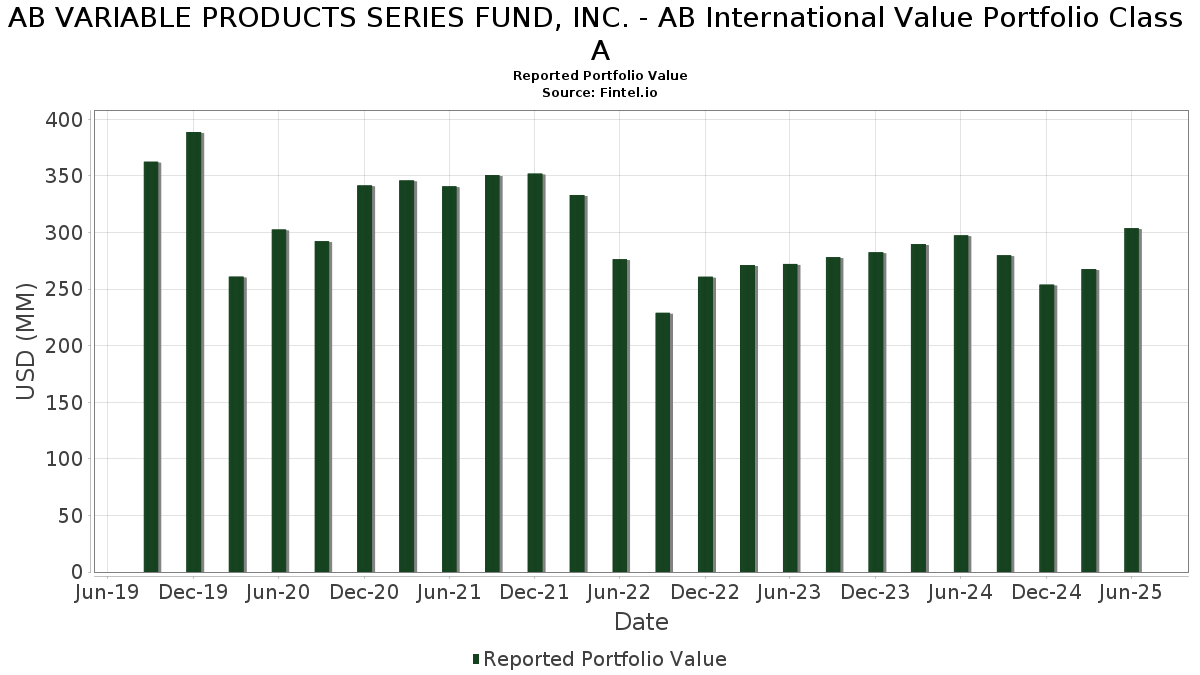

| Valeur du portefeuille | $ 303 901 056 |

| Positions actuelles | 154 |

Dernières positions, performances, ASG (à partir des dépôts 13F, 13D)

AB VARIABLE PRODUCTS SERIES FUND, INC. - AB International Value Portfolio Class A a déclaré un total de 154 positions dans ses derniers dépôts auprès de la SEC. La valeur la plus récente du portefeuille est calculée à 303 901 056 USD. Les actifs sous gestion réels (ASG) sont cette valeur plus les liquidités (qui ne sont pas divulguées). Les principales positions de AB VARIABLE PRODUCTS SERIES FUND, INC. - AB International Value Portfolio Class A sont Shell plc (GB:SHEL) , Roche Holding AG (CH:ROG) , Tokyo Electron Limited (DE:TKY) , Resona Holdings, Inc. (JP:8308) , and Airbus SE (FR:AIR) . Les nouvelles positions de AB VARIABLE PRODUCTS SERIES FUND, INC. - AB International Value Portfolio Class A incluent Mitsubishi Electric Corporation (MX:MITS N) , Persol Holdings Co.,Ltd. (JP:2181) , Toyo Suisan Kaisha, Ltd. (JP:2875) , Toho Co., Ltd. (JP:9602) , and Toyo Tire Corporation (US:TOTTF) .

Meilleures augmentations ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 0,22 | 4,79 | 1,5582 | 1,5582 | |

| 2,36 | 4,61 | 1,5025 | 1,5025 | |

| 0,06 | 4,24 | 1,3807 | 1,3807 | |

| 0,07 | 4,15 | 1,3523 | 1,3523 | |

| 0,16 | 3,48 | 1,1331 | 1,1331 | |

| 0,04 | 8,04 | 2,6189 | 0,8240 | |

| 3,19 | 3,89 | 1,2664 | 0,5581 | |

| 0,18 | 6,51 | 2,1195 | 0,4904 | |

| 0,42 | 5,47 | 1,7809 | 0,4151 | |

| 0,26 | 4,23 | 1,3778 | 0,4059 |

Principales baisses ce trimestre

Nous utilisons la variation de l'allocation du portefeuille car il s'agit de l'indicateur le plus significatif. Les changements peuvent être dus à des transactions ou à des variations de prix des actions.

| Titre | Actions (en millions) |

Valeur ($ en millions) |

% du portefeuille | ΔPortefeuille % |

|---|---|---|---|---|

| 0,13 | 4,60 | 1,4981 | -1,2704 | |

| 0,22 | 5,72 | 1,8633 | -1,1681 | |

| 0,04 | 3,05 | 0,9942 | -0,9782 | |

| 4,12 | 4,12 | 1,3402 | -0,7795 | |

| 0,08 | 3,80 | 1,2387 | -0,7137 | |

| 0,03 | 9,82 | 3,1975 | -0,5459 | |

| 0,06 | 5,77 | 1,8797 | -0,4512 | |

| 1,15 | 5,89 | 1,9191 | -0,3267 | |

| 0,26 | 2,81 | 0,9161 | -0,2748 | |

| 0,21 | 3,91 | 1,2746 | -0,2573 |

Déclarations 13F et dépôts de fonds

Ce formulaire a été déposé le 2025-08-26 pour la période de déclaration 2025-06-30. Cliquez sur l'icône du lien pour voir l'historique complet des transactions.

Mettre à niveau pour débloquer les données premium et exporter vers Excel ![]() .

.

| Titre | Type | Prix moyen de l'action | Actions (en millions) |

ΔActions (%) |

ΔActions (%) |

Valeur ($ en millions) |

Portefeuille (%) |

ΔPortefeuille (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SHEL / Shell plc | 0,31 | 16,20 | 10,78 | 11,52 | 3,5107 | -0,0743 | |||

| ROG / Roche Holding AG | 0,03 | -1,92 | 9,82 | -2,72 | 3,1975 | -0,5459 | |||

| TKY / Tokyo Electron Limited | 0,04 | 18,98 | 8,04 | 66,18 | 2,6189 | 0,8240 | |||

| 8308 / Resona Holdings, Inc. | 0,82 | -2,03 | 7,57 | 3,63 | 2,4656 | -0,2441 | |||

| AIR / Airbus SE | 0,03 | -9,83 | 7,22 | 7,13 | 2,3494 | -0,1483 | |||

| CS / AXA SA | 0,14 | -3,42 | 6,91 | 11,00 | 2,2505 | -0,0584 | |||

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 0,18 | 14,10 | 6,51 | 48,17 | 2,1195 | 0,4904 | |||

| ABN / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 0,23 | -2,67 | 6,38 | 26,14 | 2,0777 | 0,2018 | |||

| 27M / Melrose Industries PLC | 0,86 | 5,31 | 6,26 | 24,27 | 2,0378 | 0,1702 | |||

| IDEXY / Industria de Diseño Textil, S.A. - Depositary Receipt (Common Stock) | 0,12 | 24,48 | 6,21 | 30,42 | 2,0228 | 0,2565 | |||

| HLN / Haleon plc - Depositary Receipt (Common Stock) | 1,15 | -4,38 | 5,89 | -2,68 | 1,9191 | -0,3267 | |||

| RYSD / NatWest Group plc | 0,82 | -2,64 | 5,77 | 15,80 | 1,8802 | 0,0313 | |||

| NSRGY / Nestlé S.A. - Depositary Receipt (Common Stock) | 0,06 | -6,66 | 5,77 | -8,16 | 1,8797 | -0,4512 | |||

| 6758 / Sony Group Corporation | 0,22 | -31,88 | 5,72 | -30,01 | 1,8633 | -1,1681 | |||

| PRU / Prudential plc | 0,44 | 17,88 | 5,53 | 36,74 | 1,7997 | 0,3007 | |||

| CNH / CNH Industrial N.V. | 0,42 | 40,71 | 5,47 | 48,49 | 1,7809 | 0,4151 | |||

| ENEL / Enel SpA | 0,57 | -0,10 | 5,42 | 16,95 | 1,7663 | 0,0465 | |||

| 005930 / Samsung Electronics Co., Ltd. | 0,12 | -1,81 | 5,29 | 9,54 | 1,7238 | -0,0686 | |||

| DG / Vinci SA | 0,04 | 0,46 | 5,29 | 17,55 | 1,7231 | 0,0534 | |||

| BA. / BAE Systems plc | 0,20 | -13,35 | 5,29 | 11,38 | 1,7216 | -0,0389 | |||

| EDP / EDP - Energias de Portugal, S.A. | 1,21 | -2,70 | 5,28 | 25,60 | 1,7177 | 0,1604 | |||

| CRH / CRH plc | 0,06 | 0,39 | 5,23 | 4,75 | 1,7018 | -0,1481 | |||

| CCEP / COCA COLA EUROPACIFIC COMPANY GUAR REGS 11/27 1.5 | 0,06 | -2,66 | 5,19 | 3,70 | 1,6894 | -0,1658 | |||

| DSN / Danske Bank A/S | 0,13 | -3,15 | 5,11 | 20,87 | 1,6636 | 0,0960 | |||

| BBVA / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 0,32 | -3,04 | 4,99 | 9,41 | 1,6245 | -0,0666 | |||

| RYAAY / Ryanair Holdings plc - Depositary Receipt (Common Stock) | 0,08 | -0,11 | 4,87 | 35,98 | 1,5851 | 0,2575 | |||

| LUNMF / Lundin Mining Corporation | 0,46 | 0,27 | 4,81 | 30,14 | 1,5652 | 0,1955 | |||

| MITS N / Mitsubishi Electric Corporation | 0,22 | 4,79 | 1,5582 | 1,5582 | |||||

| ASRNL / ASR Nederland N.V. | 0,07 | -3,15 | 4,76 | 11,93 | 1,5487 | -0,0269 | |||

| SHL / Siemens Healthineers AG | 0,09 | 24,47 | 4,75 | 28,08 | 1,5478 | 0,1716 | |||

| TYIDY / Toyota Industries Corporation - Depositary Receipt (Common Stock) | 0,04 | -10,04 | 4,75 | 18,72 | 1,5471 | 0,0629 | |||

| 2181 / Persol Holdings Co.,Ltd. | 2,36 | 4,61 | 1,5025 | 1,5025 | |||||

| DTE / Deutsche Telekom AG | 0,13 | -37,84 | 4,60 | -38,39 | 1,4981 | -1,2704 | |||

| TLS / Telstra Group Limited | 1,43 | -3,33 | 4,57 | 16,68 | 1,4873 | 0,0356 | |||

| KPN / Koninklijke KPN N.V. | 0,93 | -3,26 | 4,56 | 11,42 | 1,4831 | -0,0328 | |||

| HMC / Honda Motor Co., Ltd. - Depositary Receipt (Common Stock) | 0,47 | 25,81 | 4,50 | 34,07 | 1,4647 | 0,2204 | |||

| 8801 / Mitsui Fudosan Co., Ltd. | 0,46 | -2,82 | 4,48 | 5,07 | 1,4573 | -0,1223 | |||

| 9009 / Keisei Electric Railway Co., Ltd. | 0,46 | 39,54 | 4,35 | 44,40 | 1,4150 | 0,2991 | |||

| REP / Repsol, S.A. | 0,29 | 0,35 | 4,30 | 10,53 | 1,4010 | -0,0424 | |||

| 2875 / Toyo Suisan Kaisha, Ltd. | 0,06 | 4,24 | 1,3807 | 1,3807 | |||||

| BB2 / Burberry Group plc | 0,26 | 0,12 | 4,23 | 61,49 | 1,3778 | 0,4059 | |||

| 9602 / Toho Co., Ltd. | 0,07 | 4,15 | 1,3523 | 1,3523 | |||||

| US0186167484 / AB Fixed Income Shares, Inc. - Government Money Market Portfolio | 4,12 | -28,00 | 4,12 | -28,01 | 1,3402 | -0,7795 | |||

| US0186167484 / AB Fixed Income Shares, Inc. - Government Money Market Portfolio | 4,09 | -0,62 | 4,09 | -0,61 | 1,3319 | -0,0083 | |||

| MRL / Marlowe plc | 0,30 | 26,73 | 3,95 | 56,65 | 1,2849 | 0,3507 | |||

| VK / Vallourec S.A. | 0,21 | -3,29 | 3,91 | -5,25 | 1,2746 | -0,2573 | |||

| EBS / Erste Group Bank AG | 0,05 | -4,07 | 3,90 | 18,06 | 1,2685 | 0,0449 | |||

| SHMUF / Shimizu Corporation | 0,35 | -3,62 | 3,89 | 20,93 | 1,2682 | 0,0741 | |||

| JD. / JD Sports Fashion Plc | 3,19 | 47,64 | 3,89 | 103,61 | 1,2664 | 0,5581 | |||

| FRE / Frendy Energy S.p.A. | 0,08 | -38,70 | 3,80 | -27,75 | 1,2387 | -0,7137 | |||

| 3405 / Kuraray Co., Ltd. | 0,30 | 39,36 | 3,79 | 43,83 | 1,2343 | 0,2569 | |||

| IJF / ICON Public Limited Company | 0,03 | 13,97 | 3,73 | -5,29 | 1,2132 | -0,2453 | |||

| TOS / Tosoh Corporation | 0,25 | -3,60 | 3,64 | 2,53 | 1,1859 | -0,1315 | |||

| TOTTF / Toyo Tire Corporation | 0,16 | 3,48 | 1,1331 | 1,1331 | |||||

| MRK / Marks Electrical Group PLC | 0,03 | 0,00 | 3,28 | -5,80 | 1,0683 | -0,2229 | |||

| GSK / GSK plc | 0,17 | -3,73 | 3,27 | -3,97 | 1,0637 | -0,1975 | |||

| 7012 / Kawasaki Heavy Industries, Ltd. | 0,04 | 0,00 | 3,21 | 25,24 | 1,0437 | 0,0947 | |||

| NXPI / NXP Semiconductors N.V. | 0,01 | -0,55 | 3,14 | 14,34 | 1,0229 | 0,0039 | |||

| CCJ / Cameco Corporation | 0,04 | -68,18 | 3,05 | -42,60 | 0,9942 | -0,9782 | |||

| AKE / Arkema S.A. | 0,04 | -4,13 | 2,98 | -7,56 | 0,9715 | -0,2251 | |||

| 669 / Techtronic Industries Company Limited | 0,26 | -4,85 | 2,81 | -12,39 | 0,9161 | -0,2748 | |||

| AA2 / Amada Co., Ltd. | 0,21 | -6,32 | 2,31 | 4,95 | 0,7533 | -0,0640 | |||

| US63906EB929 / NatWest Markets PLC | 0,14 | 0,0441 | 0,0441 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0,13 | 0,0428 | 0,0428 | ||||||

| PURCHASED AUD / SOLD USD / DFE (000000000) | 0,13 | 0,0428 | 0,0428 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,11 | 0,0357 | 0,0357 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,09 | 0,0281 | 0,0281 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | 0,09 | 0,0281 | 0,0281 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0,06 | 0,0183 | 0,0183 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0,06 | 0,0183 | 0,0183 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,05 | 0,0152 | 0,0152 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,05 | 0,0152 | 0,0152 | ||||||

| PURCHASED SGD / SOLD USD / DFE (000000000) | 0,04 | 0,0146 | 0,0146 | ||||||

| PURCHASED SGD / SOLD USD / DFE (000000000) | 0,04 | 0,0146 | 0,0146 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,04 | 0,0138 | 0,0138 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,04 | 0,0138 | 0,0138 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,04 | 0,0128 | 0,0128 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,04 | 0,0118 | 0,0118 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,04 | 0,0118 | 0,0118 | ||||||

| PURCHASED SEK / SOLD USD / DFE (000000000) | 0,04 | 0,0116 | 0,0116 | ||||||

| PURCHASED SEK / SOLD USD / DFE (000000000) | 0,04 | 0,0116 | 0,0116 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,03 | 0,0112 | 0,0112 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,03 | 0,0105 | 0,0105 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,03 | 0,0091 | 0,0091 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,03 | 0,0083 | 0,0083 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,02 | 0,0072 | 0,0072 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,02 | 0,0072 | 0,0072 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,02 | 0,0066 | 0,0066 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,02 | 0,0061 | 0,0061 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,02 | 0,0060 | 0,0060 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,02 | 0,0059 | 0,0059 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0,02 | 0,0059 | 0,0059 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,02 | 0,0058 | 0,0058 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,02 | 0,0054 | 0,0054 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,01 | 0,0046 | 0,0046 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,01 | 0,0043 | 0,0043 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | 0,01 | 0,0043 | 0,0043 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,01 | 0,0037 | 0,0037 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0,01 | 0,0037 | 0,0037 | ||||||

| PURCHASED CHF / SOLD USD / DFE (000000000) | 0,01 | 0,0029 | 0,0029 | ||||||

| PURCHASED EUR / SOLD USD / DFE (000000000) | 0,01 | 0,0027 | 0,0027 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,01 | 0,0024 | 0,0024 | ||||||

| PURCHASED NZD / SOLD USD / DFE (000000000) | 0,01 | 0,0020 | 0,0020 | ||||||

| PURCHASED NZD / SOLD USD / DFE (000000000) | 0,01 | 0,0020 | 0,0020 | ||||||

| PURCHASED SGD / SOLD USD / DFE (000000000) | 0,01 | 0,0017 | 0,0017 | ||||||

| PURCHASED SGD / SOLD USD / DFE (000000000) | 0,01 | 0,0017 | 0,0017 | ||||||

| PURCHASED GBP / SOLD USD / DFE (000000000) | 0,00 | 0,0015 | 0,0015 | ||||||

| PURCHASED NOK / SOLD USD / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| PURCHASED NOK / SOLD USD / DFE (000000000) | 0,00 | 0,0001 | 0,0001 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,00 | -0,0001 | -0,0001 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0,00 | -0,0002 | -0,0002 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0,00 | -0,0003 | -0,0003 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,00 | -0,0004 | -0,0004 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0,00 | -0,0004 | -0,0004 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0,00 | -0,0013 | -0,0013 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0,00 | -0,0013 | -0,0013 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,00 | -0,0014 | -0,0014 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0,01 | -0,0020 | -0,0020 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0,01 | -0,0020 | -0,0020 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0,01 | -0,0028 | -0,0028 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0,01 | -0,0028 | -0,0028 | ||||||

| PURCHASED USD / SOLD CHF / DFE (000000000) | -0,01 | -0,0028 | -0,0028 | ||||||

| PURCHASED USD / SOLD CHF / DFE (000000000) | -0,01 | -0,0028 | -0,0028 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0,01 | -0,0033 | -0,0033 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0,01 | -0,0033 | -0,0033 | ||||||

| US63906EB929 / NatWest Markets PLC | -0,01 | -0,0042 | -0,0042 | ||||||

| US63906EB929 / NatWest Markets PLC | -0,01 | -0,0042 | -0,0042 | ||||||

| US63906EB929 / NatWest Markets PLC | -0,01 | -0,0042 | -0,0042 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,01 | -0,0046 | -0,0046 | ||||||

| US06747W8495 / Barclays Bank plc into Metlife, Inc. | -0,01 | -0,0046 | -0,0046 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0,02 | -0,0055 | -0,0055 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0,02 | -0,0060 | -0,0060 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0,02 | -0,0060 | -0,0060 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0,02 | -0,0061 | -0,0061 | ||||||

| PURCHASED USD / SOLD GBP / DFE (000000000) | -0,02 | -0,0061 | -0,0061 | ||||||

| US63906EB929 / NatWest Markets PLC | -0,02 | -0,0072 | -0,0072 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0,03 | -0,0089 | -0,0089 | ||||||

| US90269A5341 / UBSW (LUV) (conv) 4.25% 2/6/2020 | -0,03 | -0,0089 | -0,0089 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,03 | -0,0095 | -0,0095 | ||||||

| DGZ / DB Gold Short ETN | -0,03 | -0,0100 | -0,0100 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,04 | -0,0121 | -0,0121 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,04 | -0,0121 | -0,0121 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,04 | -0,0126 | -0,0126 | ||||||

| PURCHASED USD / SOLD TWD / DFE (000000000) | -0,05 | -0,0167 | -0,0167 | ||||||

| PURCHASED USD / SOLD TWD / DFE (000000000) | -0,05 | -0,0167 | -0,0167 | ||||||

| PURCHASED USD / SOLD TWD / DFE (000000000) | -0,13 | -0,0411 | -0,0411 | ||||||

| PURCHASED USD / SOLD TWD / DFE (000000000) | -0,13 | -0,0411 | -0,0411 | ||||||

| PURCHASED USD / SOLD KRW / DFE (000000000) | -0,23 | -0,0755 | -0,0755 | ||||||

| PURCHASED USD / SOLD KRW / DFE (000000000) | -0,23 | -0,0755 | -0,0755 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0,29 | -0,0939 | -0,0939 | ||||||

| PURCHASED USD / SOLD JPY / DFE (000000000) | -0,29 | -0,0939 | -0,0939 | ||||||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0,38 | -0,1234 | -0,1234 |